Production accounting, along with financial accounting, is an integral part of management accounting.

Production accounting concerns operations related to the production of self-made products, the performance of various types of work, and the provision of services within the enterprise and to third parties.

It includes:

- quantitative accounting of production volumes, interesting to management and employees of production departments;

- accounting for operations to calculate cost per unit of production, which is necessary mainly for financial departments and company managers.

The main goal of production accounting is to control production costs to identify opportunities to improve the efficiency of the company as a whole.

Postings to accounts 20 and 90: select the method of writing off expenses

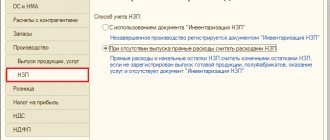

General business expenses can be written off in one of two ways. Postings for writing off general business expenses, depending on the chosen method, are presented in the figure:

The chosen procedure for writing off general business expenses must be fixed in the accounting policy.

This publication will help you cope with the preparation of accounting policies for 2021.

There you will also need to indicate the indicator in proportion to which general business expenses will be distributed to the cost of different types of products if they are written off as a debit to account 20 “Main production”. This could be the salary of key production workers, revenue, production volume and other indicators.

We will show the technology of distribution and write-off of general business expenses using an example.

Accounting entries for production costs

When accounting for the costs of the main production, postings are made on the active account. 20. The debit reflects the amount of costs by type, while the credit reflects the total cost value. Correspondence is carried out by debit with accounts - 10, 69, 02, 70, 05, 71, 60, 04, 19, 23, 21, 26, 25, 28, etc. At the end of the month, the loan account is closed to the debit of the account. 90, 43, 40. If there is work in progress, a balance is formed at the end of the month. In a similar way, expenses are collected for other cost accounts of the organization.

Accounting for intangible assets - postings

Scheme for writing off general business expenses to the cost of production (main production)

So, general business expenses for the main production have been written off - what entries need to be made in accounting?

Example

Energy Plus LLC produces two types of products:

- Capacitors (devices for storing charge and electric field energy);

- Transistors (electrical signal converters).

Since the beginning of the year, the accounting policy of Energia Plus LLC has established the procedure for writing off general business expenses by calculation items (types of products). The distribution base is the wages of production workers.

For January, the amount of general business expenses amounted to 774,023 rubles. How Energy Plus distributed expenses is shown in the table:

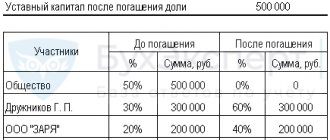

| Index | By product type | Total | |

| capacitors | transistors | ||

| Salaries of main production workers (including insurance premiums) for January, rub. | 2 027 133 | 2 759 426 | 4 786 559 |

| Share of workers' wages | 42,35% (2 027 133 / 4 786 559 × 100%) | 57,65% (2 759 426 / 4 786 559 × 100%) | 100% |

| Calculation of the amount of general business expenses attributable to each type of product, rub. | 327 798,74 (774 023 × 42,35%) | 446 224,26 (774 023 × 57,65%) | 774 023 |

In the accounting of Energy Plus LLC, the following entries were made to write off general business expenses:

According to the working chart of accounts of Energia Plus LLC, according to account 20, analytical accounting has been organized for subaccounts 20.1 “Production of capacitors” and 20.2 “Production of transistors”.

These postings were used to write off general business expenses to the cost of production in the accounting of Energy Plus LLC in January. General business expenses will be distributed and written off throughout the year in a similar manner.

General business expenses also include entertainment expenses. In accounting and tax accounting, such costs are taken into account differently. How exactly, ConsultantPlus experts told: in accounting - in this Ready-made solution, in tax - in this publication. And if you don’t have access to K+, get a trial demo access and study the material for free.

Basic accounting operations for production

The most important accounting transactions for production include:

Main production costs

They are taken into account in the corresponding calculation account 20, the debit of which reflects the costs of materials (account 10), wages (70) and taxes accrued on it (69), depreciation of fixed assets (02) and intangible assets (05), losses from defects (account 28 ), services of third-party organizations (60, 76), shortages and losses from damage to valuables (94), deferred expenses (97), and other basic expenses included in the cost directly. One of the ways to distribute costs is direct costing.

Part of the expenses of auxiliary production (account 23), general shop and general business expenses (accounts 25, 26), attributed to the production cost of finished products (details about cost), are also written off here. The credit of this account takes into account the return of materials (10), as well as the completion of production cycles for the production of finished products (40, 43) and semi-finished products sold externally (21).

More details - Postings of the main production.

Expenses of auxiliary production

Expenses of auxiliary production (account 23) include the costs of energy, repair, instrumental facilities, costs of technical control, etc., which are reflected in the same way as on account 20.

More details - Postings for expenses of auxiliary production.

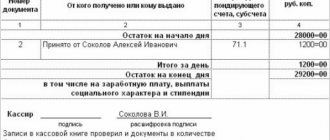

Unfinished production

WIP - materials, parts, products, semi-finished products and other labor products that have entered production, but have not yet gone through all the processing stages provided for in the technological cycle and cannot be used for consumption for their intended purpose. The cost of work in progress at the end of the month is determined by the balance of accounts 20, 23 and 29.

Read more - Postings for work in progress.

Overhead costs

General production expenses (account 25) take into account the costs of maintaining, servicing and/or repairing main and auxiliary workshops and departments that are not related to specific types of products: maintenance and operation of in-shop equipment and transport, wages for workers servicing the workshop, tool wear, electricity costs for workshop work, etc.

Read more - postings to overhead costs

General running costs

General expenses (account 26) reflect the costs of managing the enterprise as a whole, which cannot be attributed to any specific divisions and types of products: maintenance of buildings and property of the plant management, plant laboratories, expenses for administrative and economic needs, remuneration of administrative personnel, and etc.

General production and general business expenses at the end of each month are distributed among the divisions of the enterprise and types of products based on the selected base for distribution.

Marriage

Defects (account 28) – losses in production due to the release of products that do not meet the requirements of standards (specifications), which cannot be used for their intended purpose or are possible, but with restrictions and loss in price and quality.

Marriage can be internal or external, reparable or irredeemable, compensated or unredeemed.

In more detail - marriage postings

Zero revenue: what to do with general business expenses

In the absence of activity, general business expenses may also arise. What to do with them? General business expenses (as well as other types of expenses) must be recognized in accounting in a timely manner: in the reporting period in which they are actually incurred:

If expenses are not taken into account while waiting for revenue to appear, accounting and reporting indicators will be distorted. Users of reporting will be misled by the company's break-even indicator in conditions where there is actually a loss (there are expenses in the absence of income). In addition, for gross violation of the rules for keeping records of income and expenses, fines are provided (Article 120 of the Tax Code of the Russian Federation, Article 15.11 of the Administrative Code).

The question arises: how can they be fined under an article of the Tax Code if the procedure for accounting for expenses is violated? The answer is contained in paragraph 3 of Art. 120 Tax Code of the Russian Federation. The text of the article explains what is meant by the expression “gross violation of the rules for accounting for income and expenses”:

Thus, in the absence of activity, general business expenses must be reflected in the accounting accounts and written off in a timely manner. In the next section we will tell you how general business expenses are written off in this case.

The procedure for accounting for the cost of finished products

When accounting for finished products on synthetic account 43 at the actual production cost in analytical accounting, the movement of its individual items can be reflected at accounting prices (planned cost, selling prices, etc.) highlighting deviations of the actual production cost of products from their cost at accounting prices.

Such deviations are taken into account for homogeneous groups of finished products, which the organization forms based on the level of deviations of the actual production cost from the cost at the accounting prices of individual products.

The main entry with the cost of finished products is a write-off from account 43. In this case, the amount of deviations of the actual production cost from the cost at prices accepted in analytical accounting is determined by percentage. Namely, as the ratio of deviations for the balance of finished products at the beginning of the reporting period and deviations for products received at the warehouse during the reporting month to the cost of these products at discount prices.

The amounts of deviations of the actual production cost of finished products from their cost at accounting prices related to shipped and sold are reflected in the credit of account 43 and the debit of the corresponding accounts with an additional or reversal entry - depending on whether it is an overexpenditure or a saving.

Detailed accounting is carried out by storage locations and individual types of finished products.

Also see “How to calculate the volume of products sold: formula and analysis.”

Posting involving account 91: how expenses are written off in the absence of income

Commercial activities may not generate income when the business is in its infancy, during seasonal work, or under other circumstances. In such conditions, there may be no revenue, as well as other income and expenses, but it is not always possible to do without general business expenses. They accumulate on account 26 and require timely write-off.

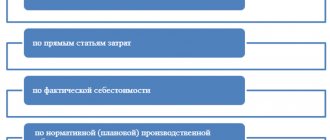

In this case, what kind of posting is made when writing off general business expenses? Possible write-off methods for such a situation are presented in the figure:

The choice of method 1 involves the distribution of general business expenses among the objects of calculation (production continues, but there is no revenue from sales of products yet). In the absence of sales, general business expenses will be taken into account in the balance of work in progress.

When choosing method 2, general business expenses are written off monthly as other expenses. This method is used in the complete absence of activity, when it is impossible to recognize general business expenses as expenses for ordinary activities.

This material will introduce you to the types of other expenses.

Results

General business expenses are written off to the debit of cost accounts 20, 23, 29 if the products are accounted for at full production cost.

If the company determines the reduced cost of production, general business expenses are written off to cost of sales. In the absence of activity and sales revenue, account 91.2 “Other expenses” is included in the postings for writing off expenses. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

General approach to finished goods accounting

According to the law, finished products are part of inventories intended for sale. Namely, the final result of the production cycle, assets completed by processing/assembly, the technical and quality characteristics of which comply with the terms of the contract or the requirements of other documents, in cases established by law (clause 199 of the Methodological Guidelines for Inventory Accounting, approved by order of the Ministry of Finance dated December 28. 2001 No. 119n).

By virtue of the Chart of Accounts for financial and economic activities and the Instructions for its application (approved by order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n), in accounting, transactions with finished products are reflected in the 43rd accounting account. It is intended to summarize information about the availability and movement of finished products.

Typically, accounting for the output of finished products is relevant for industrial, agricultural and other manufacturing enterprises.

The peculiarity of accounting for the production of finished products is that the balance on this account can only be in debit.

KEEP IN MIND

Features of accounting entries for finished products:

- finished products purchased for assembly (the cost of which is not included in the cost of manufactured products) or as goods for sale are recorded on account 41 “Goods”;

- the cost of work performed and services provided is not reflected in the finished product, and the actual costs for them as they are sold are written off from the production cost accounts to account 90 “Sales”.