Other office machines

OKOF-2 (as amended on 05/08/2018, taking into account changes came into force on 07/01/2018) All-Russian classifier of fixed assets OK 013-2014 (SNA 2008) came into force on January 1, 2017 to replace OKOF OK 013-94 For To convert the OKOF code to the OKOF2 code, use the OKOF to OKOF2 code converter.

330.28.23.23

Other office machines

Depreciation group:

including personal computers and printing devices for them; servers of various performance; network equipment of local computer networks; data storage systems; modems for local networks; modems for backbone networks – second group

(property with a useful life of more than 2 years up to 3 years inclusive)

machines for sorting and counting coins, banknotes and lottery tickets - third group

(property with a useful life of more than 3 years up to 5 years inclusive)

Full decoding of OKOF-2 code 330.28.23.23: New classifier of fixed assets 2021 / OKOF-2 code 330.28.23.23 / 330282323 / All-Russian classifier of fixed assets OK 013-2014 (SNA 2008) / Machinery and equipment, including household equipment, and other objects / Other machines and equipment, including household equipment, and other objects / Machinery and equipment not included in other groups / Other general purpose machines and equipment / Office machines and equipment, except computers and peripheral equipment / Office equipment / Other office machines

Search

Search by TIN

Checking the counterparty

Converters

Classifier changes

All-Russian classifiers

International classifiers

Directories

OKOF 2021 - apply without errors

If it is impossible to determine the OKOF code in the new classifier using the listed methods, then the institution should designate a conditional code for the fixed asset object that is remotely suitable in meaning for this fixed asset. In any case, the determination of a specific OKOF code is based on the subjective judgment of institution officials.

To begin, search for the OKOF code by the name of the fixed asset or by its purpose. If you cannot find a solution this way, then it is also possible to use the previous OKOF OK 013-94 and search for it. And then find the code from the new OKOF OK 013-2014, using the Transition key between OKOF OK 013-94 and OKOF OK 013-2014, approved. by order of Rosstandart dated April 21, 2019 No. 458.

Depreciation of office devices and nuances of effective accounting

Classification by depreciation groups is necessary for tax purposes and is associated with the process of accounting for costs included in tax calculations under the appropriate taxation system. In accounting, depreciation can be set arbitrarily, but in practice they are guided by the same standards as for NU.

It is known that for the purposes of accounting, depreciable equipment is considered to be equipment that is used in the production process for more than a year and has a cost of more than 100 thousand rubles; in accounting accounting, the cost limit is 40 thousand rubles. and the same period of use.

Question: How to reflect the modernization of a computer in accounting if it is accounted for as one inventory item of fixed assets (OS) with all accessories (devices)? The cost of a computer in accounting and tax accounting is fully depreciated. The organization applies FSBU 5/2019 “Inventories”. A computer used in the main activity (providing services) is included in the operating system at an initial cost of 102,000 rubles. The organization uses the straight-line method (method) of depreciation. The monitor, which was purchased for 19,500 (excluding VAT), was in working condition. During the modernization process, the organization replaced it with a new one with better consumer characteristics. The acquisition cost was RUB 39,600, including VAT RUB 6,600. The previous monitor was transferred to the warehouse as a spare. The cost of similar monitors is 10,000 rubles. (without VAT). The useful life of a computer in accounting and tax accounting upon acceptance for accounting was set at 25 months, and after replacing the monitor it was increased by 10 months. In accordance with the Classification of fixed assets, approved by Decree of the Government of the Russian Federation of January 1, 2002 N 1, the computer is classified in the second depreciation group. The organization uses the accrual method of tax accounting and does not apply premium depreciation. Interim financial statements are prepared at the end of each calendar month. View answer

In tax and accounting, various methods of depreciation are defined. There are only two of them in NU - linear and nonlinear. In accounting, in addition to the linear method, reducing balance methods are used, based on the sum of the number of years of use, in proportion to the volume of production.

In practice, when depreciating office equipment, the same method is often adopted for NU and BU - linear, so as not to account for additional differences that arise.

Office equipment's cost often falls in the range of 40-100 thousand rubles, and the question arises of how best to take it into account for the purposes of accounting and accounting.

How to calculate depreciation on fixed assets ?

There are two ways out of this situation:

- Write off such office equipment immediately upon commissioning in the NU and charge depreciation on it after registration in the BU. The method is not very convenient and involves the occurrence of temporary differences that are subject to additional accounting.

- Write off as expenses in NU, but not at once, but in parts (this opportunity is provided to the taxpayer by Article 254 of the Tax Code of the Russian Federation, clause 1, clause 3). At the same time, accrue depreciation for accounting purposes. Equipment that costs less than 40 thousand rubles can be written off as expenses immediately, without depreciation, both in tax and accounting.

When choosing a code according to OKOF and a depreciation group of equipment according to the OS Classifier, it is important to remember that the equipment must be a single system, a single device that collectively performs certain office functions. A depreciation group is selected in which the component parts of the device are included by the legislator to the maximum extent possible.

The depreciation policy, due to its heterogeneity and many nuances, must be spelled out in the accounting policy as its important component.

New accounting of fixed assets in 2021

From January 1, 2021, it is allowed to apply the new OS accounting standard - FSBU 6/2020 “Fixed Assets”, approved by Order of the Ministry of Finance of the Russian Federation dated September 17, 2020 No. 204n. The new rules will become mandatory starting with reporting for 2022, so now you can continue to keep records according to the rules of the current PBU 6/01, approved by Order of the Ministry of Finance of the Russian Federation dated March 30, 2001 No. 26n).

The main changes to the rules include the following:

- excluded the condition that only property that was not planned to be sold in the future can be recognized as a fixed asset. Instead, the object can be reclassified as a long-term asset for sale;

- The limit on the value of an object for recognizing it as a fixed asset was abolished. Now you can set the limit yourself in your accounting policy. For example, you can provide a limit as in tax accounting - 100 thousand rubles;

- obligated to distribute fixed assets by type and group. The types of objects are the following: real estate, vehicles, machinery and equipment, industrial and household equipment, others. Objects of the same type that are used in a similar way must be combined into groups;

- there was an obligation to check fixed assets for impairment in accordance with IAS 36 “Impairment of Assets”.

To apply the new standard in your work, you need to make a one-time adjustment in your accounting. After this, you should configure the accounting of objects by type and nature of their use.

Regulatory grounds

A depreciation group that determines the useful life (SPI) is assigned to each fixed asset. There are 10 of them in total, and the objects assigned to them differ in their service life. OS groups are united by the OS Classifier, which standardizes accounting information on objects, which, in turn, are grouped by types of OS. Thus, office devices are concentrated in groups, the code of which begins with the numbers 320 and 330. The depreciation group of the object is determined, focusing on the period of effective operation of the device. As a rule, the objects in question tend to undergo rapid moral and physical aging, so their SPI is small, and they are classified into the 2nd or 3rd depreciation groups.

From January 1, 2021, by Resolution No. 526 dated April 28, 2018, changes were made to the OS Classifier, some depreciation groups were updated and expanded. However, the updates did not affect the categories of office equipment in question. OKOF codes previously assigned to these property groups have not undergone any changes. Let us remind you which depreciation groups include various types of office equipment.

Fixed assets in accounting

In accounting, fixed assets include objects that can be used for a long period of time - over 12 months. In addition, the main asset must be:

- more than 40 thousand rubles. The accounting policy can provide for a limit below this amount, then it will be allowed to depreciate cheaper assets;

- intended for use in production or management activities or for rental and not for resale;

- capable of generating income in the future.

Objects with a useful life (LPI) of more than 12 months, but with a value less than the limit, are not taken into account either as part of fixed assets or as part of inventories. Such assets are written off as expenses at a time, bypassing account 10 of accounting (clause 5 of PBU 6/01, clause 3 of FSBU 5/2019).

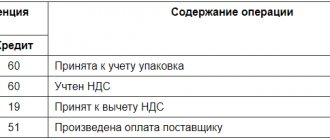

Accounting for online cash registers and fiscal drives in “1C: Public Institution Accounting 8”

Accounting records for recording the online cash register and fiscal drive and the documents used to generate them in the 1C: Public Institution Accounting 8 program, edition 1 and edition 2, are shown in the table.

Table

Transactions for accepting obligations, including monetary ones, for payment of contracts for the supply of online cash registers and fiscal storage devices and their actual payment are reflected in the usual manner and are therefore not included in the table.

In the program “1C: Public Institution Accounting 8” operations 1–6 are processed in the usual manner.

Operation 7 is reflected in the document Receipt of materials (off-balance sheet accounting), in which you should select account 02.4 “Ministry of goods not recognized as an asset.”

Account 02.4 “MZ not recognized as an asset” is used to account for material assets belonging to an institution, recognized as non-assets, until a decision is made on their future fate or, as in this case, until the expiration date of their storage in accordance with the law.

According to paragraph 335 of Instruction No. 157n, in the case of unilateral execution of an act by an institution, as in this case, material assets are taken into account in off-balance sheet account 02 in a conditional valuation: one object - one ruble. The document should indicate the number of fiscal drives accepted for storage and the corresponding cost.

When posting a document, an entry is created as a debit to off-balance sheet account 02.4 “MZ not recognized as an asset” without indicating the corresponding account.

Initial cost of fixed assets

In accounting, fixed assets are reflected at historical cost. When purchased, the cost of an asset includes the costs of its acquisition, delivery and bringing it into working condition. In addition, VAT must be included in the initial cost if the object will be used in an activity that is not subject to this tax (clauses 7, 8 of PBU 6/01).

For organizations that apply simplified accounting procedures, relaxations are provided. Thus, the initial cost of fixed assets will be formed:

- when purchasing - based on the seller’s price, taking into account installation costs;

- in case of independent construction - at the price of the contract for the creation of the object.

Other costs that are directly related to the purchase or construction of fixed assets can be written off as expenses for ordinary activities (clause 8.1 of PBU 6/01).

In tax accounting, the initial cost of fixed assets is formed taking into account the method of their receipt. You can get an object in the following ways:

- buy from a contractor or make it yourself;

- receive under a financial lease (leasing) agreement;

- accepted free of charge during inventory or from the owner;

- accept as a contribution to the authorized capital;

- buy under an exchange agreement (barter);

- received under a concession agreement.

The most common way is to purchase an asset. In this case, the initial cost of the object includes its price, as well as the costs associated with its delivery, adjustment, installation and other similar expenses.

Structure of the OKOF classifier

Each code consists of 5-12 digits:

- the first three digits indicate the type of fixed assets. For example, 310 is a type of PF “vehicles”, 320 is a type of PF “information, computer and telecommunications (ICT) equipment”, etc.;

- numbers from the fourth to the twelfth indicate the code according to the All-Russian Classifier of Products by Type of Economic Activity OKPD2 OK 034-2014 (KPES 2008), approved by Order of Rosstandart dated January 31, 2014 No. 14-st. It can consist of two, three, etc. numbers up to nine.

Let's give an example of the OKOF code with a decoding for an item such as an office calculator. It belongs to the type of fixed assets “Other machinery and equipment, including household equipment, and other objects.” This type corresponds to the numbers 330. OKPD2 code for electronic calculators is 28.23.12.110. It turns out that the OKOF code for the 2020-2021 calculator is 330.28.23.12.110.

ATTENTION . There are OKOF codes with less than 12 digits. In particular, for office machines, including a computer and a printer - 330.28.23.23. For steam boilers, including water heaters - 330.25.30, etc. This is due to the fact that OKPD2 codes for these objects consist of less than nine characters.

Find out or check OKPO, INN and other counterparty codes

More than 1100 companies

already work in the paid version of the classifier

We invite you to join them and become our client

Available only to registered users

| ATTENTION! |

| Errors in codification lead to tax risks enterprises (underpayments/overpayments of taxes). The codification and classification according to OKOF of fixed assets by the Federal Tax Service will be checked automatically from 2021. |

| FIND OUT DETAILS |

| Codification is the basis for tax control |

| Only by working on our resource will you learn correct codification and classification. Here all the information corresponds to the exact norms of the law in IS GARANT.. Get ready, from 2021 the Federal Tax Service will begin to check fixed assets automatically! |

| If you are already registered, log in to the Portal with your username (E-mail) and password. REGISTER LOGIN |

Requirements for depreciation groups

Some names contained in the old classifier were removed, and in OKOF-2019 they were replaced with generalizing positions. For example, now there are no separate lines for unique types of various software, but a common object “Other information resources in electronic form” has appeared.

Incorrect OS reflection causes many problems for enterprises. An important term used in their accounting is “fixed assets,” which include two types of property: tangible and intangible. Fixed assets are the tangible assets of a company. This conclusion is made on the basis of concepts enshrined in legislative norms.

MFP, printer, scanner, shredder

Multifunctional office devices and MFPs are not mentioned in the classifier, so you will have to determine their service life (UF) yourself.

Most experts recommend using the third depreciation group, which mentions OKOF 330.28.23.22 “Copying machines... for offices.” At the same time, there is OKOF 330.28.23.23, which we discussed above. It belongs to the second group of depreciation and includes, among other things, printers as components of a PC.

Since the MFP, in addition to printing functions, is used as a fax machine, a copy machine, etc., it is advisable to collectively use the maximum depreciation group - the third, the SPI for which is 3-5 years.

It is possible to correlate the MFP with OKOF 320.26.20.15, which characterizes machines containing (or not containing) one or more of the named devices in a single shell: storage, input or output devices.

The printer and scanner can be classified into the second depreciation group. The basis is OKOF 330.28.23.23, which includes not only the computer itself, but also the printing equipment for it. In addition, if the laser printer is equipped with a processor, then OKOF 320.26.20.13 is applicable to it. SPI for the 2-3 year group. These devices are taken into account as separate depreciation objects only if they are not part of the “computer” object.

A shredder, or paper shredder, is also recommended to be included in the 2nd depreciation group.

Computer shock-absorbing group

The current legislation provides a clear definition of property recognized as depreciable.

Prerequisites for the calculation of depreciation are that the object is owned by the company, as well as its participation in activities that generate economic income. The monitor, considered as a separate item, cannot meet this condition, since it is not able to bring profit to the enterprise. And only as part of a complex, combined with a processor, keyboard and having general control, can it be recognized as an inventory object. Let us recall that each position in such a complex of objects cannot function independently. The complex is ready for operation and is a monoblock (the shock-absorbing group is also the second), which is considered as a computer combined with a monitor in a single case and does not require additional equipment. But the situation is somewhat different with an object such as a monitor.

Cash machine

An organization providing services may have a cash register as part of its office equipment and use it for settlements with clients. Such a device is accounted for by the sum of all costs for its acquisition and, depending on the final cost, acquires the status of a fixed asset or is written off as an expense as inventory.

A cash register can be accounted for under code 330.28.23.13 “Counting machines, cash registers... and other similar machines.” They belong to the fourth depreciation group, SPI 5-7 years.

Tax accounting of fixed assets

In tax accounting, fixed assets are considered to be movable and immovable property that meets three criteria. First, the asset's useful life must exceed 12 months. Secondly, the initial cost of objects must be above the limit of 100 thousand rubles. Thirdly, the fixed asset must be used in activity as a means of labor for production, sales or management (Articles 256, 257 of the Tax Code of the Russian Federation).

If the property costs less than 100 thousand rubles, it is written off as a lump sum as part of material expenses. There is an exception to the rule. In tax accounting, regardless of cost, fixed assets include inseparable and non-compensated improvements to the leased property (clause 5 of PBU 6/01, clause 1 of Article 256 of the Tax Code of the Russian Federation).