Fixed assets are those assets that are used as labor tools for more than 12 months and cost more than 100,000 rubles.

Accounting for fixed assets in 1C 8.3 is 100% automated. First, the receipt is processed in 1C Accounting for the operating system. Next, they are accepted for accounting and assigned an inventory number.

The developers of 1C:Accounting 3.0 have reduced this operation to the execution of one document - “Receipts (acts, invoices)” with the type of operation “Fixed Assets”. In this case, there is no need to create a document “Acceptance for accounting of fixed assets”. All transactions, both on receipt and on acceptance for accounting, are created by one document - receipt.

Let's look at step-by-step instructions for accounting for OS in 1C 8.3.

Receipt and commissioning

Our team provides consulting, configuration and implementation services for 1C. You can contact us by phone +7 499 350 29 00 . Services and prices can be seen at the link. We will be happy to help you!

In the “Fixed assets and intangible assets” menu, select “Receipt of fixed assets” and create a new document.

In the header you must indicate the organization, counterparty and agreement. Set up the way to reflect depreciation and VAT expenses. If you are going to rent out the property in the future, check the appropriate box.

In the tabular part of the document, list the required fixed assets. Remember that if you buy several identical objects (for example, 3 machines), then in the “Fixed” assets directory and in this tabular section you should have 3 different positions with different inventory numbers.

The tabular part also indicates VAT, accounts (accounting, depreciation, VAT) and service life in months.

Post the document and register the invoice at the bottom of the form.

Standard reports

In Fig. 1 we see an example of a standard report, this is the balance sheet for account 01.

Fig.1

In addition to turnover and balances, this report can display additional data, for example, serial and inventory numbers. To do this, you need to go to the “Show settings” tab and add the necessary indicators and fields (Fig. 2). Additional fields can be displayed either in separate columns or in one. All 1C reports are configured in the same way.

Fig.2

Moving

The document is also located in the “OS and Intangible Materials” menu, item “Moving OS”. This document is similar to the movement of goods, only in this case, only in this case the movement occurs not between warehouses, but between departments.

In this example, we will not charge depreciation when moving. We'll do this later.

Instructions: fill out a certificate of the book value of assets

A sample certificate of the book value of assets reflects the current price value of the institution’s property assets on the balance sheet. It reflects information on the valuation of the organization's current and non-current assets. That is why it is necessary in situations where the organization’s activities are directly related to the determination of the book value of assets (BSA). There is no standardized or legally approved format for this document. A certificate of book value is not required to be completed as part of periodic or final financial statements. Each enterprise makes a decision on the form (template), content, timing and frequency of preparing the register independently, having prescribed these local standards in the accounting policies of the institution.

Inventory

The document “Inventory of fixed assets”, located in the menu “Fixed assets and intangible assets”, serves to confirm the presence or absence of fixed assets in the specified division. This document can be filled out either manually or automatically.

In the event that the values of actual availability and availability according to accounting data differ, based on this document, a write-off or acceptance of fixed assets is created.

Book value of property

Despite the fact that a certificate of book value is not included in the mandatory list of accounting documents, it can be useful for internal and external users (creditors, investors or shareholders). A single sample document on the book value of property is not regulated at the legislative level, and the certificate form is filled out by the chief accountant of the enterprise at the request of internal/external users. If a theft occurs at work, then, in addition to contacting the police, it is necessary to recalculate the property (inventory) in order to submit reports to regulatory authorities and carry out tax calculations. If you discover that fixed assets are missing, you must:

OS depreciation in 1C 8.3

Let's look at depreciation using the example of month-end closing. In the "Operations" menu, go to the "Month Closing" item.

Please note that setting up depreciation rules and methods is configured in the organization's accounting policy. Depreciation is calculated every month, starting from the month following the acceptance of the asset for accounting.

When performing a routine operation on depreciation and wear and tear of the operating system, a posting was generated in the amount of 2950 rubles. The settings indicate the linear method of calculating depreciation. The lathe in our example has a service life of 60 months. Depreciation is calculated by the cost of the asset divided by its service life. Everything was calculated correctly.

An example of depreciation is discussed in this video:

Accounting for fixed assets with zero tax value

By the tax value of a fixed asset we mean the cost of the object, which can subsequently be taken into account as expenses for profit tax purposes through depreciation, upon sale or other disposal.

The criteria for recognizing property as depreciable are named in Article 256 of the Tax Code of the Russian Federation, and the procedure for determining its value is in Article 257 of the Tax Code of the Russian Federation.

In accordance with paragraph 1 of Article 256 of the Tax Code of the Russian Federation, property that is not used to generate income is not recognized as depreciable. According to the official position of the regulatory authorities, expenses for office decoration (for example, flowers and paintings) cannot be taken into account when calculating income tax, since such expenses are not aimed at generating income and are not related to the organization’s activities (clause 1 of Article 252 of the Tax Code of the Russian Federation , letter of the Ministry of Finance of Russia dated May 25, 2007 No. 03-03-06/1/311). For the same reason, when calculating income tax, it is impossible to take into account the costs of landscaping the territory (clause 49 of Article 270 of the Tax Code of the Russian Federation, letters of the Ministry of Finance of Russia dated December 10, 2019 No. 03-03-06/1/96105, dated April 1, 2016 No. 03- 03-06/1/18575).

At the same time, there are court decisions according to which the costs of aquariums and other interior items can be included in expenses that reduce the tax base for income tax (Resolution of the Federal Antimonopoly Service of the Moscow District dated June 16, 2009 No. KA-A40/5111-09, dated 05/23/2011 No. KA-A40/4090-11). Read more in the material “Office improvement expenses: justification features, court opinion.”

The costs of landscaping a production facility, as a result of which perennial plantings are created, according to the courts, can be taken into account in income tax expenses through depreciation (resolution of the Moscow District Arbitration Court dated February 24, 2015 No. F05-413/2015 in case No. A40-59510/ 13).

Let’s assume that the organization does not want claims from the tax authorities and does not include the “disputed” fixed asset in the depreciable property as not meeting the criteria of Article 256 of the Tax Code of the Russian Federation. Let's look at an example of how this situation can be reflected in “1C: Accounting 8” (rev. 3.0).

Example 1

The organization TREAGOLNIK LLC applies OSNO, PBU 18/02 (accounting in the program is carried out using the balance sheet method without reflecting PR and BP), and pays VAT. The income tax rate is 20%.

In February 2021, the organization purchased an aquarium worth RUB 144,000.00. (including VAT 20%) and installed it in the director’s reception area.

Revenue from sales of services in February amounted to RUB 240,000.00. (including VAT 20%), there were no other income and expenses in January-February 2020.

Since the organization will never be able to recoup the cost of the aquarium in tax expenses, its tax value will be zero (it is unlikely that the organization plans to sell such an object in the future). To account for fixed assets that are not recognized as depreciable under Article 256 of the Tax Code of the Russian Federation, the following actions can be used in the program:

- reflect the receipt of a non-current asset;

- reflect the acceptance of the fixed asset only in accounting, and write off the tax value of the fixed asset.

The receipt of equipment is reflected in the standard accounting system document Receipt (act, invoice)

with the type of operation

Equipment (section OS and intangible assets).

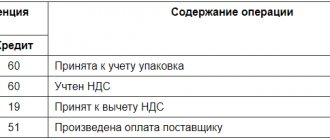

When posting the document, accounting entries will be generated:

Debit 08.04.1 Credit 60.01

— for the cost of the aquarium received by the organization (RUB 120,000.00);

Debit 19.01 Credit 60.01

— for the amount of VAT (RUB 24,000.00).

For tax accounting purposes for income tax, the corresponding amounts are also recorded in the resources Amount NU Dt

and

Amount NU Kt

for accounts where tax accounting is maintained (except for account 19 “VAT on acquired values”).

Acceptance for registration and commissioning of the aquarium is registered with the document Acceptance for registration of OS

from the section

OS and intangible assets

.

On the Tax Accounting

in the field

Procedure for including costs in expenses

, select the value

Inclusion in expenses when accepted for accounting

.

In this case, in the Expense Reflection

, you can select one of two values:

- Similar to depreciation

- in this case, the cost of fixed assets in tax accounting will be written off to the account and cost item specified to reflect depreciation expenses in accounting.

The method of reflecting expenses

is selected from the directory of the same name and is indicated in the

Method of reflecting depreciation expenses

on

the Accounting

.

In order for the cost of fixed assets not to be taken into account in tax accounting, in the Method of reflecting expenses

, you must indicate an item of costs (or an item of other income and expenses) not taken into account for profit tax purposes; - Another way

- in this case, in the

Method

, you should indicate a separate

Method for reflecting expenses

, used only in tax accounting (Fig. 1).

In this Method of reflecting expenses

, you should indicate a separate account and analysis of expenses that are not taken into account in tax accounting (for example, account 91.02 “Other expenses”), and an item of other income and expenses with the Accepted

for tax accounting

.

Rice. 1. Acceptance for accounting of fixed assets with zero tax value

When posting a document, accounting register entries are generated:

Debit 01.01 Credit 08.04.1

— for the initial cost of the fixed asset (RUB 120,000.00);

Debit 91.02 Credit 01.01

- with an unfilled amount in accounting.

For tax accounting purposes, the cost of an aquarium accepted for accounting and immediately written off is 120,000.00 rubles. reflected in special fields of the accounting register:

Amount Dt NU: 01.01

and

Amount Kt NU: 08.04.1

;

Amount Kt NU: 01.01

.

We will generate a report : Turnover balance sheet

on account 01.01 to obtain information about the initial cost of the fixed asset item. Using the report settings panel, we will simultaneously display accounting and tax accounting data (Fig. 2).

Rice. 2. SALT for account 01

As you can see, the difference between the book value and tax value of the aquarium is 120,000.00 rubles, and it is temporary due to the requirements of IAS 12, paragraph 8 of the new edition of PBU 18/02, as well as Recommendation No. R-102/2019- KpR.

In February 2021, when performing a regulatory operation, Calculation of income tax

accounting entries will be generated with simultaneous distribution among budgets:

Debit 99.02.T Credit 68.04.1

— for the amount of current tax RUB 40,000.00. (200,000.00 x 20%).

When performing a regulatory operation Calculation of deferred tax according to PBU 18

for January, included in the

month-end

a deferred tax liability (DTL) is recognized for the asset type

Fixed assets

Debit 99.02.О Credit 77

— in the amount of RUB 24,000.00. (RUB 120,000.00 x 20%).

A detailed calculation of IT is presented in the Deferred Tax Calculation Certificate

for January 2021 (Fig. 3).

Rice. 3. IT calculation

As of 01/01/2020:

- the tax rate is set at 20%;

- no deductible and taxable temporary differences were identified according to accounting data;

- deferred taxes are not recognized.

At the end of February (as of 03/01/2020):

- the book value of assets is 120,000 rubles. (column A), the tax value of assets is zero (column B). This means that in the future the organization will not be able to take into account the cost of the fixed asset;

- the difference between the book value and tax value of the fixed asset is 120,000 rubles. (120,000 rubles - 0 rubles) and is reflected in column 7. This is a taxable temporary difference, since it will lead to the formation of deferred income tax, which should increase the amount of income tax payable to the budget in the next reporting period or subsequent ones reporting periods (clause 11 of PBU 18);

- IT was recognized in the amount of 24,000 rubles. (RUB 120,000 x 20%), which is reflected in column 9.

In February 2021:

- there was an increase in the taxable temporary difference by 120,000 rubles. (120,000 rubles – 0 rubles), which is reflected in column 11;

- IT was recognized in the amount of 24,000 rubles. (column 11a).

Accordingly, the income tax expense for January-February 2020 is RUB 64,000.00. (RUB 24,000.00 + RUB 40,000.00). In this case, the conditional income tax (tax calculated according to accounting data) for the specified period is 40,000 rubles. (RUB 200,000 x 20%).

These indicators are reflected in the reference calculation Income tax expense

, formed in January (Fig. 4).

Rice. 4. Income tax expense for January 2020

At the same time, the calculation certificate reflects a constant tax expense in the amount of 24,000.00 rubles, which, in accordance with paragraph 9 of Recommendation No. R-109/2019-KpR, is defined as a numerical reconciliation between income tax expense and conditional tax expense on profit (RUB 64,000.00 - RUB 40,000.00).

Thus, the difference of 120,000.00 rubles, formed under the conditions of Example 1, represents both a temporary and permanent (“complex”) difference.

In March 2021, the aquarium begins to be depreciated on the books. As the fixed asset is depreciated, IT will be repaid.

How in “1C: Accounting 8” edition 3.0, in accordance with the new edition of PBU 18/02, take into account fixed assets that are not used to generate income (for example, an aquarium or a music center)

Instructions: fill out a certificate of the book value of assets

A sample certificate of the book value of assets reflects the current price value of the institution’s property assets on the balance sheet. It reflects information on the valuation of the organization's current and non-current assets. That is why it is necessary in situations where the organization’s activities are directly related to the determination of the book value of assets (BSA).

- founders - to familiarize themselves with the current financial situation of the enterprise;

- investors, insurance and credit organizations - to check the solvency and stability of the institution in order to make further decisions regarding the investment of funds.

Certificate of book value of assets

A certificate of the book value of assets (you can find a sample of the drafting below) is not a mandatory document. It is used by enterprises in preparing analytical summary reports in management accounting. In some cases, such a form may be required to increase confidence in the company on the part of counterparties or credit and insurance institutions. For reference, businesses can create tabular forms and develop text templates. The main task is to reflect all the non-current and current assets the company has. In the certificate they must be shown in value terms in a single currency. For clarity, it is recommended to provide data as of the beginning of the analytical accounting period and as of its end date. This will allow you to see changes in solvency and track the dynamics of improvement or deterioration in the liquidity of the enterprise’s resources.

Certificate of book value - sample and form

A certificate of book value - a sample of which will be presented below - is used to analyze and decipher one of the main components of an enterprise's non-current assets - fixed assets. Read about how to correctly draw up such a document in our material. The form of a certificate of the book value of fixed assets is not approved at the legislative level. This means that you can use any form of this document. Let us remind you that business entities have the right to develop forms of certain documents based on their needs and characteristics of their activities. Therefore, the enterprise can also approve the form and type of this document independently, securing it with the appropriate order.

Sample balance sheet

approval and maintenance of budget estimates of the central office of the Federal Service for Hydrometeorology and Environmental Monitoring, its territorial bodies and institutions - recipients of budget investments, approved by Order of Roshydromet dated _________ N ______ _____________________________________ (name of organization) Certificate of balance sheet (residual) value Name of the object _______________________________________________________________ Location of the object ___________________________________________________ Date of commissioning.

We draw up a certificate of book value - sample

A certificate of book value - a sample of which will be given in the article - is a document necessary for disclosing information about fixed assets. Before drawing up such a document, you need to familiarize yourself with the requirements for it, which will be discussed further. Also, in addition to using this certificate in the company’s own interests, investors, creditors and insurers can use it to assess the payment capabilities of their partner, as well as identify objects that can be used as collateral.