Options for purchasing an OS

In 1C there are two options for registering the acquisition and accounting of fixed assets:

Standard option , which uses two documents:

- capitalization of fixed assets - document Receipt (act, invoice) type of operation Equipment ;

- commissioning of OS - document Acceptance for accounting of OS ;

Simplified version , which uses a single document:

- capitalization and commissioning of fixed assets - document Receipt (act, invoice) type of transaction Fixed assets .

When the commissioning of the OS is carried out simultaneously with the capitalization of the OS, it is of course more convenient to reflect all operations in one document, i.e. use the Simplified version . But this option has some limitations, let's look at them.

Limitations of the application of the Simplified option for accepting fixed assets for accounting

Limitations arise due to the lack of flexible configuration in the document of the features of accounting for fixed assets in accounting and accounting records, as well as due to the simultaneous capitalization and commissioning of fixed assets, i.e. impossibility of including additional costs associated with the acquisition in the initial cost.

Through the document Receipt (act, invoice) type of operation Fixed assets , you can register the acquisition of an asset for which:

- commissioning is carried out simultaneously with receipt;

- no installation required;

- no additional expenses are required to be reflected;

- accounting uses the linear method of calculating depreciation;

- the parameters for calculating depreciation for NU and BU are the same (useful life, initial cost);

- depreciation bonus is not accrued according to NU;

- there is no special coefficient for depreciation according to NU;

- no need to indicate the customs declaration number, i.e. The OS is not imported.

The simplified version can only be applied to accounting for fixed assets, the acquisition costs of which are recorded in account 08.04 “Purchase of fixed assets”. This is due to the fact that in the document Receipt (act, invoice) transaction type Fixed Assets there is no possibility to select a different account; this account is set automatically in the posting.

For those objects for which costs must be accounted for on other accounts, for example, on account 07 “Equipment for installation”, acceptance of the object for accounting can only be done using the standard option.

A detailed comparison of two options for accepting fixed assets for accounting. PDF

Let's consider the features of filling out documents for different options for accepting fixed assets for accounting.

Ways of getting OS into the organization

Sources of financing of fixed assets are determined not only by the origin of the money invested in them, but also by the characteristics of the ways in which fixed assets enter the organization. A legal entity may experience the following:

- as a contribution to the management company;

- free of charge (as a result of discovery or donation);

- at the time of buying;

- when renting;

- under a barter agreement;

- due to creation (construction).

If in the first 4 ways the organization is involved individually, then the creation (construction) can be shared, that is, joint for several participants in this process.

Standard method

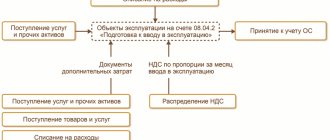

With the standard method, two documents are drawn up to accept the OS for accounting:

- document Receipt (act, invoice) type of operation Equipment ;

- document Acceptance for accounting of fixed assets .

Let's look at the features of filling them out and conducting them.

Document Receipt (act, invoice) type of operation Equipment

create a document Receipt (act, invoice) operation type Equipment through the sections:

- Purchases – Purchases – Receipts (acts, invoices) – Receipts – Equipment;

- OS and intangible assets – Receipt of fixed assets – Receipt of equipment.

On the Equipment , the acquired fixed assets and their quantity are indicated. Fixed asset objects are selected from the Nomenclature directory .

The accounting account is filled in in the document automatically depending on the settings in the Item Accounting . For the item type Equipment (fixed asset objects), the default account is set to 08.04.1 “Purchase of components of fixed assets,” but it can be changed manually in the document. PDF

Find out more about setting up item accounting accounts

to indicate account 08.04.2 “Purchase of fixed assets” in the document Receipt (act, invoice) type of operation Equipment it is used to accept fixed assets for accounting in a simplified way.

Posting a document

When posting a document, the initial cost of a non-current asset will be taken into account on account 08.04.1 “Purchase of components of fixed assets” until the document Acceptance for accounting of fixed assets is entered.

To include additional costs in the initial cost of fixed assets, for example, transportation and procurement costs, duty costs in connection with state registration or customs costs, it is necessary to prepare additional documents ( Receipt of additional expenses , Operation entered manually , Customs declaration for import ).

Document Acceptance for accounting of fixed assets

You can create a document Acceptance for accounting of fixed assets type of operation Equipment in the section:

- Fixed assets and intangible assets – Receipt of fixed assets – Acceptance of fixed assets for accounting.

On the Non-current asset , the data of the acquired asset before commissioning is indicated:

- Equipment is a non-current asset put into operation. Selected from the Nomenclature directory ;

- The main warehouse is the place of storage of the registered object;

- Account – a cost accounting account on which the initial cost of an object is formed.

On the Fixed Assets , the operating systems to be put into operation are selected from the Fixed Assets .

You can put several OS objects into operation in a document. Identical items of fixed assets must be added to the Fixed Assets as separate items and differentiated by certain criteria, for example, by work place (WW).

The document Acceptance for accounting of fixed assets has flexible configuration of the features of accounting for fixed assets in accounting and accounting records.

Parameters for calculating depreciation and paying off the cost of objects are indicated on separate tabs Accounting and Tax Accounting .

On the Accounting it is indicated:

- Accounting account – accounting account for the OS being put into operation;

- Accounting procedure : Calculation of depreciation ;

- The cost is not repaid.

When you select the Depreciation calculation , the parameters for its calculation are specified.

On the Tax Accounting , you must select the Procedure for including costs in expenses .

Depending on the procedure for accounting for costs in the tax accounting system for the acquisition of an object, in the Procedure for including costs as expenses, you can select:

- Depreciation calculation – selected for fixed assets on which depreciation will be calculated;

- Inclusion in expenses when accepted for accounting - selected for objects, the costs of acquiring them at a time will be taken into account in expenses when accepting them for accounting;

- The cost is not included in expenses - selected for objects the costs of which will not be taken into account in expenses that reduce the tax base.

For NU it is impossible to select the depreciation calculation method in the document, because in accordance with the law, it is approved in the accounting policy and applies to all fixed assets. In 1C, the method is set in the Main section - Settings - Taxes and reports - Income tax. PDF

Find out in more detail Settings for calculating depreciation of fixed assets .

Also, for objects for which depreciation is calculated, it is possible to calculate a depreciation bonus, the parameters of which are set on a separate tab Depreciation bonus . PDF

Posting a document

Types of funding sources

Sources of financing of fixed assets are divided into:

- internal;

- external.

Internal (own) include:

- depreciation of fixed assets and intangible assets;

- capital (both capital and profit).

External sources are third party tools:

- borrowed (credits, loans);

- attracted.

During the financing process, sources of funds can be combined. The organization has the right to independently determine the share of participation of each of them in paying for fixed assets. It is more preferable to assess the financial position of a legal entity from the point of view of financial stability is the predominance of its own sources over external ones.

For more information about the analysis of financial stability and the coefficients calculated in this case, read the material “Conducting an analysis of the financial stability of an organization.”

Simplified method

With the simplified method, a single document is drawn up to accept the OS for accounting:

- document Receipt (act, invoice) type of operation Fixed assets .

Let's consider the features of filling it out and conducting it.

Document Receipt (act, invoice) type of operation Fixed assets

create a document Receipt (deed, invoice) type of operation Fixed assets through the sections:

- Purchases – Purchases – Receipts (acts, invoices) – Receipts – Fixed assets;

- OS and intangible assets – Receipt of fixed assets – Receipt of fixed assets.

The tabular section indicates the acquired fixed assets from the Fixed Assets directory . There is no way to specify the number of objects in the document, i.e. Only one position in the quantity of one object can be accepted for accounting. Identical items of fixed assets must be added to the Fixed Assets as separate items and differentiated by certain criteria, for example, by work place (WW).

In this case, it is not necessary to enter the fixed asset object into the directory in advance. To fill out the Fixed Asset , you simply need to enter the name of the object and a new element will be automatically created in the Fixed Assets .

The accounting account and the depreciation account depend on the Objects are intended for rent checkbox if:

- the checkbox is checked, then the Account will be set to 03.01 “Material assets in the organization”;

- the checkbox is unchecked, then the Account will be set to 01.01 “Fixed assets in the organization”.

To avoid errors, it is not recommended to manually change accounting accounts in the document.

According to the parameters for calculating depreciation and repayment of the cost of objects, it is possible to indicate only:

- The method of reflecting depreciation expenses in the document header is the same for all entered objects;

- The service life in the tabular part is the useful life, which is set the same for NU and BU, specifically for each object.

The program itself determines in tax accounting the procedure for repaying the cost of the purchased object:

- if the cost of the object is less than 100,000 rubles. acquisition costs are included in expenses at a time;

- if the cost of the object is more than 100,000 rubles, then depreciation will be calculated according to the method established in the accounting policy for NU. PDF

When posting a document, the fixed asset card will be filled in automatically as follows:

- Asset accounting group – Asset accounting group indicated in the header of the document;

- The depreciation group will be determined automatically depending on the set service life.

The remaining data in the OS card must be filled in manually.

Find out in more detail about filling out the Fixed Assets directory .

Posting a document

Regardless of the Accounting Account in the tabular part of the document in the transactions, the costs of acquiring fixed assets will be automatically taken into account in account 08.04.2 “Purchase of fixed assets”, and then written off to the Accounting Account established in the document.

In tax accounting, objects costing less than 100,000 rubles. are not included in depreciable property and their cost is taken into account as expenses at a time when accepted for accounting. In this case, when posting a document, the cost of the object in tax accounting will be written off to the cost account with analytics, which will be automatically entered in the posting by the program as follows:

- Cost account – a cost account established for calculating depreciation in accounting, specified in the Method of reflecting depreciation expenses ; Division – Location of the OS indicated in the header of the document;

- Item group - if there is more than one element in the Item Groups directory , then the analytics for item groups is not filled in, if there is one element, then this item group is filled in in the analytics;

- Cost item is a predetermined item Non-depreciable property of the Cost Items directory. PDF

The accountant needs to understand that if he selects the document Receipt (act, invoice) type of operation Fixed assets to accept for accounting objects worth less than 100,000 rubles, then he will not be able to manually set up a cost account and analytics for it for a one-time write-off of acquisition costs such objects in tax accounting.

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Related publications

- Confirmation of the main activity if there was a change in the main activity in October? Good afternoon) The organization has changed the main activity code in the Unified State Register of Legal Entities. By…

- Acquisition of fixed assets for rental Fixed assets (FPE) intended exclusively for rental are reflected...

- The advance was issued in 2021, the purchase of fixed assets in 2021 - how to reflect it in accounting? ...

- Fill out or correct the indicators: On page 1 of Appendix 1 to Section 3, the name of the fixed asset object is not indicated 1C Enterprise 8.3 (8.3.16.1148), edition 3.0 (3.0.75.78) When checking the declaration,...

Nuances of attracted financing

Funds raised are always targeted, require mandatory reporting to the authority that provided them and are divided into:

- irrevocable, which should include budget funds for special purposes;

- repayable, provided for a time by the budget or any trust fund;

- equity, forming that part of the investment in the value of the fixed assets that will belong to other legal entities or individuals.

Read more about targeted financing in the material “Art. 251 Tax Code of the Russian Federation (2015): questions and answers.”