Organizations must prepare financial statements based on the results of 2021.

Accounting (financial) statements for 2021 Simplified accounting statements for 2021 in “1C: Accounting 8” (rev. 3.0)

The composition of the accounting (financial) statements of commercial organizations that do not have the right to use simplified accounting methods, including simplified accounting (financial) statements, for 2021:

- balance sheet;

- income statement;

- appendices to the balance sheet and income statement: statement of changes in equity;

- cash flow statement;

- other annexes (explanations), if required.

Reporting is prepared according to forms approved. by order of the Ministry of Finance of Russia dated 07/02/2010 No. 66n (as amended on 04/06/2015):

- balance sheet and financial results statement - according to the forms given in Appendix No. 1 to Order No. 66n;

- reports on changes in capital and cash flows - according to the forms given in Appendix No. 2 to Order No. 66n;

- Explanations to the balance sheet and financial results statement (when prepared in tabular form) - according to the forms given in Appendix No. 3 to Order No. 66n.

We will consider the preparation of accounting (financial) statements in “1C: Accounting 8” using the following example.

Example

Belaya Akatsiya LLC is a small enterprise, but has decided to prepare financial statements for 2021 in the scope of the accounting reporting forms provided for “ordinary” organizations.

Regulated report for reporting

In the “1C: Accounting 8” program, for the preparation of accounting (financial) statements for 2021 by a commercial organization that does not have the right to use simplified accounting methods, including simplified accounting (financial) statements, the regulated “Accounting Statements” report is intended.

To prepare reports using this report from the list of tasks, you must indicate the composition of the reporting forms “Full” in the “Accounting Policy” form (Fig. 1).

Rice. 1

To generate reports, you need to click on the task of preparing financial statements and, in the assistant form, click on the “Generate report” button (Fig. 2).

Rice. 2

As a result, a report form will be displayed on the screen (Fig. 3).

By default, reporting is prepared in whole thousand rubles, it includes all reporting forms and explanations in accordance with Order No. 66n.

Rice. 3

Passive part of the balance

The second section informs the reader of the balance sheet about how its active part is formed. It also has certain sections within itself:

- Loans and credits, as well as salaries to subordinates;

- External obligations of a long-term nature;

- Authorized and equity capital of the company.

Every accountant, when starting to compile a reporting form, is obliged to remember and observe the following equality:

Assets = Capital + Liabilities

The report is compiled not only to help management understand the vector of development of their business, but also represents regulated reporting for regulators.

Balance sheet for 2021

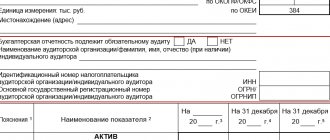

The “Balance Sheet” section is intended for drawing up a balance sheet (Fig. 4).

Rice. 4

The header part of the balance sheet contains indicators characterizing the organization. They are filled in automatically based on the data provided in the organization information form (Fig. 5).

If cells with any information about the organization are left blank, this means that there is no corresponding data in the information base. In this case, you need to add the necessary information to the “Organizations” directory, and then use the “Update” command in the menu of the “More...” button to update the report.

By default, the “Location (address)” attribute displays the postal address of the organization. If necessary, it can be changed, for example, to a legal address. To do this, just double-click on the address field and select the address in the auxiliary form.

Rice. 5

To fill out the balance sheet indicators according to the accounting data, you must click on the “Fill” button and select the “Current report” item.

Most balance sheet indicators are filled in automatically (Fig. 6, 7).

Rice. 6

Rice. 7

If there are no errors in the accounting data, then in the completed balance sheet the values in the columns with the values of the indicators on line 1600 and line 1700 should match.

If the data in the column “As of December 31, 2021” does not match it is necessary to check whether the regulatory operations for closing accounts 25 “General production expenses”, 26 “General business expenses”, 90 “Sales” and 91 “Other income and expenses” were carried out correctly. On accounts 25 and 26 there should be no balances at the end of each month of the reporting period, on accounts 90 and 91 there should be no balances in the entire account at the end of each month of the reporting period. A possible reason could be incorrect postings and balances on accounts marked “Active” and “Passive”. On the first, balances can only be debit, on the second - only credit.

All indicators for which accounting data is available in the information base will be filled in automatically. Due to the lack of necessary data in the information database, automatic completion of the indicators “Estimated Liabilities” and “Other Liabilities” of Section IV is not supported. Long term duties. Cells for values that are not automatically filled in are highlighted in yellow on the report form.

For the same reason, it may be necessary to adjust the values of individual indicators. In particular, this applies to indicators of financial investments, receivables and payables.

In the balance sheet, compiled using the regulated “Accounting Statements” report, it is possible to separate indicators about individual assets and liabilities in the “including” lines to the corresponding indicator-group of items if they are significant and if it is impossible for interested users to know about them assessment of the financial position of an organization or the financial results of its activities. You can add such indicators automatically, manually, or in a combined way.

In automated mode, you can add predefined indicators to the balance sheet, a list of which is given in the form of settings for decoding balance sheet indicators, which opens by clicking the hyperlink “Setting the composition of lines” (Fig. 8).

Rice. 8

For those indicators that need to be presented separately in the balance sheet, you need to check the box in the “Include in report” column. The action bar of the configuration form contains buttons that allow you to check or uncheck all predefined metrics at once.

The marked indicators are automatically added to the “including” lines of the corresponding indicator - a group of articles. To display values in these indicators, you need to automatically fill out the report again (Fig. 9).

Rice. 9

To add an indicator manually, you need to type in the corresponding “including” line, highlighted in yellow. If one line is not enough, then to add lines you should use the “Add line” hyperlink.

You can also use a combined method of disclosing information in the balance sheet: add predefined indicators that the organization considers significant as a whole in an automated manner, and enter detailed indicators manually. This method can be used, for example, if the organization considers significant information not about the total amount of investments in the construction of fixed assets (account balance 08.03), but about the actual costs of specific objects.

Balance sheet structure

The balance itself is very important not only for the internal user studying the results of his business and the course of action for the future. External users in the role of investors and creditors also, first of all, want to familiarize themselves with this report in order to understand the advisability of making monetary and other investments in such a business. Simply put, will this bring any dividends in the future or is the business frankly unprofitable, but this is cleverly veiled in the balance sheet. The following example table shows the structure of the report.

| No. | Chapter | Characteristic |

| 1 | Assets | Current assets |

| Non-current assets | ||

| 2 | Passive | Capital and reserves |

| Short-term liabilities | ||

| long term duties |

Assets represent everything that a company has that can be converted into cash. Often this refers to transport, buildings and various equipment.

Financial results report for 2021

The section “Report on financial results” is intended for drawing up a report on financial results.

The header part of the report contains indicators characterizing the organization. They are filled in automatically based on the data available in the information base (Fig. 10).

Rice. 10

To fill out the indicators of the financial results report according to the accounting data, you must click on the “Fill” button and select the “Current report” item. All indicators for which accounting data is available in the information base are filled in automatically (Fig. 11, 12).

Rice. eleven

Rice. 12

Due to the lack of necessary data in the information database, automatic completion of the reference indicators “Result from other operations not included in the net profit (loss) of the period”, “Basic profit (loss) per share” (indicator code 2900) and “Diluted profit (loss) per share” share" (indicator code 2910) is not supported.

In the profit and loss report, compiled using the regulated “Accounting Statements” report, it is possible to separately bring indicators about individual income and expenses in the “including” lines to the corresponding indicator of the report form if they are significant and if without knowledge of them by those interested It is impossible for users to assess the financial position of the organization or the financial results of its activities. You can add such indicators automatically, manually, or in a combined way.

In automated mode, you can add predefined indicators to the financial results report, a list of which is given in the form of settings for deciphering indicators of the financial results report, which opens by clicking the hyperlink “Setting up the composition of lines” (Fig. 13).

Rice. 13

The marked measures are automatically added to the “including” lines of the corresponding income statement measure. To display the values in these indicators, you need to automatically fill out the report again (Fig. 14).

Rice. 14

Manual decoding is performed of those indicators of the financial results report that are not mentioned in the decryption setup form, but for them in the report form there are lines “including” - changes in deferred tax liabilities, changes in deferred tax assets, etc. To add an indicator manually, you must By typing from the keyboard, fill in the corresponding line “including”, highlighted in yellow. If one line is not enough, then to add lines you should use the “Add line” hyperlink.

You can also use a combined method of disclosing information in the financial performance report: add predefined indicators that the organization considers significant in an automated manner, and detail the remaining indicators manually. This method can be used, for example, if an organization considers information about income and expenses, in the assessment of which permanent differences have arisen, to be significant.

Balance in 1C: features of compilation

The question of how to create a balance in 1C can be answered very simply. With the advent of the possibility of maintaining automated accounting, accountants no longer had many tasks that needed to be performed as preparatory work. The report form is fixed at the legislative level and can be modified within certain industries. The machine carefully monitors all regulatory changes, but you must ensure that the software is updated in a timely manner.

It has already been said that the balance sheet has two parts:

- Assets.

- Passive

Its printed form also consists of these sections. The header includes information informing the user that the report is related to a specific company:

- TIN;

- The company name cannot be abbreviated here;

- Type of ownership;

- Legal address.

- Balance currency.

This information is printed out by the machine in automatic mode. The report is generated for the selected date. Each article has a specific coding, as well as a cost indicator at the beginning and end of the period. The balance sheet includes all business transactions carried out by the accountant up to this point, so its correct preparation is extremely influenced by the timeliness of initial paperwork and other transactions.

The program colors the report items in different colors and this is not accidental. The following transcript will help you understand what's what:

- yellow positions allow editing of cells;

- white ones do not allow the user to correct them;

- light green positions can be adjusted and they are formed automatically from the data of yellow and white cells;

- green cells are written automatically by the machine and can be changed by adjusting the previous description.

You can set the following values for light green positions for certain custom parameters:

- auto-completion with the ability to correct;

- auto-fill without adjustments;

- no autofill.

Right-clicking on a selected cell brings up a context menu with a list of commands to use. The decoding will show you how the column is calculated and where the figure was added to the balance sheet, meaning the accounting register. There is also functionality for adding and deleting table rows.

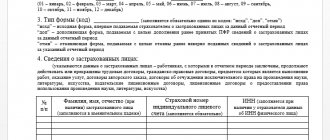

Appendixes to the balance sheet and income statement

Preparation of a statement of changes in equity

The “Statement of Changes in Capital” section is intended for drawing up a report on changes in capital.

The header part of the statement of changes in capital contains indicators characterizing the organization. They are filled in automatically based on the data available in the information base (Fig. 15).

Rice. 15

To fill out the indicators of the report on changes in capital according to accounting data, you must click on the “Fill” button and select the “Current report” item. All indicators for which accounting data is available in the information base are filled in automatically (Fig. 16-18).

Rice. 16

Rice. 17

Rice. 18

In section “1. Capital Movement” does not support automatic completion of the following indicators:

- “income attributable directly to the increase in capital” (indicator codes 3213 and 3313);

- “additional issue of shares” (indicator codes 3214 and 3314);

- “increase in the par value of shares” (indicator codes 3215 and 3315);

- “reorganization of a legal entity” (indicator codes 3216 and 3316);

- “expenses related directly to the reduction of capital” (indicator codes 3223 and 3323);

- “decrease in the par value of shares” (indicator codes 3224 and 3324);

- “decrease in the number of shares” (indicator codes 3225 and 3325);

- “reorganization of a legal entity” (indicator codes 3226 and 3326).

In section “2. Adjustments due to changes in accounting policies and correction of errors" does not support automatic completion of the following indicators:

- “adjustment due to changes in accounting policies” (indicator code 3411);

- “adjustment due to error correction” (indicator code 3421).

Section “3. Net assets" is filled in automatically.

Preparation of a cash flow statement

The section “Cash Flow Statement” is intended for drawing up a cash flow statement.

The header section of the cash flow statement contains indicators that characterize the organization. They are filled in automatically based on the data available in the information base (Fig. 19).

Rice. 19

To fill out the indicators of the cash flow report according to the accounting data, you must click on the “Fill” button and select the “Current report” item. All indicators for which accounting data is available in the information base are filled in automatically (Fig. 20-21).

Rice. 20

Rice. 21

In each subsection, before the indicator “other receipts” and “other payments” there are free lines (highlighted in yellow). If necessary, an organization can separate cash flows (receipts or payments) into separate indicators, which by default are included in other receipts and other payments, while adjusting the value of the corresponding indicator of other receipts and other payments. For each type of cash flow, you can enter four additional indicators. Adding another additional line is done using the “Add line” hyperlink.

In accordance with PBU 23/2011, cash flows in the cash flow statement in a number of cases must be reflected in a collapsed manner.

It is necessary to collapse cash flows (i.e. not to report separate receipts and payments) in cases where they characterize not so much the activities of the organization as the activities of its counterparties, and (or) when receipts from some persons determine corresponding payments to other persons, for example (clause 16 PBU 23/2011):

- cash flows of a commission agent or agent in connection with the provision of commission or agency services (except for fees for the services themselves);

- indirect taxes as part of receipts from buyers and customers, payments to suppliers and contractors and payments to the budget system of the Russian Federation or reimbursement from it;

- receipts from the counterparty for reimbursement of utility bills and making these payments in rental and other similar relationships;

- payment for transportation of goods with receipt of equivalent compensation from the counterparty.

It is also necessary to reflect cash flows in a collapsed manner in cases where they are characterized by rapid turnover, large amounts and short repayment periods, for example (clause 17 of PBU 23/2011):

- mutually determined payments and receipts for settlements using bank cards;

- purchase and resale of financial investments;

- making short-term (usually up to three months) financial investments using borrowed funds.

The current version of the regulated report provides automatic collapse:

- cash flows of a commission agent or agent in connection with the provision of commission or agency services (except for fees for the services themselves);

- indirect taxes as part of receipts from buyers and customers, payments to suppliers and contractors and payments to the budgetary system of the Russian Federation or reimbursement from it.

Adjustment of cash flow indicators for the remaining collapsed amounts is done manually.

How to create a balance in 1C: step-by-step instructions

In principle, you should not have any difficulties in generating a reporting form in the software. The main thing in this matter is to adhere to a certain algorithm of actions and step-by-step instructions you can read below:

Step 1 – In the main program menu, go to reports and stop at the list of 1C-Reporting regulated reports.

Step 2 – Right-clicking on regulated reports allows the user to view the list of them offered by the machine. Select the required company here, if there are several of them, and also indicate the period for generating the balance sheet. When you click on create, you will see all possible types of reports.

Step 3 – In this window, you continue to work and in the all category section field, select an accounting position. A complete list of reports will be displayed on the screen, starting from 2011, and you should make your choice.

Step 4 – Next, write down the company for which there is a need to generate a report and for what period it needs to be done. It is also worth indicating the type of activity:

- Does the company operate on a commercial basis?

- The company is non-profit.

The report generation form complies with the legislation and the machine updates the form to take into account innovations. You can view this in the edit of the form. After checking and implementing all the initial parameters, apply the create function.

Step 5 – The machine will offer you an empty form to work with and you will use the command to fill out the current report to get the finished result. Next, you need to responsibly check the results of the two sections and they must be equal. Otherwise, the report will be incorrect and you will have to look for the cause and location of the error in the accounting registers.

Step 6 – Provided that you completed the above steps correctly and you received a correct and correct report, you can safely print it. At the top of the working form there is a functionality of the same name and it is recommended to use it. Since your report can be sent to various inspection bodies, the team offers you the right to choose where the printed form will need to be sent. If you do not need to print the report at the moment, then you have the right to familiarize yourself with the informative data directly on the screen.

Step 7 – Any action performed in the automated system must be saved and a data recording command has been developed for the report. The functionality is highlighted in orange for user convenience. You can also find a calendar in your car that will inform you about when and where to file company reports. Information in the reporting forms is taken up to and including the date of such submission. You can find it in the tasks of the main menu, then go to the desired list.

Printing financial statements

To print financial statements, use the “Print” button on the command panel of the report form. When you click it, you should select the type of printing form from the drop-down menu (Fig. 32).

Rice. 32

To print a legal copy of the accounting (financial) statements, the print form selection switch should be set to the “Forms as amended by Order No. 66n of the Ministry of Finance of Russia dated July 2, 2010.”

To print accounting (financial) statements for submission to the tax authority if the organization does not use electronic document management with tax authorities, the print form selection switch should be set to the “Forms in the form of a machine-readable form with a two-dimensional barcode PDF417” position. To generate a machine-readable form, a unified printing module developed by the Federal Tax Service of Russia is used. If the module is not already installed, selecting this print form option will launch the print module installation program. Please note that explanations to the balance sheet and financial statements in the form of a machine-readable form are not printed, since this is not provided for by the order of the Federal Tax Service of Russia, which approved the format for presenting accounting (financial) statements on machine-readable forms.

If for some reason the organization is not able to print forms in the form of a machine-readable form with a two-dimensional PDF417 barcode, then the print form selection switch should be set to the “Forms with a title page of the form according to KND 0710099” position.

For each print option, you can select “Print Now” or “Show Form”.

If you select the “Print immediately” option, the reports will be printed immediately without preview. When you select the “Show form” option, a reporting preview form is displayed on the screen (Fig. 33-35).

Rice. 33

Rice. 34

Rice. 35

Balance sheet asset: what includes

Assets include receivables from third parties to the company. The list of assets is determined in monetary terms and each report has a balance sheet currency. That is, everything that the company owns is reflected in the first section.

Based on the table, you see that the asset is also subdivided within itself into various positions. Non-current assets are understood as property not of a short-term nature, but everything that a particular business uses for a long time. An example of this is office buildings, warehouses and other technical means in the form of machines, production belts. Everything that requires constant replenishment and acquisition for the smooth operation of the company is called current assets. It is impossible to purchase supplies, production raw materials and other necessary materials for a long time.