Home / Taxes / What is VAT and when does it increase to 20 percent? / Declaration

Back

Published: 07/28/2017

Reading time: 5 min

0

309

Line 090 of the VAT declaration in section 3 is filled in upon the fact of tax restoration, if the representative of the declaration acts as a buyer and enjoys the right to deduct “advance” VAT when making full or partial payment to his supplier for the upcoming delivery of goods.

- The procedure for deducting VAT to the supplier upon issuance of partial prepayment

- Reinstatement of VAT to the supplier on partial prepayment

- Line 090: Data Display Guide

Section 3 of the VAT return - decoding of the lines

As we have already noted, the main purpose of section 3 of the VAT tax return is to calculate the amount of tax liability payable (reimbursement) for transactions associated with rates of 20%, 10% and estimated rates of 20/120, 10/110. Let's show what information is provided here:

- On pp. 010–042, figures are entered that determine the tax base.

- Page 043 is filled in by exporters who have refused the 0% VAT rate.

- Page 044 is intended for members of the Tax Free system.

- On pp. 045–046 the basis for sales after the expiration of the customs procedure is provided.

- Page 050 shows the implementation of the enterprise as a whole.

- Page 060 reflects construction and installation works for own consumption.

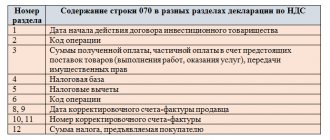

- Page 070 shows the amount of advances received for future shipments.

- Line 080 records the total amount of tax to be restored.

- Page 090 provides the amount of VAT that should be restored from previously received advances.

- Page 100 shows the amount to be restored for those transactions that are taxed at a rate of 0 percent.

- On page 118 the tax amount is displayed taking into account the restored tax. It is calculated by adding the corresponding columns pp. 010–080 and 105–115 of section 3.

- Page 120–190 are needed to reflect the amount of VAT to be deducted.

- Pages 200–210 show the amount of VAT accrued for payment or reduction. To do this, you need to subtract page 190 from page 118. If the resulting indicator is greater than zero, then it fits into page 200, if less, into page 210.

Conditions for applying a deduction for prepayment to a supplier

The right to apply the deduction shown on line 130 is given by clause 12 of Art. 171 of the Tax Code of the Russian Federation, which allows the buyer who has made an advance payment to the supplier to take advantage of a deduction in the amount of tax transferred as part of this advance payment. The tax is calculated by allocating its amount from the total amount of the prepayment at the estimated rate (i.e. 20/120 or 10/110).

Such a deduction is a mirror reflection of the obligation of the supplier who received the advance payment to calculate the tax payable to the budget from it. Moreover, for the application of the deduction (both from the buyer and from the supplier), it does not matter which method (monetary or non-monetary) the prepayment was made (clause 23 of the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated May 30, 2014 No. 33). It also does not matter whether the buyer has a debt to the supplier under another agreement (letter of the Ministry of Finance of Russia dated 03/05/2011 No. 03-07-11/45).

The buyer has the right to refuse to use this deduction. The decision on its application or non-application is best reflected in the text of the accounting policy on VAT.

In order to be able to use the deduction for the advance payment issued to the supplier, the buyer must simultaneously comply with several conditions (clause 9 of Article 172 of the Tax Code of the Russian Federation):

- the text of the supply contract must contain a clause on advance payment for a future purchase in full or partial amount;

- the fact of prepayment must be documented: payment documents, acts of transfer of property or offset of mutual claims;

- for the amount of the prepayment made from the supplier, an invoice must be received, issued by the supplier according to the rules for drawing up this document, applied when creating invoices for advances received from buyers.

Is it possible to deduct VAT if you paid more in advance than specified in the contract, or if the contract does not contain a specific advance amount, find out in ConsultantPlus. If you do not already have access to this legal system, you can get trial access for free.

Current legislation (clause 1 of Article 168 of the Tax Code of the Russian Federation) obliges the supplier to issue such invoices to the buyer upon receipt of advance payment. As in any other case requiring the issuance of an invoice, such a document must be issued no later than 5 calendar days counted from the date of the event (clause 3 of Article 168 of the Tax Code of the Russian Federation), i.e. from the date of receipt of the prepayment to the supplier.

How do you fill out section 3 of the VAT return?

The general principles of how to fill out section 3 and the VAT return as a whole are spelled out in the manner approved by our already mentioned order No. MMV-7-3 / [email protected]

Figures and other information in the reporting are transferred from accounting registers, both accounting and tax.

- To fill out page 010 gr. 3 takes the quarterly total credit turnover of accounts 90 “Revenue” and 91 in terms of income from transactions subject to VAT, and column 5 - the total debit turnover of accounts 90 “VAT” and 91 “VAT”.

- Page 070 gr. 5 is equal to the amount of VAT reflected for the quarter in the debit of account 76 “VAT on advances received.”

- Page 090 gr. 5 is the amount of tax received from the debit of account 76 “VAT on advances issued” for the tax period.

- Page 118 is the total credit turnover of account 68 “VAT”. You can check this figure with the final VAT amount in the sales book. They must be identical.

- You need to fill out page 120 with the figure corresponding to the credit turnover of account 19 for the quarter.

- On page 130 the credit turnover of account 76 “VAT on advances issued” will be displayed.

- The value on page 170 corresponds to the credit turnover of account 76 “VAT on advances received.”

- The indicator on page 190 is equal to the amount of the debit turnover of account 68 “VAT” (minus the VAT transferred to the treasury for the previous period). This line should be equal to the total VAT amount in the purchase book.

ConsultantPlus experts spoke about the nuances of filling out each line of the VAT return. To do everything correctly, get trial access to the system and go to the Ready solution. It's free.

A sample of filling out Section 3 can be downloaded from the link below:

Reinstatement of VAT to the supplier on partial prepayment

Restoration of VAT to the supplier on advance payment is provided when the advance is considered closed.

Below is a list of reasons why an advance may be considered closed:

- delivery of the goods for which the advance payment or part thereof was transferred has been completed;

- the supplier returned the advance payment in full or in part.

- the advance on account of subsequent delivery ceased to qualify as such due to a change in its purpose;

- there was a fact that the amount of an unclosed prepayment was written off to the financial results;

- prepayment is taken into account when offsetting mutual claims.

The tax authorities may require an explanation in case of refusal to restore the tax.

When recovering the amount of value added tax (which corresponds to the amount of the closed prepayment at the calculated rate), the accounting entry is carried out as follows:

D 76 / VA K68 / 02,

where 76 / VA is a subaccount for VAT accounting for the prepayment issued.

The restored amount is defined as the turnover in the debit of subaccount 76/VA in correspondence with the credit of subaccount 68/02 for the reporting period in the declaration.

Only a cadastral engineer has the right to determine the boundaries of a land plot. Have you not received your land tax receipt? How to pay the fee in this case, read here. What does the land plot plan look like? You will find a sample in this article.

Results

General regime employees are required to send a VAT return to controllers at the end of each quarter.

Its form is quite voluminous; it contains 12 sections and appendices to them. However, not all of them must be submitted to the inspectorate. Section 3 is one of the main ones; it calculates the tax, which is subsequently paid/reimbursed. In the article we talked about the purpose of all the lines in this section and some of the features of filling them out. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Consequences of applying the deduction on line 130

Tax amounts accepted for deduction on line 130 are subject to restoration from the buyer (subclause 3, clause 3, article 170 of the Tax Code of the Russian Federation) at the time of receipt of the item of purchase or the supplier returns the amount of the prepayment. The restoration is made in the same amount in which the tax was deducted. At the same time, the buyer, when accepting the purchase for accounting, deducts the VAT issued to him by the supplier in the “shipping” invoice.

An example of the restoration of VAT accepted for deduction from an advance from ConsultantPlus Organization "Alpha" (applies OSN) transfers on June 15 to the seller an advance for goods of 60,000 rubles, including VAT - 10,000 rubles. At the end of the second quarter, she declares the amount of VAT on the advance to be deducted. You can view the entire example in K+. Trial access is free.

Regulations for submitting reports

According to the current tax legislation, all VAT returns must be submitted via TKS channels. When generating a report, it is necessary to monitor changes made by the Ministry of Finance to the electronic format of the document. To submit the declaration correctly, you should use only the current version of the report.

The VAT payer or tax agent is given 25 days after the end of the quarter to prepare a report.

Keep in mind: the use of a paper version of the VAT return is allowed only for those business entities that are legally exempt from tax or are not recognized as VAT payers and certain categories of tax agents.

Filling out sections of the declaration

The reporting regulations for VAT must comply with the requirements of the instructions of the Ministry of Finance and the Federal Tax Service, set out in order No. ММВ-7-3/558 dated October 29, 2014.

Title page

The procedure for filling out the main sheet of the VAT return does not differ from the rules established for all types of reporting to the Federal Tax Service:

- Information about the payer’s TIN and KPP is written at the top of the sheet and does not differ from the information in the registration documents;

- The tax period is indicated by the code used for tax reporting. The decoding of the codes is indicated in Appendix No. 3 to the Instructions for filling out the Declaration.

- Tax inspectorate code - the declaration is submitted to the division of the Federal Tax Service where the payer is registered. Accurate information about all codes of territorial tax authorities is published on the Federal Tax Service website.

- The name of the business entity corresponds exactly to the name specified in the constituent documentation.

- OKVED code - the main type of activity according to the statistical code is indicated on the title page. The indicator is indicated in the Rosstat information letter and in the Unified State Register of Legal Entities extract.

- Contact phone number, number of completed and submitted declaration sheets and applications.

The signature of the payer’s representative and the date of generation of the report are affixed to the title page. On the right side of the sheet there is space for confirming records of the authorized person of the tax service.

Section 1

Section 1 is the final section in which the VAT payer reports the amounts subject to payment or reimbursement based on the results of accounting/tax accounting and information from section 3 of the declaration.

The sheet must indicate the code of the territorial entity (OKTMO) where the taxpayer operates and is registered. Line 020 records the KBK (budget classification code) for this type of tax. VAT payers are guided by the KBK for standard activities -001 1000 110. The KBK can be clarified in the latest edition of Order of the Ministry of Finance No. 65n dated 07/01/2013.

Attention: if the BCC is inaccurately indicated in the VAT return, the tax paid will not be credited to the taxpayer’s personal account and will be deposited in the accounts of the Federal Treasury until the identity of the payment is clarified. A penalty will be charged for late tax payment.

Line 030 is filled in only if the invoice is issued by a preferential taxpayer exempt from VAT.

In lines 040 and 050 you should record the amounts received for tax calculation. If the result of the calculation is positive, then the amount of VAT payable is indicated in line 040; if the result is negative, the result is recorded in line 050 and is subject to reimbursement from the state budget.

Section 2

This section is required to be completed by tax agents for each organization for which they have this status. These may be foreign partners who do not pay VAT, lessors and sellers of municipal property.

For each counterparty, a separate sheet of Section 2 is filled out, where its name, INN (if any), BCC and transaction code must be indicated.

When reselling confiscated goods or carrying out trade transactions with foreign partners, tax agents fill out lines 080-100 of Section 2 - the amount of shipment and the amounts received as an advance payment. The total amount payable by the tax agent is reflected in line 060, taking into account the values entered in the following lines - 080 and 090. The amount of tax deduction for realized advances (line 100) reduces the final amount of VAT.

Section 3

The main section of VAT reporting, in which taxpayers calculate the tax payable/reimbursable at the rates provided by law, raises the most questions among accountants. Sequential filling of section lines looks like this:

- Lines 010-040 reflect the amount of revenue from sales (based on shipment), taxed, respectively, at the applicable tax and settlement rates. The amount recorded in these lines must be equal to the amount of income recorded in account 90.1 and shown in the calculation of income tax. If discrepancies are found in the indicators in the declarations, the fiscal authorities will request explanations.

- Page 050 is filled in in a special case - when an organization is sold as a complex of accounting assets. The tax base in this case is the book value of the property multiplied by a special adjustment indicator.

- Page 060 concerns production and construction organizations carrying out construction and installation work for their own needs. This line reproduces the cost of the work performed, which includes all actual costs incurred during construction or installation.

- Page 070 – in the column “Tax base” in this line you should enter the amount of all cash receipts received on account of upcoming deliveries. The VAT amount is calculated at the rate of 18/118 or 10/110, depending on the type of goods/services/work. If the sale occurs within 5 days after the prepayment “falls” into the current account, then this amount is not indicated in the declaration as an advance received.

In section 3 it is necessary to enter the VAT amounts, which, in accordance with the requirements of paragraph 3 of Article 170 of the Tax Code, must be restored in tax accounting. This applies to amounts previously declared as tax deductions on preferential grounds - the use of a special regime, exemption from VAT. The restored tax amounts are reflected in total on line 080, with specification on lines 090 and 100.

In lines 105-109, data on the adjustment of VAT amounts in accounting during the reporting period is entered. This may be the erroneous application of a reduced tax rate, the wrongful classification of transactions as non-taxable, or the inability to confirm a zero rate.

The total amount of accrued VAT is indicated in line 110 and consists of the sum of all indicators reflected in column 5 of lines 010-080, 105-109. The final tax figure should be equal to the amount of VAT in the sales book based on the total turnover for the reporting quarter.

Lines 120-190 (column 3) are devoted to deductions that require the amount of VAT to be paid:

- The amount of deductions on line 120 is formed on the basis of invoices received from counterparties-suppliers and is equal to the amount of VAT in the purchase book.

- Line 130 is filled in similar to page 070, but contains data on the amount of tax paid to the supplier as an advance payment.

- Line 140 duplicates line 060 and reflects the tax calculated from the amount of actual costs when carrying out construction and installation work for the needs of the taxpayer.

- Lines 150 – 160 relate to foreign trade activities and amount to VAT paid at customs or accrued on the cost of goods imported into Russia from the Customs Union countries.

- In line 170 it is necessary to indicate the amount of VAT previously accrued on advances received if sales occurred in the reporting quarter.

- Line 180 is filled in by tax agents and contains the VAT amount indicated in line 060 of Section 2.

The result from adding the amounts of deductions for all legal reasons is recorded in line 190, and lines 200 and 210 are the result of performing arithmetic operations between lines 110 gr.5 and 190 gr.3. If the result of subtracting the amount of deductions from the accrued VAT is positive, then the resulting value is reflected in line 200 as VAT payable. Otherwise, if the amount of deductions exceeds the calculated VAT amount, you should fill out page 210 gr. 3, how VAT is refundable.

The tax amounts reflected in lines 200 or 210 of section 3 should fall into lines 040-050 of section 1.

The VAT return requires filling out two appendices to section 3. These forms are filled out:

- For fixed assets that are used in non-VAT taxable activities. An important condition is that the tax on these assets was previously accepted for deduction and is now subject to restoration within 10 years. The application reflects individually the type of OS, the date of commissioning, and the amount accepted for deduction for the current year. This application must be completed only in the 4th quarter return.

- For foreign companies operating in the Russian Federation through their own representative offices/branches.

Sections 4, 5, 6

These sections must be completed only by those payers who, in their activities, use the right to apply a zero VAT rate. The difference between the sections consists of some nuances:

- Section 4 is completed by a taxpayer who is able to document the lawful use of the 0% rate. Section 4 provides for mandatory reflection of the business transaction code, the amount of revenue received and the amount of the declared tax deduction.

- Section 6 is completed in cases where, on the date of submission of the declaration, the taxpayer did not have time to collect a complete package of documents to confirm the benefit. Unjustified transactions are included in section 6, but can subsequently be accepted for reimbursement and transferred to section 4. For this, documentation is required.

- Section 5 will have to be completed by those “zeros” who previously claimed a deduction on documents, but received the right to apply a preferential rate only in this reporting period.

Important: if there are several grounds for applying Section 5, the taxpayer must fill out separately each reporting period when the deduction was claimed.

Section 7

This sheet is intended to transmit information on transactions that were carried out in the reporting quarter and, in accordance with Art. 149 clause 2 of the Tax Code of the Russian Federation, are exempt from VAT. All documented commercial actions are grouped by codes, which are named in Appendix No. 1 to the current instructions.

The category of transactions reflected in Section 7 also includes amounts of money received into the taxpayer’s bank account on account of upcoming supplies.

Only one condition must be met - the manufacture of products or the implementation of work is long-term in nature and will be completed in 6 calendar months.

Sections 8, 9

Relatively recently appeared sections provide for the inclusion in the declaration of information listed in the sales book/purchase book for the reporting period. In order for the fiscal authorities to automatically conduct a desk audit, these sheets indicate all the counterparties “included” in the tax registers for VAT.

According to the regulations, in sections 8 and 9, information about suppliers and buyers (TIN, KPP), details of received or issued invoices, cost characteristics of goods/services, amounts of revenue and accrued VAT should be disclosed.

Important: electronic reporting modules make it possible to reconcile the data in sections 8 and 9 with counterparties before submitting the declaration. Otherwise, in the event of data discrepancies during cross-check with the Federal Tax Service, amounts to be deducted that do not correspond to the supplier’s sales book may be excluded from the calculation and the amount of VAT payable will increase.

In case of correction of data in previously declared invoices, the taxpayer is obliged to create attachments to sections 8 and 9.

Section 10, 11

These sheets are of a specific nature and must be issued only to business entities of several categories:

- commission agents and agents working for the benefit of third parties;

- persons providing forwarding services;

- developer companies.

Sections 10-11 should list information from the journal of received and submitted invoices with the amounts of VAT and taxable turnover.

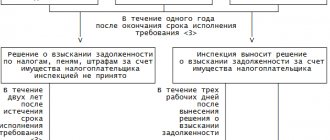

Relationship between line 130 and line 090

After posting the property from the supplier, the buyer who applied the advance tax deduction should:

- restore VAT on prepayment (subclause 3 of clause 3 of Article 170 of the Tax Code of the Russian Federation) in the amount that falls on the part of the advance paid, offset under the agreement as payment for the property received (letter of the Ministry of Finance of the Russian Federation dated November 28, 2014 No. 03-07-11/ 60891);

- reflect the advance invoice for which the deduction was applied in the sales book (clause 14 of the Rules for maintaining the sales book);

- enter the fact of tax restoration in line 090 of the VAT return (clause 38.8 of the Procedure for filling out the VAT return).

VAT will also have to be restored in the event of a change in the terms or termination of the contract, if the supplier has returned the prepayment amount (in whole or in part).

Tax officials have set up an automatic check for compliance of amounts on lines 130 and 090 and, in case of discrepancies between these indicators, require explanations on line 130 of the VAT return.

The buyer can use the right to deduction later, upon receipt and posting of property according to the invoice (letter from the Ministry of Finance dated November 22, 2011 No. 03-07-11/321, dated August 20, 2009 No. 3-1-11/651). Such actions of the buyer do not lead to an understatement of VAT obligations. In this case, the buyer does not need to restore the tax when receiving property from the supplier and, accordingly, fill out lines 130 and 090.

Composition of the declaration

The quarterly VAT return contains two sections that must be completed:

- head (title page);

- the amount of VAT to be paid to the budget/refunded from the budget.

A reporting document with a simplified format (Title and Section 1 with dashes added) is submitted in the following cases:

- carrying out business transactions that are not subject to VAT during the reporting period;

- conducting activities outside Russian territory;

- the presence of production/commodity operations of a long period - when the final completion of work requires more than six months;

- a commercial entity applies special taxation regimes (Unified Agricultural Tax, UTII, PSN, simplified taxation system);

- when issuing an invoice with a dedicated tax by a taxpayer exempt from VAT.

If the specified prerequisites are present, sales amounts for preferential types of activities are entered in section 7 of the declaration.

For tax subjects conducting activities using VAT, it is mandatory to fill out all sections of the declaration that have the corresponding digital indicators:

Section 2 – calculated VAT amounts for organizations/individual entrepreneurs having the status of tax agents;

Section 3 – sales amounts subject to taxation;

Sections 4,5,6 - are used when there are business transactions with a zero tax rate or do not have a confirmed “zero” status;

Section 7 – data on transactions exempt from VAT are indicated;

Sections 8 – 12 include a summary of information from the purchase book, sales book and invoice journal and are completed by all VAT payers applying tax deductions.