The balance sheet is a reflection of the activities and financial condition of the organization, as well as identification of the sources used to generate income. By drawing up balance sheet results, an enterprise indicates its material and economic situation as of the date of reporting.

In 2021, the balance sheet is filled out for 2021 and submitted to the Federal Tax Service until April 2, 2021 inclusive. You can download a completed sample balance sheet for 2021 in excel below.

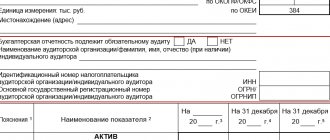

Form used in 2021

The enterprise's financial statements are submitted annually in Form 1, accompanied by a report on income and losses/financial results in Form 2, as well as additional appendices.

The appendices include a statement of changes in capital on Form 3 and a statement of cash flows on Form 4 plus a statement on the designated use of money.

If the enterprise is a small business, then reporting on accounting data is reduced - it is permissible to use simplified forms.

Important: all financial reporting forms are approved by Order of the Ministry of Finance of the Russian Federation No. 66 of 2010, as last amended. from 04/06/15.

Balance sheet for 2021

The balance sheet form for 2021, the form of which we will look at in this publication, is not that new. It was approved by order of the Ministry of Finance of the Russian Federation No. 66n dated July 2, 2010 and has been used since 2011.

An important change this year is the introduction of a new classifier OK 029-2014, and, as a result, a change in OKVED codes. Therefore, when drawing up a balance sheet and submitting reports, companies will have to pay attention to the reflection of OKVED in the balance sheet for 2021 in accordance with the newly adopted collection. Although the codes are replaced automatically, it is better to first check the information about OKVED with the tax authorities. It can be noted that only in this regard has the form of the balance sheet for 2021 undergone changes. The document form can be downloaded below.

What is balance?

A balance sheet is a financial statement that, as of the reporting date, characterizes the financial condition of the organization. Such a document is the main and most important among financial statements, since it gives the user a general idea of the financial well-being of the business entity.

What information does the balance sheet contain (form 1, 2021 form):

- The current value of all non-current assets as of the date of the document. Here you can get information about how many fixed assets are on the company’s balance sheet, what their depreciation and residual value is, how much development, know-how, etc. the company has in value terms. (intangible assets);

- An assessment of the value of all the company’s current assets, in particular, the availability of cash in cash and on current accounts, the availability of securities, cash equivalents, finished products, etc., that is, all those assets that are turned over several times during the year and take part in the production process repeatedly. A fragment of the balance sheet form for 2021 can be viewed in the balance sheet form.

| II. CURRENT ASSETS | 1210 | |

| Reserves | ||

| Value added tax on purchased assets | 1220 | |

| Accounts receivable | 1230 | |

- Information about the authorized capital and other types of capital that a given taxpayer has. Information about capital is presented in the third section of the balance sheet, which is called “Capital and revaluation”;

- Sections 4 and 5 are devoted to the company's obligations, that is, those debts that it has to creditors, the budget, employees and third parties. At the same time, there is a division of such obligations into short-term, the repayment period of which does not exceed 12 months, and long-term, the repayment period of which is more than 12 months.

That's all. In total, the balance sheet has five sections: two sections in assets and three sections in liabilities.

Balance sheet 2021: features

By filling out the form, the company itself details the indicators by item, taking into account the level of materiality of each. Financial statements must be submitted to the regulatory authorities (IFTS and statistical departments) in a form that includes line codes. We will present a sample of filling out the balance sheet for 2021 in exactly this form.

The basis for drawing up a balance are accounting registers, for example, a chess sheet, memorial orders, order journals, a balance sheet or a general ledger.

Due dates

All deadlines for submitting accounting documentation for any form of business are regulated by the Tax Code of the Russian Federation and Law No. 402 Federal Law of 2011.

The deadlines for submitting reporting documentation in 2021 will correspond to the deadlines of previous years, with the exception of the refusal to use the standard scheme for submitting a balance sheet for:

- Individual entrepreneurs and individuals with private practice;

- Foreign subsidiaries, as well as their representative offices and entities.

For all legal entities without exception, it is necessary to submit financial statements within 3 months from the end of the previous period, that is, from January 1 of the new year to the local authorities of the Federal Tax Service and Statistics. Only federal authorities can change this period.

Deadline:

In 2021, the last day for submitting the balance sheet for 2021 falls on April 2, 2021, since the official day of March 31 fell on a Saturday, which gives the right to postpone the deadline for submitting reporting forms to the first working day.

There are also nuances in the deadlines for submitting a balance for various situations:

- Upon liquidation, it is necessary to submit financial statements within 3 months from the date of entry in the Unified State Register of Legal Entities;

- When reorganizing an enterprise - within 3 months from the date of entry in the Unified State Register of Legal Entities about the suspension of the activities of the affiliated enterprise;

- New formations submit a balance sheet, like the rest, if they were formed before September 30, those that were formed later submit a report in 2021;

- Religious organizations are exempt from depositing balances.

Important: the completed balance sheet form must be submitted to the statistical authorities within the same time frame – before April 2, 2021.

Balance sheet form for 2021: how the document is structured

The balance sheet of the organization is a table, on the left side of which all the assets of the company are reflected, and on the right side - the sources of these funds. Both of them must be equal, since the value of the property cannot be more or less than the sources of its formation.

The left side is divided into 2 sections, the first contains non-current assets, and the second contains current assets.

The right side of the balance sheet is a liability, divided into 3 parts, in which information about reserves, capital and liabilities is consistently recorded.

Procedure for filling out the balance sheet 2021: asset

Fill out the balance form starting with the active part. For greater clarity, we offer a tabular version, which indicates in which line of the balance sheet which indicators should be reflected, as well as the rules for summing the values:

| Line code | Account balances included | |

| D/t | K/t | |

| Section I | ||

| 1110 | 04 | 05 |

| 1120 | 04 | |

| 1130 | 08 s/account for expenses for search work | |

| 1140 | 08 MC expense account for prospecting work | |

| 1150 | 01, 08 s/account for fixed assets, the commissioning of which has not yet been carried out | 02 |

| 1160 | 03 | 02 s/account “Depreciation of assets classified as income. investments" |

| 1170 | 58, 55 s/account “Deposits”, 73 s/account “Loan settlements” | 59 s/account “Accounting for reserves for long-term liabilities” |

| 1180 | 09 | |

| 1190 | amounts not included in previous lines of the section | |

| 1200: Total for Section I | sum of partition rows | |

| Section II | ||

| 1210 | 41,15,16, 97, 10, 11, 43, 45, 20, 21, 23, 29, 44 | 42, 14, |

| 1220 | 19 | |

| 1230 | 62, 60, 68, 69, 70, 71, 73 (excluding interest-rate loans), 75, 76 | 63 |

| 1240 | 58, 55 s/account “Deposits”, 73 s/account “Loan settlements” | 59 |

| 1250 | 50, 51, 52, 55, 57, 55 s/account “Deposit accounts” | |

| 1260 | the value of assets not included in the listed lines of section II | |

| 1200:Total for section II | sum of partition rows | |

| 1600: Total assets | sum of results of sections I and II | |

Registration rules in 2021

Data in the reporting is entered as of the last day of December for the reporting year and the two previous ones. Information for the last 2 years can be removed from previously submitted balance sheets. When filling out, rounding to the nearest thousand or million rubles is applied. If you need to show a value with a minus, then the amount is enclosed in parentheses.

Thanks to the adjustment of the forms, filling out the balance for 2021 has become much easier:

The title page of the form contains the following information:

- Date of preparation of financial statements;

- Details and name of the enterprise;

- Kind of activity.

- In the “Approval date” field, you need to display the date the document was reviewed.

- The part of the reporting with the posted table contains 5 sections, for which all information is taken from the balance sheets;

- In the first 2 sections, all funds are indicated by type and composition, and are called assets;

- The last 3 indicate the sources for obtaining assets - liabilities.

Important: any component row of the tabular section is called a balance sheet item; the right vertical columns display indicator codes and their amounts at the beginning and end of the reporting period.

All numerical values are expressed in thousands or millions without decimal notation.

Balance sheet items not involved in the expired period are not subject to accounting and are marked with dashes.

The last lines in the sections for assets and liabilities are intended to display totals, and the amounts in assets and liabilities should be identical.

Data on material assets on the off-balance sheet accounts of the enterprise must be indicated on a separate line.

Such values may include:

- Real estate rented or leased;

- Tangible and intangible assets accepted for storage or temporary use.

Upon completion of filling out the accounting reporting form, it is required to sign the manager or authorized representative and the chief accountant or person authorized to submit reports to the authorities.

Sample of filling out assets for 2021

Assets are all property owned by the company, they are divided into:

- Non-current - in use by a company for a long time, more than 12 months. These include intangible and fixed assets, long-term deposits, construction without legal grounds, tangible assets, deferred tax assets;

- Working capital is funds involved in production, used for less than 12 months and subsequently converted into cash equivalent. These include - company finances, accounts receivable for short and long payment periods, short-term investments, VAT on acquired material assets.

In the balance sheet compiled in Form 1, each item in this section is formed according to the following information:

Fixed assets - the amount of initial investments in the enterprise is indicated, minus depreciation amounts during the use of each type of fixed assets;- Intangible assets - the value of the residual price of all intangible assets is indicated - the amount of expenses for purchase and development without depreciation expenses;

- Expenses on capital investments - there is information about expenses incurred for the construction of property or for an already formed order;

- Equipment – the actual costs at the time of purchase of the goods are included;

- Financial injections - indicate the costs associated with investing in the past year;

- Material costs - in this article it is necessary to indicate the total cost of fuel, spare parts, packaging and other current costs;

- Production that has not been completed - carries information about the amount of investment in purchasing resources and preparatory stages - raw materials, materials, semi-finished products;

- Distribution costs - this item contains all costs for unsold products;

- Expenses coming in the future - expenses that have already been committed, but related to future financial years, are reflected here;

- Finished products – the cost of the goods produced is calculated, and the total amount is displayed;

- Goods – the sum of the purchase price of all finished goods;

- Completed orders for the provision of services or works, production - everything is taken into account at the generated cost:

- Debt of counterparties to the company - the amount recorded in the acts drawn up with debtors is taken into account;

- Residual funds in foreign currency of any direction and formation - values are fixed in rubles at the exchange rate of the Central Bank of the Russian Federation on the day the balance sheet is formed.

Distribution of data by items in the table

| Balance line number | Short name | Explanations for filling | Account numbers to fill out (designations: Sd. - debit balance, Sk. - credit balance) |

| Current assets of the balance sheet | |||

| 1110 | NMA | The value of intangible assets in the residual value | Sd. for accounts 04, 08.5 minus Sk. sch.05 |

| 1120 | Research results | R&D cost | Account 04 R&D subaccount |

| 1130-1140 | Search assets | Expenditures on assets for exploration work on deposits, intangible and tangible (for example, equipment, scientific research) | – |

| 1150 | OS | OS cost in residual value | Sd. for accounts 07, 08 (except 08.5), 01 minus Sk. sch.02 |

| 1160 | Investments in MC | Residual value indicator for account 03 | Account 03 |

| 1170 | Financial investments | Cash injections for a period of more than 1 year | Sd. according to accounts 58, 55 minus Sk. according to accounts 59, 63 |

| 1180 | Deferred tax assets | – | Account balance 09 |

| 1190 | Other | Other long-term assets not included in the previous lines | – |

| Non-current assets of the balance sheet | |||

| 1210 | Reserves | The sum of all working inventories: inventories, goods, products, etc. | Sd. for accounts 10, 15, 20, 21, 41, 44, 45, 97, 43, 23, 29, 28, 43, 42 minus Sk. according to accounts 14, 42 |

| 1220 | VAT | Tax filed by sellers | Sd. accounts 19 |

| 1230 | Accounts receivable | Debts of debtors | Sd. for accounts 46, 60, 62, 70, 71, 73, 76, 75, 68, 69 minus Sk. count 63 |

| 1240 | Financial investments | Short-term cash injections | Sd. according to account 58 minus Sk. according to counts 59 and 63. |

| 1250 | Money | All monetary funds | Sd. according to counts 50, 51, 52, 57, 55 |

| 1260 | Other | All those current assets that are not listed above | |

In lines 1100 and 1200 the total value of all assets for the first and second subsections is calculated, in line 1600 the total amount of balance sheet assets is shown, which will be compared with the same indicator for liabilities from line 1700.

Detailed filling of liabilities

Liabilities are balance sheet information opposite to assets; these sources are taken from outside to form assets. They consist of capital and reserves, long-term and short-term loans and borrowings.

Liabilities in the financial statements form occupy 3 sections:

- Capital and reserves – sums up all own investments that belong exclusively to the owners of the enterprise;

- Long-term liabilities - indicates the total amount of all borrowed funds - any type of lending that requires a long repayment period;

- Short-term liabilities - these include unpaid salaries, tax obligations, and other payments that the organization is obliged to pay in a short period of less than a year.

The balance sheet liabilities table begins with the authorized capital - data from the constituent documents is entered.

Further on the balance sheet form Form 1 goes:

- Reserve capital – indicates the financial balance of the authorized capital;

- Reserves to cover upcoming expenses and payments - the item contains the amount of unapplied reserves that are carried over to the next year;

- Income of the next financial year - the amount of money received in the outgoing period, but belonging to future periods;

- Profit – takes into account the net income received in the reporting period from the main activities of the enterprise;

- Credit debt - the amount of all debts of the enterprise to creditors is entered.

Filling out the 2021 balance sheet according to the lines of the passive part

| Line code | Account balances included | |

| D/t | K/t | |

| Section III | ||

| 1310 | 80 | |

| 1320 | 81 | |

| 1340 | 83 s/account “Additional assessment of fixed assets and intangible assets” | |

| 1350 | 83 (except for additional valuation of fixed assets and intangible assets) | |

| 1360 | 82 | |

| 1370 | 84 | |

| 1300: Total for Section III | sum of section III row values | |

| Section IV | ||

| 1410 | 67 | |

| 1420 | 77 | |

| 1430 | 96 | |

| 1450 | amounts not included in the lines of section IV | |

| 1400: Total for Section IV | sum of rows of section IV | |

| Section V | ||

| 1510 | 66, 67 | |

| 1520 | 60, 62, 68, 69, 70, 71, 73, 75, 76 | |

| 1530 | 98, 86 | |

| 1540 | 96 | |

| 1550 | amounts not included in the previous lines of section V | |

| 1500: Section V total | sum of rows of section V | |

| 1700: Total liabilities | sum of row values of sections III, IV and V | |

If all balance lines are filled out correctly, the final results on lines 1600 and 1700 will be the same.

Balance sheet of an enterprise: completed example 2021

A sample of drawing up a balance sheet based on accounting data grouped in the balance sheet of Crocus LLC. To simplify the problem, let’s assume that the company was organized in 2021 and is preparing a balance sheet for 2021 for the first time. The 2017 balance sheet form, a sample of which is presented, involves considering the results of the company’s work for the reporting, last and previous years. In our example, information for 2021:

Account number Balance D/t K/t 01 825 000 02 443 000 04 8700 05 3000 08 32 000 10 50 000 19 10 000 41-2 575 000 41-3 33 000 42 120 000 44 12 500 50 10 000 51 92 000 52 7800 58 5000 60 265 000 62 15 000 66 75 000 68 57 000 69 12 000 70 30 000 71 1900 76 40 000 80 620 900 82 8000 84 75 000 In accordance with the instructions for filling out the form indicated above, we will fill out the balance sheet for 2021 based on the accounting data.

Company News

The life of NPOs should be orderly, and, preferably, without fines! A short article on the topic of orderliness and annual balance.

Not all companies can submit a balance sheet in a simplified form for 2021, but only those that belong to small businesses. A small company itself can decide what is more convenient for it - a full report or its simplified version. The chosen method must be reflected in the current accounting policy.

Who submits a simplified balance sheet?

The balance sheet of a small enterprise for 2021 can be submitted using a simplified form. Companies participating in the implementation of the Skolkovo innovation project, and non-profit organizations like us, can also take advantage of this right. Balance sheets in a simplified form cannot be submitted by companies that have a mandatory audit of their statements (any joint stock company falls here, since an audit report is required for them), construction and housing cooperatives, microfinance enterprises, government agencies, notary offices, lawyers, charitable foundations, parties and a number of others.

How to draw up a balance sheet for a small business?

The balance sheet of a small enterprise is formed in accordance with the appendix to Order No. 66n, approved by the Ministry of Finance on July 2, 2010. In addition to the indicators for the reporting year, it indicates indicators for the two previous years; for this purpose, special columns are provided where data at the end of the year is entered.

The OKUD form 0710001 (the balance sheet for small enterprises now has exactly this number) is used for reporting for the current year 2021, as well as for 2021.2015. Before this, a different form was used, which was used from 2012 to 2014.

The balance sheet for small businesses 2021 includes two forms: the balance sheet itself (Form 1) and the statement of financial results (Form 2). If the company considers it necessary to provide more forms to disclose missing information, then this is permitted.

Companies using the OKUD 0710001 form indicate the data in large quantities without detailing the items, since this form reflects more general indicators and the number of lines in the form is much smaller.

It doesn’t matter which taxation system the company has chosen, possibly the simplified tax system, everyone, without exception, needs to report to government agencies and prepare annual financial statements.

Regardless of the chosen volume of reporting to be provided - complete or simplified, compliance with the legal deadlines for its submission is required.

For 2021, rent is due until April 2, 2021.

If you miss the legal deadline, fines follow. Since we submit reports without fail to two government agencies - the tax inspectorate and the statistical authorities, the fines are different. In the first case, you will have to pay 200 rubles for each document not submitted on time; in the second case, a liability of 3,000 to 5,000 rubles is provided.

When there is no activity, you still must submit zero reports, otherwise the same fines await them.

How to fill out a simplified balance sheet 2017?

For each line of the balance sheet, indicators for 3 years are given; if some indicator is missing, then a dash is placed. The code in the line is entered depending on whose share in this aggregated indicator is the largest. For example, if a company has the most accounts receivable at the end of the reporting period, then code 1230 is entered in the line “Financial and other current assets” in the balance sheet.

Simplified balance sheet for small businesses: instructions for filling out

Let's start with Balance Sheet Asset . It consists of five sections and the balance sheet currency for the Asset section (line 1600). The Asset reflects all the company’s property, which is divided into current and non-current assets.

The line “Tangible non-current assets” reflects data on fixed assets. These can be buildings, structures, transport, etc. The balance of accounts 01 and 03 is entered here minus the balance of account 02, and expenses for construction in progress (account 08) are also added.

In the line “Intangible, financial and other non-current assets” the value of intangible assets is formed (these include: scientific works, works of art, computer programs, inventions, etc.), deposit balances are reflected (account 55), long-term investments ( account 58), as well as the debit balance of accounts 60, 62, 68, 69, 70, 71, 73, 75 and 76.

Filling out the “Inventories” line of the simplified balance sheet does not differ from the generally accepted filling out of financial statements. Inventories take into account the cost of raw materials and materials not transferred to production, but recorded in the debit of accounts 10, 15, 16, the cost of finished products reflected in the debit of accounts 43 and 45, the amount of costs for work in progress recorded in accounts 20,23,29 and so on.

The line “Cash and cash equivalents” indicates the presence of the company’s funds in Russian rubles and foreign currency, which are available in the accounts or at the cash desk of the enterprise, as well as cash equivalents. The account balance is reflected: 50, 51, 52, 55 (except for the amounts reflected on lines 1170 and 1240), 57.

The line “Financial and other current assets” displays information about short-term financial investments (account 58), accounts receivable claimed for VAT, but not accepted for deduction, the amount of excise taxes and other current assets of the organization.

In the currency of the asset, this is line 1600, indicating the sum of all the indicators discussed above. It reflects all the company's assets.

The liability side of the simplified balance sheet consists of 6 sections and reflects the sources of the company’s funds. Sources come in the form of own funds, they are reflected in the line “Capital and reserves” and include information about the authorized and additional capital, the reserve fund and retained earnings. Data for accounts 80 (minus the debit balance of account 81), 82, 83 and 84 is entered here.

Companies also attract borrowed funds, which are recorded in the line “Long-term borrowed funds.” Here is the debt on long-term loans and borrowings (account 67). Long-term are understood as liabilities with a maturity period of more than 1 year. This line reflects the balance of accounts 60, 62, 68, 69, 70, 71, 73, 75 and 76. And there is also “Short-term borrowed funds”, it reflects the balance of account 66.

The title of the line “Accounts payable” fully reveals its essence. This contains the credit balances of accounts 60, 62, 68, 69, 70, 71, 73, 75 and 76.

The line “Other short-term liabilities” may well not be filled in if all the information has already been indicated.

The line indicator 1700 reflects the total amount of the organization's liabilities. The results of the Asset and Liability must be equal.

A sample balance sheet 2021 for small businesses can be downloaded HERE

If you still have questions, you can ask our specialists using the feedback form on the website