KND 0710096 reporting is nothing more than a form that is read by a machine. This tax return code contains information about the financial position of the company. The CND encrypts the balance sheet, a report on the financial component and data on the expenditure of funds.

The Federal Tax Service of the Russian Federation recommends using such a form. At the same time, only enterprises operating under simplified taxation can use this method of reporting. These include small businesses.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

+7 (499) 938-81-90 (Moscow)

+7 (812) 467-32-77 (Saint Petersburg)

8 (800) 301-79-36 (Regions)

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

This form is used for reporting starting in 2020. And since then, little has changed in filling out the documentation. But you need to familiarize yourself with the legislative and practical framework.

Law of accounting forms

Clause 1, Article 14 of Federal Law No. 402-FZ of December 6, 2011 (“On Accounting”) involves filling out three main documents:

- 1. Balance;

- 2. Statement of financial results;

- 3. Explanatory note to the annual reporting.

Simplified accounting reporting for small businesses 2018

The sixth paragraph of Order No. 113n of the Ministry of Finance of Russia dated August 17, 2012 approved the first and second forms of simplified financial statements for small enterprises.

In addition, in December 2015, the Federal Tax Service, by order, established the procedure for submitting forms electronically. A sample order can be downloaded for free here:

Simplified accounting financial statements for small firms KND 0710096 has a machine-readable format.

Simplified financial statements form, how to fill out?

In electronic form in Excel, samples of forms KND 0710096 can be downloaded here:

It is also convenient to fill out documents in Adobe Reader; they are filled out in PDF format: KND form 0710096 download for free here:

A sample of fully completed small business forms can be downloaded for free here:

Let's look at how to fill out the KND form 0710096 in more detail:

1. According to the law, an LLC is supposed to approve in March-April of the year what will happen after the reporting year, and for a JSC - in March-June. 2. If the form is not signed by the director, be sure to indicate a document authorizing a company employee to submit reports. An example of such a document is a power of attorney.

3. The legal address is indicated.

Next, fill out a simplified balance. Instructions and sample:

1. You should fill in the data line by line: Asset separately, each line, then - Passive. Unlike a regular report, simplified reports indicate several indicator values in one cell, that is, a certain group of indicators. The code must be selected according to the indicator whose specific weight is the largest in the sum of all.

2. The code should be selected based on Appendix No. 4 of Order No. 66 of the Ministry of Finance.

The financial results report must also be completed. Its result is a reflection of the profit or loss incurred by the enterprise.

Line codes

Lines in are filled in according to Appendix number four. You can download a sample application here:

A regular balance sheet for financial results is not much different from a report. The main difference is that the so-called “simplified” indicate enlarged values.

Who has the right to submit simplified financial statements?

By law, they have the right to report in this way:

- 1. Small businesses;

- 2. Participants of the Stolkovo project;

- 3. Non-profit organizations.

Note that under no circumstances can the simplified form be used by those companies that are required to be audited according to the legislation of the Russian Federation. It is also prohibited for business entities such as zheki, KPK (including agricultural), microfinance companies, the public sector, political parties, companies engaged in legal, lawyer, notary activities - they do not have the right to report by submitting “simplified documents”.

Filling out the financial documents of an enterprise is an important point, since errors in such acts can lead to serious problems with the tax office during an audit.

If you have any additional questions on this topic, you can contact our legal consultants for help.

Legal requirements for submitting accounting reports

Accounting statements are a set of documents of a certain content, compiled according to accounting data (clause 1, article 13 of the law “On Accounting” dated December 6, 2011 No. 402-FZ). Keeping accounting records is not mandatory for individual entrepreneurs, private practitioners and divisions of foreign companies that keep records in accordance with the rules of Tax legislation (Clause 2 of Article 6 of Law No. 402-FZ). Accordingly, accounting is not mandatory for them. But the legal entity must prepare and submit it (subclause 5, clause 1, article 23 of the Tax Code of the Russian Federation).

For information on which medium, electronic or paper, it is possible to submit accounting reports to the Federal Tax Service, read the material “Accounting reports do not have to be submitted electronically.”

Today there are 2 options by which accounting records are formed (order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n):

- full;

- simplified, which can be used by legal entities that have the right to conduct accounting according to simplified rules.

Simplification of reporting implies the possibility of drawing up 3 forms of reporting in a reduced volume:

- balance sheet;

- financial results report;

- report on the intended use of the funds received.

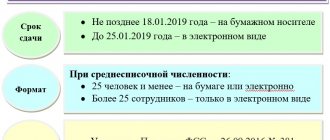

Reports can be submitted both on paper and via electronic communication channels. To submit simplified reporting for 2018 in electronic form, a special electronic format has been established [email protected]

Necessity of maintaining

In accordance with Federal Law 402, financial statements are a series of documents that include data on the financial and property indicators of organizations and enterprises, reflecting receipts, income, and data on financial results for a certain reporting period.

It is mandatory for legal entities, but individual entrepreneurs have the right not to draw it up, in accordance with Art. 6 Federal Law 402.

There are two options for its implementation: full and simplified (in accordance with Order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n). The second can be used by legal entities entitled to conduct simplified accounting.

The simplified form consists of three types of reports:

- balance;

- financial results report;

- report on the intended use of funds.

Reporting for small businesses for 2018: are there any changes?

Who has the opportunity to simplify accounting and, accordingly, reporting? The answer to this is given by clause 4 of Art. 6 of Law No. 402-FZ. The list of such entities is given in the table:

| Who can keep simplified records | Law regulating the activities of the subject |

| Small businesses | Law “On the development of small and medium-sized businesses in the Russian Federation” dated July 24, 2007 No. 209-FZ |

| NPO | Law “On Non-Profit Organizations” dated January 12, 1996 No. 7-FZ |

| Companies operating within the Skolkovo project | Law “On the Skolkovo Innovation Center” dated September 28, 2010 No. 244-FZ |

At the same time, the listed entities must meet the conditions specified in paragraph 5 of Art. 6 of Law No. 402-FZ, for example, not be subject to mandatory audit, not be a government organization, political party, not engage in microfinance, etc.

The forms of simplified reports are given in the current version of the order of the Ministry of Finance of the Russian Federation dated July 2, 2010 No. 66n. The table below reveals which reports are required for bookkeepers, as well as the features of special forms:

| Is the report required for bookkeepers? | Is there a special simplified template? (order No. 66n, appendix 5) | Features of the simplified report | |

| Financial statements | |||

| Balance | Yes | Yes | It has enlarged articles that group several elements. If any indicator is significant, it must be highlighted separately |

| Income statement | Yes | Yes | There is no division by type of expenses for core activities, there is no current income tax and other indicators that are most likely to be insignificant for bookkeepers |

| Applications | |||

| Statement of changes in equity | No for insignificant indicators | No, the general one is used, taking into account the materiality of the indicators | |

| Cash flow statement | No for insignificant indicators | No, the general one is used, taking into account the materiality of the indicators | |

| Report on the intended use of funds | Yes - for non-profit organizations and legal entities with targeted revenues; no - for others with insignificant indicators | Yes | There is no breakdown by type of contribution, no detailed breakdown of expenses |

| Explanations for reporting | No for insignificant indicators | No, the general one is used, taking into account the materiality of the indicators | |

The templates from Order No. 66n are advisory; an organization can develop its own form that corresponds to its activities, leaving and grouping the necessary articles of the general reporting forms. There are no templates for applications, since their preparation is mandatory only if the data specified there can have a significant impact on the opinion of users (subparagraph “b”, paragraph 6 of Order No. 66n).

After the establishment of a unified form of simplified reporting (Order of the Ministry of Finance of Russia dated April 6, 2015 No. 57n), changes were no longer made to Order No. 66n. Therefore, for the report for 2015, 2021, 2021 and 2021, the same forms for both full and simplified reports are valid. Accordingly, the KND 0710096 format also applies.

Read about the nuances of filling out simplified reporting.

Who has the right to draw up

Let's present the data in a pivot table.

| Subject | The law that defines this right |

| Small businesses | Federal Law 209 |

| Non-profit organizations | Federal Law 7 |

| Companies participating in the Skolkovo project | Federal Law 244 |

At the same time, in order to obtain the right to simplified accounting, a business entity must meet a number of conditions listed in Federal Law No. 402-FZ. For example, it should not be subject to mandatory audit, not be a political party, etc.

KND 0710096: simplified financial statements

Simplified reporting includes three forms:

- Simplified balance sheet,

- Simplified income statement,

- A simplified report on the intended use of funds (submitted by non-profit organizations).

Small businesses are guided by the following rules:

- The reports reflect aggregated indicators by group; breakdowns by item are not provided,

- The appendices provide only the most important information, without which a real assessment of the company's financial condition is impossible.

At the same time, small businesses are not prohibited from submitting financial statements in full forms. The use of KND 0710096 is a right, not an obligation, of the entities listed in Part 4 of Article 6 of the law of December 6, 2011. No. 402-FZ:

- Small businesses,

- Non-profit companies

- Residents of Skolkovo.

The same legal norm lists organizations that cannot report under KND 0710096:

- Companies that are required to undergo an audit are

- Housing and credit cooperatives,

- Microfinance organizations,

- State companies,

- Political parties,

- Bar associations and bureaus, legal consultations,

- Notary and bar associations,

- Non-commercial foreign agents.

Filling Features

The principles for filling out accounting records for SMP are similar to the standard principles. Thus, the balance sheet also consists of two sections: assets and liabilities. Each section provides detail for the largest groups, which, in turn, are revealed over the dynamics of several reporting periods.

If, after submitting the balance sheet, errors are identified, even significant ones, then the submitted reports cannot be corrected. Error correction is not provided for SMP. In this case, new reports are completed using a retrospective method. That is, the error is corrected in accounting, the balance sheet indicators are recalculated.

KND 0710098: with barcode

What forms are required?

In the table we will show which forms of accounting are mandatory and which are not, and on the basis of what, what are their features.

| Form, report | Mandatory or not | Availability of template by order 66n | Peculiarities |

| Accounting | |||

| Balance | Yes | Yes | Divided into consolidated articles that group several elements at once. Selection of an indicator is necessary only if its value and if it is significant. |

| About financial results | Yes | Yes | It does not contain a division by type of expenses for core activities; the current income tax is not highlighted, as are other indicators, which are most often insignificant. |

| Applications | |||

| About capital changes | No if the indicators are insignificant | The general one is used taking into account the significance of the indicators | |

| About cash flow | Likewise | Likewise | |

| Explanations | Likewise | Likewise | |

| About the intended use of funds | Mandatory only for NPOs and legal entities with targeted revenues | Yes | There is no detail or breakdown by type of contribution. |

Read more about how companies fill out reports using the simplified tax system in our article by clicking on the link.