The need to liquidate part of a fixed asset arises during the operation of complex objects consisting of one or more items for the same or different purposes, having common fixtures and accessories, common management, mounted on the same foundation and performing their functions only as part of the complex, and not independently. That is, when an object is a complex of structurally articulated objects, it can not be written off entirely, but only in that part that cannot be restored or is obsolete. At the same time, the removal of individual parts does not affect the further use of the fixed asset for its intended purpose.

Often, the procedure for partial liquidation of a fixed asset is accompanied by subsequent modernization or reconstruction of the facility. In this case, the object is improved by replacing its structural elements and systems with more efficient ones, leading to an increase in the technical level and economic characteristics of the object, the parameters of the object, their parts and the quality of engineering support change.

It is necessary to distinguish between the partial liquidation of a fixed asset and the disposal of part of it due to repairs, when faulty (deteriorated) elements are replaced . These are different events, and they are reflected in budget accounting in different ways.

Liquidation commission

To make a decision on partial liquidation of a fixed asset, create a commission that should:

- determine the possibility and feasibility of restoring part of the fixed asset that is subject to liquidation;

- determine the possibility of using individual components, parts, materials of the retiring part of the fixed asset.

The commission should include the chief accountant, employees responsible for the safety of fixed assets, and other employees appointed by order of the head of the organization. The decision on partial liquidation of a fixed asset made by the commission is approved by order of the head of the organization. After the liquidation of part of the fixed asset, an act is drawn up. The commission can draw up an act on partial liquidation of a fixed asset using form No. OS-4 or No. OS-4a.

This procedure follows from paragraph 77 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n.

Impact of liquidation of fixed assets on taxes

All transactions with fixed assets are displayed in the enterprise's balance sheet. Their write-off is no exception, but in this case it is necessary to correctly take into account the impact of these entries on the calculation of the tax base when calculating various payments to the state.

Impact on VAT:

- VAT cannot be calculated on fixed assets whose depreciation has been written off in full;

- if the balance of depreciation is still taken into account in the accounts, VAT can be restored;

- if dismantling of equipment or premises is carried out by a third-party organization, then, in accordance with the Tax Code of the Russian Federation, input VAT is accepted for deduction in the general manner;

- When selling the remaining parts on the basis of settlement documents, VAT will definitely need to be charged.

The remaining parts after dismantling the old equipment or premises are taken into account as part of non-operating income, regardless of whether they will continue to take part in production or not. Income will be considered received immediately after signing the decommissioning act. In this case, the tax base will increase by the cost of new parts.

Partial liquidation of the building

When a building (structure) is partially liquidated, its total area and other characteristics that were originally indicated during its state registration are reduced. For example, number of floors. Therefore, new characteristics of the building (structure) must be registered in the state register (clause 68 of the Rules, approved by order of the Ministry of Economic Development of Russia dated December 23, 2013 No. 765). In this case, the building (structure) is not re-registered, but only an entry is made in the register about changes in its characteristics.

To register changes, you need to submit to the territorial office of Rosreestr:

- application for amendments to the state register of rights to real estate and transactions with it;

- documents confirming changes in the relevant information previously entered into the state register (for example, a certificate from the BTI);

- payment order for payment of state duty in the amount of 1000 rubles. (Subclause 27, Clause 1, Article 333.33 of the Tax Code of the Russian Federation).

This is stated in paragraphs 4 and 5.1.1 of the Regulations approved by Decree of the Government of the Russian Federation dated June 1, 2009 No. 457, Section IX of the Methodological Instructions approved by Order of the Ministry of Justice of Russia dated July 1, 2002 No. 184.

Accounting: partial liquidation

The organization is obliged to keep records of fixed assets according to the degree of their use:

- in operation;

- in stock (reserve);

- in the stage of partial liquidation, etc.

This is stated in paragraph 20 of the Methodological Instructions, approved by order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n.

Accounting for fixed assets by degree of use can be carried out with or without reflection on account 01 (03). Thus, fixed assets that have been in the stage of partial liquidation for a long time should be accounted for in a separate subaccount “Fixed assets in the stage of partial liquidation.” This approach is consistent with paragraph 20 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n.

Debit 01 (03) subaccount “Fixed assets in the stage of partial liquidation” Credit 01 (03) subaccount “Fixed assets in operation”

– work has begun on the partial liquidation of fixed assets.

Upon completion of partial liquidation, make the following entry:

Debit 01 (03) subaccount “Fixed assets in operation” Credit 01 (03) subaccount “Fixed assets in the stage of partial liquidation”

– work on the partial liquidation of fixed assets has been completed.

This procedure follows from paragraph 2 of clause 14 of PBU 6/01 and the Instructions for the chart of accounts (account 01).

Accounting: depreciation during partial liquidation

Do not suspend depreciation on fixed assets that are in the stage of partial liquidation. There is an exception to this rule - if the liquidation of part of the fixed asset is carried out as part of reconstruction for more than 12 months (clause 23 of PBU 6/01, clause 63 of the Methodological Instructions approved by Order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n). For more information about this, see How to reflect the reconstruction of fixed assets in accounting.

Upon receipt of the act of partial liquidation, adjust the value of the fixed asset (paragraph 2, clause 14 of PBU 6/01). Calculate the monthly amount of depreciation after partial liquidation based on the adjusted initial (residual) value of the fixed asset and the previous depreciation rate.

Do not revise the useful life of a fixed asset. An exception to this rule is the partial liquidation of a fixed asset carried out as part of reconstruction. Reconstruction work can lead to an increase in the useful life of the fixed asset. In this case, for accounting purposes, the remaining useful life of the reconstructed fixed asset must be revised. For more information about this, see How to reflect the reconstruction of fixed assets in accounting.

This procedure follows from paragraph 20 of PBU 6/01 and paragraph 60 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n.

Situation: how to determine at the end of the partial liquidation of a fixed asset the amount by which its initial cost should be reduced and the amount of accrued depreciation?

The procedure for reducing the value of a fixed asset after its partial liquidation is not established by law. Therefore, the organization must develop it independently.

The best way is to determine the initial cost of the liquidated part of the fixed asset using accounting data. For example, if in the primary documents submitted by the supplier when purchasing a fixed asset, the cost of the liquidated part is highlighted as a separate line, in this case the amount of depreciation charges attributable to the liquidated part can be calculated using the formula:

| Depreciation charges attributable to the liquidated part of the fixed asset | = | Initial cost of the liquidated part of the fixed asset | : | Initial cost of the entire fixed asset | × | Accrued depreciation at the end of liquidation |

If it is impossible to determine the initial cost of the liquidated part of the fixed asset based on accounting data, it can be calculated:

- a commission created from employees of the organization;

- independent appraiser.

In this case, the share of liquidated property must be determined as a percentage of any physical indicator characterizing the fixed asset. Taking into account this share, the cost and amount of depreciation attributable to the liquidated property are calculated.

For example, for buildings (structures), the initial cost and depreciation charges attributable to the liquidated part can be determined by calculation:

| Initial cost attributable to the liquidated part of the building (structure) | = | Area of the liquidated part of the building (structure) | : | Total area of the building (structure) before liquidation | × | Initial cost of the building (structure) |

| Depreciation charges attributable to the liquidated part of the building (structure) | = | Area of the liquidated part of the building (structure) | : | Total area of the building (structure) before liquidation | × | Accrued depreciation at the end of liquidation |

The applied option for adjusting the initial cost and the amount of accrued depreciation after partial liquidation of a fixed asset should be fixed in the accounting policy for accounting and tax purposes.

After partial liquidation, depreciation on the fixed asset continues to be calculated based on its value adjusted to the cost of the liquidated part.

This procedure is confirmed by letter of the Ministry of Finance of Russia dated August 27, 2008 No. 03-03-06/1/479. Although this letter contains references to the old version of the Tax Code of the Russian Federation, the conclusions drawn in it can still be applied now, as amended by the current rules of law.

Explanation “The procedure for writing off fixed assets during liquidation, taking into account the long dismantling period”

document status

: materials for the CPT meeting

developer organization:

NCHU "BMC"

meeting date

: June 27, 2012

Explanation

“The procedure for writing off fixed assets during liquidation, taking into account the long dismantling period”

- Question :

At what point should a fixed asset be written off in accounting (K 01), provided that the fixed asset is being dismantled for more than 1 year: at the time management decides to dismantle or at the time the dismantling is physically completed?

In accordance with the approved program for the liquidation of fixed assets, the dismantling of these facilities will last more than 1 year.

The accounting regulations “Accounting for fixed assets” PBU 6/2001, approved by order of the Ministry of Finance of the Russian Federation dated March 30, 2001 No. 26n (in the text - PBU 6/01), in paragraph 29 states that: The cost of a fixed asset item that is disposed of or is not capable of bringing economic benefits (income) to the organization in the future and is subject to write-off from accounting.

At the same time, clauses 1 and 4 of Art. 9 of the Federal Law of November 21, 1996 N 129-FZ “On Accounting” establishes:

1. All business transactions carried out by the organization must be documented with supporting documents. These documents serve as primary accounting documents on the basis of which accounting is conducted.

4. The primary accounting document must be drawn up at the time of the transaction, and if this is not possible, immediately after its completion.

Liquidation of an object with a long dismantling period can be documented with a primary document in the OS-4 form only after all work has been completed and the write-off act has been approved by the head of the organization (form OS-4).

- Explanation:

A fixed asset with a long dismantling period is subject to write-off from accounting during the period when management makes a decision on dismantling, regardless of the period of completion of dismantling.

Accounting is a system for collecting, recording, grouping and presenting information about accounting objects. A feature of accounting is the fact that information about its objects is presented in monetary terms, i.e. in value terms. In addition, and this is also no less important, not any tangible and intangible objects of the real world can act as accounting objects, but only those that, in accordance with the current accounting legislation, are recognized as its objects. These include: assets, liabilities, capital, income and expenses of the organization.

For assets, as accounting objects, one of the mandatory conditions for recognition, along with the possibility of their evaluation, is the ability to bring economic benefits in the future. Therefore, an asset that cannot bring economic benefits due to physical wear and tear, due to the decision of the organization’s management to replace it, sell it, etc. or for any other reason is subject to write-off from accounting. That is why PBU 6/01 in paragraph 29 established an unambiguous rule on writing off the cost of a fixed asset item that is being retired or is not capable of bringing economic benefits to the organization

(income) in the future,

from accounting.

Compliance with this requirement in relation to assets is a condition for the presentation of reliable reports. In particular, clause 6 of the Accounting Regulations PBU 4/1999 “Accounting statements of an organization”, approved by order of the Ministry of Finance of the Russian Federation dated 07/06/1999 No. 43n, establishes: Reporting must give a reliable and complete picture of the financial position of the organization, the financial results of its activities and changes in its financial position. Financial statements prepared on the basis of the rules established by regulatory acts on accounting reliable and

Thus, the moment of write-off of an asset for which a decision on liquidation has been made should be the moment of its withdrawal from the organization’s production process, about which a corresponding document must be drawn up. Such a document may be an order from the organization’s management to begin the liquidation procedure for the OS or another document that clearly indicates that the OS will not be used in the future by the organization in its activities and, therefore, will not bring economic benefits to the organization in the future.

The form of the act on write-off of an object of fixed assets OS-4 (a, b) is an approved form of the primary accounting document, which combines the properties of an accounting register, in which data on the entire liquidation procedure of the fixed assets, and not just its beginning, is recorded in a generalized form. Its complete execution and approval by the management of the organization can serve as evidence that the liquidation procedure has been completed, and in its process certain costs have been incurred and (or) certain assets have been received. At the same time, the liquidated asset itself is no longer reflected in the accounting system due to the fact that it does not meet the criteria for recognition as an asset. In addition, the primary document itself cannot determine the moment of occurrence of a business transaction (in this case, write-off of fixed assets), but is only a means of its registration.

The costs that an organization incurs in connection with the liquidation of fixed assets are recognized in accounting as they arise in the period in which the corresponding costs were incurred. The basis for reflecting these costs in the OS-4 act and accounting are other primary documents directly documenting the liquidation process - acts on the completion of the next stage, and if stages of liquidation of the OS are not provided, then acts drawn up at the end of each reporting period.

If, when accepting fixed assets for accounting, based on the norms of legislative and other regulatory legal acts, court decisions, contracts or due to the assumed obligations to third parties, the organization has an obligation to liquidate these fixed assets after a certain period of time, in the accounting In the accounting of the organization, an estimated liability should be recognized, with its value attributable to the cost of the fixed assets introduced.

| Rabinovich Almin Moiseevich: ... it is necessary to recognize an estimated liability with its value attributable to the cost of the input fixed assets of the corresponding non-current asset, reflected in the balance sheet under the item “Other non-current assets”. |

When liquidating such fixed assets, expenses associated with it will be written off against the previously recognized provisional liability in accordance with PBU 8/10.

In accordance with the Charter and internal regulations of the BMC, tax accounting issues are not considered on their merits. At the same time, please note that

the moment of writing off fixed assets from accounting is also the basis for excluding their value from the tax base for property tax. So clause 1 of Art. 374 of the Tax Code of the Russian Federation establishes: The object of taxation for Russian organizations is movable and immovable property (including property transferred for temporary possession, use, disposal or trust management contributed to joint activities), recorded on the organization’s balance sheet as fixed assets in accordance with the established accounting procedures...

Thus, the Tax Code of the Russian Federation establishes an unambiguous connection between the value of fixed assets reflected in accounting and their value, which acts as an object of taxation. Consequently, writing off the value of fixed assets from accounting entails a reduction in the tax base for property tax by the same value.

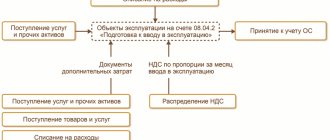

Accounting: cost adjustment

In accounting, reflect the adjustment in the value of a fixed asset after its partial liquidation with the following entries:

Debit 01 (03) subaccount “Retirement of fixed assets” Credit 01 (03) subaccount “Fixed assets in operation”

– the initial (replacement) cost of the liquidated part of the fixed asset is taken into account;

Debit 02 Credit 01 (03) subaccount “Disposal of fixed assets”

– the amount of depreciation charges attributable to the liquidated part of the fixed asset is written off;

Debit 91-2 Credit 01 (03) subaccount “Disposal of fixed assets”

– the residual value of the liquidated part of the fixed asset is written off.

This procedure follows from the Instructions for the chart of accounts (account 01).

The amount by which the initial value of the fixed asset was adjusted after partial liquidation is reflected in the inventory record card in form No. OS-6 (No. OS-6a) or in the inventory book in form No. OS-6b (used by small enterprises).

Provided reasons for disposal of fixed assets

An organization loses fixed assets for various possible reasons:

- moral and/or physical wear and tear of the property fund;

- destruction as a result of an emergency (accident, natural disaster, catastrophe, etc.);

- irreparable damage (intentional or accidental);

- theft of a fixed asset;

- loss of an object identified during inventory;

- completing a purchase and sale transaction, the object of which is OS;

- conclusion regarding the object of a gift or barter agreement;

- transfer to another legal entity or individual free of charge;

- the fixed asset has become a contribution or part of a contribution to the authorized capital of another legal entity;

- The redemption period has come for the property leased on a leasing basis.

ATTENTION! There may be other reasons for the disposal of fixed assets; the main condition for carrying out the procedure is the absence or impossibility of using the object based on the results of the next inventory.

If an object was simply moved between structural divisions within the same organization, this is not considered a disposal.