What is it for

Remuneration is systematic payments to employees for work performed. The amount of such payments directly depends on the specialist’s length of service, his qualifications, workload and the specifics of the position held.

Accounting for settlements with personnel for wages allows you to solve the following problems:

- make timely payments of wages and other remunerations;

- correctly and in full accrue all types of remuneration (sick leave, vacation pay, incentive and compensation payments);

- carry out timely deductions from wages (personal income tax and others);

- calculate contributions and fees regarding insurance coverage for workers;

- ensure full compliance with current legislative norms and requirements (labor, tax, budget legislation).

The main legal act establishing the current procedure for organizing accounting at an enterprise is Law No. 402-FZ. In addition to the Federal Law, the legal regulation of wage standards also includes the Labor and Tax Codes.

However, these norms must be fixed at the local level. In other words, each economic entity is obliged to approve the procedure for organizing accounting, including accounting for wage calculations, in its accounting policy. When drawing up a document, you should be guided by generally accepted norms and requirements, and also take into account the specifics and type of activity of the enterprise.

Publicity of financial statements

42. Accounting statements are open to users - founders (participants), investors, credit institutions, creditors, buyers, suppliers, etc. The organization must provide an opportunity for users to familiarize themselves with the accounting statements.

43. The organization is obliged to ensure the submission of annual financial statements to each founder (participant) within the time limits established by the legislation of the Russian Federation.

44. The organization is obliged to submit financial statements in one copy (free of charge) to the state statistics body and to other addresses provided for by the legislation of the Russian Federation, within the time limits established by the legislation of the Russian Federation.

45. In cases provided for by the legislation of the Russian Federation, the organization publishes its financial statements along with the final part of the audit report.

46. Publication of financial statements is carried out no later than June 1 of the year following the reporting year, unless otherwise established by the legislation of the Russian Federation.

47. The date of submission of financial statements for an organization is considered to be the day of its mailing or the day of its actual transfer by ownership. If the date of submission of financial statements falls on a non-working day (weekend), then the deadline for submission of financial statements is considered to be the first working day following it.

How to organize

As we noted above, each enterprise must develop and approve an accounting policy. This document is the basis for organizing the accounting of an economic entity. In terms of recording wage transactions, it is necessary to take into account the following important points:

- Primary documents. It is necessary to indicate in which forms and forms the primary information about operations will be reflected. It is permissible to use standardized forms or develop (modify) your own document forms.

- Accounting documentation. It is necessary to determine the forms of accounting journals, books, orders in which information about primary documentation will be collected. Payroll reporting forms should also be approved.

- Synthetic and analytical accounting of wage calculations should be organized taking into account the specifics of the enterprise’s activities in terms of developing a working chart of accounts.

- Document flow. It is necessary to approve the procedure for interaction between all services, departments and structural divisions of the enterprise in terms of reliable completion of primary and accounting documentation, as well as timely submission to responsible persons.

Check whether this information is reflected in your accounting policies. Read more about the features of drawing up and approving a key financial document in the article “Drawing up the organization’s accounting policies.”

Accounting

Commercial and non-profit organizations must use account 70 to reflect settlements with personnel for wages, in accordance with Order of the Ministry of Finance No. 94n. Information on this account is reflected separately for each employee. Making one entry for all employees or groups (divisions, workshops, departments) is unacceptable.

When calculating wages and other remunerations, an entry is made on the credit of account 70 in correspondence with the production cost accounts. For example, when calculating earnings for the main personnel, an entry is made: Dt 20 Kt 70, and for auxiliary personnel: Dt 23 Kt 70.

Transfer of salaries to bank accounts or withdrawal of money from the cash register is reflected in the debit turnover of the account. 70 in correspondence with the corresponding accounting account (50 “Cash” or 51 “Current account”).

Typical wiring:

| Operation | Debit | Credit |

| Salary accrued | ||

| Personal income tax withheld | ||

| Sick leave accrued | ||

| Insurance premiums accrued | ||

| Payment of wages to employees' bank cards is reflected |

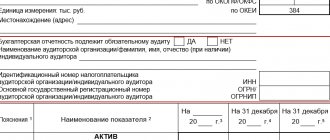

Interim financial statements

48. The organization must prepare interim financial statements for the month, quarter on an accrual basis from the beginning of the reporting year, unless otherwise established by the legislation of the Russian Federation.

49. Interim financial statements consist of a balance sheet and a profit and loss account, unless otherwise established by the legislation of the Russian Federation or the founders (participants) of the organization.

50. General requirements for interim financial statements, the content of their parts, and the rules for evaluating items are determined in accordance with these Regulations.

51. The organization must prepare interim financial statements no later than 30 days after the end of the reporting period, unless otherwise provided by the legislation of the Russian Federation.

52. The presentation and publication of interim financial statements is carried out in cases and in the manner provided for by the legislation of the Russian Federation or the constituent documents of the organization.

List of PBUs on accounting in 2019

All PBUs in force in 2021:

PBU 1/2008 “Accounting policies of the organization”; (articles, news and explanations)

PBU 2/2008 “Accounting for construction contracts”; (articles, news and explanations)

PBU 3/2006 “Accounting for assets and liabilities, the value of which is expressed in foreign currency”; (articles, news and explanations)

PBU 4/99 “Accounting statements of an organization”; (articles, news and explanations)

PBU 5/01 “Accounting for inventories”; (articles, news and explanations)

PBU 6/01 “Accounting for fixed assets”; (articles, news and explanations)

PBU 7/98 “Events after the reporting date”; (articles, news and explanations)

PBU 8/2010 “Estimated liabilities, contingent liabilities and contingent assets”; (articles, news and explanations)

PBU 9/99 “Income of the organization”; (articles, news and explanations)

PBU 10/99 “Expenses of the organization”; (articles, news and explanations)

PBU 11/2008 “Information about related parties”; (articles, news and explanations)

PBU 12/2010 “Information by segments”; (articles, news and explanations)

PBU 13/2000 “Accounting for state aid”; (articles, news and explanations)

PBU 14/2007 “Accounting for intangible assets”; (articles, news and explanations)

PBU 15/2008 “Accounting for expenses on loans and credits”; (articles, news and explanations)

PBU 16/02 “Information on discontinued activities”; (articles, news and explanations)

PBU 17/02 “Accounting for expenses for research, development and technological work”; (articles, news and explanations)

PBU 18/02 “Accounting for corporate income tax calculations”; (articles, news and explanations)

PBU 19/02 “Accounting for financial investments”; (articles, news and explanations)

PBU 20/03 “Information on participation in joint activities”; (articles, news and explanations)

PBU 21/2008 “Changes in estimated values”; (articles, news and explanations)

PBU 22/2010 “Correcting errors in accounting and reporting”; (articles, news and explanations)

PBU 23/2011 “Cash Flow Statement”; (articles, news and explanations)

PBU 24/2011 “Accounting for costs for the development of natural resources.” (articles, news and explanations)

The latest editions of all current PBUs can be found in the “Accountant’s Handbook” on “Clerk”