When and what kind of zero reports must a non-profit organization (NPO) submit?

The specifics of NPO activities can be very diverse. The status of NPOs is determined by Federal Law No. 7-FZ of January 12, 1996 “On Non-Profit Organizations” (hereinafter referred to as Law No. 7-FZ). The main difference between an NPO and other legal entities is that making a profit is not its main goal of activity, and the profit received is not distributed among the participants, but is directed towards the implementation of the main goals (Clause 1, Article 2 of Law No. 7-FZ).

Thus, the activities of NPOs (regardless of the form created) do not involve making a profit as their main goal.

Tax legislation provides significant benefits for NPOs, exempting a number of transactions from taxation. In this case, even if there are transactions, the amount of taxes payable by the NPO will be zero.

NPOs can apply a general taxation system and a simplified taxation system.

When applying the general taxation system, NPOs must take into account a number of features determined by the nature of their activities.

An NPO that has temporarily suspended its activities is required to submit: accounting, tax reporting, reporting to Rosstat, special reporting to the Ministry of Justice, as well as reporting to the Pension Fund and social security. In addition, the NPO must once a year submit information to the tax office about the average number of employees.

As we can see, despite the fact that the NPO does not make a profit, it is obliged to keep accounts and report to the tax authorities, the Pension Fund of the Russian Federation, the Social Insurance Fund, Rosstat, and the Ministry of Justice.

And in this situation, even an experienced accountant can face serious difficulties. To avoid such a situation, you should trust the professionals and entrust the accounting services of non-profit organizations to specialists.

Accounting services for non-profit organizations include:

- full accounting support;

- preparation and submission of the necessary reports;

- consultations on all accounting issues.

Zero reporting year

If an NPO applies OSNO, then by virtue of clause 1 of Article 289 of the Tax Code of the Russian Federation it is obliged to submit tax returns.

But unlike other taxpayers who submit “zeros” for income tax monthly or quarterly (depending on the chosen method of paying advance payments), non-profit organizations that do not have obligations to pay income tax submit a declaration after the end of the calendar year ( Clause 2 of Article 289 of the Tax Code of the Russian Federation).

This rule applies not only to zero declarations, but also in the case when the NPO during the tax period did not have income (expenses) taken into account when determining the income tax base (i.e. the NPO was not engaged in commercial activities).

What sheets need to be filled out for zero income tax reporting?

1. Title page.

It contains general information about the non-profit taxpayer.

The Title Page indicates the tax period for which the declaration is submitted.

The codes that determine the tax period are given in Appendix No. 1 to the Procedure for filling out the declaration. Since the NPO submits a declaration for the year, code 34 is indicated on the title page.

2. Subsection 1.1 of section 1.

Since a zero declaration is being submitted, dashes are placed in the lines where the total values are given.

3.Sheet 02.

If there are targeted revenues (which do not affect the amount of tax), NPOs additionally fill out Sheet 07 of the declaration.

A zero income tax return for non-profit organizations can be submitted on paper. If the average number of NPOs does not exceed 100 people, then the income tax return can be submitted on paper (clause 3 of Article 80 of the Tax Code of the Russian Federation).

The deadline for submitting the income tax return for NPOs at the end of the year is no later than March 28 of the year following the reporting year (clause 4 of Article 289 of the Tax Code of the Russian Federation).

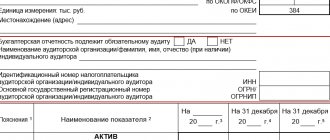

Accounting statements of a non-profit organization

NPOs submit accounting reports according to the general rules once a year, within the standard time frame - within 90 calendar days after the end of the reporting year. There are exceptions for non-profit organizations - consumer cooperatives. They can use simplified accounting forms from Appendix 5 to Order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n.

You can quickly determine the composition of financial statements for a non-profit organization using the table. For information on how to fill out accounting forms, see What documents to submit as part of financial statements.

The general rules are as follows. All NPOs hand over:

- Balance sheet;

- Report on the intended use of funds.

This is stated in paragraph 2 of Article 14 of the Law of December 6, 2011 No. 402-FZ.

Plus, some non-profits submit a financial performance report. This should be done when:

- The NGO received significant income from business activities;

- It is impossible to assess the financial position of an NPO without an indicator of the income received.

In all other cases, the NPO reflects data from business activities in the report on intended use in the line “Profit from income-generating activities.” But if this is not enough to reflect the financial position of the nonprofit, submit an income statement. This is stated in the information of the Ministry of Finance of Russia No. PZ-10/2012.

Balance sheet

Non-profit organizations fill out the balance sheet in a special way (see general instructions for filling out the Balance Sheet). Some sections need to be renamed. For example, Section III should be called not “Capital and Reserves”, but “Targeted Financing”. After all, a non-profit organization does not have the goal of making a profit. Instead of capital and reserves, NGOs reflect the balance of earmarked revenues. The balance sheet lines that NPOs must replace in Section III are named in the table below.

| Code of the balance line whose name of the non-profit organization needs to be replaced | Line names for commercial organizations | NPO line names |

| Section III of the Balance Sheet “Capital and Reserves” | Section III of the Balance Sheet “Targeted Financing” | |

| 1310 | Authorized capital | Unit trust |

| 1320 | Own shares purchased from shareholders | Target capital |

| 1350 | Additional capital (without revaluation) | Targeted funds |

| 1360 | Reserve capital | Fund of real estate and especially valuable movable property |

| 1370 | Retained earnings (uncovered loss) | Reserve and other target funds |

This procedure is prescribed in Note 6 to the Balance Sheet and in Note to Appendix 4 of Order No. 66n of the Ministry of Finance of Russia dated July 2, 2010.

Cash flow statement

The cash flow statement of NPOs is not included in the financial statements. This is directly stated in paragraph 85 of the regulation, approved by order of the Ministry of Finance of Russia dated July 29, 1998 No. 34n.

Other reports

There are special features for funds. They are required to annually publish reports on the use of their property (clause 2 of article 7 of the Law of January 12, 1996 No. 7-FZ).

Zero VAT declarations of NPOs

NPOs are VAT payers (with the exception of NPOs that use special regimes). The objects of taxation are transactions involving the sale of goods, products, works and services (Article 146 of the Tax Code of the Russian Federation). At the same time, targeted funds received by NPOs (entrance and membership fees, donations and other funds) are not subject to VAT if their receipt is not related to the sale of goods, works, services (clause 1, clause 1, article 146 of the Tax Code of the Russian Federation).

Zero VAT reporting involves submitting a declaration electronically (through an electronic reporting operator).

The following sheets are included in the zero VAT return (paragraph 2, clause 3 of the Procedure, approved by order of the Federal Tax Service of the Russian Federation dated October 29, 2014 No. ММВ-7-3/558):

- title page;

- Section 1 “The amount of tax subject to payment to the budget (reimbursement from the budget), according to the taxpayer.”

In the lines that require filling in the digital indicators of the NPO's zero declaration, dashes are inserted.

The deadline for submitting zero VAT reporting is no later than the 25th day of the month following the expired quarter (clause 5 of Article 174 of the Tax Code of the Russian Federation).

Section 3 of the Declaration of the simplified tax system: targeted financing. Filling, example

In this article we will deal with the questions that are most often raised by the Instructions for filling out Section 3 of the Declaration of the simplified tax system. Let us recall that it indicates operations for receiving and spending funds from targeted financing.

Section 3 of the Declaration of the simplified tax system is filled out by non-profit organizations. Commercial organizations fill out this section only if they receive targeted funds. If the NPO carried out commercial activities, then in addition to Section 3, you need to fill out the remaining sections of the declaration (depending on the chosen tax system “income” or “income minus expenses”).

Fill out a declaration according to the simplified tax system in the BukhSoft program. She will prepare a report on an up-to-date form, taking into account all the latest changes in the law. Before sending to the tax office, the declaration is tested by all verification programs of the Federal Tax Service

Declaration under simplified tax system online

Also use examples of filling out a simplified declaration with the objects “income” and “income minus expenses”:

For maximum income under the simplified tax system in 2021, see the link

The instructions for filling out Section 3 of the Declaration of the simplified tax system, prescribed in the Procedure for filling out the Declaration, are very concise, and often raise more questions from accountants than answers.

Let's try to deal with some of them. We will pay special attention to questions received from homeowners' associations, housing and communal services, SNT and other organizations working with the population, because

It is from this part of our users that we receive the most questions.

Do I need to fill out the “Date of receipt” and “Use period” columns for target funds?

The columns “Date of receipt” and “Term of use” are optional. In accordance with the Procedure for filling out the declaration, they are filled out only by:

- charitable organizations formed in accordance with Federal Law of August 11, 1995 N 135-FZ “On Charitable Activities and Charitable Organizations”;

- non-profit organizations upon receipt of targeted funds provided by the transferring party indicating the period of use;

- commercial organizations that have received targeted financing in accordance with paragraph 1 of Article 251 of the Code, for which a period of use has been established.

Homeowners' associations, housing and communal services, SNT and other organizations that constantly receive funds from the population do not need to add a separate line for each receipt! Receipts of the current year are grouped by receipt code and added in one line. A separate line is added for the remaining amounts of targeted contributions unspent from last year.

Section 3 of the Declaration of the simplified tax system should be filled out using the cash method or the accrual method?

The issue is controversial among accountants. Indeed, it is most convenient to fill out Section 3 according to the data in account 86 “Targeted financing”. Moreover, this is the only option in which the Declaration and Form-6 of the Balance Sheet will converge.

In account 86, accountants of most non-profit organizations reflect not only received contributions, but also accrued ones, which means that filling out the Declaration on a cash basis will lead to inevitable discrepancies with the balance sheet data, which may lead to questions from the Federal Tax Service.

For tax inspectors, to whom we and some of our users turned for clarification, the issue was not debatable. According to Federal Tax Service employees, Section 3 should be filled out using the cash method based on the amount of contributions actually received. The information section is filled out in the same way as the entire Declaration of the simplified tax system using the cash method; it reflects amounts that are not subject to single tax.

The Procedure for filling out Section 3 also states: “9.1. Section 3 is filled out by taxpayers who received targeted financing, targeted revenues and other funds specified in paragraphs 1 and 2 of Article 251 of the Code (hereinafter referred to as targeted funds).

Based on the types of targeted funds received by the taxpayer, the taxpayer selects the corresponding names and codes given in Appendix No. 5 to this Procedure and transfers them to Column 1 of Section 3.

“If the tax office has questions about the reasons for the discrepancy between Section 3 of the Declaration of the simplified tax system and Form 6 of the balance sheet, you must provide an explanation that the discrepancies are equal to the amount of target contributions accrued but not received by the organization. As a rule, such an amount is recorded in the debit of account 76 “Settlements with participants of non-commercial organizations”.

At the request of users, the Bukhsoft Simplified System program automates both methods of filling out the declaration. The default option is cash basis.

Do HOAs, housing and communal services, and SNT need to include in Section 3 funds collected from the population to pay for utilities?

Section 3 of the Declaration of the simplified tax system should include only those funds of targeted financing that are named in paragraphs 1 and 2 of Art. 251 Tax Code of the Russian Federation. Funds collected from the population for utility bills and transferred to resource supply organizations are not indicated in Article 251 of the Tax Code of the Russian Federation; there is no corresponding accounting code for these funds in Section 3.

They do not relate to targeted financing and are accounted for separately on separate accounting accounts. In relation to the calculation and transfer of utility bills, HOAs, housing and communal services and similar organizations, as a rule, act as intermediaries.

Accounting and reporting of these amounts depends on the Charter of the NPO and agreements with the owners of premises and resource organizations.

What types of income from targeted financing must be shown in Section 3 of the Declaration of the simplified tax system for homeowners' associations, housing and communal services?

In Art. 251 of the Tax Code of the Russian Federation for HOAs, housing and communal services, SNT, the following directions for obtaining targeted financing are provided:

| Type of receipt | Code for the Declaration of the simplified tax system |

| Contributions of members of the HOA, housing and communal services, SNT for the maintenance of the organization and other targeted needs provided for by the Charter of the organization and approved by the owners’ estimate | 120 |

| Contributions for major repairs | 112 |

| Contributions for current repairs | 112 |

| Funds provided for the implementation of statutory activities from budgets of all levels | 170, 171, 172 |

Source: https://www.BuhSoft.ru/article/1718-zapolnyaem-razdel-3-deklaratsii-usn

Special reporting of NPOs to the Ministry of Justice of the Russian Federation

There are special reports for NPOs that must be submitted to the Ministry of Justice of the Russian Federation. The composition of the reporting depends on the type of NPO and is posted on the website of the Ministry of Justice of the Russian Federation.

For example, for public associations, form OH0003, notification of continuation of activities, is filled out.

Information about NPOs that are foreign agents is submitted more frequently. For example, zero reporting includes a report on the activities of an NPO and information about its personnel. Such NPOs must submit an audit report, even if there was no activity.

NPOs that are foreign agents, as well as structural divisions of a foreign non-profit non-governmental organization are required to conduct an audit (Clause 1, Article 32 of Law No. 7-FZ).

Tax reporting

All non-profit organizations are required to submit information about the average number of employees to the tax office. This needs to be done even if there are no employees. In addition, all non-profit organizations are required to submit certificates in form 2-NDFL for each employee and calculations in form 6-NDFL.

For more information on this topic, see:

- What rights and responsibilities do taxpayers have;

- How to correctly fill out the certificate form 2-NDFL;

- How to draw up and submit a calculation using Form 6-NDFL.

As for the rest, the composition of tax reporting in NPOs depends on the tax regime.

Zero reporting of NPOs to the Pension Fund and social security

Please note that there is no zero reporting to the Pension Fund. “Pension” reports in the SZV-M and SZV-experience forms are submitted if the organization has employees, even if the activities of the NPO are temporarily paused.

Form SZV-M is submitted to the Pension Fund every month no later than the 15th day of the month following the reporting month.

As a general rule, the SZV-STAZH form is submitted annually before March 1 of the year following the reporting year. But there are situations when you need to submit the form early. For example, if an employee applies for a pension. Then the SZV-STAGE is submitted within 3 calendar days.

Reports in the SZV-TD form are submitted to the Pension Fund of the Russian Federation for certain personnel movements of employees (for example, hiring, dismissal, transfer to another job).

It is also necessary to submit a report if the employee has submitted an application to switch to an electronic work book or to retain a paper book. If there are no such events, then the employer does not have to submit a zero SZV-TD report.

NPOs also need to submit a zero report to the Federal Social Insurance Fund of the Russian Federation (in Form 4-FSS), even if there were no accruals in the reporting period to employees and other persons subject to compulsory insurance against industrial accidents and occupational diseases (for which a report is provided).

Reporting to the Pension Fund

Form RSV-1

All organizations that have employees must report to the Pension Fund on the results of the first quarter, half a year, nine months and calendar year in the RSV-1 form. If the average number of employees exceeds 25 people, you must report electronically. The same rule applies to newly created or reorganized companies (clause 10, article 15 of the Federal Law of July 24, 2009 No. 212-FZ).

For NPOs, reports must be submitted to OSNO within the following deadlines:

- for a year - until February 15 (on paper), February 20 (electronically) of the next year;

- for the first quarter - until May 15 (on paper), May 20 (electronically) of the current year;

- for the six months - until August 15 (on paper), August 20 (electronically) of the current year;

- 9 months before November 15 (on paper), November 20 (electronically) of the current year.

Form SZV-M

From 2021, in addition to RSV-1, employers must also submit monthly reports (no later than the 10th of the next month) to the Pension Fund for employees using the new form SZV-M (Federal Law No. 385-FZ of December 29, 2015).

NPO reporting to Rosstat

The list of reports and deadlines for each non-profit organization can be found on the website of the Federal State Statistics Service by filling out the appropriate fields: TIN, OGRN or OKPO. A number of federal statistical surveillance forms are submitted only when an observable event occurs.

If the statistical form itself indicates that it is submitted only upon the occurrence of a certain event, then zero statistical reporting is not submitted to Rosstat (Letters dated 04/08/2019 No. SE-04-4/49-SMI, dated 05/17/2018 No. 04-04-4/48-SMI, dated 01/22/2018 No. 04-4-04-4/6-SMI).

Reporting to the Social Insurance Fund

Form 4-FSS

All organizations that have employees must report to the Social Insurance Fund based on the results of the first quarter, six months, nine months and calendar year. If the average number of employees exceeds 25 people, then the report on Form 4-FSS must be submitted electronically. The same rule applies to newly created or reorganized companies (clause 10, article 15 of the Federal Law of July 24, 2009 No. 212-FZ).

The reporting deadlines are as follows:

- for the previous year - until January 20 (on paper), January 25 (electronically) of the next year;

- for the first quarter - until April 20 (on paper), April 25 (electronically) of the current year;

- for the six months - until July 20 (on paper), July 25 (electronically) of the current year;

- 9 months before October 20 (on paper), October 25 (electronically) of the current year.

Confirmation of main activity

The policyholder must annually confirm his type of activity (Order of the Ministry of Health and Social Development of the Russian Federation dated January 31, 2006 No. 55).

To do this, before April 15, you must submit to the FSS:

- application for confirmation of the main type of economic activity;

- certificate confirming the main type of economic activity;

- a copy of the explanatory note to the balance sheet for the previous year (except for insurers - small businesses).

Reporting to the Ministry of Justice of the Russian Federation

The legislation defines different reporting compositions for:

- public associations

- all other NPOs

- NPOs included in the register of non-profit organizations performing the functions of a “foreign agent”.

Public associations (public organization, social movement).

Report on form ОН0003

A report on the volume of funds and other property received by a public association from international and foreign organizations, foreign citizens and stateless persons, on the purposes of their expenditure or use and on their actual expenditure or use is posted on the portal of the Ministry of Justice of Russia.

In addition, the report can be submitted in person (by proxy) or sent by mail to the territorial body of the Ministry of Justice of Russia at the place of registration of the organization in the form of a postal item with a list of attachments. Deadline: April 15 (following the reporting year).