Closing the month in 1C 8.3: step-by-step instructions

You can view the general list if you do not specify an organization in the assistant window, or in the list window of routine operations.

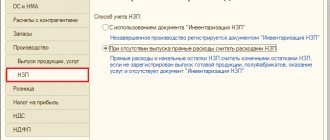

It should be noted that many parameters of exactly how the month will be closed are set in the Accounting Policy settings.

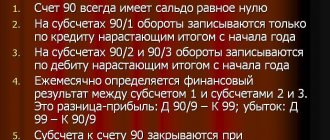

Accounts that generally do not have a balance at the end of the month, but have a balance for each subaccount - 90 “Sales”, 91 “Other income and expenses”. Depreciation on fixed assets is calculated monthly if the organization has fixed assets for which depreciation should be calculated. With the exception of fixed assets that are disposed of in the current month, depreciation on them is accrued in the disposal document.

Results

Now you know which off-balance sheet accounts should be closed at the end of the year: commercial firms do not close off-balance sheet accounts, but budget organizations must close part of their off-balance sheet accounts.

If you use computer programs for accounting, before closing the year, you should inventory the balances of the off-balance sheet accounts provided by the program. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Financial results

To determine the financial result of an organization’s activities, it is necessary to close the reporting period. In accounting, a month is recognized as a reporting period (clause 48 of PBU 4/99).

The overall financial result (profit or loss) for the month consists of the results:

– for ordinary activities (formed on account 90 “Sales”);

– for other transactions (formed on account 91 “Other income and expenses”).

The financial result for the current reporting period is summed up with the total financial result for previous reporting periods.

Determine profit (loss) from ordinary activities as the difference between:

– revenue from sales of products (goods, works, services) (excluding VAT and excise taxes);

– costs associated with production and sales.

This follows from the provisions of paragraph 5 of PBU 9/99 and paragraph 5 of PBU 10/99.

Determine the result of other operations as the difference between:

– other income;

– other expenses.

The list of other income is established in paragraph 7 of PBU 9/99, and other expenses - in paragraph 11 of PBU 10/99.

Closing the month for the simplified tax system

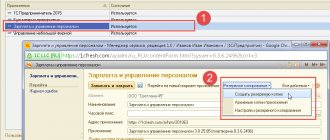

Let's set the execution period, or rather the month that we want to close.

I used the accounting policy of the organization with the simplified tax system with the tax object “Income minus expenses.”

Click the “Close month” button.

Closing a month for the simplified tax system consists of five stages. Yes, out of five, I didn’t wet myself, although we see only four on the form.

Stage zero is “Re-processing of documents for the month.” When re-posting, the sequence of accounting of posted documents is restored. When rescheduling, care must be taken to ensure that no one else works with the documents of that month. It is advisable to ask all users to exit the program. In addition, I always do and recommend to everyone to do a backup copy of the database before starting the month-end closing procedure.

Next, I will number the closing stages in accordance with the screenshot:

- First stage. Responsible for recognizing the organization's expenses. For example, salaries, depreciation and depreciation of fixed assets, acquisition of fixed assets and intangible assets, revaluation of foreign currency, etc.

- In the second stage, there is only one point - “Calculation of shares of write-off of indirect costs.”

- In the third stage, the costs of production and trading activities are calculated: cost accounts 20, 23, 25, 26 and 44 are closed.

- At the fourth stage, accounts 90 and 91 are closed, income tax is calculated and accrued. At the end of the year, the balance sheet is reformed.

“Sim-Sim, shut up!” or several secrets of “Closing the month”

Perhaps the most common reason for users to turn to the support line and simply to 1C consultants is problems with closing a month, and this mainly relates specifically to the process of closing expense accounts.

And, despite a fairly large range of errors in specific databases (of course, specific organizations with their own characteristics of activity and accounting), it should be noted that all these errors have a single source of origin. This is the stage of initial database settings, in particular, working with the Accounting Policy settings.

Incorrectness may consist either simply in a technical error in choosing one or another accounting method, or in the inconsistency of the chosen method with the realities of a particular organization. And often the root cause of this is, although forced, unjustified haste when choosing and executing these settings. Although it also happens that the user simply does not imagine the cause-and-effect relationship between one or another “flag” and the consequences, which ultimately manifest themselves at the time of carrying out monthly regulations.

So let's try to figure out what and why.

Step-by-step Balance Reformation

Closing registers of the month, year, Final postings. Determination of financial results based on the results of the month and year

All organizations are required to maintain accounting records. Compile and submit to the tax authorities a mandatory copy of the financial statements for 2020. These are the balance sheet and income statement.

A copy of the financial statements, including the financial results report, must be submitted to the tax office - the Federal Tax Service of the Russian Federation. This obligation arises in accordance with Article 23 of the Tax Code of the Russian Federation. Where it is stated in paragraph 5, paragraph 1, that the taxpayer is obliged to submit annual accounting (financial) statements to the tax authority at the location of the organization. The deadline is no later than three months after the end of the reporting year.

✅

Except for cases when the organization in accordance with Federal Law of December 6, 2011 No.

402-FZ

“On Accounting” is not obliged to keep accounting records. These include, in particular, individual entrepreneurs.

Before preparing financial statements for the year, the accountant needs to summarize the organization’s activities. Reform the balance sheet and close the accounting registers. Based on the data, the financial result of the organization’s activities is determined. Profit or loss.

When closing a balance sheet and determining profit or loss. It is necessary to be guided by the organization's Chart of Accounts. Provisions of the Tax Code of the Russian Federation and data from tax registers of the organization.

Which off-balance sheet accounts are closed at the end of the year?

As we have already found out, at the end of the calendar year, accounts for accounting costs and financial results are subject to closure. However, the accounting accounts that record the company's assets, capital, reserves, and liabilities are not closed at the end of the year. Information on them is accumulated in accordance with the purpose of the account and by the end of the year it forms the debit or credit balance of a particular account.

Since off-balance sheet accounts record not costs and financial results, but values, liabilities or individual business operations, there is no need to close off-balance sheet accounts at the end of the year. The ending debit or credit balance on these accounts on December 31 becomes the opening balance on January 1 of the following year, and off-balance sheet accounting continues to be maintained according to a simple scheme.

However, there are situations when off-balance sheet accounts may need to be closed. Let's look at the procedure for closing some off-balance sheet accounts in one of the most common accounting programs in the Russian Federation - "1C: Enterprise" configuration "Accounting". In this program, in addition to the 11 off-balance sheet accounts established by law, there are additional off-balance sheet accounts that have an alphabetic or alphanumeric code:

These accounts are used in accordance with their name, for example, to reflect special clothing transferred into operation, or receipts from customers when combining special treatment and special treatment. At the same time, amounts often remain on these off-balance sheet accounts due to incorrect conduct of business transactions on balance sheet accounts. We recommend that at the end of the calendar year you conduct an inventory of “program” off-balance sheet accounts and, if necessary, write off incorrectly recorded amounts.

There is another case where annual closure of off-balance sheet accounts is required. Above, we looked at off-balance sheet accounts from the chart of accounts for merchants. Budgetary organizations also have their own Unified Chart of Accounts (order of the Ministry of Finance of the Russian Federation dated December 1, 2010 No. 157n), according to which off-balance sheet accounts 17 and 18 must be closed by public accountants at the end of the year: balances on them are not carried over to the next year, and the closure of accounts is reflected operation with a minus sign (clauses 365, 367 of the Unified Chart of Accounts).

Read more about budget accounting in the articles:

- “Accounting in budgetary institutions”;

- “Working chart of accounts for budget accounting for 2016.”

Block 1

There is an item here : Adjustment of item cost. Before calculating the cost, the cost of the item must first be correctly calculated. This becomes especially relevant if materials are written off for production at average prices, and during the period there were several receipts at different prices. Or, in addition to the cost of materials, there were additional expenses that were not carried out immediately, but the materials had already been written off. Then their cost should be adjusted.

For example, in a month there were two receipts of materials (sewing threads), the quantity in both cases is the same. Price pcs. in one case - 30 rubles, in the second - 40. The average price should be 35, but before the second receipt it is 10 pcs. have already been written off for production. Then, at the end of the month, the cost of written-off materials will be increased.

Sometimes in such a situation, reversing entries are possible.

Fig. 15 Reversing postings are possible

Step-by-step instructions on how to close a quarter for a novice accountant

Comment! It is important to close the months sequentially, one after another, otherwise the data in the reports will be incorrect.

Particular attention should be paid to reconciling settlements with tax authorities and funds. Periodic reconciliation will help the organization avoid unnecessary fines and penalties, since payments are often suspended due to incorrectly specified details. Ideally, check with regulatory authorities quarterly after submitting mandatory reporting (declarations, payment of contributions).

According to the Federal Law “On Accounting” dated December 6, 2011 No. 402-FZ, financial statements must be reliable. Reliability can be ensured by timely and complete reflection of the facts of economic life that correspond to reality.

Consequently, subaccounts. 90 may have a balance at the end of the reporting month, but the total value of the synthetic BSC must be equal to zero.

This operation is reflected if there is special clothing (special equipment) in use, the cost of which has not been fully repaid.

Next, all primary documents are entered into the information base - data on purchases, sales, invoices, cash flows at the cash desk, banking transactions, production is reflected, current expenses are supported by documents.

There is always enough work to do in the accounting department, but by the end of the year there is traditionally more work. In order to successfully close the year and move into the new tax period, you need to carry out a number of mandatory activities.

Before you start accounting in the program, you need to configure accounting parameters, create an accounting policy for each organization, as well as select a taxation system and specify the appropriate tax options. This can be done in the “Main” section. All this directly affects how movements to close the period will be formed. Based on this, the program will determine the composition of routine operations.

Let us highlight the most significant points that may affect further accounting and preparation of annual reports.

Every month, accountants need to establish what the results of the organization’s activities are (Profit, loss). To do this, in 1C you need to close the month. Also, the correctness of report generation depends on the correctness of his work.

The procedure for closing account 26 depends on the chosen accounting policy, or more precisely, the method of forming the cost of production.

Click on this link and in the window that appears, click the “Create” button. We configure the organization's accounting policy parameters.

But the second copy of the financial statements - the balance sheet and the financial results statement must be submitted to the tax office - the Federal Tax Service of the Russian Federation. This obligation arises in accordance with Article 23 of the Tax Code of the Russian Federation.

According to the basics of accounting theory and our new knowledge, let's try to predict what we should see after the “closing of the month.” For clarity, let’s take as a basis the Turnover Balance Sheet (TSV) of our enterprise. Here is an example of OSV.

Off-balance sheet accounting

To record assets and liabilities on the balance sheet, accounts 001 to 011 are intended (order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n):

- on account 001 reflects leased assets;

- sch. 002 is intended for accounting for inventory items accepted for storage;

- sch. 003 is used to account for materials taken for processing;

- on account 004 reflects goods accepted for commission;

- sch. 005 is used to account for equipment for installation;

- sch. 006 is needed for BSO accounting;

- on account 007 accounts for uncollectible receivables;

How to take it off balance sheet, read the article “Writing off accounts receivable to an off-balance sheet account.”

- sch. 008 and 009 are needed to reflect received and issued payment security, for example, deposit amounts for returnable packaging;

- sch. 010 is used to reflect the depreciation of housing facilities, external amenities, as well as fixed assets of non-profit organizations;

- sch. 011 contains information about operating systems owned by the organization, but leased to another company.

If necessary, an organization can develop and implement additional off-balance sheet accounts or sub-accounts to existing ones. These innovations should be reflected in the working chart of accounts of the organization's accounting policies.

What are the specifics of off-balance sheet accounting? Transactions using off-balance sheet accounts are carried out using a simple system, without the use of double entry. That is, one business transaction corresponds to an entry only in the debit or credit of one off-balance sheet account. However, just like assets and liabilities reflected on balance sheet accounts, transactions with off-balance sheet assets or liabilities must be reasonable and documented.

Find out more about off-balance sheet accounting in the material “Rules for maintaining accounting on off-balance sheet accounts.”

Information about assets and liabilities held in off-balance sheet accounts does not fall into the main accounting report - the balance sheet (Appendix 1 to the order of the Ministry of Finance of the Russian Federation dated July 2, 2010 No. 66n). But the company may, at its discretion, indicate information about objects recorded on off-balance sheet accounts in an explanatory note to the accounting records (Appendix 1 to Order of the Ministry of Finance of the Russian Federation dated July 2, 2010 No. 66n).

IMPORTANT! A legal entity is required to maintain off-balance sheet accounting, since the reflection of certain business operations and values using off-balance sheet accounts meets the requirements for the reliability of reporting. If you ignore off-balance sheet accounting, the reporting will cease to be reliable, and this is a violation of Art. 15.11 Code of Administrative Offenses of the Russian Federation. The minimum fine in this case is 5,000 rubles. But an individual entrepreneur is not required to keep accounting records (Clause 2, Article 6 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ). If an individual entrepreneur decides to conduct accounting on his own initiative, then he should adhere to the appropriate accounting rules, including, if necessary, reflecting values and liabilities on the balance sheet.

The safety of property and the status of liabilities on the balance sheet must also be periodically checked. How to do this - read the article “Is it possible to carry out an inventory for off-balance sheet accounts?”

Calculation of shares of write-off of indirect expenses

This section contains only one, but very important operation for calculating the share of write-off of indirect costs.

This operation is used to determine how much the income tax base can be reduced. The program calculates shares and coefficients for expenses such as transport, hospitality, insurance, and advertising costs. The operation creates movements in special registers that will be used to close cost accounts (20, 23, 25, 26).