Accounting statements in 2021 are generated from the same basic reporting forms as for previous financial years. The information presented in it covers all operations carried out by the company for 2021, including those indicated in interim (usually quarterly) reports, if their presentation is regulated by law or carried out in order to ensure internal control of the company's activities. This publication will discuss which reporting packages are mandatory for enterprises of different organizational and legal forms.

Changes in 2021

Changes were adopted to provide the annual reporting package. According to the norms, these reports must be sent from 2021 only to the Federal Tax Service. There is no need to submit them to Rosstat. However, in this regard, those who are subject to a mandatory audit must also include an audit report in the tax kit. This innovation will only apply to reports for 2021; for 2018, reporting must be done in the same manner. From 2021, all reporting must be submitted only electronically, and the use of an enhanced digital signature is mandatory. The exception is small businesses, which are given the right to choose the method of sending the report. Reports on forms 2-NDFL and 3-NDFL must be sent to the tax office using the new forms. It is important to remember that if an employee requests a 2-NDFL certificate, he is currently issued a new form, which differs from the one submitted to the Federal Tax Service. If a business entity uses UTII, then he had to report for 2018 using a new form, which was supplemented with columns for the right to apply a deduction for the purchase of online cash registers. From 2019, when filling out this report, you must use a new deflator coefficient - 1.915. Important! For companies that operate under the simplified tax system, preferential tax rates will no longer apply from 2021, so most of these companies will have to pay contributions to the Social Insurance Fund and Compulsory Medical Insurance Fund and fill out the corresponding sections in the calculation. In the first quarter of 2021, a new form appears. Also new to simplify the 6% tax rate is the ability for taxpayers to refuse to file a declaration if they use online cash registers in their activities. Taxpayers will also have to report on VAT for 2019 on the new form, since A new declaration will come into effect (it is currently in draft) due to the transition to a tax rate of 20%. Important! Amendments have been made to the income tax return, which stipulate that entities will not be able to reduce the regional rate for this tax. This innovation must be taken into account when filling out the declaration for 2021.

Increase in minimum wage

From January 1, 2021, the minimum wage increased to 9,489 rubles ( Law No. 421-FZ dated December 28, 2017 ). In this regard, employers need to adjust their local regulations and increase wages for employees who are tied to the minimum wage. It is necessary to issue a corresponding order and make changes to the staffing table.

If an employee is paid a salary below the minimum wage, liability will arise under clause 5.27 of the Administrative Code. It involves a fine of 30,000-50,000 rubles.

In what cases should reporting be submitted electronically?

The legislation establishes that if the number of employees exceeds 100 people, then reports must be prepared and submitted by the entity only in electronic form. The same rule applies to enterprises classified as the largest. For other entities, there is the right to choose which form of reporting to use. However, from 2021, financial statements must be provided in electronic form, with the exception of small businesses. When submitting reports to the Pension Fund of Russia, the electronic form of reports is required if the number of employees exceeds 25 people. Everyone else independently decides to submit reports to the regulatory body on paper or electronically. Information on the average headcount can be submitted both electronically and on paper. The subject independently makes a decision on this issue. This rule also applies to reporting to the Social Insurance Fund.

Tax reporting deadlines in 2021: table

| Report type | Period | Due dates | Tax payment deadlines | Tax regime | ||

| BASIC | simplified tax system | UTII | ||||

| 2-NDFL | Year | There is no way to hold it - until 03/01/2019, all others until 04/01/2019. | For salary no later than the next day of payment. For sick leave and vacation pay - no later than the last day of the month. For payroll - the next day after their payment. | + | + | + |

| 6-NDFL | Quarter | 2018 – 04/01/19 Q1 2021 - 04/30/19 Q2 2021 - 07/31/19 Q3 2021 – 10/31/19 | For salary no later than the next day of payment. For sick leave and vacation pay - no later than the last day of the month. For payroll - the next day after their payment. | + | + | + |

| Calculation of insurance premiums | Quarter | 2018 – 01/30/19 Q1 2021 - 04/30/19 Q2 2021 - 07/30/19 Q3 2021 – 10/30/19 | Until the 15th day of the month following the month in which contributions are calculated. | + | + | + |

| Income tax return | Quarter(Month) | 2018 - 03.28.19, 1st quarter. 2021 - 04/29/19 Jan-Feb 2021 - 03/28/19 Jan-Mar 2021 - 04/29/19 Jan-Apr 2021 - 05/28/19 Jan-May 2021 - 06/28/19 Jan-Jun 2021 - 07/29/19 2nd quarter 2021 – 07/29/19 Jan-July 2021 – 08/28/19 Jan-Aug 2021 – 09/30/19 Jan-Sep 2019 – 10/28/19 Q3 2021 – 10.28.19 Jan-Oct 2021 – 11.28.19 Jan-Nov 2021 – 12.30.19 | No later than 2021 - 03.28.19, 1st quarter. 2021 - 04/29/19 Jan-Feb 2019 - 03/28/19 Jan-Mar 2021 - 04/29/19 Jan-Apr 2021 - 05/28/19 Jan-May 2021 - 06/28/19 Jan-Jun 2021 - 07/29/19 2nd quarter 2021 – 07/29/19 Jan-July 2021 – 08/28/19 Jan-Aug 2021 – 09/30/19 Jan-Sep 2019 – 10/28/19 Q3 2021 – 10.28.19 Jan-Oct 2021 – 11.28.19 Jan-Nov 2021 – 12.30.19 | + | _ | _ |

| VAT declaration | Quarter | 4 sq. 2021 – 01/25/19 Q1 2021 – 04/25/19 Q2 2019 – 07/25/19 3rd quarter 2021 – 10/25/19 | 4 sq. 2021 -1/3 - 01/25/19 1/3 - 02/25/19 1/3 - 03/25/19 1st quarter 2021 -1/3 - 04/25/19 1/3 - 05/27/19 1/3 - 06/25/19 2nd quarter 2021 -1/3 - 07/25/19 1/3 - 08/26/19 1/3 - 09/25/19 3 sq. 2021 1/3 - 10/25/19 1/3 - 11/25/19 1/3 - 12/25/19 | + | – | – |

| Logbook of received/issued invoices | Quarter | 4 sq. 2021 – 01/21/19 Q1 2021 – 04/22/19 Q2 2019 – 07/22/19 3rd quarter 2021 – 10/21/19 | – | – | +(for agents) | +(for agents) |

| Declaration according to the simplified tax system | Year | 2018 Legal Entity – 04/01/19 Civil Internship – 04/30/19 | For 2021 - until 04/01/2019 (LE) 04/30/19 (IP) For 1 quarter. 2019 until 04/25/19 For 2 quarters 2021 until 07/25/19 For 3 quarters 2019 until October 25, 2019 | – | + | – |

| Declaration on UTII | Quarter | 2018 - 01/21/19 Q1 2021 – 04/22/19 Q2 2021 – 07/22/19 Q3 2021 – 10/21/19 | For 2021 - no later than January 25, 2019. For 1 quarter. 2021 until 04/25/19 For 2 quarters 2021 until 07/25/19 For 3 quarters 2021 until 10/25/19 | – | – | + |

| Transport tax declaration | Year | 2018 – 02/01/19 | Established by regions in accordance with their laws | + | + | + |

| Land tax declaration | Year | 2018 – 02/01/18 | Established by regions in accordance with their laws | + | + | + |

| Declaration on Unified Agricultural Tax | Year | 2018 – 04/01/19 | For 2021 - no later than 04/01/2019. For 1 quarter. 2021 until 04/25/19 For 2 quarters. 2021 until 07/25/19 For 3 quarters 2021 until 10/25/19 | – | – | – |

| Property tax declaration | Year (Regions can set the period quarterly) | 2018 – 04/01/19 for quarterly calculations: 1st quarter. 2021 – 04/30/19 Q2 2021 – 07/30/19 Q3 2021 - 10/30/19 | Established by regions in accordance with their laws | + | +(when using cost inventory) | +(when using cost inventory) |

| 3-NDFL | Year | 2018 – 04/30/19 | For 2021 - until July 15, 2019 For the 1st half of 2021 - until July 15, 2019 For 3 quarters 2021 until October 15, 2019 For 4 quarters 2021 until 01/15/20 | + | – | – |

| Information on the average number of employees | Year | 2018 – 01/21/19 | – | + | + | + |

| Single simplified declaration | Quarter | 2018 – 01/21/19 Q1 2021 – 04/22/19 Q2 2021 – 07/22/19 Q3 2021 – 10/21/19 | – | + | + | – |

Deadlines for submitting reports to the Pension Fund

| Reporting type | Periodicity | Due dates | Payment deadlines | Tax regime | ||

| BASIC | simplified tax system | UTII | ||||

| SZV-M | Month | Dec 2021 – 01/15/19Jan. 2021 – 02/15/19 Feb. 2021 - 03/15/19 March 2021 - 04/15/19 Apr. 2021 – 05/15/19 May 2019 – 06/17/19 June 2021 – 07/15/19 July 2021 – 08/15/19 Aug 2021 – 09/16/19 62.4.16.163 Sep. 2021 – 10/15/19 Oct. 2021 – 11/15/19 Nov. 2021 – 12/16/19 | – | + | + | + |

| Information about the insurance experience SZV-STAZH | Year | 2018 – 03/01/19 | – | + | + | + |

| Information for individual accounting EFA-1 | Year | 2018 – 03/01/19 | – | + | + | + |

New report SZV-STAZH

In 2021, you will have to report for the first time using the SZV-STAZH (form from the Pension Fund Resolution No. 3p dated January 11, 2017 ), which contains information about the insurance length of employees. The report is submitted once a year and is compiled for each employee. It includes persons with whom employment contracts and civil contracts are concluded, from payments for which insurance deductions are made.

The 2021 report must be submitted by March 1, 2018 . Policyholders filing a report for 25 or more insured persons must report electronically using the TCS.

more about filling out the SZV-STAZH from our material.

Deadlines for submitting reports to the Social Insurance Fund

In 2021, only one form is still submitted to the social insurance fund - 4-FSS. The deadline for submitting it depends on the medium on which the report will be submitted - electronically or on paper. In addition, it is necessary to remember that in order to correctly assign the contribution rate for injuries, it is necessary to send a confirmation form for the main type of activity within the prescribed period.

| Reporting type | Periodicity | Due dates | Payment deadlines | Tax regime | ||

| BASIC | simplified tax system | UTII | ||||

| 4-FSS in paper version | Quarter | 2018 - 01/21/2019 1st quarter 2021 - 04/22/2019 1st half 2021 - 07/22/2019 9 months 2021 - 10/21/2019 | No later than the 15th day following the month of assessment of contributions | + | + | + |

| 4-FSS in electronic version | Quarter | 2018 - 01/25/2019 1st quarter 2021 - 04/25/2019 1st half 2021 - 07/25/2019 9 months 2021 - 10/25/2019 | No later than the 15th day following the month of assessment of contributions | + | + | + |

| Confirmation of the type of activity | Year | 15.04.2019 | – | + | + | + |

Results of intellectual activity

Minor changes affected income accounting. Now they do not have to include property rights to the results of intellectual activity that were identified during the inventory in the period from January 1, 2021 to December 31, 2021. Amendments to Article 251 of the Tax Code were introduced by Law No. 166-FZ of July 18, 2021 .

In addition, from the beginning of this year, instead of sending a report on R&D to the Federal Tax Service, it will be necessary to place data in GIS. Tax authorities will have to be notified of this using a specially designed form.

Deadlines for submitting financial statements

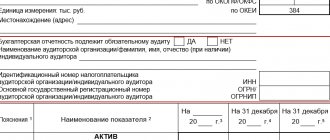

Starting from the 2021 reporting year, the submission of financial statements to statistics has been cancelled. The last time organizations must submit these forms is in 2021 for annual reports for 2018. All companies are required to send a balance sheet, profit and loss statement, and all other forms included in the accounting package, regardless of their form of ownership, tax system, organizational form. Entrepreneurs, as well as branches of foreign companies, have the right not to submit accounting reports. These entities are permitted by law not to maintain accounting records. The deadline for reporting is March 31 of the year following the reporting year. In 2021, due to a holiday, this day is moved to April 1. Attention! If a company was opened on October 1, 2018, it must submit a report to statistics for the first time only after December 31 of the following year. Due to the cancellation of reporting for 2021, such enterprises are already exempt from submitting accounting reports to Rosstat.

Approval of accounting records

The prepared financial statements are signed by the head of the company. Let us remember that it becomes legally significant and actually drawn up only after approval by the top management, for example, by a meeting of shareholders.

The date of approval of the financial statements is indicated in the title of the balance sheet. The legislator has established the deadlines possible for holding a meeting of shareholders - a JSC has the right to hold it no earlier than 2 months after the end of the financial year - from March 1 to June 30 (Article of the Law on JSC dated December 26, 1995 No. 208-FZ). For LLCs, the period for holding a general meeting of participants is set from March 1 to April 30 after the reporting year (Article of the Law on LLCs dated 02/08/1998 No. 14-FZ). The exact deadlines are established by the charters of the companies.

Deadlines for submitting reports to statistics

Rosstat periodically expands the list of forms that must be submitted by business entities. It is also necessary to remember that you cannot send an empty form - it will be rejected. The exact list of forms that must be submitted to Rosstat at the end of the year depends on the size of the enterprise (small, medium, large business), as well as on what kind of activity it carries out. Attention! In 2021, all enterprises, regardless of their form of ownership, are required to send a set of financial statements for 2021 to Rosstat. As of 2021, this obligation has been removed from them. Entrepreneurs do not submit reports to statistics, since the law allows them not to keep accounting records at all. Organizations that are classified as medium-sized enterprises and above must submit the following forms to Rosstat:

| Report title | Dispatch time |

| P-1 | The report must be sent monthly before the 4th day of the month following the reporting month. |

| P-5(M) | Must be submitted for each quarter by the 30th day of the month following the reporting quarter. |

| 1-Enterprise | Rented annually, before April 1 of the year following the reporting year |

| P-4 | The deadline for submitting this report can be set either quarterly or monthly. However, in each case it must be sent before the 15th day of the month following the reporting period |

| P-2 | The annual form is sent by February 8 of the month that follows the reporting year, quarterly reports are submitted by the 20th of the month that follows the reporting quarter |

The mandatory reporting does not include enterprises that are classified as micro, small or medium in size. Rosstat conducts sample observations for them. In order to find out the list of forms that need to be submitted this year, you should use a special service: https://statreg.gks.ru/ In addition to specialized forms by type of activity, such entities usually submit:

| Report title | Dispatch time |

| 1-IP (for individual entrepreneurs only) | Until March 2 of the year following the reporting year (in 2021 - postponed to March 4) |

| PM (micro) - only micro enterprises | Until February 5 of the year following the reporting year |

| PM - other enterprises | Quarterly delivery, by the 29th day of the year following the reporting quarter: (January 29, 2021, April 29, 2021, July 29, 2021, October 29, 2019) |

Insurance premiums for individual entrepreneurs

Speaking about the minimum wage, one cannot fail to mention one more innovation. Previously, fixed contributions of individual entrepreneurs were calculated on the basis of this indicator. However, starting from 2021, this link has been removed, that is, now the fixed contributions of individual entrepreneurs do not depend on the size of the minimum wage . The change was introduced by law dated November 27, 2017 No. 335-FZ .

Now the amount of contributions is fixed for the next few years. In 2018, with an income of up to 300,000 rubles inclusive, an individual entrepreneur will pay insurance premiums in the amount of 26,545 rubles , and over 300,000 rubles - 1% of the excess amount. The amount of contributions for the following years can be viewed here.

Penalty for failure to provide

The obligation to submit tax reports within the established deadlines is laid down in the Tax Code of the Russian Federation. If a business entity violates the specified deadline or does not send a declaration at all, fines may be imposed on it. The calculation rules have not changed in 2021. It is also necessary to remember that they apply not only directly to tax payments, but also to all types of insurance premiums (except for injuries). Additional fines have been established for certain types of taxes and reporting on property.

| Report title | How the fine is provided |

| All types of tax reports | The Tax Code establishes a general rule that for each report that was not filed or was sent in violation of the deadline, the amount of the fine is 5% of the unpaid tax on this report. A fine is imposed for each full or partial month of failure to submit. In addition, threshold values have been set. The maximum amount of the fine cannot be more than 30% of the tax amount according to the declaration, and the minimum amount of the fine is 1000 rubles. (this is usually assigned for failure to submit a zero report). |

| Declarations provided for property tax and corporate income tax | A fine of 200 rubles for each failure to submit a report or failure to submit an advance payment settlement. |

| Report form 2-NDFL | A fine of 200 rubles for each person included in the unsubmitted report. |

| Report form 6-NDFL | A fine of 1,000 rubles for each full or partial month of failure to submit a report |

| Insurance premium report | If the deadline for submission is violated, a fine will be imposed in the amount of 5% of the amount of insurance premiums for the report (i.e. for the entire reporting quarter), for each full or partial month of failure to submit the report. The minimum amount of the fine can be 1000 rubles, the maximum - 30% of the amount of accrued insurance premiums for an unsubmitted report. |

| Report form SZV-M | If the report was not submitted, then a fine of 200 rubles is imposed for each person who should have been included in the specified report. In addition, if the report was submitted, but the employee was not included in it, or was included incorrectly, then a fine of 500 is imposed rubles for each such case. |

| Report form SZV-STAZH | The company is subject to a fine of 500 rubles for each person who should have been included in the unsubmitted report. The same fine will be imposed if any of the employees were not included in the report already submitted, or were included erroneously. |

| Contribution report form 4-FSS | For a report not sent, or submitted in violation of the established deadline, a fine is imposed in the amount of 5% of the amount of quarterly fees for each full or partial month of delay. The minimum fine is set at 1,000 rubles, the maximum is 30% of the amount of contributions according to the report. |

| Accounting reporting form | If the reporting was not submitted to the Federal Tax Service or was submitted in violation of the established deadline, then a fine of 200 rubles is imposed for each report. If the report was not sent to Rosstat, then the fine is 3000-5000 rubles per report. It must be remembered that the submission of the balance sheet to Rosstat has been canceled since 2021, and the last time will be based on reporting for 2018. |

Source of material Reporting in 2021 - table and deadlines