What exactly is an objection to a tax audit report used for?

An objection drawn up on behalf of the company allows its management to appeal any actions, results and conclusions of the tax authorities who carried out the tax audit.

There are two main types of violations committed by tax authorities:

- procedural (i.e. errors in the order of the event);

- violations related to substantive law (i.e. incorrect interpretation of any documents, incomplete accounting of provided papers, etc.).

The tax office is obliged to respond to a written objection, regardless of which of these types of violations it is written about.

What you shouldn't complain about

Everything related to the company’s activities in terms of documents, finance, accounting and taxes can and should be appealed in case of disagreement.

But there are some points against which it is not advisable to file an objection with the tax office. This:

- timing of the verification procedure (start and end dates),

- inaccuracies in the preparation of the protocol,

- minor procedural violations.

All these minor details should be ignored at this stage, focusing on the essence of the claim. Here the mark “at this stage” means that they should be reserved for the court, where, if something happens, they can try to discredit the act (i.e., declare it illegal).

In addition, it should be borne in mind that an objection drawn up in accordance with all the rules, with all the necessary papers attached, regarding the audit procedure may well lead to additional control measures on the part of the tax authorities. And their results, in turn, can easily reveal more serious errors and violations in the activities of the enterprise.

How to justify an objection

Before “starting a discussion” with the tax authorities, it is advisable to stock up on one hundred percent arguments and a set of convincing documents certifying the correctness of the organization, which must be added to the objection. To do this, it is necessary to carefully study the tax audit report, and recheck all identified controversial points several times.

If, at the time of writing the tax audit report, the company for some reason lacked some documents, but it managed to restore them as soon as possible or was able to correct minor inaccuracies in the existing papers, this must be reflected in the objection.

This will reduce the amount of additional tax assessed, if any, and also avoid all kinds of fines and penalties.

All your arguments must be carefully and thoroughly explained, indicating the circumstances that led to this or that shortcoming and referring to the legislation of the Russian Federation in the field of taxes, civil law, judicial practice and company regulations.

It will be difficult for tax authorities to argue with well-founded arguments; moreover, if something happens, they will become the evidence base when the company goes to court (if, of course, it comes to that). It should also be noted here that in court it will be possible to raise only those points of the tax audit report that were previously appealed to a higher tax office.

How to protect your rights during a desk tax audit

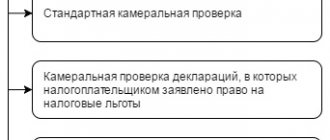

The procedure for conducting a desk audit is regulated by the Tax Code. However, tax authorities do not always strictly adhere to it. Inspectors’ deviations from established requirements provide grounds for entrepreneurs not only to defend their rights, but also to seek the cancellation of inspection results. Purpose of a desk audit The main goals of a desk audit (CD) are to monitor submitted tax returns and documents on the basis of which taxes are calculated and paid, identify errors, analyze tax reporting, and assess the reliability of the information provided. Since the beginning of 2007, changes have been made to the inspection procedure. Desk audits have the following features:

- control is carried out within the walls of the tax authority;

- the documents submitted by the taxpayer are examined;

- no special decision of the head of the tax office is required;

- the audit results are used to plan and prepare on-site tax audits.

Deadlines for conducting a desk audit The three-month period established by the Tax Code of the Russian Federation for a desk audit is counted from the day the declaration is submitted to the tax office (Article 88 of the Tax Code of the Russian Federation). Limiting the period for conducting a tax audit serves as a guarantee of respect for the rights of the taxpayer. If it is necessary to submit additional documents attached to the declaration to the tax authority, the period will be calculated from the date of their submission (resolution of the Federal Antimonopoly Service of the West Siberian District dated October 15, 2003). What are the consequences for the tax authority of violating the deadlines for conducting a desk audit? Inspections beyond the three-month period are not grounds for releasing the taxpayer from liability for identified violations and do not prevent the collection of arrears (letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated March 17, 2003, No. 71). However, missing the deadline by the tax authorities provides an opportunity to invalidate the requirement to pay the tax (resolution of the FAS of the Volga-Vyatka District dated 01/16/03, FAS of the West Siberian District dated 03/24/03). Note! When bringing a taxpayer to tax liability, the burden of proving the offense committed lies with the tax inspectorate (Article 65 of the Arbitration Procedure Code of the Russian Federation). Evidence obtained in violation is prohibited from being used in court (Article 64 of the Arbitration Procedure Code of the Russian Federation). Rights of inspectors According to the new edition of Art. 88 of the Tax Code of the Russian Federation, tax inspectors, when conducting a desk audit, have the right to demand from the taxpayer documents confirming:

- the right to apply tax benefits;

- the legality of applying deductions when filing a VAT return in which the right to a tax refund is declared;

- correct calculation and payment of taxes related to the use of natural resources.

Additional submission of documents is provided if errors are identified in filling out the tax return (calculation) and (or) contradictions between the information contained in the submitted documents. The taxpayer is notified of this fact with a requirement to make appropriate corrections within the prescribed period. REMINDER: the possibility of requesting explanations from the taxpayer is expressly provided for by the Tax Code of the Russian Federation. They are submitted in free form with documents that the taxpayer deems necessary. This is his right, not his obligation. Additional documents must be submitted within ten days from the date of receipt of the request (clause 6, clause 1, article 23, clause 3, article 93 of the Tax Code of the Russian Federation). In accordance with paragraph 1 of Art. 126 of the Tax Code of the Russian Federation, missing the established deadline entails a fine of 50 rubles for each document not submitted. However, the fine can be avoided. Clause 3 art. 93 of the Tax Code of the Russian Federation gives taxpayers the right to notify tax authorities in cases where, for some reason (for example, due to the large volume of documents required), it is not possible to submit documents within the prescribed period. This is done in writing within the day following the day the request is received, indicating the reason and deadline for submission. Within two days from the date of receipt of the notification, the head (deputy head) of the tax authority has the right, on its basis, to extend the deadline for submitting documents or to refuse this, for which a separate decision is made. Very important! Tax authorities have the right to additionally request only documents that are directly related to errors found in declarations (resolutions of the Federal Antimonopoly Service of the North-Western District dated December 22, 2005 in case No. A56-10700/2005, FAS Volga District dated October 25, 2005) and which the taxpayer really has (resolution of the Federal Antimonopoly Service of the Ural District dated March 11, 2003). A desk inspection should not replace an on-site inspection (resolutions of the Federal Antimonopoly Service of the Ural District dated January 20, 2006, and the Volga District Federal Antimonopoly Service dated January 12, 2006). The tax authority's requirement to submit documents must be formalized in writing (clause 3 of Article 88, clause 12 of Article 89 of the Tax Code of the Russian Federation). Its form is given in Appendix 5 to the order of the Federal Tax Service of Russia dated May 31, 2007 No. MM-3-06/338. It must be sent no later than three months from the date of filing the declaration if a desk audit is carried out. Pay attention to how it is composed. In their requests, tax authorities must indicate which documents they want to receive. Responsibility under Art. 126 of the Tax Code of the Russian Federation is punishable for failure to provide specific documents. If the requested documents cannot be identified, the taxpayer is not obliged to submit them (Resolutions of the Federal Antimonopoly Service of the Moscow District dated March 3, 2003 in case No. KA-A40/791-03, Federal Antimonopoly Service of the West Siberian District dated August 27, 2003). The storage period for documents is established by paragraphs. 8 clause 1 art. 23 Tax Code of the Russian Federation. Sometimes tax authorities are not bothered by the expiration of this period. REMINDER: you don’t have to respond to the tax inspector’s verbal demands (from clause 1 of Article 93 of the Tax Code of the Russian Federation). Tax advisor's advice: remember the rule: “No exact list of documents - no fine.” Having received a “non-specific” request from the tax office, write a written response to the inspectorate with a request to decipher it. What documents can an inspector request when checking your counterparty? A specific list of documents of the Tax Code of the Russian Federation has not been established. The main thing is that they are related to financial and economic transactions carried out between the entrepreneur and the counterparty. For example, an agreement, invoices, invoices, payment documents, certificates of work performed, extracts from the purchase book, a commission agent’s report (if an intermediary agreement has been concluded). Limitations on the powers of inspectors If, as part of a desk audit, an entrepreneur did not submit documents, this does not give the tax authorities the right to seize documents in accordance with Art. 94 of the Tax Code of the Russian Federation and inspect the premises of the taxpayer (Resolutions of the Federal Antimonopoly Service of the Volga District dated January 17, 2006, FAS East Siberian District dated April 29, 2002). This procedure is carried out on the basis of a resolution of an official of the tax authority carrying out an on-site tax audit (clause 1 of Article 94 of the Tax Code of the Russian Federation). Often in practice, entrepreneurs submit amended tax returns to reduce their tax obligations to the budget. The Tax Code of the Russian Federation does not limit the deadline for submitting an updated tax return. Does the tax authority have the right to conduct a second desk audit and, based on its results, make a new decision? Letter from the Ministry of Finance of the Russian Federation dated May 31. 07 No. 03-02-07/1-267 explains that, despite the absence of the concept of “repeated desk audit” in the Tax Code, officials allow it to be carried out if an updated tax return is submitted. In accordance with Art. 101 of the Tax Code of the Russian Federation, based on the results of the audit, a decision may be made to bring or refuse to bring to justice for committing a tax offense. Errors of inspectors 1. Late receipt by the tax authority of a tax return sent by mail. There is no fault of either the taxpayer or the tax authority in the work of the post office. But tax specialists often forget that the date of submission of the tax return is the date it was sent by mail with a list of the contents (and not the moment it was received by the inspectorate). As a result, this may lead to blocking of the taxpayer's current account. The misunderstanding is settled in favor of the taxpayer after he appears at the inspection office with a postal receipt. 2. The inspector, having found a violation, immediately writes an inspection report. Everything is clear to him and no explanation is required from the entrepreneur. Such an error by the inspector may be to the benefit of the taxpayer in court. The requirement of paragraph 3 of Art. 88 Tax Code of the Russian Federation. The Constitutional Court of the Russian Federation, in its ruling No. 267-O dated July 12, 2006, noted that tax inspectors cannot arbitrarily refuse additional information and explanations. 3. They forgot to “invite” them to consider objections to the inspection report. Such forgetfulness may cost tax authorities a loss in court. The requirement of paragraph 2 of Art. 101 Tax Code of the Russian Federation. The court based on paragraph 14 of Art. 101 of the Tax Code of the Russian Federation can cancel any decision on the inspection report. 4. A fine was imposed without a desk check. Recently, tax authorities have established an exchange of information among themselves, which they are trying to use for additional tax assessments. But no matter what incriminating documents the inspection has, a desk audit cannot begin. They can become the basis for an audit, but the process itself will begin only after receiving a tax return from the payer. The Presidium of the Supreme Arbitration Court came to the same conclusion in its resolution dated June 26, 2007 No. 1580/07. 5. Holding the taxpayer accountable in cases where tax law should not be applied. For example, a fine for late submission of a declaration on insurance contributions for compulsory pension insurance (one copy of which is submitted to the tax office). However, the Tax Code does not oblige the tax authorities to submit this declaration. Therefore, its untimely submission is not a tax offense. Registration of the results of a desk inspection If no errors or contradictions are identified in the declaration, the inspector simply signs the document indicating the date of inspection on the title page. This concludes the desk audit. If a tax violation is detected, an audit report is drawn up. This document must be ready within 10 days after the audit. The camera report must indicate the date of submission of declarations and other documents to the inspection. REMINDER: Clause 3 of Article 100 of the Tax Code of the Russian Federation names the mandatory details of the act. Check the violations indicated in the report, the conclusions and proposals of the inspector, and links to articles of the Tax Code of the Russian Federation. The entrepreneur (his representative) accepts the act against a receipt indicating the date of its receipt. However, he has the right not to sign or accept the act. This must be recorded. In this case, the act is sent by mail to the entrepreneur’s place of residence. The date of its delivery will be considered the sixth day from the moment of sending the registered letter (clause 5 of Article 100 of the Tax Code of the Russian Federation). If the entrepreneur does not agree with the facts stated in the act, he has the right to submit written objections to the inspectorate within 15 days from the date of receipt of the act (clause 6 of Article 100 of the Tax Code) of the Russian Federation. Objections can be made in any form. The main thing is to briefly and clearly state all claims and present compelling arguments (documents or links to legislation). The head of the inspection sets a date for consideration of the submitted objections. The taxpayer, who may be present at the meeting, is informed about this. As a result, either a decision is made to hold the taxpayer accountable or not. It comes into force 10 working days from the date of its delivery to the entrepreneur. Prosecution based on the results of the inspection According to Art. 101 of the Tax Code of the Russian Federation, based on the results of the CP, tax authorities can hold the taxpayer accountable. Failure of the tax authority to comply with the requirements of Art. 101 of the Tax Code of the Russian Federation is the basis for refusing to collect tax sanctions from an entrepreneur. If the tax inspectorate does not notify the taxpayer of the time and place of consideration of the materials of the desk audit and imposes a fine, he has the right to appeal the actions of officials. Arbitration courts believe that the procedure for proceedings in a case of a tax offense, established by Art. 101 of the Tax Code of the Russian Federation, should also be used for desk audits (resolution of the Federal Antimonopoly Service of the North-Western District dated April 1, 2003 in case No. A26-5383/02-26). Appeal You can achieve the cancellation of an illegal decision of tax authority officials by contacting an arbitration court or a higher tax authority. For now, the taxpayer can decide for himself whether to go straight to court or first contact a higher tax authority (clause 1 of Article 138 of the Tax Code of the Russian Federation), but from January 1, 2009, the procedure for pre-trial appeal of the inspector’s decision will become mandatory (clause 5 of Article 101.2 of the Tax Code RF). When submitting an application to the arbitration court, do not miss the deadline established in paragraph 4 of Art. 198 Arbitration Procedure Code of the Russian Federation. It is three months from the date of receipt of the inspection decision, and not its issuance. This also applies to desk audits. However, taxpayers can apply for reinstatement of the deadline if they miss it. Very important! No one has the right of controllers to collect fines out of court; please attach a petition to the statement of claim. In it, refer to the ability of auditors to unquestionably write off money from the accounts of an entrepreneur, which will make it difficult to fulfill civil, tax and social obligations in a timely manner. discuss the article Elmira Bagautdinova expert-tax consultant of the Razdolye Training Center, member of the Chamber of Tax Consultants of Russia

Where and how to file an objection

The objection should be submitted to the address of the territorial tax service, whose specialists carried out the audit. The document can be transferred:

- personally “hand to hand”,

- by sending it by registered mail with return receipt requested.

Both of these methods ensure that tax authorities receive the objection in a timely manner.

Today, another proven option for document delivery has become widespread: through electronic services , but only on condition that the organization has an officially registered digital signature.

Main nuances in drawing up an objection

To date, there is no strictly established sample of an objection to a tax audit report. Employees of enterprises and organizations can draw up a document in any form, based on their understanding of it.

In this case, it is advisable to take into account some office work norms and rules for writing business documentation. In particular, the objection must indicate:

- addressee, i.e. the name, number and address of the exact tax office to which the objection is sent,

- sender information (company name and address),

- number of the objection and the date of its preparation.

In the main part it should be indicated

- the act in respect of which an objection is being drawn up,

- describe in detail the essence of the claim, including all available reasons and arguments.

The document must refer to the laws that confirm the correctness of the author of the objection and indicate all additional papers attached to it (marking them as a separate attachment).

Features of appealing tax audit reports to a higher tax authority

Date of publication: 09/26/2019 07:38

Only acts of tax authorities of a non-normative nature, actions or inactions of their officials are subject to appeal to a higher tax authority and (or) to court (clause 1 of Article 138 of the Tax Code of the Russian Federation).

An act of a non-normative nature is a document of any name (demand, decision, decree, letter, etc.), signed by the head (deputy head) of the tax authority and relating to a specific taxpayer.

A complaint is an appeal by a person to a tax authority, the subject of which is an appeal against acts of a tax authority of a non-normative nature that have entered into force, actions or inactions of its officials, if, in the opinion of this person, the appealed acts, actions or inactions of officials of a tax authority violate his rights.

An appeal is recognized as a person's appeal to a tax authority, the subject of which is an appeal against a decision of a tax authority that has not entered into force on bringing to responsibility for committing a tax offense or a decision on refusing to bring to responsibility for committing a tax offense, made in accordance with Art. 101 of the Tax Code of the Russian Federation, if, in the opinion of this person, the appealed decision violates his rights.

An appeal to a higher tax authority of decisions that have not entered into force on bringing to justice for committing a tax offense or refusing to bring to justice for committing a tax offense, as well as acts of a tax authority of a non-normative nature that have entered into force, actions or inactions of its officials is provided for in Chapters 19 , 20 Tax Code of the Russian Federation.

At the same time, tax legislation does not provide for an appeal to a higher tax authority against tax audit acts, since they do not contain mandatory instructions for the taxpayer that entail legal consequences, but only state the factual circumstances of the identified violation of tax legislation, contain proposals for eliminating the identified violations and applying them to taxpayer liability measures.

The procedure for appealing tax audit reports is established in clause 6 of Art. 100 of the Tax Code of the Russian Federation, according to which the person in respect of whom a tax audit was carried out, within one month from the date of receipt of the tax audit act, has the right to submit written objections to the relevant tax authority on the specified act as a whole or on its individual provisions. In this case, the taxpayer has the right to attach to written objections or, within the agreed period, submit to the tax authority documents (certified copies thereof) confirming the validity of his objections.

Thus, the legality or illegality of the conclusions set out in the tax audit report is established not by a higher tax authority, but by the tax authority during the consideration of the tax audit materials.

What to pay attention to when preparing a document

Neither the Federal Tax Service in its acts nor the law regulates the filing of an objection in any way. That is, it can be written by hand or printed on a computer on an ordinary A4 sheet or on company letterhead.

It is strictly important to comply with only one condition: the objection must be signed by the head of the enterprise or an employee authorized to create such documents. If the form is endorsed by a proxy, it must also indicate the number and date of the power of attorney.

It is not necessary to certify an objection with a stamp today, since starting from 2021, enterprises and organizations have every right not to use stamped products in their work (unless this norm is prescribed in the local regulations of the company).

The document should be drawn up in two copies , one of which should be submitted to the tax office, the second, after the tax specialist has marked the acceptance of the document, should be kept.

The right to red tape, or Endless tax control

The ruling of the Supreme Court of the Russian Federation dated August 29, 2019 No. 305-ES19-13947 reflects like a drop of water the approach of tax authorities and courts to the deadlines established in the Tax Code of the Russian Federation, formed in recent years: “The deadline for conducting an on-site tax audit and making a decision based on its results execution is not preemptive and its expiration does not prevent the tax authority from identifying facts of non-payment of tax.”

Despite the fact that the judicial act of the Supreme Court of the Russian Federation was issued in a specific case, and the refusal to satisfy the application is due, among other things, to the fact that the delay in deadlines was due to additional tax control measures, the court made a general conclusion that the deadlines for making a decision based on the results of the tax audit were met .

The above formulation justified the widespread red tape in tax audits. Tax authorities exceed the deadlines for conducting a tax audit, the deadlines for processing its results, and the deadlines for making decisions. In the author's legal proceedings, there are several audits in which tax audit reports and then decisions were made with a delay of six months to a year and a half or were not made at all. Of course, complaints about red tape were refused.

From the author’s point of view, the institution of procedural deadlines in the Tax Code of the Russian Federation has been leveled today. Let's look at a specific case.

The tax audit report is sent to the taxpayer six months after the date of issue by post. The taxpayer did not receive either the report or notice of the place and time of consideration of the tax audit report; the letters were returned. The tax authority reviewed the tax audit report without the participation of the taxpayer and made a decision to bring the person to tax liability. Both in complaints to a higher tax authority and in two courts, we pointed out that the tax authority violated the essential conditions of the procedure for considering tax audit materials, which is the basis for canceling the decision of the tax authority to prosecute for committing a tax offense. Violation of deadlines by the tax authority prevented the taxpayer from participating in the consideration of the tax audit report, familiarizing himself with the inspectors’ findings, and submitting objections. The taxpayer did not keep track of the mail, but he did not have to wait more than six months for letters from the tax office.

However, neither the tax authorities nor the courts agree with us. The main argument: the taxpayer always bears the risk of not receiving a tax audit report and notifications at his location indicated in the Unified State Register of Legal Entities.

And here the question arises: is the taxpayer really Solveig, who waits for Peer Gynt until old age and remains faithful to him? If the tax authority delays the timing of the tax audit and registration of its results, then why are the risks of non-receipt of documents sent after a long time assigned to the taxpayer? If Solveig suffered because of her love for Peer Gynt, then should the taxpayer love the tax office and to what extent?

Unfortunately, today procedural deadlines under the Tax Code of the Russian Federation are a one-sided tool for influencing the taxpayer on the part of the tax authority, but not vice versa.

We will note the following. Approval of red tape quite reliably ensures the degradation and discredit of the tax service and creates a favorable environment for the manifestation of corruption.