Home / Articles /

Audit PRO specialists provide assistance in preparing and sending electronic reports to all regulatory authorities of the Russian Federation. Submitting papers via TCS (telecommunication channels) significantly saves the client’s time. The electronic format for filing papers minimizes the possibility of errors.

If you decide to use TKS to submit reports, but don’t know how to deal with the system, specialists will prepare the papers and send them to your territorial Federal Tax Service. Submit reports electronically

- means the complete absence of paper copies in the archive of the enterprise. But if necessary, a staff accountant or a third-party outsourcer can request a copy of the report for any period from the tax office.

Important: if the company has more than 25 employees, all papers must be submitted electronically. If the number of employees is up to 25 people, you can submit reports in paper form.

Where to get an electronic signature

Moscow

Moscow

You can obtain a qualified electronic signature at the office or our partners in the region. The signature will be made within an hour. Or you can submit an online application. The manager will check the application and then invite you to the office to receive an electronic signature.

You can order delivery of an electronic signature to your home or office. Our specialist, trained and certified according to FSB requirements, will bring the digital signature without allowing it to be compromised.

Yandex maps do not support your browser version. to update your browser.

Reporting to the Federal Tax Service in electronic format

Until 2014, the largest taxpayers, as well as organizations and individual entrepreneurs with an average payroll of more than 100 people, were required to submit tax reports in electronic format (Clause 3 of Article 80 of the Tax Code of the Russian Federation). The rest could submit declarations and various certificates in printed form - by personally visiting the tax office or sending them by Russian Post.

In January 2014, changes were made to Chapter 21 of the Tax Code of the Russian Federation, according to which all taxpayers and tax agents must submit VAT returns in electronic format, regardless of their number. Only in exceptional cases can a VAT return be submitted on paper: this right is granted to tax agents who are tax defaulters, subject to certain conditions being met (paragraphs 2, 3, paragraph 5, Article 174 of the Tax Code of the Russian Federation).

Starting from 2021, policyholders submit calculations for insurance premiums to the Federal Tax Service (Article 431 of the Tax Code of the Russian Federation). If the policyholder employs 26 or more people, Federal Tax Service specialists will accept the report for consideration exclusively in electronic form.

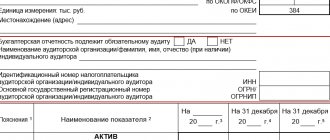

The criteria by which enterprises and individual entrepreneurs determine in what form to submit tax reports do not apply to accounting reports (balance sheet and appendices to it) - absolutely all taxpayers have the right to submit them on paper.

As you can see, most companies are required to report to the Federal Tax Service in electronic format. The tax service website has a special service that allows you to send all the necessary reports for free. But this is impossible to do without an electronic signature, which will have to be purchased at a certification center of the Russian Federation.

In addition, to send declarations through the Federal Tax Service website, you will have to enter all the data manually. You won't be able to save much, but it will take a lot of time.

In the IT services market, there are special systems for sending reports to regulatory authorities. In addition to submitting regulated forms through special services, taxpayers can request reconciliation reports from the Federal Tax Service, Pension Fund and Social Insurance Fund, receive extracts from the Unified State Register of Legal Entities, check reports for compliance with benchmarks, etc.

Try submitting reports through the Kontur.Extern system - it’s convenient and easy.

Try submitting your reports through the Kontur.Extern system. 3 months free use all features!

Try it

Features of our work

Professionals guarantee their clients:

- Accuracy and scrupulousness in drawing up declarations;

- Full interaction with regulatory authorities as part of the accounting services provided;

- Bearing full responsibility for the work performed;

- Checking reports using a logical control system;

- Elimination of errors in declarations.

In addition, we advise our clients at the stage of fruitful cooperation. With us, your business will be effective and transparent!

Electronic reporting to funds

All organizations and individual entrepreneurs that have employees are required to submit reports to the Pension Fund and the Social Insurance Fund.

Only companies with an average number of no more than 25 people have the right to report on paper.

Enterprises and individual entrepreneurs whose number exceeds the specified threshold are required to send reports (4-FSS, SZV-M, etc.) via telecommunication channels.

The FSS offers users free programs for sending reports, but to use them, you will have to study long instructions and install the program on your computer yourself. Before sending, the report must be certified with an electronic signature, which can be purchased at certification centers of the Russian Federation.

How to send a report via TKS

Submission of LLC reports

, PJSC and other forms of enterprise ownership through telecommunication channels can pass in one of the following ways:

- On the website of the Tax Service of the Russian Federation. But not all full-time specialists easily navigate the vastness of Internet resources;

- With the help of a special operator or third-party employee. These are specialist accountants.

Papers submitted late will result in administrative penalties for the enterprise.

If an error is made when preparing returns, the documents will be returned to the taxpayer until clarification is received and correct changes are made. All this takes time, which means the company will undergo possible financial risks.

when submitting reports electronically

offers its clients two types of services:

- One-time submission of documents. Here the specialist can submit reports

by agreement with the client (if necessary). For example, a full-time accountant of an enterprise is on sick leave, etc. In such cases, there is no need to create an electronic digital signature (EDS) of the principal. Submission of papers is carried out by proxy on behalf of ; - Regular cooperation. Working on an ongoing basis obliges Audit PRO specialists to prepare reports and send them to regulatory authorities in accordance with the regulations. In this case, the principal's digital signature is required. Constant cooperation is especially convenient for those who do not want or do not have the opportunity to master special software products for accountants.

In what cases is electronic reporting required for LLCs and other enterprises?

Most often, the services of a third-party specialist are used to send declarations via TCS in the following cases:

- Temporary suspension of the enterprise’s activities and the need to submit zero reports (in the absence of a full-time accountant);

- Lack of a full-time professional who can understand working with software and primary documentation;

- Lack of agreement with the operator company;

- Missed deadline for submitting paper declarations.

Audit PRO specialists work on behalf of the client. Namely, they generate reports and send them to regulatory authorities. In any case, the client receives an email notification that the Federal Tax Service has received the company’s report.

Tax and accounting reporting via the Federal Tax Service website

Tax and accounting reports can be submitted in a special service on the Federal Tax Service website. To work in it, you need an electronic signature and a program that will prepare a reporting file for uploading to the service. We will tell you how to use the service, what are the advantages and disadvantages of this method of submitting reports, and also what alternatives there are.

Service characteristics

The service for submitting tax and accounting reports on the Federal Tax Service website is designed for small businesses in special modes. It is not suitable for major taxpayers and businesses on OSNO - the service cannot submit a VAT return. Those who submit reports through intermediaries, that is, according to the authorized accounting department, will also not be able to use the service.

To register in the service, an electronic signature is required, and to submit reports, the “Legal Taxpayer” program is required.

Registration in the service

Before registering for the service, make sure that your computer meets the following requirements:

- Operating system Microsoft Windows XP or higher, or Mac OS X 10.9 or higher;

- Crypto provider with support for encryption algorithms GOST 34.10-2001 and GOST 28147-89;

- A software component for working with electronic signatures using a web browser - Crypto PRO EDS browser plug-in version 2.0. It can be downloaded directly from the registration page.

Registration is simple and does not take much time. Go to the service page, enter your email and password, and then activate your account using the link from the letter that will be sent to your email.

After registration you need to get an ID. After activating your account, the “Register certificate” button will appear in the service.

Click on this button and download the public key of your digital signature certificate. Information about the organization and CA that issued the certificate will be filled in automatically. Then click the “Submit for registration” button.

After some time, you will receive an email notification about the successful registration of the digital signature certificate. From now on, you can submit reports through the Federal Tax Service service.

Submitting reports on the Federal Tax Service website

1

Prepare all reports in the accounting program and upload them in one file

2

Launch the “Legal Taxpayer” program and enter the “Service - Register of uploaded files” mode.

3

Select the file with the reports you are going to submit.

4

On the toolbar, click the “Create shipping container” button.

5

In the settings, specify:

- The folder where the generated shipping container will be saved;

- Electronic signature certificate with which the reporting will be signed;

- Taxpayer ID received at the stage of registration in the service.

After that, click the “Generate” button. The file, ready for uploading to the Federal Tax Service website, will appear in the specified folder.

6

Log in to your personal account for submitting reports on the Federal Tax Service website, select the “File Upload” tab and upload the file passed through the “Legal Taxpayer” program.

After downloading, the service will automatically go to the page with the downloaded reports. Here you can see her status. The new file will have a “Pending” status. When the report is accepted, the status will change to “Completed (successful)”.

The date and time of receipt of the report are considered to be the date and time of receipt of the encrypted file by the Federal Tax Service, respectively.

Pros and cons of the service

The advantage of this service is that reports are submitted without intermediaries. The success of sending a report does not depend on the work of the post office or the EDF operator.

The service is also free of charge. You don’t need to pay to use it, but you still need to buy an electronic signature and cryptographic protection to work.

The disadvantages include the following nuances:

The service is not suitable for all taxpayers, but only for those who do not submit a VAT return;

The user needs to independently install an electronic signature certificate on the computer and configure the CIPF;

It is necessary to run the reporting file through the “Legal Taxpayer” program, which must be installed separately on the computer and monitored for updates;

The tax office does not have technical support, so if problems arise, you will have to contact specialists for a fee.

Therefore, it is more convenient to submit reports through an EDF operator. By connecting to the service to submit reports, you receive an electronic signature embedded in it and all the necessary software. A specialist sets up your work computer - you don’t have to install programs yourself. Generate reports directly in the service and report to any regulatory authorities.

Sending reports via the Internet to Rosstat, FSRAR, Rosprirodnadzor

Many companies regularly report the results of their activities to statistical authorities. Even small enterprises periodically fall under continuous statistical surveillance and are also required to submit certain forms.

In order not to waste time on a personal visit to Rosstat, submit your reports through Kontur-Extern.

Some companies, due to the nature of their activities, must submit declarations and other reports to Rosalkogolregulirovanie and Rosprirodnadzor. It is most convenient to submit such reports via the Internet using special services.

How to change the phone number to which the password is sent

Sometimes you need to change the phone number to which SMS messages with passwords are sent to use an electronic signature. For example, this is necessary if the phone is lost or if the employee who owns the phone goes on vacation, quits, or is transferred to another job.

How to change the phone number to which passwords are sent to use the electronic signature stored in the service is described in the article at the link.

Other changes to the settings for connecting to 1C-Reporting are described in the article at the link.

How to track reporting processing

When working in the service, tracking the processing of regulated reporting, as well as document flow based on letters and requests to regulatory authorities, is carried out in the same way as in the local (“boxed”) version of the same application.

Sent and subject to sending regulated reports are displayed in the directory of regulated reports, which is accessible using the menu command:

- in “1C: Enterprise Accounting” - Reports

-

Regulated reporting

-

Reports

, - in “1C: Enterprise Accounting” - Reporting, certificates

-

1C-Reporting

-

Reports

.

In the displayed form 1C-Reporting

:

- to display new reports, select the New

; - To view the report, click the document icon on the left side of the report line;

- To update the list of regulated reports, click the Refresh

; - To display lists of notifications, letters, reconciliations, extracts from the Unified State Register of Legal Entities/Unified State Register of Legal Entities and incoming messages from regulatory authorities, you need to select the menu items Notifications

,

Letters

,

Reconciliations

,

Unified State Register of Legal Entities

,

Inbox

.

To view information about report processing in the 1C-Reporting

Can:

- Click the hyperlink in the Status

.

The Sending Stages

window will be displayed in which you can view all stages of report processing, as well as display, download or print documents related to report processing; - In this window, select the menu command Settings

-

Exchange log with regulatory authorities

, and view the status of all exchanges with regulatory authorities.

More details about tracking interactions with regulatory authorities are described in articles 1C:ITS:

- Monitoring report processing in 1C:Accounting 8;

- Viewing the results of processing the sent report in “1C: Accounting 8”,

and in the video:

- Tracking document flow according to reporting in 1C: Accounting 8.