When an intangible asset reaches the end of its regulated useful life, the asset is subject to write-off.

The general principles of such a procedure are provided for by PBU14/2007, namely, Chapter V of this normative act. The removal of an intangible asset from the balance sheet is documented and accompanied by recording of the necessary correspondence in accounting.

Why do intangible assets leave the organization?

If an object of intangible assets has completed its regulated period of operation, but it is not retired and still brings actual benefit (economic benefit) to the organization-right holder, there is no need to write it off.

In other words, the presence of intangible assets on the business balance sheet of an enterprise with a residual value equal to zero is considered a normal situation.

A similar principle, as is known, applies to fixed assets, which also belong to the non-current assets of the company.

Thus, zero residual value of intangible assets is not a mandatory basis for the unconditional write-off of such assets in accounting.

The PBU-14/2007 standard, however, provides for typical circumstances that determine the disposal of intangible assets and their proper write-off.

Methods

It should be noted that the list of possible ways to dispose of intangible assets from economic accounting is open.

The PBU-14/2007 standard suggests the following acceptable options:

- Inventory (check, audit) revealed a shortage of intangible assets, which necessitates the need to properly write off the missing objects.

- The corresponding asset is made as a contribution under the joint venture agreement.

- The asset is transferred to third parties under a gift agreement (deed of gift).

- The asset is transferred to third parties under an exchange agreement (barter agreement).

- The asset is transferred as a contribution to the authorized capital of another company.

- The facility ceased to be used due to obsolescence.

- The exclusive right is transferred to other entities without formalizing any agreement (for example, the imposition of a penalty on an intangible property object, standard succession of property).

- In relation to a means of individualization or a product of intellectual activity, the exclusive right is alienated under an appropriate agreement, which leads to the transfer of such right to a third party.

- For a means of individualization or other product of intellectual activity, the period of validity of the corresponding right legally granted to the enterprise has expired.

- Other legal grounds.

Documenting

If an intangible asset is written off, this fact is not simply reflected in the accounting of the enterprise.

It must be prepared with the appropriate documents.

First of all, an administrative act of the organization’s management is issued - an order.

In addition, a special document is drawn up that officially certifies the fact that the asset has been written off.

We are talking about the so-called write-off act, which clearly states why the intangible asset is being removed from the enterprise.

The act of write-off is the documentary basis for the subsequent entry into the Intangible MA-1 card of the relevant entries indicating the disposal of a specific object.

The write-off note is entered by specialists from the accounting department.

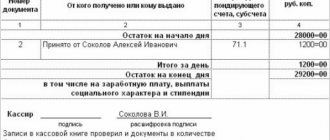

The sale of intangible assets is formalized at the enterprise with the following documents:

- an accounting card for a specific intangible asset, which indicates the reason for its disposal;

- an act documenting the fact of disposal of an intangible asset;

- invoice of the sold asset;

- agreement on the alienation of an asset.

If the intangible asset is transferred by the copyright holder enterprise to the authorized capital of another organization, this procedure is documented by the following papers:

- account card;

- act of disposal;

- decision of the community of founders;

- agreement with the valuation of an intangible asset.

If the intangible asset is transferred to a third party free of charge, the enterprise draws up and fills out the following papers:

- the corresponding mark is made on the registration card;

- free asset invoice;

- act of disposal;

- gift agreement;

- documentary evidence of acceptance.

How is the transfer and acceptance certificate drawn up?

If an intangible asset is sold (sold), a purchase and sale agreement is drawn up. If intangible assets are transferred free of charge to a third party, a donation agreement is drawn up.

In both cases, the asset is disposed of.

This fact is often confirmed by filling out a transfer and acceptance certificate, which must contain the following mandatory details:

- name of company;

- Date of preparation;

- who transferred (enterprise, division);

- who received (enterprise, division);

- accounting posting (debit/credit);

- primary cost of the object;

- regulated period of operation of intangible equipment;

- depreciation rate for an intangible asset;

- name and brief description of the intangible asset;

- link to the title document;

- signatures, approvals.

Intangible assets: what are they and how to account for them?

The essence of the concept of “intangible assets” and the procedure for their accounting is regulated by Accounting Regulations No. 14. It is here that it is explained what can be classified as intangible objects. Thus, intangible assets include:

To account for intangible assets, active account 04 is used, in which objects are reflected at their original cost.

As for the initial cost of intangible assets, it consists of the amount of costs associated with their purchase, installation and configuration (payment of duties, information and consulting services). The initial cost is established at the time the intangible asset is accepted for accounting and remains unchanged throughout the entire service life of the asset, except in cases of revaluation or depreciation of the asset. Please note that only amounts minus VAT are taken into account.

An interesting fact is that since 2008, transactions with intangible assets have been exempt from VAT.

When registering an intangible asset, a transfer acceptance certificate is drawn up, which is the basis for opening an intangible asset registration card-1. The disposal of intangible assets can be formalized by a write-off act in the OS-4 form or an acceptance and transfer act in the OS-1 form.

Accounting and postings

As mentioned earlier, the disposal of an intangible asset from an enterprise is due to various reasons.

Consequently, the basis for disposal of intangible assets predetermines the specifics of accounting for the corresponding procedure. Disposal accounting is carried out using account 91, or more precisely, subaccount 91/4.

Debit 91/4 records the residual value of the disposed object, disposal costs, as well as VAT amounts. Loan 91/4 reflects sales revenue, as well as other income due to the disposal of the object.

Balance 91/4 can be a credit (income received, profit earned) or debit (costs incurred, loss recorded).

The balance of 91/4 is transferred to 91/9 (“Balance of other income and expenses”), and then transferred to 99 (in other words, to the profit and loss account).

Unsuitability

If intangible assets are written off (discarded) from the enterprise due to further unsuitability, the following correspondence is compiled:

| Operation | Debit | Credit |

| Accumulated depreciation is displayed | 05 | 04 |

| Residual value is revealed | 91/4 | 04 |

| Fixing a loss | 91/9 | 91/4 |

| 99 | 91/9 |

Implementation

The write-off of intangible assets upon its sale (sale) is accompanied by the execution of the following transactions:

| Operation | Debit | Credit |

| Accumulated depreciation is set | 05-count | 04-account |

| Residual value is revealed | 91/4-account | 04-account |

| Sales costs are taken into account | 91/4-account | 44,70 |

| The VAT amount on sales is reflected | 91/4 | 68 |

| Sales revenue (accrued/received) is reflected | 62,76,51 | 91/4-account |

| Profit taking (if any) | 91/4-account | 91/9-account |

| 91/9-account | 99-count | |

| Fixation of loss (if any) | 91/9-account | 91/4-account |

| 99-count | 91/9-account |

Transfer of deposit or shares

If an intangible asset is transferred as a contribution (part) to the authorized capital or shares under a joint activity agreement, the following correspondence is drawn up:

| Operation | Debit | Credit |

| Accumulated depreciation is set | 05 | 04 |

| The residual value is established | 91/4 | 04 |

| The costs of transfer procedures are taken into account | 91/4 | 76.23, other |

| The contractual value of the deposit is reflected | 58 | 91/4 |

| Income is written off | 91/4 | 91/9 |

| Profit is fixed | 91/9 | 99 |

| Costs are transferred | 91/9 | 91/4 |

| The loss is recorded | 99 | 91/9 |

Read about accounting for the movement of intangible assets here.

Entry of HMA into another company

When an intangible asset is transferred to another enterprise, for the enterprise this procedure is considered a financial investment and it will subsequently receive dividends. The transfer of an object can be carried out only at the residual value; first, depreciation is written off, and then the cost is determined and recorded in account 04. Also, in posting D58 K76 the debt on the deposit should be reflected, and in D76 K04 - the transfer of the object.

| Debit | Credit | Sum | Operation | Document |

| 58.01.1 | 76.05 | Without VAT | Debt on deposit | Act |

| 04.01 | Without VAT | Write-off of depreciation | Write-off act | |

| 76.05 | 04.01 | Without VAT | Transferring an object | Act |

Tax accounting

The specifics of tax accounting depend on what kind of object is being disposed of - a depreciable asset or, alternatively, a non-depreciable one.

For tax purposes, the depreciability of intangible assets is determined by its primary cost.

This circumstance makes tax accounting of this aspect significantly different from accounting.

If the primary cost of intangible assets is less than one hundred thousand rubles, such an object is not considered depreciable for tax accounting.

The costs of purchasing this asset are initially taken into account in other expenses of the organization related to production and sales.

If intangible assets are a depreciable object, the situation with tax accounting becomes somewhat more complicated.

When an intangible asset is written off because it has ceased to be used due to obsolescence, the costs of the write-off and the depreciation still subject to accrual are recorded as non-operating costs.

The sale/exchange of depreciable intangible assets causes a decrease in sales income (sales proceeds) by the residual value of disposed assets and sales costs.

Profit taxation in this case is carried out according to a typical scheme. The loss is subject to equal inclusion in other production/sales costs over the remaining period of operation of the facility.

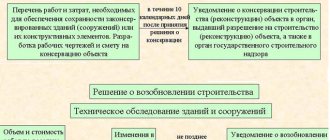

How to write off when closing an organization?

Cash and other assets of the closing (liquidated) organization remaining after the repayment of all creditor obligations are transferred legally to its founders (participants).

This norm is provided for by the Civil Code of the Russian Federation.

Since intangible assets, the legal holder of which is the liquidated organization, cannot be used in its business processes longer than the life of the organization itself, such assets are written off from the balance sheet when the enterprise is closed.

The following correspondence is compiled:

- The primary cost is written off.

- Accumulated depreciation is written off.

- The financial result of the write-off is reflected.

Depreciation

The definition and reflection of depreciation of intangible assets is regulated by the current standards PBU-14/2007. As for disposal procedures, they are reflected in account 04.

If depreciation for retiring assets was recorded in accounting by accumulating accrued values on account 05, then the transfer (write-off) of the cost of these objects should be accompanied by a write-off of accumulated depreciation.

For a retiring (written off) object, the accumulated depreciation is written off to account 04.

Thus, when an intangible asset is written off, its value, reflected in account 04, is reduced by the amount of accrued depreciation.