The article presents budget classification codes for paying duties for negative environmental impact (NEI) and the types of adverse impact on the atmosphere for which these taxes must be paid.

Enterprises and individual entrepreneurs that pollute the atmosphere and nature during their activities pay an environmental fee to the treasury. For this purpose, the KBK NVOS 2021 is indicated in the payment documents. Payments for this tax are classified by the Ministry of Finance.

KBK is a detail in a payment order that characterizes the type of payment to a particular authority. In this case, the money is paid to the Federal Service for Supervision of Natural Resources, or Rosprirodnadzor. If the code for the classification of budget income for taxes in the Federal Tax Service is displayed by the number 182, then the KBK of Rosprirodnadzor for 2021 and 2019 is administered by the number 048. The administrator code is indicated in the first three digits of the code, and you can find out the codes in Appendix 7 to Order of the Ministry of Finance No. 65n dated 01.07. 2013 (12/20/2018).

KBC NVOS for 2021 and 2021

The article presents budget classification codes for paying duties for negative environmental impact (NEI) and the types of adverse impact on the atmosphere for which these taxes must be paid.

Enterprises and individual entrepreneurs that pollute the atmosphere and nature during their activities pay an environmental fee to the treasury. For this purpose, the KBK NVOS 2021 is indicated in the payment documents. Payments for this tax are classified by the Ministry of Finance.

KBK is a detail in a payment order that characterizes the type of payment to a particular authority. In this case, the money is paid to the Federal Service for Supervision of Natural Resources, or Rosprirodnadzor. If the code for the classification of income to the budget for taxes in the Federal Tax Service is displayed by the number 182, then the KBK of Rosprirodnadzor for 2021 and 2021 is administered by the number 048. The administrator code is indicated in the first three digits of the code, and you can find out the codes in Appendix 7 to Order of the Ministry of Finance No. 65n dated 01.07. 2013 (12/20/2018).

Types of negative impacts

The work of enterprises affects the atmosphere in different ways: some enterprises pollute water resources, others pollute the air. In addition to pollution, the atmosphere, soil and water are adversely affected by the disposal of industrial waste. Thus, according to Decree of the Government of the Russian Federation No. 255 of 03/03/2017 (as amended on 06/29/2018), companies pay this duty for:

- discharge of substances that negatively affect the atmosphere into the air;

- release of various substances into water resources;

- distribution and storage of waste from the manufacture and use of products.

Oil and gas producing organizations also pay the tax.

KBC when paying a fee for waste disposal

To pay the duty for the distribution of garbage and waste on land, codes are used, the profit sub-item of which is numbered 010 in the BCC. Payments for waste disposal also vary: distribution of waste from the manufacture and use of products, simply from manufacturing, for the disposal of municipal solid waste. Each element is numbered with a corresponding number: 40, 41, 42.

| Payment | KBK |

| Disposal of production and consumption waste | 048 1 1200 120 |

| Disposal of production waste | 048 1 1200 120 |

| Disposal of municipal solid waste | 048 1 1200 120 |

KBK when paying tax for environmental pollution

By polluting the air, companies and individual entrepreneurs pay money to the budget of Rosprirodnadzor according to classification codes, in which the profit sub-item is numbered 010, and the element is numbered 10, 30, 70.

| Payment | KBK |

| Emissions of pollutants into the atmospheric air by stationary objects | 048 1 1200 120 |

| Releases of pollutants into water bodies | 048 1 1200 120 |

| Emissions of pollutants generated during flaring and (or) dispersion of associated petroleum gas | 048 1 1200 120 |

KBK when paying an environmental fee

In addition to paying funds for the distribution and release of pollutants into the atmosphere, companies pay an environmental fee to Rosprirodnadzor. The subarticle of the classification code for this tax also differs from the previous ones and is numbered 080. In the KBK environmental tax for 2021, the element reflects a different number - 10.

To deposit funds for state environmental fees, only one payment type encryption is used: 04811208010010000120.

In addition to the fact that companies contribute money in the form of pollution duties, the Ministry of Finance also implies codes that classify income into the budget, which systematize the payment of fines for late payment of fees. Budget classification codes for fines are displayed in Order of the Ministry of Finance of Russia No. 132n dated June 8, 2018 (as amended on November 30, 2018).

KBC when paying a fee for waste disposal

To pay the duty for the distribution of garbage and waste on land, codes are used, the profit sub-item of which is numbered 010 in the BCC. Payments for waste disposal also vary: distribution of waste from the manufacture and use of products, simply from manufacturing, for the disposal of municipal solid waste. Each element is numbered with a corresponding number: 40, 41, 42.

| Payment | KBK |

| Disposal of production and consumption waste | 048 1 1200 120 |

| Disposal of production waste | 048 1 1200 120 |

| Disposal of municipal solid waste | 048 1 1200 120 |

KBC for negative impact on the environment

KBK for negative impact on the environment in 2018-2021

The BCC for companies transferring payments for environmental damage to the Russian budget is established, as in the case of all other budget classification codes, in Order of the Ministry of Finance of the Russian Federation dated July 1, 2013 No. 65n. In addition, the BCCs, which must be used by payers of harmful emissions in 2018-2021, are given in the letter of Rosprirodnadzor dated 04/11/2016 No. AS-06-01-36/6155 in a 20-digit format - in the way in which they must be indicated in payment documents.

For more information about what payments for environmental damage are, read the article “Payment for negative impact for 2018 - calculation”.

KBK for environmental harm: list from Rosprirodnadzor

Thus, the BSC for negative environmental impact in 2018-2021 has been established as follows:

- 048 1 1200 120 - code is used if environmental damage due to air pollution from stationary objects is paid for;

- 048 1 1200 120 — BCC is indicated in payments for harmful emissions into water bodies;

- 048 1 1200 120 - code is used when paying for the disposal of production and consumption waste;

- 048 1 1200 120 — KBC is involved if the company pays for environmental damage caused by the combustion of associated gas in specialized installations.

It should be noted that fees for environmental damage caused by transport vehicles have been abolished by the legislator since 2015, when the new version of Art. 28 of the Law “On the Protection of Atmospheric Air” dated May 4, 1999 No. 96-FZ, which states that payment is taken only for atmospheric emissions from stationary sources (letter of the Ministry of Natural Resources dated March 10, 2015 No. 12-47/5413).

To learn about the rates at which payments for environmental damage caused in 2021 are calculated, read the material “Declaration on NVOS in 2021 - payment rates.”

Results

Russian companies that, due to their business activities, cause harm to the environment, are obliged to transfer compensation to the state. In payment orders through which these payments are transferred to the budget of the Russian Federation, the correct BCC should be indicated. Traditionally, lists of them that payers need to track are published by Rosprirodnadzor.

Results

Russian companies that, due to their business activities, cause harm to the environment, are obliged to transfer compensation to the state.

In payment orders through which these payments are transferred to the budget of the Russian Federation, the correct BCC should be indicated. Traditionally, lists of them that payers need to track are published by Rosprirodnadzor. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

BCC (budget classification codes) for paying the environmental fee for the NVOS in 2021

In the process of carrying out commercial activities, many enterprises pollute the environment. After all, they not only use natural resources, but also release emissions into the atmosphere and water. In this regard, organizations pay a fee for the NVOS and an environmental fee. What budget classification codes are used?

Types of negative impacts

The regulation regulating the procedure for compensating for negative impacts on the environment is Federal Law No. 7 of January 10, 2002 “On Environmental Protection”. This norm states that NVOS is a paid phenomenon. The procedure for determining and collecting fees is established by the Government of the Russian Federation. Currently, it is prescribed in Decree of the Government of the Russian Federation No. 632 of August 28, 1992.

In practice, the following types of negative impact on the environment :

- emissions of pollutants into the atmosphere;

- discharges of harmful chemical elements into surface water sources and liquid intake areas;

- soil contamination;

- disposal of consumer and industrial waste;

- noise, thermal, electromagnetic, ionizing effects on the environment.

This is not a complete list of types of negative impacts, but it is the main one. Payment under the NVOS is not a fiscal fee, as stated in the provisions of the Constitutional Court of the Russian Federation (Definition No. 284-O of December 10, 2002).

List of codes from Rosprirodnadzor

According to Order of the Ministry of Finance of Russia No. 35n dated February 28, 2021, certain changes were made to the legislative norms. In accordance with them, the list of BCCs has been modified. The following digital combinations appeared in it.

- For the disposal of industrial waste . In the process of manufacturing products, companies are faced with leftover raw materials that will no longer be used in their activities. For this they pay a fee. The KBK looks like this: 048 1 1200 120 .

- For the disposal of MSW (municipal solid waste) . In the process of life, households (residents of apartment buildings and private houses) also generate waste. The BCC in relation to them is established in the following format: 048 1 12 01042 01 6000 120 .

If the atmosphere is polluted by stationary objects, the person responsible for this indicates the code 048 1 1200 120 . In case of non-compliance with norms and limits regarding water bodies, the value 01030 is indicated in fourth place in the combination.

When paying for the disposal of industrial and consumer waste - 01040. In case of compensation for damage caused to the environment caused by gas combustion - 01070. Compensation for damage caused by vehicles has been abolished since 2015, which made it possible to change the current legislative norms for the better.

Who makes the payments

The Decree of the Government of the Russian Federation No. 632 talks about the procedure in which the fee is established, as well as about the persons who pay it. The norm states that this requirement applies to legal entities of Russian and foreign origin who carry out activities on the territory of the Russian Federation if it involves the use of natural resources. There is no mention of individual entrepreneurs and individuals in the legislative norm.

In Determination No. 284-O dated December 12, 2002, the Constitutional Court of the Russian Federation stated that payment for NVOS must be made by absolutely all entities that have a negative impact on the environment , and individual entrepreneurs are no exception, even on UTII.

Mechanism for determining the fee amount

The base is:

- the volume of substances that are released into the atmosphere;

- the number of elements sent into the water or relief part of the area;

- mass of industrial waste disposed at sites.

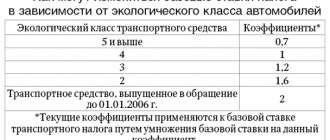

Record keeping should be carried out in relation to each type of pollutant and hazard class. The main part of the standard tariffs is prescribed in Decree of the Government of the Russian Federation No. 344 of June 12, 2003. Since 2014, there have been changes that are still relevant today. In this case, several coefficients are taken into account. An additional multiplier of 2 is used for specially protected areas.

The establishment of limits is temporary, solely within the period during which the taxpayer organizes measures to reduce emissions. If it is not possible to meet the specified parameters, the following scheme is used to determine the amount of payments :

- Calculation of the payment amount within the acceptable standard.

- Determining the amount of payment for the difference between the maximum norms and the established limits.

- Identification of the difference formed between emissions in fact and “on paper”.

- Multiplying the value obtained in point No. 3 by the differentiated rate. It, in turn, is determined on the basis of the key payment standard.

- All results obtained are added up.

Arbitrage practice

Waste generation occurs during economic activity, regardless of its type and direction. Previously, officials argued that when generating household waste, enterprises are required to make a payment. However, later the courts found that this opinion was incorrect.

As a result, Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation No. 14561/08 of March 13, 2009 appeared. The document notes that organizations and individual entrepreneurs that do not store and dispose of waste, but simply hand it over to a specialized company, do not pay the fee. However, they retain the obligation to comply with sanitary and epidemiological standards and regulations.

Thus, activities that entail a negative impact on the environment imply the need to pay appropriate environmental fees and contributions . You can determine their sizes by counting them yourself or using an electronic calculator.

How to calculate the fee for negative environmental impact? The answer is in the video below.

KBC for negative impact on the environment

Payments for such impacts on the natural environment are budget payments established by Federal Law No. 7-FZ of January 10, 2002 “On Environmental Protection”. In the article we will tell you about the BSC for negative impacts on the environment, and consider common codes.

Payment must be made for the following types of negative impacts:

- Air pollution from stationary objects;

- Pollution of water bodies;

- Storage and/or disposal of production and consumption waste.

Payment for negative impact on the environment must be transferred to the appropriate budget according to the budget classification of the Russian Federation.

Kbk 04811201010016000120 Rosprirodnadzor

The BCCs in force in 2021 for each type of impact are shown in Table 2 BCC codeName of payment048 1 1200 120 Payment for air pollution (atmospheric air) by stationary objects048 1 1200 120 Payment for air pollution (atmospheric air) by mobile objects048 1 1200 120 Payment for pollution of water bodies.

article: → "".

048 1 1200 120 Payment for the disposal of production and consumption waste048 1 1200 120 Payment for other types of negative impact on the environment048 1 12 01070 01 6000 120 Payment for emissions of pollutants generated during flaring and (or) dispersion of associated petroleum gas048 1 12 00 120Environmental feeQuestion No. 1.

Rosprirodnadzor

State duty KBK - 048 1 0800 110 - State duty for issuing a permit for the release of (pollutants) substances into the air at economic and other activity sites subject to federal state environmental control from stationary sources (RUB 3,500); KBK - 048 1 0800 110 - State fee for issuing a permit for the discharge of pollutants into the environment (3,500 rubles); KBK 048 1 0800 110 - State duty for issuing to authorized federal executive bodies a document approving standards for the generation of production and consumption waste and limits on their disposal (1,600 rubles), as well as for re-issuing and issuing duplicates of the specified document (350 rubles); KBK - 048 1 15 07010 01 6000 140 - “Fees paid by customers of documentation subject to state

advocatus54.ru

We were late with submitting the declaration on the negative impact on the natural environment.

BCC (budget classification codes) for payment of environmental fees for environmental assessments

New CBCs have appeared

on the fee for NVOS? What kind of CBC is this, is it necessary to use them, read about all this further.

More recently, information has already appeared on the websites of Rosprirodnadzor about the approval of new BCCs for paying for the NVOS in accordance with Order of the Ministry of Finance of Russia No. 35n dated February 28, 2018 “On amendments to the Instructions on the procedure for changes in the Instructions on the application of the budget classification of the Russian Federation, approved by order of the Ministry of Finance Russia dated July 1, 2013 No. 65n.”

The KBK themselves are as follows:

1. The list of codes for types of budget income and the corresponding codes of the analytical group of subtypes of budget income are supplemented with the following budget classification codes:

- 048 1 1200 120 – Fee for disposal of production waste;

- 048 1 1200 120 – Fee for disposal of municipal solid waste;

2. budget classification codes excluded:

- 048 1 1200 120 – Payment for emissions of pollutants into the atmospheric air by mobile objects;

- 048 1 1200 120 – Payment for the disposal of production and consumption waste;

- 048 1 1200 120 – Payment for other types of negative impact on the environment.

And no matter how strange it may sound, the Order of the Ministry of Finance of Russia No. 35n dated February 28, 2018 was still being registered with the Ministry of Justice of Russia back in April, and after registration the text of the order was changed. Time has passed and the new CSCs are already in full use.

Our specialists are always ready to help you prepare any environmental documentation, develop and approve an environmental impact assessment, and much more. Call!

- 04/02/2018 – 09:10 Ecological Center

Related Posts

Consequences of late payment of the tax payment?

What negative consequences may result from late or incomplete payment of fees for negative environmental impact, including quarterly advance payments?

On calculating the fee for tax assessment when placing MSW

Letter of the Ministry of Natural Resources No. 09-29/27331 dated October 23, 2017 “On calculating fees for the negative impact on the environment when disposing of MSW”

KBK NVOS for 2021: board features and scope

Payment for negative impact on the natural environment refers to payments to the state budget. Therefore, as in the case of other similar taxes, fees, deductions, payments for NVOS are assigned the appropriate BCC. This concept refers to the so-called budget classification code. This is a digital specially developed code that is used for accounting and subsequent grouping of various funds received by the state budget of the Russian Federation.

What does KBK NVOS mean and decoding of its components

The introduction of the BCC for NVOS, as well as other budget classification codes, was carried out by Order of the Ministry of Finance of the Russian Federation No. 54n, dated July 1, 2013. This document described the basic principles and rules for using budget codes, as well as the principle of their formation. But to include it in specific payment or reporting documents of a particular year, it is necessary to find updated information. For payment for the NVOS, the BCCs are contained in the Order of Rosprirodnadzor, published annually.

As noted above, budget classification codes are necessary both for making payments to the budget required by law and for filling out the required reporting. This applies to environmental payments and documentation in the same way as to all other budget payments.

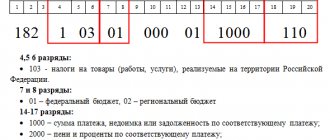

KBK NVOS is a sequence of 20 numbers, divided into several groups arranged in a certain order. Each of them carries some information about the payment. The decoding of the next KBK NVOS 2021 048 1 1200 120 is as follows:

- 048 1 means payment to the state budget under tax and non-tax revenues;

- 12 shows that we are talking about payments for the use of natural resources;

- 01010 allows funds to be attributed to the payment of polluting emissions into the atmosphere;

- 01 and the last three digits 120 mean that the payment under this BCC is made for the NVOS;

- the four digits between them can have one of four options: 1000 – if we are talking about a regular board;

- 2100 – in case of payment of accrued penalties;

- 3000 – when transferring the fine imposed in accordance with the decisions;

- 0000 – used for reporting.

Any KBK NVOS can be deciphered in a similar way, naturally, taking into account annual changes in specific figures. The payer of environmental fees does not need to worry about understanding where a specific figure comes from. It is quite enough to simply fill out the necessary payment and reporting documents correctly.

KBC fees for NVOS 2021

Every year, Rosprirodnadzor issues, based on a common Order of the Ministry of Finance, budget classification codes for environmental payments that will be applied in the next calendar period. The BCC of fees for NVOS in 2021 was contained in Order of the Ministry of Finance of the Russian Federation No. 190 dated December 1, 2015 and had the following form.

048 1 1200 120

Denotes payments to the state budget provided for the use of natural resources

048 1 1200 120

The BCC is used for payments for the tax assessment in 2021 and for the preparation of corresponding reports.

048 1 1200 120

This BCC is used when drawing up payment orders when paying the NVOS for emissions of stationary objects (the previously existing NVOS for mobile objects has been canceled since 2015 after appropriate changes were made to the current legislation)

048 1 1200 120

KBK is used to designate the fee for the NVOS for enterprises whose activities are related to harmful effluents into various water bodies

048 1 1200 120

The BCC should be included in payment documents when paying the NVOS, when the environmental management organization disposes of waste generated in the process of its activities

048 1 1200 120

Special KBK for enterprises that pay NVOS when burning associated gas in special installations

The corresponding Order of Rosprirodnadzor with the KBK of payment for the NVOS for 2017 No. AS-06-01-36/6155 was issued on 04/11/2016. They have almost the same appearance as the ones above.

The importance of correct application of the statutory BCC for NVOS is obvious. If this parameter is incorrectly specified, it is quite possible that problems will arise with government agencies, including the accrual of penalties or fines. Therefore, it is much more correct and easier to immediately fill out both reporting and various payment documents related to the transfer of funds to the budget, correctly and in accordance with existing requirements.

Using KBK for NVOS

The KBK system for payments to the budget, including for NVOS, is used to classify and account for funds received from taxes, fees and similar payments. Current domestic legislation requires payers to competently fill out both payment documents and reports submitted to various government agencies. One of these requirements is to indicate the correct budget classification code.

New KBK for 2021

You can find the KBK for 2021 and 2021 in separate materials.

From 01/01/2021, Order of the Ministry of Finance dated 07/01/2013 No. 65n, which approved the budget classification codes, loses force (Part 1 of the Letter of the Ministry of Finance dated 08/10/2018 N 02-05-11/56735). And in its place, the financial department has already issued a new KBK document (Order of the Ministry of Finance dated 06/08/2018 N 132n (hereinafter referred to as Order No. 132n)).

BCC changes in 2021

Despite the fact that the BCC 2021 was approved by a new document, the BCC for basic taxes and contributions remained unchanged, that is, the same as in 2021. In this regard, there is simply no point in listing the BCC changes in 2021 in a comparative table. But in the tables below you will find the BCCs that will be in effect in 2021.

KBK-2019

KBK for paying taxes for organizations and individual entrepreneurs on OSN

| Name of tax, fee, payment | KBK |

| Corporate income tax (except for corporate tax), including: | |

| 182 1 0100 110 |

| 182 1 0100 110 |

| VAT | 182 1 0300 110 |

| Property tax: | |

| 182 1 0600 110 |

| 182 1 0600 110 |

| Personal income tax (individual entrepreneur “for yourself”) | 182 1 0100 110 |

KBK for paying taxes for organizations and individual entrepreneurs in special modes

| Name of tax, fee, payment | KBK |

| Tax under the simplified tax system, when the object of taxation is applied: | |

| 182 1 0500 110 |

| 182 1 0500 110 |

| UTII | 182 1 0500 110 |

| Unified agricultural tax | 182 1 0500 110 |

KBC for insurance premiums

| Type of insurance premium | KBK |

| Insurance premiums for OPS | 182 1 0210 160 |

| Insurance premiums for VNiM | 182 1 0210 160 |

| Insurance premiums for compulsory medical insurance | 182 1 0213 160 |

| Insurance premiums for compulsory health insurance in a fixed amount (including 1% contributions) | 182 1 0210 160 |

| Insurance premiums for compulsory medical insurance in a fixed amount | 182 1 0213 160 |

| Additional insurance contributions to compulsory pension insurance for employees who work in conditions that give the right to early retirement, including: | |

| 182 1 0210 160 |

| 182 1 0220 160 |

| 182 1 0210 160 |

| 182 1 0220 160 |

| Insurance premiums for injuries | 393 1 0200 160 |

KBK for payment of other taxes for all organizations and individual entrepreneurs

| Name of tax, fee, payment | KBK |

| Personal income tax on income the source of which is a tax agent | 182 1 0100 110 |

| VAT (as tax agent) | 182 1 0300 110 |

| VAT on imports from Belarus and Kazakhstan | 182 1 0400 110 |

| Income tax on dividend payments: | |

| 182 1 0100 110 |

| 182 1 0100 110 |

| Income tax on the payment of income to foreign organizations (except for dividends and interest on state and municipal securities) | 182 1 0100 110 |

| Income tax on income from state and municipal securities | 182 1 0100 110 |

| Income tax on dividends received from foreign organizations | 182 1 0100 110 |

| Transport tax | 182 1 0600 110 |

| Land tax | 182 1 06 0603х хх 1000 110 where xxx depends on the location of the land plot |

| Fee for the use of aquatic biological resources: | |

| 182 1 0700 110 |

| 182 1 0700 110 |

| Water tax | 182 1 0700 110 |

| Payment for negative impact on the environment | 048 1 12 010x0 01 6000 120 where x depends on the type of environmental pollution |

| Regular payments for the use of subsoil, which are used: | |

| 182 1 1200 120 |

| 182 1 1200 120 |

| MET | 182 1 07 010хх 01 1000 110 where хх depends on the type of mineral being mined |

| Corporate income tax on income in the form of profits of controlled foreign companies | 182 1 0100 110 |

KBC for payment of penalties

As a general rule, when paying penalties in the 14th-17th categories, the value is “2100”. However, there is an exception to this rule:

| Type of insurance premium | KBK |

| Insurance premiums for OPS | 182 1 0210 160 |

| Insurance premiums for VNiM | 182 1 0210 160 |

| Insurance premiums for compulsory medical insurance | 182 1 0213 160 |

| Insurance premiums for mandatory insurance in a fixed amount, paid by individual entrepreneurs for themselves (including 1% contributions) | 182 1 0210 160 |

| Insurance premiums for compulsory medical insurance in a fixed amount, paid by individual entrepreneurs for themselves | 182 1 0213 160 |

| Additional insurance contributions to compulsory pension insurance for employees* who work in conditions entitling them to early retirement, including: | |

| 182 1 0210 160 |

* In 2021, there were 4 BCCs for paying penalties on additional contributions for periods starting from 01/01/2017, now only two remain | 182 1 0210 160 |

KBC for payment of fines

When paying a fine, as a rule, the 14th-17th digits take the value “3000”. But here we should not forget about exceptional cases:

| Type of insurance premium | KBK |

| Insurance premiums for OPS | 182 1 0210 160 |

| Insurance premiums for VNiM | 182 1 0210 160 |

| Insurance premiums for compulsory medical insurance | 182 1 0213 160 |

| Insurance premiums for mandatory insurance in a fixed amount, paid by individual entrepreneurs for themselves (including 1% contributions) | 182 1 0210 160 |

| Insurance premiums for compulsory medical insurance in a fixed amount, paid by individual entrepreneurs for themselves | 182 1 0213 160 |

| Additional insurance contributions to compulsory pension insurance for employees who work in conditions that give the right to early retirement, including: | |

| 182 1 0210 160 |

| 182 1 0210 160 |

New KBK from 2021: latest news

Currently, a document amending Order No. 132n (Order of the Ministry of Finance dated November 30, 2018 No. 245n) is being registered with the Ministry of Justice. When this document comes into force, the list of KBK will be replenished with new codes. Moreover, these new codes concern mainly ordinary individuals.

New BCCs for 2021 for individuals

The amendment order will introduce, in particular, BCC for payment of:

- tax on professional income (this tax must be paid by self-employed citizens) - 182 1 0500 110;

- single tax payment of an individual - 182 1 0600 110.

Sources: https://nalog-nalog.ru/ekologicheskij_nalog/kbk_na_negativnoe_vozdejstvie_na_okruzhayuwuyu_sredu/ https://znaybiz.ru/ecology/nalogi-i-sbory/kbk-dlya-platy-za-nvos.html https://online-buhuchet .ru/kbk-na-negativnoe-vozdejstvie-na-okruzhayushhuyu-sredu/ https://eco-cntr.ru/blog/novosti/primenyat-li-novye-kbk-po-oplate-za-nvos-ili-net https://xn--80ajpfhbgomfh1b.xn--p1ai/blog/othody/kbk-nvos-za-2016-osobennosti-platy-i-oblast-primeneniya/ https://glavkniga.ru/situations/k509353 https:/ /studme.org/1259060518765/ekologiya/plata_negativnoe_vozdeystvie_okruzhayuschuyu_sredu

KBC for 2021: current list of budget classification codes (table)

Cheat sheet for using budget classification codes

Budget classification codes (BCC) were introduced in order to streamline the flow of money into the budget and its expenditure. Using these codes, budget funds are grouped, including taxes and insurance contributions.

For example, all personal income tax receipts are divided into groups: personal income tax accrued by tax agents; Personal income tax accrued by entrepreneurs and other “private owners”; Personal income tax in the form of fixed advance payments on the income of non-residents, etc.

And for each of these groups there is a separate budget classification code.

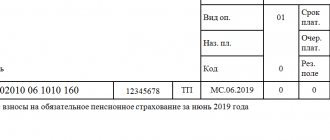

First of all, the BCC must be indicated in payment orders when transferring taxes, fees, penalties and fines. In the current form of payment, given in Appendix 3 to the Regulations of the Bank of Russia dated June 19.

12 No. 383-P, field 104 is intended for KBK (for more information about filling out a payment order, read the article “Instructions for filling out payment orders when paying taxes, penalties, fines, as well as contributions to extra-budgetary funds”). Please note that only one budget classification code can be specified in a payment order.

If you have to make payments related to two, three or more BCCs, you will have to issue two, three or more payments.

In addition, the BCC should be indicated in some tax returns: for income tax, for VAT, for transport tax, and also in the calculation of insurance premiums. This allows inspectors to record arrears of payment with one or another cash register company on the taxpayer’s personal account. As soon as the amount indicated by this BCC is received from this taxpayer, the debt will be repaid.

Read more

According to the Procedure for the formation and application of budget classification codes of the Russian Federation (approved by order of the Ministry of Finance dated 06.06.19 No. 85n), each BCC consists of 20 digits (they are called digits).

The first three digits are the code of the chief budget revenue administrator. For tax payments, insurance contributions (except for contributions “for injuries”) and state duties, this code takes the value “182”, for payments to the Social Insurance Fund “for injuries” - “393”.

The fourth, fifth and sixth digits show the income group. For income tax and personal income tax - this is “101”, for insurance premiums - “102”, for VAT and excise taxes - “103”, for property tax, transport and land taxes - “106”, for unified taxes with “simplified” , UTII and Unified Agricultural Tax - “105”, for state duty - “108”.

Digits seven through eleven are used to provide detail within each income group.

The twelfth and thirteenth categories show which budget the money will go to. If “01” is indicated, then the funds are intended for the federal budget, if “02”, then for the regional one. The values “06”, “07” and “08” mean the budgets of the Pension Fund, Social Insurance Fund and Compulsory Medical Insurance Fund, respectively. Values “03”, “04” and “05” are reserved for municipal budgets

The fourteenth to seventeenth digits show what exactly the taxpayer or policyholder is transferring: the main payment of the tax or contribution, penalties, fines or interest. For taxes and some types of contributions, in the case of the main payment indicate “1000”, in the case of penalties – “2100”, in the case of fines – “3000” and in the case of interest – “2200”.

The eighteenth, nineteenth and twentieth categories take the following values: when paying taxes and state duties it is “110”, when paying insurance premiums - “160”, when transferring payments for the use of subsoil or natural resources - “120”.

Kbk for taxes and contributions for past periods

The Ministry of Finance periodically makes changes to the list of existing BCCs. In particular, in 2021, the codes relating to insurance premiums, penalties and interest were updated (see “How the BCC for payment of insurance premiums will change from 2016”).

An accountant should remember one important rule: as soon as new BCC values appear, the previous values become ineffective and cannot be used.

When transferring a tax or contribution for the previous period, in the payment you must indicate the budget classification code, which is relevant now, and not in the previous period.

That is why, to fill out payment forms, it is better to use a web service, where all necessary updates are installed automatically, without user intervention, and the likelihood of making a mistake is negligible.

By the way, for some taxes there is a separate operating BCC for payments for past periods. An example is the single tax on imputed income. There is a current code that must be specified if in 2019 the “imputed” person transfers UTII for periods that expired before January 1, 2011. Similar codes have been introduced for the simplified tax system and the unified agricultural tax.

If a special BCC for payments for past periods is not provided, then the current code applies to all transfers regardless of the period. This applies, among other things, to income tax, VAT, personal income tax and insurance premiums.

The situation is exactly the same with the codes that must be indicated in updated declarations for previous periods.

If a taxpayer submits a “clarification” in 2021 for 2021 or earlier periods, he must enter the BCC effective in 2019.

Otherwise, it will turn out that the debt on the personal account is listed using an outdated code, but the payment was received using the current code. As a result, the debt will remain outstanding.

When filling out payments or declarations in a web service, an accountant or entrepreneur will not have to keep track of all these details. When specifying the type of tax, payment period and declaration status, the service simply will not allow you to indicate incorrect values.

What to do if the KBK is indicated with an error

In theory, an incorrectly indicated budget classification code on a payment slip (as well as an outdated BCC) does not mean that a tax or contribution has not been paid. This directly follows from Article 45 of the Tax Code of the Russian Federation. But in practice, the inspectorate and the treasury are not able to quickly figure out how to reflect an erroneous payment on a personal account. And until the payment is offset, the taxpayer will remain in arrears.

To rectify the situation, it is better to submit an application to the Federal Tax Service to clarify the payment, attaching a payment application with the bank’s mark.

Having received these documents, tax authorities will most likely conduct a reconciliation with the budget.

Based on its results, the auditors will credit the amount with the incorrect BCC to pay off the arrears (for more information about clarifying the payment, read the article “What to do if there is an error in the tax payment slip”).

If an error is made when filling out the declaration, then it is enough to submit a “clarification” with the correct BCC, and the incident will be resolved.

Elena Mavritskaya, leading expert at Online Accounting.