Sometimes excess cash is found in the cash register of a business entity.

As in the case of shortages, the fact of identifying an excess amount of cash requires documentation, accounting, and an adequate response from management. After all, the execution of all cash transactions of an enterprise is within the competence of the cashier - an employee with whom the employer enters into an agreement on full financial responsibility.

Accordingly, cash accounting is an important aspect of the economic activity of an organization.

Strict adherence to its rules and regulations is key to the smooth running of the company.

What to do if excess funds are identified during inventory?

Cash surplus means that the real amount of available cash of the enterprise, confirmed by the results of the audit performed, exceeds the amount of cash recorded in the cash accounting registers.

Excess cash in a company is often detected by the inventory commission based on the results of a cash audit.

When such facts are discovered, members of the commission carrying out the inventory of the cash register study the accounting documentation.

The commission’s tasks are to document this fact, establish the causes of the cash surplus, determine the culprit of the detected violations, and correctly eliminate the identified discrepancies in accounting.

Formula for calculating cash surplus

The basis for calculating cash surpluses are primary accounting documents: cash book, receipt and expenditure orders, etc. In general, the formula for calculating the indicator looks like this:

IKN = NK – LN, where

NK – cash in hand at the end of the day;

LN – cash limit set at the cash register.

As for the cash limit, it can be calculated in two ways.

Table 1. Determination of cash limit

| By tributaries | By outflows |

| LN = Receipts / RP * Day | LN = Receipts / RP * Day |

| RP – billing period in working days; Day – number of working days between delivery of proceeds in the form of cash | |

Important point! In practice, the average cash surplus for a certain period (quarter, year, etc.) is most often calculated. This approach allows you to evaluate the effectiveness of cash flow management over an extended period of time.

Possible reasons for the detected money

The discovery of excess cash in an organization's cash register is often perceived ambiguously by the employer.

This makes management's reaction to the facts of cash surpluses significantly different from the typical consequences of identifying cash shortages, in which embezzlement/theft usually becomes the priority version.

Thus, the presence of excess, unaccounted cash in the cash register can be caused, for example, by the sale of goods at an erroneously indicated (inflated) price or, alternatively, underweight.

Although, of course, such situations rarely arise by chance with modern control and transaction systems.

Speaking about possible reasons, we cannot exclude the fact that cashiers of trade organizations sometimes report their own money to the cash register.

This is often done when there is a shortage of change bills in order to freely give change to customers.

Sometimes employees forget about this, which causes excess cash to appear in the cash drawer.

One way or another, these facts can be regarded as violations of cash discipline, which is not acceptable from the point of view of conducting cash transactions.

Determining the culprit

In order to find out the reasons for the situation and correctly record cash surpluses in accounting, the inventory commission sends appropriate requests to financially responsible entities - the organization's cashiers.

Employees of the company who are personally responsible for the correct management of the cash register provide written explanations regarding excess cash.

Explanatory notes from responsible persons make it possible to identify the entities responsible for the appearance of cash surpluses.

In addition, the solution of this problem is effectively facilitated by reconciling factual information with accounting information.

How is an explanatory note drawn up by the cashier of an organization?

If an audit reveals a cash surplus at an enterprise, the responsible cashier is obliged to provide his employer with an explanatory note regarding this fact.

Current legislation provides that the head of a business entity must require the cashier to provide the necessary explanations in writing within 2 (two) days.

Being a financially responsible entity, the cashier does not have the right to refuse to write an explanatory note.

This paper is an official document.

It can be compiled manually or as a computer printout. One way or another, the explanatory note is written on the official form (form) of the business entity and signed by the cashier (with a transcript).

The explanatory document drawn up by the cashier regarding the detected excess cash contains two key sections:

- Description of facts/circumstances. The prerequisites for the situation that arose or the real events that led to its occurrence are indicated.

- A statement of specific reasons for the appearance of excess (unaccounted for) cash in the cash register. As a rule, there are several such reasons. They should be correctly identified to minimize the degree of guilt and mitigate future liability.

In addition, the explanatory paper, presented in two copies, must contain the following mandatory details:

- name of the business entity (employing company);

- Full name, position of the manager;

- the name of the paper itself (“Explanatory”);

- Full name, position of the responsible employee (cashier);

- date of preparation of the document, signature of the originator.

When the document is fully drawn up and signed by the cashier, it should be provided to the employer. The manager signs the paper (both copies) with the registration number. One copy must remain with the compiler (cashier).

What documents need to be completed?

The work of the inventory commission to identify and investigate cash irregularities in the organization is necessarily recorded by maintaining a special protocol, which reflects the following:

- detailing the results of the cash audit;

- description of methods used to identify cash surpluses;

- expert conclusions regarding the discovery of excess cash in the company's cash register.

The results of the activities of the inventory commission in the prescribed form are provided to the head of the organization, who authorizes the acceptance of excess cash into the cash desk by issuing a special administrative act.

The documentary basis for drawing up such an order is the cash inventory report, drawn up by the audit commission according to the INV-15 standard and containing the following information:

- basic details of the company;

- number and date of the inventory order (documentary basis for verification);

- number and date of formation of the INV-15 act;

- date of execution of the cash audit regulated by management order;

- financially responsible entity (full name, position) with signature;

- detailing of factual information and accounting data on the state of cash;

- determination of the total - the amount of the detected surplus;

- numbers of the latest cash orders (receipt / expense);

- Full name, position, signatures of all commission members;

- confirmation by the cashier of responsibility for the available cash in the cash register;

- the reason for the detected excess;

- signature of the financially responsible entity (with transcript);

- the manager's verdict regarding the discovered surplus;

- signature of the manager (with transcript and date).

Posting surplus

Unlike a shortage, where suspicions of theft or embezzlement immediately arise, a case of a surplus can have two interpretations.

If there is unaccounted money in the cash register, then perhaps some product was sold at an incorrectly indicated price or there was an underweight. In principle, with modern systems of fixation and operations, such cases should not occur by chance. It often happens that cashiers in small stores, in the absence of a sufficient number of necessary change notes, report them to the cash register from their wallet. Later, due to forgetfulness or busyness, you may not remove the change notes in time, which will lead to the appearance of surpluses and subsequent problems when they are detected.

Accounting and posting - postings

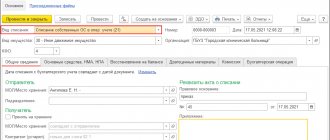

A copy of the INV-15 act is sent to the accounting department to perform the necessary accounting actions. The accountant makes the necessary postings (account correspondence).

Cash surpluses are recorded by accounting in the month of completion of the relevant check and, if an inventory was carried out, are accounted for on the date of acceptance of the detected cash.

If an annual audit was carried out, its results are reflected in the annual reports.

Identified excess cash in the cash register is reflected in accounting entries using the following entries:

| Operation (description) | Debit | Credit |

| Reflects cash revenue identified upon verification of cash register systems. | 50 | 90 |

| Cash surplus is capitalized as other income of the organization | 50 | 91 |

There is no extra money in the cash register

Checking the cash register without counting cash is a rare occurrence. If, as a result of this, the company discovers that it has extra money, prepare to defend itself. The auditors do not ignore such facts.

The amount of unaccounted money does not matter in this case. It doesn’t matter whether it’s a hidden amount of income or a penny of change left by the buyer. In any case, inspectors will try to fine you for this violation. Your options in this case depend on:

- on the type of inspection the inspectors came with;

- from the article of the Code of Administrative Offenses under which you were fined.

Tell them goodbye

Inspectors can gain access to cash by checking the company's use of cash register equipment. The auditors explain their right to count money at the cash register cash desk by Article 7 of Federal Law No. 54-FZ of May 22, 2003. The fact is that this article allows tax authorities to “monitor the completeness of revenue accounting.” However, the legislation does not establish the specific powers of inspectors during these inspections. Therefore, they try to use their capabilities to the maximum.

First, the inspectors demand that you provide them with all documents related to working on a cash register. This is the cashier-operator's journal, control tapes, Z-reports, acts of return of unused checks, etc. Then the auditors compare the readings on the control tape with cash receipts. To do this, they take X-report readings. The difference between the amount entered in it at the time of the inspection and the amount at the beginning of the work shift (according to the entry in the cashier-operator’s journal) is the revenue that the company entered on the cash register on the day of the inspection. This amount must match the amount of cash in the cash drawer of the machine.

If there is more money in the cash register, inspectors accuse the company of one of the violations:

- The company does not use CCP. The fine for this is from 30,000 to 40,000 rubles (Article 14.5 of the Code of Administrative Offenses of the Russian Federation);

- the company did not capitalize part of its cash proceeds. The fine for this is from 40,000 to 50,000 rubles (Article 15.1 of the Code of Administrative Offenses of the Russian Federation).

However, the tax inspectorate has no legal grounds to collect these fines. This can be confirmed with the following arguments.

Let's start with the fine under Article 14.5 of the Code of Administrative Offenses. The inspection can assign it only if the company does not use a cash register at all. Cases that indicate this violation are clearly stated in the Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated July 31, 2003 No. 16 (you can see their list on page 34 of this issue of the magazine). There is no such item as storing extra money at the cash register cash register in this list. Therefore, the inspectorate has no right to fine a company for not using cash registers on this basis.

Now about the fine for not posting cash proceeds. This fine also cannot be considered legal. The fact is that, by appointing him based on the results of an inspection of the company’s use of CCP, the inspection exceeds its authority. Let's explain why. As you know, the rules for recording cash proceeds are established by the Procedure for Conducting Cash Transactions (approved by decision of the Board of Directors of the Central Bank of Russia dated September 22, 1993 No. 40). This document does not apply to legislation on cash register equipment. Therefore, you cannot be fined for violating the requirements established therein based on the results of checking the company’s compliance with the legislation on cash register systems.

The Department of Tax Control Organization of the Ministry of Taxes of Russia of Russia believes that inspectors must find out whether a company receives cash proceeds within the framework of the powers established by the Tax Code. As you know, there are two types of inspections: desk and on-site. Thus, the inspectorate can fine a company for not posting cash proceeds only based on their results. This position is confirmed by the Ministry of Taxes and Taxes (letter dated April 27, 2004 No. 33-0-11/311). True, this letter is addressed to the Department of the Ministry of Taxes and Taxes of Russia for the Republic of Bashkortostan. Therefore, it is mandatory only for inspections in this region. At the same time, the position of the main tax department is clearly expressed in it, so in a dispute with auditors you can refer to this. If your tax office refuses to follow the explanations given in it, you can do so. Send an official request to the Ministry of Taxes on behalf of your company. In it, describe your specific situation, indicate the name of the company, its details, and also sign, seal and date the letter. Officials from the Ministry of Taxes and Taxes will have to review it within a month. They will send you the answer by registered mail. Such a letter will help you win a dispute with your inspectorate.

To appeal an illegally imposed fine, proceed as follows. When the inspector asks you to sign the protocol he has drawn up, make a reservation in it indicating your disagreement with the results of the inspection. In the “Explanation of the violator” column, write down your arguments. If after this the inspector nevertheless presents you with a decision to impose a fine, you can appeal it to a higher tax authority or arbitration court.

Let's talk when we meet

Thus, the real opportunity to fine a company for failure to receive cash appears to the inspectorate only during an on-site tax audit. During this process, auditors have the right to conduct an inventory of property. To do this, the tax inspector presents the head of the company with an order to conduct an inventory. It must indicate the reasons and timing of the inventory, the composition of the commission and the list of property that is subject to recount.

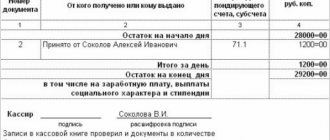

The cash register inventory goes like this. First, you will be asked to submit all cash documents. These are incoming and outgoing orders, a cash book, as well as papers related to working at a cash register machine - the cashier-operator’s journal, control tapes, Z-reports, etc. Tax authorities will put their visa on them with the note “before inventory.”

Then the cashier will be asked to give a receipt stating that by the beginning of the inventory, all cash documents were handed over to the accounting department or transferred to the commission, all money received at the cash desk was capitalized, and money issued from the cash register was written off as an expense. Please note: the cashier may refuse to give this receipt - there is no liability for this.

Based on the results of the inventory, tax officials draw up a statement. In it they indicate the amount of money that is in the cash register at the time of the check. If, following an audit, a surplus is discovered in the cash register, auditors may regard it as unrecorded cash proceeds. The result of this conclusion is predictable: the inspectorate will again try to fine you under Article 15.1 of the Code of Administrative Offences. However, even in this case it will not be easy to do.

First, the inspectorate will have to prove that the extra money in the cash register is really unaccounted cash proceeds. This can be established by identifying that the amount of money accepted at the cash register does not correspond to the number of goods sold. To do this, you need to compare primary cash documents with documents on the movement of goods and materials in the warehouse (invoices, product reports, etc.). If the tax inspectorate does not carry out such work, then it will have no grounds for a fine (resolution of the Federal Antimonopoly Service of the North-Western District dated August 11, 2003 in case No. A13-1896/03-23AP).

I have an opinion

Mikhail Solomin, chief state tax inspector of the department of organization of tax control of the Ministry of Taxation of Russia:

“Unreceived cash can only be found in the organization’s main cash register. Therefore, unaccounted money in the KKM cash register does not indicate a violation under Article 15.1 of the Code of Administrative Offenses. In addition, inspectors can detect violations under this article only within the framework of the Tax Code, that is, during an on-site tax audit.”

advice

Dmitry Severov, lawyer:

“The fact that there is unaccounted money in the cash register does not mean that the company will be fined under Article 15.1 of the Administrative Code. Before drawing conclusions about a violation, the inspector must take into account all witness statements. This condition helps many companies avoid problems during verification.

It's done like this. Estimate the maximum amount of extra money that may end up in the company's cash register. Then fill out an application on behalf of the cashier addressed to the manager. In it, the cashier requests permission to keep his personal savings in the cash register. As the amount, indicate the amount of money sufficient for insurance. All this is safely sealed with the permission signature of the director.

Thus, the cashier can explain at any time that the unaccounted money in the cash register belongs to him. And to all the inspector’s statements that this is not allowed, answer: they say, sorry, we didn’t know, it happened that way, etc. The fact is that such a violation of cash regulations is nothing more than a disciplinary offense. The legislation does not provide for any sanctions for it.”

V. Seliverstov, lawyer

conclusions

Like cash shortages, cash surpluses detected during an audit require certain actions on the part of the inventory commission, management, and the responsible cashier.

Everything is carefully documented by the protocol, an inventory act is necessarily drawn up, and the financially responsible entity prepares an explanatory document regarding the cash surplus.

The reasons for the appearance of unaccounted cash are clarified, the guilty party is determined, the employer issues a verdict on accepting the cash surplus for accounting and imposing sanctions on the culprit, and appropriate orders are issued.

Inventory

There are three main stages of conducting an inventory:

- determination of the composition of the inventory commission, the period for carrying out the inventory and the reasons for its implementation. All these components must be included in one document - an order from the manager (form INV-22);

- the inventory process itself (inspection, weighing, other operations aimed at identifying shortages and surpluses during inventory), i.e., actions of the inventory commission aimed at establishing factual information regarding the organization’s property. This stage includes the preparation of inventory documentation (property inventories);

- comparison of the information established as a result of the audit with the information contained in the accounting registers, and clarification of this information (including capitalization of inventory surpluses and write-off of shortages). This stage includes the preparation of comparison sheets, documentary summing up of inventory results, and appropriate administrative actions on the part of the organization’s management.

During the inventory, the inventory commission must comply with the instructions of the Ministry of Finance of the Russian Federation on the procedure for conducting it and recording the results, recording surpluses and actions regarding shortages.

Instructions on exactly how to carry out an inventory are contained in Recommendations of the Ministry of Finance of the Russian Federation dated June 13, 1995 No. 49 (hereinafter referred to as the Recommendations).

Surpluses discovered during the inventory process

Often, inventory is accompanied by the identification of unaccounted for surpluses. These can be fixed assets, inventory items or intangible assets. As a rule, the occurrence of surpluses is the result of accounting errors.

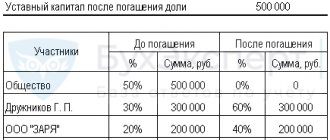

After the inventory commission compares the actual data with the accounting data, the next action is the approval by the head of the inventory results by issuing an appropriate order. The result of the implementation of this order should be to bring accounting data into conformity with the actual information established during the inventory. For this purpose, shortages and surpluses identified during inventory must be correctly written off and capitalized accordingly.

With all this, it is important to complete the inventory before the head of the organization signs the reports, and to carry out the above clarification of accounting on the date of the inventory.

The manager's initiative, formalized in the form of an order to capitalize the surplus, is the basis for settling the surplus in accounting.

Government departments do not provide a unified form for such an order. For this reason, such an order can be issued by an organization using its own approved form.

sample order for recording inventory results

Reflection of surpluses discovered as a result of the cash register inventory

Excess cash and other assets identified during the inventory are accepted for accounting. However, they will be taken into account at the current market value, and not at the prices of the previous period. As a result, on the date of discovery of the surplus, its value may be either higher or lower (which happens more often) than its price at the time of its occurrence.

Important!

When taking inventory, the difference between the actual availability and the data indicated in the accounting records must be recorded precisely in the reporting period in which the audit was carried out.

Thus, other income appears in accounting, which must be indicated on the credit of account 91 (Other income and expenses) in subaccount 91-1 (Other income). These operations are shown in the table.