Important in reporting in 2017

- The first three months of 2021 will be the reporting campaign for 2016. It will end in April with the submission of Form 2-NDFL.

- Starting from 2021, the administrator of insurance premiums is changing, so Form 4-FSS may be canceled.

- For the first quarter of 2021, companies will submit calculations of contributions to the tax office.

Connect reporting

Create a tax payment schedule based on the specified deadlines and taxation system.

BASIC

Organizations on the OSN submit tax returns and other reports to the Federal Tax Service and extra-budgetary funds.

Tax returns:

- VAT

- Profit

- Property

- Transport

- Earth

Reporting to extra-budgetary funds:

- 4-FSS

- Confirmation of main activity

- RSV-1

- SZV-M

Other reporting to the Federal Tax Service:

- For insurance premiums

- Average headcount

- 2-NDFL

- 6-NDFL

- Financial statements

VAT declaration

Companies report on VAT quarterly (Article 174 of the Tax Code of the Russian Federation).

VAT return deadlines in 2021

- for the fourth quarter of 2021 - until January 25

- for the first quarter of 2021 - until April 25

- for the second quarter of 2021 - until July 25

- for the third quarter of 2021 - until October 25

Most Russian businesses report VAT electronically. Only certain categories of VAT payers can submit a printed declaration (clause 5 of Article 174 of the Tax Code of the Russian Federation).

Income tax return

Unlike VAT, income tax is considered an accrual total; accordingly, the declaration is submitted for the first quarter, six months, 9 months and a year (Article 285 of the Tax Code of the Russian Federation). During reporting periods, advance payments are made, and at the end of the year, the Federal Tax Service budget replenishes the tax minus the transferred advances (Article 287 of the Tax Code of the Russian Federation). If the company makes a loss, you will not have to pay tax.

Deadlines for income tax returns in 2021

- for 2021 - until March 28

- for the first quarter of 2021 - until April 28

- for the first half of 2021 - until July 28

- for 9 months of 2021 - until October 30 (the deadline is shifted due to holidays)

If the average quarterly income is more than 15 million rubles, the taxpayer reports and pays advances every month (clause 3 of Article 286, Article 287 of the Tax Code of the Russian Federation).

Declaration on property tax of organizations

Companies that own property are recognized as payers of property tax.

Each subject of the Russian Federation determines its own procedure and terms for transferring taxes and advance payments (Article 383 of the Tax Code of the Russian Federation). Everyone, without exception, should report for the year.

Tax calculations are submitted for January - March, January - June and January - September, and a declaration is submitted at the end of the year.

Attention!

Subjects of the Russian Federation can cancel interim settlements (Article 379 of the Tax Code of the Russian Federation).

Deadlines for corporate property tax declarations

The property declaration for 2021 must be submitted by March 30, 2017 (Article 386 of the Tax Code of the Russian Federation).

Transport tax declaration

The transport tax affects companies that have vehicles registered with the State Traffic Safety Inspectorate (Article 357 of the Tax Code of the Russian Federation). Accordingly, these same organizations submit a declaration once a year.

Deadlines for transport tax declarations in 2021

In 2021, you need to report before 02/01/2017 (Article 363.1 of the Tax Code of the Russian Federation).

Land tax declaration

If the company owns land, it is necessary to report on land tax (Article 388 of the Tax Code of the Russian Federation).

Deadlines for land tax returns in 2021

The declaration for 2021 must be submitted before 02/01/2017 (Article 398 of the Tax Code of the Russian Federation).

Information on the average number of employees

At the end of the year, companies report the average number of employees to the Federal Tax Service. The form is light and consists of one sheet.

Deadline for submitting information on the average number of employees in 2021

The deadline for submitting information is January 20, 2017 (Clause 3, Article 80 of the Tax Code of the Russian Federation).

Form 4-FSS

Starting from 2021, the administrator of insurance premiums is changing, so Form 4-FSS may be canceled.

Deadline for submitting 4-FSS in 2021

But for 2021 you will need to report using the current Form 4-FSS by 01/20/2017 (on paper) and by 01/25/2017 (electronically).

Confirmation of main activity

Every year, companies determine the type of activity that has the greatest share. The data is submitted to the Social Insurance Fund (Order of the Ministry of Health and Social Development of the Russian Federation dated January 31, 2006 No. 55).

Deadlines for confirmation of the main activity in 2017

Until April 15, 2017, all companies submit a set of three components:

- Application indicating one leading type of activity

- Certificate confirming the main type of economic activity (with detailed calculations)

- A copy of the explanatory note to the balance sheet for 2021 (the note is not submitted by small businesses).

Form RSV-1 PFR

In 2021, instead of RSV-1, there will be a single calculation for insurance premiums.

At the moment, the new calculation has not yet been approved, and the RSV-1 form has not been canceled.

For 2021 you need to pass RSV-1

- until 02/15/2017 (on paper with a number of people not reaching 25 people)

- until 02/20/2017 (electronically)

Calculation of insurance premiums

For the first quarter of 2021, companies will submit calculations of contributions to the tax office. According to the project, the calculation consists of 24 sheets. It combines two calculations - 4-FSS and RSV-1.

Deadlines for submitting calculations for insurance premiums in 2021

- for the first quarter of 2021 - until May 2 (due to the May holidays the deadline is shifted);

- for the first half of 2021 - until July 31 (the deadline is postponed due to a holiday);

- for 9 months of 2021 - until October 30.

SZV-M

The form is also valid for 2021, but policyholders have been given more time to prepare it. Starting from the new year, the form must be submitted by the 15th day of the month following the reporting month (Article 2 of Federal Law No. 250-FZ dated July 3, 2016). This rule comes into force with reporting for December, that is, the December SZV-M must be submitted by 01/15/2017.

Reporting income of individuals

Once a quarter, form 6-NDFL is submitted to the Federal Tax Service (Clause 2 of Article 230 of the Tax Code of the Russian Federation)

Deadlines for submitting form 6-NDFL in 2021

- for 2021 - until April 3 (due to weekends, the deadline is delayed);

- for the first quarter of 2021 - until May 2 (due to weekends and May holidays, the deadline is postponed);

- for the first half of 2021 - until July 31;

- for 9 months of 2021 - until October 31.

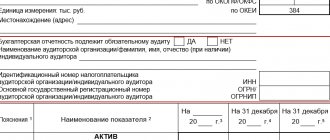

Financial statements

Companies disclose information about their financial condition, debt, reserves, and capital in their annual financial statements. The Federal Tax Service and Rosstat are waiting for a copy of such reporting from payers.

Deadlines for submitting financial statements in 2021

For 2021, reports must be submitted by March 31, 2017 (clause 5, clause 1, article 23 of the Tax Code of the Russian Federation, clause 2, article 18 of the Federal Law of December 6, 2011 No. 402-FZ).

Annual financial statements of budgetary and autonomous institutions for 2021

The financial statements of a budgetary institution are submitted as of January 1, 2021, which follows the reporting year 2021. From the article you will learn about the reporting of budgetary institutions for 2021: types and forms of reporting, composition, formation procedure and submission deadlines.

Let's consider the reporting of budgetary organizations: types and forms.

The reporting of budgetary institutions for 2021 is presented as follows:

The composition of the accounting reporting forms of budgetary institutions for 2021 is determined by paragraph 12 of Instruction No. 33n. Next, we will tell you about the procedure and deadlines for submitting reports from a budgetary institution.

The composition of the financial statements of a budgetary organization can be adjusted by the founder and the relevant financial authority. They can establish additional forms of annual reporting of budgetary institutions for 2021, the procedure for filling them out and deadlines for submission.

Preparation of financial statements in budgetary institutions 2021

To prepare reports for a budgetary institution, take data from the accounting registers: general ledger (f. 0504072), multigraph card (f. 0504054), fund and settlement card (f. 0504051). Do not forget to conduct an inventory before the annual reporting of state budgetary institutions.

Prepare financial statements of budgetary institutions taking into account information on divisions, branches and representative offices. The location of the branches does not matter. The procedure for submitting data on the activities of branches to the head office is fixed in the regulations on the division and accounting policies.

Features of reporting in a budget organization for 2021

The procedure for preparing financial statements of a budgetary institution is as follows: fill in the data with an accrual total from the beginning of the year in rubles to the second decimal place. Do not submit blank accounting reporting forms for budgetary institutions. Please provide a list of them in the text part of the Explanatory Note for the reporting period.

If an event occurred after the reporting date, reflect it in the turnover of the reporting period and include it in the reporting. For example, the cadastral value of the land has changed, you have learned about a debt, or you have found an error.

This follows from paragraph 3 of Instruction No. 157n and is confirmed in terms of the annual reporting of budgetary and autonomous institutions by letter dated 02.02.2021 from the Ministry of Finance of Russia No. 02-07-07/5669 and the Treasury of Russia No. 07-04-05/02-120.

Who approves the reports

Accounting reports in budgetary institutions are signed by the head and chief accountant of the institution. Forms with planned (forecast) and analytical indicators are approved by the head or employee of the financial and economic service.

The autonomous institution also submits annual financial statements to the founder and additionally reviews and approves them by the supervisory board. The institution attaches information about this to the reporting.

Where to submit reports

Budgetary and autonomous institutions submit reports to the founder. The founder forms consolidated accounting records of subordinate institutions.

The deadline for the institution to submit reports will be set by the founder. For federal institutions that work through the Electronic Budget system, the deadlines depend on the date of the founder’s reporting to the Treasury of Russia. But the institution’s reports are submitted no later than:

- 10 working days before the founder’s reporting deadline – for annual reporting;

- 5 working days – for quarterly reporting.

For example, if the founder submits annual reports of budgetary institutions on February 15, report to him by January 31.

If the deadline falls on a non-working day, submit reports on the next working day.

Submit reports of budgetary organizations electronically in 2021. Additionally, the founder has the right to install paper copies. On paper, bind and number with a table of contents. Submit to the founder with a cover letter. Submit electronic reporting using established formats and methods of transmission:

- federal institutions and authorities - through the “Accounting and Reporting” subsystem of the GIIS “Electronic Budget”;

- regional and local institutions and authorities - through specialized accounting and reporting subsystems.

Indicators of electronic and paper reporting of state and municipal budgetary and autonomous institutions must comply.

Do not submit your financial statements to the statistical authorities. After all, budgetary and autonomous institutions are public sector organizations. Such organizations do not submit accounting records to statistics.

How are reports accepted?

The founder accepts and checks the financial statements of budgetary institutions. When he receives the report, he will notify the institution. Then check the forms and inform the institution that:

- accepted the reporting;

- or reporting needs to be corrected due to errors.

First of all, the founder will check whether the financial statements of the budgetary institution meet the 2021 requirements:

- Instructions No. 33n;

- legal acts that approve additional forms of financial statements.

Next, the founder will check the reporting indicators against control ratios. If it finds discrepancies, it will communicate the results of the check on the next business day by notification.

The founder will check the adjusted report again.

Source: //www.budgetnik.ru/art/102008-godovaya-buhgalterskaya-otchetnost-byudjetnogo-i-avtonomnogo-uchrejdeniya-za-2021-god

simplified tax system

Simplified people do not pay the most complex taxes: VAT, income tax and property tax. Only in exceptional cases can simplifiers become payers of these taxes (clause 2 of Article 346.11 of the Tax Code of the Russian Federation).

All workers and employees must submit data on insurance premiums. This means that they, just like companies on OSNO, will submit a new calculation to the Federal Tax Service in 2017.

Simplified workers also submit to the Federal Tax Service information on the average number of employees, accounting statements and income reports of employees and other individuals. persons according to forms 2-NDFL and 6-NDFL.

Connect reporting

Land and transport taxes are paid by those companies that have these taxable objects.

A specific report in this case is the annual declaration under the simplified tax system

.

Deadlines for the annual declaration under the simplified tax system in 2021

In order to meet the deadlines, you must send taxes and declare your activities before March 31, 2017 (Article 346.23 of the Tax Code of the Russian Federation).

Simplified tax advances are transferred to the account of the Federal Tax Service (Clause 7, Article 346.21 of the Tax Code of the Russian Federation):

- for the first quarter of 2021 - until April 25;

- for the first half of 2021 - until July 25;

- for 9 months of 2021 - until October 25.

Composition and content of financial statements in 2021

The composition and content of financial statements is material that any accountant owns. But since the head of the enterprise must certify these documents with his signature and seal, it will not be superfluous to figure out what he is endorsing.

Concept and composition

Any organization carries out some financial transactions.

Even if this is a purely charitable enterprise and its staff works without wages on sheer enthusiasm, sooner or later it will be necessary to process any incoming donations or business purchases.

And any movement of cash, as well as funds from a bank account to another account, as well as intangible assets, must be recorded on paper. This is the subject of accounting.

Back to contents

Legislation on the composition of financial statements

Like other areas of activity of enterprises related to money and intangible assets, issues of financial documentation are regulated by the relevant Ministry: orders, regulations, recommendations, and so on. In particular, the composition of the financial statements is determined by Regulation 4/99, approved by Order of the Ministry of Finance No. 43 dated 06/06/1999.

Back to contents

Why is documentation needed?

Since the composition of the financial statements fully reflects everything that happens in the enterprise, management can use this information to assess the development and situation of business as a whole.

By regularly analyzing documents, you can not only see what state the enterprise is in now, but also, for example, build a production development strategy for the future. In addition, the content of financial statements is provided by:

- regulatory government bodies - the Federal Tax Service, the State Statistics Committee, the Social Insurance Fund, and so on;

- potential investors or partners;

- shareholders;

- to any interested party if the organization is required to publicly provide its reports by law.

The latter types include banks, joint stock companies, insurance companies and similar organizations: according to the law, depositors and other clients of enterprises must know who they trust with their money.

Back to contents

Composition of financial statements

Almost any document containing information about the operations of an enterprise and some final figure can to some extent be called a report. Therefore, before we say that the financial statements include such and such a form, you need to decide on the classification.

So, the reports are:

- private and general - depending on the amount of information included in them;

- internal and external - depending on the intended purpose;

- annual, semi-annual, quarterly and so on - depending on the period of time for which they are compiled.

Since the composition of the annual financial statements is most often the most important, we will dwell on it in more detail. Why are the documents for the year most important? Because all organizations submit them, regardless of their activities and tax system: according to legal requirements, absolutely everyone must keep accounting records and, accordingly, report on them.

So what should enterprises provide to regulatory authorities every calendar year and what is included in the financial statements?

This includes:

- balance sheet;

- Profits and Losses Report;

- reports and charts that complement the two above-mentioned documents.

Since 2013, the income statement is called the income statement. Previously, the package of documents sent for control had to be accompanied by an explanatory note with a detailed breakdown of the information and the result of the audit, without which the reporting was considered invalid.

Under the new rules, these forms are no longer required, but businesses that publish their financial information publicly must still be audited as before and publish the results as before.

Back to contents

Deadlines for filing accounting documents

As mentioned above, the composition of reports is also affected by the timing of their preparation. Previously, enterprises prepared information annually, quarterly and sometimes every six months; according to current rules, this is done only once a year, except for some organizations stipulated by special orders.

Documents are submitted within three months after the end of the reporting period. Since the composition of the interim financial statements completely coincides with the annual ones, experts recommend that the company’s accountants still prepare them.

Firstly, for self-checking - this will make it easier to identify shortcomings and errors, and secondly, in the event of a sudden check, you won’t have to fuss and prepare information in a hurry.

And, for example, a fully prepared quarterly financial statements can not only serve for double control over the accuracy of accounting figures and indicators, but also make the picture of the state of the enterprise more clear. In particular, the manager can see in what period which areas work with the greatest load and the greatest profitability: if you look at the indicators only for the year, you will not see this.

Back to contents

basic forms

As we have already found out above, the main forms of accounting are the balance sheet and data on financial results or profits and losses. What should be contained in these forms? We'll try to answer.

Back to contents

Balance sheet

This document is drawn up in Form 1 and contains the ratio of the assets and liabilities of the enterprise. That is, it is a clear illustration of all property, funds, raw materials, materials, equipment - everything that the enterprise owns, at least for a short time - and all debts. Indicators for assets and the amount of liabilities and equity must be exactly the same

Back to contents

UTII

It is easier for companies in this special regime to maintain tax records, because the legislation allows them not to pay a number of taxes: on profit, on property and VAT (clause 4 of Article 346.26 of the Tax Code of the Russian Federation). Other taxes are paid on a general basis.

In addition to standard reports (see the list in the example about OSNO), they fill out a UTII declaration and send it to the Federal Tax Service.

Deadlines for UTII declaration in 2021

- for the fourth quarter of 2021 - until January 20;

- for the first quarter of 2021 - until April 20;

- for the second quarter of 2021 - until July 20;

- for the third quarter of 2021 - until October 20.

Advance payments are made quarterly before the 25th day of the month following the reporting period.