Legislation regarding wage issues is constantly changing. 2021 was no exception, bringing a number of amendments that will need to be taken into account in work in 2021. They affected, among other things, advance payment of wages. By ignoring the established procedure, the employer risks being fined by the Labor Inspectorate.

The existing procedure for calculating the advance amount has been applied since October 3, 2016, after Law No. 272-FZ of July 3, 2016 established the obligation of employers to pay wages at least twice a month. The latest changes have affected mainly the terms of payment of advance payments and salaries. Let's consider how to correctly calculate a salary advance in 2021 and how long it must be transferred to the employee.

What is a salary advance?

The very concept of an advance is not mentioned in the current labor legislation and other official sources. Therefore, let us turn to Art. 136 of the Labor Code of the Russian Federation, which states that salaries must be paid to staff at least once every six months. Advance payment is considered to be the salary for the first half of the current month.

Salary payments are usually divided into 2 parts:

- the first - from the 16th to the 30th or 31st (salary for the 1st half of the current month);

- the second - from the 1st to the 15th (the balance of the salary for the previous month).

Often in various sources you can find a question about the possibility of paying salaries more than 2 times a month. It would be a mistake to give a negative answer to this question. The Labor Code specifies the minimum amount of salary payments to staff - at least 2 times a month or 1 time every two weeks. But you can pay more often. And this is not a labor violation on the part of the employer.

For example, at some enterprises salaries are paid every ten days: 3 times a month.

Is income tax withheld from the advance payment?

Personal income tax of 13% is withheld from the total monthly amount earned by the employee. This means that tax is deducted from absolutely all payments related to salary.

Thus, the amount of the advance, according to the Labor Code of the Russian Federation, in 2021 is determined in accordance with the calculation option chosen by the employer.

This information must be specified in the contract and strictly observed. In case of any violations regarding the payment of wages or advance payments, the employee has the right to apply for help to the labor inspectorate with a complaint. That is why every employer must understand and remember that adherence to labor discipline leads to long-term cooperation with the employee and successful business promotion.

Advance payment terms

03.10.2016 by law of 03.07.2016 No. 272-FZ in Art. 136 of the Labor Code of the Russian Federation, changes have been made that relate to the date of payment of wages. It must be paid to staff no later than 15 calendar days after the end of the month for which it was accrued. According to this norm, it turns out, for example, that the company’s personnel must receive their salaries for March no later than April 15. And this date is the deadline for paying insurance premiums accrued in the past month.

Read more about calculating insurance premiums here.

But this applies to the final payment for the month to the company’s employees. Since the maximum break between salary payments is half a month (that is, 15 days), it turns out that the deadline for paying the advance is the last day of the current month (30th or 31st). At the legislative level, only deadlines are limited.

Thus, the employer must set specific dates for payment of wages and advances independently.

The employer needs to establish the procedure and terms for issuing wages in internal local documents: in the regulations on wages, in the collective agreement. You can also reflect this information in employment contracts concluded directly with each employee of the enterprise.

It is recommended to indicate a specific date for payment of wages, rather than a period - for example, the 15th, and not from the 15th to the 17th. Otherwise, there may be a time gap between salary payments of more than half a month, which is contrary to the norm of Art. 136 Labor Code of the Russian Federation. This position was reflected by the Ministry of Labor in letter No. 14-2-242 dated November 28, 2013. Also, do not forget that if the date falls on a working day or holiday, the last date for paying the advance is the last working day before the holidays or weekends.

Let's look at how to calculate the advance correctly.

How to correctly calculate an advance in 2021?

On August 10, 2017, the Ministry of Labor issued letter No. 14-1/B-725, in which it explained its position regarding what payments should be included in the calculation of the advance payment.

Let's consider the basic rules for calculating advance payments in 2021 according to the opinion of the Ministry of Labor.

Rule No. 1. Advance payments for the first half of the month are made in proportion to the working hours worked in the period from the 1st to the 15th of the current month. That is, if the first half of the month the employee was on sick leave, on vacation or on leave without pay, the advance payment for these periods does not occur.

Rule No. 2. When calculating the advance, you must take into account:

- salary (tariff rate);

- other bonuses for time worked, which do not depend on the assessment of the employee’s performance (for example, for a month, quarter or year): for night work, length of service, for professional level (for example, for the category for teaching and medical staff) and so on .

Rule No. 3. When calculating an advance on wages, the following are not included in the calculation data:

- bonuses based on the results of work activities for a certain period;

- compensatory additional payments, the amount of which can be determined at the end of the month after working hours have been worked out (for example, for overtime work).

These rules also apply to advance payments in 2021.

How are salaries calculated for the first and second half of the month?

From the first rule it follows that the amount of the advance must be commensurate with the employee’s total salary for the month. It should reflect the employee’s salary for the time worked from the 1st to the 15th. However, the legislation does not provide for a clearly established amount of the advance. Since personal income tax is not withheld from the advance (we will look at the nuances in the next section), the accountant is faced with the question: how is the advance calculated in practice?

Many set a fixed amount: 40% of the employee’s monthly salary. This 40% is calculated in the following way. The monthly salary is conventionally taken as 100%. From these, 13% of personal income tax is deducted and 87% of the “net” wages for the month are obtained, and for half a month - 43.5%, which is usually rounded to 40%.

But it is still better to pay an advance based on the results of calculations for working hours worked from the 1st to the 15th, and not as a percentage of the salary. Similar recommendations are given by various departments (letters from the Ministry of Labor dated August 10, 2017 No. 14-1/B-725 and Rostrud dated September 26, 2016 No. T3/5802-6-1).

The method for calculating the advance payment must be reflected in the salary regulations of each company. Then during inspections there will be no unnecessary questions from inspectors.

What does the law say?

By law, a certain percentage of the advance payment is not established.

The answer to the question, advance payment - what percentage of the salary in 2019, is not provided for by the TKRF!

However, its minimum amount cannot be lower than the tariff rate that the employee must receive for the shifts actually worked.

According to the Labor Code of the Russian Federation, the employer must transfer wages at least once every 14-15 days. Moreover, its size can be fixed or be a certain percentage of the base part. This point must be discussed personally by the employer when hiring a person and clearly stated in the employment contract.

Today, in most cases, the documented amount of the advance is equal to half the salary. However, as practice shows, employees most often receive a much smaller portion. And this happens, first of all, with allowances and bonuses, which are paid on the day the main salary is transferred.

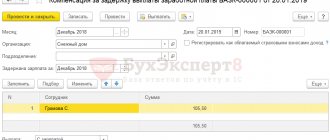

An example of calculating and recording an advance in accounting

At Prodov LLC, the collective agreement provides for a monthly advance payment deadline of the 20th. The salary of employee Drobyazko V.I. is 20,000 rubles. The employment contract also provides for a monthly bonus for professional skill level of 10% of the salary. There are 10 working days for the period from October 1 to October 15. There are a total of 22 working days in October. From October 9 to October 11, Drobyazko V.I. was on leave without pay at his own request. How much should I pay advance payment to V. I. Drobyazko for October?

Solution:

1. Let us determine the amount of the entire salary of V. I. Drobyazko for October:

20,000 + (20,000 × 10%) = 22,000 rub.

2. Let’s calculate the advance for the fully worked half-month:

(22,000 / 22) × 10 = 10,000 rub.

If V.I. Drobyazko had worked the full 10 days required, the advance payment would have amounted to 10,000 rubles.

3. In our case, V.I. Drobyazko was on leave without pay for 3 working days, therefore:

(22,000 / 22) × 7 = 7,000 rub.

On October 20, Drobyazko V.I. will be paid an advance in the amount of 7,000 rubles.

We've figured out how to calculate salary advances. The advance can be issued by the cashier directly from the organization's cash desk, and can also be transferred by the accounting department to the employees' salary accounts in the bank.

Let's look at how advances and salaries are calculated in accounting.

Dt 70 Kt 50 (51) - employees were paid wages for the first half of the month.

The accrual of the advance as part of the salary itself is not reflected in accounting, that is, receivables are formed from the working personnel. It closes at the end of the month after payroll is processed:

Dt 20 (23, 25, 26, 29, 44, 91) Kt 70 - monthly wages accrued.

What happens if the employer does not transfer the advance?

According to the Labor Code, all unscrupulous employers in case of non-payment or delay in transferring advance payments and salaries face liability in the form of fines. Their size depends entirely on the circumstances that caused problems with payments. The amount of sanctions is established by the labor commission and regulated by the Code of Administrative Offenses of the Russian Federation. As a rule, it averages up to 20 thousand rubles. for individual entrepreneurs. For large enterprises, fines are imposed on particularly large scales and can reach 50 thousand rubles.

Taxes and contributions from advance payment

So, the advance is the salary for the first half of the month. Therefore, accountants may have a question: is it necessary to charge and pay personal income tax and insurance contributions? According to paragraph 2 of Art. 223 of the Tax Code of the Russian Federation, the last day of each month is the date the employee receives income in the form of salary. Therefore, when paying an advance, the employer as a tax agent does not have the obligation to transfer personal income tax, which the fiscal authorities have repeatedly reminded in their letters (see letters of the Ministry of Finance of the Russian Federation dated July 13, 2017 No. 03-04-05/44802, Federal Tax Service dated April 29, 2016 No. BS-4-11/7893).

However, in practice an interesting situation may arise. Let’s assume that the company’s internal local document sets the advance payment date as the last day of the month. The employer, according to tax authorities, is obliged to calculate and transfer personal income tax on the advance payment, since this day is the date of actual payment of income. In this case, the Supreme Court of the Russian Federation and the Ministry of Finance consider the approach of the Federal Tax Service to be unlawful (Decision of the Supreme Court dated May 11, 2016 No. 309-KG16-1804 and letter of the Ministry of Finance dated November 23, 2016 No. 03-04-06/69181).

There is also no need to pay insurance premiums on the advance payment. They are accrued at the end of the month and paid before the 15th of the next month.

In practice, there are situations when an employee was paid an advance and he quit. What to do with insurance premiums in this case? Find out from our material “An employee received an advance or quit – should contributions be calculated?”

We also recommend looking at how to retain an unearned advance: “Art. 137 of the Labor Code of the Russian Federation: questions and answers.”

Results

The advance is the salary for the first half of the current month. Salaries are paid to staff at least 2 times a month. Not all allowances and surcharges are included in the advance payment calculation. The timing of advance payment is reflected in the internal local acts of the enterprise. They must comply with applicable labor standards. According to the general rules, personal income tax and insurance premiums are not paid from the advance payment, however, controversial situations are possible.

Often in various sources you can find a question about the possibility of paying salaries more than 2 times a month.

It would be a mistake to give a negative answer to this question. The Labor Code specifies the minimum amount of salary payments to staff - at least 2 times a month or 1 time every two weeks. But you can pay more often. And this is not a labor violation on the part of the employer. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Basic provisions

Every person, in the case of official employment, has the right to demand from his employer compliance with the Labor Code. Persons responsible for cash flow in the company are required to pay the employee monthly, at least twice, according to the days he worked. Also, the employer can, on a voluntary basis, assign additional payments to the employee in the form of cash bonuses, salaries and other types of remuneration.

In accordance with the current TCRF, he has the right to independently establish and regulate the amount of advance payments. However, their amount cannot be lower than that specified in regulations. Payment of advances must be made at least once a month, in order to avoid problems with the Federal Tax Service and the imposition of penalties.