Each company and individual entrepreneur is required to report on its activities to regulatory authorities - tax authorities, funds (PFR, Social Insurance Fund), statistics. The reporting of entrepreneurs and companies using different taxation systems is different, but its submission is a mandatory procedure, the implementation of which is established by the legislator.

Attention! Reporting deadlines in 2020

It is considered a violation not only to fail to submit reports, but also to submit them late. Let us remind you about the deadlines for submitting reports of enterprises with different taxation regimes.

Deadline for submitting financial statements in 2021

Excluding only businessmen (IPs) who take into account income and expenses, as well as divisions of foreign companies, the obligation to maintain accounting applies to all legal entities. Accounting involves the formation of:

- Balance sheet and financial results report (financial results report);

- Application reports - on cash flow (CFC), intended use of funds, changes in capital;

- Explanations for reporting.

The composition of financial statements for different enterprises is different: micro and small enterprises are limited to drawing up simplified versions of reports, other companies submit full accounting reports, but the deadline for submitting reports in 2021 remains the same for all - 3 months after the reporting year. Due to the coincidence of the last day of the due date with a weekend, accounting reports must be submitted to the Federal Tax Service and the Rosstat body no later than 04/01/2019.

What is it for?

An accountant is an extremely time-consuming and responsible position. Even small private companies with a small staff have their own accountant, albeit with remote access. As for large enterprises, there is a whole staff of workers involved in financial accounting, and they are headed by a chief accountant.

In addition to internal calculations of employee salaries, profits and losses, the accounting department is responsible for drawing up and sending special reports to the appropriate authorities. The types of documents provided are varied, and their submission dates are distributed throughout the calendar year. Only a professional can navigate them freely, and even that one may make mistakes in terms of timing.

It is important! In case of delay, the company faces a fine, and for the accountant there is sometimes a risk of criminal liability for economic crimes.

The chief accountant is personally responsible for the timely provision of reports

An accounting calendar is a document where summary data on the timing of any reporting forms is linked to the dates of the current year. It also includes a production calendar, that is, the necessary notes on all working days, weekends and holidays. Based on these data, working time standards are calculated, and wages are calculated and calculated for the company’s employees. Thus, the calendar includes schedules of both external relations with regulatory and fiscal authorities, as well as internal regulations and circulation of money.

Before the era of widespread introduction of computerized accounting tools, calendars were compiled by accountants manually, on a monthly basis. Data on the deadlines for submitting various types of reports were entered into the graphed sheets. This information was obtained from accounting newspapers and magazines. With the advent of websites on accounting topics, as well as software for enterprises, the calendar acquired an electronic form.

Today, various official online publications publish ready-made calendars, which include current dates and information. Synchronization of such calendars with data of specific enterprises is provided. There are monthly and yearly calendars. The former are regularly updated, the latter are downloaded in their entirety or are available online.

Accountant's calendar for 2021: reporting deadlines (table)

In addition to accounting, enterprises submit tax reports and reports to funds (PFR and Social Insurance Fund). Deadlines for submitting reports are specified in accordance with the law - they are shifted to the nearest weekday if it falls on a holiday (non-working day) or weekend.

Reports in 2021: due dates - table

| Presentation organ | Report | During the period | Deadline | Relevant for | |||

| BASIC | simplified tax system | UTII | Unified agricultural tax | ||||

| Inspectorate of the Federal Tax Service | VAT return (quarterly) | 4 sq. 20181 sq. 20192 sq. 20193 sq. 2019 | 25.01.201925.04.201925.07.201925.10.2019 | ■ | If you issued invoices or were tax agents | ||

| Income tax return (quarterly) | Year 20181 sq. 2019half 20199 months 2019 | 28.03.201929.04.201929.07.201928.10.2019 | ■ | ||||

| Log book of received and issued invoices (electronically) | 4 sq. 20181 sq. 20192 sq. 20193 sq. 2019 | 21.01.201922.04.201922.07.201921.10.2019 | Represented by developers, forwarders, intermediaries | ||||

| Certificate of income 2-NDFL | 2018 | 03/01/2019, if tax is accrued but not withheld. 04/01/2019 for paid income and withheld personal income tax | ■ | ■ | ■ | ■ | |

| Calculation of personal income tax amounts form 6-NDFL | 2018Q1 2019half 20199 months 2019 | 01.04.201930.04.201931.07.201931.10.2019 | ■ | ■ | ■ | ■ | |

| Transport tax declaration | 2018 | 01.02.2019 | If there is a taxable object | ||||

| Land tax declaration | 2018 | 01.02.2019 | If there is a taxable object | ||||

| Property tax declaration | 2018 | 01.04.2019 | ■ | ||||

| Advance property tax calculations | 1 sq. 2019half 20199 months 2019 | 30.04.201930.07.201930.10.2019 | ■ | ||||

| Water tax declaration (quarterly) | 4 sq. 20181 sq. 20192 sq. 20193 sq. 2019 | 21.01.201922.04.201922.07.201921.10.2019 | If there is a taxable object | ||||

| Mineral extraction tax declaration (monthly) | 12.201801.201902.201903.201904.201905.201906.201907.201908.201909.201910.201911.2019 | 31.01.201928.02.201901.04.201930.04.201931.05.201901.07.201931.07.201902.09.201930.09.201931.10.201902.12.201931.12.2019 | Legal entities and individual entrepreneurs – subsoil users | ||||

| Information on the average number of employees | 2018 | 21.01.2019 | ■ | ■ | ■ | ■ | |

| Declaration according to the simplified tax system (annual) | 2018 | 04/01/2019 – reporting deadlines in 2021 for the organization; 04/30/2019 – deadline for individual entrepreneurs | ■ | ||||

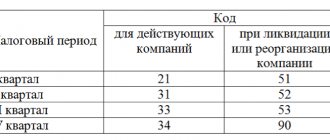

| Declaration on UTII (quarterly) | 4 sq. 20181 sq. 20192 sq. 20193 sq. 2019 | 21.01.201922.04.201922.07.201921.10.2019 | ■ | ||||

| Declaration of Unified Agricultural Tax (annual) | 2018 | 01.04.2019 | ■ | ||||

| Single simplified declaration | 2018Q1 2019half 20199 months 2019 | 21.01.201922.04.201922.07.201921.10.2019 | If in the reporting period there are no objects of taxation and turnover at the cash desk and bank | ||||

| Calculation of insurance premiums (quarterly) | 2018Q1 2019half 20199 months 2019 | 30.01.201930.04.201930.07.201930.10.2019 | ■ | ■ | ■ | ■ | |

| Declaration 3-NDFL (for individual entrepreneurs on OSNO) | 2018 | 30.04.2019 | ■ | ||||

| Pension Fund | SVZ-STAZH (information about insurance experience) annual | 2018 | 01.03.2019 | ■ | ■ | ■ | ■ |

| Information about the insured SVZ-M (information about the insured persons) monthly | 12.201801.201902.201903.201904.201905.201906.201907.201908.201909.201910.201911.2019 | 15.01.201915.02.201915.03.201915.04.201915.05.201917.06.201915.07.201915.08.201916.09.201915.10.201915.11.201916.12.2019 | ■ | ■ | ■ | ■ | |

| FSS | Calculation of 4-FSS (for industrial injuries) quarterly | 2018Q1 2019half 20199 months 2019 | on paper/electronically21.01.2019 /25.01.201922.04.2019/25.04.201922.07.2019/25.07.201921.10.2019/25.10.2019 | ■ | ■ | ■ | ■ |

| Confirmation of the main type of activity to clarify the insurance rate | 2018 | 15.04.2019 | ■ | ■ | ■ | ■ | |

Filing tax reports in 2021: deadlines

As we can see, the expectation of changes in reporting deadlines due to the many transformations introduced by the legislator to the Tax Code of the Russian Federation did not materialize. There is no talk of introducing new reporting deadlines in 2019. The innovations affected individual articles, but in general did not affect the procedure for submitting reports either to the Federal Tax Service or to the funds. We only note that the forms of many reporting documents have been modernized (for example, declarations on UTII, 3-NDFL), and therefore entities should prepare annual reports on updated forms.

Changes in the 2019 tax reporting calendar

In 2021, accountants will face many changes in legislation that will affect such areas of accounting as taxation, reporting and remuneration. Each of these changes will require corresponding changes in the accountant's calendar. Below are some important changes that will affect the 2021 accounting calendar:

- The most discussed innovation in the field of taxation is increasing the VAT rate from 18% to 20%. The new rate is marked on the calendar so that the tax is not mistakenly applied in accordance with the old rules.

- You will no longer have to enter the payment of taxes on movable property into the calendar. The timing and reasons for receiving movable property do not in any way affect the abolition of taxes.

- The 2-NDFL certificate was significantly revised, as well as the income certificate issued by the tax agent to employees regarding accrued wages.

- In connection with the change in the VAT rate, the procedure and form for reporting have changed, including the sales book and the additional sheet attached to it.

- The changes affected not only the taxes themselves, but also control. The reporting filing dates should now be circled in red if, according to the updated declaration, you declare a smaller amount to be paid. In this case, you are almost guaranteed to incur an on-site audit regarding the appropriateness and legality of reducing the amount of tax deductions.

- According to the 2021 accounting calendar, the number of visits to tax and regulatory authorities will decrease. New measures make it possible to submit financial statements in electronic form, without paper copies. The latter may be required by government agencies, but in a special manner.

- Most enterprises will be able to exclude one of the items on the calendar: now reporting is submitted only to the tax office. Rosstat, which previously also provided accounting, now has no right to demand this.

- The deadlines for submitting the main reporting forms in 2021 are as follows: three months after the end of the reporting period. The auditor's report is submitted within 10 working days from the date of its signing, but no later than the last day of the reporting year.

Starting from 2021, changes have been made to the deadlines for filing tax reports.

It is important! Tax changes must be reflected in a timely manner in the calendar so as not to rearrange the work of the accounting department at the time of reporting.

Late submission of reports: responsibility

So, the deadlines for submitting reports in 2021 have not changed, and fines for failure to submit them have remained at the same level. According to the general rules, “lateness” in filing a declaration or “Calculation of insurance premiums” may entail a fine of 5% of the amount of tax reflected for payment, but not transferred, for each month of “delay,” incl. incomplete (Article 119 of the Tax Code of the Russian Federation). The maximum fine for failure to comply with reporting deadlines is 30% of the amount of tax unpaid according to the declaration, the minimum is 1000 rubles. (for example, if a zero declaration is not submitted). For other forms of reporting, various enforcement measures are provided. Thus, failure to submit 6-NDFL is punishable by a fine of 1000 rubles. from the employer for each overdue month (clause 1.2 of Article 126 of the Tax Code of the Russian Federation). Impressive sanctions are also provided for late reporting to funds. For example, the fine according to the 4-FSS report will be 5% of the amount of contributions payable for each overdue month, but not more than 30% of contributions and not less than 1000 rubles. (Article 26.30 of the Law of July 24, 1998 No. 125-FZ). Such significant troubles can only be avoided by generating reports without violating the deadlines for their submission.

Reporting deadlines in 2021: tax reporting

Here are the deadlines for submitting the main reports submitted to the Federal Tax Service.

Type of reporting For what period is it submitted? Deadline for submission to the Federal Tax Service

| Certificates 2-NDFL | For 2021 (if it is impossible to withhold personal income tax from income) | No later than 03/01/2019 |

| For 2021 (for all income paid) | No later than 04/01/2019 | |

| For 2021 (if it is impossible to withhold personal income tax from income) | No later than 03/02/2020 | |

| For 2021 (for all income paid) | No later than 04/01/2020 | |

| Calculation of 6-NDFL | For 2021 | No later than 04/01/2019 |

| For the first quarter of 2021 | No later than 04/30/2019 | |

| For the first half of 2021 | No later than 07/31/2019 | |

| For 9 months of 2021 | No later than 10/31/2019 | |

| For 2021 | No later than 04/01/2020 | |

| Calculation of insurance premiums | For 2021 | No later than 01/30/2019 |

| For the first quarter of 2021 | No later than 04/30/2019 | |

| For the first half of 2021 | No later than 07/30/2019 | |

| For 9 months of 2021 | No later than 10/30/2019 | |

| For 2021 | No later than 01/30/2020 | |

| Income tax return (for quarterly reporting) | For 2021 | No later than 03/28/2019 |

| For the first quarter of 2021 | No later than 04/29/2019 | |

| For the first half of 2021 | No later than 07/29/2019 | |

| For 9 months of 2021 | No later than October 28, 2019 | |

| For 2021 | No later than 03/28/2020 | |

| Income tax return (for monthly reporting) | For 2021 | No later than 03/28/2019 |

| For January 2021 | No later than 02/28/2019 | |

| For January – February 2021 | No later than 03/28/2019 | |

| For January – March 2021 | No later than 04/29/2019 | |

| For January – April 2021 | No later than 05/28/2019 | |

| For January – May 2021 | No later than 06/28/2019 | |

| For January – June 2021 | No later than 07/29/2019 | |

| For January – July 2021 | No later than 08/28/2019 | |

| For January – August 2021 | No later than September 30, 2019 | |

| For January – September 2021 | No later than October 28, 2019 | |

| For January – October 2021 | No later than November 28, 2019 | |

| For January – November 2021 | No later than 12/30/2019 | |

| For 2021 | No later than 30.03.2020 | |

| VAT declaration | For the fourth quarter of 2021 | No later than 01/25/2019 |

| For the first quarter of 2021 | No later than 04/25/2019 | |

| For the second quarter of 2021 | No later than July 25, 2019 | |

| For the third quarter of 2021 | No later than October 25, 2019 | |

| For the fourth quarter of 2021 | No later than 01/27/2020 | |

| Journal of received and issued invoices | For the fourth quarter of 2021 | No later than 01/21/2019 |

| For the first quarter of 2021 | No later than 04/22/2019 | |

| For the second quarter of 2021 | No later than 07/22/2019 | |

| For the third quarter of 2021 | No later than October 21, 2019 | |

| For the fourth quarter of 2021 | No later than 01/20/2020 | |

| Tax declaration under the simplified tax system | For 2021 (represented by organizations) | No later than 04/01/2019 |

| For 2021 (represented by individual entrepreneurs) | No later than 04/30/2019 | |

| For 2021 (represented by organizations) | No later than 03/31/2020 | |

| For 2021 (represented by individual entrepreneurs) | No later than 04/30/2020 | |

| Declaration on UTII | For the fourth quarter of 2021 | No later than 01/21/2019 |

| For the first quarter of 2021 | No later than 04/22/2019 | |

| For the second quarter of 2021 | No later than 07/22/2019 | |

| For the third quarter of 2021 | No later than October 21, 2019 | |

| For the fourth quarter of 2021 | No later than 01/20/2020 | |

| Declaration on Unified Agricultural Tax | For 2021 | No later than 04/01/2019 |

| For 2021 | No later than 03/31/2020 | |

| Declaration on property tax of organizations | For 2021 | No later than 04/01/2019 |

| For 2021 | No later than 30.03.2020 | |

| Calculation of advances for corporate property tax (submitted if the law of the constituent entity of the Russian Federation establishes reporting periods) | For the first quarter of 2021 | No later than 04/30/2019 |

| For the first half of 2021 | No later than 07/30/2019 | |

| For 9 months of 2021 | No later than 10/30/2019 | |

| Transport tax declaration (submitted only by organizations) | For 2021 | No later than 02/01/2019 |

| For 2021 | No later than 02/03/2020 | |

| Land tax declaration (submitted only by organizations) | For 2021 | No later than 02/01/2019 |

| For 2021 | No later than 02/03/2020 | |

| Single simplified declaration | For 2021 | No later than 01/21/2019 |

| For the first quarter of 2021 | No later than 04/22/2019 | |

| For the first half of 2021 | No later than 07/22/2019 | |

| For 9 months of 2021 | No later than October 21, 2019 | |

| For 2021 | No later than 01/20/2020 | |

| Declaration in form 3-NDFL (submit only individual entrepreneurs) | For 2021 | No later than 04/30/2019 |

| For 2021 | No later than 04/30/2020 |

You will find the deadlines for submitting specific reports, such as the water tax or mineral extraction tax declaration, in our Accountant Calendar.

Deadlines for submitting reports to Rosprirodnadzor

Environmental payments are accompanied by reporting:

| Report type | What document is it approved by? | For what period is it submitted? | Submission deadline | Base |

| The calculation of payment for negative impact on the environment | Order of the Ministry of Natural Resources of Russia dated 01/09/2017 No. 3 | 2019 | 10.03.2020 | Clause 2 of the Appendix to Order No. 3 |

| Calculation of the amount of environmental fee | Order of Rosprirodnadzor dated August 22, 2016 No. 488 | 2019 | 15.04.2020 | Clause 10 of the Rules, approved. Government Decree No. 1073 dated October 8, 2015 |

Reporting calendar for 2021: deadlines for submitting reports to the Pension Fund

The following reports must be submitted to the Pension Fund:

Type of reporting For what period is it submitted? Deadline for submission to the Pension Fund

| Information about insured persons in the Pension Fund (SZV-M) | For December 2021 | No later than 01/15/2019 |

| For January 2021 | No later than 02/15/2019 | |

| For February 2021 | No later than 03/15/2019 | |

| For March 2021 | No later than 04/15/2019 | |

| For April 2021 | No later than 05/15/2019 | |

| For May 2021 | No later than 06/17/2019 | |

| For June 2021 | No later than 07/15/2019 | |

| For July 2021 | No later than 08/15/2019 | |

| For August 2021 | No later than September 16, 2019 | |

| For September 2021 | No later than 10/15/2019 | |

| For October 2021 | No later than 11/15/2019 | |

| For November 2021 | No later than December 16, 2019 | |

| For December 2021 | No later than 01/15/2020 | |

| Information about the insurance experience of the insured persons (SZV-STAZH) | For 2021 | No later than 03/01/2019 |

| For 2021 | No later than 03/02/2020 | |

| Information on the policyholder transferred to the Pension Fund for maintaining individual (personalized) records (EFV-1) | For 2021 | No later than 03/01/2019 |

| For 2021 | No later than 03/02/2020 |

Deadline for submitting reports to the Social Insurance Fund

The deadline for submitting 4-FSS depends on the method of submitting the Calculation (on paper or electronically):

Type of reporting For what period is it submitted? Deadline for submission to the Social Insurance Fund

| Calculation of 4-FSS on paper | For 2021 | No later than 01/21/2019 |

| For the first quarter of 2021 | No later than 04/22/2019 | |

| For the first half of 2021 | No later than 07/22/2019 | |

| For 9 months of 2021 | No later than October 21, 2019 | |

| For 2021 | No later than 01/20/2020 | |

| Calculation of 4-FSS in electronic form | For 2021 | No later than 01/25/2019 |

| For the first quarter of 2021 | No later than 04/25/2019 | |

| For the first half of 2021 | No later than July 25, 2019 | |

| For 9 months of 2021 | No later than October 25, 2019 | |

| For 2021 | No later than 01/27/2020 |

In addition, employers must confirm their main activity:

- for 2021 – no later than 04/15/2019;

- for 2021 – no later than 04/15/2020.

Deadlines for submitting reports to FSRAR

Rosalkogolregulirovanie will accept declarations on the turnover of alcoholic and alcohol-containing products:

| Report type | What document is it approved by? | For what period is it submitted? | Submission deadline | Base |

| Alcohol declaration | Government Decree No. 815 dated 09.08.2012 | 4th quarter 2019 | 20.01.2020 | Clause 15 of the Rules, approved. Resolution No. 815 |

| Declaration of grape volume | 2019 | 17.02.2020 |

Declarations are also accepted by executive authorities of constituent entities of the Russian Federation in accordance with the Rules (Resolution No. 815).

Submission of financial statements in 2021: deadlines

All organizations must submit financial statements for 2021 to the Federal Tax Service and statistical authorities no later than 04/01/2019. By the way, with reporting for 2021, the obligation to submit accounting forms to Rosstat is canceled for almost all organizations - you will only need to submit financial statements to the tax office ( Federal Law of November 28, 2018 No. 444-FZ). However, this will need to be done electronically. However, organizations belonging to small and medium-sized businesses can submit reports for 2021 on paper. The financial statements for 2021 must be submitted no later than 03/31/2020.

Deadlines for submitting financial statements

Starting from the 2021 reporting year, the submission of financial statements to statistics has been cancelled. The last time organizations must submit these forms is in 2021 for 2021 annual reports.

All companies are required to send a balance sheet, profit and loss statement, and all other forms included in the accounting package, regardless of their form of ownership, tax system, or organizational form.

Entrepreneurs, as well as branches of foreign companies, have the right not to submit accounting reports. These entities are permitted by law not to maintain accounting records.

The deadline for reporting is March 31 of the year following the reporting year. In 2021, this day is moved to April 1 due to a holiday.

Attention! If a company was opened on October 1, 2018, it must submit a report to statistics for the first time only after December 31 of the following year. Due to the cancellation of reporting for 2019, such enterprises are already exempt from submitting accounting reports to Rosstat.