How to protect the cash method of accounting for interest under the accrual method

For a long time, in practice, a scheme for optimizing income tax was widely used, in which friendly parties who entered into a loan agreement applied different taxation systems. Borrower - a general regime in which expenses are taken into account for tax purposes on an accrual basis. Lender - a special regime (for example, a simplified regime), in which income is taken into account in the tax base on a cash basis. This made it possible to receive a tax benefit without paying interest on the agreement. The borrower recognized monthly expenses for accrued interest, and the lender did not have a tax liability for unearned interest (see diagram).

Optimization of tax payments through a loan agreement

Thus, the occurrence of tax consequences could be postponed indefinitely, for example, until interest was paid when repaying the loan. However, at the suggestion of the Presidium of the Supreme Arbitration Court of the Russian Federation (resolution No. 11200/09 dated November 24, 2009), this scheme fell apart. The court indicated that unpaid interest cannot form expenses. However, there are arguments to defend the previous more favorable procedure for recognizing expenses. In addition, companies can also try to minimize tax losses. To do this, you need to apply the methodology of the Supreme Arbitration Court of the Russian Federation by analogy to income.

Previously, there were no disputes regarding unpaid interest

Just three and a half years ago, the situation seemed unshakable. Recognition of income and expenses in the form of interest on loans when applying the cash method occurs when funds are actually credited or written off. Of course, unless the obligation was terminated in another way. This procedure is established by Article 273 of the Tax Code of the Russian Federation - paragraph 2 and subparagraph 1 of paragraph 3. Companies using the simplified tax system also recognized income using the cash method - on the basis of paragraph 1 and subparagraph 1 of paragraph 2 of Article 346.17 of the Tax Code of the Russian Federation.

Determining the date of recognition of income and expenses in the form of interest on an accrual basis is regulated by three articles. According to paragraph 6 of Article 271 of the Tax Code of the Russian Federation, income in the form of interest was considered received and was included in non-operating income at the end of the month of the corresponding reporting period. And in case of termination of the agreement - on the date of termination. This norm is repeated almost verbatim in paragraph 8 of Article 272 of the Tax Code of the Russian Federation regarding the date of recognition of non-operating expenses.

As can be seen from reading the two standards, the main challenge is to determine which period can be considered “relevant”. To do this, you need to refer to Article 328 of the Tax Code of the Russian Federation, which determines the specifics of maintaining tax accounting of income and expenses in the form of interest under credit and loan agreements. The provisions of paragraph 1 of Article 328 of the Tax Code of the Russian Federation require the maintenance of analytical accounting, which reflects income and expenses in the amount of interest due. The terms of the contracts indicate how much interest is due. These amounts are determined based on the profitability established for the loan or credit and the duration of the debt obligation in the reporting period. In analytical accounting, these income and expenses are taken into account on the last day of the month of the reporting period or during the period of expiration of the contract (in accordance with the given norms of Articles 271 and 272 of the Tax Code of the Russian Federation). This procedure for recognizing expenses with the clause on the use of the accrual method is actually repeated in paragraph 2 of paragraph 4 of Article 328 of the Tax Code of the Russian Federation.

For a long time, these norms were interpreted as follows. If the parties have established a condition in the contract for the payment of interest, then, based on paragraph 4 of Article 809 of the Civil Code of the Russian Federation, this interest is accrued in proportion to the number of days of use of borrowed funds. This means that if the borrower has used the loan for at least a day, the lender has the right to receive interest. He will be able to exercise his right when the interest payment deadline specified in the agreement arrives.

Accordingly, companies have income and expenses every day. Their size is determined based on the rate of return in terms of one day. And under the rules above, accrual-basis taxpayers determine at the end of each month how much income or expense to recognize. The cash settlement may not yet have been settled, but if the accrual method is used, this does not matter for tax purposes.

Such clarifications have been repeatedly provided by the Russian Ministry of Finance. In his opinion, the basis for recognizing income and expenses was an existing debt obligation, including its terms providing for the accrual of interest (letters dated May 21, 2009 No. 03-03-05/91 and dated April 18, 2007 No. 03-03-05/ 96).

The Presidium of the Supreme Arbitration Court of the Russian Federation prohibited recognizing unpaid interest as expenses

Recognized by all participants in tax relations as the only true and unshakable system for accounting for income and expenses, it was shaken after the Presidium of the Supreme Arbitration Court of the Russian Federation adopted Resolution No. 11200/09 dated November 24, 2009. Let us recall that in the case considered in the resolution, the tax authorities refused to recognize the company in the audited periods - 2005 and 2006 - as expenses in the form of unpaid interest.

The parties to the loan agreement included very unusual conditions in the agreement: the loan was to be repaid in stages over several years until 2010. And only after that - from 2010 to 2014 - the interest was repaid. Let us recall that Articles 319 and 809 of the Civil Code of the Russian Federation generally imply the reverse procedure: the debtor first repays the interest, and then the principal amount of the debt. But, remembering the freedom of contract (clause 4 of Article 421 of the Civil Code of the Russian Federation), the tax inspectorate did not challenge the terms of the agreement in question. She tried to exclude the amount of unpaid interest from expenses.

The Presidium of the Supreme Arbitration Court of the Russian Federation proposed a new reading of the provisions of Article 328 of the Tax Code of the Russian Federation in relation to this loan agreement. The court decided that the lender’s right to receive interest arises no earlier than the period established by the agreement; this is regulated by Article 809 of the Civil Code of the Russian Federation. And based on tax norms, the taxpayer must form a tax base taking into account the income and expenses that he has incurred by virtue of the agreement. When applied to a specific case, this meant that until the taxpayer had an obligation to pay interest, he should not recognize the corresponding expenses. This means that he does not have the right to reduce taxable profit by the amount of interest not payable in the current period.

For several months, specialists from the Federal Tax Service of Russia verbally explained that taxpayers should not worry about the revision of the methodology. In their opinion, the Presidium of the Supreme Arbitration Court of the Russian Federation made a decision on a specific case in relation to the terms of the loan agreement considered in it. And those who do not provide for such payment schemes under loan agreements have nothing to worry about.

To confirm its words, the Federal Tax Service of Russia, a few months later, issued a letter dated March 17, 2010 No. 3-2-06/22. It states that the decision of the Presidium of the Supreme Arbitration Court of the Russian Federation is based on the selective application of the norms of the Code. According to the tax authorities, there were no grounds for changing the established approach to the procedure for recognizing interest in connection with the decision of the Supreme Arbitration Court of the Russian Federation.

However, their colleagues on the ground apparently believed that there were grounds for reconsideration. Because following this decision, taxpayers began to be denied recognition of expenses in the form of interest if their actual payment was envisaged in a different period. And quite often the courts supported such decisions of the inspectorates. As an example, we can cite the decisions of the federal arbitration courts of the Central from 09.25.12 No. A36-758/2011, from 08.08.12 No. A36-5098/2011, of the North Caucasus from 10.18.12 No. A53-19699/2011, of Moscow from 07.05. 12 No. A41-20293/11 districts.

Formally, tax officials do not challenge the previous procedure for recognizing expenses

The current situation is reminiscent of a version of the fairy tale about the turnip, when a giant vegetable grown by a peasant was presented to the king. He gave the worker a precious casket. And they both sat and grieved. On the one hand, the king is next to a rotting turnip, on the other, a hungry peasant is next to a gift, which cannot be sold, because it is a royal one. Everyone became happy when everything returned to normal: the turnip to the peasant, the casket to the king.

It is obvious that the duality of the approach is inconvenient for both taxpayers and tax authorities and does not suit both parties. We believe that they will try to eliminate such uncertainty in the issue of recognizing expenses and income in the form of interest under loan agreements. Perhaps the necessary clarifications will be made to the relevant articles of the Tax Code of the Russian Federation. This option was proposed by the Federal Tax Service of Russia in letter dated March 17, 2010 No. 3-2-06/22. However, now the company can defend a beneficial procedure for recognizing interest in expenses on an accrual basis.

Moreover, formally the fiscal authorities do not seem to require the use of the original methodology of the Presidium of the Supreme Arbitration Court of the Russian Federation. Thus, the Federal Tax Service of Russia determined its position immediately after the appearance of this resolution and has not changed since then. When applying the accrual method, tax authorities want to recognize income and expenses in the form of interest on borrowed obligations also on an accrual basis. And this means forming the tax base as the right to formally receive interest arises, and not as it is actually paid. In addition to the letter already mentioned, such clarifications are given in letters dated 08/11/10 No. ШС-37-3/ [email protected] , dated 06/16/10 No. ШС-37-3/ [email protected]

The Russian Ministry of Finance has also been explaining all these years that the procedure for accounting for interest when applying the accrual method does not depend on the actual date of payment of interest. Interest must be included in income and expenses evenly throughout the entire term of the debt obligation (letters dated 09.25.12 No. 03-03-06/1/500, dated 09.17.12 No. 03-03-06/2/108, dated 15.06. 11 No. 03-03-06/1/345, dated 08/16/10 No. 03-03-06/1/549).

And even the Supreme Arbitration Court of the Russian Federation itself has already clarified its position on decision No. 11200/09 in Resolution of the Presidium dated 06/07/11 No. 17586/10. In particular, the court indicated that the 2009 decision addressed the exceptional issue of accounting for interest under a loan agreement for profit tax purposes. The decision of the senior arbitrators was due to the fact that in the case they considered, the loan agreement provided for the payment of interest at a later period than the repayment of the principal amount.

It can be assumed that the court considers the earlier decision not to be universally applied. Under agreements with the usual procedure for paying interest - during the term of the loan agreement or when repaying the loan - the general procedure for accounting for expenses that was in force before the controversial decision may be applied.

District courts also quite often tend to favor the “old” interpretation of the provisions of Article 328 of the Tax Code of the Russian Federation. In these cases, when one of the parties to the arbitration refers to Resolution No. 11200/09, such a position is recognized as erroneous, indicating that this decision was made on a specific dispute.

The arbitrators note that when applying the accrual method, it is unlawful to “shift” the recognition of income and expenses in the form of interest to the period of their actual payment (resolutions of the Volga Federal Arbitration Courts dated 02.21.12 No. A55-12535/2011, dated 09.15.11 No. A55-27130/ 2010, dated 02/10/11 No. A12-13182/2010, East Siberian District dated 02/10/12 No. A78-4116/2011, Moscow District dated 07/13/10 No. KA-A40/7211-10, Thirteenth Arbitration Court of Appeal dated 09/11/12 No. A42-2049/2012).

Thus, the positions of borrowers who recognize actually unpaid interest as expenses that reduce the taxable profit of the current period look quite strong. Moreover, the logic set out in the resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation can hurt the tax authorities themselves.

There is a reason to recognize interest income “on payment” under the general regime

If the new methodology for recognizing interest becomes widespread, the described scheme for obtaining tax savings under a loan agreement will no longer work. But in addition to this, conscientious lenders under the general regime, in accordance with the position of the Supreme Arbitration Court of the Russian Federation, were deprived. After all, the Presidium did not relieve them of the obligation to recognize interest in income that was not actually received. As a result, a situation is possible when the lender’s income under the general regime does not correspond to the expenses of the borrower using the same accrual method: income is recognized monthly, and expenses are recognized after payment.

Naturally, companies tried to challenge this one-sided approach. Referring to the norms of Article 328 of the Tax Code of the Russian Federation and appealing to the Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated November 24, 2009 No. 11200/09, attempts were made to prove the legality of recognizing income in the form of interest using the cash method (only after receiving the money) and when using the accrual method. Taxpayers pointed to paragraph 6 of Article 271 of the Tax Code of the Russian Federation, which requires the recognition of income at the end of the reporting period or at the date of termination of the contract. And according to the Supreme Arbitration Court of the Russian Federation, the period for recognizing interest is determined by the date of payment in accordance with the agreement. This means that non-operating income should be recognized on the last day of the period when interest is received, or on the last day of the contract. Thus, the lender has no reason to recognize income until the money is received or the payment date is due.

This tactic does not create a new scheme for optimizing income tax. But it allows you to get tax savings by “shifting” the moment of recognition of income to the same period when, in accordance with new trends, it was necessary to recognize expenses. That is, it neutralizes the negative consequences of the decision of the Supreme Arbitration Court of the Russian Federation.

As a result, several courts, one after another, made decisions in favor of taxpayers. The courts have indicated that for the purpose of calculating income tax, taxpayers have the right to recognize income in the form of interest in the period when the right to receive it in accordance with the agreement arose. At the same time, the courts defined the “right to receive” as the right to demand payment of interest.

With this interpretation, the date of recognition of income was the date of payment of interest under the agreement. In particular, this point of view is reflected in the decisions of the Federal Arbitration Courts of the Central Federal Arbitration Court dated 01/25/12 No. A54-1577/2011 and dated 02/07/11 No. A54-892/2010, Moscow dated 10/19/12 No. A40-28488/12-140-137 , West Siberian district dated 04/06/11 No. A45-8330/2010.

Commentary to Art. 271 Tax Code of the Russian Federation

The procedure for recognizing income using the accrual method is established by Article 271 of the Tax Code of the Russian Federation. Income using the accrual method is recognized in the period in which it arises. It does not matter whether the organization received money or other property (property rights) associated with these incomes.

According to paragraph 3 of Article 271 of the Code, income from sales using the accrual method should be recognized at the time of shipment (transfer) of goods (work, services, property rights). In turn, the day of shipment is considered the day of sale. Article 39 of the Tax Code of the Russian Federation recognizes the sale of goods, work or services, respectively, as the transfer of ownership rights to goods, performance of work or provision of services.

Some contracts may provide for a special procedure for transferring ownership of goods. Most often, they indicate that ownership passes to the buyer after partial or full payment for the goods. In this case, income for the seller who uses the accrual method also arises after partial or full payment for the goods.

As for property rights, according to Article 38 of the Tax Code of the Russian Federation, property rights for tax purposes are not recognized as property (hence, also as goods). That is, the rules of Article 39 of the Tax Code of the Russian Federation do not apply here. However, with regard to this type of property rights, such as the right to claim, the procedure for determining the date of receipt of income from its sale is prescribed in paragraph 5 of Article 271 of the Tax Code of the Russian Federation. For a creditor who has received the right to a monetary claim, income is recognized on the day of subsequent assignment or execution by the debtor of this claim. If the right to claim a debt for sold goods (works, services) is assigned directly by the seller of these goods (works, services), then the date of receipt of income from this operation is considered to be the day of signing the act of assignment of the right of claim. Moreover, in this case, income is considered non-operating.

Paragraph 4 of Article 271 of the Tax Code of the Russian Federation determines when non-operating income should be recognized for tax purposes.

For example, if a company received property free of charge, income is recognized on the day when the parties sign an act of acceptance and transfer of property (acceptance and delivery of work, services).

Interest, penalties and fines are recognized as income on the day they are accrued. Some loan agreements (credit agreements) do not provide for uniform payment of interest. However, for tax purposes, such interest must be included in income in equal quarterly shares.

Income from participation in a simple partnership or from trust management of property must be recognized on the last day of the first quarter, half year, 9 months and year.

When liquidating a fixed asset item, an organization can receive income in the form of materials remaining after its dismantling. Such income is considered received on the day when the act of liquidation of depreciable property was drawn up.

And finally, targeted funds that the organization used for other purposes are included in non-operating income on the day they are received into the organization’s current account (cash).

An organization that uses the accrual method must increase or decrease its income by the amount of the amount differences (clause 7 of Article 271 of the Tax Code of the Russian Federation). We are talking about those amount differences that arise when the price of goods (work, services, property rights) is expressed in foreign currency or conventional monetary units, and payment for them is made in rubles.

1.1.1. Date of recognition of income in tax accounting

As a general rule, under the accrual method, income must be recognized in the reporting period in which the right to receive it arose, regardless of the fact of payment. At the same time, there is a rule in the Tax Code of the Russian Federation that provides grounds for taking into account income much later - after final settlements with the buyer.

In paragraph 3 of Art. 271 of the Tax Code of the Russian Federation directly states that for income from sales, the date of receipt of taxable proceeds is recognized as the moment of transfer of ownership of the goods.

Indeed, according to the contract, ownership passes to the buyer at the moment of full payment for the goods. Therefore, the seller does not accrue income tax until he receives actual cash for the item (that is, as under the cash method). The Presidium of the Supreme Arbitration Court of the Russian Federation at one time decided: with the accrual method, the contractual condition on the transfer of ownership of the goods after payment does not matter if the relations of the parties clearly indicate that the buyer (debtor) has actually assumed the rights of the owner. For example, he has not yet fully paid the seller for the goods, but has already managed to resell them. In such a situation, according to the court, the seller working on the accrual basis receives income at the time of the actual transfer of the item, and not after all settlements with his counterparty.

The Russian Ministry of Finance equated the date of sale to the moment of actual transfer of goods (Letter dated September 20, 2006 N 03-03-04/1/667). Officials pointed out that for income tax purposes, the condition of the contract regarding the special transfer of ownership of the goods after full payment means nothing at all.

It turns out that postponing the deadline for paying income tax to a later date is risky. The tax office will most likely examine the terms of the contract regarding the moment of transfer of ownership and compare it with the date of shipment. If it was before payment, the seller will be charged additional arrears and penalties. Therefore, it is safer to charge tax at the time of shipment, without waiting for the receipt of revenue.

There is still an opportunity to brush aside any quibbles and prove your full right to take advantage of the deferment.

It is necessary to provide evidence that the buyer did not actually dispose of the goods before paying for the goods and, accordingly, the formal transfer of ownership. But for this it is necessary that the seller’s unpaid goods are stored by the buyer separately from his goods (for example, in different warehouses) and it is possible to distinguish them (in different containers, packages). It is better to establish in the contract a ban on the buyer alienating the goods to third parties until he becomes the full owner.

And in addition to this, periodically monitor the availability and safety of goods in the buyer’s warehouse (for example, conduct a joint reconciliation and record the results in a report).

A buyer who signs an agreement with a special transfer of ownership will have to come to terms with the fact that this condition will delay the deduction of VAT and write-off of expenses in accounting and tax accounting. After all, both are possible only after the transfer of ownership of the goods. A similar procedure will apply if, according to the contract, the buyer disposes of the goods ahead of schedule - before final settlements with the seller.

If the contracting company begins work in one calendar year and finishes it in another, and there are no conditions for the phased delivery of completed work in the contract, then the inspector will receive a formal basis to require the contractor to recognize part of the income at the end of the first year.

The fact is that such rules are established for the so-called production with a long technological cycle. By this, the Tax Code of the Russian Federation understands the performance of work during more than one tax period (paragraph 2, clause 2, Article 271 of the Tax Code of the Russian Federation). From this norm, tax officials conclude that if the start and completion dates of work fall on different tax periods, then it no longer matters how long the work has been carried out.

The condition in the contract about the stage-by-stage delivery of completed work will not allow inspectors to apply the rules on production with a long technological cycle. There must be at least two stages. Based on the results of each, the dates for signing the act can be brought as close to each other as possible.

Let’s assume that the first stage of work that lasts from November to February can be delivered in mid-February, the second - at the end of this month.

The above fully applies to contracts for the provision of services, which are essentially similar to work (marketing research, scientific development, etc.).

When and at what rate (at the rate on the date of actual shipment or at the rate on the date of transfer of ownership) should goods received from the supplier be capitalized, taking into account that the price of the goods is expressed in conventional units, and payments under the contract are made in rubles? At what point and at what rate can VAT be deducted on these goods?

The Civil Code of the Russian Federation allows the parties to a purchase and sale agreement to establish special conditions for the transfer of ownership of the goods. Article 491 indicates that in cases where the purchase and sale agreement stipulates that the ownership of the goods transferred to the buyer is retained by the seller until payment for the goods or the occurrence of other circumstances, the buyer does not have the right to alienate the goods or dispose of them otherwise before the transfer of ownership rights to him. manner, unless otherwise provided by law or contract or follows from the purpose and properties of the goods.

The Russian Ministry of Finance has clarified the procedure for recognizing sales income using the accrual method in a situation where ownership of a product passes after full payment. According to the Russian Ministry of Finance, this condition of the contract does not in any way affect the moment of recognition of income - revenue must still be recognized on the date of the actual transfer of goods to customers and the issuance of settlement documents to them.

The authors of the Letter confirm their position in paragraph 7 of the Information Letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated December 22, 2005 No. 98.

Indeed, in this document, the Presidium of the Supreme Arbitration Court of the Russian Federation says that revenue can be recognized on the date of actual shipment of the goods, even if ownership passes to the buyer after full payment for the goods.

Before payment for the goods or the occurrence of other circumstances, the buyer does not have the right, before the transfer of ownership rights to him, to alienate the goods or dispose of them in any other way, unless otherwise provided by law or contract or does not follow from the purpose and properties of the goods.

That is, the seller’s right in this case is ensured by the buyer’s prohibition from alienating the goods or disposing of them in any other way until the transfer of ownership of the goods to him.

In other words, the retention of title by the seller does not matter if the transferred goods cannot be distinguished from other goods in the buyer's possession, or if the supplier does not control the safety of the goods and its availability with the buyer, or if the buyer has sold or otherwise disposed of the goods before they are completely sold. payment.

In this case, as the Presidium of the Supreme Arbitration Court of the Russian Federation indicated, the agreement of the parties, not reflecting their actual relations and real financial and economic results, cannot be taken into account for tax purposes.

There are no such reservations in the Letter from the Ministry of Finance. This means that the financial department quite categorically extends the conclusions of the Presidium of the Supreme Arbitration Court of the Russian Federation to those cases when counterparties do not violate the conditions for maintaining the seller’s right of ownership of the goods.

You should also pay attention to another fact indicating the instability of the position of the financial department. Two months before the release of the above Letter, the Ministry of Finance publishes another Letter dated July 20, 2006 N 03-0304/1/598, in which, in a similar situation, the authors come to the conclusion that the organization, when determining the moment of recognition of income from the sale of goods, should proceed exclusively from the period determined by the terms of the supply agreement. An exception to this rule is not allowed in the case where the taxpayer is ready to accept earlier recognition of income from the sale of goods (works, services). We also note the fact that by the time this Letter was published, the position of the Supreme Arbitration Court of the Russian Federation, expressed in its Information Letter, was already known.

In this situation, the taxpayer’s compliance with written explanations on the application of legislation on taxes and fees given by the financial authority or other authorized government body is a circumstance that excludes the person’s guilt in committing a tax offense (clause 3, clause 1, article 111 of the Tax Code

RF).

However, these Letters address the issue of the moment of recognition of income in tax accounting when using the accrual method (Article 271 of the Tax Code of the Russian Federation). The order of receipt of property does not depend on the moment of recognition of income from the other party to the transaction. In the same way, the procedure for applying value added tax deductions on purchased goods may not coincide with the moment the tax is calculated by the supplier of the goods.

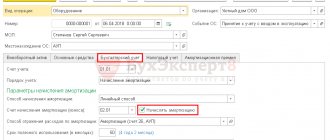

Let us consider the accounting procedure for the acquisition of property subject to a special transfer of ownership. As follows from the clarification of the issue under consideration, the acquired property will be used by the buyer as fixed assets.

Clause 2 of Art. 8 of the Federal Law “On Accounting” obliges organizations, when maintaining accounting records, to take into account property that is the property of the organization, separately from the property of other legal entities held by this organization. The received property is the property of the seller, therefore, until the transfer of ownership, it is registered with the organization separately on off-balance sheet accounts, when recording on which the double entry method is not used. The chart of accounts provides for off-balance sheet account 002 “Inventory assets accepted for safekeeping”, which, in accordance with the Instructions to the Chart of Accounts, takes into account, in particular, receipt from suppliers of unpaid inventory assets prohibited for spending under the terms of the agreement until their payment. Inventory assets are recorded on account 002 “Inventory assets accepted for safekeeping” at the prices stipulated in the acceptance certificates.

Further, at the moment of transfer of ownership, the property is written off from the off-balance sheet account and accepted for balance sheet accounting. According to the rules of accounting for fixed assets, enshrined in PBU 6/01, fixed assets are accepted for accounting at their historical cost, which recognizes the amount of actual costs for the acquisition of this fixed asset. These costs are adjusted for differences in amounts that arise in cases where payment is made in rubles in an amount equivalent to the amount in foreign currency (conventional monetary units). The amount difference is understood as the difference between the ruble valuation, expressed in foreign currency (conventional monetary units), of accounts payable for payment of an item of fixed assets, calculated at the official or other agreed rate on the date of its acceptance for accounting, and the ruble valuation of this accounts payable, calculated at the official or other agreed rate on the date of its repayment.

Considering that the cost of fixed assets in which they are accepted for accounting is not subject to change, except in cases established by the legislation of the Russian Federation (completion, additional equipment, reconstruction, modernization, partial liquidation and revaluation of fixed assets), amount differences can be taken into account in the cost an object of fixed assets only until the object is accepted into the composition of fixed assets.

The assessment of fixed assets, the cost of which upon acquisition is expressed in foreign currency, is made in rubles by recalculating the amount in foreign currency at the exchange rate of the Central Bank of the Russian Federation valid on the date of acceptance of the object for accounting as investments in non-current assets (clause 16 of PBU 6/ 01). A similar procedure can be applied to fixed assets, the cost of which is expressed in conventional units. In this case, the rate established by the terms of the agreement is also applied on the date of acceptance of objects for accounting as investments in non-current assets.

The question of at what rate investments in non-current assets should be capitalized, in this case, comes down to the question of what is considered the date of acceptance of investments in non-current assets for accounting:

— the date of acceptance of the property into off-balance sheet account 002 “Inventory assets accepted for safekeeping” at the time of shipment;

- or the date of acceptance of investments in non-current assets into balance sheet accounts at the time of transfer of ownership.

In essence, the registration of property means its reflection on the accounting accounts, which, in accordance with the Chart of Accounts, also include off-balance sheet accounts. At the same time, taking into account the requirements of paragraph 4 of Art. 8 of Federal Law N 129-FZ, it is necessary to keep records of property using a double entry method on interconnected accounts. This method is not used on off-balance sheet accounts. Consequently, the reflection of goods on off-balance sheet accounts does not mean that the property has been accepted for accounting.

Therefore, in our opinion, under special conditions for the transfer of ownership, the date of acceptance of investments in non-current assets for accounting purposes is considered to be the date of transfer of ownership, i.e. date of acceptance of the property into account 08 “Investments in non-current assets”.

Let's consider this situation from the point of view of documenting these operations. The cost of fixed assets under the contract is expressed in conventional units. The contract establishes what a conventional unit is equal to. Typically, a conventional unit is established at the exchange rate of the Central Bank of the Russian Federation for any currency on the day of payment, shipment, or other date. If, according to the terms of the contract, it is established that a conventional unit is equivalent to the exchange rate on the date of payment, until the moment of full payment for the goods we cannot talk about their final value. This means that the invoice issued at the time the goods are shipped to the buyer’s warehouse does not reflect the true value of the property. The real value of the property is expressed in conventional units, and at the moment it is impossible to determine its ruble equivalent, since payment has not yet occurred.

This means that the price of the property indicated in the invoice for the initial shipment and expressed in rubles does not correspond to the final price, since it has not yet been formed.

The amount difference in accordance with clause 8 of PBU 6/01 is understood as the difference between accounts payable at the rate on the date of acceptance and its payment, calculated at the agreed rate on the date of its repayment. In our case, accounts payable are formed at the moment of transfer of ownership of the property, i.e. at the moment when in accounting the account for investments in non-current assets is debited and the account for settlements with suppliers is credited. Since in the agreement we have agreed on the exchange rate at which the ruble equivalent of a conventional unit is determined, we must apply it on the date of acceptance of accounts payable for accounting, i.e. on the date of transfer of ownership.

In this situation, a discrepancy arises between the price applied in accounting and the price indicated in the invoices from the supplier. There are several options for resolving this discrepancy.

Firstly, counterparties can add clarification to the invoice, establishing the price in rubles on the date of transfer of ownership. The procedure for drawing up invoices for the initial shipment and during the transfer of ownership, as well as their forms, can be established by the terms of the contract.

Secondly, the form of the invoice can be changed in such a way that a new attribute “Price of property in conventional units” is added to it. Since, based on the above, we cannot talk about the final price of the property in rubles until the moment of payment, then, accordingly, it is necessary to enter the additional detail “Equivalent to the price of the property in rubles on the date of shipment to the buyer’s warehouse.”

Unfortunately, accounting regulations do not regulate the issue under consideration precisely enough. Therefore, the choice of a specific accounting methodology in this situation remains with the organization and requires mandatory regulation and reflection in the accounting policy.

The procedure for applying deductions for value added tax is established by Art. Art. 171 and 172 of the Tax Code of the Russian Federation. Today, the main conditions for applying the value added tax deduction are: 1)

goods are purchased to carry out transactions recognized as objects of taxation; 2)

availability of an invoice; 3)

acceptance of goods for registration and availability of relevant primary documents. The deduction for value added tax does not depend on the moment

recognition of expenses on purchased goods for profit tax purposes. Also, the right to apply a tax deduction does not depend on the moment the value added tax is charged to the supplier of the goods. For him, the moment of determining the tax base will be the shipment, regardless of the moment of transfer of ownership.

Tax amounts presented to the taxpayer when purchasing goods for carrying out transactions recognized as an object of taxation are subject to deductions. Clause 1 of Art. 172 of the Tax Code of the Russian Federation establishes the moment of deduction of VAT amounts presented by sellers to the taxpayer of fixed assets: registration of these fixed assets.

If the invoice at the time of shipment was issued in rubles, the answer to the question of what amount to deduct is clear, since the buyer has no reason to deduct a tax amount different from the amount indicated in the invoice . And as is known from Letter of the Federal Tax Service of Russia dated August 24, 2009 N 3-1-07/674, invoices can indicate amounts in foreign currency only if payment for the transaction is made in foreign currency under the terms of the agreement and in compliance with currency legislation.

When issuing an invoice in conventional units, it is quite difficult to determine exactly at the exchange rate on what date the deduction is accepted, since the Tax Code does not contain precise instructions for this situation.

Let's analyze the courses in more detail, on what dates they can be applied: 1)

at the exchange rate on the date of receipt of the property at the warehouse (off-balance sheet account 002 “Inventory assets accepted for safekeeping”); 2)

at the exchange rate on the date of transfer of ownership of the property (account 08 “Investments in non-current assets”); 3)

at the exchange rate on the date of payment (if it differs from the date of transfer of ownership); 4)

at the exchange rate on the date of putting the fixed asset into operation (account 01 “Fixed assets”).

The greatest number of arguments indicates that the deduction on the invoice, expressed in conventional units, is applied at the agreed rate on the date of transfer of ownership.

Firstly, tax amounts presented to the taxpayer when purchasing goods are subject to deductions (Clause 2 of Article 171 of the Tax Code of the Russian Federation). The concept of “acquisition” can be directly associated with the acquisition of property rights (Article 218 of the Civil Code of the Russian Federation). That is, these provisions can be interpreted as follows: the amount of tax presented to the taxpayer upon transfer of ownership of the goods is subject to deduction, that is, at the time the property is accepted onto the balance sheet of the organization.

Secondly, one of the conditions for applying the deduction is the use of goods in transactions recognized as an object of taxation. As mentioned above, Art. 491 of the Civil Code of the Russian Federation does not give the buyer the right to alienate the goods or dispose of them in any other way before the transfer of ownership. This means that we cannot say that this product is used for any operations.

Thirdly, unless otherwise established by this article, only tax amounts presented to the taxpayer upon acquisition of goods after the registration of these goods are subject to deductions (Clause 1 of Article 172 of the Tax Code of the Russian Federation). The Tax Code of the Russian Federation does not explain the concept of “registration”. Neither the Federal Law “On Accounting” nor the accounting regulations (PBU) provide a precise definition of this term. Therefore, accounting must be carried out using a double entry method on interconnected accounts (which is a requirement of the Federal Law “On Accounting”). Therefore, acceptance for accounting should be considered precisely acceptance on the balance sheet.

Fourthly, the application for deduction of the exchange rate on the date of commissioning is incorrect, since at this moment only the right to deduct the tax presented when purchasing the goods arises.

Fifthly, it is also incorrect to talk about the exchange rate on the date of payment, since payment for goods in accordance with the Tax Code of the Russian Federation is not a prerequisite for deducting amounts of value added tax.

Example. In September 2011, a contract was concluded for laying a water pipeline on the lands of the JSC, where:

CJSC - customer; organization A is an investor; organization B is a contractor.

Under the terms of the contract, the customer instructs and the contractor assumes obligations to perform the work. The investor is obliged to pay for the work directly to the contractor with an advance payment.

For the work performed by the customer (in addition to the main contract), the investor is obliged to pay him a remuneration.

Upon completion of construction (October), the contractor provides the customer with an invoice, certificates for completed work KS-2, KS-3, signed by three parties.

The Customer reissues an invoice (in October) for the work performed to the Investor.

Upon completion of the work, the investor puts the new water supply system on his balance sheet (01 account).