Materials used in an organization for the production of products or business needs are called inventory items (TMAs). Accounting for TMS in the 1C 8.3 program Accounting is maintained in different subaccounts of account 10 “Materials”. Let's take a closer look at the step-by-step instructions for accounting for inventory items in version 1C 8.3.

In 1C 8.3. There are two main stages of inventory accounting:

- Admission;

- Write-off.

The receipt of goods and materials into the organization occurs on the basis of registration using the “Invoice for receipt of goods”.

Write-offs are carried out in various ways and depend directly on the nature of disposal of inventory items. This article will discuss options for writing off materials for production.

Supply plan

As a rule, the purchasing department interacts with a certain number of suppliers and has the ability to record and accumulate information about the duration of order processing and delivery of ordered products by suppliers. Having data on the duration of the order cycle, you can plan the date of receipt of goods at the warehouse. And knowing the maximum capacity of the warehouse for receiving goods per shift (or per day), it is possible to ensure a relatively uniform load on the warehouse with incoming goods from several suppliers. To do this, it is necessary to draw up a plan for placing orders with suppliers (and, accordingly, for supplying goods to the warehouse), in which the daily volume of incoming cargo will not exceed 75–80% of the warehouse’s maximum receiving capacity.

Obviously, the supply plan cannot be executed with absolute accuracy. Deviation of the actual delivery date from the planned one may occur for various reasons related to the reliability of suppliers and transport companies. However, in any case, the warehouse operation will be more uniform, and warehouse resources will be used more efficiently.

Implementation of planning can be carried out using both the functions of the corporate information system and simpler tools (MS Excel or MS Project).

A simplified example of drawing up and adjusting a schedule for the delivery of goods to a warehouse is presented in Figures 1 and 2.

At the first stage, data on the order cycle and supply volume are entered into the table. The sum of the volume of deliveries to the warehouse is compared with the effective capacity of the receiving department. The supplier's order date is then moved so that the total volume of deliveries to the warehouse does not exceed the warehouse's capacity and that deliveries occur on business days.

Rice. 1 Initial delivery schedule

Fig.2. Adjusted delivery schedule

Write-off of inventory items in the 1C program: Accounting 8.3

Step 1. Filling out a demand invoice

To write off materials for production needs, an invoice requirement is used. You can create this document:

- by entering the “Production” section (1);

- then clicking the “Requirements-invoices” link (2).

Then a window for creating a new document will pop up.

In the window that appears, you need to provide the following information:

- about the organization (3);

- the date when the materials were released into production (4);

- name of the warehouse from which these materials will be written off (5).

By checking the box (6) opposite the “Cost Accounts” tab in the “Materials” subsection, you will write off the ITC to production.

Step 2. Filling out the material part of the demand invoice

The filling procedure is as follows:

- by selecting the “Materials” tab (1), you need to add inventory items to be written off;

- to add (2).

- select from the “Nomenclature” directory the material (3) to be written off for production;

- indicate its exact quantity (4);

- By default, the cost account (5) will contain account 20.01 “Main production”. If necessary, you can put other data in the cost field;

- select a group for writing off materials by clicking “Item group” (6). Typically, such groups are united by the specifics of the products manufactured, for example, “Windows”, “Furniture”, “Doors”;

- select an item to write off costs (for example, “Material costs of main production”) in the “Cost Items” field (7);

- To record the write-off of inventory items into production to reflect the write-off, click first “Record” (8), and then “Post” (9).

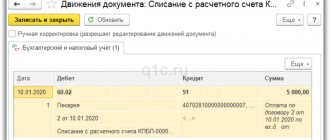

The following entry will appear in the accounting records:

DEBIT 20 CREDIT 10

— write-off of materials for production

Preparing the warehouse for acceptance

As a rule, in many warehouses no preparation is carried out at all for the acceptance of goods. Often the list and volume of goods to be accepted becomes known when the vehicle arrives at the warehouse.

This operating principle is accompanied by regular emergency situations and the appearance of queues of vehicles waiting to be unloaded. Due to the lack of prepared storage areas, goods can be placed in driveways, which subsequently significantly complicates the work of the warehouse.

The above problems can be avoided by timely receipt of accurate information about expected deliveries at the warehouse:

- list of commodity items;

- quantity, weight, volume of incoming goods (including for each product item);

- timing of goods arrival;

- storage periods of cargo, conditions of placement in a warehouse, taking into account the commodity neighborhood;

- supplier name;

- type of container (boxes, pallets); palletization standard, estimated number of pallets;

- information on additional accompanying documentation (certificates of conformity, etc.);

- the number of free places in the warehouse, their location (address).

For convenience, you should create a special document form into which this information would be exported automatically or entered manually, depending on the capabilities of the warehouse management information system.

With information about expected deliveries, the warehouse service can prepare space in the receiving area, determine the number of personnel to unload and check the quantity and quality of goods, prepare the necessary equipment, containers, packaging material, and then correctly and efficiently place incoming products for storage.

Receipt of materials in the 1C Accounting 8.3 program

Step 1. Creating a receipt of inventory items in 1C 8.3

Go to “Purchases” (1), click the link “Receipts (acts, invoices)” (2). After which a window will open in which you can create an invoice for the receipt of goods and materials.

In the window that appears, select “Receipt” (3) and click on the line “Goods (invoice)” (4). After this, an invoice form will open that you can fill out.

Step 2. Filling in the details of the invoice for the receipt of goods in 1C 8.3

In a special form you must provide the following information:

- the name of your organization;

- name of the supplier of goods and materials;

- materials receipt warehouse (3);

- details of the contract with the supplier of inventory items (4);

- date and number of the seller's invoice (5).

Step 3. Filling out the material part of the delivery note in the 1C 8.3 program

To open the nomenclature directory, you need to click “Add” (1), then the “Show all” link (2).

From the directory data, you can select exactly those materials (3) that you received. The invoice must indicate:

- quantity of inventory items (4). The total quantity of materials received into the warehouse;

- price from the seller (data can be found in the UPD invoice);

- VAT rate from the seller (information taken from the UTD invoice) (6)

Thus, the delivery note for the receipt of goods and materials into the organization is completed. To complete the procedure for posting materials, you must first click “Record” (7), and then “Post” (8).

After the capitalization was completed, a record of inventory items appeared on the debit of account 10 “Materials”. You can see the postings for the newly created consignment note by clicking “DtKt” (9).

From the pop-up window of postings, you can see that the capitalized material is attributed to account 10.01 “Raw materials and materials” (10). The debit of account 19.03 “VAT on purchased inventories” (11) will reflect the VAT of the goods received. These accounts correspond to account 60.01 “Settlements with suppliers and contractors” (12).

After you have registered the receipt of materials, you can proceed to writing them off.

Organization of goods acceptance into the warehouse

The structure and number of operations for the acceptance of goods depend on the place of acceptance and the type of cargo, as well as on the type of vehicle by which the goods are delivered to the warehouse. A generalized list of procedures for accepting goods into a warehouse, for example, of a distribution company is as follows:

- entry of a vehicle into the warehouse territory;

- control of the availability of shipping documentation;

- definition of unloading gate;

- delivering the vehicle to the ramp for unloading;

- vehicle access to the unloading site;

- external inspection of the vehicle and recording of faults, taking photographs if necessary;

- opening vehicle doors;

- supply of the required lifting vehicle;

- visual inspection of received goods (each cargo unit);

- supplying the necessary containers and placing them in containers (if necessary);

- picking up a cargo unit by a vehicle and transporting it to the ramp;

- acceptance of incoming cargo according to the number of packages in accordance with the accompanying documents;

- reconciliation and preparation of accompanying documents;

- execution of acceptance certificates indicating damage or shortage of cargo, if any;

- transfer of necessary documents to the supplier and confirmation of receipt of the cargo in the database;

- transportation of cargo to the acceptance area for final acceptance and preparation of goods for storage

Legal regulation of goods acceptance into warehouse

For a long time in our country, acceptance was carried out on the basis of two Instructions of the USSR State Arbitration Court No. P-6 and No. P-7, adopted back in the mid-sixties of the 20th century. Many companies are still guided by these regulations in their activities, although their mandatory application has been abolished. Thus, if the parties did not refer to the mentioned instructions in the contract or did not fix the conditions for acceptance of products in the contract, all issues regarding detected discrepancies are either not resolved at all or are resolved on the basis of a personal agreement between company representatives

Checking accompanying documentation

When vehicles arrive at the warehouse, first of all, the presence of accompanying documents (bill of lading, invoice, technical passport, GOST certificate of conformity, quality certificate, etc.) and their contents are checked for compliance with the conditions (sender, recipient, quantity, assortment , packaging, etc.) fixed in the supply contract. The absence of any of these documents should not suspend acceptance of the goods. In this case, a report on the actual availability of the goods is drawn up, and the acceptance report indicates which documents are missing.

Determining the safety of the appearance of the vehicle, containers and packaging

Before directly unloading the vehicle, the storekeeper responsible for acceptance checks the presence of the sender's or point of departure seals on the vehicles or containers, the serviceability of the seals, the imprints on them, the condition of the vehicle itself, and the serviceability of the container. In case of detection of violations, as well as the absence or malfunction of seals, an inspection report on the condition of vehicles is drawn up, or a note is made in the consignment note. Some companies practice photography or video recording of vehicles and cargo. Such visual information can greatly facilitate the process of agreeing on acceptance results with the supplier or transport company.

Unloading vehicles

Unloading of goods, as a rule, is carried out using various technical means. However, practice shows that goods often arrive at the warehouse in boxes, or, as warehouse workers say, “in bulk.” Loading and unloading operations with this method of transportation take considerable time, however, since the capacity of vehicles is used as efficiently as possible, enterprises often refuse pallet shipments.

In order to unload goods, for example, with a forklift, boxes (packages) are placed on pallets. Already at this stage, it is possible to form cargo units according to certain stowage standards. At the stage of registering a new product in the warehouse database, among other characteristics, it is determined how many packages can be stacked on a pallet in such a way that the capacity of the warehouse cells is optimally used. When unloading these goods in boxes (packages), they are placed on pallets in accordance with established standards. This information can be included in the task for receiving goods or transmitted to the storekeeper in the form of a separate document. Using this approach allows you to reduce the time for recounting goods, eliminate errors when determining the quantity of goods accepted, and also simplify work with cargo in all subsequent warehouse operations.

Preliminary acceptance - checking the quantity and appearance of the packaging of the received goods

Often, the so-called primary acceptance, which consists of recalculating packages and examining the appearance of the packaging, is carried out simultaneously with the unloading of goods. After unloading is completed, the warehouseman responsible for receiving, in most cases, already has sufficient information to prepare shipping documents.

If a shortage or substandard product is detected, a product acceptance report is drawn up, which indicates the number of the waybill and invoice, the quantity of the missing/substandard product, its total cost, the alleged causes of damage, the persons involved in the acceptance, their signatures and the date of drawing up the report. If one of the parties does not agree with the content of the act, she is given the right to additionally record her opinion in the act. After detecting shortages/damage to the cargo and drawing up a report, it is necessary to notify the supplier of the results of acceptance.

Acceptance of returns from customers, as a rule, is carried out according to an algorithm similar to acceptance. The difference is that it is recommended that the goods be posted and placed in the warehouse only after the goods have been identified by a Defect Specialist. After acceptance of such goods, one of the following types of processing is carried out:

- Rework - in the event of a possible correction of a violation of the quality of the product, it can be repaired, repackaged, repacked, etc. depending on the type of product

- Return to supplier or replacement by supplier

- Recycling and write-off

How to keep inventory records of inventory items?

In manufacturing companies, I often see a serious mistake in the way warehousing is organized. A striking example is one of my clients in the Omsk region. The company produces equipment for the food industry. So at this plant the warehouse was subordinated to the deputy for production. “Well, this is convenient - the senior foreman directly supervises the storekeepers and there are no problems with issuing materials,” the managing director tells me.

But! At the same time, there was no normal warehouse accounting. The reason is simple - for production workers, the main thing is to release products on time, and accounting and order in the warehouse are in second place for them.

The lack of normal accounting in the program led to the fact that the production workers themselves no longer understood how much and what material they needed to purchase in order to put an order into production. They won’t recalculate everything manually every time. And if the true need for materials, taking into account leftovers, is not known, then there are 2 options - either not to take the order, or to purchase what is needed just in case. And literally in 2 years of such work, the cost of purchasing all the owner’s profit led to terrible cash gaps. Loans, debts, stress...

But it's never too late to put your warehouse accounting in order. It is necessary to transfer the warehouse management to the supply department, which must report to the deputy for production preparation. And the implementation of accounting tools (regulations, forms for receipt and write-off, movement) should be entrusted to the chief accountant, since storekeepers report to the accounting department on all issues of accounting for inventory and materials.

Below I will give you a brief reminder on inventory accounting. It contains the main actions and accounting and reporting frameworks.

1. Issuance of goods and materials.

Based on the material consumption standards, a limit intake card is issued. This card is the primary document for the storekeeper to release material assets from the warehouse to the foreman.

A limit-fence card

is used if an organization has limits on the supply of materials to register the supply of materials that are systematically consumed in the manufacture of products, as well as for ongoing monitoring of compliance with established limits on the supply of materials for production needs and is a supporting document for writing off material assets from the warehouse.

As a rule, limit and intake cards are issued by a planning engineer or a PRB engineer, who reports to the production site foreman. The limit card is agreed upon by a technologist and economist.

After issuing the goods and materials from the warehouse, the storekeeper draws up the reporting form M-11 “Demand-invoice”: he keeps 1 copy, and transfers 1 copy to the accounting department.

Fig. 1 - Requirement - form M-11 invoice

The release of materials into production is carried out by the warehouse upon presentation by a representative of the structural unit of his copy of the limit card.

The foreman and the storekeeper are financially responsible persons and an agreement on financial liability is concluded with them on the basis of Resolution of the Ministry of Labor No. 85 of December 31, 2002.

2. Write-off of inventory items.

The procedure for the movement and write-off of inventory items into production is determined by the regulations (order) on the movement of inventory items. This document must identify specific employees responsible for each stage of work and briefly but unambiguously describe the procedure for their actions. The regulations must be clear to all participants in the process and avoid ambiguous interpretations. Samples of primary documents are attached to the regulations.

Recommendations for organizing the write-off of inventory items.

After the products are manufactured and delivered to the warehouse, an acceptance certificate is drawn up.

Fig. 2 – Sample Acceptance Certificate

In parallel with the acceptance certificate, an act of write-off of inventory items is drawn up. The act of writing off inventory and materials reflects the list and quantity of materials used to produce a specific order.

The act is signed by a permanent commission consisting of the following employees: Deputy Director for Production, Head of Workshop, Technologist, Economist. Below the commission is signed by the financially responsible person - the site foreman. The act is approved by the Director. Then the master provides the signed document to the accounting department of the enterprise.

The form of the act of writing off inventory items can be developed to suit the specifics of the enterprise and make it convenient for all participants in the process. One of the options for this form is presented above.

| Order No. K1236 - 1 pc. | ||||||||||

| Materials (name) | Item number | Unit change | Quantity as per norm | Actually spent | ||||||

| Qty | Price per one. | Amount, rub. | ||||||||

| Intermediate shaft assembly 1080.05.332-1sb | PC. | 1 | 31 065,96 | |||||||

| Main raw materials and materials | 2 277,17 | |||||||||

| Sheet 3 GOST 19903-2015 Art. 3 GOST 16523-97 | 1610002533 | kg | 0,330 | 0,330 | 0,330 | 13,09 | ||||

| Sheet 6 GOST 19903-2015 Art. 3 GOST 14637-89 | 1610002534 | kg | 1,120 | 1,120 | 1,120 | 44,15 | ||||

| Sheet 10 GOST 19903-2015 Art. 09G2S GOST 19281-2014 | 1610002535 | kg | 1,500 | 1,500 | 1,500 | 56,82 | ||||

| Sheet 16 GOST 19903-2015 Art. 09G2S GOST 19281-2014 | 1610002536 | kg | 3,750 | 3,750 | 3,750 | 143,01 | ||||

| Sheet 20 GOST 19903-2015 Art. 09G2S GOST 19281-2014 | 1610002537 | kg | 2,900 | 2,900 | 2,900 | 109,85 | ||||

| Sheet 25 GOST 19903-2015 Art. 09G2S GOST 19281-2014 | 1610002538 | kg | 15,720 | 15,720 | 15,720 | 595,49 | ||||

| Sheet 30 GOST 19903-2015 Art. 09G2S GOST 19281-2014 | 1610002539 | kg | 33,800 | 33,800 | 33,800 | 1 314,76 | ||||

| Composite materials and components | 689,54 | |||||||||

| Cotter pin 3.2x32 GOST 397-79 | 1610002540 | PC | 2,000 | 2,000 | 2,000 | 0,02 | ||||

| Cotter pin 8x50 GOST 397-79 | 1610002541 | PC | 4,000 | 4,000 | 4,000 | 67,80 | ||||

| Bolt M12x100 GOST 7798-70 | 1610002542 | PC | 2,000 | 2,000 | 2,000 | 13,56 | ||||

| Bolt M12x110 GOST 7798-70 | 1610002543 | PC | 2,000 | 2,000 | 2,000 | 12,60 | ||||

| Bolt M12x120 GOST 7798-70 | 1610002544 | PC | 2,000 | 2,000 | 2,000 | 0,02 | ||||

| Asbestos brake tape LAT-2-8x90 GOST 1198-93 | 1610002545 | m | 1,172 | 1,172 | 1,172 | 545,68 | ||||

| Washer 36 GOST 11371-78 | 1610002546 | PC | 4,000 | 4,000 | 4,000 | 49,86 | ||||

| Auxiliary materials | 206,03 | |||||||||

| Electrode UONI 13/45 3.0mm | 1610002545 | kg | 0,060 | 0,060 | 0,060 | 3,64 | ||||

| Solid oil GOST 1033-79 | 1610002546 | kg | 0,875 | 0,875 | 0,875 | 21,10 | ||||

| Soil GF-021 red-brown GOST25129-82 | 1610002547 | kg | 3,225 | 3,225 | 3,225 | 181,29 | ||||

| Accessories | 15 893,22 | |||||||||

| Pulley 1080.05.337-1 | 1610002548 | PC | 1,000 | 1,000 | 1,000 | 7 706,78 | ||||

| Block 1080.05.334 | 1610002549 | PC | 2,000 | 2,000 | 2,000 | 8 186,44 | ||||

| Products from the GP warehouse | 12 000,00 | |||||||||

| Wheel 1080.33.00 | 1610002550 | PC | 1,000 | 1,000 | 1,000 | 12 000,00 | ||||

| PC | ||||||||||

| TOTAL costs | 31 065,96 | |||||||||

Actions of participants in the inventory write-off process:

The master draws up a write-off act. The technologist (or other technical specialist) checks the write-off report based on the amount of material written off, comparing the fact with the standards. Signs the document. At the same time, the technologist should not be subordinate to the production deputy in order to monitor the absence of overexpenditure of goods and materials. If a technologist sees an overestimation of the amount of material written off, then he must initiate an investigation into the reasons for their elimination - raise the issue at the level of management of the workshop or enterprise. The write-off act is signed by the person appointed responsible for organizing all work on accounting and write-off - the head of the site or the deputy for production.

The regulations should also reflect the procedure for regular analysis

write-off of materials. A person responsible for carrying out this analysis has been appointed (economist, accountant). If during the analysis an overexpenditure of resources is revealed, the head of the enterprise is obliged to conduct an analysis, identify and eliminate the causes.

3. Working with waste.

First, you need to classify the waste into what will be business waste and what will be scrap metal. Then appoint a person responsible who will report on the generation of this waste. Based on the results of the period (once a month), the official draws up a report on the generation of business waste and fills out a report for this amount. The act is signed by a permanent commission, which is approved by regulations (order).

The accounting department brings business waste to the warehouse.

The Receipt Order

form in Form No. M-4 is used to account for materials received from suppliers or from processing.

The receipt order in one copy is drawn up by the financially responsible person on the day the valuables arrive at the warehouse. The receipt order must be issued for the actual amount of valuables received. Of course, most of the inventory accounting operations should be automated. But we should not forget the main goal of all accounting - to give a complete and reliable picture of the balances and needs for inventory and materials at the current moment. This is necessary for making the right management decisions on launching a particular order into production and purchasing exactly those materials that are really needed.

The table that shows the percentage of supply and the need for goods and materials for EACH order is very large and there is no way to insert it here, so if you need it, write me an email. I will send it to you in Excel.

Here is a fragment of this table:

And if you still have questions about how to organize and automate material accounting in 1C, you can write to me by email. I will definitely answer you.

You can also download instructions for writing off inventory items with sample forms.

Sincerely, Elena Masalova is the founder and head of the Digital Management consulting agency.