The audit report on the accounting (financial) statements is an important element of information for users of the statements of any economic entity, since it increases the confidence of owners, counterparties, banks considering loan applications, and other entities that the statements are truthful and prepared in accordance with the rules accounting, there are no significant distortions associated with errors or dishonesty, or concealment of financial or non-financial information important to users.

Who is subject to mandatory audit?

Currently, organizations are legally defined whose annual financial statements are subject to mandatory audit (Table 1).

Table 1 — Subjects of mandatory audit

| Regulatory framework | Organizations whose accounting (financial) statements are subject to mandatory audit |

| Federal Law “On Auditing Activities”, Art. 5 (as amended on December 29, 2020 No. 476-FZ) | Organizations whose securities are admitted to organized trading |

| Organizations that are professional participants in the securities market, credit history bureaus | |

| Funds (except for state extra-budgetary, international), if the receipt of property, including cash, in the year preceding the reporting year exceeded 3 million rubles. | |

| Other organizations, except for state unitary enterprises, municipal unitary enterprises, agricultural cooperatives, their unions, consumer cooperatives, if income determined according to tax accounting rules in the year preceding the reporting year exceeded 800 million rubles. or the amount of balance sheet assets at the end of the year preceding the reporting year exceeded 400 million rubles. | |

| Federal Law “On Joint Stock Companies”, Art. 88 | Joint stock companies |

| Federal Law “On Banks and Banking Activities”, Art. 42 | Credit organizations |

| Federal Law “On the organization of insurance business in the Russian Federation”, Art. 29 | Insurance organizations |

| Federal Law “On Mutual Insurance”, art. 22 | Mutual insurance societies |

| Federal Law “On Organized Auctions”, Art. 5 | Trade organizing organizations |

| Federal Law “On Clearing, Clearing Activities and Central Counterparty”, Art. 5 | Clearing organizations |

| Federal Law “On Investment Funds”, Art. 50 | Joint-stock investment funds, mutual fund management companies |

| Federal Law “On Housing Savings Cooperatives”, Art. 54 | Housing savings cooperatives |

| Federal Law “On participation in shared construction of apartment buildings and other real estate and on amendments to certain legislative acts of the Russian Federation”, Art. 3 | Developers |

| Federal Law “On Credit Cooperation”, Art. 28, and | Credit consumer cooperatives |

| Federal Law “On Microfinance Activities and Microfinance Organizations”, Art. 15 | Microfinance companies |

| Federal Law “On Non-State Pension Funds”, Art. 22 | Non-state pension funds |

| Federal Law “On Political Parties”, Art. 35 | Political parties |

| Federal Law “On Consolidated Financial Statements”, Art. 5 | Organizations preparing and publishing consolidated financial statements |

The annual reporting of the Bank of Russia, state companies and state corporations, state and municipal unitary enterprises (in cases where the need for an audit is determined by the owner of a state unitary enterprise or municipal unitary enterprise), the Deposit Insurance Agency, the United Institute for Development in the Housing Sphere, the United All-Russian Association is also subject to mandatory independent audit. insurers, Professional associations of insurers, associations of insurance entities, the National Association of Self-Regulatory Organizations of Appraisers, the Association of Tour Operators in the Field of Outbound Tourism, non-profit organizations - foreign agents, organizers of gambling and lotteries, as well as some other socially significant organizations, a list of which can be found at website of the Ministry of Finance of the Russian Federation. For example, a list of cases of mandatory audit of organizations’ financial statements for 2021 is published here.

IMPORTANT! The number of mandatory audit subjects has decreased significantly since January 1, 2021, due to amendments to the Federal Law “On Auditing Activities”. In particular, small businesses with revenue from 400 to 800 million rubles were “excluded” from mandatory audit. and the amount of balance sheet assets from 60 to 400 million rubles, as well as funds whose annual receipts do not exceed 3 million rubles. However, if a contract for a mandatory audit of financial statements by such an organization was concluded and began to be carried out by auditors before these changes entered into force (i.e., until December 31, 2020 inclusive), the financial statements of the economic entity are subject to release (publication) along with the auditor’s report.

It should also be noted that, despite the fact that joint-stock companies as subjects of mandatory audit are not named in the new edition of Art. 5 of the Law on Auditing, the requirement to attract auditors to audit their annual accounting (financial) statements remains unchanged, since it is provided for in Art. 88 of the Law on Joint Stock Companies. Moreover, this rule applies to both public and non-public joint stock companies.

In recent years, when reviewing the materials of audit assignments by external auditors of audit quality, an amazing situation was observed: the shareholders (founders) approved one auditor in the prescribed manner, and the audit report issued by another auditor was posted on Fedresurs .

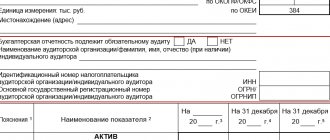

This, of course, suggests that the auditor chosen by the owners turned out to be “uncomfortable” and the manager had to find a more loyal inspector. Today, the first page of an organization’s balance sheet reflects information about a mandatory audit (whether the organization is subject to it or not) and the auditor with whom the contract is concluded. This is, firstly, a measure to prevent the replacement of the auditor, and secondly, it requires the audited entity to timely enter into an agreement for the provision of statutory audit services.

The procedure for publishing annual financial statements by open joint-stock companies

Approved by order of the Ministry of Finance of the Russian Federation dated November 28, 1996 No. 101.

1. General Provisions

1.1.

In accordance with the Federal Law “On Accounting” dated November 21, 1996 No. 129-FZ, the annual financial statements of open joint-stock companies are subject to mandatory publication no later than June 1 of the following reporting year.

Hereinafter, “annual financial statements” are referred to as “accounting statements”, and “open joint-stock company” is referred to as “company”.

The publicity of financial statements consists of their publication in newspapers and magazines accessible to users of financial statements, or the distribution among them of brochures, booklets and other publications containing financial statements, as well as their transfer to the territorial bodies of state statistics at the place of registration of the organization for presentation to interested users.

1.2.

Publication of financial statements is the announcement by the company of financial statements in the media for public information.

The financial statements of a company are considered published in the media accessible to all shareholders of the company if the publication actually took place in at least one periodical, which may be determined by the charter of the company or by decision of the general meeting of the company.

1.3.

Publication of financial statements is carried out after:

- verification and confirmation by an independent auditor (audit firm);

- its approval by the general meeting of shareholders.

A company may publish its financial statements if both of these procedures have been completed.

2. Contents of publication of financial statements

2.1.

The Balance Sheet and the Statement of Financial Results (Profit and Loss Account) are required to be published.

2.2.

The Balance Sheet may be published in an abbreviated form. The abbreviated form of the Balance Sheet submitted for publication is developed by the company on the basis of the Accounting Regulations “Accounting Statements of an Organization” PBU 4/96.

2.2.1.

The abbreviated form of the Balance Sheet may include only total indicators for the sections provided for in paragraph 4.3 of PBU 4/96, if the following financial indicators of the company’s activities are simultaneously available:

- the currency of the Balance Sheet at the end of the reporting year, not exceeding four hundred thousand times the minimum wage established by the legislation of the Russian Federation;

- revenue (net) from the sale of goods, products, works, services for the reporting year, not exceeding one million times the minimum wage established by the legislation of the Russian Federation.

In the Balance Sheet form, which includes only the totals for sections, lines for which there are no numerical values of assets and liabilities are given but crossed out.

2.2.2.

The abbreviated form of the Balance Sheet must include indicators for the groups of items provided for in paragraph 4.3 of PBU 4/96, if there is at least one of the following financial indicators of the company’s activities:

- the currency of the Balance Sheet at the end of the reporting year, exceeding four hundred thousand times the minimum wage established by the legislation of the Russian Federation;

- revenue (net) from the sale of goods, products, works, services for the reporting year, exceeding one million times the minimum wage established by the legislation of the Russian Federation.

The groups of Balance Sheet items provided for in paragraph 4.3 of PBU 4/96 for which the company does not have indicators may not be presented, except in cases where the corresponding indicators occurred in the year preceding the reporting year.

2.2.3.

To determine the financial indicators specified in paragraphs 2.2.1 and 2.2.2, the minimum wage established by the legislation of the Russian Federation is accepted as of the end of the reporting year.

2.3.

The form of the Financial Results Report submitted for publication must include all the indicators provided for in paragraph 5.2 of PBU 4/96. Allowed:

- do not include in the form of the financial results statement the interim results provided for in paragraph 5.2 of PBU 4/96;

- do not provide articles in the Statement of Financial Results for which the company does not have indicators, except in cases where the corresponding indicators took place in the year preceding the reporting year.

In addition to what is provided for in paragraph 5.2 of PBU 4/96, the financial results report must include information on the decision of the general meeting of shareholders on the distribution of profits or coverage of losses of the company for the reporting year, unless such information is published separately or as part of any other document subject to in accordance with the Federal Law “On Joint Stock Companies” for publication in the media.

2.4.

The company must adhere to the form of financial statements adopted by it for publication from one reporting year to another.

Changes to the forms of the Balance Sheet and the Statement of Financial Results selected for publication are permitted in the event of a change in the conditions provided for in paragraphs 2.2.1 and 2.2.2 of this Procedure, and in other cases, the validity of which is confirmed by an independent auditor (audit firm).

2.5.

Indicators of published forms of financial statements are formed by directly transferring similar indicators and (or) combining relevant indicators from the company’s annual financial statements compiled according to standard forms approved by the Ministry of Finance of the Russian Federation for reporting for the reporting year.

No discrepancies are allowed between the indicators of the published forms of financial statements and the corresponding indicators of the annual financial statements compiled according to standard forms approved by the Ministry of Finance of the Russian Federation for reporting for the reporting year.

2.6.

For each numerical indicator of the financial statements, except for the company's statements published for the initial reporting year, data for the period preceding the reporting year must be provided.

2.7.

Accounting statements are published in millions of rubles. A company that has significant turnover of goods, liabilities, etc. can publish financial statements in billions of rubles with one decimal place.

2.8.

Publication of financial statements must include:

- full name of the company, including an indication of its legal form;

- reporting date and (or) reporting period;

- currency and format for presenting numerical indicators of financial statements;

- full names of positions of persons who signed the financial statements, their surnames and initials;

- the date of approval of the financial statements by the general meeting of shareholders (unless it is indicated in other documents published together with the financial statements);

- location (full postal address, telephone and fax) of the executive body of the company, where an interested user can familiarize himself with the financial statements and receive a copy thereof in the manner prescribed by the legislation of the Russian Federation, as well as information about the state statistics body to which the company submitted a legal copy of the financial statements reporting compiled according to standard forms approved by the Ministry of Finance of the Russian Federation for reporting for the reporting year.

2.9.

Together with the financial statements, information on the results of an audit conducted by an independent auditor (audit firm) and financial statements drawn up according to standard forms approved by the Ministry of Finance of the Russian Federation for reporting for the reporting year must be published.

If the financial statements are published in abbreviated forms, then instead of the full text of the final part of the audit report prepared by an independent auditor (audit firm) in accordance with the Procedure for drawing up an audit report on financial statements, approved by the Commission on Auditing Activities under the President of the Russian Federation on February 9, 1996 ( protocol No. 1), the publication must contain the opinion (assessment) of an independent auditor (audit firm) on the reliability of the financial statements (unconditionally positive, conditionally positive, negative, disclaimer of opinion).

If the company publishes the financial statements in full, then the publication must include the full text of the final part of the audit report prepared by an independent auditor (audit firm) in accordance with the Procedure for drawing up an audit report on financial statements, approved by the Commission on Auditing Activities under the President of the Russian Federation on February 9, 1996. (protocol No. 1).

In any case, information on the results of the audit of financial statements must also include the full name of the auditor (audit firm), the type and number of the license to carry out audit activities, and the date of the audit report.

3. Final provisions

3.1.

Costs associated with the publication of financial statements (including costs for the preparation, publication and mailing of a special brochure (booklet) with the company's financial statements) are included in the cost of products (works, services) as costs associated with production management.

Reimbursement amounts for the costs of copying and forwarding financial statements received from interested users are credited to the company's profit and loss account.

Head of the Department of Methodology and Accounting and Reporting A.S.BAKAEV

Posting information about mandatory audit on Fedresurs

Information on the results of a mandatory audit must be posted on the Federal Resources Agency (in the Unified Federal Register of Information on the Facts of the Activities of Legal Entities).

In contrast to the information in the GIR BO, the audit report on Fedresurs is not published in full, but only in part of the most important information for users (who conducted the audit, in relation to which statements and for what period, what opinion the auditor expressed and what were the grounds for this opinion , as well as other information provided for in paragraph 6 of article 5 of the law on auditing).

To post information, the head of the audited entity must obtain an electronic signature from one of the certification centers from the list on the Fedresurs website. Special software can be used on this site for free. But posting information is paid. If the manager does not have an electronic signature to post information about the audit report or other information, you can contact a notary, who will sign the message with his digital signature and post it on the Federal Resource.

At the time of writing, for posting one message on Fedresurs, a fee of 860.35 rubles is charged, including 20% VAT. Qualified digital signature certificates for the Fedresurs website (as well as other business purposes, for example: submitting accounting and tax reporting, registering online cash registers, receiving financial services, etc.) are issued by authorized certification centers; the cost of issuing an digital signature ranges from 2,800 to 3,000 rubles.

Failure to comply with the requirement to post information is an administrative offense (clause 6-8 of Article 14.25 of the Code of Administrative Offenses of the Russian Federation):

- violation of the established deadlines for posting information on the Federal resource will entail a warning or a fine of 5,000 rubles for the official;

- failure to provide information or posting false information - the fine increases and can range from 5,000 to 10,000 rubles;

- repeated violation may result in a fine for the manager from 10,000 to 50,000 rubles. or even to his disqualification for up to three years.

Thus, the costs of posting mandatory information on the Fedresurs (in this case, about the results of a mandatory audit) cannot be compared with the possible financial consequences of failure to comply with this requirement.

Features of information disclosure by joint stock companies

The annual accounting (financial) statements of a joint stock company, both public and non-public, are disclosed by publishing its text on the Internet page (usually on the company’s official website) no later than three days from the date of drawing up the auditor’s report, but no later than three days from the date of expiration of the deadline established by the legislation of the Russian Federation for submitting a legal copy of the compiled annual accounting (financial) statements.

In 2021, this date falls on April 5: since the deadline for posting reports along with the audit report falls on a weekend (Saturday 04/03/2021), the end date of this period is considered the nearest working day. These requirements are set out in the Regulation of the Bank of Russia dated December 30, 2014 No. 454-P “On the disclosure of information by issuers of equity securities” and are controlled by the Central Bank of the Russian Federation.

IMPORTANT! For joint stock companies whose securities are admitted to organized trading, interim (quarterly) financial statements are also subject to publication on the website. However, it must be published together with the auditor's report, provided that an audit of these statements was carried out.

Very significant sanctions for violating the procedure and deadlines for disclosing information by joint stock companies are established in clause 2 of Art. 15.19 of the Code of Administrative Offenses of the Russian Federation: a fine in the amount of 30,000 to 50,000 rubles may be imposed on officials. or a decision may be made to disqualify the manager for a period of 1 to 2 years. The fine for organizing in this case is from 700,000 to 1,000,000 rubles.

Answer:

Obtaining the status of a public joint stock company is generally associated with the public placement (circulation) of its shares or securities convertible into shares. In turn, public placement (circulation) of PJSC shares and PJSC securities convertible into shares is possible only if there is a prospectus.

Upon admission to organized trading of shares in respect of which a prospectus has been registered, PJSC are obliged to:

- disclose annual and semi-annual consolidated financial statements. The obligation in the general case (with the exception of SMEs) arises regardless of the inclusion of the organization’s shares in the quotation list;

- disclose annual and semi-annual individual financial statements. An obligation arises for organizations outside the group if shares are included in the quotation list.

If shares are not admitted to organized trading, then PJSC are not required to disclose financial statements.

If a PJSC (except for SMEs) has registered a prospectus for the issue of securities convertible into shares, then the PJSC is obliged to publish consolidated statements in accordance with IFRS, regardless of the admission of these securities to organized trading.

If a PJSC (except for SMEs) has registered a prospectus for the issue of securities convertible into shares, then the PJSC is obliged to publish consolidated statements in accordance with IFRS, regardless of the admission of these securities to organized trading.

Below is a detailed explanation.

What is public placement (circulation) of securities

The placement of issue-grade securities is the alienation of issue-grade securities by the issuer to the first owners through the conclusion of civil transactions, and the circulation of securities is the conclusion of subsequent civil transactions with these securities, as a result of which the transfer of ownership of them occurs (clause 14, 16 clause 1 article 1 of the Federal Law of April 22, 1996 N 39-FZ “On the securities market”).

Public placement of securities by open subscription (public circulation of securities) is considered to be the placement (circulation) of securities by offering them to an unlimited number of persons, in particular (clauses 15, 17, paragraph 1, article 1 of the Federal Law of April 22, 1996 N 39- Federal Law “On the Securities Market”):

- at organized auctions;

- and/or using advertising.

The following is not a public placement (appeal):

- at organized auctions:

- securities intended for qualified investors;

- securities that are subject to the requirements and restrictions established for the placement and circulation of securities for qualified investors;

- placement of securities and transactions with them using investment platforms.

How to obtain PJSC status

A PJSC is a joint-stock company whose shares and securities convertible into shares are publicly placed (by open subscription) or publicly traded (Clause 1, Article 66.3 of the Civil Code of the Russian Federation)*.

*If, as of 07/01/2015, the charter and name of a JSC created before 09/01/2014 indicate that it is a PJSC in the absence of signs of publicity, such a JSC must, by 01/01/2021, register a prospectus for the issue of shares and conclude an agreement with the trade organizer on the listing of shares or change the charter, excluding from names public status (clause 7 of article 27 of the Federal Law dated June 29, 2015 N 210-FZ, clause 5 of the Letter of the Bank of Russia dated November 25, 2015 N 06-52/10054).

Clause 1 of Art. 7.1 of the Federal Law of December 26, 1995 N 208-FZ “On Joint-Stock Companies” provides for a special procedure for obtaining PJSC status, which assumes that such status is received by an already existing joint-stock company.

To obtain public status as a joint stock company (Clause 6, Article 19 of the Federal Law of April 22, 1996 N 39-FZ “On the Securities Market”):

- submits documents to the Bank of Russia for registration of a prospectus for the issue of securities ;

- submits documents to change information in the Unified State Register of Legal Entities about the company's corporate name, containing an indication that it is public. These documents should be accompanied by confirmation that the company has already applied to the Bank of Russia with an application to register the issue prospectus;

- receives a decision to register a securities prospectus. This decision comes into force from the date of entry of the indication on the public status of the company in the Unified State Register of Legal Entities.

Public placement (including at organized trading) and circulation of PJSC shares and PJSC securities convertible into shares is possible only after registration of the issue prospectus (Clause 1.1 Article 14, Clause 2, 2.1 Article 27.6 of the Federal Law dated 04/22/1996 N 39-FZ “On the securities market”). A joint stock company acquires the right to publicly place (by open subscription) shares and securities convertible into its shares from the date of entering into the Unified State Register of Legal Entities information about the company's corporate name indicating that such a company is public (Clause 1, Article 97 of the Civil Code of the Russian Federation ).

As a general rule, the issue procedure must be accompanied (and in some cases may be accompanied) by the preparation and registration (in rare cases, by the submission of a notice of preparation) of a prospectus for the issue of securities . If the issue prospectus was not drawn up and registered at the time of the issue, then it can be drawn up and registered subsequently (clause 5 of article 19, clauses 1, 2 of article 22 of the Federal Law of April 22, 1996 N 39-FZ “On the Securities Market papers").

Thus, joint-stock companies acquire public status if at the same time (Decision of the Supreme Court of the Russian Federation dated January 09, 2019 N 309-KG18-10040):

- shares of the company and other securities convertible into them are publicly traded in accordance with securities legislation;

- The charter and company name of the company contain information that this company is public.

In what cases does the obligation to disclose financial statements under IFRS arise?

In the case of registration of a securities prospectus, the issuer, which, together with other organizations, creates a group, is obliged to prepare and disclose consolidated financial statements in accordance with the rules of IFRS (clause 2, clause 4, clause 4.1, 12, article 30, clause 2, clause 2, Article 27.6 of the Federal Law of April 22, 1996 N 39-FZ “On the Securities Market”, Part 2 of Article 2, Part 1 of Article 3 of the Federal Law of July 27, 2010 N 208-FZ “On Consolidated Financial Statements” ):

- after the start of the placement of issue-grade securities (the start date is indicated in the message about the start date of the placement of securities);

- after registration of a securities prospectus, if such a requirement is established in the prospectus itself or the registration is not related to the placement of securities;

- after the decision to register the prospectus of shares comes into force (this is the date the indication of public status is entered into the Unified State Register of Legal Entities) when the issuer acquires the status of a PJSC.

There are exceptions to the general rule (clause 2, clause 4, article 30 of the Federal Law of April 22, 1996 N 39-FZ “On the Securities Market”):

- the issuer is a specialized financial company, a specialized project finance company, or a mortgage agent;

- a prospectus for the issue of shares has been registered, but the shares are not admitted to organized trading;

- the issuer is a SME, and the securities are not included in the quotation list.

However, it must be taken into account that there is still an obligation to prepare and publish consolidated or individual (in the absence of a group) financial statements in accordance with IFRS (annual and interim) in accordance with the law on consolidated financial reporting - if the organization’s securities are included in the quotation list (clause. 8 part 1, part 5 article 2, part 1 article 7 of the Federal Law of July 27, 2010 N 208-FZ “On Consolidated Financial Statements”, Letter of the Ministry of Finance of Russia dated July 11, 2019 N 07-01-09/51283 ).

That is, it turns out that if the shares of an SME are included in the quotation list, then it is obliged to prepare and publish reports in accordance with IFRS, even if it is not part of the group.

And if securities are excluded from the quotation list, then the issuer:

- the obligation to disclose consolidated financial statements established by the securities law will remain if it is part of a group (Information of the Ministry of Finance of Russia N OP 6-2015);

- the obligation to disclose individual financial statements established by the law on consolidated financial statements will cease - if it is not part of a group.

In general, the procedure for making a decision on the preparation and publication of PJSC reports can be presented in the form of a diagram:

How a PJSC disclose financial statements

The obligation to disclose the financial statements of the issuer (both consolidated and individual) extends (Clause 12, Article 30 of the Federal Law of April 22, 1996 N 39-FZ “On the Securities Market”, Part 1 of Article 7, Part 3 of Art. 5 of the Federal Law of July 27, 2010 N 208-FZ “On Consolidated Financial Statements”, clause 67.3 of the Bank of Russia Regulations of December 30, 2014 N 454-P):

- to the annual financial statements of the issuer with an attached auditor's report in relation to such statements;

- on the interim financial statements of the issuer, compiled for the reporting period, consisting of six months of the reporting year, with the attachment of an auditor's report or other document drawn up based on the results of verification of such statements in accordance with auditing standards.

The procedure and timing of disclosure of financial statements depend on the laws in accordance with which the PJSC must publish its statements.

| Reporting type | The obligation arises under Federal Law No. 39-FZ (PJSC is part of the group, the issue prospectus has been registered) | The obligation arises under Federal Law N 208-FZ (PJSC is not part of the group, but the securities are included in the quotation list) | The obligation arises both under Federal Law N 39-FZ and under Federal Law N 208-FZ (PJSC is part of the group and the securities are included in the quotation list) |

| Annual (together with the auditor’s report) | Consolidated financial statements are disclosed by publication on the Internet on the website of a distributor of information on the securities market (clause 12, article 30 of Federal Law N 39-FZ, clauses 2.5, 68.1 of Bank of Russia Regulations dated December 30, 2014 N 454-P) : • no later than three days after the date of drawing up the audit report, but no later than 120 days after the end of the reporting year; • as part of the issuer's quarterly report for the second quarter or for the first quarter, if it was compiled before its end. | Place individual financial statements on the Internet (usually on their own website) or in the media no later than 150 days after the end of the reporting year for which the statements were prepared. If it is not posted on your own website, then on your own website you need to indicate information about the place of disclosure of the annual reports (Parts 2, 3, 5 Article 7, Part 7 Article 4 of Federal Law N 208-FZ). | Consolidated financial statements disclosed as provided for in paragraph 12 of Art. 30 of Federal Law No. 39-FZ, - by publishing on the Internet on the website of a distributor of information on the securities market (Part 5, Article 7 of Federal Law No. 208-FZ, clauses 2.5, 68.1 of the Bank of Russia Regulations dated December 30, 2014 N 454-P): • no later than three days after the date of drawing up the audit report, but no later than 120 days after the end of the reporting year; • as part of the issuer's quarterly report for the second quarter or for the first quarter, if it was compiled before its end. On your own website you must place information about the place of disclosure of annual reports (Part 3, Article 7 of Federal Law No. 208-FZ). |

| Interim (together with the audit report or other document based on the results of the audit) | Consolidated financial statements are disclosed by publishing on the Internet on the website of a distributor of information on the securities market (clause 12, article 30 of the Federal Law of April 22, 1996 N 39-FZ, clauses 2.5, 68.2 of the Bank of Russia Regulations of December 30, 2014 N 454-P): • no later than three days after the date of drawing up the audit report or other document drawn up in accordance with auditing standards, but no later than 60 days after the end date of the second quarter; • inclusion in the issuer's quarterly report for the third quarter. | Place individual financial statements on the Internet (usually on their own website) or in the media no later than 90 days after the end of the reporting year for which the statements were prepared. If it is not posted on your own website, then on your own website you need to indicate information about the place of disclosure of the annual reports (Parts 2, 3, 5 Article 7, Part 7 Article 4 of Federal Law N 208-FZ). | Consolidated financial statements disclosed as provided for in paragraph 12 of Art. 30 of Federal Law No. 39-FZ, - by publishing on the Internet on the website of a distributor of information on the securities market (Part 5, Article 7 of Federal Law No. 208-FZ, clauses 2.5, 68.2 of the Bank of Russia Regulations dated December 30, 2014 N 454-P): • no later than three days after the date of drawing up the audit report or other document drawn up in accordance with auditing standards, but no later than 60 days after the end date of the second quarter; • inclusion in the issuer's quarterly report for the third quarter. On your own website you must place information about the place of disclosure of annual reports (Part 3, Article 7 of Federal Law No. 208-FZ). |

Please note that in 2021, issuers are required to disclose financial statements within virtually the same timeframes, regardless of which federal law imposes this obligation on them:

- consolidated financial statements published in accordance with the rules of Federal Law dated 04/22/1996 N 39-FZ (clause 3, part 7, article 12 of Federal Law dated 04/07/2020 N 115-FZ, clause 4 of the Bank of Russia Information dated 04/13/2020):

- no later than 210 days after the end of the reporting year (07/28/2020), but no later than 3 days from the date of the auditor’s report - for annual reporting for 2021;

- no later than 180 days after the end of the six-month reporting period (December 28, 2020), but no later than 3 days from the date of drawing up the auditor’s report (another document based on the results of the audit) - for interim reporting for six months of 2020;

- individual financial statements published in accordance with the rules of Federal Law No. 208-FZ, clause 1, 2, part 7, art. 12 of Federal Law dated 04/07/2020 N 115-FZ, Information message of the Ministry of Finance of Russia dated 04/09/2020 N IS-accounting-26):

- no later than 210 days after December 31, 2021;

- no later than 180 days after the end of the semi-annual reporting period 2021.

What happens if you do not disclose financial statements according to IFRS

Failure to comply with publication deadlines, as well as other violations of the procedure for disclosing information (for example, posting false information) may entail liability (Part 2 of Article 15.19 of the Code of Administrative Offenses of the Russian Federation):

- for an organization - a fine from 700 thousand to 1 million rubles;

- for an official - a fine from 30 thousand to 50 thousand rubles. or disqualification for a period of one to two years.

However, within 20 days from the date of the decision to impose it, the fine can be paid in half (Part 1.3-1 of Article 32.2 of the Code of Administrative Offenses of the Russian Federation).

Can a PJSC be exempted from the obligation to disclose reports by decision of the Bank of Russia?

No, he can not. To obtain exemption, by decision of the Bank of Russia, a PJSC, at a minimum, will have to change its status to non-public.

What will change in information disclosure for 2021?

Starting with the reporting for 2021, there will be an obligation to disclose individual financial statements of PJSC, which, together with other organizations, does not form a group (clause 2, clause 4, article 30 of the Federal Law of April 22, 1996 N 39-FZ “On the Securities Market”, part 9, Article 24 of the Federal Law of December 27, 2018 N 514-FZ, clause 52.4 of the Bank of Russia Regulations of March 27, 2020 N 714-P).

This means that even if securities are excluded from the quotation list, but the issuer is not part of the group, it will continue to disclose individual IFRS statements in accordance with securities legislation.

Previously, the obligation would have ceased, since according to the legislation on financial reporting it is necessary to disclose statements regardless of the creation of a group, but subject to the inclusion of securities in the quotation list. And according to the securities law, inclusion/non-inclusion in the quotation list in the general case did not play a role, but there was only a requirement to disclose consolidated statements.

Sincerely, Shuvalova I.V.