Product returns in 2021

According to the recommendations of the tax office, in any case of returns, it is necessary to use one method when the seller, who issued an invoice to the buyer upon shipment, always issues an adjustment invoice. This will be the basis for the seller to claim a tax deduction and for the buyer to recover VAT.

This procedure, according to Letter No. SD-4-3/ [email protected] (clause 1.4), will apply both to goods shipped before 2021 and after.

In the beginning of the year program, when returning goods to the supplier, you need to enter the document “ Receipt Adjustment

”, and not the document “

Return of goods

”, as it was before, and for this adjustment, register the adjustment invoice (UCD) received from the seller.

Mirror situation: if you are a seller, then you need to use the document “ Adjustment of sales

"and issue an adjustment invoice (UCD) to the buyer.

In this case, the documents “ Return of goods

" remain in the program as an archive, so that you can complete some documents, see what happened before, until 2021. But then the main documents are "

Adjustment of implementation

", "

Adjustment of receipts

".

Simplification of VAT reporting preparation

In order to simplify accounting control, the VAT assistant has been changed in new releases of the program. With the help of which it will now be possible to generate VAT reporting in a simplified form. Starting from release 3.0.67, it is enough to enter the primary documents and launch this Assistant.

The VAT Assistant will tell you the sequence of performing regulatory operations for those who:

- separate VAT accounting,

- mediation activities,

- import and export of goods, VAT accounting for construction and installation work,

- separate VAT accounting,

- accounting of separate divisions,

- performing the duties of a tax agent.

The assistant can be launched from the section “Reports” – “VAT” – “VAT reporting”

.

The assistant will check the data itself and tell you what errors there are, if any. If some data is missing, for example, OKTMO, the assistant will say that the data is missing and that it needs to be filled out. After he calculates everything, a declaration will be generated that can be sent to the regulatory authorities.

We will prepare a VAT return for you

Order service

Supplement received in 2021

Let's consider a more complex situation. In 2021, advance payment has been received (at a rate of 18%) and shipment is scheduled for next year. Let’s assume that an agreement was signed with the buyer on an additional payment of VAT in the amount of two percent in 2021. Such an additional payment must be considered as an additional payment of cost, VAT on which must be calculated at a rate of 18%.

Let's see how this situation will be reflected in the program. Let’s assume that in 2021, an “Invoice for payment” was issued to the buyer at a rate of 18% and an “Invoice issued for advance payment” was issued at the same rate, since it was planned that the shipment would be in the same year.

Then, when it became clear that the shipment would take place next year, an additional payment of 2% was received from the buyer and this additional payment was made in 2021. When transferring the additional tax payment to the buyer, in the payment order when filling out the purpose of payment, it is necessary to make a note that he is transferring exactly “Additional VAT payment of 2%.”

The tax office recommends, when reflecting such additional payments in tax reports, to use an adjustment invoice for the amount of the additional VAT payment at a rate of 18%, which must be prepared to accompany the invoice issued for the amount of the prepayment received in 2021.

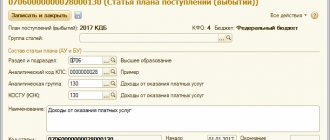

After changing the type of invoice to “Adjustment for advance payment”, the tabular part of the document will be changed, in which it is important for the accountant to indicate for which invoice such an adjustment invoice for advance payment is drawn up.

The document contains substrings: “before change” and “after change”. The substring “before change” will automatically contain the value from the invoice of the one being adjusted. The additional payment received will be automatically added to the “after change” subline, that is, the adjustment invoice for the advance payment will be filled in automatically. Since the surcharge was in 2021, this surcharge is an additional payment of the cost and VAT will be calculated at a rate of 18% of the surcharge.

The printed form of the advance adjustment invoice is similar to the advance invoice. Column 5 will be empty, there will be zeros there. Column 8 will indicate the amount of VAT, taking into account the tax on the additional payment received. The seller must register this adjustment invoice in the sales book for the fourth quarter of last year at a rate of 18%.

Then there is a shipment of these goods in 2021 at a rate of 20%. To claim a tax deduction, the seller will need to register in the Purchase Book both an advance invoice for the amount of the advance payment that was received in 2021, and on which VAT was calculated at the rate of 18/118, and an adjustment invoice for the additional payment tax Two lines will be registered in the Purchase Book: for a regular invoice for an advance payment and for an adjustment invoice for an advance payment. The second line indicates both the regular invoice number and the adjustment invoice number.

Technical errors

To identify technical errors, you should use the “VAT Accounting Data Reconciliation” service. It allows you to reconcile invoices with counterparties. It will reflect discrepancies between the other party's invoice information and your organization's.

Accordingly, it will be possible to send a message to the buyer so that he makes corrections, or to correct errors in the SF from the supplier.

To do this, go through the “Administration” menu, “Organizer” section, and follow the “System account setup” hyperlink in the Mail subsection. Here in the window that opens you need to enter your email address, password and check the appropriate boxes.

Next, in the “Purchases” or “Sales” menu, select “Reconciliation of VAT accounting data” in the calculation block.

In order to receive data from the supplier, you need to click on the “Supplier Requests” hyperlink. Next, select those with whom you plan to reconcile and click the “Request registers” button.

In order for the supplier to send the register, the employee must click on the “Customer Requests” hyperlink in his program on his part. Select your organization and click the “Reply” button. Consequently, reconciliation can only be carried out with those companies that also have 1C: Accounting 8.3 installed.

In the reconciliation window, click the “Reconcile” button to create a reconciliation of SF data between your organization and suppliers.

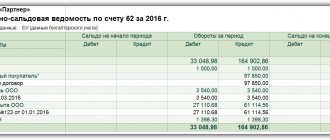

If everything is in order, a message will be displayed that no discrepancies were found. If there are technical inaccuracies, they will be reflected in the generated report. Let's assume that discrepancies are found in this version. According to your company, there is invoice No. 500 dated 02/02/2020 for the amount of 72,000 rubles, but according to the contractor there is no such invoice. However, your company does not have it, but the contractor displays SF No. 50 dated 02/02/2020 in the amount of 72,000 rubles. Accordingly, we can conclude that the accountant made a mistake; instead of number 50, number 500 was entered.

If you do not correct this oversight, you will receive a notification from the Federal Tax Service about a data discrepancy. Therefore, this determination of the correctness of accounting must be approached with all attention and care.

By clicking on the erroneous SF, you can make corrections to your document.

What you need to consider when working in 1C

- Update: make sure in advance that your program is up to date.

- If you have a non-standard database, there are additions regarding VAT, processing, additions to printed forms - all this needs to be checked and brought into compliance with the law and the new VAT rate.

- If you are not the one who enters the primary documents (for example, managers or assistants do this), warn them about the entry and the need to use, check, and set a new VAT rate when entering documents into the database.

- If there is an exchange between programs, pay attention to the documents being uploaded, the correctness of the rate used (open and check the documents being uploaded and uploaded)

Additional payment received in 2021

The third situation is even more complicated. All the conditions are the same, but the additional payment of 2% took place in 2021. In this case, in accordance with the recommendations of the Federal Tax Service, the additional payment should be considered as an additional payment of the tax amount, and not the cost. When receiving an additional payment, the seller must issue an adjustment invoice for the difference between the tax amount on the original advance invoice and the tax amount calculated taking into account the additional payment.

In the program, as before, you need to issue an “ Invoice to the buyer for payment

", issue an "

Invoice issued for advance payment

" and register it in the Sales Book.

In 2021, an additional payment was received from the buyer. When transferring additional tax payment to the buyer in the payment order, when filling out the payment instructions, it is necessary to make a note that he is transferring exactly “additional VAT in the amount of 2%”.

To reflect the received amount of additional tax payment, you must enter a correction invoice for the amount of additional VAT payment. It is prepared for the invoice for the amount of the prepayment that was received in 2021. The program automatically fills out the document and inserts the “necessary” rates into the sublines before and after the change, and the VAT amount is calculated correctly. Since the surcharge came in 2021, this surcharge amount is the amount of the surcharge tax.

For shipments in 2021, applying the 20% rate, to reflect the two percent VAT surcharge, the seller will need to record an adjustment invoice in the sales ledger - this will be the first line and a shipping invoice - this will be the second line.

In order for the seller to be able to claim a tax deduction, he needs to register in the purchase book both an advance invoice, which was issued for the amount of the 2021 prepayment and on which VAT was calculated at a rate of 18%, and an adjustment invoice for the additional payment of tax 2021 G.

An advance that was received in 2021 for shipment in 2019.

An explanation of the application of VAT during the transition period of the Federal Tax Service is given in Letter No. SD-4-3 of October 23, 2018 / [email protected] Let’s consider how tax authorities recommend reflecting a particular transaction, and then how this is supported in the program.

The first situation: if the shipment is planned in 2021, you must immediately take into account that the new rate of 20% will apply. In the invoice for payment, you must indicate the cost of goods based on a rate of 20%, and highlight this rate. In this situation, the Federal Tax Service says that if payment is received in 2021, VAT must be calculated on the advance received at the rate of 18/118, since there is no basis for applying a different rate.

The program requires an “Invoice to the Buyer” to be issued in 2021 at a rate of 20%. But since the advance payment was received before the beginning of the next year, the “Invoice for advance payment” must be issued at the rate of 18/118. This mechanism is implemented in the program, and it itself substitutes the correct bet. This invoice must then be recorded in the Sales Ledger.

Accordingly, next year there will be a shipment at a rate of 20%, and the invoice will be at a rate of 20% accordingly. In 2021, the invoice form does not change. The rate of 20% is still indicated in column 7. Posting the document “Sales of goods” and generating an invoice will make a new entry in the accumulation register “VAT Sales”. Based on these records, the Sales Book for the first quarter of 2021 will be generated.

The Ministry of Finance has developed a project according to which amendments will be made to Government Decree No. 1137 dated December 26, 2011 (prepared by the Ministry of Finance of the Russian Federation on November 12, 2018). This resolution will come into force after one month from the date of its official publication and no earlier than the first day of the next tax period for value added tax. At the moment, this project is still under consideration. These amendments will affect changes only in the Sales Book and Accounting Journal.

Two columns with the new rate will be entered in the Sales Book. In turn, columns with a rate of 18% will remain - they are needed to issue adjustment invoices for 2021 and earlier. Since, according to the Letter from the Federal Tax Service, the VAT rate of 18% must be written in the document.

In the accounting journal form, only the rate will be changed to the current one.

The purchase book will not change, since only the VAT amount is filled in, without the rate.

In version 3.0.67 of the program, the Sales Book is already available, which reflects the rate of 20%. Therefore, now, after updating the program, you can create a Sales Book for the first quarter of 2021 in the version in which it will be valid in 2021.

After the sale and offset of the advance payment, it is necessary to reflect the VAT deduction. This is done in the document “ Creating purchase ledger entries”

"

Advances received

tab reflects the received prepayment amount and the amount of VAT previously calculated from the amounts of advances received and offset against the shipment.

According to the records of the VAT Purchases register, a purchase book is being formed for the first quarter of 2021, where VAT is reflected at a rate of 18%.