Monitoring of fixed assets (fixed assets) is of particular importance, since this property, as a rule, is characterized by significant value and retains its properties for a long time.

The results of the inventory may be different:

- full compliance of the real state of affairs with accounting data;

- identifying discrepancies in the form of surpluses or shortages.

Information about established surpluses/shortages for certain fixed assets is subject to mandatory reflection in the accounting system.

First of all, it is necessary to consider how surplus operating systems discovered during inventory are accounted for and accounted for.

Striving for the goal

The main goals of inventory are to identify and eliminate discrepancies between the accounting and actual availability of goods for all product items.

This is stated in the Law “On Accounting” No. 129-FZ and Guidelines for the Inventory of Property and Financial Liabilities No. 49. In order for the accountant to be able to correctly reflect the results of the audit, it is necessary to plan its implementation. The director issues a corresponding order, and not only the warehouses themselves, but also the product database must be prepared for the recount. Don’t miss an important point: registration of inventory results is carried out simultaneously in both warehouse and accounting. The storekeeper is appointed responsible for this, with whom an agreement on liability must be concluded.

Based on the results of the inventory in the warehouse, all surpluses and shortages that arose in the course of the company’s activities are identified. The accountant's task is to reflect this data in accounting. If discrepancies are identified, it is necessary to draw up a comparison statement in form No. INF-19. In addition, you need to write off losses within the limits of natural loss. And shortages and surpluses are indicated in the reconciliation sheet in accordance with the assessment in accounting.

What is this concept?

The procedure for inventorying company assets involves the sequential implementation of the following activities:

- Determination of regulations for the upcoming inventory. The composition of the executive commission is formed, deadlines are set, and the reasons and grounds for conducting an inventory of existing objects are specified. All these points must be reflected in a written order, which is specially issued by the management of the organization.

- Direct inventory of groups of objects of interest. The commission determines the actual quantity and actual condition of the property being inspected. The results of the actions taken are reflected in the inventory documentation, which includes an inventory of assets.

- Comparison of received and initial information. At this stage, the results of the audit are compared with accounting data. The information is clarified - identified surpluses are credited, detected shortages are written off. Comparison statements are generated and the final results of the inventory are documented. The company's management is taking appropriate administrative measures.

When conducting an inventory of assets, the appointed executive commission must follow the instructions of the Ministry of Finance of the Russian Federation, which clearly regulate the procedure for carrying out this procedure, recording its results, as well as the necessary actions in case of detection of inconsistencies - shortages, surpluses.

Thus, surplus fixed assets are objects of the corresponding group of non-current assets that were previously absent from the organization’s balance sheet, but were identified (discovered) based on the results of the inventory.

Indeed, an inventory of an enterprise's assets often reveals unaccounted for items.

Of course, such surpluses are most often found in the category of material reserves, but sometimes the executive commission manages to find fixed assets that for some reason are not listed according to accounting data.

Of course, the presence of unregistered (“extra”) OS objects in an enterprise is a consequence of errors made in the accounting system.

Finding the culprit

If a shortage is detected, the company's management must decide at whose expense the damage will be written off. There are few options: if a company employee is to blame for the shortage of goods, then the company’s loss will be covered from the employee’s salary. But keep in mind that inspectors scrutinize these operations carefully. Questions may arise not only regarding taxation and accounting for deductions, but also regarding the legality of punishing an employee.

If the director nevertheless decides to cover the shortfall at the expense of the employee, it is necessary to take into account that there are several types of financial liability: full, limited or collective. Full compensation for damage is possible in several cases:

- when the law contains a direct reference to compensation in the event of a shortage of valuables entrusted to the employee on the basis of an agreement or a one-time document;

- when the damage was caused under alcohol, drug or toxic intoxication;

- when the damage was caused due to criminal actions recorded by a court verdict or as a result of an administrative offense;

- in case of disclosure of secret information or failure of the employee to fulfill his official duties;

- when full financial responsibility is established by an employment contract concluded with the head of the company, his deputy and the chief accountant.

If a collective agreement has been concluded with the guilty employees, then the goods are entrusted to all personnel. On this basis, the shortage can be withheld from a group of people.

Dangerous middleman

But there are cases when, during an investigation, it turns out that the shortage did not arise through the fault of the receiving or sending party. After all, there is often an intermediary between two warehouses or companies - a carrier. The liability of a transport company is regulated by Chapter 40 of the Civil Code of the Russian Federation. Thus, Article 796 of the Civil Code of the Russian Federation states that the forwarder is liable for damage to goods unless he proves that the shortage of cargo occurred due to circumstances that the carrier could not prevent and the elimination of which did not depend on him.

In case of loss of transported goods, its cost is reimbursed in full. If only damage to the product was discovered, then the amount of compensation should cover the price by which the value of the product was reduced. In addition, the contractor returns to the sender the funds that were transferred for the service.

It should be remembered that documents on the reasons for the failure of the cargo, drawn up by the carrier, are taken into account by the court along with other documents that may serve as the basis for the liability of the carrier, sender or recipient of the cargo.

Write-off as expenses

In the absence of culprits, the amounts of the shortfall that were recorded in the original account 94 “Shortages and losses from damage to valuables” are written off to the debit of subaccount 91 “Other income and expenses.”

The write-off procedure is given in Article 12 of the Federal Law “On Accounting”. Example: A fire occurred at the warehouse of Tekhnik JSC, as a result of which a batch of computer equipment was destroyed. They carried out an inventory, as a result of which the commission found that equipment worth 60,000 rubles had deteriorated. The fire inspection authorities concluded that the fire occurred as a result of a lightning strike, that is, there were no perpetrators. The company's accountant makes the following entries: Debit 94 Credit 41 in the amount of 60,000 rubles. – the cost of burnt equipment was written off based on the inventory results to the shortage account; Debit 91 (99) Credit 94 - the amount of the shortfall resulting from the fire is written off as company expenses.

Accounting for inventory results

All organizations are required to ensure the accuracy of accounting. To do this, they must periodically conduct an inventory of assets and liabilities. The article will tell you how to reflect its results in accounting.

ON THE. Gabetz, expert of AG "RADA"

The inventory procedure is regulated by a number of documents:

– Federal Law of November 21, 1996 No. 129-FZ “On Accounting”;

– Regulations on accounting and financial reporting in the Russian Federation, approved by Order of the Ministry of Finance dated July 29, 1998 No. 34n;

– Methodological guidelines for inventory of property and financial obligations, approved by Order of the Ministry of Finance of June 13, 1995 No. 49.

An inventory is carried out to identify the actual availability of property, compare it with accounting data and verify the completeness of the reflection of liabilities in accounting. It can be voluntary or mandatory.

The timing of voluntary inventories, their number, the list of inspected property and liabilities is established by the head of the company. For example, the availability of goods and money in the cash register can be checked quarterly, non-current assets – once a year. The specific timing of inventory must be determined in the company's accounting policies.

Mandatory inventory is carried out in the following cases:

– before the preparation of annual financial statements, but not earlier than October 1 of the reporting year;

– when changing materially responsible persons;

– when identifying theft, abuse or damage to property;

– in case of natural disasters, fire or other emergency situations;

– during reorganization or liquidation of an organization, etc.

They check the property at its location and financially responsible persons.

To do this, it is necessary to create a permanent inventory commission. It should include representatives of the administration, accounting workers, and other specialists. It is approved by order of the head of the organization. Financially responsible persons must participate in the inventory. If at least one member of the commission is absent, its results are considered invalid.

Based on the results of checking the actual presence of valuables, inventory lists or acts are drawn up (forms INV-1 to INV-17). They are then checked against accounting data. If there is a discrepancy between the obtained figures, comparison statements are drawn up (forms INV-18 and INV-19). The forms of accounting documentation for inventory were approved by Decree of the State Statistics Committee of August 18, 1998 No. 88.

The results of the inventory are reflected in the records in the month when it was completed, and the results of the annual audit are recorded in December records.

If, during the inventory of property, it actually turned out to be more than according to accounting data, then the surplus is included in non-operating income in both accounting and tax accounting. This is indicated by paragraph 3 of Article 12 of the Law of November 21, 1996 No. 129-FZ “On Accounting” and paragraph 20 of Article 250 of the Tax Code.

Surplus is accounted for at market value. This is stated in paragraph 29 of the Guidelines for accounting of inventories (approved by order of the Ministry of Finance dated December 29, 2001 No. 119n), in paragraph 34 of the Guidelines for accounting of fixed assets (approved by order of the Ministry of Finance dated July 20, 1998 No. 33n), as well as in paragraph 5 of Article 274 of the Tax Code. The principles for determining the market price are given in Article 40 of the Tax Code.

Example

As of December 1, 2003, CJSC Raketa carried out an annual inventory. During the investigation, excess boards in the amount of 1.5 cubic meters were identified. Their market price for 1 cubic meter is 8,000 rubles. excluding VAT.Based on the results of the inventory, the Raketa accountant made an entry in the accounting records:

Debit 10 Credit 91-1

– 12,000 rub. (8000 rubles x 1.5 cubic meters) - excess materials are taken into account.

–end of example–

Deficiencies, as a rule, are detected more often than surpluses.

The procedure for their write-off depends on the availability of natural loss norms approved by ministries and departments. Deficiencies within the limits of such norms are written off as production or distribution costs, and in excess of the norms - at the expense of the guilty parties. If the perpetrators are not identified or the court refuses to recover losses from them, then these losses are written off to financial results. However, in any case, the shortage is first reflected in the debit of account 94 “Shortages and losses from damage to valuables.” Missing material assets are accounted for at actual cost, and fixed assets - at residual cost.

In tax accounting, losses from shortages and damage to inventory items during their storage and transportation within the limits of natural loss rates are considered material expenses. But only if these norms are approved in the manner established by Government Decree No. 814 of November 12, 2002. If this is done earlier, then taxable profit cannot be reduced by the amount of the shortfall.

Example

In the production department of a pharmacy, during the inventory, a shortage of ethyl alcohol in the amount of 0.2 liters was revealed in the amount of 108 rubles. It was formed during the manufacture of medicines.By Order of the Ministry of Health of July 20, 2001 No. 284, the rate of natural loss for ethyl alcohol is equal to 1.9 percent of its quantity sold during the period between inventories.

To establish the standard amount of alcohol, the accountant made a calculation.

Since the previous inventory, 11 liters of alcohol have been used in the manufacture of medicines, so 0.209 liters (11 liters x 1.9%) of alcohol can be written off as expenses.

Thus, the shortage can be written off in full to production costs (0.2 < 0.209).

The following entries were made in accounting:

Debit 94 Credit 10-1

– 108 rub. – a shortage of alcohol was detected;

Debit 20 Credit 94

– 108 rub. – the shortfall within the limits of natural loss norms is written off as expenses.

Since this norm was approved before the Government established the order (before November 12, 2002), in tax accounting the amount of the shortfall does not reduce taxable profit.

–end of example–

The excess shortage must be compensated by the culprit (Articles 238–243 of the Labor Code).

Moreover, VAT on the missing property must be restored if it was previously claimed for deduction. If the tax has not yet been submitted for deduction, then it must be written off at the expense of the person responsible for the shortage. In accounting, shortages in excess of norms and in their absence are reflected by postings:

Debit 94 Credit 01, 04, 10, 40, 43

– a shortage has been identified;

Debit 19 Credit 68 subaccount “VAT calculations”

– previously credited VAT on missing property was restored;

Debit 94 Credit 19

– restored VAT is included in the cost of missing valuables;

Debit 73 subaccount “Calculations for compensation of material damage” Credit 94

– the shortfall (including VAT) is attributed to the guilty party;

Debit 70 Credit 73 subaccount “Calculations for compensation of material damage”

– the amount of the deficiency is withheld from the employee’s salary.

Please note: the amount of deduction from an employee’s salary for each payment is limited to 20 or 50 percent (Article 138 of the Labor Code).

If the culprits of the shortage are not identified or the court refuses to collect it, then the losses are written off to the debit of account 91-2 “Other expenses”. In tax accounting, on the basis of subparagraph 5 of paragraph 2 of Article 265 of the Tax Code, these losses are recognized as non-operating expenses. But only if there is a document from the police confirming the absence of those responsible.

During the inventory, there are situations when the financially responsible person simultaneously reveals shortages and surpluses. If these are material assets of one type, then the misgrading that has arisen can be corrected in accounting by offsetting surpluses and shortages. And only in equal quantities.

Please note: collection of the deficiency from the guilty person, writing it off as expenses, offset of surpluses and shortages are carried out by written order of the head of the company.

Inventory of calculations consists of checking the validity of the amounts of receivables and payables listed in the accounts, the reality of their collection. During it, the status of settlements with banks, the budget, extra-budgetary funds, suppliers, buyers, accountable persons, etc. is checked. Settlements with banks are necessarily reconciled at the end of each year. Usually, if there are no discrepancies with the company, a special form issued by each bank is filled out and signed. If errors are found in bank statements, they are usually corrected immediately, without waiting for the next inventory count.

To reconcile the calculations with the budget, an official request is made to the tax office. Based on the request, the company is issued an act that indicates the types of taxes, the amounts accrued for each of them (based on declarations), the actual receipts of tax payments, the amount of arrears and overpayments, as well as penalties and fines. Identified discrepancies are eliminated either in the accounting of the company or in the accounting of the income tax.

Firms regularly reconcile settlements with extra-budgetary funds when submitting quarterly reports.

When taking inventory of settlements with suppliers and customers, reconciliation reports are also drawn up. They indicate the dates and numbers of documents for shipment, the cost of goods (including VAT) for each document, the dates and amounts of payment. As practice shows, it is impossible to prepare and coordinate reconciliation statements with all counterparties, especially in large companies. Yes, this, in our opinion, is not necessary. With most of them, you can agree on debt balances over the phone. And only with those who have constant contacts with your company or have outstanding debt for a long time, it makes sense to conduct written reconciliations. They must be signed by both parties.

Particular attention should be paid to the presence of receivables and payables for which the statute of limitations has expired. Let us recall that in the general case it is three years (Article 196 of the Civil Code). But shortened statutes of limitations may apply to certain types of obligations. Overdue debt must be written off based on the inventory report, justification and order of the head of the company.

Debt to suppliers for goods, work or services is usually included in VAT accounting. According to paragraph 18 of Article 250 of the Tax Code, overdue accounts payable are included in non-operating income. At the same time, VAT on it is written off for non-operating expenses (subclause 14, clause 1, article 265 of the Tax Code):

Debit 60, 76 Credit 91-1

– accounts payable are written off;

Debit 91-2 Credit 19

– charged to non-operating expenses VAT on written off accounts payable.

Accounts receivable for which the statute of limitations has expired and other debts that are unrealistic for collection are added to other expenses in accounting (clause 12 of PBU 10/99), and in tax accounting they are included in financial results (subclause 2, clause 2 Article 265 of the Tax Code). A firm using the accrual method may create an allowance for doubtful debts. In this case, it has the right to write off unreceivable debts at the expense of this reserve.

In accounting, a reserve is created for the entire amount of debt, including VAT. The Ministry of Taxes and Duties has spoken about this more than once. It recently confirmed its position in letter dated September 5, 2003 No. VG-6-02/945 in response to question 2.

If there is a reserve, the write-off of accounts receivable is reflected by the posting:

Debit 63 Credit 62, 76

– accounts receivable are written off from the reserve for doubtful debts.

If the reserve is not created or is insufficient, then the write-off of such debt is documented by posting:

Debit 91-2 Credit 62, 76

– accounts receivable are written off for financial results.

Written off debt reduces taxable profit on the basis of subparagraph 2 of paragraph 2 of Article 265 of the Tax Code. In this case, it is necessary to take into account the restrictions on the size of the reserve established by Article 266 of the Code.

Please note: debt written off due to the debtor's insolvency must be taken into account within the balance sheet for five years in case of its possible repayment. For this purpose, account 007 “Debt of insolvent debtors written off at a loss” is used.

If , then there is a problem with VAT.

According to the Ministry of Finance and the Ministry of Taxes, it should be accrued at the time the debt is written off (letter of the Ministry of Finance on a private request dated January 6, 2000 No. 04-02-05/1 and letter of the State Tax Inspectorate for Moscow dated February 26, 1999 No. 12-14 /6898). The arguments of the officials given in the letters are not controversial. However, despite the fact that in this case there is no termination of the counter-obligation, as required by paragraph 2 of Article 167 of the Tax Code, in our opinion, VAT should still be charged. At least in order not to put companies that have paid the tax “on shipment” in an unequal position with those who work “on payment”. When conducting an inventory of settlements with employees for wages, accountable amounts, etc., the timing of their issuance is checked. Overdue amounts of unpaid wages are transferred to the accounts of depositors, deposited amounts with an expired statute of limitations are written off to financial results. Overdue accountable amounts must be included in the employee’s income and personal income tax must be calculated on them. This must be done in the month when the employee was supposed to submit the advance report.

Not too much extra

As a result of the inventory, surpluses may be identified that must be capitalized. Many accountants have problems with this. You need to start by valuing the goods at market value at the time of discovery.

This is reflected by the following wiring:

Debit 41 Credit 91.1 – surplus goods are capitalized.

The main thing you need to pay attention to is tax accounting. The fact is that, in accordance with paragraph 250 of the Tax Code, surpluses identified as a result of inventory must be included in the company’s non-operating income. This means that they must be taken into account when calculating income tax. In addition, in accordance with paragraph 2 of Article 254 of the Tax Code, when determining the amount of material expenses, the cost of the surplus is determined as the amount of income tax calculated from non-operating income. That is, it will be possible to write off as losses not the entire market value of capital assets, but only the amount of income tax paid in connection with the found inventory.

Capitalization of surplus during inventory: postings using examples

We present examples of the receipt of the value of property identified by inventory.

Example 1

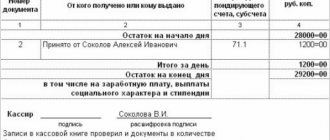

On March 15, 2019, during an audit of cash in the company’s cash desk, a surplus of 15,000 rubles was identified, which should be capitalized on the date of the inventory. The accountant recorded this transaction with the following entry:

Dt 50 Kt 91/1 in the amount of 15,000 rubles.

Example 2

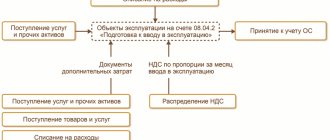

The inventory on March 20, 2019 revealed an unaccounted fixed asset item - a milling machine worth 100,000 rubles. (price is determined based on current market prices). The surplus was capitalized during inventory. Wiring:

Dt 01 Kt 91/1 – in the amount of 100,000 rubles.

Example 3

On March 22, 2019, excess materials worth RUB 12,000 were installed at the company’s warehouse. The amount of surplus is determined based on the market price of inventory items on the inventory date. Their acceptance for accounting is accompanied by posting:

Dt 10 Kt 91/1 – 12,000 rub.