The modernization of fixed assets in 1C 8.3 means a change in their original properties. As a rule, it makes sense to modernize for the better. For example, add additional functionality or processing accuracy.

Accordingly, for this it is necessary to purchase the necessary additional equipment and carry out installation work. The work can be done in-house, or done by third parties. In this article, we will consider the option when the work is performed by another organization, as this will cover the topic more fully.

For example, let’s modernize a woodworking machine from the 1C Accounting 8.3 demo database. Namely, we will replace its engine.

Modernization of OS when applying the general taxation regime

When reflecting transactions related to an increase in the initial cost of fixed assets and a change in their useful life in accounting, one should be guided by PBU 6/01 (approved by order of the Ministry of Finance of Russia dated March 30, 2001 No. 26n) and Methodological guidelines for accounting of fixed assets (approved. by order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n), and when reflected in tax accounting - Chapter 25 of the Tax Code of the Russian Federation.

According to the rules established by the listed acts, changes in the initial cost of fixed assets at which they are accepted for accounting are allowed in the case of completion, additional equipment, reconstruction, modernization, partial liquidation and revaluation of fixed assets. At the same time, the costs of modernization and reconstruction may increase the initial cost of fixed assets of such an object if, as a result of modernization and reconstruction, the initially accepted standard performance indicators (useful life, power, quality of use, etc.) of such fixed assets are improved (increased). Similar rules are established for tax accounting.

The useful life in accounting must be revised if, as a result of reconstruction or modernization, there has been an improvement (increase) in the initially adopted standard indicators of the functioning of a fixed asset item. If the useful life of a fixed asset in accounting increases, it can also be increased for tax accounting purposes, but only within the limits established for the depreciation group in which such a fixed asset was previously included.

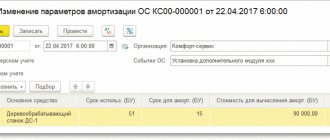

In the 1C: Accounting 8 program, the “OS Modernization” document is used to reflect the increase in the initial cost of fixed assets for accounting and tax accounting, as well as to change their useful life. Let's consider the method of reflecting an increase in the value of a fixed asset using an example.

Example 1

The organization purchased a computer in January 2008 worth 20,000 rubles, with a useful life of 60 months. Depreciation is calculated using the straight-line method in both accounting and tax accounting. In May of the same year, it was decided to increase the computer's RAM capacity. The amount of modernization expenses (both for accounting and tax purposes) amounted to 1,500 rubles. (excluding VAT). This amount was made up of the cost of the RAM module (1,200 rubles) and the cost of installing it in the computer system unit, performed by a specialist from a service company. The useful life did not change as a result of modernization.

Construction objects

Before increasing the cost of a fixed asset, it is necessary to first collect the costs associated with its modernization at the construction site. To accumulate such costs, account 08.03 “Construction of fixed assets” is intended, which allows you to conduct analytics on construction projects, cost items and construction methods. In our case, we should create a construction object for which the costs of upgrading the computer will be collected. It is convenient to enter the name of the construction project the same as that of the fixed asset for which costs are accumulated. This will make it easier to find and increase the visibility of analytical information.

Collection of modernization costs

Goods purchased from third-party suppliers are registered using the document “Receipt of goods and services” with the transaction type “purchase, commission”. In our example, on the “Products” tab of this document, you should fill in information about the memory module being registered. Since the module is intended for equipment modernization, it can be taken into account on account 10.05 “Spare parts” (see Fig. 1).

Rice. 1

Services for installing a memory module can be reflected in the same document, on the “Computer” tab. This can be done using the “Demand-invoice” document (see Fig. 2).

Rice. 2

As a cost account, you need to specify the construction project accounting accounts with the corresponding analytics for accounting and tax accounting. In our example, this will be invoice 08.03 with the same analytics that were used when registering services for installing a memory module:

- Construction objects: Computer;

- Cost items: cost accounting item for modernization of fixed assets;

- Construction methods: Contract.

When posting the document, a posting will be made relating the cost of the memory module from the credit of account 10.05 to the debit of account 08.03. As a result, all costs for upgrading the computer will be collected in account 03/08.

Increase in initial cost

After the costs related to the modernization of a fixed asset are allocated to the construction site, you can fill out the “OS Modernization” document, with the help of which the amount of such costs will be transferred from the construction site to the fixed asset.

In the “Event” input field, you need to select an event that characterizes the modernization of a fixed asset. The selected event when posting a document is entered into the information register “Events with fixed assets”. Using this register, you can obtain information about all events that occurred with the fixed asset by setting up the appropriate selection. The event type must be "Upgrade". If an event with this type is not in the directory, it needs to be created.

In the “Object” input field, you should select the construction object at which the costs for modernizing the fixed asset were collected.

On the “Fixed Assets” tab in the tabular section, you should list the fixed assets that are being modernized. To do this, it is convenient to use the “Selection” button located in the command panel of the tabular section. In our example, the main tool “Computer” is being upgraded (see Fig. 3).

Rice. 3

After selecting fixed assets in the “OS Modernization” document, you can automatically fill in the remaining columns of the tabular section based on the program data. To do this, click on the “Fill” button in the command panel of the tabular part of the document, and select “For OS list” in the drop-down menu.

If several fixed assets are selected in the tabular part of the OS Modernization document, then the amount of costs accumulated at the construction site will be distributed among these fixed assets in equal shares.

Then, on the “Accounting and Tax Accounting” tab, you should indicate the total amount of costs (for both accounting and tax accounting) accumulated at the construction site. After the accounting accounts for construction projects are indicated (in our example, 03/08), you can click on the “Calculate amounts” button in the “OS Modernization” document and the corresponding fields will be filled in automatically by the program.

After filling out the document, you can print out the acceptance certificate for repaired, reconstructed, modernized fixed assets (form No. OS-3).

When posting, the “OS Modernization” document transfers the amount of costs from the credit of the construction projects accounting account to the debit of the fixed assets accounting account. In our example, the following postings will be made:

Debit 01.01 Credit 08.03 - in the amount of 1,500 rubles.

The corresponding entry will be generated in tax accounting.

Features of calculating depreciation after modernization...

...for accounting purposes

According to the clarifications of the Ministry of Finance of Russia, in accounting, when the initial cost of an item of fixed assets increases as a result of modernization and reconstruction, depreciation should be calculated based on the residual value of the item, increased by the costs of modernization and reconstruction, and the remaining useful life (letter of the Ministry of Finance of Russia dated June 23, 2004 No. 07-02-14/144).

Consequently, after the modernization, the cost must be calculated, which will serve as the basis for further depreciation. It is defined as follows - see diagram.

Scheme

The amount received is reflected in the “Remaining” column. cost (BU)". In our example, this amount will be 20,166.68 rubles. (20,000 - 999.99 - 333.33 + 1,500).

When carrying out the “OS Modernization” document, the residual value and remaining useful life are remembered. In our example, the remaining useful life is 56 months. (60 - 4).

The new value and the new useful life for calculating depreciation are applied starting from the month following the month in which the modernization was carried out.

In our example, starting from June 2005, the amount of depreciation charges for accounting purposes will be 360.12 rubles. (20,166.68:56).

...for tax accounting purposes

The procedure for calculating depreciation after modernization for tax accounting purposes differs from how it is accepted in accounting. The rules for calculating depreciation in tax accounting are established by Article 259 of the Tax Code of the Russian Federation.

Starting from the month following the month in which the modernization was carried out, the changed original cost and useful life are used to calculate depreciation.

In our example, starting from June 2005, the amount of depreciation deductions for tax accounting purposes will be 358.33 rubles. (21,500.00: 60).

It remains to add that after the expiration of its useful life, the cost of the computer in tax accounting will not be fully repaid, since over 60 months the depreciation amount will be 21,399.80 rubles. (333.33 x 4 + 358.33 x 56).

The remaining 100.20 rubles. will be included in the depreciation amount calculated in the 61st month of using the computer.

Accounting for modernization costs when applying the simplified tax system

When reflecting operations related to the modernization, completion and additional equipment of fixed assets, accounting should be guided by PBU 6/01, and for the purpose of calculating the single tax paid in connection with the application of the simplified tax system, Chapter 26.2 of the Tax Code of the Russian Federation.

In the 1C:Accounting 8 program, the document “OS Modernization” is intended to reflect the modernization, completion and additional equipment of fixed assets.

Example 2

The organization purchased a computer in January 2008 worth 20,000 rubles, with a useful life of 36 months. In April of the same year, it was decided to increase the computer's RAM capacity. The amount of modernization costs amounted to 1,500 rubles. This amount was made up of the cost of the RAM module (1,200 rubles) and the cost of installing it in the computer system unit, performed by a specialist from a service company.

Collection of modernization costs

Before increasing the value of a fixed asset, it is necessary to first collect the costs associated with its modernization. To accumulate such costs in accounting, account 08.03 “Construction of fixed assets” is intended. Analytical accounting on the account is carried out for construction projects. To account for modernization costs, the object of analytical accounting will be “Installing memory in the i1000 computer.”

Let's create this object in the "Construction Objects" directory.

The purchase of a memory module from a third party and services for its installation are reflected in the document “Receipt of goods and services” with the type of operation “Construction objects”.

On the “Construction Objects” tab we indicate the cost of the memory module.

Services for installing a memory module are reflected in the same document on the “Not Accepted” tab.

This is due to the fact that such expenses are not accepted in the usual manner, but reduce the tax base as part of the cost of a constructed fixed asset or modernization carried out according to the rules that are provided for expenses for the acquisition, construction and modernization of fixed assets.

Increase in the initial cost of a fixed asset

After the costs related to the modernization of a fixed asset are allocated to the construction site, you can fill out the “OS Modernization” document.

In the “Event” input field, you need to select an event that characterizes the modernization of a fixed asset.

The event type must be "Upgrade". If an event with this type is not in the directory, it needs to be created.

The specified event will be used in the name of the expense object in the book of income and expenses.

In the “Object” input field, you should select the construction object at which the costs for modernizing the fixed asset were collected.

On the “Fixed Assets” tab in the tabular section, you should list the fixed assets that are being modernized (see Fig. 4).

Rice. 4

If several fixed assets are selected in the tabular part of the OS Modernization document, then the amount of costs accumulated at the construction site will be distributed among these fixed assets in equal shares.

Then, on the “Accounting and Tax Accounting” tab, you should indicate the total amount of costs (for both accounting and tax accounting) accumulated at the construction site.

After the accounts for accounting of construction projects are indicated (in our example, 03/08), you can click on the “Calculate amounts” button and the corresponding fields will be filled in automatically by the program.

In the expense payment table, you must provide information about all payments, indicating the date and amount of payment.

If payment to the supplier is made after the execution of the document “OS Modernization”, such payment must be registered with the document “Registration of payment for OS and intangible assets for the simplified tax system and individual entrepreneurs”, for which the document provides a special tab “OS Modernization”, on which you can specify the modernization document.

Recognition of expenses for modernization of fixed assets

Recognition of expenses for modernization, completion and additional equipment of fixed assets is carried out in the same manner as the recognition of expenses for the acquisition of fixed assets - at the end of the reporting period with the document “Month Closing” (Fig. 5).

Rice. 5

As a result of the document, expenses will be recognized separately for the acquisition of a fixed asset and for its modernization, and the following records will be generated:

- in section I of the Book of Income and Expenses;

- in section II of the Book of Income and Expenses.

As a result, having generated the Book of Income and Expenses for the half-year, we will obtain a calculation of expenses for fixed assets.

Contract method of modernization of fixed assets

With the contract method, we collect all costs on account 08.03 in correspondence with account 60 (76), using the document Receipt of goods and services: section Purchases - Receipts (acts, invoices) - Receipts - Goods, services, commission:

How to reflect the modernization of fixed assets in 1C 8.2 using the example of an organization with a simplified tax system is discussed in more detail in the following article.