The “Debt Adjustment” document is located in the “Regulations” section panel.

.

Debt adjustments can be made for a variety of reasons. This document allows you to adjust mutual settlements with the following types of transactions:

- offsetting – used for mutual repayment of receivables and payables of one or two counterparties;

- debt write-off – used to write off bad debt.

In addition, the document can be used to document the entry of initial balances for mutual settlements with counterparties.

Debt offset

Debt adjustment is a business transaction that has a direct impact on the total result of mutual settlements.

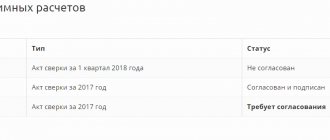

First, it’s worth understanding in what cases the “Debt Adjustment” document is needed. Adjustments are most often formed on the basis of documents such as a reconciliation act, an information letter from the counterparty, or under an additional agreement or contract. If the data of the supplier and the buyer do not match, for example, incorrect information was taken into account, errors were made in the documents, or changes were made that were not agreed upon with the other party to the contract, it is necessary to make an offset.

To carry out offsets, go to the “Sales”

or

“Purchases”

, select the

“Debt Adjustment”

and click the

“Create”

.

Then you need to select the type of operation. The program provides five different types: advance offset, debt offset, debt transfer, debt write-off and other adjustments. Directly for offset, 3 out of 5 options can be used: advance offset, debt offset and other adjustments.

Now let's look at each operation in more detail.

If the buyer has a debt to the organization or a third party to your organization, then the “Advance Settlement”

. It can also be used with advances issued to a counterparty.

What should be done? We need to select the “Advance offset”

, then select the counterparty whose advances we want to include in the adjustment and enter data into the tabular section using the

“Fill”

. It is available in two versions, at the top of the document and in the table. The difference is that the top button fills in the entire document, that is, accounts payable and receivable, while the bottom button fills in only the required type of debt. After this, reference amounts for debt will appear in the document.

The main thing to remember is that in order to post a document, the amounts of accounts payable and receivable must be equal, otherwise the program will generate an error and will not post the document. Therefore, if you have a difference, then the amounts must be adjusted manually and equalized.

Debt adjustment

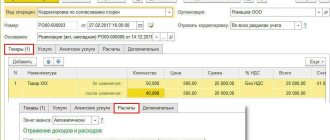

Select the “Debt Adjustment” item in the 1C 8.3 “Purchases” or “Sales” menu.

Our team provides consulting, configuration and implementation services for 1C. You can contact us by phone +7 499 350 29 00 . Services and prices can be seen at the link. We will be happy to help you!

Create a new document from the list form that opens and fill out the header. The most important field is “Type of operation”. Depending on it, the composition of the fields changes. Let's look at these types in more detail:

- Settlement of advances. This type is selected if it is necessary to take into account advances in mutual settlements.

- Debt offset. Selected if it is necessary to change mutual settlements against the debt of the counterparty to us, or a third party.

- Transfer of debt. This type is necessary for transferring debts, advances between counterparties or contracts.

- Debt write-off. This implies complete write-off of the debt.

- Other adjustments.

Transfer of debt

Also, situations often arise when one counterparty decides to pay the debt of another. In such situations, a debt transfer should be made. To carry out such an operation, you should indicate in the document, after selecting the desired operation, the counterparty whose debt obligations need to be transferred, then indicate the counterparty who will subsequently pay off the obligations.

Next, fill in all the necessary details: old and new agreement, accounting accounts, currency and others. It should also be noted that this type of operation will help not only transfer debt from one counterparty to another, but also transfer it between contracts. In this case, the columns “Buyer (supplier)”

and

“New buyer (supplier)”

are filled in by the same counterparty, but different contracts are indicated.

Postings for netting

The essence of these operations: the debt of counterparty “A” under its agreements is extinguished by the debt of counterparty “B” under its agreements.

Let's look at the operation using a specific example.

02/10/2015 provided in the amount of 6,000 rubles. (including VAT - 1000 rubles). .02.2015 “made a shipment of goods in the amount of 9,000 rubles. (including VAT - 1500 rubles). and “B” offset their mutual debt in March 2015.

On 03/03/2015, an act of offset was signed and an offset of 6,000 rubles was made.

The following entries were made in the accounting department:

| date | Account Dt | Kt account | Sum | Contents of operation | Document |

| 10.02.2015 | 44 | 5000 | Payment of cost | Payment order | |

| 10.02.2015 | 19 | 1000 | Reflection of the VAT amount | Payment order | |

| .02.2015 | 90/Revenue | 9000 | Revenue from sales of goods is recognized | Invoice | |

| .02.2015 | 90/VAT | 68/VAT calculations | 1500 | Reflection of the VAT amount on goods sold | Invoice |

| .03.2015 | 6000 | Requirements have been offset against | Settlement act dated 03/2015. |

As for accounting in, the postings will be “mirror” to the postings, i.e. for the amount of 9000 rubles. the purchase will be shown, and for 6000 rubles. - sale.

Debt write-off

If a situation arises where the debt has not been and will not be paid due to any circumstances, then the debt should be written off. To do this, in the document you should select the counterparty whose debt is to be written off, and indicate all debt obligations in the tabular section. Also, this type of operation can be used not only for buyers, but also for debtors, because not all suppliers return the advances transferred to them when terminating contracts or refusing services.

It is important to pay attention to the fact that after the “Fill”

the tabular part will include all debt obligations, even those that can still be paid, so they should be removed from the list, leaving only those that can be written off.

On the “Write-off account”

, you must specify the account to which the payables or receivables will be written off.

If none of the proposed options suits you, then you can use this type of operation as “Other adjustments”

. The main thing is that after posting the document, create a balance sheet to make sure that the selected operation is correct.

Debt write-off operations

In order to write off debt, appropriate grounds are required. These include:

- expiration of the statute of limitations;

- impossibility of fulfilling the obligation (liquidation of the company);

- unreality of recovery.

Example No. 1: Write-off of accounts receivable

15..2013 carried out an inventory of settlements with customers, during which a reserve was created - 80,000 rubles.

08..2014 the debt to was recognized as unrealistic for collection (the debtor company was liquidated). The amount of bad debt amounted to 120,000 rubles. (including VAT - 20,000 rubles).

| date | DT account | Kt account | Sum | Contents of operation | Document |

| 15..2013 | 91-2 | 80000 | A reserve for doubtful debts has been formed | Accounting policy | |

| 08..2014 | 80000 | Part of the bad debt was written off using the reserve created | Accounting certificate-calculation | ||

| 08..2014 | 91-2 | 40000 | The balance of accounts receivable not covered by the reserve amount is written off | Accounting certificate-calculation | |

| 08..2014 | 76/Deferred VAT settlements | 68/VAT calculations | 20000 | VAT is charged on the amount of written off receivables | Accounting certificate-calculation |

Example No. 2: Write-off of accounts payable

On 31..2014, during an inventory check of settlements with suppliers, overdue accounts payable in the amount of 20,000 rubles were identified, with the statute of limitations expired in June 2014.

| date | Account Dt | Kt account | Sum | Contents of operation | Document |

| 31..2014 | 91/Other income | 20 000 | Expired accounts payable written off | Leader's order. |

Accounts receivable management using 1C:Enterprise 8

I'll tell you my story that happened to me.

After buying my new car for about six months in the fall, closer to winter, I was pleasantly surprised to discover that it, it turns out, has a heated function for the side mirrors. This can greatly make life easier for a car enthusiast in frosty weather. Another six months later, it turned out quite by accident that my modest city hatchback could have a hidden button to open the trunk without simultaneously opening all the locks on the four other doors of the car. This is incredibly convenient when you are poking around in the trunk, practically immersed there headlong, and therefore you can easily not notice an intruder next to the driver's door. I continue to make my discoveries to this day, which greatly amuses my friends and acquaintances - more experienced drivers. Another example. I personally know several people who, when buying a mobile phone, did not have a complete understanding of all the functions available in it, and only then discovered what a huge amount of benefits can be obtained from this wonderful benefit of civilization.

What am I leading to with all this? Many years of experience in the IT field allowed me to compile some statistics regarding how aware software users are of the real capabilities of the software product they are using. The statistics are as follows: The vast majority (namely, more than 80%) of companies, when purchasing this or that software, initially have an idea only of the general concept of the solution; at best, they know individual functional blocks (most often this is the functionality for which, actually, the product is purchased). Everything else “remains behind the scenes.”

Of course, at the stage of choosing software, such an approach is completely justified - after all, you can’t immediately try to grasp the immensity. But the problem is that almost half of the users of licensed software never manage to fully “declassify” the rich functionality of the system throughout its entire lifespan. But how much time and money could this or that function save?

There are plenty of reasons for this - both objective and subjective. Modern ERP systems are not so easy to learn; the price for system flexibility is often its complexity, and key users of the system do not always have the opportunity to devote time to study documentation or attend training.

As a result, there are situations when, having invested the Nth amount of money in a project for implementing an information system, after completion of the project the company uses the system’s capabilities not at one hundred percent, but, let’s say, at sixty percent. What about the other forty? Perhaps, with their help, the company will be able to obtain from the information system the necessary data that influences the adoption (or non-acceptance) of a decision that is strategically important for the company. The price of the issue here is very high.

Without knowing about the heating button, I can easily clear the frost from the side view mirrors of the car with a spatula. If I'm not in a hurry. What if I’m late and don’t have time for unnecessary movements? What if it’s minus 30 degrees outside and I still have gloves at home? So it turns out that, in a state of deep frostbite, I arrive at work an hour late. Although you could just press one button. But you had to know exactly where to click.

Shifting the topic closer to the subject of the article, I will inform you that there are “buttons where to press” in “1C: Enterprise 8.0.” (namely, this system will be discussed today) is an incredible amount. The topic of this article is “Management reporting in 1C:Enterprise 8.0. "enables its author to reveal his knowledge in this area on the scale of an entire book (and possibly in several volumes). But knowing how difficult it is for key users of the system to find time to read literature (the lack of time has already been mentioned above, and therefore we will act consistently), today we will choose for discussion only one narrow topic - “Accounts Receivable”.

Companies that work with their customers and clients exclusively on prepayment basis are in the minority in Russia today, and therefore the issue of accounts receivable management is still relevant. What is the total amount of accounts receivable and what does it consist of? How big or small is this figure compared to last month or the same period last year? What is the structure of “receivables” by date of occurrence? Which buyers and customers do not pay for our products? What specific orders (applications), shipments have not been paid for? What are the reasons for non-payment and when can I expect payments? What actions are taken by company employees to recover accounts receivable and how effective are they? These are, perhaps, the questions that company leaders would like to know the answers to.

So, let's see how a company using the 1C:Enterprise 8 software system can get answers to these questions.

Who are our debtors and how much do they owe us?

The figure shows a report that provides information on the amounts of debt of counterparties to the company on a certain date (in our example, at the end of the day on July 31), in the selected currency (in our example, it is USD).

The report is detailed by counterparties - buyers and customers of the company.

As can be seen from the report, the total amount of accounts receivable as of July 31, 2005. is 93,310.83 USD. The list of debtors includes 13 counterparties, and two organizations especially “distinguished themselves” - Zarya and Iskra, whose debt to the company is significantly greater than that of other counterparties. This means that it is these two counterparties that you need to pay special attention to first.

In cases where the list of debtors does not fit on one page, the “Accounts Receivable - Chart” report will help you visually select the counterparties with the largest debt.

In this case, we chose the chart type - “pie volume”, and the data labels - “percentage”. The diagram clearly shows that the debts of the two organizations Zarya and Iskra together actually account for more than 80% (40.81% + 40.93%) of the total amount of receivables, while all other debtors of the company account for only 20%. (The above example seems to correspond to the well-known Pareto principle: 20% of buyers - 80% of receivables).

However, in reality everything is much more interesting. In particular, one of the features is that many companies have several legal entities, and our debtors are no exception. Let's imagine a small holding (let's call it Glavtorg), consisting of a trading house (Trading House LLC), a chain of retail stores (Set Stores LLC) and a manager). Let's assume that each of the holding's legal entities is a buyer of our products and has receivables. The amount of debt of each of Glavtorg's legal entities is not so large as to attract our attention. However, for the holding as a whole, there may be a fairly impressive figure that deserves to be worked on.

In “1C:Enterprise 8.0” it is possible to indicate the parent organization for each counterparty (thus indicating that the counterparty belongs to the holding), and then generate the necessary analytical reporting in the context of holdings. This capability is shown in Figures 3 and 4.

Thus, having received a report on accounts receivable, grouped by the main counterparties, we saw that debtors Zarya and Iskra actually provide 80% of the amount, but the remaining part of the debt is not at all “spread out” among the other counterparties, but falls mainly on the Shopping Center Snowflake. Trade, represented by several legal entities, accounts for 13.45% of “receivables”.

Note that grouping information in reports by parent counterparties is precisely one of those features of 1C:Enterprise 8.0 that not all users of the system are aware of.

Is this a lot or a little? They did the math and shed a few tears...

Having received the amounts of receivables (in general and for each debtor), we will try to draw conclusions regarding these figures. The first thing we need is a comparison with previous periods. Only by analyzing the dynamics of changes in accounts receivable over a certain (preferably long) period of time will we be able to assess how good or bad the situation is today.

The Figure shows a report that compares accounts receivable amounts as of three different dates—August 1, 2005, February 1, 2005 (six months ago), and February 1, 2004 (one and a half years ago). The earliest of the three dates, February 1, 2004, was chosen as the reference time period (the one with which the other two will be compared). The other two periods are compared with the reference.

The report is generated in the management accounting currency (in our example - USD) and is detailed by counterparties. Such detailing makes it possible to look at the dynamics of changes in the volume of “receivables” over a period of time for each debtor we are interested in separately. In our case, the debtor “Zarya” is alarming, the amount of debt has increased sharply over the past six months. A slight increase in debt (by 21.056% compared to February last year) was observed by individual entrepreneur A.P. Bobrov. Neva TD repaid its debt almost completely (99.983%). The bottom eight lines of the report are counterparties whose debt arose relatively recently - in the period from February to July of the current year, because neither as of February 1 of this year, nor as of February 1 of last year, there were no “receivables” for them. This is a relatively “fresh” debt.

In general, it follows from the report that over the past year and a half, the volume of receivables from buyers and customers to the company has grown from 13,421.65 USD to 93,310.83 USD. In percentage terms, the growth is 595% (that is, the debt has increased almost 7 times). Is this situation normal? Yes, this situation can be considered normal if during the analyzed period the company’s revenue also increased 7 times. Generally speaking, it is much more interesting to evaluate the volume of accounts receivable not in itself, but in relation to the company’s revenue. This indicator is calculated by dividing the amount of accounts receivable at the end of the period by the amount of revenue for the period, and is expressed as a percentage. Let's see what the value of the indicator is in our case. The calculation of the indicator is presented in Figure 6. The value of the indicator is more than 70%. Many companies consider the norm to be within 10%. From this point of view, our 71.55% is a catastrophic value, and, of course, the company must take some action aimed at reducing the volume of accounts receivable. And for this it is necessary to understand the reasons for this volume, and then we will form in “1C: Enterprise 8.0.” a number of analytical reports that will help us with this.

But before we go any further, let's go back to Figures 5 and 6 and look at how we were able to get 1C:Enterprise 8.0. reports of exactly this type (I suspect that this is not obvious to all 1C:Enterprise 8.0 users).

How we got the right numbers in the right form or a few words about the “Budgeting” subsystem

The reports presented in Figures 5 and 6 are actually obtained from the Budgeting subsystem. The subsystem is part of the main solution on the 1C:Enterprise 8.0 platform - “Manufacturing Enterprise Management” (abbreviated as “UPP”). The integrated solution "UPP" contains several subsystems: production management, sales management, purchasing management, cash management, budgeting, personnel management, equipment management, accounting, IFRS. It is not always advisable to implement absolutely all subsystems, and therefore the decision about which SCP capabilities will be used by the company is made individually in each specific case, depending on the specifics of the company’s activities and the goals of implementing an information system based on SCP. The decision to implement the “Budgeting” subsystem, as a rule, is made based on the fact that the main capability of the subsystem is the preparation of budgets. However, let’s see what else the “Budgeting” subsystem can do in terms of generating management reporting. Using the “Budgeting” subsystem it is possible to:

- Create a forecast balance and a number of other forecast forms, taking into account various options (scenarios) for the future financial condition of the company, analyze forecast data (Figure 7),

- Obtain a management balance sheet and other financial reports based on actual data for the selected period, conduct a financial analysis of the data and compare profits with another period (Figure 7),

- Compare two or more budgets (in general and item by item) for different periods of time, compare different options (scenarios) of budgets for the same period,

- Conduct plan-fact analysis, identify deviations of fact from plan (in absolute values and percentages),

- Compare actual data from several periods,

- Calculate indicators of any type (using formulas specified by the system user), based on planned (budget) or actual data.

To obtain data on the amounts of receivables for three different dates and compare the amounts with each other (Figure 5), we used the report of the “Budgeting” subsystem, which is called “Comparative analysis of balances on budgeting accounts.” In the report generation parameters settings (called by clicking the “settings” button located in the top panel of the report), we indicate the type of data and dates on the “general” tab as shown in Figure 8.

Next, on the “Selection” tab, you must indicate “Account”, “equals”, then select from the proposed list the account with the name “Customers’ debt, current”.

To get detailed information about debtor counterparties in the report, add the “Counterparty” grouping on the “Groups” tab. Having made all the settings described above and clicking the “Generate” button, we will receive a report exactly as in Figure 5. Of course, in the operational circuit of the 1C:Enterprise 8.0 system (in particular, in the “sales management” subsystem) you can also get information on accounts receivable, and in a variety of analytical aspects. But for a beautiful comparison of data from several periods “with one button,” the capabilities provided by the “Budgeting” subsystem are better suited.

Now let’s return to Figure 6. The form presented in the figure was also obtained through the “Budgeting” subsystem, and specifically using the so-called “financial calculations”. Financial calculations are a flexible tool in the 1C:Enterprise 8.0 system that allows the system user to build financial reports of any type. The user of the system independently sets the structure of the financial calculation - indicates which lines and indicators will be present in the report, and by what formulas the values of these indicators will be calculated (Figure 9). At the same time, you can “pull” data into financial calculations both from the “budgeting” subsystem and from other subsystems - for example, “production management” or “personnel management”. The main thing here is to know where to get the necessary data, and actually writing the formulas itself is not at all difficult. In our example, we took data from the “budgeting” subsystem, since all actual data (including data on revenue for the period and accounts receivable at the end of the period) in our case are reflected in this subsystem.

Let's dive into analytics

So, it's time to start looking into the causes of accounts receivable. In order to make assumptions regarding the reasons for the “receivables”, we will try to “twist” these figures in various analytical sections. Only by analyzing the same situation (number, problem) from several different angles can relatively correct conclusions be drawn. From what angles can we look at “receivables” in the information system “1C:Enterprise 8.0”? It can be viewed, at a minimum, in the following analytical sections:

- For counterparties-debtors (we already did this at the very beginning).

- By intervals of debt occurrence.

- Under agreements concluded with counterparties-debtors.

- By types of contracts.

- By orders (applications).

- By types of orders (applications).

- By types of counterparties (in terms of the types of classifications accepted by the company), for example, by geographic regions of the counterparties’ location.

- For managers who shipped products (goods, services) to counterparties-debtors.

- For the main managers of counterparties-debtors.

- By company divisions.

The Figure shows a report providing information on accounts receivable by occurrence interval. Please note that the interval values (number of days) by which the amounts in the report are grouped are not strictly specified by the program, but are entered directly by the system user. Moreover, you can enter and store several options in the system at the same time, and when generating a report, select the desired option.

This opportunity is clearly illustrated in Figure 11 - when generating the report, we introduced a new option for intervals (month, quarter, year, more than a year) and immediately received data on accounts receivable in the context of these periods.

As practice shows, the shorter the period for which the debt arose, the greater the likelihood of the debtor repaying the debt. Of course, there may be exceptions, but in any case, with equal efforts expended by the company to repay the debt, “fresh” debts are usually repaid with much greater success.

Let's do a little calculation based on this assumption. Let’s estimate the chances of receiving a debt for a period of no more than 30 days at 90%, from 31 to 90 days at 80%, from 90 days to 1 year at 60%, and over 1 year at only 20%. The calculation results are presented in Figure 12. From them it follows that first of all it is advisable to work with the counterparty “Iskra”, and secondly with “Zarya” and “Fresh Wind”. And it makes sense to simply write off the debt of such organizations as World of Light, Glavspetsstroy and Neva TD. Prioritization is necessary, because the resources that a company can allocate to work with debtors are not endless. (In fact, all employees of the company cannot deal only with this issue from morning to evening).

The calculation described above and the conclusions that we drew from it are just one example of how you can use the reporting generated in 1C:Enterprise 8.0 for analysis and decision-making.

The next issue we will consider is the analysis of accounts receivable in the context of contracts and orders.

Analysis of accounts receivable in the context of contracts and orders (applications) of buyers

Generally speaking, information about accounts receivable in the context of contracts and customer orders in “1C: Enterprise 8.0” can be obtained from several types of reports, namely: “Mutual settlements with counterparties”, “Debt by counterparties”, “Accounts receivable-diagram”, except In addition, some universal shapes will also work. However, we will deliberately continue to use only one report “Debt by counterparties”, thanks to which we will study the capabilities of the system in terms of various groupings and data selections. In other words, we will see how, based on the same report template, you can get several different forms.

Let's start with the fact that not all information can be included in any report, but only information that satisfies a certain criterion (or several criteria). What we will do now is to select in the contract report only those contracts that were concluded with four specific debtor organizations - “Zarya”, “Snezhinka Trade Center”, “Fresh Wind” and “Morozko”. To do this, in the selection conditions for the counterparty at the top of the report, we will indicate the type of condition - “In the list” and then add to the list those counterparties that interest us.

Data grouping in reports can be done both vertically (by rows) and horizontally (by columns).

In our case, the horizontal grouping is done by counterparties, and the vertical grouping is by counterparties’ agreements.

Thus, we received a beautiful report on accounts receivable in the context of contracts concluded with buyers and customers.

Now suppose that the company has several types of contracts that differ from each other in terms of payment by the buyer for shipped products. It would be logical to analyze under what types of contracts debt arises more often?

There is such a possibility in the system. Agreements in “1C:Enterprise 8.0” can be divided by type, using, for example, the analytical attribute “Type of mutual settlements”.

Further in the “Debt by Contractors” report, it is enough to group the data according to this analytical criterion, and we will immediately receive an answer to our question.

The report on accounts receivable, grouped by type of agreement, is presented in Figure 17.

What follows from the report? What follows is that accounts receivable in the company exist only under two types of contracts. The first is contracts that require payment by the buyer directly upon shipment of products. The second type is contracts for which payment is made by the buyer once a month on the last day, for products shipped during the month.

At the same time, the debt under the first type of agreement is significantly greater than under the second. Perhaps the company should reconsider the terms of contracts with payment upon shipment, since it is precisely for them that debt arises in significant amounts? Or, perhaps, it makes sense not to enter into such agreements at all, but to work with your counterparties on some other terms, thus reducing the likelihood of “receivables” arising in the future. Although, frankly speaking, looking at our report, it is not at all obvious that the cause of all the troubles lies precisely in the contracts.

In this regard, it makes sense that you can “dig” even deeper and see for which orders (applications) the debt arose. I would like to note that such a possibility in the system exists only if in the contracts the attribute of conducting mutual settlements “for orders” is selected, and not “for the contract as a whole.”

To obtain information about the “receivable”, we will use the same report “Debt of counterparties”, but this time in the report settings we will set two groupings by rows - “Counterparty” and “Transaction”. “Transactions” in this case simply mean customer orders.

The counterparty “Morozko” did not pay us for two orders, “Snezhinka” and “Fresh Wind” each have one unpaid order. Unfortunately, we will not be able to detail the debt of the counterparty Iskra by order. It is for the above reason - in the agreement with Iskra, under which the debt arose, the sign of conducting mutual settlements “under the agreement as a whole” is established.

Next, you can conduct an even more in-depth analysis of orders according to various criteria, grouping orders by company divisions, responsible employees and any other information that is present in customer requests. Or isn't even present. For example, let's set our task to find out whether delays in customer payments are in any way related to the quality of the company's products. To accomplish this task, we propose to do the following: based on a customer survey, indicate directly in the orders how the buyer evaluates the quality of the products shipped according to the order, and then group all orders for which there is a “receivable” according to these estimates. And then correlate the information received with the amounts of receivables for orders.

However, when we open the “Buyer’s Order” document in “1C:Enterprise 8.0”, we will not find in it such a field (details) in which we could enter information about the buyer’s assessment of the quality of the products under the order. Does this mean that our task is impossible? Not at all. In “1C:Enterprise 8.0” it is possible to add any additional details called “properties” to documents (and not only documents). Taking advantage of this wonderful opportunity, we came up with a new property, which we called “Customer assessment of product quality by order” and even set possible values for it: “Satisfactory”, “Unsatisfactory”.

After we indicated in the orders how the buyer evaluates the quality of the shipped products, it became possible to obtain a report on receivables of the following type - see Figure 20 (the figure shows both the report itself and its configuration in terms of data groupings):

As follows from the report, non-payments by customers are unlikely to be caused by complaints about the quality of the company's products. Only in one case (an order in the amount of 1,625.00 USD from the buyer “Morozko”) the buyer is clearly not satisfied with the quality of the product, which, of course, may be the reason for the buyer’s non-payment of this order. For other orders, such a conclusion cannot be made.

So why don't they pay?

So why don't they pay? You can, of course, survey the debtors themselves, reflect the survey results in 1C:Enterprise 8.0, and then build a report on orders, grouped by reasons for late payments. For example, in this form (Figure 21):

Of course, it is not always possible to obtain objective data through a survey, but in our example (Figure 21), there is something to think about. In almost half of the cases, debtors cited the reason for non-payment as an agreement on a deferred payment with the sales manager, while the terms of contracts with buyers did not seem to provide for deferrals. A report grouped by the “Responsible” attribute of the “Buyer’s Order” document will help you figure out which employees are showing inappropriate initiative (it is assumed that the employee who is listed as responsible worked with this buyer’s request).

To summarize the above, we note that there are extremely many options for constructing analytical reporting in 1C:Enterprise 8.0. In our example, we worked almost all the time with one single type of report, “Debt of counterparties,” and even then we had not exhausted all its capabilities. In “1C:Enterprise 8.0” (if we talk about the complex solution “Manufacturing Enterprise Management”) there are more than a hundred types of forms of management analytical reporting, in addition there are several universal forms (“balances and turnover”, “list\cross-table”, “diagram universal"), as well as a special tool "report console", which allows you to make a random selection of data from the system. Thanks to this, companies using 1C:Enterprise 8.0 have at their disposal a powerful analytical tool that is useful for all departments of the company. If you learn to use it correctly. And this is not at all as difficult as it might seem at first glance.

Returning to our example on the topic of “accounts receivable”, in conclusion we will consider one more small issue. I really want to know when our debtors plan to repay their debts?

How in “1C:Enterprise 8.0” you can obtain data on planned cash receipts from customers

The Cash Management subsystem, which is part of the 1C:Enterprise 8.0 solution. Managing a Manufacturing Enterprise” makes it possible to plan cash receipts from customers, reflect actual payments and correlate facts with plans.

The Figure shows an example of the “Planned Cash Receipts” report. The report is structured by counterparties. In fact, the presented form is a plan-actual analysis of the receipt of funds from customers. The “receipt” column contains information about how much we plan to receive from the buyer in a given period (in our example, this is the 3rd quarter of 2005). The “expense” column reflects the actual cash receipts from customers for the same period. In the columns “beginning balance” and “final balance” we can see how much of the planned receipts remains to be paid to the buyer (at the beginning and at the end of the period, respectively, in our example - 07/01/2005 and 09/30/2005). If the columns “beginning balance” and “final balance” contain an amount with a minus sign, then it shows how much the buyer’s actual payment exceeded the planned one.

The “planned cash receipts” report can be detailed by customer orders, contracts, departments, specific dates of planned and actual payments, currencies, payment types, etc. — the minimum list of possible options is presented in the Figure.

Thus, having generated the “Planned cash receipts” report, with the necessary analytics and for the required time interval (or at the current moment in time), we will be able to see from whom and for what we expected (or are currently expecting) cash receipts. Of course, we will receive all this information provided that the planned payments are registered in the information system.

In addition to registering planned payments from buyers in the system, we can also strongly recommend registering events (negotiations) with buyers about the return of receivables. Storing such data in the system will allow, based on it, to regularly analyze what efforts the company’s employees make to return receivables (and by comparing the volume of negotiations and the amount of debt returned to the company, also to evaluate what the result of these efforts is). An example of how you can register negotiations with a debtor in 1C:Enterprise 8.0 is shown in Figure 25.

Let's sum it up

So, using the example of working with accounts receivable, we became familiar with some of the capabilities of the 1C:Enterprise 8 software system in terms of generating management reporting.

It is obvious that this system can indeed become a real assistant in the daily work of analysts and managers at all levels in a modern Russian company. The construction of management reporting in 1C:Enterprise 8.0 is based on more than a hundred types of report templates covering several areas - production management, equipment, procurement, logistics, inventory management, sales and CRM, personnel management, financial management: budgeting, management accounting , Russian accounting and IFRS. Each of the templates can, in turn, be flexibly customized by the report user for specific tasks. However, one cannot help but notice that such a powerful tool also requires adequate effort to study it, since not all the capabilities of the system are simple and understandable at first glance. To dive into the topic “Management reporting in 1C:Enterprise 8”, we can recommend visiting the CT center office to familiarize yourself with 1C.

The result of the training will be noticeable - the company will discover new opportunities for analyzing its activities, helping to make the necessary management decisions in a timely manner. In addition, having thoroughly studied the software system, the company provides itself with relative independence from consultants.

Registration of write-offs in “1C: Accounting 8”, ed. 3.0

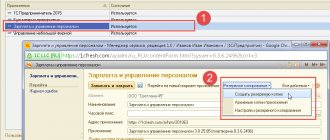

Next, an “Order for conducting an inventory” and an “Inventory report for settlements” are drawn up. In "1C: Accounting 8", ed. 3.0, it is reflected like this. In the upper left corner you need to click the yellow arrow icon and open the main menu, select “All functions” in the drop-down list. In the window that opens, select the “Documents” section and select the required form (“Settlements Inventory Report”).

In the act, in the “Accounts receivable” field, select the counterparty and the amount of the debt, in the “Settlement accounts” field, mark the required ones, in the “Inventory taking” column, enter data about the order: number and date of the base document and the reason (for example, liquidation of the counterparty), in the tab “Inventory Commission” indicates the selected chairman and members of the commission.

Next, the order (Form INV-22) and the act (Form INV-17) are printed.

Based on the act, the “Inventory certificate of settlements with buyers, suppliers and other debtors and creditors” is filled out. The certificate indicates documents confirming the debt (invoices, certificates of work performed, services rendered).

After these measures are taken, an order is issued to write off the receivables (due to the impossibility of collection). The order is issued in free form. It contains information about the organization/entrepreneur-debtor, documents confirming the existence of the debt, its size and period of formation (agreement, primary documentation, payment order and bank statement certified by the bank), the amount of write-off. Please note that the payment order and bank statement, certified electronically, must be certified for the court by a living seal and signature at the bank.

Next in the program, debt adjustment is processed. It is located in the “Sales” tab in the “Settlements with counterparties” column.

In the adjustment, select the type of operation “Write-off of debt” and in the “Write off” field select the appropriate item. In the “Buyer’s debt...” tab, select the counterparty and the amount of debt, and in the “Write-off account” tab – account 91.02 and in expenses – “Write-off of accounts receivable (payable)”.

If there is a reserve for doubtful debts, then the amount is written off at its expense. If the debt amount exceeds the reserve amount, the balance goes to expenses on account 91.02.

If it is possible to collect the debt in the future, then it is taken into account for 5 years in off-balance sheet account 007 in the context of counterparties.

If it is impossible to collect the debt - the individual entrepreneur has died, the organization has been liquidated and other options, the write-off order must indicate that the debt will not be taken into account in account 007 and for what reason.

As a result, after all the activities, you will have a package of documents in your hands:

- order to conduct an inventory;

- powers of attorney for third-party individuals - members of the commission (if any);

- act of inventory of payments;

- certificate of inventory of settlements with buyers, suppliers and other debtors and creditors;

- order to write off debt;

- an extract from the Unified State Register of Legal Entities or Unified State Register of Individual Entrepreneurs on the liquidation of the organization, exclusion of individual entrepreneurs from the register (if any);

- court decisions.

All these documents, as well as those confirming the written off debt, must be kept for 5 years.

When making a debt adjustment, you need to take into account that when making an advance to a supplier, you need to indicate “Advances to suppliers” in the “Write off” field.

What to include in the agreement?

The debt novation agreement must indicate: information about the initial obligations (which of them are subject to replacement or termination); references to the primary documents on the basis of which the debt was formed (note: only a debt reconciliation act as a basis for innovation is not enough, since rights and obligations do not arise directly from it); original contract and method of fulfillment of the obligation. In addition, the novation agreement must comply with the legal norms applicable to the contract that defines the newly arising obligation. For example, when nominating the debt of a buyer of goods (works, services) into a loan, the agreement must contain the essential terms of the loan agreement.

If, before the conclusion of the agreement on novation of the debt of the negligent buyer, fines or penalties were accrued to him, then the agreement must reflect information about the fate of the already accumulated amounts of sanctions. Otherwise, due to the termination of the initial obligation to repay the debt, the obligation to accrue penalties will also cease.

The novation agreement can either provide for a condition on preserving the creditor’s rights to receive the penalty accrued at the time of conclusion of the agreement, or increase the amount of the novation debt by the amount of the debt.

What else do you need to know

In no case should you forget that the receivables you have written off for another five years must be reflected in off-balance sheet account 007 with the title “Debt of insolvent debtors written off at a loss.” This posting is reflected in “Accounting 8” on the accounting, taxes and reporting tab in the normal interface and on the transactions tab in “Taxi”.

Plus, “Debt Adjustment” can also be used for other operations, for example, for netting. The same document is also used to reflect the transfer of debt to a 3rd party.

As you can see, this is one of the very useful and, most importantly, multifunctional tools of the 1C: Accounting 8 program, which significantly facilitates accounting, which is so difficult in our time. The good thing is that the configuration contains many equally valuable tools that help us formalize business transactions correctly.