Joint reconciliation of settlements with the Social Insurance Fund

Sometimes it becomes necessary to reconcile the information available to the payer and the fund. For this purpose, a special application is drawn up in any form. The Fund will issue a special act in response. FSS employees have the right to invite the payer to conduct a joint reconciliation of payments to the budget. The payer himself may also request it.

Most often, this is done to avoid any troubles with FSS employees, or to find out about the presence of debts or overpayments by the company.

As a rule, this reconciliation is carried out every quarter, after the reports are submitted. But the law does not provide for a time frame, so it can be arranged at any time.

These calculations help organizations eliminate possible problems with the Social Insurance Fund. And when liquidating a company, you can easily deal with existing debt and incorrect tax collection information. This reconciliation will help you get your funds back and avoid fines.

Application for verification with the Social Insurance Fund: how to submit and its sample

It is important to understand that this kind of document does not have a specific form in law. This means that payers will fill it out on their own. A sample document can be downloaded here ˃˃˃

In order to obtain information from the fund, you need to request the following documents from it:

Get 267 video lessons on 1C for free:

- Free video tutorial on 1C Accounting 8.3 and 8.2;

- Tutorial on the new version of 1C ZUP 3.0;

- Good course on 1C Trade Management 11.

- A certificate of existing insurance premiums and fines. Here you can see whether the company has an overpayment or debt to the fund;

- The settlement status will tell you about all payments made.

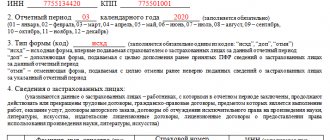

To carry out reconciliations, you must first write an application. Its structure is not provided for by law, but must contain certain columns. In other words, the application for reconciliation with the Social Insurance Fund does not have a specific sample, but it must contain some information:

- Contributions and codes for them must be written down. Otherwise, the verification will be carried out in full on all available contributions;

- the application must also contain information about the payer: full name, tax identification number, checkpoint, registration number, subordination code;

- inside the application the request itself and the requirement for reconciliation are described;

- Such a document must be signed either by the head of the organization or the chief accountant:

Instead of providing information about contributions that need to be verified, you can add an appendix with this information to your application. It is thanks to it that the reconciliation process can be significantly simplified and accelerated.

You need to know that to submit this type of document, the payer must contact the Social Insurance Fund at the location of the organization. You must bring the application in person to the fund’s employees or send it electronically.

Reconciliation report with the Social Insurance Fund

There is no specific deadline for the transfer of information in the legislation. But if a debt is discovered from a company, the FSS is obliged to notify the payer about it within ten days. The answer is provided in the form of a Reconciliation Report:

This document contains all the information on contributions to the Social Insurance Fund. Fund employees have the right to send the act by mail or hand it over personally to the payer.

Then, when all the information matches the data from the payer and the Social Insurance Fund, the reconciliation is considered completed. If there are differences, the organization faces a lengthy process of rechecking and correcting its data.

Reasons for drawing up a Reconciliation Report with the Social Insurance Fund

Reconciliation is an important document, because no one is immune from errors. This document will allow you to avoid incorrect information. There are several reasons why fund reconciliation may be necessary. This:

- reorganization or liquidation of the enterprise;

- to identify debt to the fund or overpayment for the return of funds;

- to systematize information;

- Reconciliation is also carried out by organizations that are going to participate in competitions and tenders for licensing.

What is settlement reconciliation?

Clause 9 of Article 18 of Federal Law No. 212 “On Insurance Contributions” states that the Social Insurance Fund can initiate reconciliation of settlements with the payer. This procedure is carried out on the basis of the rules established by the same law - Federal Law No. 212. It is carried out on the initiative of both the body itself and the payer. The frequency of the event can be any. Reconciliation can be initiated on any date. However, the procedure is usually carried out every quarter. In particular, it is planned after sending the report in Form 4-FSS.

NOTE! In connection with current changes in legislation, from January 1, 2021, control over the timeliness and completeness of payment of insurance contributions and fees to the Social Insurance Fund is transferred to the Federal Tax Service.

Since the payment of insurance premiums is now the responsibility of the fiscal service, they should be paid to the accounts of the Federal Tax Service (for reporting periods after January 1, 2021). Until this date, payments were made to the FSS accounts. To avoid confusion, until the end of 2021 you could continue to pay on your usual accounts, but in 2021 you will have to pay according to the new requirements.

Features of the reconciliation report

The reconciliation report is the primary documentation. On its basis, you can verify the quality of the accounting department’s activities. It allows you to timely detect and eliminate financial offenses. The act indicates not only the obligations, but also the items for which debts arose. For example, these could be debts due to penalties.

Basic moments

In order to carry out a reconciliation with the Pension Fund, the payer of contributions must request from the control authorities one of the following documents:

| Help | Concerning the status of settlements for insurance premiums |

| Information | Regarding the status of payments on a specific date |

By means of a certificate, the applicant is informed about the presence of arrears in insurance payments or excessive overpayment. The certificate is compiled as of a specific date.

The information provided by the Fund provides a breakdown of all payments made by the policyholder in the period shown in the submitted request.

If there is no arrears or overpayments, the reconciliation process is considered completed.

When the information of the Pension Fund and the policyholder differs not in favor of the payer, there is a need for a more thorough reconciliation of payments.

To do this, all calculations regarding insurance premiums, fines and penalties are checked. The consequence of such a check is drawn up in a reconciliation report with the Pension Fund.

Many payers are interested in how to request a settlement balance, but it is not as difficult as it might seem.

What is the role of the document

First of all, the act of reconciling settlements with the Pension Fund plays the role of a supporting document. Before creating financial statements for the year, an organization or individual entrepreneur is required to reconcile calculations with extra-budgetary funds.

Based on the results of the reconciliation, arrears, erroneously accrued penalties, and overpayments are identified. The payer can return these to his current account or count them against future payments.

The basis is precisely the act of reconciliation. In addition, the policyholder may at any time, on his own initiative, request a reconciliation report.

For example, when for some reason there is doubt that the paid insurance premiums have reached their destination or an unscheduled inventory of calculations is carried out.

The Pension Fund is obliged to send the payer a decision, demand or order on the payment of insurance premiums. If the policyholder does not agree with the data specified in the document, he can appeal the Fund’s request.

But first, it is highly advisable to reconcile the calculations. It is quite possible that the paid contributions were simply not received by the Pension Fund or were not received in full.

The legislative framework

The bodies that control the payment of insurance transfers, in particular the Pension Fund of the Russian Federation, as well as the Federal Tax Service, must conduct a joint reconciliation of paid insurance premiums and related payments based on the payer’s application.

This is stated in paragraph 8, part 1, article 18.4 of Federal Law No. 212 of July 24, 2009.

For example, according to clause 1, part 1, article 18.4 of Federal Law No. 212, an organization may need a reconciliation report for calculations in the case when it wants to receive an installment plan or deferred payment.

The application form for joint reconciliation is not fixed, therefore a document is drawn up in free form. Reconciliation can also be carried out at the initiative of the Pension Fund.

As a rule, control authorities initiate this process if an overpayment of contributions is detected. The possibility of carrying out such a reconciliation is stated in Part 9 of Article 19, Part 4 of Article 26 of Federal Law No. 212.

Based on the results of the reconciliation, the company receives the right to submit an application for clarification of payment or an application for a refund or offset of the excess amount. Any reconciliation ends with the execution of a settlement reconciliation report.

The form of the reconciliation report on insurance premiums, penalties and fines with the Pension Fund of the Russian Federation was approved by Resolution of the Pension Fund of the Russian Federation No. 511 of December 22, 2015.

It is noteworthy that Federal Law No. 212 does not regulate the procedure for delivering a reconciliation report to an organization. But based on the form of the act, two methods can be used to transfer a document - personal delivery or transfer by post.

There are no clear deadlines for the execution of the reconciliation report, nor are there strict regulations regarding the reconciliation procedure itself.

Reconciliation goals

Reconciliation allows you to track outgoing deductions and control the formation of debts. It is usually initiated by the payer when there is a likelihood of a conflict with the fund regarding the volume of transferred contributions. It is also needed to detect overpayments as part of liquidation or reorganization. Reconciliation is usually carried out in the presence of these circumstances:

- Reorganization.

- Liquidation.

- The need to track the presence of debt.

- Establishing the amount of overpayments.

- Systematization of information.

- The company plans to participate in government competitions and tenders.

At the end of the event, a reconciliation report is issued. It is an essential document within the financial activities of the enterprise.

Every month the legal entity must make contributions to the fund. If they don't exist, debt will form. Its presence can negatively affect a variety of aspects of activity. These consequences are possible:

- Negative reputation in the market.

- Failure of transactions with counterparties.

- Loss of public investment.

- Negative payment history.

- Judicial debt collection.

- Seizure.

Reconciliation allows you to monitor the status of your payments. It is recommended to carry it out at least once a quarter. This frequency ensures timely tracking of all debts.

FOR YOUR INFORMATION! Regular control allows you to reduce the fiscal burden on the entity in the form of fines and penalties for debts.

IMPORTANT! It is on the basis of the reconciliation report that an application for the refund of tax overpayments is drawn up.

Offset of overpayment

After the Pension Fund employees receive an application for offset or return of the amount of money, as well as upon completion of the reconciliation and signature of the act, the offset period begins. The decision on a refund or credit is made within 10 working days from the date of:

- signing the reconciliation report;

- if this has not been carried out, receive an application for credit.

If the fund makes a positive decision, based on Articles 26 and 27 of Law No. 212-FZ, the amount is credited within 30 calendar days

. If, after approving the application, the PRF has not returned the overpaid amount 30 days later, it will be possible to recover interest from this body, accrued daily at a refinancing rate of 1/300.

Also, upon approval of the application for offset, the enterprise can recover from the Pension Fund an amount in the amount of excess penalties and fines with interest at the same refinancing rate (1/300). But if a company has debts on these fines, it will first have to pay them, and then the Pension Fund of Russia will return the excess amount.

There may also be a case in an organization when an accountant made an error in the details, discovered it, compiled and paid for the correct report and submitted a letter to the bank. Then the organization overpays, and Social Insurance becomes a debtor.

The FSS informs the debtor of the discovery of an error after the expiration of the payment period for insurance payments within 10 working days. But it would be much better for the insurer not to wait for the fund to discover the error, but to independently contact the authorities and request a reconciliation.

How to get a reconciliation report before 2018

The specifics of the procedure depend on the specific reporting period for which the report is required. First, let's consider the option when a reconciliation report is required for the period up to December 31, 2021 inclusive. In this case, it must be requested from the Federal Tax Service.

There are two ways to obtain a certificate. Let's look at them.

Drawing up an application

To receive the certificate, you need to fill out an application. Its form is not regulated by regulations. However, you need to provide essential information: details of the legal entity, date of application. The response to the application should arrive within five days.

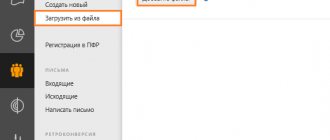

How to obtain a reconciliation report in 2021 and beyond

There are few fundamental differences from the usual procedure. The most important change is that payments will now have to be made to other current accounts - no longer the Social Insurance Fund, but the Federal Tax Service. To apply for reconciliation, you will have to contact the tax office at the place of registration of the legal entity. Further, the algorithm is in many ways similar to what was used for the FSS.

- Submitting an application (the requirements for it remain unchanged).

- Formation of a reconciliation report (this is done by the Federal Tax Service based on the application received). The act is drawn up in two copies and sent to the applicant - the payer.

- Having received the act, the applicant enters his information into it and forwards (hands over in person or electronically) one of the copies to the tax authorities.

- If discrepancies are found, reconciliation continues with the study of supporting documentation. If necessary, adjustments are made to the original act.

- If there were no discrepancies or they were successfully eliminated, the act is signed by both parties (the payer and the representative of the Federal Tax Service). In other words, the parties sign that they agree with the information contained in the act.

- Signatures certify the completion of the reconciliation and approval of the calculations contained in it.

Examples of responses to various types of requests

Certificate on the status of settlements for taxes, fees, penalties and fines

Such a certificate allows you to verify that the tax is actually transferred to the budget, and credited to the correct BCC, and also check for the presence of penalties and fines. The information in the certificate is given for specific types of tax (fee, contribution).

Extracting transactions for settlements with the budget

This document is requested if the accountant discovers arrears. The list of transactions recorded by the tax authority will help you find an error if it was made during the transfer of tax.

Benefits of receiving a reconciliation

Reconciliation of calculations ensures the solution of these problems:

- Review of financial statements. Errors and typos are discovered during the process.

- Streamlining reporting. Reconciliation allows you to prevent a mess in documents and eliminate existing discrepancies.

- Systematization of information. This will prevent underpayments.

The reconciliation procedure can be initiated by the FSS itself. This is also done by systematizing information.

Organizations must make contributions to insurance funds within the deadlines established by law. When preparing reports, it is necessary to verify the data on payments made. To do this, you can use a service such as online reconciliation with the Social Insurance Fund to identify inaccuracies before submitting documents.

How to copy electronic VLSI reporting to another computer

To transfer data to another computer, you will need to perform a number of steps:

- Copy the cryptographic information security serial number for yourself and create a backup copy of the database.

- On your new computer, download the latest version of the VLSI program from the website.

- Install the program, and then delete the db folder in the directory and instead copy the folder with the same name from the backup.

- Install a new version of the program and enter its serial number.

- Launch the program and wait until automatic system monitoring takes place.

- Check whether the reporting was transferred correctly.

- The next time you send reports to the inspectorate, write a letter there asking them to check whether they received the reports. This will ensure that everything is working properly.

There is also another option - simply copy the VLSI folder from one computer to another, but this method may lead to errors.

Why is reconciliation necessary?

Often, when conducting audits of economic activity, companies need to reconcile data on deductible funds. This makes it possible to control outgoing deductions and ensure that debts do not form.

Reconciliation with the Social Insurance Fund can be carried out for the following reasons:

- during company reorganization

- upon liquidation of the company

- to determine debt

- to determine the amount of overpayments on deductions

- for data systematization

- for the company to participate in state competitions and tenders

The reconciliation report is an important document when conducting economic activity. The legislation establishes the procedure for monthly contributions to various structures. If money from the company does not go to the budget, this can lead to serious consequences.

The resulting debt affects many things. From concluding deals with partners to receiving investments from state-owned companies. A negative payment history may influence the outcome of such decisions.

If a debt is discovered, the company will be given the opportunity to voluntarily pay the due amounts to the fund. Failure to take these actions may lead to litigation. After which the organization’s accounts may be seized, and the necessary funds will be forcibly withdrawn.

To properly control your activities regarding the deductions made, you should arrange reconciliations at least once every 3 months. This will allow you to always be aware of debts and overpayments.

Test Rules

Each billing period is a calendar year, within which the offset is made. For previous offsets in the current billing period, overpaid amounts are not refunded.

Article 10 No. 212-FZ indicates the timing of the reporting and billing periods. One calculation report consists of four reports - not quarterly, but for 1 quarter, half a year, 9 months and a year. Interim reports are submitted to the FSS of the Russian Federation and the Pension Fund on a quarterly basis. If, after repaying the debt in the next quarter, the policyholder becomes the debtor, then the settlement period may extend until the end of the current year.

The amount of money is fully returned only after the policyholder has paid off all debts on fines and penalties

. Money from the Social Insurance Fund is also returned by the territorial authority within 10 working days from the date of submission of the full package of documents, which is established by Article 4.6 No. 255-FZ. The amount is indicated in column 7 of table 3 of the reporting.

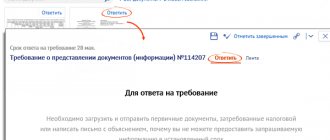

How to request a reconciliation with the FSS

If a reconciliation report with the Social Insurance Fund is required, how can I request it from the fund? According to current legislation, such activities must be initiated directly by the company itself, which requires this certificate.

Today you can obtain the necessary document in the following ways:

- on a personal visit

- through specialized Internet services

With the help of modern digital technologies, the issuance of the act occurs quite quickly. To receive it via the Internet, a company can register on the official website of the fund. There is a special form to fill out, where information about the payer must be entered.

The entered details will remain with the registration. After which the company will have access to the main resources of the site. So, using this service you can track the movement of funds in your account and find out about the balance or debt. In addition, there is a service for generating statements for a certain period.

These data can also be requested in paper form. An extract can be generated and sent to the specified legal address of the company.

The second way to obtain data using the Internet is to turn to specialized government services. There you can get a certificate about the status of your current account in insurance funds. However, such services cannot provide more information for a detailed presentation.

How can I request a reconciliation report with the Social Insurance Fund? You can contact the branch at the place of registration of the company during a personal visit. To do this, you need to draw up an application in the proper form and submit it to the insurance service employees.

How to make an application

The application form itself does not have a legal form. This means that companies independently create the necessary form according to a general template. However, such a paper must indicate the following key points:

- types of deductible contributions and their codification;

- information about the institution with its exact address and name;

- details of the applicant's company.

The content itself states a request to receive an act for a specified period of time. At the end, such a document must be signed by the head of the company and certified with a seal.

If you need advice on this issue, please contact our company. Specialists will answer all your questions and help you correctly draw up the necessary application to the fund.

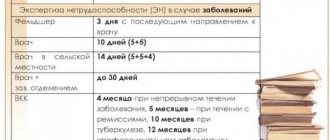

Who may need sick leave verification

We can talk about checking:

Since July 2021, electronic sick leave began to operate at the federal level (before that in several regions). Unlike paper ones, which are handed out to patients, they are stored on the FSS servers. If necessary, they can be accessed by:

Each of them can request access to sick leave for different purposes.

Let's take a closer look at how to check sick leave in the two indicated varieties when using the FSS website and other available resources. Let us agree that such a check is required to be carried out by the employer, a representative of the medical institution and the patient himself.