In accordance with paragraph 1 of Article 164 of the Tax Code of the Russian Federation, a zero VAT rate can be applied in the following cases: for exported goods, for international transportation services, for the sale of other goods, works, services specified in paragraph 1 of Article 164 of the Tax Code of the Russian Federation, in passenger transportation, when sale of goods, works, services in the field of space activities, sales of precious metals and other operations. Let us consider individual cases of applying the zero VAT rate when exporting goods and international transportation.

Zero VAT rate for export of goods

A zero VAT rate is applied when exporting goods, as well as when placing products under the free customs zone procedure. In connection with the entry into force of the law of May 30, 2021 No. 150-FZ, significant changes in legislation occurred on July 1, 2021. Exporters are given the opportunity to receive VAT deductions in an accelerated manner. These changes do not apply to the sale of commodities. Raw materials in accordance with paragraph 3 of clause 10 of Article 165 of the Tax Code of the Russian Federation include mineral products, products of the chemical industry and related industries, wood and products made from it, charcoal, pearls, precious and semi-precious stones, precious and base metals and products from them. Accordingly, VAT on incoming documents when selling other products for export, which by definition does not relate to raw materials, can be taken into account in the usual manner for goods, works, services, property rights that are accepted for accounting from July 1, 2021.

Thus, the procedure for confirming exports has undergone changes in terms of the absence of the obligation to restore VAT from July 1, 2021. However, other procedures regarding the collection, timing and procedure for confirming exports, as well as recording transactions for goods, works, services, property rights that were accepted for accounting before July 1, 2021, remained the same.

Sales of services

Accounting in 1C

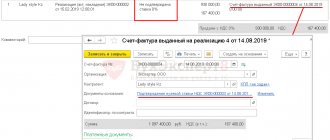

Sales of services are documented in the document Sales (act, invoice) transaction type Services (act) in the section Sales – Sales – Sales (acts, invoices).

Pay attention to filling out the column:

- %VAT is the VAT rate that will be applied instead of the 0% rate. In our example, 18% .

The document is filled out in currency, since the agreement is concluded in EUR. In the postings, the amounts are reflected in both rubles and foreign currency.

This is due to the fact that accounting in the Russian Federation is carried out in rubles. The value of assets or liabilities in foreign currency is subject to conversion into rubles (clause 4 of PBU 3/2006).

Postings according to the document

The document generates transactions:

- Dt 62.22 Kt 62.21 - offset of advance payment;

- Dt 62.21 Kt 90.01.1 - revenue from the sale of services;

- Dt 90.03 Kt 68.02 - VAT accrual on revenue.

According to the legislation, the tax base for VAT in foreign currency is recalculated into rubles at the rate of the Central Bank of the Russian Federation on the date of sale (clause 3 of Article 153 of the Tax Code of the Russian Federation), the rate on the date of the advance is not taken into account. Therefore, revenue in accounting and NU may differ from the tax base for VAT.

When converting revenue from foreign currency into rubles for:

- BU and NU the exchange rate of the Central Bank of the Russian Federation is applied on the date of the advance and on the date of sale (clause 9 of PBU 3/2006, clause 8 of Article 271 of the Tax Code of the Russian Federation);

- To calculate the tax base for VAT, only the exchange rate of the Central Bank of the Russian Federation on the date of shipment of goods is used (clause 3 of Article 153 of the Tax Code of the Russian Federation).

Calculation of the ruble amount of sales proceeds and the tax base including VAT.

date Name Amount, EUR Well Amount, rub. April 16 Revenue from sales of services (the paid part is assessed at the exchange rate on the date of prepayment) 350 75,7507 26 512,75 April 27 Tax base for VAT 350 79,2839 27 749,37

Transfer of documents when exporting to the EAEU

As before, in the case of export to countries that are members of the Eurasian Union, the following documents must be submitted to the inspection: contract, sales document (usually the TORG-12 invoice form is used), transport documents, application for payment of indirect taxes. Moreover, in accordance with paragraph 9 of Article 165 of the Tax Code of the Russian Federation, the period for collecting and submitting documents is 180 calendar days from the date of placing the goods under customs export procedures. The documents must be submitted simultaneously with the VAT return for the quarter in which the papers are fully collected, but no later than the quarter in which the 180-day period expires. In case of export to other countries, it is also necessary to provide documents within a similar period: a contract, a customs declaration (its copy) with marks from the Russian customs authority that released the goods in the export procedure, transport documents.

Read also “When do inspectors require confirmation of a zero VAT rate?”

A special case

In a situation where the goods are placed under a customs procedure in a free customs zone, then the following must be submitted:

- agreement (copy of the agreement) concluded with the resident;

- a certificate (copy of the certificate) is provided, indicating the registration of the person as a resident of the special economic zone;

- bank statement (copy of bank statement) as well as a copy of the cash receipt order, which confirms the receipt of revenue;

- customs declaration (copy of the customs declaration) with the necessary marks from the customs service.

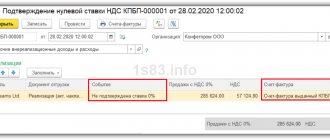

Confirmation of zero VAT rate on exports

To confirm the zero VAT rate on exports, it is possible to send instead of customs declarations and other documents confirming the export of goods: registers of customs declarations indicating the registration numbers of the relevant declarations instead of copies of the declarations themselves and registers of transport, shipping and (or) other documents confirming export goods, instead of copies of the specified papers.

Registers are submitted only in electronic format in the prescribed form. If you miss the deadline specified in the Tax Code, the taxpayer will be obliged to apply a rate of 10 or 18 percent to these transactions in the manner established for transactions for the sale of goods (works, services) on the domestic market. In the VAT return, the amount of documented exports at a zero VAT rate in the current quarter must be reflected in section 4 of the declaration. This section also reflects the amount of input VAT attributable to export sales, which is accepted for deduction in the current quarter. As stated above, along with the declaration, documents must be sent to the tax authority confirming the validity of applying the zero VAT rate. In the sales book, sales of services for export should be reflected in column 16 with transaction type code 01.

Use the online calculator to calculate VAT

Receipt of advance payment from a foreign buyer

Accounting in 1C

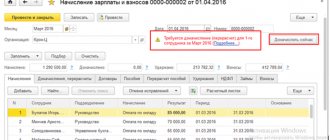

Receipt of an advance payment to the current account from the buyer is documented in the document Receipt to the current account transaction type Payment from the buyer in the Bank and cash desk - Bank - Bank statements section.

Pay attention to filling out the field:

- VAT rate - sets the VAT rate that will be used instead of the 0% VAT rate, in this case 18% .

Since payment by the buyer is made in foreign currency, the document states:

- Bank account - a transit currency account in EUR, into which funds are received from the buyer;

- The accounting account is “Currency accounts”, it is installed automatically when you select a foreign currency bank account.

Postings according to the document

The document generates transactions:

- Dt Kt 91.01 - revaluation of foreign currency balances on a foreign currency account in the form of a positive exchange rate difference;

- Dt Kt 62.22 - receipt of advance payment from the buyer.

Provision of international transportation services

In the case of provision of international transportation services in accordance with subclause 2.1 of paragraph 1 of Article 164 of the Tax Code of the Russian Federation, international transportation is also subject to a zero VAT rate. In this case, transportation for which the point of arrival/departure is located outside the territory of Russia is recognized as international. In the case of international transport, certain features must be taken into account. Thus, the contract must provide for the direct provision of a separate type of services for international transportation, i.e. these services should not be specified as an additional type of service under the main supply contract, etc. In addition, organizations providing international transportation services must use a zero VAT rate regardless of the number of companies and contractors providing transportation services. The zero VAT rate will apply even if the services are provided using several modes of transport.

Read also: “The zero VAT rate can be abandoned”

Zero and Twenty mixed together

We are exploring the issue of proper application of the VAT rate when transporting goods for export.

Recently, a colleague had a question from practice, the essence of which was as follows.

Question. The organization acts as a forwarder and organizes air transportation of goods along the route Yuzhno-Sakhalinsk - Malaysia. Customs clearance of goods is carried out at Sakhalin customs. Transportation consists of two stages: Yuzhno-Sakhalinsk - Moscow; Moscow - Malaysia.

The first airline applies a VAT rate of 20%, because... transportation is carried out across the territory of the Russian Federation. The freight forwarder, realizing that he may have the risk of refusal to deduct VAT (since the air carrier knew that the goods were exported), does not accept input VAT for deduction. This VAT amount is also not taken into account in income tax expenses.

How can a freight forwarder minimize risks? Are there any tools to influence carriers who carry goods across the territory of the Russian Federation as part of international transportation to ensure that they still apply a 0% VAT rate?

When solving the task, in order to structure the position, it was necessary to identify a number of sub-questions and answer them consistently.

- How is the taxation of freight forwarder services structured? How is the freight forwarder's taxable turnover determined - based on his remuneration or taking into account the cost of transportation, the costs of which are reimbursed by the client? Accordingly, who has the right to deduct VAT charged by the carrier: the forwarder or the client?

Applying these questions to our situation, it was necessary to decide for whom the risks associated with the carrier’s application of an incorrect VAT rate arise: for the forwarder or the client?

- When carrying out international transportation, can a carrier refuse to apply the 0% rate? What are the consequences of applying an incorrect rate?

- Under what conditions does transportation qualify as international?

- Can any civil law methods be used to protect the interests of the freight forwarder?

1. Under a transport expedition agreement (Article 801 of the Civil Code of the Russian Federation), the forwarder undertakes, in accordance with the instructions of the client (sender or recipient of the cargo) and at his expense, to organize the transportation of cargo, concluding transportation contracts on behalf of the client or on his own behalf, as well as to provide services related with transportation (ensure the dispatch or receipt of cargo, check its quantity and condition, prepare the documents necessary for transportation, etc.). A transport expedition agreement is an intermediary agreement, which is built on the model of an agency or commission agreement and also contains elements of an agreement for the provision of services for a fee.

2. Chapter 21 of the Tax Code of the Russian Federation does not directly establish the specifics of determining the tax base for VAT for freight forwarders . At the same time, these features can be derived based on the provisions of clause 3.1 of Article 169 of the Tax Code of the Russian Federation, which determine the procedure for issuing invoices by the forwarder[1].

According to this norm, forwarders [2] (regardless of whether they are VAT payers or not), concluding transportation contracts on their own behalf and in the interests of clients, are required to keep a log of received and issued invoices in relation to forwarding activities (as activities carried out in the interests of another person).

This obligation arises for the forwarder if the tax base for VAT [3] or income for calculating personal income tax, income tax, unified agricultural tax, simplified tax system [4] is determined by him as the amount of remuneration for forwarding services (excluding the cost of transportation, the costs of which are reimbursed by the client) .

3. From the provisions of paragraph. 2 and 3, paragraph 3.1, Article 169 of the Tax Code of the Russian Federation, it follows that the Code provides the parties to the contract with the opportunity to choose the most effective option for them .

These rules apply if the transport expedition agreement provides for the determination of the cost of the forwarder's services separately from its costs for transportation, which are subject to reimbursement by the client.

In this case, the forwarder “re-invoices” the VAT paid to the carrier to the client, who decides on the right to deduct this tax (based on his tax status, the nature of the activity for which transportation services were purchased, the legality of the carrier applying a rate of 20% instead of 0).

Accordingly, if the allocation of reimbursable costs is not provided for in the contract and the price of the freight forwarder’s services is formed with the inclusion of transportation costs, then the freight forwarder, who is a VAT payer, the tax base for this tax is determined based on the total cost of services. In this case, the right to deduct VAT paid to the carrier is the right of the forwarder, in the exercise of which he will have to resolve the issue of the legality of the carrier applying a rate of 20% instead of 0.

4. The exercise of the right to deduct VAT paid to the carrier during international transportation at a rate of 20% instead of 0 depends on the answer to the question: does the carrier have the right to refuse to apply the 0% rate ? If the answer to this question is positive, the exporter (in this case, the freight forwarder) cannot be denied the right to deduct.

Clause 7 of Article 164 of the Tax Code of the Russian Federation provides for such a possibility of refusal, provided that the decision to apply a 20% rate for international transportation services by the carrier is reported to the tax authority. With this decision, the application of a 20% rate cannot be selective; this rate must be applied by the carrier in relation to all international transport services specified by him.

In our example, the application of a 20% rate is based on the carrier’s assessment of the movement of goods along the Yuzhno-Sakhalinsk – Moscow route as not falling into the category of international transportation (including in the case when goods placed under the customs export regime are transported).

5. Let us assume that the carrier’s stated position regarding the qualification of the disputed services as not related to international transportation is incorrect. In this case, we are talking about the application of an inappropriate rate for transactions subject to VAT, which, according to established law enforcement practice, means that the customer cannot exercise the right to a tax deduction .

This approach was formed by the Presidium of the Supreme Arbitration Court of the Russian Federation in resolutions fourteen years ago No. 9263/05, 9252/05 . The basis was the motive of “the taxpayer’s lack of the right, at his own discretion, to change the established

tax legislation tax rate".

In making this decision, the Presidium believed that by doing so it was supporting exporters. Indeed, with the reverse approach, all carriers (which often occupy a dominant position in the relevant market), not wanting to implement the procedure for confirming the 0% rate and the right to VAT refund, will tax the services they provide at a rate of 20%.

From an economic point of view, this would mean diverting the exporter's money in the amount of tax paid for a period of time until he confirms the 0% rate and receives a refund. Carriers, on the contrary, would receive free lending in a mirror image.

Developing this position, the Presidium of the Supreme Arbitration Court of the Russian Federation assessed the condition for payment of VAT at a rate of 20% in relation to international transportation services as insignificant, which meant the invalidity of the transaction in this part and the customer’s right to demand a refund of the VAT amount as overpaid on the basis of the rules on unjust enrichment (on on the basis of subparagraph 1 of Article 1103 of the Civil Code of the Russian Federation on the return of what was executed under an invalid transaction)[5].

6. With the adoption by the Constitutional Court of the Russian Federation of 03.06.2014 No. 17-P “On checking the constitutionality of clauses 6 and 7 of Art. 168 and paragraph 5 of Art. 173 of the Tax Code of the Russian Federation", in which the idea was expressed about the right of persons who are not VAT payers, as well as taxpayers in relation to transactions named in Article 149 of the Tax Code of the Russian Federation, to enter into legal relations for the payment of this tax and issue invoices to the buyer with a highlight in them VAT, the precondition was laid for the revision of the position of mandatory application by the carrier of the 0% rate .

In my opinion, there is no fundamental difference when the contractor issues VAT on non-taxable transactions and transactions taxed at a rate of 0%. These situations must be dealt with uniformly.

However, the practice never came to uniformity. I am not aware of any examples where the courts, with reference to the said resolution of the Constitutional Court of the Russian Federation, stated the right of the contractor to apply a rate of 20% instead of zero and, as a consequence, the right of the customer to deduct VAT. On the contrary, there are counter examples permitted in accordance with the approach of the Presidium of the Supreme Arbitration Court of the Russian Federation (see, for example, the rulings of the Supreme Arbitration Court of the Russian Federation dated November 27, 2015 No. 307-KG15-14655, dated April 27, 2018 No. 307-KG18-1802).

The Supreme Court of the Russian Federation, when considering the case regarding the company "TD "Eldago Yug" ( SKES determination dated April 25, 2018 No. 308-KG17-20263 ), had the opportunity to establish a unified legal approach. However, this did not happen. SKES RF Armed Forces recognized the right of the forwarder to tax deduction of VAT paid to the carrier at a rate of 18% instead of 0, not on the basis of the carrier’s right to choose the rate, but on the basis of his ignorance of the further delivery of cargo for export transported by him within the borders of the Russian Federation.

7. Thus, at the moment, it should be stated that practice does not recognize the right to deduct VAT paid at a rate of 20% instead of 0. In this case, the customer can defend himself by insisting on the application of the proper rate and demanding an unjustified amount of tax paid from the contractor . It is also permissible to resolve disagreements regarding the proper VAT rate by submitting a pre-contractual dispute to the court for resolution: in accordance with Article 445 of the Civil Code of the Russian Federation, if the conclusion of an agreement for the carrier is mandatory by force of law (for example, due to its classification as a natural monopoly), or by agreement of the parties on the basis of Article 446 of the Civil Code of the Russian Federation.

8. From the perspective of the current day, apparently, it should be recognized that this decision to protect the customer in a civil dispute is not optimal . After the Constitutional Court of the Russian Federation stated in Resolution No. 17-P dated June 3, 2014, that the seller (performer) decides on the issue of taxation of VAT on the sale of goods (performance of work, provision of services), when such transactions are non-taxable due to their nature (Article 149 of the Tax Code of the Russian Federation ) or the tax status of the seller (performer), such discretion should be recognized when choosing a rate of 20% instead of 0. The assumption of such a choice is especially necessary when there is uncertainty in law enforcement on the issue of the proper rate (as is the case in the issue under consideration).

Denying the customer the right to a deduction when the parties agree on a rate of 20% instead of 0 in conditions where the budget does not incur losses due to the carrier paying the specified amount of tax to the budget is not a fair decision.

The motives for protecting the interests of the buyer, which were guided by the Presidium of the Supreme Arbitration Court of the Russian Federation in 2005, recognizing as unacceptable the parties’ agreement on a rate of 20% instead of 0, today no longer look convincing . There are other ways to maintain a balance of interests between the parties to the transaction. Firstly, if the customer disagrees with the counterparty’s proposal to tax transportation services at a rate of 20% instead of 0, he can enter into a transportation agreement with another carrier, for which the application of a zero rate (and all the associated administrative inconveniences of confirming it and receiving a VAT refund) will be be a competitive advantage. If it is mandatory for the carrier to conclude an agreement due to its classification as a natural monopoly, the carrier may be forced by the court to enter into an agreement at a 0% rate . If the problem of the proper rate is due to the uncertainty of law enforcement practice, then the parties can also refer this pre-contractual dispute to the court in accordance with Article 446 of the Civil Code of the Russian Federation.

9. In conclusion, it is necessary to answer the question: is there uncertainty in the application of the VAT rate when transporting between points located on the territory of the Russian Federation, if such transport is carried out in relation to goods placed under the export regime.

The Presidium of the Supreme Arbitration Court of the Russian Federation in a significant number of cases[6] expressed the position that the application of a 0% VAT rate is permissible in relation to the transportation of goods placed under the customs export regime.

If the goods are not placed under customs regime, then the zero rate is not applicable. In this case, it does not matter that the carrier is informed by the customer about the subsequent placement of the goods under the export customs regime and its export abroad.

The fact that transported goods are placed under the customs export regime is an objective and very understandable criterion. The subjective criterion (the carrier’s knowledge of the cargo owner’s intention to export the goods) cannot be considered as proper, since it is probabilistic in nature. For some reason, such an intention could not be realized by the owner and the carrier, without receiving export documents, would not be able to confirm the validity of applying the 0% rate.

In this sense, the above-mentioned decision of the SKES of the Armed Forces of the Russian Federation (determination No. 308-KG17-20263 of April 25, 2018) is indicative, within the framework of which the idea was expressed about the legality of the carrier’s application of the 18% rate due to his ignorance of the further delivery of cargo for export transported by him within the borders of the Russian Federation.

10. Unfortunately, the objective criterion (placing goods transported across the territory of the Russian Federation under the customs export regime) was not directly reflected in the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated May 30, 2014 No. 33 “On some issues that arise in arbitration courts when considering cases related to the collection of VAT".

A decision based on an objective criterion was reached in a different way.

According to the explanations contained in paragraph 18, “the provision of transportation services by several persons (multiple persons on the side of the contractor or the involvement of third parties (sub-contractors) by the main contractor) does not in itself prevent the application of a 0% tax rate by all persons involved in the provision of services. This rate is also applied by carriers providing services for the international transportation of goods at certain stages of transportation.”

From the above explanations it follows that if there are several carriers, they must be involved in transportation within the framework of a single transportation process. In the categories of civil law, this transportation must be direct or direct mixed (if transportation is carried out by different modes of transport). This can only take place when a single transportation document is issued and only if the goods accepted for transportation are placed under the customs export regime.

The understanding of transportation carried out by several carriers (one of which carries goods across the territory of the Russian Federation, and the other abroad) as international only if it is carried out within the framework of one contract and is documented in a single transportation document [7] was discussed at a meeting of the Presidium of the Supreme Arbitration Court of the Russian Federation when considering [8] draft resolution of the Plenum on VAT.

11. Taking into account the practice of the Presidium, as well as the legal position of the Plenum of the Supreme Arbitration Court of the Russian Federation, for a carrier to apply a 0% rate, it is not enough just that the goods transported through the territory of Russia are placed under the customs export regime. It is also necessary that the carrier carrying out transportation between points located on the territory of Russia be involved in transportation within the framework of a direct transportation contract (which is documented in a single transportation document).

The Plenum of the Supreme Arbitration Court of the Russian Federation allowed a complication of the conditions for qualifying transportation as international, which was due to the appearance in the Tax Code of the Russian Federation[9] of the concept of international transportation (transportation in which the point of departure or destination of goods is located outside the territory of the Russian Federation).

To clarify what should be understood by a contract of carriage in direct communication, we will cite the statements of leading Russian civil experts.

According to O.S. Ioffe, “the presence of one transport document is a necessary condition for qualifying transportation as carried out in direct mixed traffic: if, for example, the cargo travels by rail to a seaport using a railway bill of lading, and is transported from one seaport to another port According to the bill of lading, there are two independent contracts of carriage. Transportation in direct mixed traffic in this case will be if the cargo was delivered to the railway once and traveled the entire route according to the originally issued railway waybill.” V.V. Vitryansky o[10].

12. Summarizing the above considerations, we will draw the following main CONCLUSIONS :

- Informing the carrier by the customer that the goods transported through the territory of Russia will subsequently be placed under the customs export regime and exported abroad has no legal significance[11].

- For a carrier to apply a 0% rate for transportation across Russia, it is necessary that the goods not only be placed under the customs export regime, but also that such transportation is carried out under a direct transportation agreement (which is documented in a single transportation document).

- The carrier does not have the right to choose to apply a rate of 20% instead of 0.

- If the carrier unreasonably uses a rate of 20% instead of 0, the customer does not have the right to deduct VAT. Its defense is possible only through the recovery of the paid amount of VAT as unjust enrichment.

Questions similar to the one that became the topic of this material are often raised within the framework of educational tax intensives organized by the “Support” project (https://podderzhka.org/taxpro/buy-abonement/), the legal direction of which I have the pleasure of leading. And seemingly trivial situations, if you look deeper, become much more ambiguous than they initially looked. In the field of tax relations, given the current quality of legislative technology, problems await businesses literally out of the blue. Share with us questions and incidents from your personal experience, and we will try to answer the most interesting of them.

Sometimes harmful, outdated and simply ridiculous provisions, which for various reasons remain in the text of legal norms or have migrated into judicial practice, can be eliminated by organizing a broad discussion in the professional environment.

[1] Bearing in mind that this procedure is derived from the determination of the tax base.

[2] This procedure also applies to commission agents, agents operating on a commission model, and developers. The procedure for issuing invoices defined in clause 3.1 of Article 169 of the Tax Code of the Russian Federation corresponds to the rules for determining the tax base for VAT for persons carrying out activities in the interests of another person on the basis of agency agreements, commission agreements or agency agreements (clause 1 of Article 156 of the Tax Code of the Russian Federation) . These persons determine the tax base as the amount of income they received in the form of remuneration.

[3] For VAT payers.

[4] For VAT defaulters and persons exempted from fulfilling the obligation to pay this tax in accordance with Article 145 of the Tax Code of the Russian Federation.

[5] See resolutions of the Presidium of the Supreme Arbitration Court of the Russian Federation dated April 9, 2009 No. 16318/08, November 23, 2010 No. 9657/10, December 21, 2010 No. 1993/09, November 8, 2011 No. 6889/11.

[6] Resolutions of 1.04.2008 No. 14439/07, of 20.11.2007 No. 7205/07, of 6.11.2007 No. 10246/07, No. 10249/07, No. 10160/07, No. 10159/07, No. 1375/07 .

[7] This feature, without emphasis on it, is mentioned by the SKES of the Armed Forces of the Russian Federation in the decision of April 25, 2018 No. 308-KG17-20263 in the descriptive part of the decision: “transportation invoices do not confirm the fact that the carrier was involved as a co-contractor (sub-contractor) to perform a separate stage of international transportation of export goods.

[8] See discussion from 26 min. https://www.youtube.com/watch?v=p5Ni9A4MzTQ

[9] Para. second clause 2.1 clause 1 article 164 of the Tax Code of the Russian Federation.

[10] Quotes are given from the work of M.I. Braginsky, V.V. Vitryansky “Contract Law. Agreements on transportation, towing, transport expedition and other services in the field of transport" (Book 4) - Statute, 2003.

[11] This circumstance was rightly drawn attention to in the letter of the Federal Tax Service dated June 14. 2021 No. SA-4-7/ [email protected] No. On sending recommendations on the application of deductions for value added tax, taking into account judicial practice" (fifth paragraph from the end).

“When establishing during a tax audit that the taxpayer’s counterparty has information at his disposal that the transactions he carries out in favor of the taxpayer are related to the international transportation of goods, the tax authorities should take into account that this circumstance in itself cannot serve as an independent basis for denying the taxpayer the right for the application of VAT deductions.”

Is it necessary to indicate VAT in the contract?

The price of the goods must be specified in the contract; this is an essential condition of the transaction. But there are no regulations regarding the allocation of value added tax from the price. From the point of view of the law, you don’t have to highlight it, but you still need to do it so as not to get confused. If you write nothing at all about VAT, you will need to work with the tax in a special manner.

Price terms can be formulated in different ways. The main thing is that the seller and buyer clearly understand whether VAT is included in the price of the product, at what rate and in what amount.