Account 16 in accounting

When acquiring inventory items as part of business activities by companies and organizations, it may happen that the actual value differs from the accounting value.

Companies use the so-called standard cost of material assets in the process of moving them, since at that time their actual cost has not been fully formed. In a situation where the valuation does not coincide with the market value, the deviations that occur are accumulated at the specified position. The indicated amounts are part of the enterprises' expenses.

The sixteenth position of the Chart of Accounts is active-passive. Its debit part takes into account the amount representing the positive difference between the market and actual cost of a given category of goods. If it so happens that the company saved money by purchasing inventory and materials at prices lower than their cost estimate, then the savings are taken into account in the credit part.

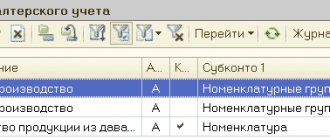

The designated account is designed to reflect both single deviations and accumulate the cost difference in inventory. This position does not provide for the creation of subaccounts.

Regulatory framework

Accounting for material and production values is carried out on the basis of various documents. For ease of understanding, they are divided into several levels.

- First level. Legislative acts, administrative documents and decrees adopted by the President.

- Second level. Generally accepted accounting standards for record keeping.

- Third level. Various methodological recommendations.

- Fourth level. Documents adopted within the enterprise itself.

Thus, account 16 plays an important role in accounting and is used in reflecting a large number of transactions.

Reflection of cost differences in transactions

If the organization adheres to accounting prices, then in the case of purchasing inventory items, all costs for this purchase are reflected in the following entries:

Dt 15

Kt 60, 76, 71, 20, 23, etc.

After this, the purchased materials are received, which is recorded in the following accounting entry:

Dt 10.41

Kt 15.

In a situation where a difference is formed between the calculated and actual cost of purchased inventory, it is necessary to make the following accounting entries:

Dt 16

Kt 15.

The amount that was taken into account in the debit part of account 16 should subsequently be written off to the debit of those accounts where the inventory items themselves are accounted for. Let's assume that the materials were released into main production, which is reflected as:

Dt 20

Kt 10.

In this case, the resulting difference should be written off to account 20, i.e.:

Dt 20

Kt 16.

Thus, in the debit part of the transaction, accounts such as 25,26, 44, 91, etc. can be used.

It is quite natural that the resulting deviation can be both positive and negative. In the second scenario, the amount indicated in the 16th position should be indicated with a minus, i.e. reverse.

Accountant's Directory

It is allowed to use discount prices upon receipt of goods and materials. But under such conditions, it is necessary to apply account 16 “Deviation in the cost of material assets.” It records the resulting difference in cost.

Often, organizations whose activities require a large amount of materials of various kinds use the services of different suppliers. Depending on the terms of purchase, transportation costs and other factors, prices for the same homogeneous product may vary. Sometimes inventories (goods) need to arrive before documents containing information about the actual cost arrive.

In such cases, organizations may resort to discount prices. Their size is approved periodically and remains unchanged for a certain time (for example, during the year). For these purposes, account 16 is used in accounting.

The economic department, if necessary, revises the value of accounting prices, based on one or more conditions:

- Established negotiated prices.

- Actual cost of materials.

- The amount of the planned price approved by the organization. Used for internal movement of materials.

- Average prices are set when there are many goods of the same group.

The actually formed cost of goods cannot be changed, with rare exceptions. The actual cost includes the following costs:

- amounts paid directly to the supplier;

- customs duties and related non-refundable taxes;

- accrued remuneration to intermediary organizations;

- costs for delivery of goods, procurement, storage;

- other expenses.

If it is impossible to immediately determine the correct price, organizations use accounting ones. This provision should be stated in the accounting policy.

The capitalization of materials occurs on account 15 “Procurement and acquisition of material assets” by analogy with the usual receipt of goods and materials. Next, the resulting difference between the real and accounting prices is formed using account 16. The capitalization itself is reflected in 41 or 10.

The resulting difference in cost is then written off to production costs, selling costs, and other expenses.

The resulting deviations are taken into account monthly in the appropriate accounts. The write-off is carried out in proportion to the accepted accounting value. For this purpose, the total value of deviations obtained at the beginning of the month and those formed during the month is divided by the sum of received inventory items and the balance at the end of the month.

When is count 16 effective?

The identified percentage (after multiplying the resulting result by 100) is subject to write-off.

Simplified options for writing off deviations directly to cost accounts are also allowed if their value does not exceed 10%. Deviations can be fully taken into account in the cost of materials if the specific weight of their value is up to 5%.

Postings

- Receipt of materials or goods using accounting prices:

Dt 15 - Kt 60 - materials received from the supplier;Dt 19 - Kt 60 - VAT identified on accepted materials;

Dt 15 - Kt 60 - other associated expenses upon admission (transport, etc.);

Dt 10 - Kt 15 - acceptance of materials at discount prices;

Dt 15 - Kt 16 - posting if the accounting price is higher than the actual one;

Dt 16 - Kt 15 - if the discount price is less than the acquisition costs;

- Writing off deviations as costs:

Dt 44 (20, 25, 26) - Kt 16 - the resulting difference in the cost of materials (goods) is written off. Provided that the accounting price is less than the actual cost, then the positive difference is attributed to costs. In the event that accounting prices are higher, costs are reversed by the resulting difference. As a result, purchased materials (goods) are written off as expenses at actual cost.

Victor Stepanov, 2021-12-06

Questions and answers on the topic

No questions have been asked about the material yet, you have the opportunity to be the first to do so

Save the article to social networks:

Account 10. Materials

Account 10 “Materials” is intended to summarize information about the availability and movement of materials.

On a separate subaccount to account 10 “Materials,” postage stamps, paid air tickets and other similar documents can be taken into account in the amount of the actual costs of their acquisition.

Acceptance for accounting of materials actually received by the organization is reflected in the debit of account 10 “Materials” and the credit of accounts 15 “Procurement and acquisition of materials”, 20 “Main production”, 23 “Auxiliary production”, 60 “Settlements with suppliers and contractors”, 71 “Settlements with accountable persons”, 75 “Settlements with founders”, 91 “Other income and expenses”, 98 “Deferred income” and other accounts.

The cost of materials used in production or for other purposes is reflected in the debit of accounts 20 “Main production”, 23 “Auxiliary production”, 25 “General production costs”, 26 “General business expenses”, 29 “Service production and facilities”, 44 “Sales expenses ” and other accounts and credit account 10 “Materials”.

When materials are disposed of, their cost is reflected in the debit of accounts 90 “Income and expenses from current activities”, 91 “Other income and expenses” and other accounts and the credit of account 10 “Materials”.

Analytical accounting for account 10 “Materials” is carried out by places of storage of materials, their individual names and financially responsible persons.

(part twenty p.

Account 16 in accounting: definition and postings

16 in ed. Resolution of the Ministry of Finance dated December 20, 2012 N 77)

Account 10 “Materials” has the following subaccounts:

Account 10 “Materials” corresponds with the accounts:

Other Section 2 Accounts

Account 10. MaterialsAccount 11. Animals for growing and fatteningAccount 14. Reserves for reducing the cost of inventoriesAccount 15. Procurement and purchase of materialsAccount 16. Variance in the cost of materialsAccount 18. Value added tax on purchased goods, works, services

Source: //1atc.ru/schet-10-subscheta/

Methods for writing off deviations

Each company has the right to independently choose its preferred method of writing off the cost difference. In this regard, I would like to draw attention to the following existing ways to solve this situation:

- writing off the resulting difference to accounts where production costs or costs in the circulation process are taken into account. A similar method is applicable if the share of such costs does not exceed 10% of the valuation of inventories;

- write-off based on the share determined from the cost of inventories at accounting prices at the beginning of each month. In the event that this method significantly reduces the accuracy of the data, these data are subject to adjustment by the resulting amount in the next month. In this situation, you should be aware that the maximum value of materiality in a deviation is set at no more than 5%;

- The indicated problem can be solved using the specific standard for such deviations from the accounting cost estimate of the inventory. If the actual price differs greatly from the standard price, then appropriate adjustments should be made to the indicators of identified deviations;

- You can also write off the resulting deviation in full on a monthly basis to the value of the inventory used. Such an approach is possible only when the share of such deviations in the accounting price of materials does not exceed 5%.

Reversal of balances at the end of the reporting period

As noted above, the actual cost of PMZ may exceed its accounting value. In this situation, a negative difference accumulates on the 16th count, i.e. a credit balance is formed.

At the end of the reporting period, these amounts must be reversed, for which the following entry is made:

Dt 20, 23, 25

Kt 16 REVERSE.

As a result of such entries, materials and raw materials are written off at actual cost.

Posting examples

Let's consider a practical example that clearly shows the reflection of cost deviations of inventory items.

Let’s imagine a situation in which a certain trading enterprise purchased auto parts in the amount of 250 units at a price of 970 rubles. for each. The total cost of the batch ultimately amounted to 242,500 rubles, the amount of VAT was 43,650 rubles. At the same time, the accounting cost of these parts is 1,015 rubles.

In this case, the accounting entries should be as follows:

Dt 10

Kt 15 – 253,750 rubles, cost of auto parts at discount prices;

Dt 15

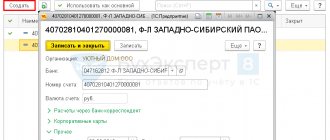

Kt 60 – 198,850 rubles, actual cost of goods;

Dt 19

Kt 60 – RUB 43,650, tax reflected;

Dt 15

Kt 16 – 11,250 rubles, write-off of the difference between the accounting and actual cost.

Innovation 2021: TKR with simplified methods of accounting

Clause 4 art. 6 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ lists organizations that can use simplified accounting methods:

- organizations related to small businesses;

- non-profit structures;

- participants of the Skolkovo project.

Read more about the nuances of simplified accounting in the article “Features of accounting in small enterprises.”

For such organizations, by order of the Ministry of Finance of the Russian Federation dated May 16, 2016 No. 64n, new clauses 13.1–13.3 were introduced in PBU 5/01. Let's look at their contents in order:

- All simplifications are given the opportunity to include TZR immediately in expenses for ordinary activities.

- A micro-enterprise can immediately write off purchased supplies as expenses. The rest have the right to this only if there are insignificant balances of inventories at the end of the month.

- If the purchased inventories and associated equipment will be used for administrative purposes, then they can also be written off directly as expenses for ordinary activities.

Example 5

If Ursa Minor LLC from example 3 used simplified accounting methods, then the transactions would be reflected as follows:

| Description | Dt | CT | Amount, rub. |

| The purchase of honey from beekeepers is reflected | 875 000 | ||

| Transport costs reflected | 75 000 | ||

| The salary of the forwarder is reflected | 67 000 | ||

| Social contributions accrued on the forwarder's salary | 20 234 |

Example 6

If Ursa Minor LLC from example 3 was a micro-enterprise and used simplified accounting methods, then the transactions would be reflected as follows:

| Description | Dt | CT | Amount, rub. |

| The purchase of honey from beekeepers is reflected | 875 000 | ||

| Transport costs reflected | 75 000 | ||

| The salary of the forwarder is reflected | 67 000 | ||

| Social contributions accrued on the forwarder's salary | 20 234 |