Who is required to submit the SZV-M report for January 2020?

All employers must submit the SZV-M report for January 2021. In particular:

- organizations and their separate divisions;

- lawyers, detectives;

- notaries;

- individual entrepreneurs.

The SZV-M report for January 2021 must reflect information about all employees who performed work on the basis of employment agreements from January 1 to January 31. It makes absolutely no difference:

- payments were made to individuals in January or were absent;

- whether the organization (IP) actually carried out activities in January or not.

Please note that form SZV-M must be submitted even if employment contracts were simply concluded.

Based on the letter of the Pension Fund of the Russian Federation dated July 27, 2016 No. LCH-08-19/10581, if individuals work (provide services) under a civil contract, then data about them is reflected in the SZV-M report subject to the following conditions:

- individuals were paid remuneration;

- contributions were calculated on the amount of the remuneration.

That is, if in January 2021 no remuneration was accrued to employees under a civil contract and no contributions were made for its amount, such employees do not need to be included in the SZV-M report for January 2020.

Conclusion: in the SZV-M form for January 2021 you must include:

- employees with valid employment contracts, regardless of whether they were accrued income in January 2021;

- employees with valid civil contracts, subject to payment of income to them in January 2021 and accrual of insurance premiums on the amounts paid.

Zero form: Pension Fund position

Do I need to submit a zero SZV-M report for August 2021? The question is interesting and controversial.

| Position 1 | Position 2 |

| There cannot be a zero SZV-M in principle. If not a single person is included in the form for August, then submitting such an empty SZV-M loses all meaning. No one needs blank forms because they do not contain the necessary information. | The PFR branch in the Altai Territory on August 1, 2017 said this: even when there are no hired employees, the policyholder still submits SZV-M. But without a list of insured persons. |

SZV-M due date: JANUARY 2020

In 2021, as was the case before, organizations and individual entrepreneurs send a monthly report on employees in the SZV-M form to their Pension Fund branch.

Based on Article 11 of the Law on Personalized Accounting of the Pension Fund of Russia No. 27-FZ, the deadline for submitting the SZV-M report in 2021 is the 15th day of the month following the reporting period.

Thus, the deadline for submitting SZV-M for January 2021 is February 17 (Monday). The deadline for submitting SZV-M for January 2021 has been postponed from February 15 to February 17 due to the coincidence of the deadline with a weekend - February 15, 2021 falls on a Saturday.

If you submit the SZV-M for January 2021 later than February 17, the policyholder will face a fine of 500 rubles for each employee (which is indicated in the report for January 2021).

The deadlines for submitting reports in the SZV-M form in 2021 are:

- February 17;

- March 16;

- April 15;

- May 15;

- June 15;

- July 15;

- August 17;

- September 15th;

- October 15;

- November 16;

- December 15.

We would like to add that sending the SZV-M report by mail will take longer than submitting the document via electronic channels. SZV-M reporting will be considered submitted on time if it is sent by post before 24 hours of the last day established for its submission (clause 8 of Article 6.1 of the Tax Code of the Russian Federation). Confirmation of the timely dispatch of the SZV-M by mail is the postmark on the inventory of the attachment in the valuable letter of the Russian Post.

If ahead of schedule

Please note that the submission of the SZV-M report for March 2021 may be early. That is, already in March. There is no need to wait until April.

But there is a possible catch: if you send the SZV-M for March 2017 early, there is almost always a chance that the already submitted report will need to be clarified. For example, a new specialist will be hired on the last day of March, when the report has already been submitted. And such cases cannot be excluded.

For more information about this, see “SZV-M can be passed early.”

And do not forget that when submitted electronically, the SZV-M form for March 2021 will reach the fund’s office faster than by mail on a paper form.

SZV-M report form in 2020

It should be noted that the form of the SZV-M report in 2021 remains the same. Policyholders use the form that was approved by Resolution of the Pension Fund Board of February 1, 2016 No. 83p.

The SZV-M report form consists of four sections:

1. Details of the policyholder. 2. Reporting period. 3. Form type. 4. Information about the insured persons.

On January 8, 2021, Pension Fund Resolution No. 1077p dated December 7, 2016 came into force. The resolution approved a new electronic format for personalized accounting information in the SZV-M form.

That is, starting from the report for December 2021, an updated version of SZV-M is in effect, which must be sent to the Pension Fund. Let us add that the electronic form of the SZV-M report is created in XML format. encoding UTF-8.

Details about filling out the electronic report form are in the Pension Fund document, which can be downloaded at the bottom of the page (contains basic technical information).

Please note that on the official website of the Pension Fund (section “For Employers”) you can download a free report verification module. Link to the module https://www.pfrf.ru/strahovatelyam/for_employers/programs_for_employers~3150/

Electronic format

Please note: from January 8, 2021, the Pension Fund of Russia resolution dated December 7, 2016 No. 1077p came into force, which approved a new electronic format for personalized accounting information in the SZV-M form.

This means that from the report for December 2016, an updated electronic version of the SZV-M form is in effect. Only this is suitable for sending to the SZV-M fund for January 2021!

PFR_034-012-008689_034012_SZV-M_20170204_b26caf26-0c3c-4cf-b01-1f65f4540df0.xml

Electronic SZV-M is created in XML format in UTF-8 encoding.

However, there are no fundamental changes. You can learn more about all the technical details here.

Since January 8, 2021, Resolution of the Pension Fund of December 7, 2016 No. 1077p has been in effect, which approved a new electronic format for personalized accounting information in the SZV-M form. This FIU document contains basic technical information for submission to the SZV-M fund for March 2021.

PFR_[registration number]_[TO code PFR]_SZV-M_[file generation date]_[GUID].xml

PFR_034-012-008689_034012_SZV-M_20170410_b26caf26-0c3c-4cf-b01-1f65f4540df0.xml

You can learn more about all the technical details here.

How to fill out the SZV-M report for January 2020

Completing the SZV-M report for January 2021 is, in principle, no different from filling it out for other months. The only caveat is that in the “Reporting period” field you should indicate code 01 (it indicates January). All other sections of the document are filled out as standard.

Let's give an example. Alye Parusa LLC (TIN 920496581321, KPP 920137491, registration number PFR092-303-654321) employs:

Ivanov Ivan Ivanovich (director). SNILS 183-060-671 47, TIN 920187152369. Nadezhdina Lyubov Petrovna (accountant). SNILS 184-070-951 49, TIN 920298741236.

Filling out the form

Filling out the SZV-M form for August 2021 has no fundamental features. Only in the “Reporting period” field indicate the month code – “08”. It shows that you are submitting the August report. Otherwise, everything is standard. The following is a sample of filling out this form for August 2021:

And here you can fill out this sample.

Forms and methods of submitting the SZV-M report

Form SZV-M for January 2021 can be submitted:

- in electronic form (for employers with 25 or more employees);

- on paper (24 or fewer employees).

For the incorrect choice of the established method of submitting tax reports in electronic form, tax liability in the form of a fine is provided. The fine is 200 rubles. In other words, if your SZV-M report contains information about 25 or more people, and you provided the report on paper, then get ready to pay 200 rubles for choosing the wrong method for submitting SZV-M.

Methods for submitting a report in paper form:

- personally;

- through an authorized representative;

- by mail.

Only an individual entrepreneur has the right to submit the SZV-M report in person. Organizations can submit the document through an authorized representative.

In the new edition of paragraph 4 of Art. 11 of the Law on Personalized Accounting No. 27-FZ contains the rule that in 2021, the employer is obliged to issue copies of all reporting forms to the Pension Fund to individuals within the following periods:

- from the moment of the person’s application - no later than 5 calendar days;

- on the day of dismissal (termination of the civil law contract).

That is, it is not necessary to issue a copy of the SZV-M to each employee. It is allowed to issue an extract from the SZV-M to an employee, since the report contains personal data of other employees, and their disclosure to third parties is prohibited.

General Director: should he be included in the report?

There is no need to include the only director - the founder - in the SZV-M for August 2021. This is evidenced by the explanations of the Pension Fund dated 05/06/2016 No. 08-22/6356 and the Ministry of Labor dated 07/07/2016 No. 21-3/10/B-4587. But only if 2 conditions are met:

- There is no employment contract with him.

- He does not receive any payments from the organization.

That is: if in August an employment contract was not concluded with the director, and he did not receive any payments, then the SZV-M form for August 2021 for such companies without staff need not be submitted at all.

Note that previously the Pension Fund insisted: the company is obliged to submit SZV-M to the sole founder, even if it did not enter into an employment or civil contract with him (letter dated 05/06/2016 No. 08-22/6356). Therefore, some accountants still prefer to play it safe and still take the SZV-M with one director. This is, in principle, not prohibited.

The Pension Fund branch is obliged to accept the SZV-M for August 2021, even if it shows only one director and there is no agreement with him.

Clarifying report of SZV-M for January 2020

It is necessary to clarify the SZV-M form for January 2021 if errors were made in the primary report (with the “original” type). For example, an incorrect TIN or SNILS was indicated. Current legislation does not establish deadlines for submitting clarifying SZV-M reports.

At the same time, some territorial divisions of the Pension Fund of the Russian Federation claim that supplementary (cancelling) reports should be submitted no later than the deadline for submitting the document for the reporting period. If these terms of provision are violated, the policyholder faces a fine of 500 rubles (for each employee).

We can summarize that before February 17, 2021, if necessary, you need to have time to submit not only the “source” of the SZV-M report, but also its updated form.

Reports SZV-KORR and SZV-ISKH

The Pension Fund of the Russian Federation has introduced the following reporting forms:

1. SZV-KORR - “Data on the adjustment of information recorded on the individual personal account of the insured person” - to correct the information of the insured employee in the Pension Fund of the Russian Federation.

2. SZV-ISH - “Information on earnings (remuneration), income, amount of payments and other remunerations, accrued and paid insurance premiums, periods of labor and other activities counted in the insurance period of the insured person.”

3. “Information on the policyholder transferred to the Pension Fund of the Russian Federation for maintaining individual (personalized) records (EDV-1).”

Section 3. Form type (code)

In this section, you should note one of three codes that indicate the type of form being presented:

- “iskhd” - initial;

- “additional” - complementary;

- “cancel” - canceling.

The original form is the form that the policyholder submits for the first time during the reporting period. For example, if he submits the initial report for April 2021, then in section 3 he needs to enter the code “source”:

As can be seen from the explanations given in the SZV-M form, the code “additional” should be entered if the policyholder decided to supplement the information that was previously accepted by the Pension Fund of the Russian Federation. For example, if for some reason the employer did not indicate in the initial report information about an employee who was registered during the reporting period, then it is necessary to supplement the already submitted reports with information about this employee. To do this, you need to fill out the form with the code “additional”. As for the “cancel” code, it is entered into the SZV-M form, which is submitted to cancel previously submitted information. For example, a cancellation form must be submitted if the policyholder in the original form indicated an employee who was fired before the start of the reporting period.

Please note that the procedure for filling out forms with the codes “add” and “cancel” is not specified anywhere. In this regard, accountants may have questions about how exactly they should prepare supplementary and canceling SZV-M reports. Let's give a few examples.

- The policyholder submitted form SZV-M, in which he entered information about employees dismissed before the start of the reporting period. Do I need to cancel the entire original report (provide the same information as in the original report, but indicate the form code “cancel”) or is it sufficient to list only those individuals who were “superfluous” in the original form in the cancellation form?

- The insured decided to supplement the original report with information about employees that were not included in the original report. In this case, should only new people be listed on the form with the code “additional”, or should all insured persons be listed (including those indicated on the original form)?

- The insured intends to clarify the TIN of one of the employees, since there was an error in the original report. Do I need to first cancel previously submitted information (submit the form with the code “cancel”), and then submit a supplementary form? Or is it enough to submit only the form with the code “additional”?

Elena Kulakova, an expert at the “Kontur.Otchet PF” service (she writes on the Online Accounting forum under the nickname KEGa) confirms that there are no clear answers to these questions. In her opinion, the following should be done:

- in the supplementary form it is necessary to list only those individuals in respect of whom errors were made in the original form, as well as those insured persons whose information was not included in the original form;

- in the cancellation form, you should indicate only those individuals whose information needs to be completely removed from the initial data uploaded to the Pension Fund database.

SZV-STAZH report

Please note that you will need to submit both the SZV-M and SZV-STAGE forms! Organizations will have to submit reports SZV-STAZH and EDV-1 (on two pages). For unemployed citizens, information about the insurance period is provided by the employment service.

The SZV-STAZH report, unlike the SZV-M form, must be submitted once a year: for 2021 - no later than March 1, 2021 (based on amendments to paragraph 4 of Article 2 of the Federal Law of 07/03/16 No. 250-FZ). If the last day for submitting the report falls on a weekend (holiday), then based on the letter of the Pension Fund of the Russian Federation dated 04/07/16 No. 09-19/4844, then it can be submitted on the next working day.

The form of the new SZV-STAZH report was approved by Resolution of the Board of the Pension Fund of the Russian Federation No. 507 p dated December 6, 2018. The document must include the following information:

1. Full name of the employee.

2. SNILS of the employee.

3. Operating time (period) of operation.

4. Work codes and grounds for preferential retirement (early retirement).

It should be taken into account that the new SZV-STAZH report will need to include all employees with whom civil or labor contracts were concluded (for the provision of services, performance of work). Employees with whom copyright contracts were concluded must also be included in the report on the insurance experience.

Please note that there should be no problems filling out the new SZV-STAZH report. You can take the SZV-M report as a sample, since the information about the policyholder in these two forms is the same. Information about employees must be indicated in Section 3.

You can download the 2021 SZV-STAGE form and find out detailed information about this reporting here.

In conclusion, we add that according to the general rules for submitting information about insured persons, organizations with more than 25 employees must submit new reports exclusively in electronic form, signed with an enhanced qualified signature.

If the number of employees is less than 25 people, then on the basis of clause 2 of Art. 8 of Law No. 27-FZ, SZV-STAZH can be taken on paper.

Submission procedure

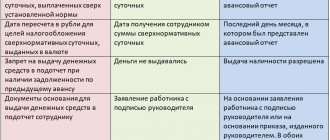

The SZV-M form for August 2021 can be submitted electronically or on paper (see table).

| Methods and conditions for passing SZV-M | |

| Situation | Delivery method |

| The number of people whose information is included in the report is 25 or more people | You are required (!) to submit the form electronically |

| The number of declared employees does not exceed 24 people | You can report on paper |

The fine for submitting the SZV-M in the wrong form – on paper/electronically – is 1,000 rubles.

This might also be useful:

- Payment for negative environmental impact in 2021

- Which OKVED code should be indicated in the reporting for 2021?

- Reduced insurance premium rates in 2021

- Deflator coefficient for the simplified tax system for 2021

- Changes in the field of insurance premiums in 2021

- Deadline for submitting 2-NDFL in 2021 for 2021

Is the information useful? Tell your friends and colleagues

Dear readers! The materials on the TBis.ru website are devoted to typical ways to resolve tax and legal issues, but each case is unique.

If you want to find out how to solve your specific issue, please contact the online consultant form. It's fast and free!