An entrepreneur is registered as an employer only by the Social Insurance Fund. Therefore, if you fired all your employees and are not going to hire new ones, deregister with the Social Insurance Fund. Provide the fund with:

- Statement

— Copies of documents that confirm that the employment relationship has terminated: a copy of the termination agreement or a copy of the dismissal order. And not for all fired employees, but only for the last fired one.

The application can be submitted through the State portal → “FSS of the Russian Federation” → “Registration and deregistration of policyholders - individuals who have entered into an employment contract with an employee” → “Deregistration...”.

What reports must be submitted to the Pension Fund upon termination of relations with an employee?

With the introduction of electronic work books, it is important not to miss which reports to submit to the Pension Fund when dismissing an employee in 2021:

- SZV-TD (sample and instructions for filling out from ConsultantPlus);

- SZV-STAZH (sample and instructions for filling out from ConsultantPlus);

- SZV-M (sample and instructions for filling out from ConsultantPlus);

- RSV (sample and instructions for filling out from ConsultantPlus);

- SZV-ISH (sample and instructions for filling out from ConsultantPlus);

- SZV-K (sample and instructions for filling out from ConsultantPlus).

The SZV-ISH form is submitted for reporting periods until 2021. If, upon termination of the employment relationship, you discovered that information about the insured persons was not submitted until 2021 or was submitted in error, form a SZV-ISH. There are no deadlines, submit it as soon as you discover an error.

The SZV-K form is submitted for the period before December 31, 2001. The procedure and conditions for submission are the same as for SZV-ISH: immediately after an error is discovered, if the information was not provided on time.

For other forms, there is a deadline for submission and there are requirements for completion. The general rule is to provide reliable information. Incorrect data will result in administrative liability.

ConsultantPlus experts analyzed the top 10 questions and answers regarding electronic work books and reports to the Pension Fund of Russia. Use this information for free.

New SZV-TD report in 2021

The workload on accountants and personnel officers has increased - new reporting forms have appeared regarding the organization's employees. Among them is SZV-TD. The form was approved in the last days of 2021. The Pension Fund of the Russian Federation delayed until the last minute, but still issued a resolution establishing the form and procedure for filling out the SZV-TD (Resolution of the Board of the Pension Fund of the Russian Federation dated December 25, 2019 No. 730p).

Thus, the main question of what form to submit the report on has been resolved.

Let us recall that the purpose of this form is to update information about the work activities of employees contained in the Pension Fund database for the functioning of the electronic work record book system.

By what criteria is the obligation to submit a SVZ-TD determined? This form is submitted by those enterprises that have employees, and the need to submit it arises only if personnel changes were made in the reporting month.

The form must be submitted to the territorial body of the Pension Fund by the 15th day of the following month after the month in which personnel movements took place. For example, if a company hired two employees from February 3, 2021, then it will submit the SZV-TD for February until March 16, 2021 (since March 15 is a Sunday).

If there were no reasons to fill out the SZV-TD within a month, then there is no need to submit the form.

Important! The Pension Fund has provided for tightening the deadline for submitting SZV-TD from 2021. According to clause 1.8 of the resolution of the Board of the Pension Fund of the Russian Federation dated December 25, 2019 No. 730p, starting from January 1, 2021, in case of hiring and dismissal of employees, the SZV-TD form will be expected from the organization on the next working day after the issuance of the personnel order.

It turns out that the form is issued by the employer only in cases of personnel changes. One of the reasons is the dismissal of an employee. Next, we will consider the features of this case.

RSV

The employee is given Section 3 of this form. Data is submitted to the Pension Fund for the entire period; after the termination of the employment relationship, subsection 3.2 is not filled out for the dismissed employee.

Please note for what period the DAM should be issued when dismissing an employee in 2021: for the reporting period in the last quarter of which the date of termination of the contract falls.

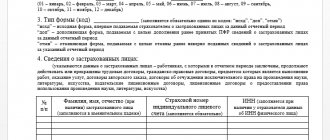

Let's summarize the reports in table form:

ConsultantPlus experts analyzed what forms and within what time frame are submitted to the Pension Fund for personalized accounting. Use these instructions for free.

How to report for fired employees

We will only talk about IP. First, an LLC cannot operate without employees. Secondly, even if there are none, you still need to submit almost all zero reports, because LLC is the employer by default. We talked about this before.

Even if you fired all your employees in the middle of the year and deregistered with the Social Insurance Fund, continue to submit RSV, 6-NDFL to the tax office and 4-FSS to the Social Insurance Fund until the end of the year. These reports are built on a cumulative basis, so it is important not to interrupt it. 2-NDFL, SZV-STAZH at the end of the year will also need to be sent. Only SZV-M can not be submitted to the Pension Fund.

But you don’t have to submit reports for the next year. Of course, if you continue to work without employees.

⚠️ The SZV-TD report must be submitted no later than the next working day after the employee’s dismissal.

The individual entrepreneur fired all employees in 2021, but did not deregister with the Social Insurance Fund. Do I need to submit zero reports in 2021?

There is no clear answer to this question and no clear explanations from regulatory authorities. Call your branch of the Federal Tax Service, the Pension Fund of the Russian Federation and the Social Insurance Fund and find out whether it is possible not to send zeros for 2021. If you do not plan to hire employees in the near future, it is better to deregister as an employer. Then there will definitely be no questions for you. Moreover, this can be done remotely, using the government services portal.

Submit reports without accounting knowledge

Elba is suitable for individual entrepreneurs and LLCs with employees. The service will prepare all the necessary reporting, calculate salaries, taxes and contributions, and generate payments.

Try 30 days free Gift for new entrepreneurs A year on “Premium” for individual entrepreneurs under 3 months

Normative base

Government Decree No. 590 of 04/26/2020 “On the specifics of the procedure and timing for the submission by policyholders to the territorial bodies of the Pension Fund of the Russian Federation of information on the labor activities of registered persons”

Resolution of the Board of the Pension Fund of the Russian Federation No. 83p of 02/01/2016 “On approval of the form “Information about insured persons” »

The volume of reporting submitted by an organization is growing every year, and it is becoming more and more difficult to remember which documents are required, in what order and within what time frame. To help HR officers and accountants figure out and not get confused what reports need to be submitted when dismissing an employee in 2021, we have collected all the information in a visual table:

Special reports for some categories

Part-timers

When considering which report is submitted to the Pension Fund when dismissing part-time workers and which is not, we focus on the SZV-TD form. It must be taken for all employees, not just the main ones. That is, you will have to submit information when dismissing both internal and external part-time workers. Moreover, if an internal part-time worker quits, but remains the main employee after that, you will still have to report on the termination of one of his employment contracts.

Foreigners

The employment of foreigners has features that differ depending on their status, reasons for staying in the Russian Federation, etc. But in all cases, when figuring out what reports to send to the Pension Fund when dismissing citizens of other countries, it is important not to forget about the need to notify the employment authority within three days. migration issues. Otherwise, the procedure for dismissal and submission of reports is the same as for Russians.

Pensioners

When dismissing pensioners, the same reports are submitted as when dismissing any other employees. Particular attention should be paid to preparing and sending the SZV-TD and SZV-STAZH forms to the Pension Fund, since the correctness of the calculation of the future pension depends on their correct submission.

Harmful and Beneficial

For persons working in harmful and dangerous working conditions, in the Far North, who have benefits, it is also important to have SZV-STAZH information in order, if necessary, to confirm the preferential length of service.

GPC Contractors

The question of what report needs to be submitted when dismissing an employee working under a GPC agreement is not entirely correct. Strictly speaking, such a person is not an employee. His work record is not kept, and there is no need to submit the SZV-TD. But some contributions for remuneration under contract agreements are paid, so it is necessary to hand over the RSV, SZV-M, SZV-STAZH forms to the employee.

What and where to submit

Almost any personnel officer or accountant, when figuring out what reports need to be submitted if an employee quits, will come across information about the mandatory issuance of the following reporting forms to the employee.

SZV-M

The obligation to submit information about SNILS and TIN of employees on a monthly basis (the deadline for submitting the SZV report to the Pension Fund of the Russian Federation is no later than the 15th day of the month following the reporting month) is enshrined in clause 2.2 of Art. 11 Federal Law No. 27-FZ dated April 1, 1996 “On individual (personalized) registration in the compulsory pension insurance system.” When terminating an employment contract, the employee must be provided with information for the last month of his work.

SZV-STAZH

This form contains information about the employee's length of service and insurance premiums. In general, it is submitted before March 1 of the year following the reporting year. When the TD is terminated, it is not necessary to submit it immediately; information about those dismissed can be submitted along with those employed; it is important to meet the deadline. The exception is the employee's retirement. In such a situation, information should be sent to the Pension Fund within 3 days. But the document is always given to the employee on the day of dismissal.

It includes information for the last year, and about periods of work - from 01/01/2017 to the day of termination of the employment contract.

RSV (section 3)

The information included in section 3 of the reporting upon dismissal reflects the employee’s income and contributions paid on it. When preparing the document, amounts are generated from the beginning of the last reporting quarter to the day the employee was dismissed.

Please note that there is no urgent need to provide data to the Pension Fund; all of the above reports are submitted within the specified time frame. The employee is given a printed copy of the documents, certified by the signatures of responsible persons and seals.

There is also information that must be transmitted to regulatory authorities on the day of termination of the employment relationship or the next day.

SZV-TD

From 2021, in addition to the already familiar package of documents, both legal entities and individual entrepreneurs will be required to report on personnel activities for all employees. It was assumed that the submission of information would become monthly during the transition period (until 2021). But the COVID-19 pandemic has made adjustments. Controlling structures needed up-to-date information about the situation on the labor market. In this regard, the government adopted a resolution changing the procedure for submitting information. What changes were made according to the SZV-TD report in April 2021?

The main thing that officials of organizations should remember: now it is necessary to submit information about the hiring and dismissal of all employees no later than the day following the day the order on the upcoming event is issued. True, the question arises of how to submit such reports to the Pension Fund when an employee is dismissed if the date of the event and the date of the event do not coincide. Often, when trying to submit information through EDF systems, an erroneous protocol is received. Pension Fund employees, as well as technical specialists, recommend in this case that reports be submitted after the date of dismissal, although formally this contradicts the government decree. Until this gap in the legislation is eliminated, the employer will have to decide for himself what to do.

New report on the portal “Trudvsem” (to the employment service)

The government decree also establishes the employer’s obligation to promptly provide information about:

- number of employees working remotely;

- number of people working part-time or part-time;

- the number of employees who are idle;

- the number of employees on unpaid leave;

- the number of people laid off due to the COVID-19 epidemic, quarantine and restrictive measures.

When talking about what kind of reporting is submitted to the Pension Fund when an employee is dismissed in 2021, this information is usually not mentioned. Indeed, it is not handed over every time, but if the employment contract is terminated due to layoffs or due to the employee refusing to work part-time, then this must be reflected on the portal. In this case, the employee is not given anything, since the report is quantitative and personal data does not appear in it.