- Purpose of the article: displaying information about assets on the balance sheet of an enterprise with a circulation period of more than 12 months, information about which was not displayed in other lines due to the insignificance of the information.

- Line number in the balance sheet: 1190.

- Account number according to the chart of accounts: account balances, , , etc. can be displayed here. in amounts that relate to equipment for installation.

Line 1190 of the balance sheet displays data on all remaining non-current assets (circulation period exceeding 12 months), which were not indicated in the previous asset lines of the balance sheet due to the immateriality of the information.

Note from the author! According to PBU 4/99, information about the company’s assets and liabilities must be displayed separately in the financial statements if it is material. Data is considered significant when, if omitted or distorted, it is impossible to fully monitor the financial and economic activities of the company and assess its financial condition as a whole.

Other non-current assets are:

- equipment on the company's balance sheet, the commissioning of which is possible only after the installation procedure (debit balance account 07). Account 07 collects information about the costs incurred for the purchase of technical equipment (purchase, transportation, agreement with contractors), i.e. the initial cost of the fixed asset is formed without assembly and installation costs. After completing all the necessary procedures, the value of the asset passes to Dt08;

- the company's costs accounted for in separate subaccounts 08, which in subsequent reporting periods will be transferred to the company's fixed assets or intangible assets, as well as costs incurred for unfinished research and development activities;

- deferred costs (account 97), for example, transfer of advance payments for granting the right to use the results of intellectual activity or costs for the development of new natural deposits, if the period for writing off these costs is more than 12 months;

- taken into account in a separate subaccount account 01 is the cost of perennial plantings that will reach the age of operation in future reporting periods;

- advance payments transferred to counterparties to pay for work and services related to the construction of fixed assets of the company (account 60). Information about partial advance payment for these works is also displayed here;

- acquired construction in progress - line 1190 will display the costs of continuing the work.

Line 1190 – non-current assets of the company: the company’s assets are displayed here, the circulation period of which is more than 12 months, information about which is not significant, the data is not reflected in the main lines of the balance sheet in the section of non-current assets.

According to the law, there is no clear scheme for including certain accounts in this line. The financial statements display information as of the current period, December 31 of the previous year; as of December 31 of the year preceding the previous one, the company independently decides on the materiality of the information. Comparison of indicators from previous years should be carried out comprehensively with monitoring of the remaining lines of the balance sheet section.

The concept of non-current and other non-current assets

Non-current assets are a unique type of company property. A whole section in the assets of the balance sheet is dedicated to them. Some of these assets cannot be touched, they have no material form, but some of them are very material .

Take our proprietary course on choosing stocks on the stock market → training course

According to current legislation, non-current assets are divided into:

- Fixed assets

- Financial assets

- Intangible assets

- Other noncurrent assets

The company's fixed assets include everything with the help of which the final result of the organization's activities is created. They include equipment and machinery, land, real estate, animals, leased property, library funds and other similar property. It is usually recorded at the price at which it was purchased.

Shares, bonds, loans, investments are prominent representatives of the group of financial assets. All company investments for a period of more than 1 year are financial assets of the organization.

Intangible assets are a large group. They cannot be touched; they have no material form. R&D, advertising, trademark purchases and other similar acquisitions are examples of such assets. Expenses for their acquisition are taken into account at the time they are incurred.

| IMPORTANT! Know-how also falls into the category of intangible assets. They are best protected by the state and do not expire. Often, a patent and know-how are inseparable concepts, so the cost of a patent increases significantly |

The last large group is other non-current assets. This is all that did not fall into the above-mentioned groups. For example, these could be the costs of registering a trademark or creating the organization itself (in this case, the costs must be borne by the founders themselves and they must be included in the authorized capital).

The composition of other non-current assets is presented in the table:

| Type of asset | Account | Explanation |

| Perennial plantings | Balance according to D01 | Information is taken from the corresponding sub-account if the amounts were not reflected on line 1150. The age of such plantings should be less than the period of their use |

| Installation equipment | Balance on D07, 15, account balance 16 | Information is taken only that relates to equipment for installation, if the indicators were not reflected on other lines. This also includes spare parts for equipment to be installed |

| Expenses that the organization incurs on objects - future fixed assets, intangible assets, as well as R&D | Balance according to D08 | Information is taken into account in accordance with subaccounts to account 08 |

| Advances and prepayments in connection with the construction of fixed assets | Balance according to D60 | Information is taken from the corresponding sub-account to account 60 |

| Deferred expenses with a period of more than 1 year | Balance according to D97 | We select only those that relate to expenses with a repayment period of more than 12 months. This also includes the amount of a one-time payment for the right to use the result of intellectual activity |

Non-current assets are used by the organization for more than 12 months. They are included in the cost of manufactured products in parts over the period of their use.

| Business valuation | Financial analysis according to IFRS | Financial analysis according to RAS |

| Calculation of NPV, IRR in Excel | Valuation of stocks and bonds |

What refers to tangible assets

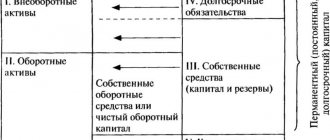

The property assets of an organization are usually divided into 2 main groups – non-current (NCA) and current. The first includes objects withdrawn from the turnover of the enterprise in order to achieve specified operational goals. The second includes those resources that complete a full cycle during the reporting period of 1 calendar year and are involved in daily activities.

Grouping of non-current assets:

- Fixed assets – buildings for production/non-production purposes; rights to land and land plots; administrative buildings; production equipment, including those not put into operation; vehicles, etc. Includes objects provided for rent.

- Material exploration objects - according to PBU 24/2011, such assets include various structures, equipment and vehicles used in the search and/or development of natural resources. For example, these are drilling rigs and pipelines.

- Investments in material projects - include material resources provided to other organizations for a fee for temporary possession. These are rental agreements, rental agreements, leasing agreements.

- Other types of SAI.

Grouping of current assets:

- Inventories - raw materials, fuel, semi-finished products, materials, goods, finished products, work in progress.

- Other types of assets.

All types of tangible assets of an enterprise are subject to reflection in the financial statements as of a given date, disclosing the coding by item. The cost expression is based on accepted methods for assessing MA upon admission and departure.

Note! Intangible assets, long-term/short-term financial investments, cash resources and equivalents, securities, and accounts receivable are not considered tangible assets.

How can you get non-current assets onto the organization’s balance sheet?

Non-current assets can enter an organization in different ways:

- Purchase. The organization itself can purchase the asset it needs

- Production. The asset can be created by the company itself. In this case, the organization will receive exactly what it needs

- A non-current asset may be at the disposal of the company as a contribution to the authorized capital

No matter how the asset ends up in the organization, you need to have correctly completed documentation on hand and register it correctly.

Accounting for tangible assets

Accounting for property assets of an enterprise is carried out by reflecting business transactions on working accounts. The main ones include accounts from 01 to 26, 40, 41, 45, 29, 44. Accounting for inventories is carried out in accordance with PBU 5/01, fixed assets - in accordance with PBU 6/01. The procedure for generating transactions and the value expression are determined in accordance with Order No. 34n dated July 29, 1998. At the same time, the rules for assessing various types of material resources are regulated in detail by clause 23 of the Order:

- For objects received for a fee, the cost is the sum of all actual expenses.

- For objects received free of charge, the property is valued based on market prices at the time of capitalization.

- For objects manufactured in the company, the cost of production is taken into account.

Attention! An enterprise has the right to use other valuation methods, including the reservation method, if provided for by the legislation of the Russian Federation.

Tangible assets in the balance sheet are reflected in the corresponding lines as of the reporting date:

- Page 1140 – material search objects.

- Page 1150 – fixed assets.

- Page 1160 – investments in material assets.

- Page 1190 – other types of SAI.

- Page 1210 – inventory and materials.

- Page 1260 – other types of OA.

Basic standard entries for accounting for tangible assets:

| Business operation | Debit | Credit |

| Equipment purchased for a fee | ||

| VAT allocated in the cost of the asset | ||

| The initial cost of received equipment is reflected | ||

| Received goods and materials from the warehouse of the enterprise | ||

| VAT allocated | ||

| Accrued depreciation on equipment | 20, 44, 23, 25, 29, 26 | |

| The costs of modernizing the OS facility are reflected | 69, 70, 10 | |

| The sale of fixed assets was carried out, the amount of VAT was allocated separately | ||

| Recorded write-off of accrued depreciation | ||

| The write-off of the residual value of the sold fixed asset is reflected |

For successful operation, companies and entrepreneurs need to have particularly valuable property that can provide benefits for a long time. This category of assets is usually called non-current assets. In accordance with PBU 4/99, companies must reflect assets in accounting forms, in particular the balance sheet. In order to determine which property belongs to the non-current group, it is necessary to refer to the provisions of the law.

From which accounts is information collected to calculate line 1190? Calculation procedure

A total of seven accounts can participate in the formation of the amount on line 1190 of the balance sheet.

Account 01 takes into account data that relates only to young plantings. Other property recorded in the account in this section is not shown in the section in question.

Account 07 reflects the availability of equipment that must be installed before operation. Typically, such equipment is installed on capital projects under construction, which means that developers use the account in their work.

Account 08 is used when purchasing assets. From this account, the property can subsequently be transferred to the category of fixed assets.

Accounts 15 and 16 are used only in the context of analytics for the equipment that needs to be installed.

Data for account 60 is taken in the amount of preliminary receipt of funds for fixed assets under construction.

Line 1190 also contains data on expenses that will be closed in future periods. The repayment period for such expenses is more than a year.

What accounting data is used. when filling out line 1190 “Other non-current assets”

when filling out line 1190 “Other non-current assets”

From the above it follows that when filling out line 1190 “Other non-current assets” data on the balance as of the reporting date for accounts 08, 07, 15 and 16 can be used (in the part related to equipment for the installation) , 97 (analytical account for accounting for expenses with a write-off period of more than 12 months), 60 (in terms of advances and prepayments for work and services purchased for the construction of OS), as well as account 01, subaccount 01-5, analytical account “Young plantings”. The balance on these accounts is formed as line indicator 1190 only if this information is unimportant. Non-current assets of the organization, information about which is significant, must be reflected in section. I of the Balance Sheet separately (paragraph 2 of clause 11 of PBU 4/99, Letter of the Ministry of Finance of Russia dated January 24, 2011 N 07-02-18/01).

| Line 1190 “Other non-current assets” of the Balance Sheet | = | Debit balance for account 08 <*> | + | Debit balance for account 07 <*> | + | Debit balance of account 15 in the part related to equipment for the installation <*> | + — |

| + — | Balance on account 16 in the part related to equipment for the installation <*> | + | Debit balance on account 97 (analytical expense account with a write-off period of more than 12 months) | + | Debit balance on subaccount 01-5 (analytical account “Young plantings”) <*> | + | Debit balance on account 60 in terms of advances and prepayments for work, services related to the construction of fixed assets |

<*> Provided that the amount of unfinished capital investments is not included by the organization in the indicators of lines 1110 “Intangible assets”, 1120 “Results of research and development”, 1150 “Fixed assets” and 1160 “Profitable investments in tangible assets”.

In general, the indicators in line 1190 “Other non-current assets” as of December 31 of the previous year and as of December 31 of the year preceding the previous year are transferred from the Balance Sheet for the previous year.

The “Explanations” column provides an indication of the disclosure of this indicator.

Example of filling line 1190

"Other noncurrent assets"

EXAMPLE 1.9

The organization decided to separately reflect unfinished capital investments on a separate, independently entered line in section. I “Non-current assets”, and in case of insignificance of indicators - on line 1190.

Indicators for accounts 08, 07 and 97 in accounting (indicators for account 01, subaccount 01-5, analytical account “Young Plantations”, for accounts 15 and 16 in the part related to equipment for installation, as well as for account 60 in the part There are no advances or prepayments for work and services related to the construction of fixed assets):

rub.

┌───────────────────────────────────────────┬─────────────────────────────┐

│ Indicator │As of the reporting date (December 31, 2015)│

├───────────────────────────────────────────┼─────────────────────────────┤

│ 1 │ 2 │

├───────────────────────────────────────────┼─────────────────────────────┤

│1. Balance on the debit of account 08, subaccounts 08-3│ 5,939,100 │

│and 08-4 │ │

├───────────────────────────────────────────┼─────────────────────────────┤

│2. Balance on the debit of account 08, subaccount 08-8 │ 860 900 │

├───────────────────────────────────────────┼─────────────────────────────┤

│3. Balance on the debit of account 07 (cost │ 860,000 │

│equipment subsequently subject to │ │

│acceptance for accounting on account 01) │ │

├───────────────────────────────────────────┼─────────────────────────────┤

│4. Balance on the debit of account 97, analytical│ 586,806 │

│expense accounts with a write-off deadline │ │

│over 12 months (lump sum payments) │ │

└───────────────────────────────────────────┴─────────────────────────────┘

Fragment of the Balance Sheet for 2014

┌───────┬─────────────────────────────────┬────┬────────┬───────────┬───────────┐

│Belt- │ Name of indicator │ Code│ At 31 │ At 31 │ At 31 │

│opinions │ │ │ December│ December │ December │

│ │ │ │ 2014│ 2013 │ 2012 │

├───────┼─────────────────────────────────┼────┼────────┼───────────┼───────────┤

│ 1 │ 2 │ 3 │ 4 │ 5 │ 6 │

├───────┼─────────────────────────────────┼────┼────────┼───────────┼───────────┤

│ 2.2 │Unfinished capital │1185│ 3012 │ 1604 │ — │

│ │investments in basic objects │ │ │ │ │

│ │means │ │ │ │ │

├───────┼─────────────────────────────────┼────┼────────┼───────────┼───────────┤

│ 1.5 │Other non-current assets │1190│ 2127 │ 4890 │ — │

└───────┴─────────────────────────────────┴────┴────────┴───────────┴───────────┘

Solution

The cost of unfinished capital investments in fixed assets is:

as of December 31, 2015 - 6,799 thousand rubles. (RUB 5,939,100 + RUB 860,000);

as of December 31, 2014 - 3012 thousand rubles;

as of December 31, 2013 - 1,604 thousand rubles.

The cost of other non-current assets is:

as of December 31, 2015 - 1,448 thousand rubles. (RUB 860,900 + RUB 586,806);

as of December 31, 2014 - 2127 thousand rubles;

as of December 31, 2013 - 4890 thousand rubles.

A fragment of the Balance Sheet in Example 1.9 will look like this.

┌───────┬─────────────────────────────────┬────┬────────┬───────────┬───────────┐

│Belt- │ Name of indicator │ Code│ At 31 │ At 31 │ At 31 │

│opinions │ │ │ December│ December │ December │

│ │ │ │ 2015│ 2014 │ 2013 │

├───────┼─────────────────────────────────┼────┼────────┼───────────┼───────────┤

│ 1 │ 2 │ 3 │ 4 │ 5 │ 6 │

├───────┼─────────────────────────────────┼────┼────────┼───────────┼───────────┤

│ 2.2 │Unfinished capital │1185│ 6799 │ 3012 │ 1604 │

│ │investments in basic objects │ │ │ │ │

│ │means │ │ │ │ │

├───────┼─────────────────────────────────┼────┼────────┼───────────┼───────────┤

│ 1.5 │Other non-current assets │1190│ 1448 │ 2127 │ 4890 │

└───────┴─────────────────────────────────┴────┴────────┴───────────┴───────────┘

3.1.1.10. Line 1100 “Total for Section I”

The indicator of this line is the sum of the indicators for the lines of the balance sheet with codes 1110 - 1190 and reflects the total value of non-current assets available to the organization.

Some features of reflecting information in line 1190 of the balance sheet

When filling out line 1190 in the organization’s balance sheet, you need to take into account some points.

Not all organizations have other non-current assets at their disposal, therefore, in the absence of indicators, the line may remain empty.

The line is filled with amounts that are not included in other similar lines. Typically, insignificant values are shown here that should be reflected in accounting, but do not have much meaning. .

Indicators that are significant are reflected separately and are not included in the calculation of the amount on line 1190. The financial statements have a fairly large number of users, the most important of which are the owners of the organization. Often they understand little about accounting, but must have complete and detailed information about the availability of property, cash and other assets of the company. The same applies to liabilities. In light of this, the concept of materiality is applied when certain report indicators may influence decision-making regarding the company’s future activities. In this regard, all important (material) indicators should be reflected on separate lines .

What is included in non-current assets on the balance sheet

Answering the question of what refers to non-current assets on the balance sheet, let us turn to Order No. 94n of the Ministry of Finance dated October 31, 2000. This document introduced the currently valid chart of accounts, which structured non-current assets and divided them into groups depending on from properties and other inherent characteristics.

In accordance with this document, non-current assets include:

- fixed assets, which include labor tools that the organization uses for a significant period of time (for more than one year), capable of generating income. An important characteristic is the ability to transfer its cost to products in parts when calculating depreciation. Fixed assets include such valuable assets as buildings, structures, as well as machines, installations and other expensive equipment;

- intangible assets, that is, valuable property with a useful life of more than one year, but not having a tangible form. These include various innovations, developed software, the company’s business reputation;

- investments in material assets;

- financial investments;

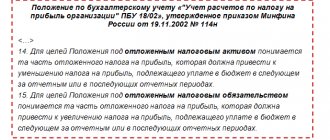

- Deferred tax assets.

An example of calculating the amount of line 1190 of a balance sheet asset

Let's give a simple practical example of calculating the amount on line 1190.

Vasilek LLC bought the trademark for 400,000 rubles. VAT is 66,666.67 rubles and is included in the total amount. To formalize the transaction, documents were collected and submitted to the appropriate authority. In this case, costs were incurred in the amount of 5,000 rubles. Registration did not finish until the end of the year.

We present the calculation in the table:

| Wiring | Explanation | Sum |

| D 08 K60 | Expenses that the company incurred during the purchase | 333333,33 |

| D19 K60 | VAT accounting | 66666,67 |

| D68 K19 | VAT to be reduced | 66666,67 |

| D08 K76 | Accounting for registration costs | 5000,00 |

Thus, the amount of other non-current assets is:

333333.33 + 5000.00 = 338333.33 rubles. This amount must be entered in line 1190.

How non-current assets are reflected in the balance sheet (line)

The balance sheet reflects the assets owned by the company. All company assets on the balance sheet are arranged in descending order of liquidity. Accordingly, first of all, the accounting report presents the values that are most difficult to exchange for money, that is, non-current assets.

The first section of the balance sheet is devoted to non-current assets. A separate line is provided for each group of non-current assets. Non-current assets in the balance sheet are lines 1100 - 1190.

Thus, line 1100 is used to reflect intangible assets. Accordingly, intangible assets must be reflected at value as of the reporting date.

Line 1120 is used to reflect R&D expenses.

If the company uses intangible assets or fixed assets for the purpose of searching for mineral deposits, lines 1130 and 1140 must be completed, respectively.

To reflect information about owned fixed assets, the accountant must use line 1150 of the balance sheet.

Line 1160 of the report is used only if the company has leased assets;

Line 1170 is used if the organization has securities, bonds, shares and other financial assets;

Deferred tax assets, which represent temporary differences arising when calculating income taxes, are also classified as non-current assets, despite the fact that their occurrence is not associated with periodicity and, in principle, is a random phenomenon. If SHE is available, their value must be reflected in line 1180.

If the company has assets that are not included in the groups presented above, it is necessary to indicate their value in line 1190.

Non-current assets are reflected in the balance sheet at their value, both residual and initial, depending on the type of asset.

It is customary to reflect ONA, financial investments, and R&D results at the initial cost. All other non-current assets must be accounted for on the balance sheet at their residual value, that is, minus accumulated depreciation.

Thus, non-current assets in the balance sheet are an entire section, namely lines 1100 to 1190 of the accounting document, dedicated to particularly valuable property owned by the company.