This approach is documented in letters of the Ministry of Finance dated January 11, 2016 No. 03-03-06/40 and dated March 2, 2007 No. 03-03-06/1/146, Federal Tax Service of Russia dated March 14, 2005 No. 02-1-07/23). Include these depreciation amounts in expenses from the 1st day of the month following the date when the modernization was completed (clause 7 of article 259.1, clause 9 of article 259.2 of the Tax Code of the Russian Federation).

Example 1. Depreciation of OS after upgrade. Officials' option The company bought a woodworking machine and included it in the 4th depreciation group, establishing a useful life of 80 months. The initial cost of the OS is 420,000 rubles. (without VAT). After some time, the company decided to modernize the machine. For these works the contractor was paid 110,000 rubles. (without VAT). At the time of their completion, the facility had been in operation for 60 months. Depreciation accrued using the straight-line method amounted to RUB 315,000. (RUB 420,000 / 80 months x 60 months). The organization decided not to increase the SPI of the fixed asset. Amopremium does not apply. The amount of depreciation charges after modernization is 6,625 rubles. ((RUB 420,000 + RUB 110,000) / 80 months). The remaining useful life of the OS is 20 months (80 – 60). During this period, the company will accrue depreciation in the amount of 132,500 rubles. (RUB 6,625 x 20 months). That is, the final amount of depreciation during the SPI is 447,500 rubles. (315,000 + 132,500). But depreciation did not “eat up” all of the changed original cost of the object. Its balance at the end of the SPI is 82,500 rubles. ((420,000 + 110,000) – 447,500). This means that the company will continue to accrue depreciation outside the SPI until it fully pays off the “current” cost of the fixed assets. For this she will need 13 months. In the last month, equal to 3000 rubles. (RUB 82,500 – (RUB 6,625 x 12 months)).

As we can see, the period for repaying the value of the asset through depreciation has increased. Of course, such “smearing” is not beneficial for companies. At the same time, from the provisions of the main tax document it follows that it is not prohibited to charge depreciation on fixed assets outside of its SPI. After all, paragraph 5 of Article 259.1 of the Code states that depreciation is terminated only when the cost of the object is completely written off or fixed assets are disposed of from the depreciable property for any reason.

Organizations don't like this approach and have been fighting it for years. Companies advocate an alternative option, in which depreciation is calculated based on the residual value of the object, increased by the amount of modernization costs, and the remaining fixed income. In this case, they refer, inter alia, to paragraph 3 of paragraph 1 of Article 258 of the Tax Code of the Russian Federation. This allows you to transfer the cost of fixed assets to expenses during an initially determined period, as well as to avoid differences between accounting and tax accounting (clause 60 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n).

With a similar approach, in our example, depreciation after modernization will be 10,750 rubles. ((RUB 420,000 – RUB 315,000 + RUB 110,000) / 20 months). As a result, the machine is completely depreciated for the remaining SPI.

Of course, fiscal officials are not happy with this option. But the judges don’t see anything “criminal” in him. An illustrative example is Resolution of the AS of the West Siberian District dated September 1, 2016 No. F04-3528/2016. It states: the provisions of paragraph 2 of Art. 257 and paragraph 1 of Art. 258 of the Tax Code of the Russian Federation establishes a procedure for determining depreciation taking into account the changed initial cost and the remaining SPI and, as a consequence, changes in the depreciation rate for modernized objects. And in Resolution No. F06-4506/2015 dated January 22, 2016, the Volga District Autonomous District emphasized: if, as a result of modernization, the SPI remains the same, the company takes into account the cost of such OS over the remaining service life, increasing the amount of its monthly depreciation. Similar conclusions can be found in many other verdicts (see resolutions of the Moscow District AS dated November 2, 2016 No. F05-16149/2016 and the FAS of the same district dated April 6, 2011 No. KA-A40/2125-11, Volga District FAS dated July 17, 2007 No. A49-998/07, left in force by the Determination of the Supreme Arbitration Court of the Russian Federation dated November 22, 2007 No. 14740/07). At the same time, the judges note that the inspectors’ method leads to the repeated write-off of previously recorded costs (depreciation), which is unlawful.

By the way, in recent comments, financiers are no longer so categorical. They indicate that depreciation after modernization “may (!) be accrued” according to the initially established standards (see, for example, letter dated August 30, 2019 No. 03-03-06/1/66957). Therefore, in our opinion, companies have all the prerequisites for successfully applying a more advantageous point of view.

Important

The initial cost of a modernized fixed asset does not include interest on targeted loans or borrowings. They must be taken into account separately as part of non-operating expenses in accordance with Article 265 of the Tax Code of the Russian Federation. This is the opinion of both the Ministry of Finance (letter dated October 23, 2009 No. 03-03-06/1/682) and the servants of Themis (Resolution of the Federal Antimonopoly Service of the North Caucasus District dated October 23, 2008 No. F08-6332/2008).

Depreciation after modernization

Companies have the right to modernize fixed assets that are either fully depreciated or still have a residual value. In both situations, it is necessary to take into account reconstruction costs and calculate depreciation. How to do it? The algorithm of actions is as follows:

- Accumulation of all modernization costs, i.e. collection of documented expenses and drawing up the total amount. Modernization work can be carried out by attracting third-party specialized companies, or on your own (if there is appropriate potential). The document confirming the commissioning of the facility modernized by the contractor is the acceptance certificate signed by representatives of the company and the contractor, and the scope of work and the amount of costs is the act f. KS-2 and certificate of cost of work f. KS-3. Work on the reconstruction of the facility using economic means (on our own) is confirmed by a whole block of documents: requirements-invoices for the release of goods and materials, limit cards, work orders. Completion of work and commissioning is recorded by an internal acceptance certificate indicating the full cost of the work;

- Registration of the protocol of the inventory commission for the commissioning of a modernized facility with a decision to increase the cost of the facility and increase the useful life after modernization, if the capital work carried out actually increased the SPI. In accounting, there is no procedure for determining a new SPI if an object with an expired term is being modernized, however, clause 20 of PBU 6/01 and clause 60 of the Guidelines for fixed assets accounting, approved by Order of the Ministry of Finance of the Russian Federation dated October 13, 2003 N 91n, allow the extension of SPI if As a result of the work carried out, the functional characteristics of the facility improved. At the same time, changing the SPI of the reconstructed OS in accounting is a right and not an obligation of the company. Note that most often the SPI is extended by the amount of time necessary to write off capital costs.

- According to the Ministry of Finance, the amount of modernization costs increases the initial cost (IC) of the fixed assets, and the depreciation rates for writing off these costs are those that were initially applied when the property was put into operation. This opinion also works in practice.

Calculation in accounting

The ultimate goal of the operation under consideration is always to improve the quality characteristics of the object, increase its productivity and efficiency. In other words, this process is carried out so that the fixed asset becomes better and more profitable.

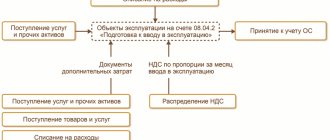

Expenses made during these activities are collected in the debit of account 08, then transferred to the cost of the fixed asset by posting Dt 01 Kt 08.

That is, the initial value of the cost at which the object was recorded in accounting on account 01 increases during the modernization process.

What happens to depreciation?

We also recommend reading: How to calculate depreciation on leased property?

Should depreciation accruals be suspended?

If the period for completing improvement work is equal to or exceeds 12 months, then monthly depreciation is suspended until all work on the fixed asset is completely stopped.

If the rework period is less than a year, then depreciation deductions do not need to be stopped.

Depreciation continues to accumulate on the credit of account 02 in correspondence with cost accounts 20, 23, 44.

Does the useful life change?

After the termination of the modernization work, the debit of account 01 shows the large cost of the fixed asset, that is, all investments in the improvement and retrofitting of the fixed asset were included in the initial cost of the asset.

In some cases, the useful life is also recalculated.

Its duration can be either increased or left without adjustments.

An increase in the period is not always allowed; it is possible when there is really a reason for it:

- production capabilities increase, power increases;

- the operating mode changes;

- the initial performance indicators of the equipment are improved.

The company is not obliged to change the term of use - this is its right, not its obligation. In practice, the SPI is usually increased for the time necessary to write off the capital costs incurred in connection with the modernization.

How to calculate monthly deductions taking into account changes?

Further calculation of depreciation upon completion of modernization is carried out based on the new increased cost of the fixed assets, taking into account a possible change in the SPI.

The exact calculation procedure is not prescribed in the legislation; no specific rules are contained either in the PBU or in the Chart of Accounts. However, there are clarifications in paragraph 60 of the Methodological Guidelines for OS Accounting, approved by Order of the Ministry of Finance of the Russian Federation No. 91n dated 10/13/03.

Depreciation on an asset is calculated based on two indicators - the remaining value, taking into account depreciation and added capital investments and the updated useful life.

Calculation of residual value:

The share of the cost of a depreciable fixed asset that has already been written off through deductions (depreciation) is calculated:

Formula:

Depreciation = Initial article * Number of years/months of operation / SPI (in years or months)

The remaining cost is calculated, which has not yet been written off due to depreciation, without taking into account capital investments during modernization.

Formula:

Remaining article = Initial article - Wear

The remaining cost is calculated taking into account the capital investments made in the fixed asset:

Formula:

Residual cost = Remaining cost + Capital investment

Knowing the calculated residual value and the updated useful life, you can calculate the amount of depreciation deductions.

Example

Initial data:

The equipment was registered for 200,000.

His SPI is 5 years.

The equipment was used for 2 years, then underwent modernization, the result was an increase in cost by 50,000, and an increase in SPI for 2 years.

Depreciation was calculated using the straight-line method.

How to calculate depreciation after modernization?

Calculation:

Residual value after changes = 200,000 – (200,000 * 2 / 5) + 50,000 = 170,000.

New SPI = (5 – 2) + 2 = 5 years.

Monthly depreciation after modernization = 170,000 / 60 = 2833.33.

For fully stocked OS

If an item of fixed assets is completely depreciated, that is, its useful life has expired, then after the modernization carried out in relation to it, the SPI can be extended.

In practice, a number of months is added sufficient to write off the capital funds invested in modernization while maintaining the same depreciation rate.

Example

Initial data:

The company decided to update the machine, which is completely depreciated. This object was initially classified as depreciation group 4 and an SPI of 5 years was established for it.

The initial cost when accepting fixed assets for accounting was 600,000, SPI = 60 months. The depreciation rate using the linear method is 1.67% (1/60 months).

The facility was accepted in January 2014, and depreciation began on February 1. On January 1, 2021, the machine was depreciated in full, its SPI ended.

Modernization work began in January 2021 and ended in March 2021. The amount of capital investment = 300,000.

How much depreciation should be calculated and over what period?

Solution:

To maintain a depreciation rate of 1.67%, you need to make monthly calculations in the amount of = (600,000 + 300,000) * 1.67 / 100 = 15030.

Number of months to write off capital investments = 300,000 / 15,030 = 19 months.

The balance of capital investments in the amount of 14,430 (300,000 - 15,030 * 19) will be written off in the 20th month of operation.

Depreciation after modernization

An example of calculating depreciation for a fully depreciated object

In 2021, the company completed the modernization of the production line belonging to the 4th depreciation group with SPI from 5 to 7 years. Substation lines upon commissioning (January 2010) – 500,000 rubles. The SPI was set at 80 months. Depreciation rate (RA) – 1.25% (1/80 month). Depreciation was calculated from February 2010 to September 2021, and at the end of 2021, when it was decided to reconstruct the line, the facility was fully depreciated. In March 2021, the corresponding work was completed, the amount of reconstruction without VAT amounted to 350,000 rubles. From April 2021, the company begins to write off modernization costs, using the mechanism for calculating depreciation as follows:

C after modernization is 850,000 rubles. (500,000 + 350,000). The NA should be the same as at the time the line was entered, i.e. 1.25%. Consequently, the amount of monthly depreciation will be 10,625 rubles. (RUB 850,000 x 1.25/100). The costs of the completed modernization should be written off over 32 months at 10,625 rubles. (340,000 rubles), in the 33rd month the amount of depreciation will be 10,000 rubles.

How to calculate depreciation of fixed assets after reconstruction (modernization)

As a general rule, fixed assets that have been undergoing reconstruction (modernization) for more than 12 months should be excluded from depreciable property. That is, depreciation on these objects must be suspended. An exception to this rule are fixed assets that the organization continues to operate even during reconstruction (modernization). Depreciation on such objects can be calculated in the usual manner.

The basis for the temporary exclusion of fixed assets from depreciable property is an order from the head of the organization on their reconstruction or modernization.

If an object is taken out of service during reconstruction (modernization), depreciation must be stopped on the 1st day of the month following the month the reconstruction (modernization) began. You can resume depreciation calculations from the 1st day of the month following the month of completion of reconstruction (modernization).

This procedure is provided for in paragraph 3 of Article 256 of the Tax Code of the Russian Federation.

Situation: is it necessary to suspend depreciation of a fixed asset in tax accounting if the reconstruction (modernization) was planned to be completed in less than a year, but its actual period turned out to be longer?

Yes, it is necessary if during reconstruction (modernization) the object is not used in activities aimed at generating income.

The organization does not have the right to charge depreciation on fixed assets that are taken out of service for more than 12 months during the period of reconstruction or modernization. It is not the planned, but the actual period of reconstruction (modernization) that is taken into account. The Federal Tax Service of Russia makes this conclusion in letter dated March 14, 2005 No. 02-1-07/23. Consequently, if in the reporting period the organization took into account depreciation charges on such fixed assets, the income tax will need to be recalculated.

Advice: if you register reconstruction (modernization) work as several completed stages, depreciation can continue to be charged, even if the duration of the work exceeds 12 months.

In this case, you will need to issue:

- several orders for reconstruction (modernization);

- several contracts with performers of work for each stage of reconstruction or modernization (and the duration of each stage should not exceed 12 months).

It is desirable that there are breaks between the stages of reconstruction (modernization). After each reconstruction (modernization), it will be necessary to review the initial cost of the fixed asset.

As a rule, after reconstruction or modernization:

- the initial cost of the fixed asset changes (clause 2 of Article 257 of the Tax Code of the Russian Federation);

- The organization has the right to increase the useful life of a fixed asset. This is possible if, after reconstruction or modernization, the characteristics of the fixed asset have changed in such a way that this will allow it to be used longer than the previously established period (Clause 1 of Article 258 of the Tax Code of the Russian Federation).

Note that the initial cost of the object can change only if the organization has incurred costs for reconstruction or modernization. If reconstruction (modernization) work is carried out free of charge, there is no reason to increase the initial cost. In this case, the cost of capital investments will have to be included in non-operating income (clause 8 of Article 250 of the Tax Code of the Russian Federation). Determine the amount of income in accordance with market prices. Such clarifications are contained in the letter of the Ministry of Finance of Russia dated September 1, 2015 No. 03-03-06/1/50225.

As for the useful life, it can be increased only within the depreciation group to which the fixed asset belongs. If before reconstruction (modernization) the maximum useful life of a fixed asset was established, it cannot be increased. This is stated in paragraph 1 of Article 258 of the Tax Code of the Russian Federation.

Situation: is it possible to recalculate the depreciation rate in tax accounting if, after modernization (reconstruction), the initial cost has changed, but the useful life remains the same? Depreciation is calculated using the straight-line method.

No you can not.

Regardless of whether the useful life of a fixed asset has changed after modernization (reconstruction) or not, the organization cannot change the depreciation rate in tax accounting. The Tax Code of the Russian Federation does not provide for such a right.

This conclusion is confirmed by the regulatory agencies (letters of the Ministry of Finance of Russia dated September 23, 2011 No. 03-03-06/2/146, dated September 10, 2009 No. 03-03-06/2/167, dated February 12, 2009 No. 03-03-06/1/57 and the Federal Tax Service of Russia dated March 14, 2005 No. 02-1-07/23).

After modernization (reconstruction), continue to charge depreciation in tax accounting according to the previous standards.

When applying the linear method, use the formula:

| Monthly depreciation amount | = | Initial cost of fixed assets after reconstruction (modernization) | × | Depreciation rate |

This procedure follows from paragraph 2 of Article 257, paragraph 2 of Article 259.1 of the Tax Code of the Russian Federation, letters of the Ministry of Finance of Russia dated September 23, 2011 No. 03-03-06/2/146, dated July 5, 2011 No. 03-03-06/ 1/402.

When applying the nonlinear method, use the formula:

| Monthly depreciation amount | = | The total balance of a depreciation group (subgroup) taking into account changes in the value of a fixed asset included in this depreciation group (subgroup) after reconstruction or modernization | × | Depreciation rate |

This procedure follows from paragraph 2 of paragraph 3 and paragraph 2 of paragraph 4 of Article 259.2 of the Tax Code of the Russian Federation.

Situation: is it possible to continue to charge depreciation using the straight-line method after the end of the useful life if it was not revised after the reconstruction of the fixed asset?

Yes, you can.

After reconstruction (modernization) of a fixed asset, its initial cost increases. If the useful life has not been revised, then at the time of its end the fixed asset will not be fully depreciated. In the situation under consideration, the organization has the right to charge depreciation in tax accounting until the cost of the fixed asset is fully repaid. Such clarifications are contained in letters of the Ministry of Finance of Russia dated July 5, 2011 No. 03-03-06/1/402, dated September 10, 2009 No. 03-03-06/2/167, dated February 12, 2009 No. 03- 03-06/1/57.

An example of depreciation calculation in tax accounting. After modernization, the initial cost of the fixed asset increased, but the useful life did not change. Depreciation is calculated using the straight-line method

Equipment is listed on the organization's balance sheet. Its original cost, according to tax records, was 110,000 rubles. When a fixed asset was accepted for accounting, its useful life was set at 36 months. Depreciation was calculated using the straight-line method.

The monthly depreciation rate for the facility is: 1: 36 months. × 100% = 2.7778%.

The accountant took into account monthly expenses in tax accounting: 110,000 rubles. × 2.7778% = 3056 rub.

In March–July, by decision of the organization’s management, equipment was modernized. The period of actual use of the fixed asset before modernization was 12 months. During this time (up to and including March), depreciation charges were taken into account as expenses in the amount of 3,056 rubles. × 12 months = 36,672 rub.

During the modernization, no depreciation was accrued on equipment. After modernization, the initial cost of the fixed asset increased and amounted to 115,000 rubles. (modernization costs - 5,000 rubles). The organization did not change the useful life.

Starting from August, the monthly depreciation amount for equipment is: RUB 115,000. × 2.7778% = 3194 rub.

Taking into account previously accrued depreciation, the residual value of the equipment in tax accounting is equal to: 115,000 rubles. – 36,672 rub. = 78,328 rub.

The number of months required to completely write off the cost of a fixed asset is: RUB 78,328. : 3194 rub. = 25 months

There are 24 months left until the useful life of the equipment expires. However, an organization has the right to charge depreciation in tax accounting even after the expiration of its useful life until the cost of the equipment is fully repaid.

Situation: how to calculate depreciation in tax accounting if at the time of reconstruction (modernization) the fixed asset is fully depreciated? After reconstruction (modernization), the initial cost of the fixed asset increased.

According to the Ministry of Finance of Russia, in this case, the organization must calculate depreciation according to the standards that were determined when the fixed asset was put into operation (letters dated September 23, 2011 No. 03-03-06/2/146, dated September 10, 2009 No. 03-03-06/2/167, dated February 12, 2009 No. 03-03-06/1/57). When using the straight-line method, calculate the amount of depreciation based on the new original cost. When applying the non-linear method, calculate the monthly depreciation amount based on the total balance of the depreciation group that includes this fixed asset, increased by the cost of its reconstruction (modernization). Apply this rule regardless of the cost of reconstruction (modernization) - more than 100,000 rubles. or less than 100,000 rub.

An example of calculating depreciation of a fixed asset after modernization in tax accounting. At the time of modernization, the fixed asset is fully depreciated. Depreciation is calculated using the straight-line method

The organization's balance sheet contains fixed assets. The initial cost of the object according to tax accounting data is 110,000 rubles. When a fixed asset was accepted for accounting, its useful life was set at 36 months. Depreciation was calculated using the straight-line method.

The monthly depreciation rate for the facility was: 1:36 months. × 100% = 2.7778%.

The accountant took into account monthly expenses in tax accounting: 110,000 rubles. × 2.7778% = 3056 rub.

By March, the fixed asset was completely depreciated.

In March–July, by decision of the organization’s management, the fixed asset was modernized.

After modernization, the initial cost of the object increased and amounted to 116,000 rubles. (modernization costs - 6,000 rubles).

Starting from August, the accountant takes into account monthly as part of depreciation charges: 116,000 rubles. × 2.7778% = 3222 rub.

It will take two months to completely write off the cost of a fixed asset (modernization costs).

An example of calculating depreciation of a fixed asset after modernization in tax accounting. At the time of modernization, the fixed asset is fully depreciated. Depreciation is calculated using the non-linear method

The organization's balance sheet contains fixed assets. The initial cost of the object according to tax accounting data is 110,000 rubles. When a fixed asset was accepted for accounting, its useful life was set at 36 months.

The fixed asset is included in the second depreciation group. Depreciation was calculated using a non-linear method.

As of March 1, the fixed asset was fully depreciated. The total balance of the depreciation group as of March 1 was 250,000 rubles.

In March–July, by decision of the organization’s management, the fixed asset was modernized.

From March to July, the accountant calculated depreciation based on the depreciation rate established for the second depreciation group (8.8%):

| Month | Total balance of the depreciation group as of the 1st day of the month | Amount of accrued depreciation |

| March | 250,000 rub. | 22,000 rub. (RUB 250,000 × 8.8%) |

| April | 228,000 rub. (RUB 250,000 – RUB 22,000) | RUB 20,064 (RUB 228,000 × 8.8%) |

| May | RUB 207,936 (RUB 228,000 – RUB 20,064) | RUB 18,298 (RUB 207,936 × 8.8%) |

| June | RUB 189,638 (RUB 207,936 – RUB 18,298) | RUB 16,688 (RUB 189,638 × 8.8%) |

| July | RUB 172,950 (RUB 189,638 – RUB 16,688) | RUB 15,220 (RUB 172,950 × 8.8%) |

Modernization costs amounted to 30,000 rubles.

The total balance of the depreciation group as of August 1 was 187,730 rubles. (RUB 172,950 – RUB 15,220 + RUB 30,000).

The amount of accrued depreciation for August amounted to 16,520 rubles. (RUB 187,730 × 8.8%).

Situation: how to calculate depreciation of fixed assets after modernization (reconstruction) in tax accounting if the organization applies a depreciation bonus?

An organization has the right to write off at a time 10 percent (30% for fixed assets included in the third to seventh depreciation groups) of modernization (reconstruction) costs, if such a provision is fixed in its accounting policy (clause 9 of Article 258 of the Tax Code of the Russian Federation). When calculating depreciation, do not take into account amounts written off as bonus depreciation.

If an organization carries out modernization (reconstruction) several times during its useful life, it has the right to apply a depreciation bonus for each modernization (reconstruction). This was stated in the letter of the Ministry of Finance of Russia dated August 9, 2011 No. 03-03-06/1/462.

If an organization uses the straight-line depreciation method, after modernization (reconstruction), calculate depreciation in tax accounting using the formula:

| Monthly depreciation amount | = | Initial cost of fixed assets (including changes) | – | Depreciation bonus when writing off 10% (30%) of the cost of a fixed asset | – | Depreciation bonus when writing off 10% (30%) of modernization (reconstruction) costs | × | Depreciation rate calculated when accepting fixed assets for accounting |

When using a nonlinear method, use the formula:

| Monthly depreciation amount | = | The total balance of the depreciation group (subgroup), increased by the cost of modernization (reconstruction), minus the depreciation bonus | × | Depreciation rate in accordance with paragraph 5 of Article 259.2 of the Tax Code of the Russian Federation |

In the same order, determine the amount of depreciation charges if, at the time of modernization (reconstruction), the residual value of the fixed asset (total balance of the depreciation group (subgroup)) is zero.

This conclusion follows from the provisions of paragraph 9 of Article 258, Articles 259.1 and 259.2 of the Tax Code of the Russian Federation and letters of the Ministry of Finance of Russia dated March 13, 2012 No. 03-03-06/1/126, dated February 6, 2012 No. 03-03-06 /2/16.

Situation: how to reflect in tax accounting the costs of reconstruction (modernization) of property worth less than 100,000 rubles? The facility was put into operation after January 1, 2021.

Costs for reconstruction (modernization) of objects costing less than RUB 100,000. include in the calculation of income tax in the reporting period in which the reconstruction (modernization) was completed. This is due to the fact that property that was put into operation after January 1, 2021 and the cost of which is less than 100,000 rubles is not depreciable (clause 1 of Article 256 of the Tax Code of the Russian Federation). The cost of such objects is taken into account as part of material costs when putting them into operation (subclause 3, clause 1, article 254 of the Tax Code of the Russian Federation). The initial cost of such property is not formed in tax accounting, therefore the organization has the right to include expenses for its reconstruction (modernization) as part of other expenses associated with production and sales (clause 1 of Article 252, subclause 49 of clause 1 of Article 264 of the Tax Code of the Russian Federation ). This must be done in the reporting (tax) period in which the reconstruction (modernization) work was completed.

Similar clarifications are contained in letters of the Ministry of Finance of Russia dated October 4, 2010 No. 03-03-06/1/624, dated November 26, 2008 No. 03-03-06/1/651. Despite the fact that these letters were issued when the limit on the value of depreciable property was different, essentially these clarifications can still be used as a guide today.

Calculation of depreciation during modernization

If an object with an existing residual value is being reconstructed, then monthly depreciation is calculated according to accepted standards throughout the entire period of capital work. Clause 23 of PBU 6/01 dictates the suspension of the accrual of depreciation if it continues for more than 12 months. The Tax Code of the Russian Federation in this case agrees with a similar approach (clause 3 of Article 256 of the Tax Code of the Russian Federation). After the modernized facility is put into operation, the amount of monthly deductions changes, since both the SPI and the cost of the operating system change.

The calculation of depreciation for an asset begins on the first day of the month following the month in which this object was accepted for accounting; for example, for an object put into operation in March, depreciation will begin to be calculated according to the adjusted calculation on April 1. And it doesn’t matter whether depreciation accumulations were suspended due to exceeding the legally established reconstruction period or not.

When using the linear method, depreciation in accounting is calculated using the formula:

A = (OS + M) / SPI, where:

- OS - residual value of fixed assets;

- M - modernization costs;

- SPI - new SPI after modernization or the remaining one if it has not been changed.

Features of accrual in tax accounting

If the duration of modernization exceeds the annual period, it is necessary to stop accruing depreciation in tax accounting, which is confirmed by clause 3 of Article 256 of the Tax Code of the Russian Federation.

After completing actions related to modernization in relation to a fixed asset, the amount of depreciation deductions and the duration of their accrual can be adjusted.

The reason for this is the addition of capital investments to the initial cost and changes in the useful life.

SPI in tax accounting can be adjusted, but in a limited range provided for the depreciation group into which the fixed asset was included at the initial stage when entering the company. This is stated in paragraph 2, clause 1, article 258 of the Tax Code of the Russian Federation.

The SPI may not change. The decision to make adjustments is made by the organization at its own discretion.

If the enterprise considers that there are no grounds for changes, then further depreciation charges will be carried out on the basis of the balance of the joint venture and the residual value, which includes the capital investments made.

Depreciation after modernization

An example of a calculation for an object with an existing residual value:

The machine was retrofitted at an initial cost of RUB 220,000. and SPI 5 years after 3 years of operation in the amount of 50,000 rubles. The machine has been in operation since February 2013, depreciation has been calculated since March 2013. The modernization of the machine began in January 2021 and ended in February 2021 inclusive. Depreciation was accrued in the amount of RUB 132,000. (220,000 / 60 x 36). SPI after retrofitting was increased by 2 years, and depreciation, taking into account the increase in cost and SPI, began in March 2021.

Monthly depreciation amount:

(220,000 – (220,000: 60 months x 36 months) + 50,000) / 48 months = 2875 rubles , i.e. PS is reduced by the amount of accrued depreciation of 132,000 rubles. (220,000 / 60 x 36) and increases by the amount of modernization. The resulting cost of the operating system is divided by 48 months, i.e. by the established SPI.

Based on this calculation algorithm, it is easy to determine deductions for other methods of calculating depreciation.

There is another approach

To be fair, it should be noted that in the absence of clear rules governing the procedure for writing off the costs of modernizing a fully depreciated operating system, in practice there are other options for writing off modernization costs that differ from the Ministry of Finance - for example, based on the depreciation rate established anew, and not from that norms that were determined when the fixed asset was put into operation. This is exactly what the taxpayer did, whose dispute with the tax authorities was considered by the FAS PO arbitrators ( Resolution of 02.12.2013 in case No. A12-8247/2012 ).

During the audit, the tax authority established that as of September 1, 2005, for tax accounting purposes, the residual value of the fixed asset object - the building - was zero, the useful life determined by the taxpayer for tax accounting purposes (366 months, or 30.5 years) had expired .

In 2008, the taxpayer completed the reconstruction of the building. The cost of the work amounted to about 53 million rubles. For tax accounting purposes, the useful life of the asset is set at 43 months. The company included in the expenses of the audited period the amount of accrued depreciation taking into account the specified period (which the inspectors did not agree with, insisting on calculating depreciation based on a useful life of 366 months).

The arbitrators recognized the organization was right. At the same time, they indicated that at the time of completion of the reconstruction the building was completely depreciated; its previously determined useful life for tax purposes had expired. Therefore, the company has the right to choose any method of accounting for the relevant reconstruction costs, including by calculating depreciation in a manner determined independently in accordance with Art. 258 Tax Code of the Russian Federation .

Note that such examples are rare, and an organization, if it wants to apply a similar technique, should assess its chances of success in a dispute with the tax authorities.

On the modernization of fixed assets, depreciation for which is calculated using increasing factors

According to paragraphs. 1 clause 1 art. 259.3 of the Tax Code of the Russian Federation in relation to depreciable fixed assets used for work in an aggressive environment and (or) increased shifts, taxpayers have the right to apply a special coefficient to the basic depreciation rate, but not higher than 2. Note that the provisions of this norm apply to depreciable fixed assets that were registered before January 1, 2014.

Suppose an organization is modernizing an asset that was registered before this date, when calculating depreciation for which a coefficient of 2 is applied. The question arises: how should modernization expenses be taken into account for tax purposes?

According to the Ministry of Finance, set out in Letter No. 03-03-06/1/1777 , after modernization of a fixed asset item registered before 01/01/2014, the organization has the right to continue to apply a special coefficient in relation to such an item until complete write-off the cost of this depreciable property.

We believe that these recommendations are also relevant for fully depreciated operating systems.