Income and revenue in Russian. PBU 9/99 as a mirror of the work of the Russian Ministry of Finance"

PBU 9/99 “Income of the organization” was approved by order of the Ministry of Finance of Russia dated May 6, 1999. No. 32 n and came into force on January 1, 2000. Of course, the development of the Regulations was carried out “in pursuance of the Accounting Reform Program in accordance with international financial reporting standards.”

Here, as in the development of most other PBUs, the corresponding IFRS1 standard was taken as a basis. This led to the abundance of norms, which are a tracing (literal translation) of the Western standard, somehow adapted to the rules of the Russian language. It must be said that the developers’ adaptation turned out to be more than weak, but this is not their problem, but that of the accounting department workers, and even those who teach these Russian accounting standards.

After the date of approval of PBU 9/99, changes were made to it by four orders of the Ministry of Finance of the Russian Federation:

- dated December 30, 1999 No. 107n - in connection with the approval of the Instructions on accounting in budgetary institutions (Order of the Ministry of Finance of Russia dated December 30, 1999 No. 1 07n). Since the amendments excluded budgetary institutions from the scope of the Regulation, the subsequent cancellation of the Instruction did not require additional changes to PBU 9/99;

- dated March 30, 2001 No. 27n - the basic rules for recognizing income from ordinary activities are extended to the recognition of operating income; in addition, it is clarified that other income may also include income from the revaluation of non-current assets (in this case, the requirements of PBU 6/012 regarding accounting for the results of revaluation of fixed assets should be taken into account);

- dated September 1, 8, 2006 No. 116n - the differentiation of other income of the organization into operating, non-operating and emergency was excluded;

- dated November 27, 2007 No. 156n - any mention of amount differences was excluded from the text.

As a result of each successive change, the text of PBU 9/99 became more and more scanty, but by no means more understandable. Of all the listed changes, the least obvious, in our opinion, were those introduced by Order No. 116n. Be that as it may, all other income of an economic entity, based on their economic content, can be divided into income:

- received from sales operations (but outside the scope of the main activity), as well as as a result of other use of the organization’s assets;

- non-sales (the receipt of which is not related to the sale of products, works, services or other assets of the organization);

- the right to receive which may arise in connection with emergency circumstances, i.e. these are revenues arising as a consequence of emergency circumstances of economic activity (natural disaster, fire, accident, nationalization of property, etc.).

The corresponding changes (albeit by another order of the Ministry of Finance of Russia - dated September 18, 2006 No. 115n) were made to PBU 4/993 and other documents of the accounting regulatory system that regulate the rules for grouping and detailing data for accounting reporting purposes. As a result, the distribution of other income by sources and reasons for their receipt can now only be made in an explanatory note to the balance sheet and profit and loss account. Since such issues should be disclosed in the accounting policy of the organization (i.e., the decision to disclose such information is essentially an act of goodwill by the management of the business entity), in practice, interested users of the financial statements are actually deprived of the opportunity to find out what operations this very management performs outside the normal course of business.

The question may seem idle only at first glance. If you look, for example, at the income statement of one of the largest taxpayers, you will find that the amount of other income is four times the amount of income from ordinary activities. Are minority shareholders really not interested in what the top management of the company does 80% of their working time?!

By the way, if changes were made by order No. 11 6n, it would be possible to resolve one of the main, not so much problems, but inconsistencies between accounting and tax legislation. Only, apparently, the Russian Ministry of Finance is of little interest in this area. And so it continues: what is called non-operating income in tax accounting is classified as other income in accounting. It’s even more interesting with expenses, but more on that in the next commentary - to PBU 10/99.

Income concept

The definition of income (what, in general, all other rules of PBU should be based on), given in paragraph 2 of PBU 9/99, should be quoted:

“The income of an organization is recognized as an increase in economic benefits as a result of the receipt of assets (cash, other property) and (or) repayment of liabilities, leading to an increase in the capital of this organization, with the exception of contributions from participants (owners of property).”

The translational (borrowed) nature of the definition is obvious. Well, that's where it goes. Maybe someone even likes it - it seems like it introduces them to the best practices of developed countries. But here’s the problem: if you read this definition according to the rules for reading Russian words and letters that were taught at school, you get something that is not entirely explainable.

It turns out that income can be recognized by the organization not only after the receipt of assets (the words “as a result” are difficult to interpret in any other way), but only after these incomes are included in the profit - not of the current year, but undistributed. The latter is explained by the fact that in determining income we are talking about the capital of the organization, and in section III of the balance sheet4 there are neither accounts payable nor profit of the current year (account 99 “Profits and losses”). It would be more correct to talk about the liabilities of an economic entity. But, apparently, the developers were simply let down by the dictionaries. Is it necessary to clarify that such a reading of the official definition of income contradicts other norms of PBU 9/99, if only because it actually excludes the possibility of recognizing income “on a narrow basis”.

The distribution of other income by sources and reasons for their receipt can now only be made in an explanatory note to the balance sheet and profit and loss account.

The list of receipts that are not income (clause 3 of PBU 9/99) does not require any comments. It simply names those receipts that either will never belong to the organization (for example, VAT or goods received on commission), or can be turned into the property of an economic entity, but subject to additional conditions or additional procedures (advances, deposits, pledge and so on.).

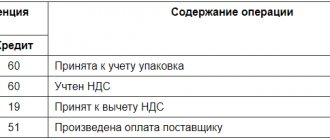

Reflection of income in accounting

Section II of PBU 9/99 is devoted to regulating the procedure for reflecting income from ordinary activities in accounting. However, this regulation is very sparse, unclear and can be applied in practice only after a number of additional clarifications.

From the definition of income from ordinary activities (clause 5 of PBU 9/99), we can conclude that in this case, synonymous with income are revenue from the sale of products and goods, receipts related to the performance of work, the provision of services. If we translate the norms of clause 6 (and clause 6. 1 - 6.3) of PBU 9/99 into acceptable Russian, we can conclude that, depending on the completeness of the receipt of funds and other property in payment for products (works, services), three situations:

- the amount of receipt completely covers the accounts receivable, which indicates the equality of debit and credit turnover in account 62 “Settlements with buyers and customers”. In this case, revenue will be determined by the amount of cash and the cost of other property received in payment for products, which in this situation is equal to the credit turnover on account 90 “Sales”, i.e. volume of products shipped;

- the amount of receipts covers only part of the proceeds. In this case, the amount of revenue is the sum of the debit turnover on account 5 1 “Settlement accounts”, etc. in the part attributable to payment for products (works, services), and the difference between the debit and credit turnover on account 62, which is the same as and in the first situation, it actually represents the credit turnover on account 90;

- There are no receipts to pay for products (works, services), i.e. there is a sale of products and goods (performance of work, provision of services) on the terms of a commercial loan provided in the form of deferment and installment payment. In this case, revenue is accepted for accounting in the full amount of receivables, i.e. based on wiring: D 62 - K 90.

Thus, the amount of revenue received by an enterprise (organization) is determined by the credit turnover on account 90, regardless of whether the products (work, services) are paid in full, partially, or not paid at all due to the provision of a commercial loan to the buyer.

In other words, a procedure has actually been established in which income (revenue) must be taken into account at the time of registration of the entry to the credit of account 90. There is nothing strange or unusual about this. Over the years that have passed since the date of adoption of PBU 9/99 and the entry into force of Chapter 25 of the Tax Code of the Russian Federation (for VAT - since 2006), everyone has become accustomed to the fact that in accounting and tax accounting, income is generated “by shipment”. But how does this procedure comply with the general definition of income given in paragraph 2 of PBU 9/99?

Here it is appropriate to say a few words about the norms of clause 12 of PBU 9/99. It establishes a list of conditions, in the event of non-fulfillment of which (at least one) the organization’s accounting records recognize receivables, and not revenue.

The list is striking in its obviousness and, in fact, in fact, emptiness. Well, for example, how should we understand the following condition: “... the organization has the right to receive this revenue arising from a specific agreement or confirmed in another appropriate manner”? It is possible to imagine a situation where the shipment of goods, works or services is carried out just like that, without any contract or agreement, probably only in an extremely isolated room: for example, in the office of an official who is absolutely out of touch with life.

The second condition is no better than the first: “ ... . the amount of proceeds can be determined.” In order to violate this condition, the accountant must simply do the impossible - independently come up with and record the amount of sales revenue without any supporting documents. But such accountants not only do not occur, they are also difficult to imagine.

Of the remaining conditions, subsection has some practical value. “d” clause 12 of PBU 9/99: “... the right of ownership (possession, use and disposal) of the product (goods) has passed from the organization to the buyer or the work has been accepted by the customer (service provided).” But it is not original either - in fact, it is a retelling of the main norm of Art. 39 Tax Code of the Russian Federation.

Accounting for other income

Section III of PBU 9/99 defines the general rules for accounting for other income. As already noted, in 2006 The concepts of “operating” and “non-operating” income were excluded from the documents of the system of regulatory regulation of accounting. Now all income is other and, accordingly, the list of other income is also general.

When combining the text of paragraphs 7 and 8 of PBU 9/99, they could hardly do without overlaps. So it turns out that the last position in the list of other income is “other income” (formerly “other non-operating income”). Thus, someone who tries to comprehend how a part can be a whole, and the whole can be a part, without having a penchant for philosophical reasoning, may develop signs of split consciousness. The Ministry of Finance of Russia does not inform or explain how to apply this overlay (not a conflict, but vice versa) in practice.

As for the features of reflecting certain types of other income in accounting, the developers of PBU 9/99 either limited themselves to rewriting the text from other regulations (in particular, the Regulations on Accounting and Financial Reporting in the Russian Federation), or left them without attention at all.

For example, practically nothing is said about the specifics of accounting for income in connection with the provision of fixed assets and intellectual property for temporary use (rent, etc.) (except for the reference norm of clause 15 of PBU 9/99). Meanwhile, the long-promised PBU, which would separately regulate rental issues, never saw the light of day (from PBU 6/0 1 the corresponding norms were thrown out back in 2001). And the long-awaited changes to PBU 9/99 and PBU 14/20005 in connection with the adoption of part four of the Civil Code of the Russian Federation were lost somewhere in the bowels of the financial department. But the new part of the Civil Code of the Russian Federation comes into force on January 1, 2008!

When combining text p. 7 and 8 PBU 9/99 could hardly do without overlays. so it turned out that the last position in the list of other income is “other income” (previously - “other non-operating income”)

So accountants have to invent accounting schemes based on the norms of other regulations - also fragmentary and stingy. And then tax or other regulatory authorities come and write their vision of the problem into the inspection reports.

Also, the elaboration of the issue of accounting for income in the form of gratuitously received assets cannot but cause some bewilderment. Yes, a separate clause 10.3 of PBU 9/99 is devoted to this issue. But nowhere does it say that such revenues should be reflected in deferred income (as established by the Instructions for the Application of the Chart of Accounts6). So think about which document is more important - the Instructions or the PBU.

In practice, questions are inevitable: where should such income be reflected - immediately on the credit of account 91 “Other income and expenses” or first on account 98 “Deferred income”? When should the amount of the value of assets (primarily current assets) be added to accounting profit - at the time of receipt or at the time of transfer to production? And in this regard, when should permanent tax liabilities be reflected? After all, if you incorrectly reflect, formally, the statements (in particular, the profit and loss statement) may be considered unreliable - with all the ensuing consequences.

We cannot ignore this type of other income, such as the revaluation of the organization’s assets. We somehow do not practice additional valuation of inventories (and this is not regulated either legislatively or normatively). The revaluation of fixed assets is described in detail (albeit a little confusing) in PBU 6/01. But it says nothing about its inclusion in other income - either additional capital or retained earnings.

From all that has been said, we can conclude that the activity of developing individual PBUs is very highly specialized, and perhaps even terribly secret: developers are deprived of the opportunity to familiarize themselves with the norms of other documents of the accounting regulatory system (including those that were adopted earlier).

Revenue recognition

Section IV of PBU 9/99 establishes general rules for income recognition. The strangeness of the norms of paragraph 12 was discussed earlier, so let’s dwell on the provisions of other paragraphs of this section.

In accordance with clause 13 of PBU 9/99, revenue from the performance of work, the provision of services, and the sale of products with a long manufacturing cycle can be recognized in accounting in one of two possible ways:

- as soon as the work, service, product is ready;

- upon completion of work, provision of services, production of products in general.

Let us recall that to reflect in accounting operations related to stages of work completed in accordance with concluded contracts that have independent significance, the Chart of Accounts (Instructions for using the Chart of Accounts) provides account 46 “Completed stages of work in progress.”

This account is intended for use by construction and other organizations performing work of long duration. This means that, in many respects, the provisions of paragraph 13 of PBU 9/99 and the characteristics of account 46 in the Instructions must correspond with the norms of PBU 2/947. This Regulation is the oldest, approved even before the adoption of the Civil Code of the Russian Federation and, naturally, is outdated. But the new edition - PBU 2/07, which the Russian Ministry of Finance solemnly promised to present in March 2007 - is hopelessly stuck somewhere. In the text of the draft PBU 2/07, an obvious terminological discrepancy between the new (updated) PBU and the norms of other similar documents was striking. In particular, one could conclude that the developers of this project understand revenue like market hawkers - like money in the cash register or in a current account. How else can we explain the fact that one of the active subaccounts of account 46 was supposed to be called “Revenue”? Therefore, it is no wonder that PBU 2/07 did not see the light of day within the promised time frame. And the norm of paragraph 13 of PBU 9/99 in these conditions seems, if not suspended, then inapplicable in practice.

The text of clause 14 of PBU 9/99 looks especially mysterious, one might say, mysterious: “If the amount of revenue from the sale of products, performance of work, provision of services cannot be determined, then it is accepted for accounting in the amount of production costs recognized in accounting this product, the performance of this work, the provision of this service, which will subsequently be reimbursed to the organization.”

Even those who do not participate in entrepreneurial activities themselves (study or work in the public sector) know that the main element of any business agreement involving the sale of assets is its price. This means that only two options are possible: either there is a contract price and it should be reflected in accounting, or there is no contract price and then there is nothing to reflect.

In addition, the quoted text comes into direct conflict with the norm of subsection. “b” clause 12 of the same PBU 9/99. So it’s impossible to even imagine what the developers were thinking when formulating clause 14.

Disclosure of information about income received

In Section V of PBU 9/99, in our opinion, a general concept is implemented to minimize the amount of information required to be disclosed in reporting. Essentially, the reporting must indicate the procedure for recognizing revenue (cash method or accrual method), and also reflect two groups of income - from ordinary activities and others. An indication of the disclosure of information on the method of determining the readiness of work, services, products, revenue from execution, provision, sales of which is recognized as readiness, can currently be considered invalid.

Clause 18.1 of PBU 9/99 establishes that revenue and other income constituting 5% or more of the organization’s total income for the reporting period are shown for each type separately. However, as can be judged from the reports of the largest taxpayers, this requirement is by no means mandatory - they show all other income as one amount.

In addition, clause 18.2 of PBU 9/99 allows the income statement to be shown minus expenses related to these incomes. You don’t have to be an expert in accounting to understand: collapsing balances on active-liability accounts can be successfully used to hide the facts of ineffective work of the management of an economic entity, while the right to reflect this collapsed balance in reporting significantly violates the rights of interested users of accounting information (assigned, by the way, legislatively, and not a regulatory act of the line ministry).

But the requirement of paragraph 19 of PBU 9/99, obliging to describe in detail information regarding the proceeds received as a result of the fulfillment of contracts providing for the fulfillment of obligations (payment) in non-monetary means, looked like an anachronism even at the time of approval of PBU 9/99 (the crisis caused default, already passed). In modern conditions, commodity exchange transactions have such an insignificant share in the total number of business transactions that they hardly deserve such close attention and such detailed regulation of deciphering information about such transactions.

As a general conclusion, we have to state that when developing PBU 9/99, the Russian Ministry of Finance not only failed to avoid the general problems and shortcomings that accompany the process of accounting reform: ambiguity, inaccuracy and inconsistency of individual norms and formulations, the inability to directly apply the established norms, etc. d. In this Regulation, which can be called one of the fundamental standards of the Russian accounting system, all of the listed shortcomings appeared in an exaggerated form.

1Comparison of the provisions of Russian accounting standards and IFRS can only be made speculatively, without any practical consequences, and therefore is not the subject of our attention.

2 The accounting regulation “Accounting for fixed assets” PBU 6/0 1 was approved by order of the Ministry of Finance of Russia dated March 30, 200 1. No. 26n.

3 The accounting regulation “Accounting statements of an organization” PBU 4/99 was approved by order of the Ministry of Finance of Russia dated July 6, 1999. No. 43n.

4The balance sheet (form No. 1 ) was approved by order of the Ministry of Finance of Russia dated 22 , 2003. No. 67n.

5 The accounting regulation “Accounting for intangible assets” PBU 1 4/2000 was approved by order of the Ministry of Finance of Russia dated October 16, 2000. No. 91 n.

6 The chart of accounts for accounting the financial and economic activities of organizations and the Instructions for its application were approved by order of the Ministry of Finance of Russia dated October 31, 2000. No. 94n.

7 The accounting regulation “Accounting for agreements (contracts) for capital construction” PBU 2/94 was approved by order of the Ministry of Finance of Russia dated December 20, 1994. No. 167.

How is the concept of income formed in accordance with PBU 9/99?

Depending on the definition of this concept, the reflection of income in accounting reports, as well as their further taxation, largely depends. According to PBU, an organization’s income is defined as an increase in economic benefits as a result of the gradual receipt of assets (property and cash) and the systematic repayment of all liabilities leading to a decrease in the organization’s capital. However, income cannot be understood as the contributions of participants who form the organization’s fund thanks to the property of the owners.

For accounting purposes, the organization’s income does not recognize all kinds of receipts from legal entities and individuals not related to the enterprise. Thus, the report does not take into account:

1) The amount of value added taxes, various types of excise taxes, sales taxes, export duties and other types of similar mandatory payments; 2) The amount of commission on contracts, agency and similar contracts in favor of the committee; 3) The amount received in the preliminary stages of payment for products, works, goods and services; 4) The amount of the advance payment for products, goods, services, etc.; 5) The amount of the deposit received and the value of only the property that is pledged, if the agreement provides for the transfer of all types of pledged property for the use of the pledgee; 6) The amount received from borrowers when repaying loans or borrowings provided to borrowers.

Thus, when preparing accounting records, not all types of income are taken into account when planning reports. Moreover, revenue under the new legislation can be calculated using different methods.