The goal of any enterprise is to obtain the highest possible level of income with minimal costs. When running a company, it is extremely important to avoid using unnecessary financial resources during the production of goods or provision of services, so as not to increase costs. However, there should be no supply interruptions or shortages. There needs to be a balance. To do this, you should carefully monitor the amount of materials that the company currently has. To achieve this goal, it is necessary to conduct high-quality accounting of the availability and movement of inventories in the organization. Most often, these operations are carried out by qualified employees. Proper monitoring makes it possible to optimize the company's performance and increase profits. This article will discuss what it is, what types there are, and how calculations should be made to avoid possible errors.

Concept

Before describing the procedures and giving the specification, it is necessary to find out what we are dealing with. The abbreviation MPZ is often used in scientific sources and documents. In short, accounting of inventories at an enterprise is the totality of all assets of the company used as raw materials or materials in the process of producing goods or services, specifically for sale. For example, the ingredients from which dishes are prepared in a cafe. In addition, this list includes funds that are involved in management. If they are purchased for further sale, then they must also be included in this list. It is important to note that their full cost is included in the final price of the product on the market.

Types of MPZ, their gradation according to technical characteristics

Inventory inventories are classified into groups depending on their purpose and role in the manufacturing process. The following types are distinguished:

- raw materials;

- semi-finished products purchased;

- spare parts;

- fuel;

- household supplies and equipment;

- packaging materials and containers;

- construction materials;

- special clothing and special equipment;

- auxiliary materials;

- others.

Within each category, stocks are divided into smaller groups depending on their belonging to a specific variety, type, size and other characteristics. This is a gradation according to technical characteristics, which then becomes the basis for creating lists of inventories. They are necessary when systematizing inventories used in production and organizing analytical accounting.

What are the tasks and features?

What is primary accounting of the receipt and disposal of inventories at an enterprise - this is a way to achieve several main goals. Among them:

- monitoring the safety of material assets in appropriate condition at all stages of the process;

- clear and timely documentation of the amount of expenses at each stage of production of goods, calculation of costs, as well as recording of the resources remaining after all cycles;

- detection of unused assets and their subsequent sale;

- uninterrupted implementation of agreements with suppliers, control of materials that are in transit.

Changes in inventory composition

Inventories according to the new FSBU 5/2019 are assets that a company uses in the production of products (performing work, providing services) or sells in the normal cycle of operations, or in a period not exceeding 12 months.

The list of reserves according to FSBU 5/2019 is large. But they can be divided into 3 large groups according to unifying characteristics.

- Traditional MPZ:

- inventory items, raw materials, fuel, spare parts, components, purchased semi-finished products for further production.

- inventory, tools, workwear, special equipment, containers (except for cases when such assets are recognized in accounting as fixed assets). That is, there will no longer be a choice: if they have a useful life of more than a year, they will be classified as fixed assets.

Classification of inventory accounting according to PBU

Accounting regulations are a normative act that regulates the composition of inventories. The document was approved by the Ministry of Finance of the Russian Federation. According to the information contained in it, values are divided into the following categories:

- raw materials used in production;

- support resources;

- purchased semi-finished products;

- energy sources, returnable waste;

- packaging, as well as components;

- household equipment used in work.

It is worth mentioning what can be considered a unit of accounting for inventory materials. First of all, the code in the nomenclature is used. However, a party or group can perform. The main thing is to ensure that the full scope of information and control capabilities are provided.

Composition of main and auxiliary oil and gas reserves

Basic production inventories are the main components of manufactured products. These are components of products, basic materials and raw materials in their composition, purchased semi-finished products. In this case, raw materials are considered to be agricultural and mining products, and materials are considered to be manufacturing products. Semi-finished products, before participating in the production of products, went through certain stages of processing, but have not yet become products.

Auxiliary supplies are considered to be those items of labor that are used for the maintenance of the main property (lubricant) or for the maintenance of facilities (cleaning the premises). This also includes MPZs that impart certain qualities or properties to basic materials (paint and varnish coatings).

The organization's production inventories include a separate group “Low-value and high-wear items” (LBP). Low-value assets are those whose value is less than that established for fixed assets, regardless of the period of their use. Wearable items include those whose service life is less than a year.

In accounting documents

To carry out transactions clearly and efficiently, synthetic accounts are used. Among them:

- “Materials” - used to summarize data on the movement of fuel, components, raw materials involved, packaging and other assets. The documentation indicates the actual cost. In some cases - discount prices. Divided into 11 subaccounts.

- “Animals for growing and fattening” is a list of animals, birds, and bee families that participate in the commercial activities of the organization. All information about young animals, adults that are fattened, as well as herds intended for marketing is entered.

- “Procurement and acquisition of material assets” is a set of information about the purchase of inventories that are involved in production cycles.

- “Deviation in value” - it displays all the data on the difference in the price of assets that were accepted into the enterprise. Their actual cost is indicated.

- “Products” - here the situation regarding the availability and movement of products that were purchased for further resale is described.

- "Finished products".

In addition to synthetic accounts, off-balance sheet accounts are also used in accounting for the movement of inventories. These include:

- “Materials accepted for processing” - here we monitor customer-supplied raw materials, which are not paid for by the company. This includes assets that are kept in warehouses for certain reasons. For example, if the customer received unpaid resources from the supplier, which, according to the terms of the contract, are prohibited from being put into operation until full payment is made.

- “Goods accepted for commission.” The terms of the concluded contract are taken into account.

Nomenclature and accounting unit of inventories

Each type of material is assigned a nomenclature code (number) according to the numbering system established at the enterprise. By combining inventories into groups according to their functions, location and other characteristics, a nomenclature is formed containing data about each material. The accounting price of the type of inventory may also be reflected here, then such a list is called a price tag nomenclature.

The established nomenclature code is subsequently specified each time the materials are used. Receipt, disposal, transfer to a warehouse or release to production are accompanied by entries in accounting documents not only of the names of inventory items, but also their numbers. This allows you to avoid errors in accounting and warehouse accounting.

A unit in inventory accounting is taken to be a group of homogeneous inventories, a batch, an item number, etc. Each organization independently sets this indicator. It is worth considering that it must provide control over the availability and movement of materials, as well as contribute to the formation of reliable and complete information about them. Accounting for inventories is carried out in quantitative (material) and monetary terms.

Primary documents

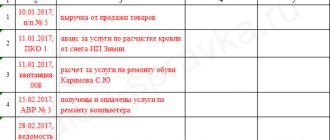

The papers that are used when accounting for inventories in the warehouse and in the accounting department are standard.

When assets come into the possession of an enterprise, a receipt order in form M-4 is used to register them, as well as an acceptance certificate (in form M-7). The first is upon arrival from the supplier. The responsibilities of the warehouse manager include checking whether the actual quantity corresponds to the officially declared quantity. The second is issued if discrepancies are detected, as well as when working with uninvoiced deliveries. This document is drawn up by a special commission, and a representative of the sending company or an uninterested party must be present. The paper is prepared in two samples. The first one is sent to the accounting department and is used as a reason for depositing the amount into the accounts. The other goes to marketers. Based on this, complaints will be made to the supplier.

If materials were transported by car, the primary documentation is the consignment note. It is issued in 4 copies. The first of them is used to write off assets from the sending company. The second is used so that the recipient can capitalize them. Another one is needed for settlements with the carrier company. The latter serves as an appendix to the route sheet.

There are a number of regulations according to which expenses for production needs are recorded. Among them:

- Limit collection card - issued by the marketing department, used for systematic deliveries.

- Request for release of materials - given in the case of a one-time operation.

- Invoice. When transferring resources to third party organizations, it is issued on the basis of concluded contracts.

It is worth noting that companies have the right to develop their own forms and reduce their number by combining them.

Do you want to implement Warehouse 15? Get all the necessary information from a specialist.

Thank you!

Thank you, your application has been accepted!

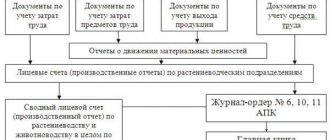

Accounting for inventories in accounting

All primary records of material assets must be transferred to the accounting department at the time established by the document flow schedule or other document of the internal control system. It is she who receives and checks the primary accounting documents for the correctness of their execution and the legality of the actions taken.

Accounting takes place in the context of specific material storage areas, and among them - for each name (item number), group of materials, subaccount and synthetic accounting account.

The accounting department should duplicate accounting in warehouses with the only difference being that it is supposed to keep numerical and monetary accounting, while in warehouses and divisions - only numerical ones.

Inventory valuation

To better understand the issue, you can use the given example of inventory accounting. The table shows calculations using the FIFO method.

| Options | Number of units | Unit price | Sum |

| Balance at the beginning of the month | 30 | 15 | 450 |

| Receipts (batch) | |||

| number one | 40 | 18 | 720 |

| number two | 20 | 20 | 400 |

| number three | 80 | 25 | 2000 |

| Sum | 140 | – | 3120 |

| Expenses – 150 kilograms | |||

| Write-offs | 30 | 15 | 450 |

| 40 | 18 | 720 | |

| 20 | 20 | 400 | |

| 60 | 25 | 1500 | |

| Total losses for the specified period | 150 | – | 3070 |

| Remainder | 20 | 25 | 500 |

Posting

Inventories are accepted for accounting at the actual cost of each of them. It recognizes the amount of all expenses incurred by the company in the process of purchasing them. Exceptions include VAT and other refundable taxes, as well as cases regulated by law. The list of costs may include:

- transfer of money to suppliers in accordance with the contract;

- fees for consulting and other services;

- customs duties;

- intermediary remuneration;

- logistics costs;

- other items related to the procurement of inventories.

Organization and features of accounting for disposal of inventories

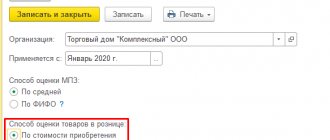

According to PBU, the company carries out this procedure in one of several available ways. The first is the cost of each unit supplied. In addition, you can calculate the average value for all. The third is the FIFO method. It was demonstrated in the table above.

Each of the described ways is applied for one year.

Components of the actual cost of inventories

PBU 5/01 specifies that inventory should be accepted for accounting at its actual cost. The position also regulates the components of this value. This includes amounts associated with the acquisition of inventories:

- spent on paying bills to the supplier according to the supply agreement;

- customs duties and other fees;

- non-refundable taxes;

- paid for consulting and information services;

- delivery and procurement costs (including insurance);

- expenses for packaging, sorting, part-time work and other actions aimed at bringing the MPZ to a usable state;

- remuneration to intermediaries involved in the transaction;

- other costs directly related to the purchase of materials.

The actual cost does not include general business expenses.

Calculating the value is usually not difficult. But this becomes possible only at the end of the month, when the accounting department receives numerical data on all components of the cost of inventory (invoices, payment documents, etc.). At the same time, materials move daily, their release cannot be stopped - all production will “stand down”, and the enterprise will suffer heavy losses. At the same time, accounting for the movement of assets must be carried out in a timely manner, which is why it became necessary to introduce special methods for calculating actual prices or establishing planned costs.

Documenting

As stated above, there are several regulations that can be used to capture motion.

The receipt of assets at the company's warehouse is formalized using a receipt order or a materials acceptance certificate. The decision to use one of these papers is made after carefully calculating the amount of resources and comparing it with that specified in the contract. If the results match, the first option is applied.

The consignment note acts as the primary regulatory document for accounting for inventories if transportation was carried out by cars. Internal movement is specified by the organization's employees in the requirement.

There are limit-fence cards that are used to fix costs.

Documentation of inventory in the warehouse

The procedure depends on the chosen method. There are several options:

- quantitative-sum;

- through reporting by relevant employees;

- operational and accounting.

The latter is considered the most effective. He is the most progressive and rational. It uses special accounting cards. The accounting department issues them for each registration number, and then transfers them to the warehouse manager against signature.

The employee must enter a receipt order into the document in the appropriate column after each arrival. Additionally, the balance after each operation is indicated. In addition, the consumption of assets is recorded based on requirements or limit-taking papers. According to the schedule developed by the company management, the employee will submit the results to the accounting department. There they are transferred to the statement, which is opened for one year.

The described method of accounting for inventories has a number of strengths. The first is the speed of data collection and processing. In addition, the accountant can constantly monitor the correctness of the operation. Another advantage is the regular comparison of information.

Do you want to implement “Store 15”? Get all the necessary information from a specialist.

Thank you!

Thank you, your application has been accepted.

Synthetic registration

It is maintained in the “Materials” account, which was mentioned earlier. Remaining assets are entered into debit, expenses and release for various needs, and vice versa - into credit. This is done at the cost price of each of them.

Sales of materials are shown in Other Income and Expenses. This takes into account the price of sold resources, VAT paid, expenses associated with the sales process, as well as revenue from it.

Work in progress and finished goods

The actual cost of work in progress and finished products includes costs associated with the production of products, performance of work, and provision of services (clause 23 of FSBU 5/2019). Such costs include:

- material costs;

- labor costs;

- contributions for social needs;

- depreciation;

- other costs.

They, in turn, are divided into direct and indirect (clause 24 of FSBU 5/2019). Each company determines the classification of costs into direct and indirect independently.

The actual cost of work in progress and finished products does not include (clause 26 of FSBU 5/2019):

- costs incurred due to improper organization of the production process (excessive consumption of raw materials, materials, energy, labor, losses from downtime, defects). Previously, they were turned on;

- administrative expenses (if they are not directly related to production);

- storage costs, if they are not related to the technology of production, performance of work, provision of services. Previously, they were included without reservations;

- other costs that are not necessary for the production of products (performance of work, provision of services).

Please note that starting from 2021, the procedure for the subsequent assessment of inventories, their write-off, as well as the restoration of the reserve for impairment of inventories will change.

Methods for accounting for inventories during procurement

There are two main ways this operation can be performed. The first is to generate the actual cost in the “Materials” account. It is advisable to use it only in certain cases. For example, when a company has a small volume of supplies over a period of time. If the company has a small range of assets or the accounting department receives all the information at a time. The table provides an example of such calculations.

| № | Contents of operation | Debit | Credit |

| 1 | The price of goods and materials was calculated using the invoice and invoice | 10 | 60 |

| 2 | Accounting for value added tax | 19 | 79 |

| 3 | Logistics costs | 10 | 76 |

| 4 | Remuneration for intermediary companies | 10 | 76 |

The second is to use separate accounts. For example, “Accounts payable”.

Postings for the movement of MPZ

Carrying out business transactions entails a change in data on the amount of funds and liabilities of the enterprise, therefore each movement must be recorded in accounting data. To ensure timely reflection of information, postings are made. When registering a receipt, the inventory accounts will be debited in correspondence with the following accounts:

- 60 (76) upon purchase;

- 75 – in case of receipt from the founders;

- 86 – with targeted financing;

- 98 – when received free of charge;

- 20, 29 – if the supplies were produced independently.

VAT on purchased materials is allocated to account 19.

Upon disposal, the amounts are written off by posting Dt 20, 23, 29 Kt 10. Sales of inventories to third parties are carried out by account assignment Dt 91.2 Kt 10, 43. VAT on assets sold is reflected by the entry: Dt 91.2 Kt 68.

Methods for accepting inventories for accounting during inflows and settlements with suppliers

These operations are carried out on the basis of concluded contracts. During shipment, supply companies draw up settlement papers and hand them over to the customer. In addition, a road invoice is issued. All documents are transferred to the marketing department. Its employees check them, register them, accept them and give their approval for the transfer of funds. Afterwards, each of them is assigned an individual number, and then they are sent to the accounting department for payment. Paperwork related to logistics costs is transferred to the forwarder.

For operations, a special account “Settlements with suppliers and contractors” is used.

Increase in the cost of inventory (which is included in account 340 of budget accounting)

The term “increase in the value of inventories” can be considered in several aspects. Thus, in budget accounting, it is understood as the fact that expenses for payment of contracts for the purchase of inventories are allocated to the article code KOSGU 340.

The corresponding code for KOSGU is used by government, budgetary institutions, as well as organizations that have the authority to receive budgetary funds. It records the expenses of a state or municipal organization for the purchase or production of materials and equipment. They can be represented by objects such as:

- medicines and medical equipment,

- Food,

- fuel,

- building materials,

- furniture,

- spare parts,

- special equipment for research,

- stern.

In commercial accounting, an increase in the cost of inventories is understood as the fact of writing off certain expenses associated with the purchase of inventories to increase their value. Each such write-off is recorded as a separate entry.

Procedure for registering uninvoiced supplies

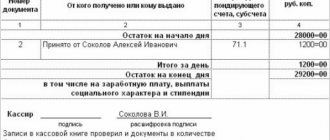

Keeping records of the use of inventories often has to be carried out in the absence of a payment certificate. The regulations provide for a separate procedure for this. Received valuables are first received at the warehouse; later, employees draw up a receipt, which is then handed over to the accounting staff. In this case, the estimated prices of assets are used for the operation. Once entered into the journal, they are accepted. Payment is made in the month following the reporting month. The transaction is registered in a separate line of order number 6.

Other inventories - what applies to them

The term “other inventories” mainly characterizes the accounting of budgetary institutions. In budget accounting - carried out by state and municipal organizations - other inventories include (clause 118 of the order of the Ministry of Finance of the Russian Federation dated December 1, 2010 No. 157n):

- special equipment for research,

- young animals of all types of animals and fattening animals, birds, rabbits, fur-bearing animals, bee families, regardless of their cost,

- offspring of young animals in the presence of draft animals in institutions,

- planting materials,

- reagents and chemicals, glass and chemical utensils, metals, electrical materials, radio materials and radio components, photographic equipment, experimental animals and other materials for educational purposes and research work, precious and other metals for prosthetics, as well as disabled equipment and vehicles for disabled people,

- household materials (light bulbs, soap, brushes, etc.), office supplies (paper, pencils, pens, rods, etc.),

- dishes,

- container,

- stern,

- books,

- spare parts for the repair and replacement of worn parts in machinery and equipment, vehicles, industrial and household equipment,

- special purpose materials,

- other similar assets.

Resources classified as other inventory are assets of budgetary institutions, which, as in the case of inventories of commercial organizations, are accounted for in separate accounting accounts. According to the Unified Chart of Accounts (common for all budgetary organizations), account 105 06 is used.

Moreover, in many cases it is supplemented by a 3-digit analytical code of KOSGU. For example, reflecting an increase in the cost of inventories.

In commercial accounting, “other” in the manner determined by local regulations, as a rule, includes inventories with the least degree of significance from the point of view of use in the production process (based on the criteria established by the responsible specialists of the company).

Accounting for the organization's inventories that are in transit

This category includes situations in which payment papers were accepted, but resources or part of them did not arrive at the warehouse for various reasons. In this case, the column “For unarrived cargo” is used for registration. The company is obliged to accept them on its balance sheet upon completion.

After the actual receipt of the valuables, an inspection is carried out. If surpluses are identified, they are accounted for and also recorded. Then the supplier issues payment requests. If a shortage is detected, the cost is calculated and a complaint is submitted to the sender. The tariff for rail transportation depends on the weight of the cargo. Allowances and discounts are determined according to the price.

Order size optimization involves determining inventory requirements

This area of analysis deals with the calculation of the standard indicator of the company’s need for certain material reserves - so as to optimize their purchases in the required volume when ordering from suppliers. In this case, the task of responsible specialists comes down to finding such a quantity of reserves that, on the one hand, is sufficient to maintain the production process, and on the other hand, is not too much in terms of the cost of their acquisition and maintenance.

Thus, in most enterprises, determining the standard for inventory is a necessary part of analyzing the state of inventories, coupled with determining the factors influencing their volume.

Inventory

At least once a year, according to the requirements, the company undertakes to conduct an inventory of the assets at its disposal. The procedure for conducting it is not regulated. It is designated by the head of the enterprise. The official decides how often the procedure needs to be carried out, on what dates it is carried out, as well as the list of property that is checked. Exceptions are cases when the operation is mandatory under current legislation.

To make the process easier, you can use special software. For example, “Warehouse 15” from Cleverens helps automate many warehouse operations, including inventory.