The site is a computer program (Article 1261 of the Civil Code of the Russian Federation). Therefore, creating a website means developing a special computer program.

An organization can develop a website on its own (including with the involvement of third-party specialists under a copyright agreement) or contact a specialized organization.

To open a website, in addition to developing a computer program, an organization must:

- register a website domain name;

- pay for hosting services - renting space on the provider’s server where the site will be hosted.

In the tax accounting of an organization, the costs of creating a website can be taken into account as part of:

- intangible assets;

- other expenses associated with production and sales (if the organization creates a website that is not an intangible asset by a third party);

- labor costs, purchase of materials and other expenses (if the organization creates a website that is not an intangible asset, using its own resources).

Depreciation

In tax accounting, the cost of creating a website worth over 100,000 rubles. write off through depreciation (clause 1 of article 256 of the Tax Code of the Russian Federation). On the procedure for writing off in tax accounting the costs of creating a website worth 100,000 rubles. and less, see What property is considered depreciable in tax accounting.

For more information on the rules for calculating depreciation on intangible assets, see the recommendations:

- How to determine the initial cost of an intangible asset in tax accounting;

- How to calculate depreciation of intangible assets using the straight-line method in tax accounting;

- How to calculate depreciation of intangible assets using the non-linear method in tax accounting.

Expense recognition date

If an organization uses the accrual method, reduce the tax base as expenses arise for creating a website (clause 1 of Article 272 of the Tax Code of the Russian Federation). For example, take into account the cost of materials after they are written off from the warehouse, and the salaries of employees in the month of accrual. It is at this moment that expenses are recognized as economically justified (clause 1 of Article 252 of the Tax Code of the Russian Federation).

If the organization uses the cash method, reduce the tax base provided that the expenses incurred are paid (clause 3 of Article 273 of the Tax Code of the Russian Federation). For example, materials used to create a website must not only be written off, but also paid to the supplier (subclause 1, clause 3, article 273, clause 5, article 254 of the Tax Code of the Russian Federation).

Income tax: domain registration

Situation: how to reflect the costs of registering a website domain name when calculating income tax?

The accounting treatment of a domain name depends on whether the site is an intangible asset or not.

The website domain name is not an object of intellectual property (the result of intellectual activity). In addition, as an independent object, a domain name is not capable of bringing economic benefits to an organization. Therefore, the domain name is not taken into account as a separate object of intangible assets (clause 3 of Article 257 of the Tax Code of the Russian Federation).

However, without a domain name, the site cannot function. Therefore, if a website is taken into account as part of intangible assets, the costs of the initial registration of a domain name should be included in its initial cost (clause 3 of Article 257 of the Tax Code of the Russian Federation). Consider the costs of subsequent domain name registration as part of other expenses (subclause 49, clause 1, article 264 of the Tax Code of the Russian Federation).

If the website is not an intangible asset, consider the costs of both the initial and subsequent registration of a domain name as part of other expenses (subclause 49, clause 1, article 264 of the Tax Code of the Russian Federation).

If an organization uses the accrual method, then the costs of subsequent domain name registration are taken into account evenly over the entire term of the contract. If such a period is not specified in the agreement, then the costs can be taken into account at a time (i.e. at the moment when the registration authority issued documents to the organization confirming the re-registration of the domain name for a new period) (subclause 3, clause 7, article 272 Tax Code of the Russian Federation). If an organization uses the cash method, then an additional condition for recognizing the costs of re-registration of a domain name is their payment (clause 3 of Article 273 of the Tax Code of the Russian Federation).

This position is confirmed by the tax service (see, for example, letter of the Federal Tax Service of Russia for Moscow dated January 17, 2007 No. 20-12/004121).

Inclusion in the NMA

If all exclusive rights to the site belong to the organization (and not the developers), then it can be taken into account as part of intangible assets. In this case, other conditions listed in paragraph 3 of PBU 14/2007 must be observed. Namely:

- exclusive rights to the site are confirmed by documents (for example, an agreement with an employee involved in the development of the site; an official assignment for the creation of a site; an author's order agreement with a third-party specialist; an act of acceptance and transfer of the exclusive right, etc.);

- the organization does not plan to transfer (sell) exclusive rights to the site in the next 12 months;

- the site is used in the production of products (works, services) or for management needs;

- using the site may bring economic benefits (income);

- the period of use of the site exceeds 12 months;

- the initial cost of the site can be determined.

There are no cost restrictions for including a website among intangible assets in accounting. It is also not necessary to register exclusive rights to a website with Rospatent (Article 1262 of the Civil Code of the Russian Federation).

Income tax: advertising on the website

Situation: is it possible to take into account the costs of creating a website as part of advertising costs when calculating income tax? The website contains advertising information of the organization. A website is not an intangible asset.

Yes, you can.

If an organization’s advertising information is posted on a website, the organization has the right to take into account the costs of its creation as part of advertising costs (clause 4 of Article 264 of the Tax Code of the Russian Federation). Moreover, for calculating income tax, such expenses are accepted without restrictions. This is due to the fact that the Internet is classified as telecommunication networks (Part 8 of Article 28 of the Law of March 13, 2006 No. 38-FZ). And expenses for advertising distributed through telecommunication networks are not standardized when calculating income tax (paragraph 5, paragraph 4, article 264 of the Tax Code of the Russian Federation).

A similar point of view is reflected in letters of the Ministry of Finance of Russia dated January 29, 2007 No. 03-03-06/1/41, dated March 12, 2006 No. 03-03-04/2/54, Federal Tax Service of Russia for Moscow dated 26 August 2005 No. 20-08/60490.

An example of how the costs of creating a website are reflected in accounting and tax purposes. The organization applies a general taxation system. The organization does not have exclusive rights to the website

Alpha LLC decided to create its own website. Work on creating the site was carried out by a third party. The cost of website development was 45,000 rubles. (including VAT – 6864 rubles). The development of the site was completed (the work acceptance certificate was signed) in January 2021. Exclusive rights to the site belong to the developer organization. The site is used to post general information about the organization. According to the agreement concluded with the copyright holder, the period during which Alfa has non-exclusive rights to the site is 10 years (120 months).

Alpha pays income tax monthly and uses the accrual method to calculate tax.

Alpha's accountant reflected the costs of creating the website as follows.

In January 2021:

Debit 97 Credit 60 – 38,136 rub. (RUB 45,000 – RUB 6,864) – the costs of creating the website are reflected as deferred expenses;

Debit 19 Credit 60 – 6864 rub. – VAT is taken into account on the cost of work on creating the website;

Debit 68 subaccount “Calculations for VAT” Credit 19 – 6864 rub. – VAT is accepted for deduction on the cost of work on creating a website;

Debit 012 “Intangible assets received for use” – 45,000 rubles. – the cost of rights to the website received for use is taken into account.

In accounting, the costs of creating a website will be written off over 10 years. Every month, Alpha’s accountant will record:

Debit 26 Credit 97 – 318 rub. (RUB 38,136: 120 months) – part of the costs for creating the website for the current month was written off as expenses.

In tax accounting, the costs of creating a website are also recognized evenly over the period of use (10 years). Therefore, every month from January 2021 to December 2025 (inclusive), the accountant will contribute the costs of creating a website in the amount of 318 rubles. included in other expenses.

Accounting for the creation of an Internet site

Organizations use the Internet for a variety of purposes. Some people need it to receive this or that information, others to communicate with clients, others to advertise their own products. There are two ways to post information on the Internet about the activities of an organization, its products, as well as advertising of manufactured goods (works, services): by creating a web page or a website.

A web page is one page (in one window).

A website is many pages, with a certain structure, different sections, hyperlinks, and other features (forum, guest page, newsletters, galleries).

The page can be part of a website. And the site, in turn, can consist of one page.

The web page mainly contains information about the activities of the organization, its products, as well as advertising of the goods (works, services) produced. Creating a web page means placing a file or group of files pre-written in a specific format on the provider’s server.

The advantage of a web page is the low cost of its creation and maintenance. The development of design, layout, writing programs, updating information is mainly carried out by the organization's programmers, but much more often this work is performed by specialized companies.

Creating a website begins with developing the design, its structure, operating principle, and information arrangement. At the same time, the necessary software is selected. This is mainly done by professional web designers.

In the future, information and software can be maintained by the organization itself. Creating a website gives the organization more opportunities; it can host standard and specialized software, visual images of products, and price lists. This allows you to attract the largest number of customers.

After the work of web designers, it is necessary to create a domain name for the site, and it must be registered. After which the site must be placed on the Internet, the user must have access to the server on which the site is hosted.

Note!

An Internet site is an object of copyright, and it is at least a combination of two objects of copyright:

— computer programs that ensure its functioning;

— graphic solution (design).

Therefore, for tax and accounting purposes, as well as when determining the legal status of a site, it must be considered as a single object. This is due to the fact that the constituent elements of the site cannot perform their functions separately from each other.

Property rights to the site.

According to the Law of the Russian Federation of July 9, 1993 No. 5351-1 “On Copyright and Related Rights” (hereinafter referred to as the Copyright Law), in relation to objects of copyright, the author owns personal non-property and property rights.

Personal rights can belong only to the author, that is, they cannot be transferred by contract, while property rights can be alienated.

Property rights to an object of intellectual property can be transferred only under an author's agreement, as established by Article 30 of the Copyright Law. Within the framework of this law, in practice, the issue of transferring property rights to the website being created can be resolved by concluding an author’s order agreement with a specialized organization.

The agreement must indicate the specific property rights that the organization receives. In paragraph 2 of Article 31 of the Copyright Law there is the following wording:

«rights not directly transferred under the copyright agreement are considered not transferred.”

And paragraph 1 of Article 31 of the Copyright Law states that the section of the agreement devoted to the transfer of property rights must necessarily indicate the period and territory of use for which these rights are transferred. Otherwise, the agreement is considered concluded for five years, and the territory for the use of rights will be only the territory of the Russian Federation. Moreover, it is advisable to indicate in the contract that the transferred rights are used without limiting the territory. Then providing the ability to download and open the site to users located abroad will be legal. As for the period for which rights are transferred, it can be unlimited.

Exclusive (non-exclusive) rights to site elements.

If the author (and he owns the exclusive rights to use his development in any form) transfers exclusive rights to an organization, this means that only it can use them and has the right to prohibit their use by other persons, including the author himself. This is stated in paragraph 2 of Article 31 of the Copyright Law. If non-exclusive rights are transferred, then they can be used by the customer organization, other persons to whom the author (holder of exclusive rights) transferred the same non-exclusive rights, and the author himself. This is permitted by Section 31 of the Copyright Act.

What rights are transferred - exclusive or non-exclusive - must be stated in the contract. If there is no such indication, the transferred rights will be considered non-exclusive. This is established in paragraph 4 of Article 30 of the Copyright Law.

An organization can obtain exclusive rights to a website in another way. As follows from Article 14 of the Copyright Law, these rights will belong to her in the event that the site is developed by employees who are in an employment relationship with her. Of course, unless otherwise provided in the agreements between them and the organization.

Websites can be created for both production and advertising purposes.

The functioning of the site is ensured by a computer program. It is the main element on which the accounting of the site as a whole depends.

If an organization has acquired exclusive rights to use a software product, and they are properly documented, it accounts for the created website as an intangible asset in both tax and accounting.

Accounting for the costs of creating a website on the Internet.

Accounting for the costs of creating a website depends on whether the organization receives exclusive rights to these intellectual property objects (computer programs) or not.

An organization that acquires exclusive rights to a created website must have a document confirming the right to an object of intellectual property (certificate of official registration).

If an organization has acquired exclusive rights to use a software product, it accounts for the created website in accounting as intangible assets (hereinafter intangible assets) (clause 4 of Order of the Ministry of Finance of the Russian Federation dated October 16, 2000 No. 91n “On approval of the accounting regulations “Accounting for intangible assets” "PBU 14/2000" (hereinafter referred to as PBU 14/2000).

The costs of creating a website will be the initial cost of this intangible asset. Moreover, this does not depend on who developed the site - employees of the organization or a specialized company. The costs of creating a website include expended material resources, third-party services, patent fees, remuneration of programmers, and the like. VAT amounts are not included in the initial cost.

The useful life of a website in accounting is determined based on the validity period of the patent, certificate and other restrictions on the terms of use of intellectual property.

If the useful life of the site cannot be determined, then, according to paragraph 17 of PBU 14/2000, it is taken equal to 20 years, but not more than the life of the organization.

In accounting, depreciation for a site is calculated from the 1st day of the month following the month in which it was accepted for accounting as intangible assets (clause 18 of PBU 14/2000). A website is accepted for registration upon completion of work on its creation, at the time it is posted on the Internet.

Example 1.

Programmers of a trade organization, as part of their official duties, developed software for the organization’s website. The employer received all exclusive rights to use the program for an indefinite period. Accounts it as an intangible asset. The useful life for accounting purposes is determined to be 60 months. This was confirmed by an order from the head of the organization.

The organization incurred the following expenses in connection with the creation of the website.

The salary of programmers for the entire period of website creation is 25,000 rubles.

Unified social tax accrued from the salaries of programmers - 5,333 rubles.

Insurance contributions for compulsory pension insurance – 3,500 rubles.

Contributions for compulsory social insurance against accidents at work - 100 rubles.

Depreciation of fixed assets involved in the development of the site is 3,000 rubles.

Material costs – 1,500 rubles (excluding VAT).

In accounting, operations to create a website are reflected as follows:

| Account correspondence | Amount, rubles | Contents of operation | |

| Debit | Credit | ||

| 08-5 | 70 | 25 000 | The costs of creating a website are reflected (programmers’ salaries) |

| 08-5 | 69 | 8 933 | The costs of creating the site are reflected (UST, accrued from the salaries of programmers, insurance contributions for compulsory pension insurance, contributions for compulsory social insurance against accidents at work) |

| 08-5 | 02 | 3 000 | The costs of creating the site are reflected (depreciation of fixed assets involved in the development of the site) |

| 08-5 | 10 | 1 500 | The costs of creating a website are reflected (material costs) |

| 04 | 08-5 | 38 433 | The site is reflected as part of the intangible assets |

| 44 | 05 | 640,55 | Depreciation has been calculated for the site (38,433/60 months) |

End of the example.

If an organization does not receive exclusive copyrights to a website, it should take into account the costs incurred in accounting in the same way as the costs of acquiring non-exclusive rights to use a software product. That is, as expenses for ordinary activities, in accordance with paragraph 5 of PBU 10/99, as other expenses.

However, in accordance with paragraph 18 of PBU 10/99, which enshrines in accounting the principle of temporary certainty of facts of economic activity, the costs in question must be included in deferred expenses.

According to the Chart of Accounts, initially the costs of creating a website are included in deferred expenses, reflected in account 97 “Deferred Expenses”. Such expenses can be written off as expenses evenly, in proportion to the volume of manufactured or sold products and in other ways during the period to which they relate (clause 65 of Order of the Ministry of Finance of the Russian Federation dated July 29, 1998 No. 34n). In this case, they are included in expenses for ordinary activities during the period of use of the software product specified in the contract with the supplier, or (if there is no such indication in the contract or the software product was created by the organization itself) during the period established by order of the head of the organization.

The procedure for writing off deferred expenses is reflected in the accounting policies of the organization.

Accounting for the costs of a created website depends on whether it is advertising in nature or not. If it contains information of an advertising nature, then advertising costs can be accounted for in a separate sub-account “Advertising expenses”, opened to account 44 “Sales expenses”.

Example 2.

The organization Mega LLC entered into a copyright agreement with a specialized company to create an Internet site. For the development of the design, Mega LLC paid 21,240 rubles (including VAT - 3,240 rubles), for the software used for the site - 24,780 rubles (including VAT 3,780 rubles).

The terms of the agreement provide for the transfer of all exclusive rights to the site design for a period of five years without limiting the territory of use.

For the software developed for the site, Mega LLC received non-exclusive rights to reproduce, distribute and process without limiting the territory of use - also for a period of five years. Mega LLC received non-exclusive rights to the software, therefore, it cannot take the site into account as part of the intangible assets.

The accountant of Mega LLC makes the following entries:

| Account correspondence | Amount, rubles | Contents of operation | |

| Debit | Credit | ||

| 08 -5 | 60 | 18 000 | The costs of creating intangible assets are reflected |

| 19 | 60 | 3 240 | VAT included for design development |

| 04 | 08 | 18 000 | The exclusive right to design is reflected as part of the intangible assets |

| 68 | 19 | 3 240 | Accepted for VAT deduction |

| 97 | 60 | 21 000 | The costs of creating a website are reflected as deferred expenses. |

| 19 | 60 | 3 780 | VAT is included on the cost of work on creating the website software |

| 68 | 19 | 3 780 | Accepted for VAT deduction |

| 60 | 51 | 46 020 | The cost of the work of CJSC "Programmer" is reflected |

| Then, every month for five years, the accountant of Mega LLC makes the following entries: | |||

| 04 | 05 | 300 | Depreciation of intangible assets has been calculated (18,000/60 months). |

| 44 | 97 | 350 | Included in costs 1/60 of the cost of software |

End of the example.

The organization's expenses paid for updating the site are recognized in accounting as expenses for ordinary activities.

Example 3.

In July of this year, the organization incurred expenses to update the website intended for advertising purposes. The update is necessary to change the range of goods sold, as well as to establish trade discounts.

According to the agreement with the company carrying out the work to update the site, the cost of the work was 12,000 rubles (including 18% VAT - 1,831 rubles).

| Account correspondence | Amount, rubles | Contents of a business transaction | |

| Debit | Credit | ||

| 44 | 60 | 10 169 | The organization's expenses for updating the organization's website are reflected (12,000 rubles - 1,831 rubles) |

| 19 | 60 | 1 831 | VAT is taken into account on the cost of updating the site |

| 68 | 19 | 1 831 | Accepted for deduction of VAT on the cost of website updating work |

| 60 | 51 | 12 000 | Paid for work to update the site |

End of the example.

Tax accounting of expenses for creating a website on the Internet .

If an organization has acquired exclusive rights to use a software product, then the organization accounts for the created website in tax accounting as intangible assets.

According to Article 257 of the Tax Code of the Russian Federation, intangible assets acquired and (or) created by the taxpayer are the results of intellectual activity or other objects of intellectual property (exclusive rights to them) used in the production of products (performance of work, provision of services) or for the management needs of the organization.

For profit tax purposes, the initial cost of a website as an intangible asset is determined from the actual costs of its acquisition (creation) and bringing it to a state suitable for use, excluding VAT and excise taxes, except in cases provided for by the Tax Code of the Russian Federation.

Paragraph 5 of Article 270 of the Tax Code of the Russian Federation states that expenses for the acquisition and (or) creation of depreciable property are not taken into account when determining the tax base for corporate income tax. You can only take into account the costs associated with creating a website by including them in the cost of this intangible asset and repay it by calculating depreciation.

The useful life of a website in tax accounting is determined based on the validity period of the patent, certificate and (or) other restrictions on the terms of use of intellectual property, as well as from the terms of use specified in the contract. If it is impossible to determine the useful life, then, according to paragraph 2 of Article 258 of the Tax Code of the Russian Federation, the useful life is taken equal to 10 years, but not more than the life of the organization itself.

The organization's expenses for creating a website through which it sells its goods (work, services) comply with the requirements of Article 252 of the Tax Code of the Russian Federation - are economically justified and aimed at generating income. For tax purposes, they are recognized as depreciation is calculated.

Moreover, if the site contains exclusively advertising information, then in this case, depreciation accrued during its use is classified as advertising expenses for profit tax purposes in accordance with subparagraph 28 of paragraph 1 of Article 264 of the Tax Code of the Russian Federation. As follows from paragraph 4 of the same Article 264 of the Tax Code of the Russian Federation, advertising expenses include, in particular, expenses for advertising events through telecommunication networks. Such expenses are not standardized. Consequently, the amount of accrued depreciation for the reporting (tax) period fully reduces the tax base.

Organizations using the accrual method recognize depreciation as an expense on a monthly basis, in accordance with paragraph 3 of Article 272 of the Tax Code of the Russian Federation:

“Depreciation is recognized as an expense on a monthly basis based on the amount of accrued depreciation, calculated in accordance with the procedure established by Articles 259 and 322 of this Code.”

Organizations using the cash method - in amounts accrued for the reporting (tax) period only for paid-for depreciable property (subclause 2 of clause 3 of Article 273 of the Tax Code of the Russian Federation):

“depreciation is taken into account as an expense in the amounts accrued for the reporting (tax) period. In this case, depreciation is allowed only for depreciable property used in production, paid for by the taxpayer. A similar procedure applies to capitalized expenses provided for in Articles 261 and 262 of this Code.”

According to paragraph 2 of Article 258 of the Tax Code of the Russian Federation, depreciation for the site is calculated from the 1st day of the month following the month in which it was put into operation. In this case, the moment of commissioning of the site is considered the moment of its placement on the Internet.

If the site is not an intangible asset, advertising expenses for income tax purposes include the costs of its creation, taken into account as expenses at a time or evenly depending on the period for which non-exclusive rights to the software are granted.

Creation of a website on the Internet, which contains information about the organization and its products; all costs of creating the website and its support are classified as advertising expenses. This position is also stated in the Letter of the Department of Tax Administration for the city of Moscow dated May 7, 2003 No. 26-12/25025. Moreover, it is necessary to separate costs that are taken into account at a time (website creation) and costs that should be taken into account during the term of the contract (website support).

Domain name registration.

Let us dwell in more detail on the issues of accounting for costs associated with assigning a domain name.

The website is assigned a domain name.

If an Internet user does not have his own website, then such a user will not have a domain name.

A domain name is assigned to a site without fail after the site is created. This name must be unique and must give an idea of the name of the organization and the products that the organization produces. The autonomous non-profit organization "Regional Network Information Center" carries out mandatory registration of domain names. Domain name registration is the entry of information about the domain and its administrator into a central database to ensure unique use of the domain.

The validity period of domain name registration is one calendar year. At the end of the year, it must be extended for the next year and so on.

The procedure for registering and using a domain name is enshrined in the Law of the Russian Federation of September 23, 1992 No. 3520-1 “On Trademarks, Service Marks and Appellations of Origin of Goods.”

Article 4 of this Law introduces a ban on the use by others of a trademark on the Internet, in particular a domain name. With this, the Law of the Russian Federation of September 23, 1992 No. 3520-1 “On Trademarks, Service Marks and Appellations of Origin of Goods” solves a legal problem that has led to numerous legal disputes.

The essence of the problem is as follows. A domain name makes it easy to find the site you need on the Internet. The owner of a resource chooses a domain name in such a way that one can judge the name of his company, activity, product produced, and so on.

As we have already noted, those who want to create their own website on the Internet must register a domain name with the autonomous non-profit organization “Regional Network Information Center”. When registering, the name is checked for uniqueness in the database of already assigned names. Until now, no verification of the similarity of a registered domain name to any trademark has been carried out. After all, in Russian legislation there were no such restrictions on the choice of name.

As a result, foreign trademarks were often registered as domain names (Resolution of the Federal Antimonopoly Service of the Moscow District dated May 31, 2004 in case No. KG-A40/4075-04-P, Resolution of the Federal Antimonopoly Service of the Ural District dated July 8, 2004 in case No. F09-2072 /2004-GK).

The Supreme Arbitration Court of the Russian Federation tried to solve this problem (Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated January 16, 2001 No. 1192/00). In their Resolution, the judges noted that today domain names actually serve as a trademark, allowing one to distinguish the goods or services of some business entities from similar goods or services of other entities. Therefore, the deliberate registration as domain names of well-known brands that do not contain a means of individualizing the subject as a participant in economic turnover, inherently leads to a violation of the rights of the owner of the trademark.

Now the ban on using someone else’s trademark as a domain name is clearly stated in paragraph 2 of Article 4 of the Law of the Russian Federation of September 23, 1992 No. 3520-1 “On Trademarks, Service Marks and Appellations of Origin of Goods.”

Let's consider how to correctly take into account the costs associated with assigning a domain name and registering it with an organization that has created its own website on the Internet.

Although the legal nature of a domain is close to the nature of a trademark, the domain cannot be identified with a trademark, which is confirmed by judicial practice on the legality of using domains similar to trademarks.

A domain is neither a means of individualizing a legal entity, nor a means of individualizing any products (works, services), such as, for example, a trademark.

The main purpose of creating domains on the Internet is to differentiate different areas of the information space.

A domain name is also not a product of intellectual activity. Accordingly, the costs of registering a domain name cannot be considered expenses for the acquisition of an intangible asset, since they do not meet the conditions specified in paragraph 3 of PBU 14/2000.

These expenses, in our opinion, should be classified as expenses for ordinary activities in accordance with paragraph 5 of PBU 10/99 as other expenses, which should initially be taken into account as deferred expenses, and then (during the domain registration period, which , as a rule, is a calendar year) to be written off evenly as expenses for ordinary activities.

Note that a similar point of view is reflected in the Letter of the Ministry of Finance of the Russian Federation dated March 26, 2002 No. 16-00-14/107 “On the actual costs associated with registering a domain name in ROSNIIROS”:

“In connection with the letter, the Department of Accounting Methodology and Reporting informs that in accordance with the requirements of the Accounting Regulations “Accounting for Intangible Assets”, PBU 14/2000, approved by Order of the Ministry of Finance of the Russian Federation dated October 16, 2000 No. 91n, the registered domain name does not apply to intangible assets. Actual expenses associated with registering a domain name in RosNIIROS are recognized as expenses of the organization for accounting purposes.”

Thus, the actual costs associated with registering a domain name are recognized as expenses of the organization for accounting purposes.

For tax purposes, the costs of registering a domain name, in our opinion, should be classified as costs associated with production and sale as costs for information system services (SWIFT, Internet and other similar systems), in accordance with subclause 25 of clause 1 of Article 264 of the Tax Code of the Russian Federation.

If an organization places advertising information on the website, then, in accordance with subparagraph 28 of paragraph 1 of Article 264 of the Tax Code of the Russian Federation, taking into account paragraph 4 of Article 264 of the Tax Code of the Russian Federation, the costs are classified as other expenses associated with production and sales.

According to paragraph 4 of Article 264 of the Tax Code of the Russian Federation:

"4. An organization's advertising expenses for the purposes of this chapter include:

expenses for advertising events through the media (including advertisements in print, radio and television broadcasts) and telecommunication networks;

expenses for illuminated and other outdoor advertising, including the production of advertising stands and billboards;

expenses for participation in exhibitions, fairs, expositions, for the design of shop windows, sales exhibitions, sample rooms and showrooms, production of advertising brochures and catalogs containing information about goods sold, work performed, services provided, trademarks and service marks, and ( or) about the organization itself, for the discounting of goods that have completely or partially lost their original qualities during exhibition.

The taxpayer's expenses for the acquisition (production) of prizes awarded to the winners of drawings of such prizes during mass advertising campaigns, as well as expenses for other types of advertising not specified in paragraphs two - four of this paragraph, carried out by him during the reporting (tax) period, for for tax purposes are recognized in an amount not exceeding 1 percent of the proceeds from sales, determined in accordance with Article 249 of this Code.”

Moreover, since the period during which an organization uses a unique domain name is defined in the agreement (usually a calendar year), the costs of its registration should be taken into account for tax purposes evenly over the specified period.

Thus, the registered domain name itself cannot be reflected in accounting as a separate object of intangible assets, since it is not the result of intellectual activity, as required when determining whether it belongs to intangible assets, paragraph 3 of Article 257 of the Tax Code of the Russian Federation and PBU 14/2000.

In this situation, two options are possible:

1) If the Internet site has just been opened, received registration documents as a software product, and the initial registration of the domain name has been carried out.

In this case, all costs associated with the assignment and registration of a domain name will be included in the initial cost of the site as an intangible asset.

Without a domain name, neither the organization nor third-party users will be able to use the site. In accordance with Article 257 of the Tax Code of the Russian Federation, the initial cost of depreciable intangible assets includes all expenses for their acquisition and bringing them to a state in which they are suitable for use. Therefore, the costs of the initial registration of a domain name, without which the site cannot function, are taken into account in the initial cost of the intangible asset.

Example 4.

The organization has created a website on the Internet.

For the development of the site, under an agreement with a specialized organization, 29,500 rubles were paid, including VAT 18% - 4,500 rubles.

For the initial registration of a domain for a year, the organization paid the registrar company 1,180 rubles, including 18% VAT - 180 rubles.

The organization owns the exclusive right to this software package, which has properly executed documents.

The following entries will be made in the organization's accounting records:

| Account correspondence | Amount, rubles | Contents of operation | |

| Debit | Credit | ||

| 60 | 51 | 29 500 | Paid for website development |

| 08-5 | 60 | 25 000 | Costs for website development are reflected |

| 19 | 60 | 4 500 | VAT included |

| 60 | 51 | 1 180 | Paid domain name registration |

| 08-5 | 60 | 1 000 | Costs for initial domain registration are taken into account |

| 19-2 | 60 | 180 | VAT included |

| 04 | 08-5 | 26 000 | The site was put into operation |

| 68 | 19 | 4 680 | Accepted for VAT deduction |

End of the example.

2) If a domain name is re-registered.

The costs of domain name re-registration are recognized as current expenses of the organization. Domain name re-registration is carried out annually. It provides the organization with the opportunity to retain a specific name for its website on the Internet. Re-registration of a domain name does not lead to a change in the quality characteristics of the Internet site and therefore does not affect its initial cost.

The costs of re-registering a domain name for tax purposes are included among other costs associated with production and sales.

Organizations that determine income and expenses on an accrual basis reduce their taxable income monthly during the life of the domain name registration. But this is only true if the contract specifies the period for which registration is carried out. If such a period is not specified, expenses are taken into account at a time.

Organizations using the cash method also reduce taxable income either lump sum or monthly, depending on whether the registration period is specified in the agreement, but only if these expenses are paid.

For accounting purposes, expenses for the initial registration of a domain name are taken into account in the same manner as in tax accounting. They are included in the initial cost of the Internet site as intangible assets in accordance with paragraph 6 of PBU 14/2000.

The costs of subsequent re-registration of the site in accounting are included in deferred expenses. Such expenses, in accordance with paragraph 8 of PBU 10/99, are classified as other expenses for ordinary activities. They should be written off to cost accounts on a monthly basis.

Example 5.

The organization paid for the re-registration of the domain name for the next period (12 months) in the amount of 708 rubles, including VAT 18% - 108 rubles.

The following entries will be made in the organization's accounting records:

| Account correspondence | Amount, rubles | Contents of operation | |

| Debit | Credit | ||

| 60 | 51 | 708 | Paid domain name registration |

| 97 | 60 | 600 | Domain re-registration costs included |

| 19 | 60 | 108 | VAT included |

| 68 | 19 | 108 | Accepted for VAT deduction |

| 20 | 97 | 50 | Expenses for domain re-registration are included in cost |

VAT of all conditions provided for in Articles 171 and 172 of the Tax Code of the Russian Federation.

End of the example.

Hosting services.

After creating a website and registering a domain name, an organization must enter into an agreement with the provider for hosting services (disk space rental). Providers, for a fee established by the contract, provide the organization with disk space on their server, permanently connected to the Internet, to host a website on it, and also provide site administration, including its technical maintenance and registration in various Internet search engines.

Thus, the organization is obliged to enter into a contract for the provision of paid services (hosting services) with an Internet provider.

In accordance with current legislation, a service is an action carried out on order and in many cases does not have a material result.

Let us remind you that organizations providing communication services are guided by the provisions of Chapter 39 of the Civil Code of the Russian Federation “Paid provision of services”:

Consequently, the provision of communication services is carried out by the provider under a service agreement, under which, in accordance with Article 779 of the Civil Code of the Russian Federation, the contractor undertakes, on the instructions of the customer, to provide services (perform certain actions or carry out certain activities), and the customer undertakes to pay for these services.

When concluding a hosting agreement, the provider does not represent the interests of communication organizations in relations with clients, does not carry out their instructions and does not receive remuneration from them. Consequently, the provider, when fulfilling an agreement for the provision of communication services, is not an intermediary between communication organizations and its clients - Internet users, therefore, the activities of providers to provide access to the Internet within the framework of a paid service agreement concluded with a client - Internet user are not qualified as mediation activities.

Accounting.

In accounting, hosting costs are included as other costs for ordinary activities.

After concluding a hosting agreement, the organization transfers a monthly fee for services to the provider, the costs of which are written off to account 44 “Sales expenses” in the month for which the hosting services were paid.

Tax accounting.

For profit tax purposes, expenses for hosting services are classified as other expenses related to production and sales.

If the information posted on the website is of an advertising nature, then these expenses are taken into account as advertising in accordance with subparagraph 28 of paragraph 1 of Article 264 of the Tax Code of the Russian Federation:

“Article 264. Other expenses associated with production and (or) sales

1. Other expenses associated with production and sales include the following expenses of the taxpayer:

………

28) expenses for advertising produced (purchased) and (or) sold goods (works, services), activities of the taxpayer, trademark and service mark, including participation in exhibitions and fairs, taking into account the provisions of paragraph 4 of this article”;

If the information posted on the site is not of an advertising nature, then, according to subparagraph 49 of paragraph 1 of Article 264 of the Tax Code of the Russian Federation, costs for hosting services are included in other costs associated with production and (or) sales.

In accordance with subparagraph 3 of paragraph 7 of Article 272 of the Tax Code of the Russian Federation, expenses for hosting services are recognized in tax accounting on the date of settlements under the terms of concluded contracts, on the date of presentation of settlement documents to the organization, or on the last day of the reporting (tax) period.

“Input” VAT presented to the organization by providers is accepted for deduction in the generally established manner, subject to the requirements established by Articles 171 and 172 of the Tax Code of the Russian Federation.

Income tax: modernization

Situation: how to take into account the costs of upgrading a program (website) when calculating income tax? The program is accounted for as an intangible asset (the organization owns exclusive rights to the website).

Depending on the nature of the work being carried out, the costs of upgrading the website may be accounted for as a separate intangible asset or as the cost of updating programs.

This is explained as follows.

The site is a computer program (Article 1261 of the Civil Code of the Russian Federation). Upgrading a computer program should mean changing it. There are two types of modernization: adaptive and complete. With adaptive modernization, minor changes are made to a computer program to ensure its functionality. Complete modernization (modification) leads to the separation of the updated program into a separate object. This is stated in paragraphs 4.1, 4.5, 4.10 of GOST R ISO/IEC 14764-2002, adopted and put into effect by Resolution of the State Standard of Russia dated June 25, 2002 No. 248-st.

Thus, modification of the site, which involves changing its program code, leads to the emergence of a new object of copyright (subclause 9, paragraph 2, article 1270 of the Civil Code of the Russian Federation). That is, having modernized (reworked) the site, the organization created a new (derivative) work based on an existing one, namely a new site.

The Tax Code does not provide for a change in the initial value of intangible assets in the event of its modernization (letter of the Ministry of Finance of Russia dated December 13, 2011 No. 03-03-06/1/819).

If the new site meets the requirements for intangible assets, then take it into account as part of the intangible assets in the amount of the modernization carried out (clause 3 of article 257 of the Tax Code of the Russian Federation). Write off the cost of a new intangible asset through depreciation (clause 1 of article 256 of the Tax Code of the Russian Federation).

If a new website (copyright object) does not meet the requirements for intangible assets, or changes are made to it solely for the purpose of its functioning (changing the structure within the existing program code, correcting defects, etc.), then such costs when calculating the tax on take into account the profit as other expenses associated with production and sales, taking into account the principle of uniformity (subclause 26, clause 1, article 264, clause 1, article 272 of the Tax Code of the Russian Federation). Similar clarifications are contained in letters of the Ministry of Finance of Russia dated November 6, 2012 No. 03-03-06/1/572, dated July 19, 2012 No. 03-03-06/1/346, dated October 31, 2011 No. 03- 03-06/1/704, dated September 29, 2011 No. 03-03-06/1/601.

RESULTS

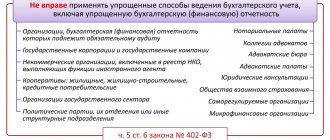

It is possible to take into account software costs only under the simplified tax system with the object “income minus expenses” if the general conditions for recognizing expenses are met: the costs are economically determined and documented.

If the site meets the criteria for intangible assets and you own exclusive rights to it, consider the costs for it as expenses for intangible assets. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Income tax: hosting services

When calculating income tax, include hosting services as other expenses (subclause 49, clause 1, article 264 of the Tax Code of the Russian Federation). If the site contains only advertising information, then hosting costs can be taken into account as part of advertising costs (clause 4 of Article 264 of the Tax Code of the Russian Federation).

Organizations using the accrual method include the cost of hosting in expenses at the time of receipt from the provider of documents indicating the actual provision of services (for example, an act or report) (subclause 3, clause 7, article 272 of the Tax Code of the Russian Federation). If an organization uses the cash method, then it must have documents confirming the provision of services, as well as pay for hosting services (clause 3 of Article 273 of the Tax Code of the Russian Federation).

VAT

The creation of a website does not apply to construction and installation work performed by an organization for its own consumption. Therefore, there is no need to pay VAT on the costs of creating a website on your own. This follows from subparagraph 3 of paragraph 1 of Article 146 of the Tax Code of the Russian Federation.

Input VAT on costs associated with creating a website should be deducted at the time they are reflected in accounting (for example, on account 08 - for works and services, on account 10 - for materials, on account 97 - as part of deferred expenses) (p 2 Article 171, paragraph 1 Article 172 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated November 11, 2009 No. 03-07-11/295). Along with this, other conditions required for deduction must be met.

If an organization carries out both taxable and non-VAT-taxable operations and plans to use the site in both types of activities, distribute the input tax on the cost of materials (work, services) (clause 4 of Article 170 of the Tax Code of the Russian Federation).

Posting expenses for website creation

When creating a website recognized as an intangible asset using an economic method, typical correspondence will be as follows:

- D08.5 – K70 – salaries were accrued to the personnel involved in the development of the site.

- D08.5 – K69 – insurance premiums are calculated from the salaries of employees who, as part of their job responsibilities, are involved in the creation of a website.

- D08.2 – K02 – depreciation of equipment involved in the creation of the site has been accrued.

- D08.5 - K10 - are shown in the accounting of operations for the consumption of material resources during the development of the site.

- D04 – K08.5 – the site is hosted and launched (the asset is put into operation).

- D44 - K05 - posting is used to reflect depreciation charges for the current electronic resource on a monthly basis.

If the creation of a website and its preparation for launch is entrusted to a third-party organization, then the following corresponding entries between accounts will be made in the accounting:

- D08.5 – K60 – this is how the costs incurred for website development are shown.

- D19 – K60 – VAT amounts are accepted for accounting.

- D04 – K08 – the emergence of exclusive rights to elements of a new intangible asset is shown.

- D97 - K60 - postings are drawn up in situations where the costs of creating electronic resources are taken into account in future periods and are subject to gradual reflection by current dates.

- D60 - K51 - the entry reflects the total cost of the work performed by the contractor.

When carrying out operations to update the site, account 44 is debited and account 60 is credited. The correspondence between debit 19 and credit 60 allocates the amount of VAT on the resource modernization service received. Payment for work according to the invoice and the agreed upon act is made by generating a debit turnover on account 60 and a credit turnover on account 51.

OSNO and UTII

If an organization uses a website in activities on the general taxation system and in activities on UTII, then the costs of its creation must be distributed (clause 9 of Article 274 and clause 7 of Article 346.26 of the Tax Code of the Russian Federation). This is due to the fact that when calculating income tax, expenses related to activities on UTII cannot be taken into account. This situation is possible if, for example, the site simultaneously advertises goods that are sold both retail and wholesale. If an organization uses a website for only one type of activity, the costs of its creation do not need to be distributed.

For more information on how to distribute expenses related to both tax regimes, see How to take into account expenses for income tax when combining OSNO with UTII.

If the contractor for the creation of the site (supplier of the materials necessary to create the site) has issued an invoice, then the amount of VAT allocated in the invoice must also be distributed. For more information about this, see How to deduct input VAT when separately accounting for taxable and non-taxable transactions. The amount of VAT that cannot be deducted should be added to the share of expenses for the organization’s activities subject to UTII (subclause 3, clause 2, article 170 of the Tax Code of the Russian Federation).