Accounting and tax accounting of fixed assets in 2016

Accounting and tax accounting of fixed assets are determined by different regulatory documents, as a result of which accountants use different methods of writing off fixed assets, which lead to the formation of differences, and as a result, to the emergence of a tax liability. What surprises await us in 2021 with the introduction of new limits on the value of fixed assets?

From January 1, 2021, a new limit on the value of fixed assets for tax accounting is introduced - 100,000 rubles. For accounting, the limit has not changed - 40,000 rubles. How to write off the cost of fixed assets without creating temporary differences, and is this possible? How to correctly formulate the rule for writing off the cost of fixed assets in the accounting policy? Would, for example, the following formulation be correct: “Property worth less than 100,000 rubles with a useful life of more than a year is classified as material expenses and is written off as expenses evenly, based on its useful life (clause 3, clause 1, article 254 of the Tax Code of the Russian Federation) )", "Property worth from 40,000 to 100,000 rubles with a useful life of more than a year is classified as material expenses and is written off as expenses evenly, based on its useful life (clause 3, clause 1, article 254 of the Tax Code of the Russian Federation)." “Property worth up to 40,000 rubles with a useful life of more than a year is classified as material expenses and is written off as expenses at a time at the time of commissioning.”

Let's consider how the law interprets this situation. Based on paragraph 1 of Art. 256 of the Tax Code of the Russian Federation, depreciable property for profit tax purposes is property, results of intellectual activity and other objects of intellectual property that are owned by the taxpayer (unless otherwise provided for in Chapter 25 of the Tax Code of the Russian Federation), are used by him to generate income and the cost of which is repaid by depreciation charges. Depreciable property is property with a useful life of more than 12 months and an original cost of more than 100,000 rubles.

In accordance with paragraph 1 of Art. 257 of the Tax Code of the Russian Federation, fixed assets for profit tax purposes are part of the property used as means of labor for the production and sale of goods (performance of work, provision of services) or for the management of an organization with an initial cost of more than 100,000 rubles.

The criterion in the amount of 100,000 rubles is valid from 01/01/2016 and applies to depreciable property objects put into operation starting from 01/01/2016 (clauses 7, 8, article 2, parts 4, 7, article 5 of the Federal Law dated 06/08/2015 No. 150-FZ).

Accounting for fixed assets

Accounting for fixed assets is determined in accordance with clause 4 of PBU 6/01 “Accounting for fixed assets” (hereinafter referred to as PBU 6/01), which states that property is recognized as a fixed asset subject to certain conditions: 1. The object is used for the production of products (performance works, provision of services), for the management needs of the organization or for provision by the organization for a fee for temporary possession and use or for temporary use; 2. The period of use of the object is determined by a duration exceeding 12 months; 3. The object is obliged to bring economic benefits (income) to the company in the future; 4. The company does not intend to subsequently resell the property.

Moreover, companies have the right to reflect objects that meet the above conditions and cost within the limit approved in the accounting policy, but not more than 40,000 rubles per unit, in accounting as part of inventories (MPI) (4 paragraphs of paragraph 5 of PBU 6/01). But this rule is not the company’s obligation, but only its right, therefore it must be enshrined in the company’s accounting policies.

Tax accounting of fixed assets

As for tax accounting, here the value limit for property to belong to a fixed asset is determined by law, and does not allow the company to approve it independently. Those. from 01/01/2016 after changes made to Articles 256, 257 of the Tax Code of the Russian Federation, the following situation is possible: the same object, put into operation on 01/01/2016, costing, for example, 75,000 rubles in accounting will be recognized as an object of fixed assets, but will not be depreciable property for income tax purposes.

Expenses for the acquisition of property that is not depreciable are classified as material expenses in accordance with paragraphs. 3 p. 1 art. 254 Tax Code of the Russian Federation. Moreover, the cost of non-depreciable property is included in material costs in full when it is put into operation. In addition, if the value of property is written off over more than one reporting period, the taxpayer has the right to independently determine the procedure for recognizing the value of this property as part of material expenses, taking into account the period of its use or other economically feasible indicators.

Thus, taxpayers have the right to independently determine the period for writing off the value of property that is not depreciable, taking into account economically sound indicators, which should be enshrined in the accounting policy. The law does not establish any restrictions on the timing of write-offs and the amounts of non-depreciable property.

Waiting for change

Adjustments to the lower limits of the value of fixed assets in accounting and tax accounting occurred more than once, and, as a rule, an increase in one limit was followed by a similar increase in the second. The latest increase in the minimum value of fixed assets was carried out unilaterally. True, on 06/07/2016 the Ministry of Finance of the Russian Federation announced plans to develop five new accounting standards, including for fixed assets. But the timing of these changes is not yet known.

Luiza Bayanova , project manager "Kontur-Accounting Active"

Cost limits

In accounting, property worth up to 40,000 rubles can be legally written off as expenses at a time (PBU 6/01). This means that it does not need to be taken into account on account 01 and amortized.

The situation is completely different in tax accounting. Fixed assets more expensive than 100,000 rubles must be depreciated; anything cheaper will have to be written off immediately as expenses (Clause 1, Article 256 of the Tax Code of the Russian Federation). This rule applies only to property put into operation after December 31, 2015.

Let us summarize the rules for accounting for fixed assets.

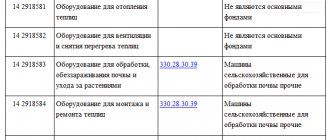

1.OS up to 40,000 rubles

Accounting: can be written off as expenses immediately as part of the inventory or registered as a fixed asset and depreciation charged.

Tax accounting: write off immediately upon commissioning as costs.

2.OS from 40,000 to 100,000 rubles

Accounting: register as a fixed asset and calculate depreciation.

Tax accounting: write off immediately upon commissioning as costs.

3.OS more expensive than 100,000 rubles

Accounting: register as a fixed asset and calculate depreciation.

Tax accounting: register as a fixed asset and calculate depreciation.

As you can see, the tax and accounting rules for fixed assets unconditionally coincide if the property is more than 100,000 rubles. You can compare tax and accounting when purchasing an operating system less than 40,000 rubles by writing off the property as expenses at a time.

In all other cases, temporary differences will arise (PBU 18/02).

However, in tax accounting, non-depreciable property up to 100,000 rubles can be written off in parts (clause 3, clause 1, article 254 of the Tax Code of the Russian Federation). But in this case, it is safer to write off in the same way property worth up to 40,000 rubles, and valued from 40,000 to 100,000 rubles.

General OS statistics

Finally, let us remind you about the ability of StatCounter to combine statistics for desktops and mobile devices together. This is what the overall picture looks like as of July 2021:

And so it changed throughout the year. As you can see, back in December 2015, all versions of Android managed to bypass the most popular version of Windows and have been noticeably ahead since then.

If we talk about specific figures for the year and recent months, here they are:

- about the author

- Recent publications

Raik

Igor Andreev is the author of articles for ITRew.ru and Our-Firefox.ru. I am passionate about modern technologies, I talk about them in my texts) Follow me — twitter.com

Raik recently posted (see all)

- The most anticipated smartphones 2021 (updated) - 05/04/2021

- Rating of smartphone manufacturers 2021 - 03/05/2021

- Choose the best gadgets as a gift in 2021 - 02/17/2021

Tell others:

- Click to share on Twitter (Opens in new window)

- Click here to share content on Facebook. (Opens in a new window)

- Click to print (Opens in new window)

- Click to share on Pinterest (Opens in new window)

- Click to share on Telegram (Opens in new window)

- Click to share on WhatsApp (Opens in new window)

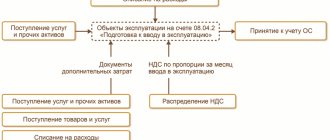

Accounting for temporary differences using an example

Let's look at an example of how to take into account the differences that arise in accounting.

Stena LLC bought a monitor in January 2021. In the same month, the monitor was put into operation in the HR department. The cost of the monitor excluding VAT is 51,300 rubles. Useful life 36 months. According to the accounting policy, a monitor is a fixed asset in accounting, and a low-value property in tax accounting.

Debit 01 Credit 08 - 51,300 - the monitor is put into operation.

Debit 68 Credit 77 - 10,260 (51,300 × 20%) - deferred tax liability (DTL) is reflected.

Starting in February and for 36 months, the accountant of Stena LLC will make the following entries:

Debit 44 (26, 25, etc.) Credit 02 - 1,425 (51,300: 36) - depreciation accrued in February.

Debit 77 Credit 68 - 285 (1,425 × 20%) - deferred tax liability repaid.

When purchasing property, it is important to know the nuances of its accounting. Errors can lead to incorrect income tax calculations. Incorrect entries can lead to distortion of accounting and reporting. Act in accordance with the rules of accounting policies, the Tax Code of the Russian Federation and approved PBUs, then the inspectors will not have any questions.

Source

The popularity of mobile OSes versus desktop ones, Apple's problems, the successes of Samsung and the Chinese

Microsoft's main concern right now is the mobile market. The problem is that mobile devices are gradually replacing desktop PCs:

After a slight adjustment in June, StatCouner again recorded a record volume of traffic from mobile devices in July. Smartphones and phablets alone already generate 44.75% of traffic, compared to 37.15% for the same period last year.

StatCouner has been observing this growth for a long time, and the key question is: at what point will it slow down. It is already obvious that mobile devices will take at least half of the traffic. However, they can move much further, significantly narrowing their “living” space for Microsoft, as well as for a number of other companies, including hardware companies.

What makes the situation worse for Microsoft is that it actually failed to enter the mobile market itself. Yes, there is a seemingly successful line of Surface tablets, but look at the picture above: what kind of traffic is generated by the stalled tablet market and how smartly smartphones and phablets are moving forward.

All of Microsoft's attempts, from the ridiculous story with the Kin smartphones in 2010 to the already quite solid Lumia line, ultimately ended negatively.

Moreover, what ultimately happened with Lumia is difficult to understand. Why, when, at what stage and who in the company’s management decided to put an end to this line, and, therefore, put Windows Mobile under severe attack is a mystery.

Of course, MS, given its colossal resources, will clearly not give up the battle for mobile devices and is now simply preparing to announce a certain new line of smartphones, now, most likely, under the Surface brand. However, is the corporation really so confident in it that it shut down devices that were selling up to 10 million per quarter?

However, Microsoft is far from the only ones who are planning or even already having problems. For example, Apple. In July, the company summed up the results of the next quarter and again announced a decrease in income.

The first time Apple did this was in April of this year, now the situation has repeated itself again, and Tim Cook is already suggesting that the next reporting period may turn out to be “so-so.”

Revenues are declining due to decreased demand for all key Apple devices. First of all, this concerns iPhone smartphones, which form the lion's share of the corporation's financial revenues. Over the last quarter, Apple was able to sell “only” 40 million devices compared to 47.5 million in the same period last year.

The compact and more affordable iPhone SE, shown in March, not only did not help increase sales of Apple devices in quantitative terms, but also seemed to harm in terms of income, since some users preferred this cheaper model instead of the iPhone 6S and 6S Plus.

As a result, there is every reason to believe that the iPhone SE will not have subsequent models, just as the iPhone in a plastic case with the letter “C” in the name did not have them. Thus, Apple’s second attempt to enter a more affordable price category turned out to be a failure.

In addition to the iPhone, iPad sales are falling. Here, however, the two iPad Pros presented last fall and this spring managed to slow down this decline. Mac sales are also falling, and income from the “Other” category, which, among other things, includes the Apple Watch smart watch, is also declining. Their second version will be released in the fall, but it is already obvious that the Watch is unlikely to ever bring in the same money as the iPhone or even the iPad, although high hopes were placed on them.

The main horror of Apple at the moment is that their flagship product for this fall - iPhone 2021 (the name is unknown, it’s not a fact that there will be a number “7”) differs very slightly in terms of design from the 6S and is minor, not major renewal, as previously happened in even years. This means that Apple can then announce failures for another four quarters until the release of the anniversary iPhone 2021.

The company's fans even believe in the latest device, released ten years after the presentation of the first iPhone, as a salvation from all troubles. According to rumors, the iPhone 2021 should have an “edge-to-edge screen,” a touch-sensitive Home button, and a new design with an OLED display to boot.

It's funny, but these rumors could further harm sales of the model coming out this year. And that same miracle display in 2017 can eliminate frames not from the entire front side of the device, as fans dream, but only from its side edges, as Samsung has been doing for the second year in its flagships. Moreover, it will supply displays for Apple.

By the way, it is the Korean Samsung, together with an armada of Chinese companies, that now act as the locomotive thanks to which Android, having dealt with all other systems, began to push iOS out of the market. In July, Android reached 65.17, up 0.64% from the previous month. The share of iOS, on the contrary, fell by 0.75% over the month.

Thanks to the success of the flagship Galaxy S7 and budget Galaxy J, Samsung feels great financially, actively pushing Apple even in the USA.

At the beginning of August, the Korean giant demonstrated the Galaxy Note 7, its most sophisticated gadget, occupying the highest level in price categories. It is noteworthy that our SGN7 with 64 GB of permanent memory, despite its threatening price tag of 65 thousand, will cost a thousand less than even the most affordable iPhone 6S Plus, which has only 16 GB of memory. And this despite the fact that the new Galaxy Note has a larger screen, more RAM, and even a proprietary stylus included.

In turn, the Chinese are even more impressive. For example, Xiaomi alone, which only recently announced its first laptops, is about to enter the smartwatch market. Before that, she showed the largest phablet and rethought the Mi Band bracelet, adding a built-in display.

Along the way, Xiaomi presented its first smartphone with a dual camera and an OLED display, and these displays are also made in China by Chinese companies. An entry-level VR gadget has just been announced, and a presentation of the flagship Mi Note smartphones is scheduled for the second half of August. And all this in just a few months from just one Chinese company.

Because of this activity of the Chinese and the growing strength of Samsung, it is becoming difficult for many manufacturers even in the Android camp. Although statistics show the overall growth of devices running Android, many companies there are starting to have problems due to the onslaught of competitors. It’s not good for Taiwanese HTC, the flagship G5 from the Koreans LG showed a very weak result, the market share of the Indian Micromax is declining, the sales of Xperia from the Japanese from Sony have dropped dramatically:

As for manufacturers who once tried to stay on the market with other OSes, all their attempts have long ago failed. In the statistics, you can see the market shares of WP and WinRT from Microsoft, a whole group of deceased OS from Nokia, the Blackberry system, and the Bada platform from Samsung, which are getting closer and closer to zero. WebOS, which Palm and HP once wanted to make leaders, has already completely disappeared. And Firefox OS and a number of other systems, unfortunately, did not even score hundredths to get at least to the “bottom” of these statistics.

This is how the popularity of mobile operating systems has changed over the past year and month, respectively:

The only thing that is a little curious is Tizen, but to be honest, we doubt that Samsung intends to promote it seriously and, most likely, is simply leaving it as an experiment and (or) insurance in case of an unforeseen deterioration in relations with Google.