How to write a cover letter for the documents provided to the tax office, sample

07/19/2018 No. 02-23/13 To the Chief

On No. 148 dated July 15, 2018, Federal Tax Service Inspectorate No. 11 in Taganrog

V. G. Vasiliev

About providing documents

In response to your request No. 148 dated July 15, 2018 for the provision of documents to verify the accuracy of the reporting documentation for April 2021, I am sending the following documents:

- Tax return in form 3-NDFL on 5 sheets in 2 copies. (copy).

- Turnover tax declaration on 1 sheet in 2 copies. (copy).

- Report on the amounts of accrued income of the insured persons on 5 sheets in 1 copy. (copy).

Date, signature, full name.

The covering letter is an integral part of the package of documents provided to the Federal Tax Service, except in cases where the provided documentation contains all the necessary information and does not require additional explanations.

If it is necessary to respond to a request from the tax service, a covering letter is drawn up, which is an explanatory note to the updated VAT return or other tax information sent to the tax office.

When writing a cover letter, it is recommended to follow the general rules that are developed for writing a business letter. At the beginning of the response, indicate the name of the organization, as well as information about the official to whom the response is addressed.

Taxpayers may be interested in the company's unprofitable activities, in which case the taxpayer's explanations must fully disclose the reason for the loss in the requested reporting period. To do this, the letter deciphers income and expenses for a certain period of time.

Since January 24, 2017, the Federal Tax Service order dated December 16, 2016 No. ММВ-7-15/682 on approval of the format of explanations to the VAT return in electronic form has been in force. This format is used by all VAT payers who submit electronic reports. The procedure for a taxpayer's actions upon receipt of a request to provide explanations on the VAT return is described in detail in the letter of the Federal Tax Service of the Russian Federation dated November 6, 2015 No. ED-4-15/19395.

How to write an explanatory note to the tax office regarding VAT? Only electronically. Explanations on VAT presented in “paper” form are not considered submitted, and in this case this may be regarded by tax authorities as an unlawful failure to provide the requested information, which threatens with a fine of 5,000 rubles (Clause 1 of Article 129.1 of the Tax Code of the Russian Federation).

Whatever the request from the tax inspectorate: about detected errors, contradictions between reporting forms, about a reduction in the amount of tax in an updated declaration, or about the reasons for the loss, in any case it is necessary to respond to the request. For reporting submitted exclusively via telecommunication channels, an electronic format for submitting explanations is provided at the request of tax authorities.

A letter of request is a special form of business message, which is drawn up in cases where one interested party wants to receive any information from the other party. A request can be made for a variety of reasons, in order to obtain:

- price lists,

- documents,

- information about goods and services,

- discounts and promotions,

- delivery or payment terms and other information.

Letters of request can be the beginning of a long, fruitful cooperation, and also, in the case of already established business relationships, a good method of influencing partners when they are working too slowly or not efficiently enough.

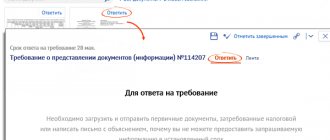

If a revised declaration is sent, the message should explain the reason for the clarification. For example, an error in calculations. When responding to requests for clarification of any controversial issues identified during a desk audit, it is worthwhile to clearly but briefly provide answers to the questions asked by the tax authorities. In what form should the support be provided? The support can be in paper or electronic form.

The electronic format of explanations came into effect on January 24, 2017. The message can be sent electronically along with documents via TKS. This must be done with explanations regarding VAT. It is worth remembering that electronic messages must have a special format, approved by order of the Federal Tax Service of Russia dated December 16, 2016 No. ММВ-7-15/682. The letterhead requires the presence of mandatory details:

- Full and exact name of the organization;

- Actual and legal addresses;

- Primary state registration/taxpayer identification number;

- Phone, fax, email;

- Outgoing document number and date;

Application for tax deduction

A tax deduction is an amount that reduces the calculation base when calculating personal income tax. There are standard, social, property, professional and investment deductions.

There is a separate article on tax deductions and the 13% refund procedure on Lifehacker. Step-by-step instructions for filing all types of deductions are also available on the Federal Tax Service website.

The standard tax deductions include the so-called child deduction. If you are officially employed and are the parent or guardian of a minor, you can reduce your tax burden. An application for a “children’s” tax deduction is submitted to the employer. But if for some reason the latter did not reduce the amount of taxation or the income was not received through labor, you can do this through the Federal Tax Service.

Social deductions include types of expenses such as tuition (your own or your children’s) or treatment, as well as charity. Property tax deduction is provided when purchasing real estate or land.

From March 31, 2021, the refund of overpaid personal income tax, as well as the refund of overpayments for property taxes, is carried out upon an application approved by order of the Federal Tax Service dated February 14, 2017 No. ММВ-7-8 / [ email protected] (Appendix No. 8).

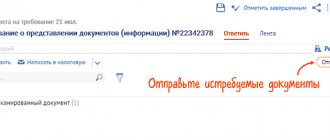

How to prepare documents before sending them to the Federal Tax Service

The reasons why tax officials may have questions for a taxpayer during a desk audit are listed in clause 3 of Art. 88 of the Tax Code of the Russian Federation:

- Reason 1 - the camera revealed errors in the reporting or contradictions between the reporting data and the information available to the tax authorities.

What the Federal Tax Service will require is to provide clarifications or make corrections to the reporting.

- Reason 2 – the taxpayer submitted a “clarification” in which the amount of tax payable, compared to the previously submitted report, became less.

What the Federal Tax Service will require is to provide explanations justifying the change in indicators and the reduction in the amount of tax payable.

- Reason 3 – unprofitable indicators are stated in the reporting.

What the Federal Tax Service will require is to provide explanations justifying the amount of the loss received.

Having received a similar request from tax authorities to provide an explanation to the tax office (a sample can be seen below), it should be answered within 5 business days. There are no penalties for failure to submit, but you should not ignore the tax authorities’ requirements, since, without receiving a response, the Federal Tax Service may assess additional taxes and penalties.

Please note: if the taxpayer belongs to the category of those who are required to submit a tax return electronically in accordance with clause 3 of Art. 80 of the Tax Code of the Russian Federation (for example, on VAT), then he must ensure the receipt from the Federal Tax Service of electronic documents sent during the desk audit. This also applies to requests for explanations - within 6 days from the date of sending by the tax authorities, the taxpayer sends an electronic receipt to the Federal Tax Service Inspectorate confirming receipt of such a request (clause 5.1 of Article 23 of the Tax Code of the Russian Federation). If receipt of the electronic request is not confirmed, this threatens to block the taxpayer’s bank accounts (Clause 3 of Article 76 of the Tax Code of the Russian Federation).

The Tax Code of the Russian Federation does not establish additional mandatory requirements for documents submitted at the request of the tax authority. The only requirement is certification in the prescribed manner, if necessary.

According to general practice, the number of documents requested by the tax authority often amounts to several thousand or hundreds of documents. This is a very time-consuming and usually pointless process.

Attention! Our qualified lawyers will assist you free of charge and around the clock on any issues. Find out more here.

In this regard, a rule has developed according to which hundreds of documents are not required to be certified. Documents of the same type are put into one folder, bound and numbered. Next, an inventory is compiled for this folder. On the initial sheets, the employee indicates the register of documents that are transferred to the authority.

After this, the threads of the documents on the last sheet are fastened. The official puts the seal of the organization and his signature. The last sheet should contain information about how many sheets are inserted and stapled. After completing this procedure, adding new documents to the folder is not allowed.

Often, since tax services do not know all the specifics of the production activities of each subject of tax legal relations, the latter receive requests for documents that are not maintained in this organization.

It also happens that the list of documents is not available at the enterprise at the moment when the inspection is carried out due to the presence of objective reasons.

We suggest you familiarize yourself with: Banks that provide loans in Eldorado

Attention! Among these reasons are:

- transfer of information at the request of government authorities;

- seizure of information by law enforcement agencies;

- destruction of information due to an emergency;

- destruction of materials after their storage period has expired;

- as a result of theft of materials.

If one of the above situations exists, after receiving the request, you should send a notification to the tax service that the requested document cannot be submitted. Copies of documents confirming the impossibility of providing the requested data are attached to the notification. These may be certificates issued by government or other authorities.

Important! Representatives of tax authorities are not authorized to demand the provision of information that they have already received during the process of conducting a desk or field audit.

The exception is materials presented in the original, as well as cases where documents at the tax authority were lost due to an emergency.

When an organization receives a request from the tax service to resubmit documents previously submitted, the recipient of such a request draws up a response notification addressed to the head of the department.

This document states that the documents have already been submitted previously, and therefore their resubmission is impossible. A copy of the registers of previously submitted information with the presence of marks from the tax authority is attached to the sent notification.

The taxpayer has the right not to submit tax documents when officials have not found any errors or inconsistencies in the submitted declaration.

In the presence of such circumstances, bringing a person to penalties established for such cases is not allowed. This is confirmed by the practice of the judiciary.

Attention! It is allowed not to submit materials that have previously been submitted to the tax authority for consideration, as evidenced by clause 5 of Art. 93 Tax Code of the Russian Federation.

In accordance with the Resolution of the Supreme Court of the Russian Federation dated July 9, 2014 No. 46-AD14-15, the taxpayer may not transfer the staffing table, personal cards and other personnel documentation.

There is a list of cases in which the tax authority, when conducting an audit, has the right to request information:

- when the declaration contains a claim for VAT refund. This is not any type of tax deduction. Based on clause 25 of the Supreme Arbitration Court Resolution No. 57, VAT refund is the excess of the declared deductions over the amount of tax payable;

- when the declaration declares the right to receive benefits. Benefits are considered to be relaxations provided for by tax legislation for a certain category of persons;

- when an amended tax return is submitted two years after filing the first return;

- when officials have discovered errors or inconsistencies in the submitted declaration.

So, taxpayers must remember the rule: the tax service must have certain grounds for requesting materials. The list of materials that may be requested by officials is also limited.

In accordance with established practice, it can be said that, regardless of the circumstances, the taxpayer may be subject to collection measures in the event of failure to comply with the requirements of the tax service.

Of course, the taxpayer has the right to appeal such a decision in court, but such a procedure takes a lot of time.

Remember! If there is a conflict situation with the tax authority, there are recommendations that should be used:

- the requirements must be fulfilled within the specified period, without delaying the procedure without objective circumstances;

- If there are any ambiguities in the authority’s requirements, you should contact the institution for clarification in writing.

When there are controversial situations in which the recipient of claims knows that his rights have been violated, he can turn to supervisory authorities or the court to protect his rights.

Watch the video. In what form should documents be submitted upon request by the tax authorities?

Author of the article:

Anna Maksimenko

Each enterprise is registered in the tax office database; registration provides owners or authorized persons with the right to draw up and send requests to the tax office for the purpose of:

- evidence of due diligence;

- protecting yourself from unprofitable deals;

- determine whether the counterparty is recognized as a bona fide person.

List of requests that a company can send to the tax office:

- for tax calculation;

- providing individual tax advice;

- submission of information about existing bank accounts of a company, firm, organization (read about how to make a request for reconciliation with the tax office here);

- an idea of the presence or absence of current accounts (for details about what a certificate of open accounts is from the tax office and how to issue a letter of request, read this article);

- interpellation about the good faith of the counterparty.

After the completed request in written format is sent to the fiscal service, inspection staff are required to consider the request within 30 calendar days from the date of its registration. The period for consideration of the request may increase to 60 days by decision of the tax inspector, but in this case the fiscal service must notify the taxpayer of the lengthy consideration of the request and indicate the reason.

We wrote about the features of drawing up a request to the tax office about the taxation system in a separate article.

A request is a document intended for business communication, its purpose is to obtain reliable and interesting information to the person who compiled it.

The following have the right to make a request:

- authorized persons;

- entrepreneurs;

- accountants.

A request to the tax office must be made in accordance with the regulations of the Federal Tax Service dated September 30, 2004 No. 506 “On approval of the Regulations on the Federal Tax Service”:

the request must be stated in a formal style;- it can be provided to fiscal service employees in electronic and printed form;

- the document must contain information of an individual and legal entity;

- references to legal laws related solely to the essence of the request are allowed;

- the document must be endorsed by a representative of the tax office and an authorized person of the company.

We advise you to prepare requests sent to the tax service in two copies in order to protect yourself from improper due diligence.

Results

If the taxpayer made an error in the KBK or other fields of the payment order and the payment was received in the budget system of the Russian Federation, then the payment is considered executed. In this case, you should send an application to the Federal Tax Service to clarify the payment.

If critical errors were made: in the recipient's account number or the name of the recipient bank, the payment does not go to the budget. In this case, you need to re-transfer the tax amount to the correct details, pay penalties and write an application for a refund of the incorrectly paid tax to your current account.

Sources: Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Who draws up the document and how is it drawn up?

- In the upper left corner of the document, write down its number and date of preparation; below, write down the number and date of the tax service request, in response to which the letter was sent.

- In the upper right corner indicate the full name of the Federal Tax Service department, its address, full name. tax officer to whom a written explanation is addressed.

- Then write the title of the document (for example, “On sending documents”).

- The text of the letter indicates the reason why it was sent to the Federal Tax Service.

- The following is a list of documentation to be sent.

- In the final part, indicate the position and full name. responsible official.

We invite you to familiarize yourself with: Receipt of no claims against the employer. 2021 sample

Attached copies of documents must be certified by the signature of the head and the seal of the organization on each sheet.

What to do if the bank made a mistake in the payment order

It happens that the taxpayer promptly submitted the correct paper version of the payment slip for taxes (contributions) to the bank. The bank executed it, but the payment went unaccounted for due to an error by the bank clerk.

As a rule, the taxpayer learns about arrears and penalties from a request from the Federal Tax Service. To correct the situation, you can do the following:

- Request a written explanation of the situation from the bank.

- Send an application to the Federal Tax Service to clarify the payment with a request to recalculate the accrued penalties and indicating the guilt of the bank employee.

- Attach to the application an explanation from the credit institution, a stamped payment slip and a bank statement for that day.

ConsultantPlus experts explained in detail how to clarify a tax payment if there is an error in a payment order. Get free demo access to K+ and go to the Ready Solution to find out all the details of this procedure.

What to do in a situation where the documents requested by the tax authority are missing

Please note! The norms of tax legislation establish that an official may require the submission of documents only when there are grounds for conducting a tax audit or when conducting a “counter” audit of a counterparty or other persons who have information about the activities of the taxpayer being audited.

Clause 1 Art. 87 of the Tax Code of the Russian Federation establishes the following list of types of inspections: desk and field. A desk audit is organized at the location of the tax service on the basis of materials submitted by the taxpayer, as well as on the basis of other documents that the authority has.

A desk audit can be carried out within three months after the submission of documents by the person paying taxes to the tax service. The law does not allow extension of the period for conducting research of materials or its suspension.

Please note! The following grounds are identified for conducting a desk audit and requesting documents:

- when an organization applies benefits established by tax legislation;

- if the organization expresses a desire to return to VAT;

- in the event of an audit regarding tax payments made in connection with the use of natural resources;

- when resolving issues related to tax control.

The tax authority has no other reasons for requesting information.

Important! An on-site tax audit can only be carried out on the territory of the taxpayer who sent the tax materials. The basis for its implementation is the decision of the head of the tax service.

The maximum period for conducting such an inspection cannot exceed two months. If there are objective reasons, this period can be increased to 4 months. In exceptional cases, for example, when additional inspections are carried out, the period may be extended to six months.

When an on-site tax audit is suspended, the law does not allow the requisition of any tax documents or the submission of demands for their collection. The delivery of such a document, as well as their request during this period of time, is unacceptable.

To provide information based on the requirements of the Federal Tax Service of the Russian Federation, the law allocates a certain period of time:

- within 5 working days, information is provided about a specific transaction that was concluded with the object of inspection by the tax authority;

- within 10 working days, information is provided by the object of inspection after receiving the request;

- within 5 days, explanations are provided regarding the corrected or updated declaration, in the event of a desk tax audit.

Important! When a person, for objective reasons, cannot provide the required information within the specified period, he may ask for a deferment.

To do this, no later than one day after receiving the request, a notification is sent to the tax authority, which indicates the following data:

- a list of reasons why it is impossible to provide documents within the allotted period;

- the period of time during which the documents will be submitted.

After receiving the notification, the tax service is authorized to make a decision no later than two days after receipt. It should be noted that the decision is made by officials at their own discretion; therefore, documents must be prepared immediately.

A single concept of a system implementing taxation in Russia is not enshrined in legal acts. However, it can be given if we analyze the entire group of subjects and objects involved in the process of establishing a tax and transferring it to a certain treasury.

Documents submitted to the tax office must be accompanied by an explanatory note

According to federal law, taxes may be levied at the following levels:

- Federal - on the territory of the entire state, regardless of the specifics of the region or the activities of the payer;

- At the regional level - they are established by regulations of the constituent entities of the Russian Federation and are required to be paid by taxpayers living in the territory of these regions;

- Local - accepted by local governments, subject to payment by residents of cities, towns, villages, etc., aimed at replenishing local budgets.

In accordance with the levels presented above, taxes are established by laws and regulations issued by the federal legislative body, management structures of the constituent entities of the Russian Federation, as well as local district and city councils.

In addition to administrative documents adopted by government bodies at all federal levels, the structure of the tax system is also made up of separate documents that are issued by executive authorities - the Ministry of Finance, tax inspectorates, etc.

As part of tax obligations, the following may be paid:

- Taxes (have the nature of an individual payment that is made without refund);

- Fees (usually aimed at obtaining certain permissions or rights by the payer);

- Contributions to insurance (are mandatory and are aimed at providing payers in various situations - during pregnancy, in case of disability (both temporary and permanent), etc.).

The Tax Code is a structural element of the tax system of the Russian Federation

The Russian tax system is a complex of subjects and objects that include levels of taxation, all types of tax contributions, the regulatory framework on the basis of which the collection of taxes is legal, government agencies that accept the relevant legal acts, taxpayers (individuals, entrepreneurs, legal entities, etc.) ). This also includes principles for establishing fees, explanatory documentation and all types of taxation systems.

Important! Despite the concept not established by law, the tax system of the Russian Federation is the most important element in the structure of the state, ensuring the implementation of most types of activities and being one of the main sources of filling the country’s budget.

A covering letter is a so-called note, which is an integral part of the exchange of business documentation between individuals and government agencies (their representatives) or between representatives of government agencies at all levels.

Note! There is no single form for such a document and it can be compiled in any form. The only requirements are the written (printed) form and the need to adhere to the official business style of writing when writing (excluding colloquialisms and errors). Moreover, if the letter is drawn up by an organization that has letterhead, placing text on it is quite acceptable.

Requirements are made only for some elements of the content of the cover letter:

- It must have complete information about the sender (details indicating the person who compiled the document, the name of the body that transmits the package of documents with this form, feedback data, number in outgoing correspondence, information about the addressee);

- An explanation of the reason why official papers are transmitted (this could be a response to a request, fulfillment of a requirement, a request coming from the sender, etc.);

- A list of all documentation, to which a cover letter is attached;

- Date of preparation;

- Signature of the person who drew up the paper.

Important! If the cover letter is drawn up by specialists from authorities or structures, the surname and initials of the originator and means of communication with him are indicated under the main text in a reduced font.

A covering letter is a kind of explanatory note for the accounting and tax documentation sent to the Federal Tax Service. It indicates which documents and in what quantity were sent. Thanks to this, tax officials can easily understand the purpose of the documents received. And if part of them is lost, the sender will be able to prove that he is right.

A covering letter to the tax office regarding the provision of documents performs the following tasks:

- facilitates interaction between the tax service and taxpayers;

- allows you to clearly understand what each submitted document represents;

- determines the purpose of the papers submitted for verification;

- allows you to avoid possible misunderstandings regarding the completeness of the provided package of documents;

- simplifies the registration of accepted papers in the office of the tax authority.

We invite you to read: Tax deduction for vision correction surgery

If the organization decides not to send any requested papers for verification, the reason for this decision must be justified in a covering letter.

Purpose of provision

The letter serves as an explanation for the documents submitted to the tax authority. There are many reasons for providing information to the Federal Tax Service. The most common cases:

- Reply providing an explanation related to the receipt of a letter from the tax office. The explanation is given for the purpose of conducting desk audits of declarations by the inspectorate (clause 3 of Article 88 of the Tax Code of the Russian Federation).

- Explanation of the applicant regarding the submission of an updated tax return to the tax office due to an error (clause 1 of Article 80 of the Tax Code of the Russian Federation).

- Providing an inventory of the attached documents (clause 2 of Article 93 of the Tax Code of the Russian Federation).

Cover letters facilitate and streamline document flow because:

- disputes that may arise regarding the completeness of the submitted papers are prevented;

- the work of the office responsible for registering accepted documents is simplified;

- clarity is provided regarding the purpose of sending documents to the Federal Tax Service;

- accepted papers quickly reach the right specialist.

Compilation rules

A unified form of support is not established by law, but there are rules for its preparation, developed in practice. It must contain the following details:

- name of the tax office and, if necessary, full name. the employee to whom the documents are sent;

- name and address of the sender;

- number and date of the request in response to which an explanation is sent;

- title;

- contacting a specific employee of the Federal Tax Service or the inspectorate as a whole;

- text;

- a list of attached materials with the number of sheets and copies;

- the position of the sender, his surname and initials, as well as signature;

- Full name, phone number and email of the compiler.

A sample of how to write a cover letter to the tax office is presented below.

The text of the message is compiled depending on the purpose for which it is being prepared. For example, if it contains a list of documents, it is recommended to start it with the phrases: “At your request, we are sending you...”, “We are sending to your address...”, etc. If the appeal is to a specific tax officer, the words “You”, “ “To yours” are written with a capital letter. If a revised declaration is sent, the message should explain the reason for the clarification. For example, an error in calculations.

When responding to requests for clarification of any controversial issues identified during a desk audit, it is worthwhile to clearly but briefly provide answers to the questions asked by the tax authorities.

Despite their different internal contents, they have common rules for compilation:

- full spelling of the name of the executive or municipal authority to which the request will be sent;

- indicate the personal data of the individual who will receive the request: full name, address (ideally, email and signature of the official);

- indicate the applicant’s details: name of the company, its TIN, address, full name and signature of the management, telephone or email for feedback.

The request can be made on the company's letterhead or on a sheet of A4 format (the header will be written in the upper left corner).

What documents require written support?

As a general rule, the letter is attached to those papers for the Federal Tax Service that do not contain information about the sender and recipient.

But there are also documents that are allowed to be sent without explanation. Among them are primary tax returns without attachments. The provision of such declarations is justified by certain legislative norms, so an explanation of the reasons for their submission is not required. They also contain information about the sender and recipient. If the primary declaration contains any annexes, the accompanying documents must be attached.

Without written support, complaints are also sent to higher authorities regarding the actions of the Federal Tax Service. Such shipments must contain information about the sender and recipient, as well as a list of documents provided.

Accompanying the updated tax return

A covering letter must be drawn up when submitting an updated tax return. ConsultantPlus has a detailed guide that will help you complete and submit it. Use it for free.

What is the content?

When making a request, the authorized person must concisely and clearly formulate: for what purpose, on what basis he needs to obtain information from a legal entity (INFS), referring to legal and federal laws. Below we will look at the content of each request.

A statement about the presence of debts on taxes, fees and fines is written in order to obtain information about the financial debts of a company or entrepreneur to the state. Filling out is possible in two ways: manually and electronically.

There is no regulated form for filling out the request, but there is a recommended example for filling out the certificate, approved on July 2, 2012 by the Administrative Regulations, Order No. 99, Appendix No. 8.

Contents of the tax debt request:

- name of the body where the company or entrepreneur is registered;

- information about the legal entity: full name;

- full name of the applicant’s organization or his personal full name;

- legal address of the company or individual entrepreneur INN/KPP.

Reference. If the request is written on behalf of an entrepreneur, and he submits it personally, then instead of the TIN/KPP, the tax service only needs to provide the TIN.

- the purposes of your request: to receive a certificate of the status of payment or fulfillment of the obligation to pay taxes;

- stating the date when the applicant needs to receive a statement of tax arrears;

- details of the company or individual entrepreneur, and the method of receiving a response to the request;

- signature and endorsement of the document with a seal, if any.

The document is drawn up on a blank sheet or form; the contents of the “header” include the following information:

- the name of the government body or municipal organization to which the request will be sent;

- Full name of the person providing information to the applicant;

- Full name of the applicant (IP) or organization that needs to indicate: the name and location of the enterprise;

- phone number and email for feedback.

Main part of the request:

appeal to an official;- link to legal documents, for example: according to Article 51 of the Constitution of the Russian Federation as amended in 2015 and Article 8 of the Law of the Russian Federation “On Information, Information Technologies and Information Protection”, I ask you to provide me with information...;

- description of the essence of the request;

- an indication of the request that the recipient must make, for example: I ask you to respond to a request for information in the manner prescribed by law.

The final part: endorsement of the document (signature with transcript and date of preparation).

Contents of the certificate: the city where the document was drawn up and the date are recorded in the left corner.

Main part:

- name of the counterparty and full name of the executing person;

- a description of the document on the basis of which the contract was concluded;

- the name of the agreement and the companies that entered into the transaction;

- list of registration of the counterparty at the place of registration: regional INFS number, date of registration, TIN/KPP of the company;

- reference to the applicable taxation system of the supplier company;

- indication of purpose reference to legal or legislative documents;

- a list of obligations fulfilled by the counterparty to the tax authority of the Russian Federation;

- listing the powers that the counterparty has;

- clarification of the obligations with which the supplier agrees, based on the concluded agreement with the applicant;

- a clause obliging the supplier to draw up a written explanation if he does not provide a complete package of documents;

- list of required documents accompanying the application;

- approval of the request by authorized persons: signature with transcript, seal of the organization.

The settlement status certificate contains the following information:

- To whom, where and from whom the request is addressed.

- Taxpayer number, company name, INN/KPP, location and telephone number for feedback.

- Full name of the applicant, address of actual residence, series and number of passport, telephone number.

- A request for the issuance of a certificate regarding the status of the settlement as of a certain date.

- Method of receiving a response from the fiscal service: in person, by mail.

When choosing a method of receiving in person, the official must indicate: telephone number and full name of the person representing the interests of the organization; If the tax service receives a response by mail, the official must indicate the legal address of the company when drawing up the request. - Place where the certificate is provided.

- Signature of the individual entrepreneur or signature of the head of the organization with a transcript.

To which tax inspectorate should I report the transfer?

If you follow the letter of the law, then an application to switch to a simplified taxation system from the new year must be submitted to the inspectorate where the existing businessman is already registered with the tax authorities. This is indicated in paragraph 1 of Article 346.13 of the Tax Code of the Russian Federation.

But as to whether it is possible to submit a notification to the same Federal Tax Service where documents for state registration are submitted, it is not precisely stated. The fact is that in large cities and some regions special registration inspectorates have been created. So, in Moscow this is the 46th inspection, in St. Petersburg - the 15th. That is, documents for registration are submitted only to them, and are registered with the Federal Tax Service according to the registration of the individual entrepreneur or the legal address of the LLC.

In practice, tax authorities (the same 46th Moscow Federal Tax Service) accept applications for the simplified tax system without any problems when submitting documents for registration, but in some places, as we have already said, they require you to apply at the place of tax registration. In your particular case, it may well turn out that the inspectorate where you submit documents and which registers you for tax purposes will be the same. Then the question of choosing the Federal Tax Service simply does not arise. You can find out the inspection code on the tax service website.

What papers are included?

List of required documents attached to the request:

- internal charter of the organization;

- a document confirming the inclusion of a legal entity in the Unified State Register;

- for an LLC, it is necessary to submit a document confirming the registration of a legal entity entered into the Unified State Register in accordance with the Federal Law of December 30, 2008. No. 312-FZ;

- TIN;

- decision of the governing body on the appointment and assumption of office of an executive body;

- power of attorney issued to an official;

- lease agreement for the organization's premises at the legal address;

- license;

- a document confirming the absence of tax arrears in the original;

- documents confirming the legality of the use of exclusive rights, if any;

- documents confirming the use of non-standard tax regimes.

The information presented revealed in detail the content of requests for tax arrears, the provision of information, the integrity of the counterparty and the status of settlements. By following the described instructions, there will be no difficulties in creating a request and saving your own time.