New in annual reporting from 2021

There have been changes in the annual financial statements for 2021 that will need to be taken into account when submitting them. See the table for everything new in reporting.

| Reporting form | What's new |

| Financial statements |

|

| 2-NDFL, 6-NDFL |

|

| 3-NDFL |

|

| Declaration on UTII |

|

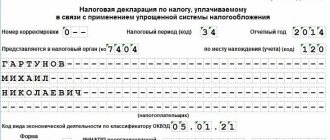

| Declaration according to the simplified tax system |

|

| Income tax |

|

| VAT |

|

| Property tax declaration |

|

| Transport and land tax |

|

| Insurance premiums |

|

Composition and forms of annual reporting

Taxpayers must report for 2021 to the Federal Tax Service, Pension Fund, Social Insurance Fund and Rosstat.

Pension Fund

- SZV-M. Organizations and individual entrepreneurs that have employees are required to report monthly to the Pension Fund of Russia using the mandatory form SZV-M. Submit your December report by January 15th. LLCs that have no employees but a single founder must also report.

The employee’s salary and contributions from it do not need to be indicated in the report; the Pension Fund is only interested in personal information: full name, SNILS and Taxpayer Identification Number.

— SZV-STAGE. This is one of the reports that employers submit to the Pension Fund every year. The 2021 form must be submitted by March 1, 2021 inclusive.

The form must indicate information about the policyholder, the period of work of the insured persons and the amount of contributions to pensions.

- SZV-TD. This report must be submitted if an employee has submitted an application to choose the form of a work record book, has been transferred to another permanent job, is deprived of the right to hold a certain position, etc. If one of these cases occurred in December, the report is submitted by January 15, 2021. Upon hiring and dismissal, the report is submitted on the next working day; information is not duplicated in the monthly report. If an SZV-TD employee has not been submitted once in 2021, you must report by February 15, 2021.

— DSV-3. If an employer pays additional insurance premiums for an employee, then the Pension Fund must submit a register in the DSV-3 form every quarter. The form for the last quarter of 2021 is due by January 20.

In the form, indicate the details of the employer, information about the insured employee and the amount of contributions - basic and additional.

Violation of the rules for submitting reports threatens that it will be considered not submitted and a fine of 500 rubles will be charged for each employee.

Federal Tax Service

— Certificate of average number of employees. Organizations with and without employees, as well as individual employers, no longer submit a separate SSC certificate. This information from the 2021 report was transferred to the RSV form.

— RSV. Employers-insurers submit a single calculation of insurance premiums to the Federal Tax Service. This calculation shows only the amounts of accrued premiums and insurance payments. Payments for the 4th quarter of 2020 must be submitted by February 1 (since January 30 is a Sunday).

— UTII. All UTII payers submit an imputed tax return for the 4th quarter. Hurry up to report for 2021 before January 20.

- USN. This declaration is submitted only by simplified tax payers. Do not forget that the reporting deadlines for individual entrepreneurs and organizations differ: for entrepreneurs - until April 30, and for organizations - until March 31.

- Financial statements. All organizations submit annual reports, regardless of the tax system. Submit 2020 reports by March 31, 2021.

The forms included in the annual reporting are approved by the Law “On Accounting” No. 402-FZ: balance sheet, financial results statement and appendices thereto.

All companies must submit financial statements for 2021 electronically. The exception no longer applies even to small businesses - they must report electronically for 2021 (Article 2, Clause 4 of Federal Law No. 444-FZ of November 28, 2018).

Annual financial statements are submitted to the tax office at the place of registration. At the same time, there is no need to submit a report for 2021 to Rosstat.

— VAT. This declaration is quarterly and must be submitted to everyone who pays VAT and issues invoices with it. The report for the 4th quarter of 2021 must be submitted by January 25.

— Income tax. The form of this declaration has changed in 2021. All taxpayers must submit it to OSNO. Report for 2020 no later than March 29.

Send the declaration to the tax office at the location of the company, and if there are several branches within one entity, independently select the inspectorate to which you will report. If you are not one of the largest taxpayers and do not have 100 employees, you can file a return on paper, otherwise only electronic format is available.

— 2-NDFL. Using this form, the employer reports the employees' income and taxes paid on it for the last time for 2021. Using the same certificate, you can inform the tax office that the tax could not be withheld and confirm the employee’s income. Information for 2020 must be submitted by March 1 inclusive.

— 6-NDFL. The last day to submit the report for 2021 is March 1. The form is filled out with a cumulative total from the beginning of the year and shows the total income of all employees of the organization.

The form is filled out with a cumulative total from the beginning of the year and shows the total income of all employees of the organization.

Small companies with up to 10 employees can report in paper form. The rest are only in electronic form. The headcount criteria were reduced from 25 to 10 people - such conditions have been in effect since 2021 (Federal Law dated September 29, 2019 No. 325-FZ).

— 3-NDFL. This report is submitted by individual entrepreneurs to OSNO and ordinary individuals. The new form will go into effect with the 2021 report, so be careful when preparing to submit it. Try to submit your reports by April 30 to avoid penalties.

FSS

4-FSS. This is a quarterly report that includes the calculation of contributions for injuries and illnesses. All entrepreneurs and organizations rent it out. In 2021, the report for the past year must be submitted by January 25 in paper form or by January 27 in electronic form. The form of delivery depends on the number of employees for whom deductions are made. You can report on paper only if the number of such employees in the previous year did not exceed 25 people. All other companies submit only an electronic form (Article 24 of Federal Law No. 125-FZ).

Rosstat

In 2021, continuous statistical observation is taking place, so mandatory reporting forms are provided for small businesses and entrepreneurs:

- Form No. MP-SP - submitted by all small businesses, including micro-enterprises. You must report by March 31, 2021, or by May 1 if the report is sent through government services.

- Form No. 1-entrepreneur - submitted by all individual entrepreneurs, regardless of the type of activity and taxation system. You must report by March 31, 2021, or by May 1 if the report is sent through government services.

The full list of reports to the statistics service is quite large, but you probably don’t have to submit everything. The official website of the statistics service will help you navigate through a large number of statistical forms and determine which ones Rosstat expects from you - https://websbor.gks.ru/online/info. Enter your INN, OGRN/OGRNIP or OKPO to get an up-to-date list of forms indicating the due date and frequency.

An organization that fails to submit reports on time may receive a fine of up to 70,000 rubles from territorial authorities, and in case of repeated violation - up to 150,000 rubles. Rosstat does not always send a notification about submitting reports, but failure to receive it is not a reason for not submitting the forms, so check them yourself.

Due dates

The deadlines for submitting reports for 2021 are indicated in the documents that regulate the corresponding type of report. For convenience, we will group the deadlines for submitting reports for 2021 into tables.

Deadlines for submitting reports to the Federal Tax Service

| Reporting to the Federal Tax Service | Reporting deadlines in 2021 |

| Certificate of average number of employees | We no longer sell separately |

| Declaration on UTII | January 20th |

| VAT declaration | The 25th of January |

| Calculation of insurance premiums | March 1 |

| Income tax return | March 29 |

| Property tax declaration | 30th of March |

| Financial statements | March 31 |

| Declaration according to the simplified tax system | March 31 (legal entities), April 30 (individual entrepreneurs) |

| 2-NDFL | March 1 |

| 6-NDFL | March 1 |

| 3-NDFL | April 30 |

Deadlines for submitting reports to the Pension Fund

| Reporting to the Pension Fund | Reporting deadlines in 2021 |

| SZV-M | January 15, February 15, March 15, April 15, May 17, June 15, July 15, August 16, September 15, October 15, November 15, December 15 |

| SZV-TD | if there were personnel events in the previous month - January 15, February 15, March 15, April 15, May 17, June 15, July 15, August 16, September 15, October 15, November 15, December 15 if there were hiring or dismissal - no later than the working day following the day of issue of the order (other document) |

| DSV-3 | January 20th |

| SZV-STAZH | March 1 |

Deadlines for submitting reports to the Social Insurance Fund

| Reporting to the Social Insurance Fund | Reporting deadlines in 2021 |

| 4-FSS |

|

| Confirmation of main activity |

|

In order not to forget the deadlines for submitting reports for the year and the 4th quarter of 2020, use the accountant’s calendar.

Fines

Fines are imposed for non-compliance with the rules for preparing and submitting reports. They can be received for late delivery and violation of the order of submission. Each report may reveal other violations, but we will talk about fines, which are the same for everyone.

Penalty for failure to submit reports

If a company is late in submitting reports to the Federal Tax Service, Social Insurance Fund or Pension Fund, it will receive fines.

The fine for this violation will be 5% of the amount of taxes or contributions accrued for the entire period or for the last 3 months of the period for which the report is overdue. The accrual period depends on the type of report, for taxes - for the amount of the declaration, for contributions - for the amount for the last 3 months.

The delay period starts counting immediately from the day following the deadline for payment. In this case, both full and partial months are taken into account. It is important that you will not be able to pay less than 1,000 rubles for being late, but a fine of more than 30% of the insurance premiums will not be charged.

Administrative fines are also imposed for failure to submit financial statements to the tax authorities and Rosstat.

The penalty from the Federal Tax Service is 200 rubles for each form not submitted. For example, if an organization submits only a balance sheet and a statement of financial results, the fine will be 400 rubles. And if you need to submit other reports, such as a report on changes in capital, on cash flows, on the intended use of funds, the fine will increase to 1,000 rubles.

The director and accountant of the organization can also be fined from 300 to 500 rubles.

The penalty from Rosstat is from 20,000 to 150,000 rubles for failure to submit reports or for providing false information.

Penalty for violating the order of presentation

For each report there are two presentation options - paper and electronic. If an organization or entrepreneur chooses the wrong form, they will receive a fine. According to Article 119.1 of the Tax Code of the Russian Federation, such a violation is punishable by a fine of 200 rubles.

Reporting on contributions. 4-FSS

In 2021, form 4-FSS is used, approved by Order of the FSS of the Russian Federation dated September 26, 2016 N 381.

Deadline for submitting Form 4 - Social Insurance Fund for the 1st quarter of 2021:

- in electronic form – April 26, 2021;

- on paper – April 20, 2021.

The FSS explains that in connection with the payment of insurance coverage by the territorial bodies of the Fund directly to the insured persons on the basis of Federal Law dated December 29, 2020 N 478-FZ in 2021, form 4-FSS is filled out taking into account the following features:

- in Table 2, the indicators of line 15 “Expenses for compulsory social insurance” are not filled in;

- Table 3 is not filled out and is not submitted (Letter of the Federal Insurance Service of the Russian Federation dated 03/09/2021 N 02-09-11/05-03-5777).