Property value limit in 2021

Until January 1, 2021, the residual value of fixed assets used to generate income should not exceed 100,000,000 rubles.

From January 1, 2021, for the application of the simplified tax system, there is a limit on the residual value of fixed assets equal to 150,000,000 rubles (Federal Law of July 3, 2021 No. 243-FZ).

According to the Federal Tax Service, expressed in letter No. SD-4-3/ [email protected] , from January 1, 2021, even those organizations whose residual value of fixed assets as of October 1, 2021 was more than 100,000,000 rubles. But provided that as of January 1, 2021, this figure did not exceed 150,000,000 rubles.

Property is valued based on accounting data.

Old deadlines and codes: what to do with them?

Now let’s talk about whether it is necessary to review the service life of fixed assets from 2021 . We hasten to reassure you: for property that was registered before December 31, 2016 inclusive, the law does not require anything to be re-registered or revised.

Thus, the standard service life of fixed assets according to the updated Classification does not need to be replayed. The fact is that it is determined only once - when the property is put into operation. And it can be extended only if the company decides to improve the facility through modernization and reconstruction. This is a common point for both types of accounting.

Feel free to leave the previous codes in the “primary” for your OS. At the same time, nothing prevents you from adding new ones next to them. Why are we talking about this? But because the developers of accounting software can rush ahead of you and replace all the old codes.

Let us remind you: you can find out the new code by the old value from the first table of Rosstandart order No. 458 dated April 21, 2016. Moreover, many positions have ceased to be considered fixed assets at all.

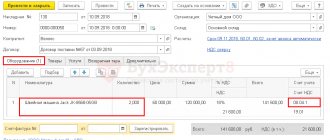

Here's a good example:

Who is subject to the property value limit?

The Tax Code contains a direct indication that the mentioned limitation on the value of fixed assets applies only to organizations (clause 16, clause 3, article 346.12 of the Tax Code of the Russian Federation). There is no such restriction for individual entrepreneurs.

However, financiers only agree that entrepreneurs can switch to the simplified tax system without taking into account the limit on the residual value of property (letter of the Ministry of Finance of Russia dated May 21, 2010 No. 03-11-11/147). But they will be able to retain the right to use the simplified tax system if they meet the requirements of paragraph 3 of Article 346.12 of the Tax Code, including the cost of fixed assets, which is determined according to accounting data (letter of the Ministry of Finance of the Russian Federation dated February 13, 2015 No. 03-11-12 /6555, dated January 18, 2013 No. 03-11-11/9, Federal Tax Service of the Russian Federation dated January 15, 2013 No. ED-3-3/69).

One can argue with this position. After all, the provisions of subparagraph 16 of paragraph 3 of Article 346.12 of the Tax Code apply only to organizations. In addition, individual entrepreneurs using the simplified tax system are not required to keep accounting records at all, and therefore to determine the residual value of fixed assets (clause 1, clause 2, article 6 of the Federal Law of December 6, 2011 No. 402-FZ).

But, taking into account the opinions of officials on this issue, entrepreneurs will have to defend this point of view in court.

Read also “Value of property for applying the simplified tax system”

Documents upon receipt of fixed assets

Since 2013, organizations are not required to use unified forms of primary documents (with the exception of public sector enterprises), but can continue to use them on a voluntary basis. The company must record this fact in its accounting policies.

In this regard, you can develop the documents that you must prepare upon receipt of fixed assets yourself. Or you can use unified forms of primary accounting documents. They were approved by Decree of the State Statistics Committee of Russia dated January 21, 2003 No. 7.

When accepting one item, an act of acceptance and transfer of a fixed asset object is drawn up in form No. OS-1, and when a group of objects is received, an act is drawn up in form No. OS-1b. A special act is provided for accounting of buildings or structures (form No. OS-1a).

An object of fixed assets accepted for accounting is recorded in an inventory card (form No. OS-6), and a group of items is recorded in a group accounting card (form No. OS-6a). Small enterprises maintain a single inventory book according to form No. OS-6b.

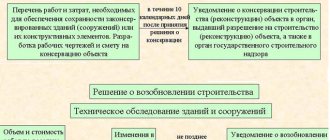

The facility was received under a concession agreement

According to the Ministry of Finance, when determining the limit on the value of fixed assets, simplified companies should take into account real estate acquired under a concession agreement (letter dated August 26, 2015 No. 03-11-09/49191).

Since the letter deals with the transfer of property under a concession agreement, financiers turn to the provisions of Federal Law No. 115-FZ of July 21, 2005 “On Concession Agreements” (hereinafter referred to as Law No. 115-FZ).

According to Part 1 of Article 3 of this law, under a concession agreement, one party (the concessionaire) undertakes to create or reconstruct real estate, the ownership of which belongs or will belong to the other party (the grantor). In addition, the concessionaire undertakes to carry out activities using this property. In turn, the grantor undertakes to provide the concessionaire with the right to use and own this property.

At the same time, Law No. 115-FZ also establishes that property transferred under a concession agreement is reflected on the balance sheet of the concessionaire (and not the grantor), and separately from the rest of its property. The concessionaire maintains independent accounting for this object and also charges depreciation on it.

Based on this, the Ministry of Finance draws the following conclusion. The residual value of the property received under the concession agreement must be taken into account by the “simplified” person to calculate the limit on the value of fixed assets for the purpose of applying the simplified tax system (clause 16, clause 3, article 346.12 of the Tax Code of the Russian Federation). And if the residual value of fixed assets received under the concession agreement exceeds the permissible limit, the “simplified” concessionaire loses the right to apply this special regime.

Read also “Concession agreement under the simplified tax system: we charge VAT”

Classifier of fixed assets for determining the depreciation group and SPI

The useful life is the period (number of months) during which a company expects to use an asset and receive economic benefits from it.

Depending on this period, fixed assets in tax accounting belong to one or another depreciation group. When accepting an object for accounting, each organization independently establishes the SPI for the date of its commissioning. But before establishing the SPI for the acquired fixed asset, you need to determine which of the ten depreciation groups the object belongs to.

Each group has a minimum and maximum useful life. An organization can select SPI within a specific depreciation group in which the fixed asset is included.

If the fixed asset belongs to a type that is not named in the Classification approved by the Government of the Russian Federation, then the SPI for such an object should be established on the basis of technical documentation or manufacturers’ recommendations. If the technical documentation does not contain SPI, the organization can use data from the Classifier of Fixed Assets. The fixed asset code must be found in OKOF and the depreciation group must be determined according to this code (code ranges in the Classifier are given in addition to the names of fixed assets in the explanation column).

How to determine the value of property when changing tax regimes

When switching from the regular tax system

When changing the regular taxation system to a simplified residual value of property and rights, it is determined as the difference between their original cost and the amount of depreciation accrued before the transition to the “simplified” system.

When switching from Unified Agricultural Tax

When switching to the simplified tax system from the unified agricultural tax, this indicator is calculated as follows. The residual value of fixed assets and intangible assets, which developed at the time of the transition to agricultural tax, is reduced by the amount of expenses provided for in subparagraph 2 of paragraph 4 of Article 346.5 of the Tax Code.

When switching from UTII

If you switch to the simplified tax system from UTII, find the residual value as the difference between the purchase price (construction, production, creation) of these assets and the amount of depreciation for the period of application of UTII. Calculate this value according to accounting rules.

How to determine

In 2021, you need to continue to find out the code of a specific fixed asset using the fixed asset service life classifier OK 013-94. And the depreciation group of the registered property is according to the government Classification dated January 1, 2002 No. 1.

Starting in 2017, the situation will change dramatically. Your main documents in the question of how to determine the service life of fixed assets will be:

- collection OK 013-2014 with new codes;

- updated mid-2021 Depreciation classification.

What is most reassuring is that the mechanism for determining the useful service life of fixed assets has remained the same - as in the current year (see table).

| № | What to do |

| 1 | First, find the most suitable name of your property in OK 013 and remember the code |

| 2 | It happens that an identical name is missing in the classifier. Then - the group to which your object can be assigned. See group code. |

| 3 | Then use the code to find your OS in the Classification (the codes are there in the left column) |

| 4 | See the depreciation group into which the property falls |

| 5 | Determine the useful life period according to this group |

Which operating systems are taken into account when calculating the limit?

If you exceed the 150 million mark, keep the following in mind. Only depreciable fixed assets are taken into account in the calculation of this indicator (clause 16, clause 3, article 346.12 of the Tax Code of the Russian Federation). Since land plots are not depreciable property, their value is not taken into account when determining the limit.

In a letter dated July 31, 2013 No. 03-11-06/2/30602, the Russian Ministry of Finance considered a situation where a company bought transport vessels at a cost that exceeded the permissible OS limit and registered them in the Russian International Register of Ships (RMRS). Since ships registered with the RMRS are excluded from the list of depreciable property (clause 3 of Article 256 of the Tax Code of the Russian Federation), their value does not need to be taken into account when determining the limit on fixed assets.

How to determine the depreciation group of a fixed asset in 2018?

To select the correct depreciation group, it is necessary not only to study the Classification of OS and OKOF, but also to perform the following steps:

- It is necessary to determine whether the object belongs to fixed assets;

- You need to select the OS depreciation group;

- The correct service life should be set;

- The deadline must be recorded in the relevant documents.

To determine whether an object belongs to the OS, you need to check whether the service life of the property exceeds 1 calendar year.

The value of the asset must exceed one hundred thousand rubles. These criteria are the main ones, and if the asset is suitable, then it is necessary to assign it to one of the groups and select the period of use.

back to menu ↑

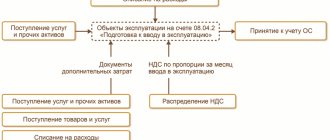

How to meet the fixed asset value limit

If the limit is exceeded, you can get rid of the “dangerous” excess property. To do this, take an inventory.

Write off broken down or obsolete objects. Some of the equipment can be sold.

Try to leave the property that you purchased at the end of the year preceding the transition to the simplified tax system as a capital investment until next year. After all, capital investments are not fixed assets (clause 3 of PBU 6/01). Therefore, property purchased or built before the transition to the simplified tax system will become a fixed asset only after you take it into account in account 01.

As a result of this maneuver, you will receive a double benefit: firstly, you will be able to switch to the simplified tax system; secondly, you will write off the object as expenses according to the “simplified” rules, which is much more profitable.

Finally, part of the “extra-limit” fixed assets can be “transferred” to a friendly company (entrepreneur), and then rented or leased from them. Such property cannot be included in the calculation of the limit, even if it is on your balance sheet.

note

If you pay “imputed” tax for certain types of activities, then when transferring other industries to “simplified taxation”, you must comply with the restrictions on the number of employees and the value of property for the company as a whole, and the maximum amount of income - separately by type of activity (clause 4 of Art. 346.12 Tax Code of the Russian Federation).

EXAMPLE.

HOW TO DETERMINE IF A COMPANY CAN APPLY THE STS A company that sells food products employs 15 people. The company has: - a warehouse building with an office with an initial cost of 12,500,000 rubles. and a depreciation amount of 1,600,000 rubles; - several computers and office furniture with an initial cost of 200,000 rubles. and a depreciation amount of 50,000 rubles. For nine months of the current year, the company sold goods for 17,700,000 rubles. (including VAT - 2,700,000 rubles). To determine whether it is possible to apply a simplified system, the company’s accountant made the following calculation: - the average number of employees (15 people) is less than 100 people; - the residual value of depreciable property is 11,050 000 rub. ((12,500,000 – 1,600,000) + (200,000 – 50,000)). This value is less than 150,000,000 rubles; the company’s revenue for nine months is 15,000,000 rubles. (17,700,000 – 2,700,000). This is less than 112,500,000 rubles. Thus, the company meets all the criteria that allow it to switch to a simplified tax system starting next year.

Depreciation of fixed assets

Depreciation is the gradual transfer of the cost of a fixed asset to the cost of products (works, services). You must charge depreciation on each asset monthly, beginning in the month following the month you put the asset into service.

Depreciation accrual stops on the 1st day of the month following the month when the fixed asset item is completely depreciated or written off from the balance sheet of your company (sold, liquidated, etc.).

Depreciation must be calculated over the entire useful life of the fixed asset.

The approximate service life of fixed assets is given in the Classification of fixed assets included in depreciation groups (approved by Decree of the Government of the Russian Federation of January 1, 2002 No. 1). In it, all property is divided into 10 groups:

| Group number | Useful life of the property | ||||||||||||||||||

| 1 | From 1 year to 2 years inclusive | 2 | From 2 to 3 years inclusive | 3 | From 3 to 5 years inclusive | 4 | From 5 to 7 years inclusive | 5 | From 7 to 10 years inclusive | 6 | From 10 to 15 years inclusive | 7 | From 15 to 20 years inclusive | 8 | From 20 to 25 years inclusive | 9 | From 25 to 30 years inclusive | 10 | More than 30 years |

If the Classification does not indicate the useful life of the fixed asset you purchased, you can set it yourself (for example, based on the expected service life of the fixed asset). If the equipment is fully depreciated, but your company continues to use it, there is no need to charge depreciation on such equipment.

You must record depreciation in accounting as a credit to account 02 and a debit to the corresponding cost (expense) account:

DEBIT 20 (23, 25, 26, 29, 44, 91-2) CREDIT 02

– depreciation of fixed assets has been calculated.

For some fixed assets, depreciation is not charged. For example, for those whose consumer properties do not change over time (land plots, environmental management facilities).

There are four ways to calculate depreciation of fixed assets:

- linear method;

- reducing balance method;

- method of writing off value by the sum of the numbers of years of useful life;

- method of writing off cost in proportion to the volume of products (works, services).

You can use any of the listed methods. The selected method must be applied throughout the entire useful life (that is, service life) of the fixed asset.

Linear method

The straight-line method of calculating depreciation involves evenly accruing depreciation over the useful life of the fixed asset.

PRIMERAO Aktiv purchased a machine for use in its main production.

The initial cost of the machine is 120,000 rubles. Useful life – 5 years. The annual depreciation rate will be 20% (100%: 5). Therefore, the annual depreciation amount will be 24,000 rubles. (RUB 120,000 × 20%). Every month for 5 years, the Aktiva accountant will make the following entry: DEBIT 20 CREDIT 02

– 2000 rub. (RUB 24,000: 12 months) – depreciation of the machine was accrued for the reporting month.

Reducing balance method

When calculating depreciation using the reducing balance method, the annual depreciation rate is determined based not on the initial, but on the residual value of the fixed asset at the beginning of each reporting year.

EXAMPLE Let's return to the previous example and calculate the amount of monthly depreciation charges using the reducing balance method.

The annual depreciation rate, as in the previous case, will be 20% (100%: 5). In the first year of depreciation, the annual depreciation amount will be 24,000 rubles. (RUB 120,000 × 20%). The residual value of the machine at the end of the first year is RUB 96,000. (120,000 - 24,000). Every month during the first year of operation of the facility, the Asset accountant will make the following entry: DEBIT 20 CREDIT 02

- 2000 rub.

(RUB 24,000: 12 months) – depreciation of the machine was accrued for the reporting month. In the second year of using the machine, the annual depreciation amount will be RUB 19,200. (RUB 96,000 × 20%). The residual value of the machine at the end of the second year will be 76,800 rubles. (96,000 - 19,200). Monthly during the second year of depreciation, the Asset accountant will make the following entry: DEBIT 20 CREDIT 02

- 1600 rubles. (RUB 19,200: 12 months) – depreciation of the machine was accrued for the reporting month. In the third, fourth and fifth years, depreciation will be accrued in the same way.

Method of writing off cost based on the sum of the numbers of years of useful life

When writing off the cost by the sum of the numbers of years of its useful life, depreciation is calculated based on the original cost of the object using the following formula:

| Annual depreciation amount | = | Number of years remaining until the end of the asset's service life | : | The sum of the numbers of all years of the useful life of the object | × | Initial cost of the object |

EXAMPLE In our example, the useful life of the machine is 5 years. Therefore, the sum of the numbers of years of the useful life of the machine will be: 1 + 2 + 3 + 4 + 5 = 15 years. In the first year of operation of the machine, the annual depreciation amount will be: 5 years: 15 years × 120,000 rubles. = 40,000 rubles. Every month during the first year of depreciation, the Asset accountant will make the following entry: DEBIT 20 CREDIT 02

– 3333.3 rubles.

(40,000 rubles: 12 months) – depreciation of the machine was accrued for the reporting month. In the second year of depreciation, the annual depreciation amount will be: 4 years: 15 years × 120,000 rubles. = 32,000 rubles. Every month during the second year of depreciation, the Asset accountant will make the following entry: DEBIT 20 CREDIT 02

– 2666.7 rubles.

(RUB 32,000: 12 months) – depreciation of the machine was accrued for the reporting month.

Penalties and penalties for loss of simplified tax system

There are situations when exceeding the maximum value threshold for fixed assets cannot be avoided. In this case, you need to consider the following.

If, despite the measures taken, the “simplified” person does not meet the 150 million limit of the residual value of fixed assets, he loses the right to apply the simplified tax system. The loss of the right to apply this special regime occurs from the beginning of the quarter in which the excess was allowed (clause 4 of Article 346.13 of the Tax Code of the Russian Federation). The “simplified” person will have to switch to a different taxation regime and calculate taxes as if he were a newly created organization (a newly registered individual entrepreneur).

Moreover, you will not have to pay penalties and fines for late payment of monthly payments during the quarter in which the former “simplified” switched to OSN. Since the amount of such payments paid during the transition to a different taxation regime is not regarded as an additional payment due to incomplete payment of taxes on time. These are the rules of paragraph 4 of Article 346.13 of the Tax Code.

Based on this, in letter dated December 1, 2015 No. 03-11-06/2/70012, the Ministry of Finance reminds that exceeding the permissible limit of the residual value of fixed assets entails the loss of the right to use the simplified tax system from the beginning of the quarter in which such an excess occurred , and transition to a different taxation regime in the period of excess. In this case, the taxpayer is exempt from paying penalties and fines.

Classifier of fixed assets and transition keys

In order to simplify the transition to the new Classifier of Fixed Assets, Rosstandart issued an order “On approval of direct and reverse transition keys between the editions of OK 013-94 and OK 013-2014 (SNS 2008) of the All-Russian Classifier of Fixed Assets” (Rosstandart order dated April 21, 2016 No. 458), which contains tables of correspondence between old and new OKOF codes (the direct transition key establishes the transition from OK 013-94 to OK 013-2014 (SNA 2008), and the reverse transition key, on the contrary, establishes the transition from OK 013-2014 (SNA 2008 ) to OK 013-94).

For most objects, the name remains the same, only the code number and the name of the subgroup have changed.

For example, according to the new Classification, the 2nd depreciation group (with a useful life of more than two years and up to three years inclusive) will include computers (the subgroup “Other office machines” with code 330.28.23.23 includes: personal computers and printing devices for them ; servers of various capacities; network equipment for local area networks; data storage systems; modems for local networks; modems for backbone networks).

According to the current (old) Classifier, this subgroup (which includes personal computers and printing devices for them, servers of various capacities, network equipment for local computer networks, data storage systems, modems for local networks, modems for backbone networks) also belongs to 2- th depreciation group with a useful life of more than two years and up to three years inclusive. But it is called “Electronic computing equipment” and has code 14 3020000.

In some cases, specific types of fixed assets are not included in the Classifier of fixed assets OK 013-2014, and then compliance must be established based on the characteristics of similar or similar objects.

The Classifier of Fixed Assets OK 013-2014 (SNA 2008) provides a definition of fixed assets. These are manufactured assets that are used repeatedly or continuously over a long period of time, but not less than one year, to produce goods and provide services. Some of the positions of the current OK 013-94 do not correspond to the new definition of fixed assets. For them, in the “Name of position” column of the correspondence table, an entry is made: “They are not fixed assets.”

For example, microphones, loudspeakers, headphones, headsets with code 14 3230200, microphones with code 14 3230201, loudspeakers with code 14 3230202, drilling and slotted hammer drills with code 14 3315443, line equipment rooms, amplifiers and low-frequency stands with code 14 3222400 now are not fixed assets.

The accountant uses the codes of the Classifier of Fixed Assets when filling out Federal Statistical Observation Form No. 11 “Information on the availability and movement of fixed assets (funds) and other non-financial assets.” Also, in some cases, the determination of the right to use the UTII system may depend on the OKOF code.

But first of all, the All-Russian Classification of Fixed Assets is used to determine the depreciation rate of fixed assets in tax accounting, since in accordance with the Tax Code, taxpayers, when determining the depreciation group in which depreciable property should be included, are required to use the Classification of Fixed Assets approved by Resolution No. 1. A this Classification, in turn, is based on the OKOF classifier.

Classification

There are ten property depreciation groups. Let's look at them.

- 1 group. SPI of property objects from this group - from one year to two years. For example, special and mobile compressors.

- 2nd group. SPI OS ranges from two to three years. Examples are snow removal machines and mowers.

- 3 depreciation group of fixed assets of the classifier. For example, devices for counting coins and banknotes. Their STI ranges from three to five years.

- 4th group. This includes property whose life expectancy is from five to seven years. For example, lifts and forklifts.

- 5 depreciation group of fixed assets of the classifier. It includes property objects whose life expectancy is from seven to ten years. For example, water heaters and heating boilers.

- 6 group. The period of use of property objects of this group ranges from ten to fifteen years. This includes sea pontoons and floating piers.

- 7 group. The SPI OS of this group ranges from fifteen to twenty years. For example, trolleybus and tram networks that do not have supports.

- 8 group. It includes property objects whose useful life ranges from twenty to twenty-five years. For example, metro lines.

- 9 group. The SPI of property objects from this group ranges from twenty-five to thirty years. An example is sewer networks made of ceramics and cast iron.

- 10 group. It includes property objects whose useful life is more than thirty years. For example, cruise ships and floating docks.