The process of filling out documentation is not easy. In this article you will learn how to correctly fill out 3-NDFL for 2015, and you will be able to.

[sc:docObr id=»https://grazhdaninu.com/wp-content/uploads/2017/07/Nalogia_Ru_Forma_3-NDFL_2015.pdf» mytext=»3-NDFL declaration for 2015»]

- Download the blank 3-NDFL form for 2015 from this link.

- A sample of the completed 2015 declaration can be downloaded from this link.

- Download the program developed for processing 3-NDFL for 2015 here.

Let's start filling out

You can fill out the 3-NDFL declaration by hand or on the computer.

You can use a special program that, when printing the declaration, will put a two-dimensional barcode on it. And this year, for the first time, citizens have the opportunity to fill out and send a tax return, as well as receive a deduction, without leaving home. All this thanks to the special Internet service “Personal Account” on the Federal Tax Service website. Read more about this here: https://www.klerk.ru/inspection/437577/

The declaration form consists of many sheets (Title page, Sections 1, 2, Sheets A, B, C, D, D1, D2, E1, E2, G, H, I). But this does not mean that you will have to fill out all these sheets.

The title page and Sections 1, 2 are filled out by all persons submitting the declaration. But other sheets are used only if necessary. Thus, Sheet A is intended to reflect taxable income received from sources in the Russian Federation, with the exception of income from business, advocacy and private practice. Therefore, if you received money while working under an employment contract in a Russian company, then you must fill out this sheet. When filling it out, a certificate of income in form 2-NDFL, which your employer issued to you, will help.

Sheet D1 is intended to reflect the property tax deduction claimed in connection with the purchase of housing. And to reflect the social tax deduction - sheet E1.

Next, we will describe the steps to fill out the 3-NDFL declaration, providing for clarity a sample of filling out the declaration itself. Let's use the example conditions for this.

Example:

Dmitry Savelievich Voronov works as a manager at Premier LLC, registered in the Russian Federation. His salary is 60,000 rubles. In 2015, he purchased an apartment in Dmitrov for RUB 3,000,000. He has no children, so he was not given standard tax deductions.

To simplify the calculation, let’s assume that Voronov’s travel, sick leave and vacation pay were not accrued or paid. Also, amounts not subject to personal income tax were not paid.

Thus, his total income (also taxable) for 2015 amounted to 720,000 rubles. (RUB 60,000 x 12 months). The amount of accrued and withheld personal income tax was 93,600 rubles. (RUB 720,000 x 13%).

Declaration form 3-NDFL

Those individuals who apply for a tax deduction and at the same time decide to enter data into the declaration by hand must use a special form, namely 3-NDFL (it can be downloaded from the link given above).

Since the blank form is characterized by the presence of as many as nineteen pages, the taxpayer should not rush to print it out. We recommend that you first decide or consult with a tax inspector about which sheets should be submitted for verification in order to receive the deduction you need.

For reference! This form 3-NDFL was adopted on November 25, 2015 by publishing an order under the number MMV-7-11/544 by such an executive body as the Federal Tax Service.

How to start easily navigating the form

So that applicants for the deduction are not intimidated by the large number of pages of the tax return form for 2015 and can easily find the area of the document that they need, it is usually divided into four parts:

- Title page. The first page of the 3-NDFL form is entirely devoted to passport information about an individual applying for a tax discount, or data of a similar nature, but taken from another identity document. In addition, here you need to enter the codes of the adjustment, tax period and inspection to which the declaration will be sent for consideration, as well as indicate the total number of its pages.

- The part about taxes. The individual is required to inform the tax agent of the amount he expects to be reimbursed (section 1). In addition, you need to perform all the necessary calculations of the taxable base (section 2, paragraph 1), as well as the amount that will be accrued to the applicant for deduction as compensation (section 2, paragraph 2).

- The part about profit. Since the process of calculating a deduction involves the return to an individual of the income tax that was paid by him, the declaration requires an indication of its amount in ruble currency. The taxpayer also needs to enter data on the sources of income along with their names and do not forget to enter the amount of profit they bring (sheet A or B).

- The part associated with a specific type of deduction. After the first three parts are completed, an individual needs to select from seven sheets (D1, D2, E1, E2, F, Z, I) the one whose name corresponds to the type of deduction needed for him. For example, if a taxpayer wants to reimburse the tax for profits received as a result of professional activities, then he needs to fill out a sheet J.

ATTENTION! Those applicants for reduction of the tax base who are entrepreneurs or make a profit through private legal activities must additionally fill out sheet B. And in cases where the taxpayer has any income that is not legally subject to personal income tax, then he must fill out sheet G.

Design rules

Sometimes it happens that an individual does not receive compensation that is due to him as a deduction due to the fact that the tax return was carelessly completed. In this regard, we recommend paying attention to the following few details:

- How to fasten the sheets of the form? All pages of the 3-NDFL form must be stapled. This will eliminate the possibility of losing one or more sheets. The binding procedure must be carried out carefully - the staples must be placed in the upper right or left corner of the sheet so that they do not capture text or barcodes.

- How to print the form? For printing, you must use white A4 sheets. One sheet must correspond to exactly one page of the 3-NDFL form. That is, for example, if a taxpayer wants to print page D1, then he must allocate a separate blank sheet for it and not print or write anything else on the reverse side.

- What is unacceptable? If the declaration contains any corrections, amounts of money indicated in foreign currency, difficult-to-read information, unreliable data, information that goes beyond the boundaries of the fields intended for their entry, and entries written in the wrong format (not from left to right, but vice versa) , then such a document will be considered incorrectly filled out.

Filling out the title page

The declaration begins with the title page. At the top of the page you need to enter your Taxpayer Identification Number. The same must be done on each completed declaration sheet. If you have forgotten your TIN, you can find it out from the tax registration certificate, from the 2-NDFL certificate or on the website of the Federal Tax Service of Russia .

By the way, the Filling Out Procedure states that if an individual is not an entrepreneur, then he has the right not to indicate his TIN. True, provided that the Title Page indicates:

- code of the country;

- his personal data: date and place of birth, full passport details.

At the bottom of each completed page of the Declaration, with the exception of the Title Page, in the field “I confirm the accuracy and completeness of the information specified on this page,” you must put your signature and the date of signing.

Please indicate the correction number below. Since you are most likely submitting the 2015 declaration for the first time, you will indicate “0” there. In case of resubmission of the declaration (this happens if errors are detected in the “primary” declaration), indicate “1”. If more “clarifications” follow in the future, then each such “clarification” will be assigned its own correction number, in chronological order.

The tax period code should be “34”, and next to it should be the tax period “2015”. In the column “Submitted to the tax authority (code)” you will enter the code of the tax office at the place of your permanent residence. The country code will be “643” (for Russian citizens), and the taxpayer category code will be “760” (for individuals claiming tax deductions). After this, reflect your Last Name, First Name, Patronymic, date and place of birth.

Next, enter your passport details indicating the document code “21”. Taxpayer status “1” if you are a tax resident of Russia. Next, indicate your postal address of residence, and before that put the number “1”. “Residence address outside the Russian Federation” does not need to be filled in. And finally, provide your phone number.

You will fill in the line “The declaration is drawn up on ___ pages” and “with the attachment of supporting documents or their copies on ___ sheets” later, when you can count the number of pages of the declaration and the number of sheets of attached documents.

In the lower left part of the page, under the line “I confirm the accuracy and completeness of the information specified in this declaration,” you indicate the number “1.” Leave the following lines blank. Above the line “Name of the document confirming the authority of the representative” put your signature and the date of completion. Leave the lower right part of the title page under the heading “To be completed by a tax authority employee” blank.

A sample of filling out the title page is presented below.

Declaration 3-NDFL for 2015 (download) for income tax in Excel (Excel) and PDF (PDF) format

The 3-NDFL declaration for 2015 must be sent to the tax office no later than April 30, 2021. However, this is not a working day - Saturday. Therefore, the deadline for submission (taking into account the May holidays) falls on the first working day - May 4, 2021. For information on in what cases you must submit a 3-NDFL declaration, how to fill it out, register it and send it to the tax office, see the link.

Our website contains an updated form of personal income tax declaration 3, taking into account all changes in PDF and Excel format. You can easily download the 3-NDFL declaration for 2015 to your computer. Personal income tax declaration form 3 is given in Excel and PDF format. By downloading the 3rd personal income tax declaration for 2015, you can fill it out yourself: either directly on the computer, or by hand printing out the necessary sheets.

You can also fill out the 3-NDFL declaration online on our website. To fill out 3-NDFL online, follow the link. Our service is designed to quickly fill out the necessary declaration sheets for those who sold a car, real estate or other property in 2015.

Fill out Sheet A

The next sheet to fill out is “Sheet A”.

It should reflect all income received for 2015. As we noted earlier, a 2-NDFL income certificate from the employer (employers) will help you with this. First, you indicate the tax rate - “13”%, and then the code of the type of income. If your income is only your salary received in 2015, then you will need to enter “06”.

Next, transfer information about your employer from the 2-NDFL certificate: TIN, KPP, OKTMO code and company name. And also indicate the amounts:

- income;

- taxable income;

- tax calculated;

- tax withheld.

This data is contained in section 5 of Help 2-NDFL.

If there were several employers last year, then data for each of them should be reflected in sheet A.

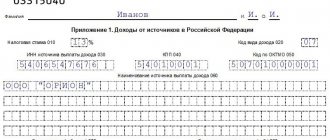

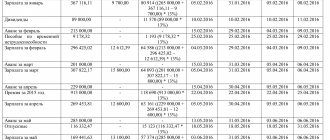

A sample of filling out Sheet A is presented below.

Tax return form

As you know, every year the declaration form changes slightly. In this regard, individuals who fill out a form for a tax rebate need to pay attention to what year it was compiled for, and also that it is completed exactly according to the 3-NDFL form.

Reference Information! Before downloading the 3-NDFL form, taxpayers are advised to check that this document was issued by the Federal Tax Service. Form 3-NDFL for 2014 was approved on December 24 (of the same year) after the order was put into effect, which was assigned the number MMV-7-11/671.

How to fill out

Form 3-NDFL consists of a certain number of pages, in some of which it is necessary to enter data, in some - depending on the situation, and in some - it is not necessary at all. However, each sheet must be signed by the applicant for income tax refund, have a mark with the current date, as well as his identification code, last name, first name and patronymic (the last two indicators do not need to be written in full, it is enough to indicate the initials).

The structure of a blank tax return form is as follows:

- Required pages. An individual must enter data on certain pages of 3-NDFL. These include a title page (designed to indicate information about the taxpayer), the first and second sections (dedicated to calculating the size of the income tax base, as well as the amount of compensation due to the applicant for a tax discount), as well as a sheet marked with the letter A (required to enter data on sources and amounts of income).

- Pages to be completed in special cases. There are sheets on your tax return that are designed for specific situations. For example, sheet B, which should be issued only by individuals who earn money abroad. This also applies to sheet B, intended for taxpayers related to a certain type of activity (individual entrepreneurs, lawyers and private lawyers). The last sheet from this category is marked with the letter G and is needed so that the taxpayer can mark income from which personal income tax should not be withdrawn;

- Optional pages. All other pages following sheet D and marked starting from mark D1 and ending with mark I relate to a certain type of deduction. The taxpayer needs to select a sheet under the letter that corresponds to the name of the deduction due to him by law, and enter information on it, and all the other above-mentioned pages do not need to be filled out or printed.

It should be noted that if an individual decides to reimburse the tax for two types of tax deductions at once and he has the right to a procedure of this kind, then this is quite possible to implement by filing just one 3-NDFL. For example, on sheet E1 you can immediately apply for both social and standard types of tax discounts.

Design nuances

We advise all applicants for a reduction in the tax base who are faced with filling out 3-NDFL manually to pay attention to the following few nuances, since if they are not observed, the document will be considered illegal:

- Empty cells. It is necessary to write information, regardless of whether it is numbers (only Arabic is used) or letters (only Russian is entered), starting from the left edge of the field. If, after specifying the data, some cells remain unused, then dashes must be placed in them. In situations where the entire field remains empty (for example, an individual does not need to enter the name of a locality because he lives in a city), a dash is placed in each cell.

- Taxpayer's representative. If for some reason the applicant for a tax discount is preparing the declaration not independently, but with the help of a representative, then the appropriate mark must be placed on the title page (number 2). Also in the 3-NDFL form you will need to enter the last name, first name and patronymic of the representative, details of the document evidencing his authority, as well as his personal signature and the current date.

- Sources of profit. Often an individual has several sources of income. Such data must be entered into sheet A, which is divided into three parts. Thus, if the taxpayer’s profit is related to three sources, it is necessary to fill out all three parts, and if with a large amount, then sheet A must be continued by adding a new page.

Fill out Sheet D1

Sheet D1 is intended for calculating the property tax deduction claimed in connection with the purchase of housing.

First, the object name code is indicated. For example, put the number “1” if you purchased a residential building, “2” if you purchased an apartment, and “3” if you purchased a room. Then you need to reflect the type of ownership of the object. So, if the property is individual, “1” is entered in the corresponding field. If the common share is “2”, the common joint property is “3”, the property of a minor child is “4”.

Next, it is necessary to reflect the characteristic of the taxpayer: 01 - owner of the object, 02 - spouse of the owner of the object, 03 - parent of a minor child (owner of the object), 13 - taxpayer claiming a property deduction for expenses associated with the acquisition of an object into the common shared ownership of himself and his minor child , 23 – a taxpayer claiming a property deduction for expenses associated with the acquisition of an object in the common shared ownership of the spouse and his minor child.

Then enter the postal address of the apartment (house, room) in respect of which the deduction is issued.

If the purchase of an apartment was carried out under a purchase and sale agreement, then after the address the date of receipt of the certificate of ownership should be indicated (clause 1.7). But if the apartment was purchased at the construction stage, under an equity participation agreement, then you will need to indicate the date of receipt of the apartment acceptance certificate (clause 1.6). Clause 1.10 is completed if the apartment or house was purchased as shared ownership. In this case, in clause 1.10 you need to indicate your share of ownership.

Paragraph 1.11 reflects the year in which the property tax deduction began to be used, in which the tax base was first reduced. For example, if the purchase of an apartment took place last year, then in paragraph 1.11 you write “2015”.

After which you need to determine the amount of expenses for purchasing an apartment and if it does not exceed the limit of 2 million rubles, then enter it in clause 1.12. If the apartment cost more than 2 million rubles, then in paragraph 1.12 indicate the limit amount. If you purchase housing with a mortgage, in clause 1.13 you can indicate the interest on the loan you paid until the end of 2015.

If you are claiming a deduction for the first time in 2015, leave paragraphs 2.1, 2.2, 2.3, 2.4 blank. Clauses 2.5 and 2.6 must be completed if you received a property deduction through your employer in 2015.

In paragraph 2.7, it is necessary to indicate the size of the tax base in relation to income taxed at a rate of 13%, minus the tax deductions provided. This amount can be found in paragraph 080 of sheet A. If you have several employers indicated, then the sum of paragraphs 080 of sheet A is taken.

In paragraph 2.8 you will reflect the amount of expenses for the purchase of an apartment, which is accepted for deduction in 2015. However, this amount cannot exceed the size of the tax base (from paragraph 2.7). If you do not claim an interest deduction in your return, paragraphs 2.9 and 2.11 will be blank.

Clause 2.10 indicates the balance of the property deduction carried over to subsequent years, which can be determined by subtracting the amount specified in clause 2.8 from the amount of clause 1.12.

A sample of filling out Sheet D1 is presented below.

3-personal income tax for 2015 in Excel (Excel): how to fill out

It is necessary to fill out only those declaration sheets for which you have the necessary data. Therefore, most sheets will not be included in the declaration. There is no need to fill them out and submit them to the tax office. Therefore, for most, the declaration consists of 5-6 sheets. Under any conditions, the declaration must include a “Title Page” and a Section indicating the amount of tax to be reimbursed or paid.

For example, if you did not receive income that is taxed at a higher rate (30% and 35%), then the sheets “Section 2. Calculation of the tax base and the amount of tax on income taxed at a rate of 30%” and “Section 3. Calculation of tax bases and tax amounts for income taxed at a rate of 35%” do not need to be filled out, printed, or submitted as part of the declaration. Therefore, before filling out the 3rd personal income tax declaration in Excel, it is better to delete the extra sheets.

When filling out the 3-NDFL declaration on a computer, you need to use the Courier New font size 16 - 18 points. When filling out a personal income tax return by hand, this is done in block letters.

Filling out Section 2

Next, we proceed to filling out Section 2.

In paragraph 1 (line 010), you need to write down the amount from sheet A from line 070 “Income amount”. If you indicated several employers, then you need to indicate the sum of all lines 070 of sheet A.

Item 2 (line 020) in our case is not filled in, since it is intended to reflect the total amount of non-taxable income, for which sheet D is used (for example, if the company paid financial assistance for the birth of a child). But in our example they are absent.

In paragraph 3 (line 030) you need to indicate the same amount as in paragraph 1. If an individual had non-taxable income in 2015, that is, filled out the above paragraph 2, then when calculating the indicator reflected in paragraph 3, it would follow from point 1 subtract point 2.

The next paragraph is 4 “Amount of tax deductions”. The declaration contains a hint - which items of which sheets need to be added up to get this amount. According to our example, in paragraph 4 of Section 2, you should indicate the data in paragraph 2.8 of sheet D1.

Item 6 “Tax base for tax calculation” (line 060) is calculated as follows: from the amount reflected in item 3 (line 030) the amount reflected in item 4 (line 040) is subtracted. If the result is negative or equal to zero, then a zero is entered in line 060. In our example, we get zero.

In paragraph 8 “Total amount of tax withheld at the source of payment” you need to indicate the amount of line (lines) 100 of sheet A. In paragraph 14 “Amount of tax to be refunded from the budget” you need to calculate (clause 8 + clause 9 + clause 10 + clause 11 - clause 7). Since in our case all points except point 8 are equal to 0, the sums of points 8 and 14 are equal.

A sample of filling out Section 2 is presented below.

Sample form 3-NDFL for 2014

As mentioned above, there are several types of tax compensation that a taxpayer may qualify for. In this regard, it would be advisable to consider a sample form 3-NDFL for 2014, dedicated to a specific type of deduction - standard.

The number of pages of such a form includes five sheets - title, section 1, section 2, sheet A and sheet E1. Since the procedure for preparing the first three sheets usually does not cause problems, we suggest going straight to the samples of sheets A and E1.

Sample sheet A

First of all, the applicant for a reduction in the tax base needs to enter the identification code and page numbers, and then write his surname in large Russian letters and put his initials next to it. You will then need to provide information in the following fields:

- Cells requiring registration of codes. This is cell 010, concerning the size of the tax rate (the number 13 is put in it), cell 020, dedicated to the type of profit (for a standard deduction, you need to use code 06 or 07), as well as 030 (identification code of the source of income), 040 (reason code for setting accounting) and 050 (code according to the all-Russian classifier of municipal territories).

- Box 060. Here you need to enter the official exact name of the enterprise that generates income for the individual who has applied for a reduction in the tax base.

- Cells relating to the amount of income. In the fields signed with numerical combinations 070, 080, 090 and 100, you must indicate the total amount of income, the size of the tax base, as well as the amount of personal income tax withdrawn from it.

Sample sheet E1

In order to receive standard compensation, in the 3-NDFL form, individuals will need to fill out only the first paragraph of sheet E1, and then summarize the entered results in the fourth paragraph.

First you need to indicate the number of months for which the taxpayer’s final income did not exceed the maximum allowable limits (for 2014 this is the amount of 280,000 rubles). Then it is necessary to note the amount of the deduction in the subclause that corresponds to the specific circumstances (for example, if a parent raising a child alone applies for standard compensation, then this is subclause 1.5.), and duplicate the specified value in subclause 1.8.

Attention! After filling out the first part of sheet E1, do not forget about its fourth paragraph, as well as putting the date and signature.

Filling out Section 1

And the preparation of the tax return is completed by filling out section 1 “Information on the amounts of tax subject to payment (surcharge) to the budget/refund from the budget.”

In this sheet, under the words “Values of indicators” about (return from the budget).

The budget classification code is as follows: 18210102010011000110. OKTMO code is your employer’s code (you can view it on Sheet A or in the 2-NDFL income certificate). In the line “Amount of tax to be refunded from the budget” you should indicate the amount from paragraph 14 of Section 2.

A sample of filling out Section 1 is presented below.

There are no deadlines for filing a 3-NDFL declaration by citizens claiming a tax deduction. Therefore, you can submit a declaration for 2015 at any time throughout the year. The deadline for filing a declaration in this case is not limited to April 30 of the following year, since filing a declaration is a right, not an obligation, of a citizen.

The only restriction that applies to the deadline for filing a declaration and application is the rule of paragraph 7 of Article 78 of the Tax Code of the Russian Federation: an application for a refund of the amount of overpaid tax can be submitted within three years from the date of payment of the specified amount. That is, he must apply for a refund of the amount of tax paid by the taxpayer on income received, for example, in 2015 before the end of 2021.

Sample tax return

In order for applicants for a reduction in the tax base to be able to cope much more easily with filling out the 3-NDFL declaration, we suggest looking at a specific example of a completed form. Since almost every taxpayer has one or more children, a sample tax return that focuses on the standard deduction type will be most relevant to them.

How many sheets do you need to fill out?

In order to receive standard tax compensation for a child, parents will need to fill out four more pages in addition to the title page of form 3-NDFL. First of all, this is section one, which requires entering information regarding the amount that the taxpayer wants to receive as compensation.

You must also provide information in section two. As a rule, this is various information about the taxable base, as well as the amount that will be paid to the individual after the deduction is calculated.

After the above pages have been completed, the applicant for the standard deduction can begin to enter data into sheets A and E1. In the first of these sheets, the taxpayer needs to report his income (write down the amount of profit for the tax period, the amount of taxes withdrawn from him, and also note the name of the source giving the income). And the second sheet E1 is intended exclusively for information related to standard and social tax rebates.

How to enter information about the standard deduction

It is very easy to fill out sheet E1, intended for calculation information about deductions of a standard type. The taxpayer will only need to complete the first paragraph of this sheet, and not the entire one, as well as the fourth paragraph. Next to each field in which you need to specify some information, there is a digital designation.

In order to receive standard compensation, an individual needs to fill out the cells next to which are the following numbers:

- 030 – here you need to write the number of months counted from the beginning of the tax period for which the taxpayer’s total income was no more than 350,000 rubles. For example, if for January, February, March and April an individual’s salary was equal to 87,500 rubles, then the total amount of his profit for these months is equal to 350,000 rubles and he must indicate the number four in this cell;

- 040 – here you will need to enter the amount of the tax discount provided to the taxpayer, who is a parent. That is, this is the amount that will be deducted from the total profit until personal income tax is withdrawn from it;

- 080 – The total amount of the standard deduction is entered in this cell. Usually this is the same figure that is written in cell 040. But sometimes it happens that an individual has the right to several standard compensations at the same time, and then in field 080 he needs to take this fact into account by indicating their total amount;

- 190 – This includes the amount of not only the final standard compensation, but also social compensation (since sheet E1 also relates to it). Thus, if a taxpayer submits documents to receive a standard deduction, then you simply need to copy the amount from cell 080 into this cell.

Two deductions in one declaration

Is it possible to submit one declaration simultaneously for two deductions: property and social?

Yes, you can. There is a separate sheet to reflect each deduction. First of all, you will be returned the social deduction, and then the property one, but in total no more than the amount of tax withheld from your wages.

Since the amount of the property deduction is greater than income, the underused portion will be transferred to the next year. But the law does not provide for the possibility of transferring the balance of unused social tax deductions to the next tax period.