The introduction of online cash registers led to significant changes to Law 54-FZ, the key legal act regulating the use of cash register equipment (CCT) in the Russian Federation.

For example, the use of an online cash register by an organization or individual entrepreneur allows you to abandon a number of reporting documents and accounting registers in the cash register system.

As it turned out, however, this relaxation does not apply to the main cash documents specified in the Directive of the Central Bank of the Russian Federation No. 3210-U dated March 11, 2014, and the cash book, also mentioned in this regulatory act.

The features of maintaining and filling out a cash book (CC) by a business entity using an online cash register should be considered in more detail.

The essence of the process of implementing online cash registers

From July 1, 2017, cash registers of a new type - online cash registers, characterized by:

- a higher degree of security for sales data generated on them;

- the ability to transmit this data in real time to the Federal Tax Service.

At the same time, a number of changes were introduced:

- to the list of persons obliged to use CCP;

- procedure for registering and using cash registers;

- register of mandatory details of documents generated by the cash desk.

However, despite a fairly wide range of changes in working with cash register systems, the essence of these changes boils down to the fact that cash registers of a technically higher level began to be used for cash payments. And it was precisely this circumstance that caused most of the changes in the procedure for working with them. These changes did not affect the rules for accounting for revenue received through cash register systems, despite a number of innovations in the documentation of some cash transactions. Therefore, the question of how to keep records at online cash registers has only one answer: in the same order as before. There are no innovations in it.

Some businesses, usually online stores, prefer to use cloud services instead of cash registers. A cloud online cash register is a service through which an online store connects to a remote online machine located in the service’s data center. All information about calculations is carried out through this device, which is transmitted through the fiscal data operator to the tax office. And the cloud service ensures the connection of cash registers to the online store website, setting up online cash registers and uninterrupted access to them.

The cloud service allows you to rent several cash registers without a cash register and register them with the tax office.

Changes in the processing of documents at the cash desk

A new approach to documents drawn up when using cash registers was outlined with the appearance of the updated text of Art. 1, paragraph 1 of which now states that when using cash register equipment one should be guided by:

- Law No. 54-FZ itself;

- regulations adopted in accordance with it.

That is, this automatically abolished the need to prepare previously considered mandatory documents, the unified forms of which were approved by Decree of the State Statistics Committee of December 25, 1998 No. 132:

1. acts:

- on transferring cash meter readings to zero (form KM-1);

- on taking meter readings when transferring the cash register for repairs (form KM-2);

- on the return of money to customers (form KM-3);

- on checking cash at the cash desk (form KM-9).

2. Magazines:

- cashier-operator (form KM-4), letter of the Ministry of Finance of Russia dated June 16, 2017 No. 03-01-15/37692;

- registration of meter readings (form KM-5);

- recording calls from technical specialists (form KM-8).

3. Reference reports:

- certificate-report of the cashier-operator (form KM-6);

- information on meter readings and revenue (form KM-7).

At the same time, new documents that are related to cash payments made using online cash registers have been approved by Law No. 54-FZ (clause 4 of article 4.1):

- shift opening report;

- correction cash receipt;

- report on closing the fiscal drive;

- operator confirmation.

Other documents have changed their form and requirements for details. With the use of the main cash document (check or BSO), it became possible not only to process receipts for purchases, but also such operations as (Clause 1, Article 4.7 of Law No. 54-FZ):

- refund to the buyer;

- issuing funds to the client;

- receiving funds from the client.

However, changes in documents drawn up using cash registers did not in any way affect the rules for maintaining documentation for the operating cash desk, approved by the Bank of Russia Directive No. 3210-U dated March 11, 2014. Therefore, it is still required to issue cash orders for receipts and expenses (clause 4.1) and maintain a cash book (clause 4.6). In relation to cash revenue, it will be mandatory to register it daily according to a receipt order, drawn up on the basis of a shift closing report generated on the online cash register, which is an analogue of the z-report created at the cash register with ECLZ.

Let's look at how to organize cash accounting in the cash register.

What is a Cash Book?

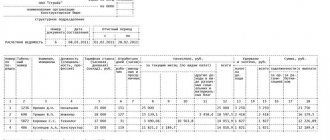

The cash book (hereinafter referred to as the CC) is a consolidated document that records:

- Based on data on cash receipt orders (PKO) - the amounts that were received at the enterprise's cash desk.

- Based on data on expenditure cash orders (RKO) - the amounts that were spent from the enterprise's cash register.

In turn, PKO and RKO can be formed on the basis of various supporting documents. For example, fiscal ones, that is, those that are created using cash register equipment (primarily, we are talking about receipts and expense receipts, reports). If a business entity is not obliged to use cash register equipment, then instead of fiscal documents, sales receipts and strict reporting forms can be used as primary ones when preparing orders.

In this case, the cash desk of an enterprise means not only the specially equipped place of a cashier or accountant, but also, in principle, any place where the enterprise receives or issues funds. By “cash register” it is more legitimate to understand here not an object, but a process. Incoming or outgoing transactions can be carried out at any point of the enterprise and, in principle, even outside it, both at a stationary object and in a mobile one (and even directly in motion - when calculations are carried out “on the go” in a car or “on the fly” in airplane).

CC is used both in the case of documenting transactions in which cash register is used, and in the case of cash transactions that are not subject to fiscalization (for example, this may be the issuance of funds to an employee of an enterprise on account and the acceptance of the unspent balance). Thus, with respect to QC, fiscal documents are only a special type of primary documents.

Accounting for cash receipts

Revenue accepted into the online cash register is reflected in the taxpayer’s operating cash register. This procedure is recorded by postings:

- in retail trade that does not provide for customer analytics:

Dt 50 Kt 90.1;

- for cash payments with customers who are legal entities or individual entrepreneurs, in respect of which analytical accounting is important:

Dt 50 Kt 62 and Dt 62 Kt 90.1.

If payments are made using a plastic card, then account 57 is involved in the transactions:

Dt 57 Kt 90.1 or Dt 57 Kt 62.

Fiscal documents: formats

Federal Law No. 84, which regulates the use of cash register equipment, defines the requirements for documentation generated during the use of online cash registers (Article 4.1, paragraphs 4 and 5).

The requirements mainly affect reports and details of checks, storage periods in the FN (30 days).

Important! Before you start documenting a new discipline, you need to study the list of mandatory fiscal documents. All requirements are concentrated in the Order of the Federal Tax Service dated March 21, 2021 No. ММВ-7-20/229.

All documentation is completed at the online checkout. It is stored for 30 days in the memory of the FN. The automatic mode issues papers to the Federal Tax Service via the Internet. If the data does not arrive within 24 hours, the cash register will be blocked.

Accounting for refunds to the buyer for goods

Reflection in accounting for a refund for goods returned by the buyer depends on when this event occurred:

- in the same tax period with the sale (and it does not matter whether the day of sale coincides with the day of return) - in this case, reversing entries are used;

- different tax periods - here the return during the period of its implementation will have to be reflected through non-operating income and expenses.

Separately from the receipt of revenue, the return transaction will be shown even if the day of return coincides with the day of sale, since Law No. 54-FZ (clauses 1 and 4 of article 4.1, clause 3 of article 4.3, clause 1 of article 4.7) requires separate registration, storage and transfer to the Federal Tax Service of each document generated by the cash desk.

Accounting transactions using reversing entries will look like this:

- goods received from buyer:

Dt 41 Kt 76 (62);

- refund made:

Dt 76 (62) Kt 50 (51);

- adjusted revenue:

Dt 76 (62) Kt 90.1 reversal;

- Corrections have been made to write off the cost of goods sold:

Dt 90.2 Kt 76 (62) reversal.

If retail accounting is kept at sales prices, then upon return there will be an entry to restore the amount of the trade margin:

Dt 90.2 Kt 42.

If the tax periods of the sale and return do not coincide, then in the last 3 transactions, instead of subaccounts 90, account 91 with similar subaccount numbers will be used.

With regard to adjusting the amount of VAT on sales (if the seller works with this tax), it should be taken into account that here, in accordance with the requirements of the Tax Code of the Russian Federation (clause 5 of Article 171), it will be necessary to make a deduction for the amount of tax corresponding to the amount of the refund. In this case, the purchase book must contain the details of either an adjustment invoice or an expense cash order that formalized the issuance of money to the buyer (letter of the Ministry of Finance of Russia dated March 19, 2013 No. 03-07-15/8473).

Since for the correct implementation of the deduction (indicating the details of the document giving the right to it), the VAT amount must be reflected on account 19, the logical entry for reflecting the amount intended for deduction would be:

Dt 90.3 Kt 19 reversal.

It will essentially replace 2 entries: for adjusting VAT on revenue (Dt 90.3 Kt 68 reversal) and for calculating the same amount of tax for deduction (Dt 19 Kt 68 or Dt 68 Kt 19 reversal).

The deduction for the amount reflected in account 19 on the date of its accrual will be made by the usual posting for it:

Dt 68 Kt 19.

Accounting for other settlements with the client

Other cash payments with the client at the cash desk may include:

- payments for goods accepted for commission;

- payment for recyclable materials purchased from the population;

- issuance of winnings;

- settlements under an agency agreement.

These are expense transactions documented by posting:

Dt 76 (60) Kt 50 (51).

The account number options on the debit portion of this entry will depend on what is written in the accounting policies regarding the accounting for a particular payment. And in the credit part for the situation of transferring money to a plastic card, an account of 51 will appear.

Accordingly, when returning funds issued to the client, a reverse posting will occur, in which account 57 will participate when making payments through a plastic card:

Dt 50 (57) Kt 76 (60).

Situation No. 1: Individual entrepreneur works only with cash

Not all individual entrepreneurs are required to have online cash registers. Some may still not have a cash register and work for cash.

If you are exempt from cash register transactions, then, naturally, you cannot issue a check to the buyer. But you are still required to issue a document confirming the payment, which contains all the details, as in the check. This could be a sales receipt or a payment receipt.

An individual entrepreneur has the right not to maintain a cash book and not to issue receipts and expenditure orders. However, in life only single entrepreneurs, that is, without employees, allow themselves such luxury. Although they still record their income and expenses somewhere, that is, in fact, they keep a cash book. If you have employees, then it is better to keep cash documents in order to control them.

The individual entrepreneur gives the documents confirming the payment to his buyers or customers. The question of storing them does not arise before him. But for the same purpose of monitoring their employees, many entrepreneurs have a copy of such documents (either printed in duplicate or issued as a carbon copy). There are no special requirements for storing such papers; most often they are simply filed monthly or quarterly.

It is convenient to store cash orders and books in electronic form. But this is possible if all employees have electronic signatures. If not everyone has signatures, then the documents will have to be printed and stored in this form.

Results

The transition to the use of online cash registers essentially represents the replacement of previously used cash register systems with higher-level technology, which makes it possible to better protect cash register data from changes and increase the degree of control of the tax authorities over them.

It is with this kind of changes that the main aspects of updating the procedure for using CCP are associated. Despite the fact that their consequence was the abolition of the obligation to use some documents previously drawn up when using cash registers, these changes did not affect the procedure for reflecting in accounting transactions related to the acceptance and issuance of cash through cash registers.

Therefore, accounting for the movement of funds passing through the cash register is carried out in the same manner.

Is a cashier-operator's log necessary?

From July 2021, the journal may not be kept. This applies to all companies that have switched to online cash registers. The KM-4 form records all inflows and outflows, so it remains useful for internal accounting.

You can continue to fill out KM-4 on a voluntary basis to record the inflow and outflow of financial resources. This documentation does not need to be submitted to the tax authority. The cashier operator's journal is of particular importance for individual entrepreneurs. Information about income and expenses is very important for making management decisions.

In order to control the receipt and expenditure of money per day or per shift, the document reflects the following information:

- Initial and final information from the cash register counter for the working period.

- The amount of revenue received during the day or shift.

- The amount of funds received or spent in non-cash or cash form.

- Money given to customers using checks for returning products.

- Companies that have not switched to the new cash register system must fill out the cashier-operator log.

At the end of each day or shift, the cashier must enter the above data into the journal, following the rules: put dashes in the lines of KM-4 where information is missing; enter information chronologically.