Who has the right to receive money

Each employer, according to Part 1 of Art. 19 Federal Law dated December 6, 2011 No. 402-FZ “On Accounting”, is obliged to organize and maintain internal control of the facts of economic activity. The procedure for monitoring the issuance of money to accountable persons must be determined by the head of the company. He may issue an order with a list of persons entitled to receive funds from the organization’s cash desk.

Accountable persons are persons to whom an organization or individual entrepreneur gives money to carry out instructions and who are obliged to provide a report on their use. Accountable persons can be any employees of the enterprise

What is an advance report?

An advance report is a document confirming the expenditure of funds issued to an employee and spent by him on the needs of the enterprise (or individual entrepreneur). In it, the accountant indicates:

- the amount received;

- the purposes for which it is taken;

- expenses for which it was spent;

- remaining or overspent amount.

To confirm the expenses incurred, primary documents for each expenditure transaction are attached to the report.

The unified version of the report forms called “AO-1”, approved by Decree of the State Statistics Committee of the Russian Federation dated August 1, 2001 No. 55, has ceased to be mandatory since 2013. Therefore, you can approve your own form, the main thing is to include in it all the details mentioned in Art. 9 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ. But even despite this possibility, many continue to work on the AO-1 form, because it is familiar and convenient.

AO-1 can be found here.

How to receive the money

Until August 19, 2017, in order to receive money on account, an employee had to send an application to the accounting department or human resources department, which indicated the required amount and an explanation of what it would be spent on.

However, since August 19, it has become easier to issue reports. The amendments are provided for by Directive of the Central Bank of the Russian Federation dated June 19, 2017 No. 4416-U. It is not necessary to submit an application from this date. To issue money, an order from the director or another administrative document of the company is sufficient. The form of such a document is arbitrary. But it must contain the following details:

- FULL NAME. accountable person;

- document registration number;

- about the amount of cash;

- about the period for which cash is issued;

- about appointment (optional);

- director's signature and date.

Below are the new reporting samples from August 19th.

Application from an employee

Download

Order on accountable persons

Download

What is the maximum amount that can be reported in 2021? – all about taxes

Instructions of the Bank of Russia No. 3210-U). Consequently, money can be issued, including to the contractor, on account. He may need them, for example, to purchase materials to perform work under a civil contract.

This amount can be given to him for the report, for example, from the cash register. Accountable amounts can be transferred to the bank card of the accountable person, incl. for salary (Letter of the Ministry of Finance No. 03-11-11/42288).

Until recently, in order to receive cash on account, an employee had to submit an application for the issuance of funds to the accounting department or human resources department.

A sample of such an application shows that it was necessary to indicate the required amount, as well as explain for what purposes it will be spent. However, as of August 19, 2021, the situation has changed. The amendments are provided for by Directive of the Central Bank of Russia No. 4416-U.

For this reason, accountable money can be obtained exclusively through the cash desk of a trading organization, which maintains a special cash book for such purposes. Any amounts issued from the cash register, be it wages or funds for company expenses, are allocated to employees on the basis of an expense order, which records the following information:

- details of the employee who received the money;

- sum;

- special purpose;

- order number;

- term of use;

- date of issue.

The size of the accountables is determined by the director of the company, and he also withdraws the required amount from the company’s current account. If you don’t need a lot of money, you can take it from the remaining cash in the cash register at the time the employee applies. Scheme for the director The issuance of accountable funds for the head of the company is carried out in the same manner as in the case of other employees.

Understanding the new reporting rules

Attention

We attach a sample order for the issuance of accountable funds to several employees when they are sent on a business trip.

Sample order for the issuance of accountable funds 2021 Application for the issuance of accountable funds Despite the fact that applications are not required to be written according to the rules for the issuance of accountable funds, some organizations find it more convenient to work with applications. In this case, the previous application form can be somewhat simplified.

For example, remove the clause that the employee has already submitted an advance report on accountable funds issued to him earlier.

This requirement is no longer valid; now it is possible to give money to the accountable even if he has not yet paid off the previous advance received.

However, if a company wants to maintain such a requirement, then it can simply change the wording. For example, you can indicate that a new advance is issued only if the employee has reported on the old one.

Money for reporting: what has changed in the issuance rules

Then, an order is issued to reimburse the money spent.

How much and to whom can money be given for reporting + registration

Issuing money exclusively for the purposes of the company’s business activities, matching the goals of a specific advance with actual expenses, and reasonable amounts of funds issued will help your company avoid unnecessary questions during tax audits.

Order for the issuance of money Download Subscribe to our channel in Telegram We will tell you about the latest news and publications. Read us wherever it is convenient for you.

Always be aware of the main thing! Subscribe Dear readers, if you see an error or typo, help us fix it! To do this, highlight the error and press the “Ctrl” and “Enter” keys simultaneously.

We will learn about the inaccuracy and correct it.

For example, you can indicate that a new advance is issued only if the employee has reported on the old one. New procedure for cash transactions and issuing money on account: 5 important innovations From this date, you can issue money to an employee on account without his application. To issue money, an order for the issuance of funds from a report or other administrative document of the company is sufficient.

Important

The same rules for issuing money on account continue to apply in 2018. So, the issuance of funds for reporting in 2021 is possible on the basis of an order or other administrative document (clause 6.3 of Bank of Russia instructions No. 3210-U). At the same time, there are no restrictions on the amount of accountable amounts and the period for issuing money.

Moreover, there are no special requirements for how to draw up an order for the issuance of accountable amounts. In our opinion, it makes sense to record in the order: the employee’s full name, amount, goals and terms of issue.

New procedure for cash transactions and issuing money on account: 5 important innovations

Accountable funds are issued to an employee for expenses directly related to the work of the organization where he is on staff. For example, this could be travel money or funds allocated monthly for the purchase of stationery, or payment for printing materials. The issuance of money to the account is carried out in a certain order, requiring compliance with all the rules.

First of all, a statement must be written from the accountable person about the need to allocate funds for production expenses.

The application is also drawn up when the manager of the enterprise needs funds, since these expenses are necessarily subject to accounting entries.

You can receive accountable funds either in cash at the company’s cash desk or on a bank card. As for the period for which the money is issued, it is determined by the head of the company.

How is money disbursed?

The maximum limit that the director has the right to write out on a report for operations related to the increase of fixed assets does not exceed 100 thousand rubles.

Established deadlines A mandatory condition for accountable payments is the presentation of a complete cost report to the accounting department.

Reporting should be submitted after the expiration of the period for using the funds, namely three days after its expiration.

The issuance of money for reporting is carried out for the period specified by the management of the company. Each enterprise independently determines not only the amount, but also the duration of use of the money under the report. The fact is that the law does not provide specific deadlines for the return of these funds.

Organizations can issue them, for example, for three days or six months. For each employee, the director himself determines the reporting time. If the advance was issued exclusively for these purposes, then issuing a larger advance will look at least strange.

Of course, if a company employee needs to pay in cash to several suppliers at once or under several contracts with one supplier, he can account for more than 100 thousand rubles.

Do not forget that the issuance of money is accompanied by the execution of an order (at the end of the article).

Suspicious transactions with accountants As we can see, there are no obvious restrictions on the maximum amount to report in 2021. But this does not mean that advances from the cash register can be issued in any amount. Tax inspectors may really not like some transactions with accountable persons:

- “Circulation” of cash in the cash register through expense reports.

This trick is when money from the cash register is daily reported, returned, issued again, etc.

What has changed in the algorithm for issuing funds for reporting The new rules for reporting 2021 represent the following order of sequential actions:

- The employee submits to the accounting department an order for the issuance of money against a report signed by the head of the institution in any form.

- Accountable persons, the changes of 2021 approved this innovation, may now have debt on previously issued advances. But before issuing, you need to make a complete reconciliation of mutual settlements with him.

- The employee provides an advance report no later than 3 working days after the date established in the order. All available documents confirming expenses must be attached to the advance report.

Source:

Issue for reporting in 2021

If the advance was issued exclusively for these purposes, then issuing a larger advance will look at least strange. Of course, if a company employee needs to pay in cash to several suppliers at once or under several contracts with one supplier, he can account for more than 100 thousand rubles.

Do not forget that the issuance of money is accompanied by the execution of an order (at the end of the article). Suspicious transactions with accountants As we can see, there are no obvious restrictions on the maximum amount to report in 2021. But this does not mean that advances from the cash register can be issued in any amount.

Tax inspectors may really not like some transactions with accountable persons:

- “Circulation” of cash in the cash register through expense reports. This trick is when money from the cash register is daily reported, returned, issued again, etc.

What amount can be issued for reporting?

In the Russian Federation, all payments in national currency that are carried out within the framework of one agreement should not exceed 100 thousand rubles. This is indicated in paragraphs 5 and 6 of the Directive of the Central Bank of the Russian Federation dated October 7, 2013 No. 3073-U.

It is believed that this limit cannot be exceeded. But there are also some nuances. This limit on expenses is established only for settlements with other organizations and individual entrepreneurs (see clause 6 of the Directive of the Central Bank of the Russian Federation No. 3073-U). But it does not apply to settlements with individuals, who in this case are employees of the enterprise. This includes wages, social benefits, personal needs of the head of the organization and the issuance of funds on account. In this case, issuing a larger amount will not be considered a violation of cash discipline.

Is it possible to report more than 1 million and how to do it correctly?

The good thing about this method is that nothing needs to be artificially formalized: the founding director receives his own money and contributes it to the accountable debt. The main thing is that the debtor agrees to this. Perhaps the arguments given above will convince him.

As a rule, dividends are paid at the end of the year. But the general meeting of shareholders (participants) may decide to pay dividends based on the results of a quarter, half a year or nine months. These are so-called interim dividends.

Then, each time, receiving interim dividends, the founding director can use part of them to pay off the account. You will need to withhold personal income tax at a rate lower than usual - 9, not 13 percent (clause 4 of article 224 of the NKRF).

There is no need to pay contributions from dividends, because these are payments not within the framework of labor relations (letter from the Federal Social Insurance Fund of the Russian Federation dated December 18, 2012 No. 15-03-11/08–16893).

What is the maximum amount that can be reported?

- cash at the cash desk;

- to the company's bank account.

However, in this case, a problem may arise with the bank itself. Thus, some financial institutions refuse to accept cash if the company issued it electronically.

To avoid this problem, when transferring funds through a bank, you do not need to mention that this is an accountable return. It is best to indicate the money as other income, or by canceling the receipt order, return the remaining funds to the employee and carry out the return as a deduction of debt from wages.

Online magazine for accountants

Attention

If you do not indicate these funds as accountable in the tax report, the Federal Tax Service will take this as a violation. In addition, for receiving this money, a tax fee will be withdrawn from the accountable person.

All accounting reports of the enterprise are maintained in the 1C program, accountable funds are no exception. In case of failure to return the balance of money or report on expenses within the established time frame, the missing amount is reflected both on the credit side - settlements with accountable persons, and on the debit side - shortages and losses. In the future, the missing amounts are written off and entered into the program as wages to staff or payments for other expense transactions.

What is the maximum amount that can be reported in 2017?

In accounting, accrued dividends are reflected as follows: Debit 84 Credit 70 subaccount “Calculations for payment of dividends”

- dividends were accrued to the founding director.

As you can see, there is nothing complicated in this method. The only limitation is that it is risky to issue dividends from cash proceeds.

It can only be spent on the purposes listed in the new Directive of the Bank of Russia dated October 7, 2013. No. 3073-U. But dividends are not mentioned in this document. There is no direct liability for misappropriation of cash proceeds in the legislation.

But there is a risk that tax authorities will accuse the company of failing to comply with the procedure for storing available funds. And for this there is a fine of up to 50,000 rubles. (Article 15.1 of the Code of Administrative Offenses of the Russian Federation). But how then to pay dividends? It all depends on the organizational and legal form of your company - LLC or JSC. If you have an LLC.

How to properly reset the debt on accountable amounts of an employee

Personal income tax; Debit 70 subaccount “Calculations for payment of dividends” Credit 71

- 180,000 rub. — dividends are offset against the debt on accountable funds;

Debit 70 subaccount “Calculations for payment of dividends” Credit 51

- 62,060 rub. (266,000 – 23,940 – 180,000) — the remaining amount of dividends was transferred to Spiridonov.

If you have JSC. Since January 1, 2014, joint-stock companies have been paying dividends strictly by bank transfer (clause 8 of Article 42 of the Federal Law of December 26, 1995 No. 208-FZ).

This means that you will first need to transfer money to the director’s bank card or bank account, and then he will have to return this money to the company, that is, pay off the accountable debt.

Setting up an offset and issuing cash, as is the case with an LLC, is risky.

Is a report required for the amount received?

According to clause 6.3 of the Instructions of the Central Bank of the Russian Federation dated 03/11/2014 No. 3210-U, until 08/19/2017 it was impossible to issue money on account if the employee did not provide a report on previously received amounts.

But the Central Bank made changes to the report. Now accountable documents can be issued even if the employee has not repaid the debt on previously issued funds. However, this does not mean that employees no longer need to prepare advance reports on the amounts spent. The employee must submit reporting documents on the money spent to the accounting department.

What is the maximum amount that can be reported in 2021?

Reporting in 2021 - is there a maximum amount? Such a question is completely natural, especially considering the consistently high interest of regulatory authorities in cash transactions made by taxpayers. Let's figure out whether there are restrictions on the amounts issued for reporting.

What amount can be given for reporting in 2021?

Accounting and the amount of settlement with the supplier are not the same thing

Payments made by notaries through accountants

What operations may be of interest to controllers

Consequences of unjustified issuance of amounts on account

Results

What amount can be issued for reporting in 2021?

The rules for issuing cash on account are regulated by clause 6.3 of the instructions of the Bank of the Russian Federation “On the procedure for conducting cash transactions by legal entities and the simplified procedure for conducting cash transactions by individual entrepreneurs and small businesses” dated March 11, 2014 No. 3210-U and are as follows:

- Money is given to the reporting employee only for the purpose of meeting expenses related to the business activities of the company (or individual entrepreneur).

- The basis for issuance is an employee’s statement containing an indication of the amount of the requested amount, as well as the period for which it is taken, the date and visa of the manager, or an order from the head of the legal entity (or individual entrepreneur).

- The issuance of cash to an accountant is accompanied by the execution of an expenditure document - an order in the OKUD form 0310002.

The possibility of issuing the following amounts on account does not depend on the absence or presence of debt on the funds previously issued to the individual.

The employee is required to report on the amounts spent (an advance report with supporting documents attached) within 3 days, calculated from the end of the period for issuing accountable funds. Moreover, after approval of the advance report, he has the right to receive excess funds spent on his own purchases.

IMPORTANT! The 3-day rule applies to absolutely all employees of the company, including the manager. Even if the manager is the only employee.

“Sample for filling out an advance report in 2017-2018” will help you fill out the advance report correctly .

And about how to reflect an advance report in accounting, read the article “Features of advance reports in accounting .

As you can see, the above rules do not indicate what amount can be reported in 2021 (its maximum values). However, there are no similar restrictions in other regulations, which means that companies and entrepreneurs can determine the amount of amounts issued for reporting (including in non-cash form) at their own discretion.

IMPORTANT! The maximum period for which money can be issued to accountants is not established by law. It, like the amount of accountable funds, is determined by economic entities independently.

Accounting and the amount of settlement with the supplier are not the same thing

When there is a conversation about limiting the amounts involved in accountable business operations, confusion often arises and the amount of 100,000 rubles is mentioned. Where did she come from?

It should be understood that the process of receiving and spending funds by an accountable employee includes 2 main business operations:

- Receiving money from the employer as an account for purchases necessary for the implementation of its activities.

- Purchasing goods and services from a supplier and making payments to him.

And if the first operation, as we found out, does not imply legislative restrictions on amounts, then the second in terms of cash payments (i.e., money issued on account) is strictly regulated by the Bank of Russia instruction “On making cash payments” dated 07.

10.2013 No. 3073-U, establishing the maximum amount for them. According to clause 6 of this document, the limit is in the amount of 100,000 rubles. applies to cash payments under one agreement made between legal entities, entrepreneurs, as well as between a legal entity and an individual entrepreneur.

IMPORTANT! The above restriction does not apply to ordinary individuals (citizens who are not entrepreneurs) participating in settlements with companies and individual entrepreneurs. At the same time, an individual employee who acts in a transaction not independently, but on behalf of his employer (for example, by proxy), is also obliged to comply with cash payments (Article 182 of the Civil Code of the Russian Federation).

NOTE! Regarding the establishment of the maximum possible amount of 100,000 rubles. The legislation does not provide for any time limits (for example, the common misconception “100,000 rubles in one day”). Thus, this limit cannot be circumvented by dividing the payment amount under the agreement into several payment transactions made on different days.

Payments made by notaries through accountants

Let's consider the situation. The employer-notary plans to issue cash on account to the employee for the purchase of a computer worth more than 110,000 rubles. Does he have the right to do this and can the seller refuse to accept the full amount in cash to the notary office employee?

In this case, there will be no restrictions on the amount of amounts - neither on the amount reported (since there are no such restrictions in principle), nor on the amount paid.

The fact is that notarial activity is recognized as a legal activity performed on behalf of the state and is not recognized as entrepreneurial, since it is not accompanied by the extraction of profit (Resolution of the Constitutional Court of the Russian Federation dated May 19, 1998 No. 15-P).

Source: https://nalog-nalog.ru/buhgalterskij_uchet/vedenie_buhgalterskogo_ucheta/kakuyu_maksimal_nuyu_summu_mozhno_vydat_v_podotchet/

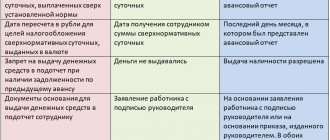

Report deadlines

There is no legislatively specified period within which an employee must submit a report on the money spent. Therefore, it is usually indicated in the employer’s order.

According to clause 6.3 of the Directive of the Central Bank of the Russian Federation dated March 11, 2014 No. 3210-U, the employee is obliged to provide a report on the amounts received no later than three working days after the expiration of the period for which these amounts were issued.

If the return period has not been established, the employee must submit the report on the same day on which he received them. This is indicated in the letter of the Federal Tax Service of Russia dated January 24, 2005 No. 04-1-02/704.

But there are special conditions for this. According to clause 26 of the Regulations, approved by Decree of the Government of the Russian Federation of October 13, 2008 No. 749, the employee is obliged to report on them within 3 working days from the date of return.

Order for issuance of accountable amounts 2021 sample

To issue money to an account, you need to draw up an order. See how to issue an order for the issuance of accountable amounts in 2021, download a detailed sample, and find out how else you can issue an order for the issuance of accountable amounts, as well as how to issue money to several employees at once.

Order on accountable persons in 2021

A company can issue money for reporting in 2021 on the basis of one of two documents:

- Employee statement;

- Order (instruction) of the director.

Important! The company independently chooses which document to use. It is better to enshrine this decision in a local act. You can focus on both documents - but clearly define when and which of them is drawn up.

The requirements for the order to issue money for reporting in 2018 are as follows:

- The amount to be disbursed must be indicated;

- The period for which the money is issued must be indicated;

- The head of the company must certify the document with a signature.

The order can be issued on company letterhead, but this is solely at the discretion of the company. There is no such obligation in the law.

Important! The employee must report on the funds issued within 3 working days.

Look at a sample order for the release of money for reporting (sample 2018).

Order for the issuance of accountable amounts: sample 2021 for a business trip

To issue money for reporting in 2021, it is not necessary to draw up a separate document. The company can simplify document flow by including information about the issuance of funds in reporting to other orders. For example, information about reporting can be indicated in a business trip order, indicating this after the travel information.

Look below for a sample order on sending on a business trip and issuing money for reporting in 2021.

When to use an application for the issuance of money for reporting

The company itself has the right to decide whether to use the application for the issuance of money for reporting purposes or not. The application is convenient to use in cases where you need to issue a certain amount of money for a specific purpose, for example, the purchase of office equipment.

The requirements for the application are the same as for the order:

- The amount to be disbursed must be indicated;

- The period for which the money is issued must be indicated;

- The head of the company must certify the document with a signature.

See below for a sample application for the issuance of funds.

Order on accountable persons: one for all individuals

The company has the right to issue an order on accountable persons in 2021, indicating several employees there at once. The Central Bank of the Russian Federation first indicated this right in its letter, Letter of the Central Bank of the Russian Federation dated October 13, 2017 No. 29-1-1-OE/24158.

If the company decides to draw up such a single order for accountable persons, then keep in mind the following mandatory points:

- Indicate the full names of the employees to whom the money is given;

- The amount issued and the period for which this money is issued must be indicated for each employee separately.

Why is this necessary? The cashier will issue a cash order for each employee separately, so he must see how much to give to whom.

Each employee will draw up an advance report independently, so the order must set a clear deadline for each employee so that there is no violation of the 3-day deadline.

Look at a sample order for accountable persons in 2021.

Order for issuance of accountable amounts on salary cards: sample in 2021

Not all companies have and maintain a cash register. In this case, you can issue money on account to employees’ salary cards. But this point must be fixed in a local act of the company, for example, in the accounting policy. It is enough to include the following phrase “The company issues accountable amounts either through the cash register or transfers them to employee salary cards”

At the same time, it is safer to draw up a similar order to issue a report or application to an employee with a director’s visa. If this is not done, then there is a risk that the tax authorities and the bank may decide that this is not accountable income, but other income, and demand personal income tax from it.

For a sample order for issuing money to report on salary cards in 2018, see below.

Order to report to the manager

In order to report funds to the general director, he needs to draw up an application (an order is not suitable in this case).

In this case, the director’s statement will differ from the statement of an ordinary employee:

- The director draws up an application in the name of the company, and not in the name of the director;

- Instead of the phrase “I ask you to issue” you should indicate “it is necessary to issue”;

- At the end, the director puts his signature, which at the same time authorizes the release of money on account.

Sample application for reimbursement of expenses in 2021

If an employee spent his own money for the company’s purposes, then the company must reimburse him for this money. In this case, the employee must draw up a statement, which will be the basis for compensation for the employee’s expenses. At the same time, it is no longer necessary to indicate that these amounts are accountable, because this issuance of money will no longer be accountable.

View a sample application for employee reimbursement in 2021.

Responsibility for the absence of an order or statement

There is no direct rule by which a company can be held liable for the absence of an order to issue reports. Tax officials may try to impose a fine of 50 thousand rubles. according to Art. 15.1 of the Code of Administrative Offenses of the Russian Federation, as for violation of work with cash.

However, according to the court, the absence of a statement or order is a violation of the procedure for issuing cash, and not a violation of the procedure for conducting cash transactions. And there are no fines for this (see, for example, the decision of the Seventh Arbitration Court of Appeal dated March 18, 2014 No. A03-14372/2013).

Source: https://www.RNK.ru/article/215726-prikaz-na-vydachu-podotchetnyh-summ-2018-obrazets

We are changing the regulations on conducting cash transactions

Changes in accountable amounts in 2021 also affected documentation. Since the procedure for issuing accountable amounts has changed since August 19, 2021, enterprises should update the regulations on working with accountable amounts.

Employees can receive accountable funds in cash at the company's cash desk. The company can also transfer money to a bank card, including an employee’s salary card (see Directive No. 3073-U, letter of the Ministry of Finance of Russia dated July 25, 2014 No. 03-11-11/42288). To make this possible, the procedure for settlements with reporting employees should be recorded in the company's accounting policies.

Money is issued through the cash desk according to the following requirements:

- When preparing cash documents, the accountant must be guided by the provisions of instruction No. 3210-U.

- Money is issued to an accountable person on the basis of an order (or other administrative document) or his written application. According to the letter of the Central Bank of the Russian Federation dated 09/06/2017 No. 29-1-1-OE/2064, the order must be signed by the director, it must indicate the date and registration number.

- The period for which accountable funds are issued is established in the administrative document for their issuance. The deadline for the report, according to paragraph. 2 clause 6.3 of instruction No. 3210-U, is 3 days. During this time, the accountable must report or return the money to the organization.

- The issuance of money for reporting from the cash register is formalized by an expense order. Return of balances of accountable amounts - receipt orders. Money can also be issued by transferring it to the applicant’s bank card (letter of the Ministry of Finance dated August 25, 2014 No. 03-11-11/42288). The accountant can also return the money by transferring funds to the company’s current account. However, the possibility of non-cash accountable payments should be enshrined in the accounting policy.

- There is no limit on the amounts that can be reported. Therefore, the enterprise has the right to issue money to the accountable person in any amount. The settlement limit (RUB 100,000 per agreement) must be taken into account only when making payments between enterprises.

- Issuing money on account to a person who has a debt on accountable amounts is not a violation of the law from 08/19/2017.

- Organizations and individual entrepreneurs can issue money on account not only to those employees who work on the basis of a permanent employment contract, but also to those who are in civil legal relations with the enterprise (letter of the Central Bank of the Russian Federation dated October 2, 2014 No. 29-1-1-6 /7859).

- Issue from the cash register to the report is documented by posting Dt 71 Kt 50. You can also indicate Dt 71 Kt 51 when transferring funds to the card.

What are the requirements for cash register work?

Directive of the Bank of Russia dated October 5, 2020 No. 5587-U provided, in particular, that organizations and entrepreneurs can conduct cash transactions using automatic devices that operate automatically without the participation of employees.

Automatic devices, the design of which provides for the acceptance or issuance of banknotes, must have the function of recognizing at least four machine-readable security features over the entire area of the banknote, the list of which is established by Bank of Russia Regulation No. 630-P dated January 29, 2018.

A ban has been introduced for cashiers to issue banknotes that contain damage, including:

- contamination of the surface of the front or back sides, leading to a decrease in image brightness by 8% or more;

- extraneous inscriptions consisting of two or more signs or symbols;

- extraneous drawings, stamp impressions;

- contrasting spots with a diameter of 5 mm or more.

If a Bank of Russia banknote contains one or more of these damages, as well as others specified in clause 2.9 of Bank of Russia Regulation No. 630-P dated January 29, 2018, they should be handed over to the bank.

It is clarified that, according to a cash receipt order, it is necessary to issue from the organization’s cash desk the cash necessary for carrying out cash transactions, not only to a separate unit, but also to load an automatic device.

Previously on the topic:

“Separate buildings” will be freed from cash books

The Federal Tax Service has the right to demand cash documents and fine for failure to submit

Main rules

Let's summarize the above:

- Any amount can be issued against the report.

- From August 19, 2017, in order to receive money on account, an employee only needs an order from the head of the company. You don't have to write a statement.

- Also, regarding accountable persons, the 2021 changes say that from August 19, 2017, they can receive cash on account, even if they have not repaid the debt on the previous advance.

- Accountable amounts can be transferred to bank cards.

- From August 19, 2021, it is necessary to update local acts on settlements with accountable persons.

Regulations on the procedure for settlements with accountable persons

Now let's take a closer look at the procedure for filling out the document.

Filled out by employee

Front side.

So, on the front side of form No. AO-1, the employee must:

- Indicate the company name and OKPO code.

2. Enter the date the document was compiled and assign a number.

3. In the “report in amount” column we enter the amount that the employee spent on the household needs of the enterprise. For example, he was given five thousand rubles, but he spent four thousand. Therefore, in this column he indicates four thousand.

4. We indicate the name and code of the structural unit.

5. After this, indicate your full name. the accountable person, his personnel number and profession (position).

6. Enter the purpose of the advance.

7. On the left side of the table located on the front side of the form, indicate the amount of the amount received from the company’s cash desk (or to a bank card). If necessary, indicate the amount of money issued in foreign currency.

8. We indicate the total amount of funds received.

9. We indicate the amount spent on the business needs of the enterprise.

10. Indicate the amount of the balance.

Reverse side.

11. On the reverse side of the form, in columns 1-6, the employee must list all documents (sales receipts, cash receipts, etc.) confirming the expenses made by the employee, indicating the amounts spent. Documents must be numbered according to the order in which they are listed in the expense report.

Now about what information the employee should enter in the appropriate columns:

- 1 — payment number assigned to the document confirming expenses;

- 2 - date of check;

- 3 — check number;

- 4 - name of the document confirming expenses;

- 5 - the amount of expenses incurred in rubles is entered here;

- 6 - to be filled in if necessary. It indicates the amount of the expense incurred in foreign currency;

- the “Total” line indicates the total amount of expenses.

12. After the employee has filled out the required fields, he must put his signature on the form with a transcript. Next, you need to submit the document to the accounting department. The accountant will check that the form is filled out correctly.

Filled out by an accountant

Front side.

13. After receiving the form, the accountant must ensure that it is filled out correctly. If no errors are found, the accountant makes a note about this in the “report verified” column and signs it.

https://www.youtube.com/watch?v=2j9Os6zoBF4

14. Next, the accountant indicates information about the entered balance/overspending.

After this, the accountant proceeds to further fill out the form.

15. The accountant fills out the detachable part of the form, signs it and gives it to the employee

Reverse side.

16. The accountant records information in columns 7 and 8. The amounts of expenses accepted for accounting are indicated here. Column 9 indicates the numbers of accounting accounts that are debited for the amount of expenses. The amounts indicated by the employee and the accountant must be the same.

After this, the accountant fills out the front side of the expense report.

Front side.

17. On the front side in the right table, the accountant enters the following information:

- balance or overspending of the previous advance;

- the amount of the advance received from the enterprise's cash desk;

- amount of money spent;

- balance or overexpenditure of advance amounts;

- accounting entry - information is taken from the data in column 9, which is on the reverse side.

18. Next, the accountant sends the document to the chief accountant, who also checks it. After checking the expense report, the chief accountant puts his signature on it and sends it to the head of the enterprise for approval.

19. The director approves the document and returns it to the accounting department. After that, it is stored in the company’s accounting department for 5 years. After this period it is destroyed.

possible on our website.

Download

When issuing accountable amounts to an employee for settlements with counterparties, you should remember the maximum amount of cash settlements under one agreement concluded between organizations, between organizations and individual entrepreneurs.

According to clause 6 of Directive No. 3073-U, cash payments in rubles and foreign currency between participants in cash payments within the framework of one concluded agreement are carried out in an amount not exceeding 100,000 rubles. or an amount in foreign currency equivalent to RUB 100,000. at the official exchange rate of the Bank of Russia on the date of cash payments.

It is worth noting that such a restriction applies to the fulfillment of civil obligations provided for in an agreement concluded between participants in cash payments, and (or) arising from it and executed both during the validity period of the agreement and after its expiration (paragraph 2 P.

One contract or several?

The limit on the amount of settlements with cash is valid within the framework of one agreement, and therefore participants in cash settlements try to circumvent this limitation by dividing the amount into several agreements. When checking cash discipline, tax authorities try to attract participants in cash payments who have artificially broken the agreement.

That is, if organizations and individual entrepreneurs enter into several agreements of the same type, payment for which will be made in cash, the Federal Tax Service considers such agreements as formally concluded, aimed at completing one and not several transactions. As a result, the tax authorities hold the parties to the transaction administratively liable under Part 1 of Art. 15.1 Code of Administrative Offences.

At the same time, judicial practice is for the most part on the side of participants in cash payments. Argument: the conclusion of essentially standard contracts of a civil law nature cannot serve as a basis for the conclusion that the parties entered into one transaction and exceeded the established amount of cash settlement (resolution of the Second Arbitration Court of Appeal dated 23.05.