Property and property rights

The Tax Code of the Russian Federation, focusing on the Civil Code of the Russian Federation, determines that property is objects of civil rights that the Civil Code of the Russian Federation recognizes as property, with the exception of property rights (clause 2 of Article 38 of the Tax Code of the Russian Federation). But the Civil Code of the Russian Federation considers property rights as an integral part of the concept of a thing. Thus, Article 128 of the Civil Code of the Russian Federation refers to the objects of civil rights, in particular:

- things including cash and certificated securities;

- other property, including non-cash funds, uncertificated securities, property rights;

- results of work and provision of services;

- protected results of intellectual activity and means of individualization equivalent to them (intellectual property).

According to the Civil Code of the Russian Federation, property is divided into movable and immovable. According to Article 130 of the Civil Code of the Russian Federation, real estate is real estate, which includes both things and property rights to these things.

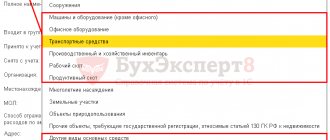

There are two types of immovable property:

- things that are immovable by their nature. These are land plots, subsoil plots, isolated water bodies, as well as objects firmly connected to the ground, the movement of which is impossible without commensurate damage to their purpose (including forests, perennial plantings, buildings and structures);

- things classified as real estate by law. These include aircraft and sea vessels, inland navigation vessels, and space objects (orbital stations, satellites, etc.) subject to state registration.

As for movable property, things that are not related to real estate are recognized as movable property. In turn, property rights are divided:

- to real rights (ownership rights, economic management rights, operational management rights);

- rights of obligation (the right to claim a debt (accounts receivable), the right to compensation for damage caused to the life or health of a citizen, damage caused to the property of an individual or legal entity);

- the right of authors and inventors to remuneration for the works and inventions they create;

- inheritance rights.

Property rights are so called because they are directly related to things.

The owner of the property has real rights in relation to the property: the rights of ownership, use and disposal of his property (Article 209 of the Civil Code of the Russian Federation). The peculiarity of obligatory property rights is that the object of the right is someone else’s action. All rights arising from contracts belong to them. Thus, goods are recognized as property under the Civil Code of the Russian Federation and, accordingly, property for the purposes of the Tax Code of the Russian Federation. The right to claim debt (accounts receivable) is recognized as a property right. Example 1. Emergence of property rights

The seller is the owner of the goods. A product is property. The seller and the buyer have entered into a purchase and sale agreement, under which the seller undertakes to transfer the goods to the buyer, and the buyer undertakes to pay for these goods. As a result, the seller and buyer arose counter obligatory property rights:

- the right to receive the goods by the buyer from the seller;

- the right to receive payment by the seller from the buyer.

Therefore, based on the norms of the Civil Code of the Russian Federation and Article 38 of the Tax Code of the Russian Federation, for tax purposes, property should be understood as what the taxpayer owns by right of ownership (the right of economic management, the right of operational management).

And property rights are the rights of participants in legal relations related to the ownership, use and disposal of property (goods, services, work performed, money, securities, etc.).

Even a child knows that a machine is movable property... But not the tax authorities

Good afternoon, dear colleagues.

This is not the first time I have encountered this and I am always surprised. I am surprised when tax authorities classify machines and equipment as real estate and try to charge property taxes. In my opinion, even a child knows: if a machine can be moved to an adjacent room, then it does not belong to real estate. One of the justifications is that the machine is on a foundation. And what?

Ruling of the Supreme Court of the Russian Federation No. 307-ES19-5241 dated July 12, 2021 in case No. A05-879/2018 . The court is on the side of the businessman. Tax officials assessed additional property tax, classifying the wood pellet shop equipment as real estate. The most interesting thing is that the lower courts accepted the position of the tax authorities. Thanks to the Supreme Court for defending the taxpayer’s position.

What guided the inspectorate and the courts? I quote: “The company accepted for accounting as separate objects of fixed assets the workshop building, the transformer substation, as well as the objects installed in the building - equipment for the wood pellet production line, a transverse conveyor for supplying chips, a transverse conveyor for supplying chips and sawdust, a transverse conveyor for supplying bark, automatic fire and dust explosion protection system “Firefly”.

The basis for additional accrual of arrears on the property tax of organizations, the corresponding amounts of penalties and fines was the conclusion of the inspectorate about the need to classify all the above-mentioned objects as real estate (building and its component parts), and the company’s unlawful application to these objects of tax exemption, provided for in paragraph 25 of Article 381 Tax Code for movable property". Either stand or fall. In addition, the criterion of technological interconnection was added to the justification...

What did the Supreme Court decide? The most interesting thing is that the tax authorities themselves ignored their own Letter from the Federal Tax Service of Russia dated March 28, 2018 No. BS-4-21/ [email protected] , which provided an explanation for the qualification of technological equipment. The document says that despite the fact that the equipment can be mounted on a foundation, in the opinion of the Russian Ministry of Industry and Trade, it cannot be qualified as real estate, since it does not meet the above criteria and acts in civil circulation independently precisely as equipment for which Repeated dismantling and moving to another location with subsequent installation is possible.

Based on the results of consideration of the cassation appeal, the Supreme Court and the Judicial Collegium for Economic Disputes of the Supreme Court of the Russian Federation sent the case for a new consideration, overturning the decisions of the lower courts.

Conclusion

You may encounter the fact that the tax authorities consider machines and equipment in your business to be real estate. If they're worth millions of dollars, you'll be hit with crazy taxes. Therefore, use this court decision and the Letter of the Federal Tax Service of Russia, which I referred to in this article. Prove that the machines can be moved, and the tax authorities do not have the right to assess additional property taxes.

I hope this article was helpful to you. Share with friends and acquaintances and like: the more likes, views and comments, the more people will learn how to deal with illegal actions of tax officials.

Thank you, good luck with your business.

Taxable income...

According to tax accounting rules, all income that is not revenue from the sale of goods (work, services) and property rights is considered non-operating income. Their open list is in Article 250 of the Tax Code of the Russian Federation. For example, non-operating income includes:

- dividends;

- interest received under loan and credit agreements;

- gratuitously received property and property rights;

- income from previous years identified in the current period;

- amounts of accounts payable written off due to the expiration of the statute of limitations;

- the cost of surplus inventories and other property identified during the inventory, etc.

Among non-operating income subject to income tax is income in the form of gratuitously received property (work, services) or property rights (clause 8 of Article 250 of the Tax Code of the Russian Federation).

After all, income is not only the actual receipt of money. Income (economic benefit) from the free use of property consists of the money saved that the company would have paid if it had used the property for a fee.

In this case, income must be assessed based on market prices, but not lower than the residual value - for depreciable property and not lower than production (purchase) costs - for other property (work performed, services provided). The taxpayer - recipient of property (work, services) must confirm information about prices with documents or by conducting an independent assessment.

Analytical accounting of fixed assets

Analytical accounting of income and expenses for fixed assets must be kept separately for each object. The exception is fixed assets, which use a non-linear method - here depreciation can be taken into account for the group as a whole.

Analytical accounting must contain the following information:

- about the initial cost of an object sold (disposed of) in the reporting (tax) period;

- on changes in the initial cost during completion, additional equipment, reconstruction, partial liquidation;

- about the adopted depreciation method;

- about the useful life;

- on the amount of accrued depreciation for the period from the start date of depreciation accrual to the end of the month in which such property was sold (disposed of) - using the linear method;

- on the amount of accrued depreciation and the total balance of each depreciation group - with the non-linear method;

- on the residual value of objects upon disposal;

- on the selling price of the fixed asset;

- on the date of acquisition and date of disposal;

- on the date of transfer into operation, on the start date of conservation, reconstruction, modernization and transfer for free use;

- on costs associated with the sale (disposal) of the object.

Property tax accounting

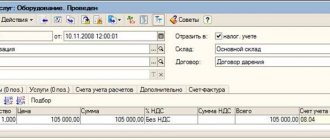

The accrual of the amount of property tax and advance payments is reflected in the settlement account for taxes and fees No. 68 .

Since property tax accounting rules are not established by law, organizations have the right to independently choose an accounting method . securing it in your accounting policies.

There are two options for recording accrued tax amounts: :

- The Ministry of Finance in its letter recommends using account 26 - the general business expenses account, and reflecting the accrual of property tax payable with the following entry:

Debit account 26 and credit account 68 in the subaccount for property tax payments.

- But since the letter from the Ministry of Finance is not of a regulatory nature, legal entities have the right to use the second option, which was previously enshrined in the instructions of the State Tax Service of Russia. In the second option, miscellaneous expense account 91.2 is used. The accrual of tax amounts is recorded in the debit of account 91.2 and the credit of account 68.

The fact of transfer of amounts due for payment of property tax of the enterprise . is reflected in accounting by turnover from the debit of account 68, the subaccount for property tax accounting and the credit of account 51.

In addition, the accounting policy must reflect the moment of accounting for expenses .

If accounting for property tax occurs using the shipment method, then tax expenses are reflected on the last day of the reporting (tax) period .

When using the cash method, property tax expenses are taken into account after the tax is transferred to the budget .

Why were such amendments needed?

This decision has an interesting background: in September of this year, Law No. 325-FZ adopted changes, according to which the list of objects taxed at cadastral value would actually become open from 2021. This list would be expanded to include objects named in Chapter 32 of the Tax Code of the Russian Federation (that is, in the chapter devoted to the property tax of individuals). The corresponding wording appeared at that time in paragraphs. 4 paragraphs 1 art. 378.2 Tax Code of the Russian Federation.

However, apparently, the deputies decided to specify the list of “cadastral” real estate, which was implemented by Law 379-FZ. It is worth noting that the amendments to which this review is devoted are dated by a later law, which means that the conflict that arises is resolved in their favor. Changes introduced earlier by Law No. 325-FZ do not need to be applied.

Time limits established for advances on property

The deadline for payment of advances will vary by constituent entity of the Russian Federation (clause 1 of Article 383 of the Tax Code of the Russian Federation). You can check the deadlines for each region on the Federal Tax Service website.

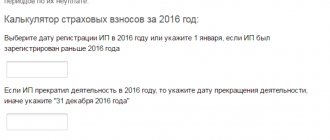

In this case, the reporting periods should be considered quarterly periods of the year, equal in relation to the type of tax base (clause 2 of Article 379 of the Tax Code of the Russian Federation):

- quarter, half-year, 9 months, if the base is determined by the average (average annual) cost;

- quarter, if the base depends on the cadastral valuation.

These are the ones you need to focus on when determining the deadline for paying advances.