Free legal consultation!

Not every willing entrepreneur or legal entity can switch to the “simplified” system.

To do this, certain requirements must be met (they are established in the Tax Code): • the number of enterprises is no more than 100 people; • lack of branches; • the amount of revenue for the year does not exceed 150 million rubles; • residual value of fixed assets – no more than 150 million rubles; • share of third parties in the authorized capital – no more than 25%.

An organization that meets these requirements can submit an application to the Federal Tax Service at the place of registration to switch to the simplified system. This must be done within a month after the termination of activities subject to UTII or no later than December 31 of the current year, in order to keep records on the simplified tax system from the next day.

There is one nuance in the transition: if revenue from the beginning of the year exceeds 150 million rubles, you will have to return to OSNO, and from the beginning of the quarter when this limit was exceeded.

There are also restrictions on types of activities: for example, organizations producing goods subject to excise taxes cannot switch to the simplified tax system. It is also impossible to choose between UTII and simplified tax system: if an activity falls under UTII, there are no other regimes for this type of activity. However, enterprises operating in different areas, some of which are subject to UTII, and some not, will have to keep separate records and submit both a declaration under the “imputed tax” and reporting under the simplified tax system.

Balance is different, or “Balance” for small businesses

In concern for certain categories of organizations, the Ministry of Finance of the Russian Federation finally issued Order No. 113n dated August 17, 2012 (hereinafter referred to as the Order).

For some time, the draft of this document (almost verbatim) was posted on the ministry’s website, and now it has been adopted. However, at the moment it has not yet been officially published. In this regard, the question remains open when the Order will take effect. Let us note that the draft contained clause “4”, which stated that the document was to come into force starting with the annual accounting (financial) statements for 2012. Now there is no such clause, which means that the Order will come into force 10 days after the day of official publication, as is accepted by the current legislation in relation to regulatory legal acts of federal executive authorities.

And again benefits for small businesses

The document under consideration amends the order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n “On the forms of financial statements of organizations.” In fact, the Order approved new, additional forms of accounting statements - balance sheet and profit and loss account.

These accounting forms are not intended for all taxpayers, but only for small businesses.

Therefore, first let us recall who has the right to classify themselves in this category.

The criteria for classifying taxpayers as small businesses are enshrined in Federal Law No. 209-FZ dated July 24, 2007

“On the development of small and medium-sized businesses in the Russian Federation.” Without considering medium-sized businesses (the new simplified form of balance sheet does not apply to them), we will highlight the following categories of small businesses:

- consumer cooperatives;

- commercial organizations (except for state and municipal unitary enterprises);

- individuals carrying out entrepreneurial activities without forming a legal entity (individual entrepreneurs);

- peasant (farm) farms.

All these persons, firstly, must be entered into the Unified State Register of Legal Entities (USRLE) or into the Unified State Register of Individual Entrepreneurs (USRIP).

Secondly, must meet the following conditions:

- for legal entities -

the share of participation of the Russian Federation, constituent entities of the Russian Federation, municipalities, foreign legal entities, foreign citizens, public and religious organizations (associations), charitable and other funds in the authorized (share) capital (share fund) should not exceed 25 percent (for excluding assets of joint-stock investment funds and closed-end mutual investment funds); - for legal entities -

the share of participation owned by one or more legal entities that are not small and medium-sized businesses must not exceed 25 percent (this restriction does not apply to business entities whose activities involve the practical application (implementation) of the results of intellectual activity, exclusive the rights to which belong to the founders (participants) of such business entities); - for all -

the average number of employees for the previous calendar year should not exceed one hundred people inclusive, including for micro-enterprises - up to fifteen people; - for all -

revenue from the sale of goods (work, services) excluding VAT or the book value of assets (residual value of fixed assets and intangible assets) for the previous calendar year should not exceed the limit values established by the Government of the Russian Federation. In accordance with the Decree of the Government of the Russian Federation dated July 22, 2008 No. 556 “On the maximum values of revenue from the sale of goods (works, services) for each category of small and medium-sized businesses” since 2008 for a small enterprise the “ceiling” is 400 million rubles, for microenterprises - 60 million rubles.

Let us remind you that Law No. 209-FZ does not require registration as a small business entity, so in order to be one, you just need to comply with the established requirements. They, as a rule, are checked every time an enterprise or individual entrepreneur applies for state support in this capacity, for example, when submitting an application to switch to the simplified tax system, and now when submitting a simplified balance sheet form.

Let’s clarify the situation a little for entrepreneurs. Individual entrepreneurs and persons engaged in private practice are exempt from accounting if they keep records of income and expenses in accordance with the legislation on taxes and fees (Article 6 of Federal Law No. 402-FZ). Therefore, they may not represent even a simplified form of balance sheet.

Simplified balance: basic rules

Individual entrepreneurs do not keep accounting records and do not submit an annual balance sheet; this form is provided only for legal entities. If an enterprise applies several tax regimes, including OSNO, it must report in full, that is, include indicators for the enterprise as a whole. A simplified balance sheet is a form of document where only those lines for which there are indicators are filled out. For example, if the company does not have fixed assets, there is no need to fill out the corresponding line.

Useful: Preferential types of activities under the simplified tax system A simplified balance sheet under the simplified tax system is submitted if the organization applies only one taxation system. The form of the simplified balance sheet is the same as the full one, only not all asset and liability lines are filled out.

The balance sheet must be submitted by March 31 of the following year. If this date falls on a weekend - Saturday or Sunday - the balance is due on the first working day, that is, on Monday.

What the law says

Now let's see how the accounting law regulates this provision. The current law (Federal Law No. 129-FZ dated November 21, 1996) provides that the financial statements of organizations, with the exception of the statements of state (municipal) institutions, as well as public organizations (associations) and their structural divisions that do not carry out entrepreneurial activities and have no other disposed property turnover for the sale of goods (works, services), consists of:

(see text in the previous edition)

- balance sheet;

- profit and loss statement;

- appendices to them, provided for by regulations;

- auditor's report (if an audit is required)

- explanatory note.

At the same time, this law provides that organizations that have switched to a simplified taxation system and organizations that have received the status of participants in the Skolkovo project are exempt from the obligation to maintain accounting records. True, nothing is directly said about the simplified composition or form of accounting.

On January 1, 2013, the Federal Law of December 6, 2011 No. 402-FZ “On Accounting” comes into force. It regulates the simplification of accounting methods, including simplified accounting (financial) reporting

, for small businesses and certain forms of non-profit organizations.

The main innovation is balance and the so-called Form No. 2 has lost a lot of weight. The balance sheet contains five lines to reflect asset items and six for liability items.

Note that organizations that have received the status of participants in the Skolkovo project will also have the right to use simplified accounting methods, including simplified accounting (financial) statements established for small businesses. This is explicitly stated in the new accounting law. Therefore, to the list of persons classified as small businesses that we cited above, we will add this category of taxpayers.

Let us remember one more point. The Ministry of Finance of the Russian Federation constantly informs that small businesses that are not required to conduct an audit of the reliability of financial statements can present financial statements only as part of the balance sheet and profit and loss statement without additional transcripts, that is, not in detail. The instruction on the scope of financial reporting forms, approved by Order of the Ministry of Finance of Russia dated July 22, 2003 No. 67n, is posted on the website of the Ministry of Finance of Russia.

“Lightweight” reporting forms

Let's return to the financial statements themselves. (see text in the previous edition)

Order No. 66n established that small business organizations prepare financial statements according to the following simplified system:

- the balance sheet and profit and loss account include indicators only for groups of items (without detailing indicators for items);

- in the appendices to the balance sheet and profit and loss statement, only the most important information is provided, without knowledge of which it is impossible to assess the financial position of the organization or the financial results of its activities.

And now the Order has approved specific simplified forms of the balance sheet and profit and loss account. And this will be the required minimum of accounting with which small businesses will have to report according to the new rules.

There will be no need to submit any change of capital forms, cash flow forms or explanatory notes.

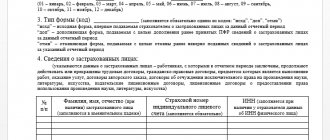

The main innovation is balance and the so-called Form No. 2 has lost a lot of weight. The balance sheet contains five lines to reflect asset items and six for liability items. Form No. 2 has even less - only seven lines. Moreover, if the usual balance sheet had several sections, assets, for example, were divided into non-current and current, then in the simplified form there are no sections. In such a balance you only need to fill in the lines:

By assets

:

- Tangible non-current assets. According to the explanations in the form of links to the lines of the form, this line should include fixed assets and unfinished capital investments in fixed assets.

- Intangible, financial and other non-current assets. This should also include the results of research and development, unfinished investments in intangible assets, research and development, and deferred tax assets.

- Inventories.

- Cash and cash equivalents.

- Financial and other current assets, including accounts receivable.

By liabilities

:

- Capital and reserves.

- Long-term borrowed funds.

- Other long-term liabilities.

- Short-term borrowed funds.

- Accounts payable.

- Other short-term liabilities.

Now, if a small enterprise still has such separate data as VAT on acquired assets, estimated liabilities, deferred tax liabilities, etc., then they can be safely added to the “Other long-term liabilities” indicator.

Form No. 2 is also a “light” version. In its seven lines it will be necessary to reflect:

- Revenue.

- Expenses for ordinary activities.

- Percentage to be paid.

- Other expenses.

- Profit tax (income).

- Net income (loss).

As you can see, in the simplified Form No. 2 many indicators are not visible (gross profit/loss, income from participation in other organizations, profit/loss before tax, current income tax, including PNO and PNA and changes in IT). However, there are small clarifications (links) to the report form, which, for example, clarify that in the “Revenue” line the data is given minus VAT and excise taxes, that is, exactly the same as according to the rules for drawing up regular Form No. 2.

And, for example, expenses for ordinary activities must include cost of sales, selling and administrative expenses. In “Income taxes (income)” - current income tax, changes in deferred tax liabilities and assets.

What is really missing from the new form is background information such as revaluation results, basic and diluted earnings/loss per share. There will be no need to display such information even in collapsed form.

note

: new samples of balance sheet and Form No. 2 already assume that financial statements will be submitted only annually. This is evidenced by the wording of the columns indicating the reporting period. Most likely, the submission of interim reporting (for a month or quarter) will be canceled from January 1, 2013. True, the obligation to prepare monthly and quarterly reports is not canceled, and the fact that they will not have to be submitted to the tax authority changes little for accountants.

Among other things, the Order supplements the following norm: “If the financial statements of certain categories of organizations (for example, small businesses) include aggregated indicators that include several indicators (without their detail), the line code is indicated by the indicator that has the greatest share in composition of the aggregated indicator."

Thus, organizations independently determine which line (indicator) to include certain information. But this must be done while observing the above rule.

Guide for the simplified tax system

With this e-book, you will easily understand all the intricacies of the simplified taxation system, competently draw up a balance sheet and financial statements. You will receive the electronic edition immediately after payment to your email. Find out more about the publication >>

An example of filling out a simplified balance sheet for the simplified tax system

As an example of filling out a simplified balance sheet for the simplified tax system, let’s take a conditional enterprise that applies only a simplified taxation regime.

The balance sheet consists of the following lines:

1. Tangible non-current assets are fixed assets, construction in progress, fixed assets acquired but not put on the balance sheet. 2. Intangible assets: licenses, computer programs, etc. 3. Inventories - goods, raw materials, materials and semi-finished products, finished products, if the company is engaged in production. 4. Cash – the balance of funds in the enterprise’s cash register and bank accounts. 5. Financial assets – accounts receivable, bills of exchange, prepayments and other financial investments.

The asset balance consists of the sum of the lines (the total cost of the organization's working and non-current assets).

The liability balance consists of the amount of capital (authorized, reserve and additional), retained earnings or losses, long-term and short-term monetary obligations (loans, credits, accounts payable, tax liabilities).

Useful: How to keep separate records of the simplified tax system and UTII

When preparing annual financial statements, the balance sheets of assets and balance sheets of liabilities must be equal. In the general ledger, the numbers are reflected in rubles and kopecks, and they must converge to the kopecks. In the form submitted to the Federal Tax Service, the values are enlarged (up to thousands of rubles, millions of rubles).

Sample (algorithm) for drawing up a balance sheet:

• line 1150 indicates the residual value of non-current assets; • line 1170 – residual value of intangible assets; • in line 1210 enter the total cost of all materials, goods, etc. available in warehouses; • if buyers owe you money, the amount of debt must be indicated in line 1230; the amount of prepayments made to suppliers is also added here; • in line 1250 you should indicate the amount of balances on current accounts in banks and the amount of cash stored in the company's cash desk.

To summarize: we add up the values for all rows.

Next, we create a passive section:

• the amount of authorized capital, reserve capital, remaining retained earnings must be indicated in line 1370; • lines 1410, 1510 are filled in if there are loan obligations to financial institutions; • line 1520 – the amount of unpaid supplier invoices, arrears of staff wages and tax obligations, as well as insurance payments that will need to be paid in January from the December salary; • line 1700 – total amount for the passive section.

If the balance sheet is drawn up correctly, the amounts of lines 1600 and 1700 should be equal. Accounting statements can be sent to the tax office.