Decor

Proper documentation of conservation is a prerequisite for recognizing the costs of its implementation when calculating corporate income tax.

The decision on conservation is formalized by order of the head of the organization.

In this order, it is necessary to indicate the conservation period and list the measures that need to be taken to transfer the OS to conservation (clause 63 of the Guidelines for accounting for OS).

After these activities have been carried out, an act on transferring the OS to conservation should be drawn up.

There is no unified form of the act on the transfer of fixed assets for conservation, so it is drawn up in any form.

The act is signed by the members of the commission and approved by the head of the organization. The act reflects the economic feasibility of mothballing a fixed asset object.

The act must indicate:

- OS transferred to conservation;

- date of transfer of the OS for conservation;

- activities that were carried out to transfer the OS to conservation;

- the costs of carrying out these activities.

This act, approved by the head of the organization, will be the primary document in order to:

- take into account conservation costs in expenses;

- suspend the accrual of depreciation on fixed assets transferred to conservation for more than three months.

Documenting

The procedure for documenting the transfer of fixed assets for conservation and their re-conservation is not regulated by legislative acts on budget accounting, so the institution must develop it independently.

We propose the following algorithm of actions:

- The order of the manager to conduct an inventory is approved in order to identify property not used in the activities of the institution.

- Inventory lists are compiled in the manner prescribed by Order No. 52n.

- An order is issued from the manager to create a commission to transfer environmental facilities to conservation. The duties of the commission include inspecting objects in order to assess the economic feasibility of conservation and drawing up the relevant documents.

- The manager's order to transfer environmental assets to conservation is approved. It specifies the reasons for the transfer, a list of conserved property, its book value and conservation periods.

- An act on the conservation of fixed assets is drawn up. The form of this document should be developed independently and fixed in the accounting policy of the organization, since the form of the act is not approved by Order No. 52n. The act must contain the name of the OS, inventory number, book value, amount of accrued depreciation, residual value, reasons, terms of conservation, signatures of members of the commission of the head of the institution.

- An estimate of conservation costs is drawn up, indicating the costs of maintaining mothballed objects in good condition.

- A record of conservation is made in the inventory card for recording non-financial assets (f. 050431, 0504032), if this procedure is carried out for a period of three months or more.

When re-opening:

- The manager's order to conduct an inventory is approved in order to identify the actual presence of property under conservation.

- Inventory lists of non-financial assets are compiled in the manner established by Order No. 52n.

- An order is issued from the head to create a commission for the reactivation of fixed assets, which will assess the technical condition of fixed assets subject to reactivation and draw up relevant documents.

- The manager's order to re-mothball fixed assets is approved.

- An act on the reactivation of fixed assets is drawn up in the form approved by the accounting policy of the institution. It must contain the name of the fixed asset, its inventory number, initial cost, the amount of accrued depreciation, residual value, information about the technical condition of the reactivated object, signatures of the members of the commission for the reactivation of fixed assets and the head of the institution.

- An estimate of the costs of carrying out the re-preservation work is being drawn up.

- An entry about re-preservation is made in the inventory card for accounting for non-financial assets (f. 0504031, 0504032), if conservation was carried out for a period of more than three months.

Let us note that in the unified forms of inventory cards for accounting for non-financial assets (f. 0504031, 0504032), which are approved by Order No. 52n, there are no fields for reflecting information about the conservation (re-preservation) of fixed assets. Therefore, the institution can modify these forms (introduce additional columns, sections) and consolidate their application in the accounting policy (clause 6 of Instruction No. 157n).

Accounting

After the manager signs the order and approves the act of transferring fixed assets to conservation, the fixed assets are transferred to conservation.

At the same time, in accounting, the object transferred for conservation continues to be included in the OS.

Fixed assets under conservation, along with fixed assets in operation, should be accounted for separately on account 01 “Fixed Assets”.

Therefore, in the organization’s chart of accounts, it is necessary to provide for account 01 “Fixed Assets” a subaccount “Fixed Assets for Conservation”.

Preservation of OS

The main goal of conservation of fixed assets (FPE) is to preserve the technical and operational properties of fixed assets during a period of downtime with the possibility of further restoration of their functioning.

Conservation is relevant, for example, during a temporary cessation of an organization’s production activities, a suspension of construction, and also in other cases when objects are temporarily not used.

Conservation is not carried out for fixed assets that are unsuitable for use due to moral or physical wear and tear; they are subject to write-off based on the decision of the organization’s permanent commission for the receipt and disposal of assets.

The conservation procedure should be beneficial to the institution, as it is associated with additional costs required to ensure the safety of objects, as well as to maintain them in good condition.

Depreciation of fixed assets during the conservation period

For assets mothballed for three months or less, depreciation during the mothballing period is accrued in the usual manner.

Depreciation refers to expenses for ordinary activities, regardless of the results of the organization’s activities in the reporting period and is reflected in the accounting records of the reporting period in which it is accrued (5, paragraph 5, clause 8, clause 16 of the Accounting Regulations “Organization’s Expenses” PBU 10/99, approved by Order of the Ministry of Finance of Russia dated May 6, 1999 N 33n, clause 24 PBU 6/01).

For OS preserved for a period of more than three months (clause 23 of PBU 6/01, clause 63 of the Methodological Instructions dated October 13, 2003 N 91n):

— from the first day of the month following the month of transfer to conservation, depreciation accrual stops;

It is worth noting that in accounting, the time period during which the property is mothballed (even if it exceeds a three-month period) will not affect its useful life.

But according to accounting laws, depreciation can be calculated even after the end of the useful life of fixed assets (clause 22 of PBU 6/01).

It follows from this that after the reactivation of objects, depreciation can be continued in the same manner until their cost is fully repaid.

Thus, from the first day of the month following the month in which the asset was re-mothballed, depreciation is resumed in the same amount as before mothballing.

How is the transfer of operating systems for conservation and their depreservation formalized?

The procedure for documenting operations for transferring fixed assets to conservation and their re-preservation is not regulated by the legislative acts of the Republic of Kazakhstan, therefore the enterprise must develop it independently and consolidate it in its accounting policies.

The mothballing of fixed assets is not provided for in IFRS.

According to paragraph 55 of IAS 16 “Fixed Assets”, depreciation of an asset stops starting from the earlier of two dates:

1) the date of transfer to assets held for sale (or inclusion in a disposal group that is classified as held for sale) in accordance with IFRS 5;

2) the date of derecognition of the asset.

In accordance with paragraph 27 of the NSFR, depreciation of fixed assets and intangible assets is accrued from the first day of the month following the month in which the asset becomes available for use, and continues to accrue until its disposal, and if the asset has not been used for a certain time .

Thus, depreciation does not stop when the asset is idle or when the asset ceases to be in active use, unless the asset is fully depreciated.

Transferring the OS to conservation:

1) the order of the first manager to conduct an inventory is approved in order to identify property temporarily not used in the activities of the organization;

2) inventory lists (matching statements) for fixed assets are compiled;

3) an order is issued to create a commission to transfer fixed assets to conservation;

4) an order is approved to transfer fixed assets to conservation, which indicates the reasons for the transfer, the list of property to be preserved, the book value and terms of conservation;

5) an act on the conservation of fixed assets is drawn up, the form of which should be developed independently and fixed in the accounting policy of the organization;

6) an estimate of conservation costs is drawn up, indicating the costs of maintaining mothballed objects in good condition;

7) a record of conservation is made in the inventory card of the fixed asset if this procedure is carried out for a period of more than three months.

OS depreservation:

1) the order of the first manager to conduct an inventory is approved in order to identify the actual presence of property under conservation;

2) inventories of fixed assets are compiled;

3) an order is issued to create a commission for the reactivation of fixed assets, which will assess the technical condition of fixed assets subject to reactivation and draw up (sign) the relevant documents;

4) the order to re-mothball fixed assets is approved;

5) an act on the reactivation of fixed assets is drawn up in the form approved by the accounting policy of the organization. The act on reactivation of fixed assets must contain the name of the fixed asset, inventory number, initial (book) value, amount of accrued depreciation, residual value, information about the technical condition of the reactivated object, signatures of members of the commission for reactivation of fixed assets and the head of the organization;

6) an estimate of the costs of carrying out re-preservation work is drawn up (if necessary);

7) a record of re-preservation is made in the inventory card for recording fixed assets if the conservation was carried out for a period of more than three months.

Expenses for maintaining a fixed asset during the conservation period

Expenses for the maintenance of a fixed asset (FPE) during the conservation period do not increase its initial cost (clause 14 of the Accounting Regulations “Accounting for Fixed Assets” PBU 6/01, approved by Order of the Ministry of Finance of Russia dated March 30, 2001 N 26n).

These expenses relate to the period when this fixed asset is not involved in production activities.

Consequently, the costs associated with its maintenance are not taken into account when determining the cost of production.

These expenses are recognized as other expenses and are reflected in accounting in the month of their implementation (clauses 4, 11 of the Accounting Regulations “Expenses of the Organization” PBU 10/99, approved by Order of the Ministry of Finance of Russia dated 06.05.1999 N 33n) in the debit of account 91 “ Other income and expenses”, subaccount 91-2 “Other expenses” (Instructions for the application of the Chart of Accounts for accounting financial and economic activities of organizations, approved by Order of the Ministry of Finance of Russia dated October 31, 2000 N 94n).

Postings for conservation of fixed assets will be as follows:

| Wiring | Operation |

| Dt 01 "Fixed assets" subaccount "Fixed assets for conservation" - Kt 01 "Fixed assets" subaccount "Fixed assets in operation" | OS has been put into storage |

| Dt 91/2 - Kt 10 (60, 70, 69) | Costs for preservation are reflected (maintenance of preserved OS) |

| Dt 01 "Fixed assets" subaccount "Fixed assets in operation" - Kt 01 "Fixed assets" subaccount "Fixed assets for conservation" | OS unmothballed |

The procedure for preserving fixed assets

In order for the procedure to be carried out within the framework of the law, it is necessary to comply with the documentation regulations. This procedure has been approved at the federal level for all budgetary and other government agencies, and commercial firms can independently develop sample documents, including an act and order on the conservation of an object.

The general algorithm of actions includes:

- Drawing up an application for conservation of the OS by the responsible official - the document is confirmed by a technical justification about the inexpediency of further operation of the facility and is submitted to the head of the company.

- Approval of a decision on the need for a conservation procedure for an object - the company’s management body participates in the consideration.

- Issuing an order on OS - for example, when the operation of real estate is suspended, an order is drawn up to preserve the building - a sample is below.

- Carrying out inventory activities.

- Drawing up an act - the document indicates that the facility is temporarily ceasing to be used.

- Formation of accounting entries - preserved fixed assets are transferred to the debit of a separate subaccount to the account. 01 for further control, and conservation costs are reflected in account 91.

Order on preservation of OS - sample

Income tax

Non-operating expenses take into account costs (clause 9, clause 1, article 265 of the Tax Code of the Russian Federation, clause 2 of the Letter of the Ministry of Finance dated September 15, 2010 N 03-03-06/1/590):

- for conservation - on the date of approval by the head of the organization of the conservation act;

- for the maintenance of mothballed fixed assets (including repairs and security) - on the last day of the month in which these costs were incurred;

- for re-preservation - on the date of approval by the head of the organization of the act on re-preservation of the OS.

Property tax calculated on the cost of mothballed fixed assets is taken into account in other expenses (clause 1, clause 1, article 264 of the Tax Code of the Russian Federation, Letter of the Federal Tax Service dated August 22, 2012 N ED-4-3 / [email protected] ).

If an asset for which a depreciation bonus was applied is being preserved, then there is no need to restore it when transferring it to preservation.

When mothballing an asset before it is put into operation or in the same month in which it is put into operation, depreciation can be calculated and a depreciation bonus applied only after re-mothballing (Letters of the Ministry of Finance dated December 22, 2014 N 03-03-06/1/66272, dated 03/07/2014 N 03-03-06/1/10085).

For assets mothballed for three months or less, depreciation during the mothballing period is accrued in the usual manner.

For OS preserved for a period of more than three months (clause 2 of Article 322 of the Tax Code of the Russian Federation):

- on the first day of the month following the month of transfer to conservation, depreciation accrual stops;

- from the first day of the month following the month in which the fixed assets are re-mothballed, depreciation accrual is resumed in the same amount as before mothballing.

What is conservation of fixed assets

Temporary transfer of fixed assets for conservation implies a forced suspension of operation of the facility. In this case, it is automatically assumed that after some time the asset will begin to be used again. The economic meaning of this measure is that the enterprise gets the opportunity to maintain production capacity without losing extra funds.

Savings are also achieved due to the absence of depreciation charges in accounting: according to clause PBU 6/01, depreciation is suspended in accounting when the asset is mothballed for a period of more than 3 months. The same rule applies to tax accounting (clause 3 of Article 256 of the Tax Code). Depreciation stops accruing from the month following the month the object is transferred for conservation (clause 2 of Article 322 of the Tax Code of the Russian Federation), and is resumed from the month following the month of re-preservation. The mothballed OS continues to be listed in accounting - in a separate subaccount to account 01.

What are the reasons for mothballing fixed assets? As a rule, organizations are forced to resort to such measures in the case of seasonal work; when production is reduced or temporarily suspended; as a result of breakdown of machinery and equipment or during repair work. The company is not obliged to transfer operating assets to conservation (with the exception of strategic institutions), but has the right. Since conservation costs are allowed to be accepted as non-operating for tax accounting (subclause 9, clause 1, article 265 of the Tax Code of the Russian Federation) and as other costs for accounting (clause 4, 11 PBU 10/99), sometimes it is useful to transfer unused objects to conservation for a period of 3 months

Tax paid in connection with the application of the simplified tax system

The costs of conservation, re-preservation, as well as the maintenance of mothballed OS are not taken into account in tax expenses.

If an asset is transferred for conservation for a period of more than three months, the cost of which has not yet been fully taken into account in expenses, then the inclusion in expenses of the costs of acquiring this asset is suspended for the period of preservation (Letters of the Federal Tax Service dated December 14, 2006 N 02-6-10 / [email protected] , Federal Tax Service for Moscow dated January 18, 2007 N 18-03/3/ [email protected] ).

Example

An organization purchased production equipment under a sales contract and put it into operation in May 2021.The contractual cost of the equipment is RUB 944,000. (including VAT RUB 144,000).

The purchased equipment belongs to the third depreciation group.

The useful life established by the organization for accounting and tax accounting purposes is 38 months (based on the Classification of fixed assets included in depreciation groups, approved by Decree of the Government of the Russian Federation dated January 1, 2002 N 1).

Due to a temporary decrease in orders at the end of May 2021, the OS facility was transferred, by decision of the manager, to mothballing for more than three months from 06/01/2016 to 09/30/2016.

Depreciation for accounting and tax purposes is calculated using the straight-line method.

Income and expenses are determined using the accrual method.

Then, based on the established useful life (38 months), the monthly amount of depreciation charges will be 21,052.63 rubles. (RUB 800,000 / 38 months).

The accrual of depreciation charges for an asset begins on the first day of the month following the month in which the asset was accepted for accounting, in this case, June.

At the same time, the accrual of depreciation charges when transferring an asset by decision of the head of the organization to conservation for a period of more than three months is suspended.

In this case, by decision of the manager, the facility was mothballed from 06/01/2016 to 09/30/2016.

Therefore, no depreciation is charged for the period June - September 2021.

Starting from October 2021, depreciation on fixed assets is accrued in accordance with the generally established procedure.

In accounting, the conservation operation of an asset should be reflected with the following entries:

Contents of operations Debit Credit Amount, rub. Primary document In May 2021 Costs for purchasing equipment are reflected 08 60 800 000 Supplier shipping documents VAT presented by the equipment supplier is reflected 19 60 144 000 Invoice Accepted for deduction of VAT presented by the equipment supplier 68-VAT 19 144 000 Invoice Purchased equipment is reflected as part of fixed assets 01″Fixed assets in operation” 08 800 000 Certificate of acceptance and transfer of fixed assets Payment for equipment has been transferred to the supplier 60 51 944 000 Bank account statement In June 2021 The initial cost of equipment transferred to conservation is reflected 01″Fixed assets for conservation” 01″Fixed assets in operation” 800 000 The manager’s order to transfer the equipment to conservation, Conservation Act,

Inventory card for recording a fixed asset item

Upon completion of conservation The initial cost of the equipment is reflected as part of the OS in operation 01″Fixed assets in operation” 01″Fixed assets for conservation” 800 000 Inventory card for recording a fixed asset item Starting October 2021 for 38 months Accrued depreciation on equipment 20 (26,44) 02 21 052,63 Accounting certificate-calculation

Conservation of capital construction projects

Created: July 01, 2015

Conservation of a capital construction project is a temporary suspension of construction for a period of more than 6 (six) months and bringing the facility and the territory used for construction to a condition that ensures the strength, stability and safety of the main structures, and the safety of the facility for the population and the environment.

In the event of termination of construction (reconstruction) of a capital construction project or if it is necessary to suspend construction (reconstruction) of a facility for a period of more than 6 months with the prospect of its resumption in the future in accordance with Art. 52 clause 4 of the Town Planning Code of the Russian Federation, the developer must ensure conservation of the capital construction project.

The rules for the conservation of a capital construction project, approved by Decree of the Government of the Russian Federation of September 30, 2011 No. 802, establish the procedure for the conservation of objects.

The decision on conservation (with the exception of a state-owned property) and on the source of funds to pay the costs associated with the conservation of the object is made by the developer (customer).

Conservation of a capital construction project can be carried out at varying degrees of completion of construction.

The degree of completion of construction is determined as follows:

- Initial stage of construction;

- Middle stage of construction;

- High stage of construction;

- Final stage of construction;

After making a decision to mothball a capital construction project, the developer is obliged to:

— determine the list of works for conservation of the object;

— appoint persons responsible for the safety and security of the facility;

— determine the time frame for the development of technical documentation necessary to carry out conservation work on the facility;

— carry out an inventory of completed construction work;

— ensure the preparation of technical documentation;

And also the developer is obliged, within 10 calendar days after making a decision to mothball the facility, to notify the contractor, the body that issued the construction (reconstruction) permit, as well as the state construction supervision body if the construction (reconstruction) of the facility is subject to state supervision .

Resumption of construction

In the event of resumption of construction (reconstruction) at a previously mothballed facility, the developer (customer) carries out:

a) technical inspection of the facility, the results of which determine the required volume and cost of work to restore the structural elements or parts of the facility that were lost or destroyed during the conservation period;

b) introducing (if necessary) changes to previously prepared project documentation with the subsequent conduct of state examination and state environmental examination of these changes, if the legislation of the Russian Federation provides for such an examination, or the preparation of new project documentation.

And also the developer (customer) is obliged in advance, but no later than 7 working days before the resumption of construction (reconstruction) of the facility, to send to the body that issued the permit for the construction (reconstruction) of the facility, as well as to the state construction supervision body if construction (reconstruction) of the facility is subject to state construction supervision, notification of the resumption of construction (reconstruction) of the facility.

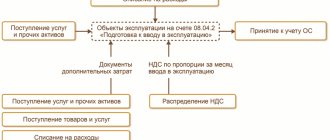

Figure 1 summarizes the above information.

Figure 1. Conservation of a capital construction project.

Comments

- Comments

- In contact with

Download SocComments v1.3

Add a comment

JComments

Sale of a mothballed fixed asset

When selling depreciable property, the taxpayer has the right to reduce the income received by its residual value (clause 1, clause 1, article 268 of the Tax Code).

And when selling other property, by virtue of the provisions of paragraphs. 2 p. 1 art. 268 of the Code, the organization reduces the income received by the price of acquisition (creation) of this property, as well as by the amount of expenses associated with their acquisition.

Since an object transferred to conservation for a period of more than three months is excluded from depreciable property, it follows from the literal interpretation of these norms that it belongs to other property.

Therefore, income from its sale can be reduced by the price of its acquisition and other costs associated with its purchase.

However, representatives of the Federal Tax Service in Letter dated January 12, 2021 N SD-4-3 / [email protected] pointed out the fallacy of this approach.

They explained their position as follows:

In this case, expenses (or part thereof) for the purchase of fixed assets will be taken into account as expenses twice (through the depreciation mechanism and when selling the fixed assets).

And this is unacceptable due to the interpretation of paragraph 5 of Art. 252 of the Code.

Let us remind you that this norm stipulates that the amounts reflected in the taxpayer’s expenses are not subject to re-inclusion in the taxpayer’s expenses. Accordingly, according to representatives of the Federal Tax Service, when selling a “mothballed” OS, the provisions of paragraphs. 2 p. 1 art. 268 of the Code do not apply.

Operations for the sale of fixed assets that are under conservation are reflected on lines 010 – 060 of Appendix 3 to sheet 02 of the income tax return.

In the letter, the tax service also provides examples from arbitration practice to support its position.

These are the decisions of the Eleventh Arbitration Court of Appeal dated December 9, 2009 in case No. A55-9340/2009, FAS SZO dated June 25, 2007 in case No. A56-51992/2005, FAS PO dated March 30, 2005 No. A12-21856/04-S29, in which judges indicate the illegality of the taxpayer’s application of the provisions of paragraphs. 2 p. 1 art. 268 of the Tax Code of the Russian Federation when selling fixed assets that are under conservation.

In other words, in such situations, income from the sale of a “mothballed” object is reduced by its residual value, which is defined as the difference between the initial cost of the fixed assets and the amount of depreciation accrued over the period of operation.

Example

An organization purchased and put into operation a fixed asset in February 2012. Its initial cost was 1,600,000 rubles.The fixed asset was assigned to the fourth depreciation group with a useful life of 80 months (from March 2012 to October 2021 inclusive).

The organization uses the straight-line depreciation method.

The monthly depreciation rate is 1.25% (1/80 month).

The monthly depreciation amount is 20,000 rubles. (RUB 1,600,000 x 1.25%).

In April 2021, a decision was made to transfer this fixed asset to conservation for a period of eight months (from April 5 to December 5 inclusive).

From May 1, 2021, depreciation on this fixed asset will cease.

In August 2021, the mothballed object was sold at a price of RUB 826,000. (including VAT - 126,000 rubles).

For tax purposes, income from sales amounted to 700,000 rubles. (826,000 - 126,000).

When selling a mothballed asset, the organization has the right to reduce the income from its sale by the residual value of this object.

Before conservation, depreciation on fixed assets was accrued over 50 months. (from March 2012 to April 2021 inclusive).

A total of 1,000,000 rubles were accrued. (RUB 20,000 x 50 months).

The residual value is 600,000 rubles. (1,600,000 - 1,000,000).

The profit from the sale of property will be 100,000 rubles. (700,000 - 600,000).

In accounting, the transaction for the sale of a mothballed object must be reflected as follows:

Contents of operations Debit Credit Amount, rub. Primary document In February 2012 Costs for purchasing equipment are reflected 08 60 1 600 000 Contract of sale, Supplier shipping documents

VAT presented by the equipment supplier is reflected 19 60 288 000 Invoice Accepted for deduction of VAT presented by the equipment supplier 68-VAT 19 288 000 Invoice Purchased equipment is reflected as part of fixed assets 01″Fixed assets in operation” 08 1 600 000 Equipment acceptance certificate Payment for equipment has been transferred to the supplier 60 51 1 888 000 Bank account statement From March 2012 to April 2021 inclusive Accrued depreciation on equipment 20 02 1 000 000 Accounting certificate-calculation On the date of transfer of equipment for conservation The initial cost of equipment transferred to conservation is reflected 01″Fixed assets for conservation” 01″Fixed assets in operation” 1 600 000 The manager’s order to transfer the equipment to conservation, Conservation Act

In August 2021 Other income from the sale of equipment is recognized 62 91-1 826 000 Equipment purchase and sale agreement, Certificate of acceptance and transfer of fixed assets

The initial cost of the retired equipment is reflected 01 “Disposal of fixed assets” 01″Fixed assets for conservation” 1 600 000 Certificate of acceptance and transfer of fixed assets The amount of accrued depreciation on retired equipment is reflected 02 01 “Disposal of fixed assets” 1 000 000 Certificate of acceptance and transfer of fixed assets, Accounting certificate-calculation

The residual value of the equipment is written off 91-2 01 “Disposal of fixed assets” 600 000 Certificate of acceptance and transfer of fixed assets VAT charged to the buyer of the equipment 91-2 68-VAT 126 000 Invoice

Accounting for mothballed objects

Material assets that are under conservation continue to be included in fixed assets (paragraph 2, clause 7 of the GHS “Fixed Assets”).

When conservation of property for a period of more than three months and its subsequent re-conservation, accounting entries for the corresponding analytical accounts of account 101 00 “Fixed assets” are not made, only the corresponding entry is made in the inventory card (clause 10 of Instruction No. 162n).

At the same time, in order to reflect additional data in the reporting, when forming its accounting policy, the institution has the right to provide additional analytics for account 0 101 00 000 in relation to objects under conservation (Letter of the Ministry of Finance of the Russian Federation No. 02-07-07/84237).

Also, to reflect in accounting the transfer of fixed assets to conservation for a period of three months or less, it is necessary to provide for this in the accounting policy of the institution (clause 6 of Instruction No. 157n).

From 01/01/2018, mothballed property is depreciated according to new rules. According to paragraphs. “b” clause 8 of the GHS “Impairment of Assets” conservation is one of the internal signs of asset impairment. Therefore, if an item of fixed assets is idle and not used, depreciation on it is not suspended (clause 34 of the GHS “Fixed Assets”). The exception applies only to objects whose residual value has become zero.

Taking into account the above, it is necessary to charge depreciation for all fixed assets that are under conservation.

If the object was mothballed before 01/01/2018 for a period of more than three years and, in accordance with the previously valid provisions of Instruction 157n, depreciation was not accrued for this object, then from 01/01/2018 it must begin to be accrued (Letter of the Ministry of Finance of the Russian Federation No. 02-07-07 /84237).

Clause 85 of Instruction No. 157n, in force until 01/01/2018, provided for the suspension of depreciation when transferring an asset to conservation for a period of more than three months.

Example. The fixed asset facility was mothballed from 01/01/2017 for 2/3 years. Its useful life is 7 years, book value is 115,000 rubles, before conservation, depreciation on it was accrued in the amount of 57,500 rubles. The object was preserved for 1 year (12 months). During this period, no depreciation was accrued on it.

As of 01/01/2018, the remaining period of conservation of the object is 1 year (12 months), and the remaining useful life of the object is 2.6 years (30 months). The institution decided to resume depreciation from the specified date. The accounting policy provides for the straight-line method of calculating depreciation.

The program must reflect the following correspondence: Dt 1,401.20,271 – Kt 1,104.34,411 in the amount of RUB 1,917.

The monthly depreciation charge for a mothballed object is reflected based on its residual value and remaining useful life ((115,000 - 57,500) rubles / 30 months).

Corporate income tax return

Transactions on the sale of depreciable property are subject to reflection in Appendix 3 to sheet 02 of the corporate income tax declaration.

| Indicators | Line code | Amount in rubles |

| Number of objects for sale of depreciable property – total | 010 | 1 |

| Including objects sold at a loss | 020 | – |

| Proceeds from the sale of depreciable property | 030 | 700 000 |

| Residual value of sold depreciable property and expenses associated with its sale | 040 | 600 000 |

| Profit from the sale of depreciable property (excluding objects sold at a loss) | 050 | 100 000 |

| Losses from the sale of depreciable property excluding objects sold at a profit) | 060 | – |

Sale of a mothballed fixed asset item at a loss

If the property is sold at a loss, the following features are taken into account.

According to paragraph 2 of Art. 268 of the Tax Code of the Russian Federation, if the purchase price of a product, taking into account the costs associated with its sale, exceeds the proceeds from its sale, the difference between these values is recognized as a taxpayer’s loss, taken into account for tax purposes.

Paragraph 3 of this article provides that if the residual value of depreciable property, taking into account the costs associated with its sale, exceeds the proceeds from its sale, the difference between these values is a taxpayer’s loss, taken into account for tax purposes in the following order:

The resulting loss is included in the taxpayer's other expenses in equal shares over a period defined as the difference between the useful life of this property and the actual period of its operation until the moment of sale.

And only if the remaining SPI is equal to zero or a negative number, then the amount of the resulting loss is recognized by the organization as part of other expenses in full in the month in which the sale occurred (see Letters of the Ministry of Finance dated July 12, 2011 N 03-03-06/ 1/417, dated May 12, 2005 N 03-03-01-04/1/253, etc.).

When selling fixed assets, the taxpayer has the right to reduce income from the said operation by the residual value of these objects.

How to calculate a loss if the property was mothballed

According to paragraph 3 of Art.

256 of the Tax Code of the Russian Federation, fixed assets transferred by decision of the organization’s management for conservation for a period of more than three months are excluded from depreciable property for the purpose of calculating income tax. When an object of fixed assets is re-mothballed, depreciation is accrued on it in the manner in force before its mothballing, and the useful life is extended for the period that the object is mothballed.

If a taxpayer sells at a loss a fixed asset that, for one reason or another, has been mothballed for more than three months, then when determining the actual service life of this object (on the basis of which the period for writing off the loss is calculated), the mothballing period is not taken into account.

Application of PBU 18/02

As a result of the sale of an fixed asset, an organization forms a deductible temporary difference (DTD) due to the different order of recognition in accounting and tax accounting of a loss from the sale of fixed assets (the loss is recognized at a time in accounting and evenly over a period defined as the difference between its useful life and the actual period of its operation until the moment of sale in tax accounting).

This IVR corresponds to a deferred tax asset (DTA) (clauses 11, 14 of the Accounting Regulations “Accounting for calculations of corporate income tax” PBU 18/02, approved by Order of the Ministry of Finance of Russia dated November 19, 2002 N 114n).

During the period defined as the difference between its useful life and the actual life of its operation until the moment of sale of months (as the loss from the sale of an fixed asset is recognized in tax accounting), the named IVR and ONA are reduced (repaid) (clause 17 of PBU 18/02 ).

Example

Let’s use the data from the above example with the only difference that the fixed asset, which was being preserved, was sold at a price of 531,000 rubles. (including VAT – 81,000 rubles).

For tax purposes, income from sales amounted to 450,000 rubles.0).

When selling a mothballed fixed asset, the organization has the right to reduce the income from this operation by the residual value of this object.

The loss from the sale of property is 150,000 rubles. (450,000 - 600,000).

From the moment equipment depreciation began (March 2012) to the month of its sale (August 2021), 54 months passed.

The period during which the property was conserved (4 months) is excluded from this period.

In fact, the equipment was operated for 50 months (54 - 4).

Therefore, in accordance with paragraph 3 of Art. 268 of the Tax Code of the Russian Federation, the taxpayer will reflect the loss in other expenses for 30 months (80 - 50).

The amount of loss recognized in tax accounting monthly will be 5,000 rubles. (RUB 150,000 / 30 months).

The amount of this loss will be included in other expenses starting in September 2021.

In accounting, the operation of accrual and repayment of IT must be reflected as follows:

Debit 09 Credit 68 “Calculations for corporate income tax” - 30,000 rubles. - ONA accrued (RUB 150,000 x 20%);

Within 30 months:

Debit 68 “Calculations for corporate income tax” Credit 09 – 1,000 rubles. – reduced (repaid) OTA (RUB 30,000 / 30 months).