The reasons for closing a current account vary. In most cases, this happens at the initiative of the client, less often - at the request of government agencies or the desire of the financial institution itself.

The need to close the PC usually occurs when:

- the appearance of an offer with more favorable conditions in another financial institution;

- reluctance to continue cooperation due to emerging conflict situations;

- the need to obtain services that the bank does not provide or provides, but not fully/too expensive;

- internal organizational changes in a business representative (entrepreneur or organization);

- the emergence of concerns about the reliability of the financial institution and whether it will retain its license in the near future.

The closure of a DC at the initiative of government agencies is carried out in the event of bankruptcy of an organization or its liquidation. In this case, not just any specific ones, but all of the company’s accounts are closed. The procedure is carried out with the participation of managers temporarily appointed to this position.

It is possible that the bank itself closes the account. But this happens very rarely, because it is not profitable for a financial institution to lose the profit received from the client in the form of service fees, etc.

Banks close active accounts only if there are compelling reasons:

- the entrepreneur is a US citizen and evades taxes (violation of the FATCA agreement);

- suspicions arise that a business representative is “money laundering” or financing terrorism;

- no movement of funds through the RS has been observed for at least two years.

Closing an account at the bank's initiative can take quite a long time. First, the financial institution requests explanations and documents from the client to confirm the legality of the transactions, issues warnings, and blocks accounts. According to current legislation, a bank is allowed to close a personal account only if it has been able to stop at least 2 cases of suspicious transactions within a year.

Lending to small and medium-sized businesses

Apply now

After the account is closed at the initiative of the bank, it will be more difficult for the client to open a new account or take out a loan from another financial institution. This does not apply to the closure of a non-working PC owned by an entrepreneur or company that has ceased operations.

Grounds for closing an LLC current account

Closing a current account of a legal entity may occur for the following reasons:

- I was no longer satisfied with the level of service: Internet banking began to work worse, problems began to take longer to resolve, there were constant queues at the branch, it was difficult to get through to technical support, etc.

- Another bank offered a more attractive cost for opening an account and additional services, low loan rates, etc.

- In connection with the reorganization or termination of work of the legal entity. faces.

- Based on a court decision.

- At the bank's request.

- Change of organization owner or registered address.

We recommend reading: Where to open a current account for individual entrepreneurs and LLCs: comparison of tariffs and reviews.

Reasons for closing a current account

They may depend on the decision of the individual entrepreneur and company management or on other organizations. At the initiative of management, a bank account is closed if:

- The process of liquidation or reorganization is underway.

- The decision was made to change bank.

- The company has changed owner.

- The company's actual registered address has changed.

- For two years, the current account of an LLC or individual entrepreneur was not used in financial transactions.

The court may order the account to be closed if it has ordered the company to cease its business activities. Or if the legal entity violated the provisions of 115-FZ.

What documents are needed to close a bank account?

To close an account, you will need to provide the following to the bank:

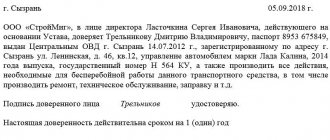

- Passport of the person who has the right to perform this procedure.

- Power of attorney (if a representative applies).

- An extract from the Unified State Register of Legal Entities, which is valid for 1 month. You can receive it through the tax office within 5 days.

- A checkbook and previously received business cards.

- A document that confirms the consent of all founders to close the account.

- A document indicating the person who can close the account. The term of authority should not end at the account closure stage.

Along with the necessary documents, the company representative submits to the bank a completed application to close the account.

RS closing procedure

How quickly a financial institution closes an unneeded checking account depends on several factors. First of all, these are the terms of the contract and the type of cooperation.

It is most difficult for entrepreneurs and companies that have an open loan with the same bank to close a personal account. First, you need to once again familiarize yourself with the terms of the loan agreement, since sometimes there is a clause about the need for early repayment of the remaining debt when closing the loan agreement at the client’s initiative.

The process occurs a little faster if the client has decided to terminate all relations with the financial institution. The bank may demand a fee for terminating the contract and conduct checks in order to find as many grounds as possible for additional collection of funds.

The easiest way to close an RS is for clients who do not want to stop collaborating with a financial institution, but are planning to reorganize their business or open a new company. In such a situation, managers will treat the liquidation of the account as a formality and will help in performing all the necessary operations: transferring the balance of funds to new details and so on.

How can a legal entity close a current account?

To close a bank account, a legal entity needs to submit a package of documents to the branch where the account was opened. The specialist will issue an application - you need to fill it out, sign and stamp it.

If there are arrests, you must first eliminate their cause and only then contact the bank.

If there are any outstanding fees on your account, be sure to pay them. Otherwise, the account will not be closed. If there is money in the account, you can get it from the bank using a checkbook or transfer it to another account. Typically, when transferring money due to account closures, there is no transfer fee.

What to include in the application

The application must include:

- Legal details persons: organization address, name, TIN.

- Account number to be closed.

- Reason for refusal of RKO.

- Checkbook details and blank pages.

- Full name and position of the person who wants to close the account. Some banks require passport details.

- If there is money in the account - details for transfer to another bank (full name and city of the bank, BIC, current account number in another bank, correspondent account, name of legal entity and INN).

- Date of filling out the application.

- Signature and seal.

If any information in the application is incorrect, it will be canceled and the account will not be closed. This is especially true for transfer details. To avoid unpleasant situations, it is recommended to take a copy of the account closure application with an acceptance mark.

Can a bank refuse to close a current account?

The bank may suspend the closure of an account if it is seized or blocked at the request of government authorities.

This usually occurs due to the organization's debts. As soon as they are repaid, the bank receives a decree that cancels the seizure or stops operations, and closes the account.

A more complicated situation arises if a loan has been issued to an LLC or individual entrepreneur at the same bank where it is planned to close the account, and it has not yet been repaid. The loan agreement can be drawn up separately from the cash settlement agreement, but the bank will require repayment of the loan before closing the account.

This is due to the fact that after closing the account, the bank will not be able to collect the debt from the working capital that goes to the current account.

Can a bank independently close an organization’s current account?

A bank can close a company’s current account on its own only under Art. 859 of the Civil Code, which indicates the absence of any movements in the account over the past 2 years.

Before closing a legal account. a written notification is sent to the person. If within 2 months after this the account remains inactive, the bank independently closes it.

The bank asks to close the account if the organization is engaged in illegal withdrawal of funds and violates 115 Federal Laws. First, he demands to provide supporting documents. If documents are not provided within the designated period, the organization must close the account.

Termination of relations with the bank may be facilitated by the presence of service debts. When an organization does not pay for bank services for a long time, the bank may go to court and demand payment of the debt and then close the current account. While legal the person does not repay the debt, the bank cannot terminate the agreement.

We recommend reading: Rating of banks for small businesses with profitable cash settlement services for individual entrepreneurs and LLCs.

Procedure for closing a current account

You can close a current account only with a zero balance. If there is money in your account, withdraw it to other accounts. The account that will be closed should only have the amount left to pay the commission and debts to creditors.

In many banks you can close an account for free. But some organizations have a commission, which usually does not exceed 500 rubles.

There is no need to notify the tax, pension fund and social insurance fund about the closure of an LLC and individual entrepreneur account. This obligation was canceled after 52-FZ and 59-FZ were adopted.

How to close a current account for LLC and individual entrepreneur:

- Submit an application to close your account.

- Pay off debts for bank services, if any.

- Hand over bank cards and checkbooks.

- Withdraw the remaining funds.

- Receive a document confirming account closure.

The bank closes the account within seven working days. An entry about account liquidation is made in internal bank documents on the next business day after termination of the cash settlement service agreement.

Closing an account at the initiative of an entrepreneur or LLC management takes place quickly. The time period increases if the organization is being liquidated. This is due to the fact that you first need to pay off debts to creditors.

What does the account opening notice contain?

The law provides for a form for transmitting information. As such, there is no form for the company to open a current account; the accountant of the credit institution fills out an electronic Excel form, entering the following information into it:

- code of the tax authority where the notification about opening a current account is sent;

- name of the bank or its branch where the client applied;

- the exact address of the branch where the agreement was concluded or its branch;

- bank registration number, its BIC, INN, KPP, OGRN;

- name of the client: company or individual entrepreneur;

- the series and number of the client’s certificate of registration is not taken into account by the Federal Tax Service;

- date of conclusion of the service agreement, its number;

- date of invoice formation, its number;

- information about the bank representative indicating telephone number and position.

Now the client does not need to fill out the form himself; by law, this responsibility is assigned to credit institutions. They inform the Federal Tax Service about the opening of a current account in 2021 and are responsible for the timeliness or relevance of the transmitted information.

Important! If the tax notice about opening a current account was not sent within the period of 5 days established by law, the bank employee responsible for sending the information bears responsibility. A fine of 1000-2000 rubles is imposed on him.

In addition, the bank is also fined for late submission of an account opening notice. According to the Tax Code of the Russian Federation, Article 132, the fine is 20,000 rubles.

Open a current account

How to pay taxes if your current account is closed

Individual entrepreneurs are not required to have bank accounts. This allows them to pay their taxes in cash and the closed account situation is not a problem for them. It is more difficult for organizations. The position of the Ministry of Finance is that they cannot pay taxes in cash.

If the funds were issued on account, and subsequently the organization received an advance report from an authorized employee (and all the necessary details were indicated in the payment document), then it is permissible to pay taxes in cash through a representative of the company. This is evidenced by some decisions of arbitration courts, as well as instructions of the Constitutional Court. But problems with crediting funds with such payment cannot be avoided. Therefore, it is better to think in advance when the LLC will close its account during liquidation, and not to rush too much.

From cash to receivables

If your bank's license has been revoked, you will have to admit that you are unlikely to ever be able to use the money stuck in it.

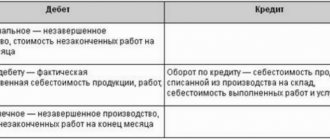

But they will have to be taken into account and reflected in the reporting. After all, a lot of time can pass from the moment the license is revoked until the bank is liquidated or declared bankrupt. The first thing to do is to write off the money from the current account on the date of revocation of the license and transfer the amount to accounts receivable.

Make the wiring:

- Debit 76, subaccount “Settlements on claims” Credit 51

.

Thus, the suspended amount will remain as part of assets, but it must be reflected in the balance sheet not as part of cash, but as part of accounts receivable.

When can a client close an account?

There are other reasons to close a client account:

- Reorganization or liquidation, including due to bankruptcy.

- Dissatisfaction with services.

- Lack of working Internet banking or poor performance.

- Inconvenient location of bank offices, as well as the inability to solve problems at a distance.

- Questionable financial position of a financial institution.

These are just the main reasons for closing a current account, but there are many more. For example, when issuing a loan, some banks ask you to refuse cooperation with other companies.

The Civil Code regulates the rights of the parties regarding the procedure. Client interests are more important, because the client has the right to terminate cooperation with the organization at any time.

The bank has the right to take the initiative to terminate customer service only in two situations:

- The account is not used (no transactions have been made on it for more than 2 years).

- There are less funds in the account than specified in the agreement or regulated by the rules of the organization.

Closing a Credit Card Account

In this case, the situation will be more complicated. A credit card is a loan, the amount of which is not issued to the borrower, but is credited to the account. And this account is linked to a special issued credit card.

Therefore, the main condition for closing this account is the absence of debt on the loan. That is, the debt must be fully repaid. This means paying off interest and principal. If such conditions are met, then closure occurs on a general basis upon presentation of a passport. In this case, you need to fill out an application form and sign it. From this moment on, the account will be closed and the client will receive a certificate of closure.

What happens after the closure of the PC

After the RS is closed, the money sent to it will be returned to the addressee. Therefore, if an entrepreneur or organization continues to operate, they must inform their partners of new details.

There is no need to notify the tax, insurance company or other government agencies. The bank will do this.

For future checks and your own accounting, it is better to immediately order an extract for a closed RS. It will be possible to restore data later, but this will require more time and effort, especially if the bank or company is liquidated.

Algorithm of client actions when closing an account

Closing a bank account is always carried out strictly according to one algorithm. After submitting an application to terminate the account, you need to request information from the company about the amount of funds remaining on it.

One week is given for withdrawal of funds. During this time, the individual entrepreneur must decide how he wants to transfer money from the account - receiving funds through the cash register or transferring them to other details. If the client does not make a choice within a week, then the banking company can dispose of the remaining funds.

If the account is closed by an entrepreneur who remains bankrupt, the remaining money is transferred to the bankruptcy trustee.

Such an application shall indicate the details of the recipient, as well as attach identification documents and a copy of the document approving the person as a bankruptcy trustee.

The corresponding closure entry appears in the Open Accounts Register the day after the funds are transferred. The client receives a certificate of successful completion of the procedure.

Application to close an account in Sberbank

Previously, such applications were filled out manually by clients in the presence of a bank employee. However, customer service processes are speeding up. And manually filling out an application means slow service and creating a long queue. Therefore, a sample application is located on the computer of bank branch employees. Consequently, when a client applies with a coupon, the employee simply prints out two copies of the application. All that remains is to sign them.