What has changed in the rules for SZV-M

The unified form of monthly pension reporting in the SZV-M form is familiar to all accountants, without exception. The report has been submitted to the Pension Fund of the Russian Federation for more than two years. As of October 1, 2018, officials approved a number of innovations in the procedure for preparing and submitting pension reporting. The key change is that the procedure for submitting reporting information to the Pension Fund has been adjusted. Now the report is considered submitted if an official notification is received from the Pension Fund of Russia about its acceptance. That is, if the organization submitted the report on time (by the 15th day of the month following the reporting month), but the notification was not received, then the SZV-M is considered not submitted. In this case, the institution faces fines for corrections in the SZV-M - 500 rubles for each insured person in an unaccepted reporting form.

Another important innovation: the Russian Ministry of Labor resolved disputes that lasted several years. In Letter No. 17-4/10/B-1846 dated March 16, 2018, officials stated that information on the sole founder of the company is submitted to the Pension Fund. That is, if the organization does not have employees, and there is only one general director, who is the sole founder, then information must be submitted to him.

The current procedure, approved by Order of the Ministry of Labor dated December 21, 2016 No. 766n, was adjusted by Order of the Ministry of Labor of Russia dated June 14, 2018 No. 385n. The changes came into force on 10/01/2018.

Instructions for adjusting SZV-M

Is it possible to submit an adjustment to SZV-M and how to make an adjustment to SZV-M?

Sooner or later, all specialists whose responsibilities include the monthly preparation and submission of this report to the Pension Fund of Russia face such questions. If you need to correct SZV-M data, we suggest the following sequence of actions:

Step 1: preliminary

Before deciding how to adjust the SZV-M, make sure that the personalized accounting data that you are going to adjust has been accepted by the Pension Fund:

Previously, we talked about the ways in which SZV-M can be presented.

Step 2: Select Form Type

If you are convinced that the initial report has been accepted by the fund, you can proceed directly to the adjustment procedures.

The SZV-M adjustment in 2021 is made according to the same rules that were in force in previous periods.

First determine what needs to be done:

- supplement the information in the original SZV-M;

- cancel (zero) the information from the report submitted to the Pension Fund.

Depending on this, select the required type of SZV-M form for adjustment:

The “Additional” form type is selected in the case when you forgot to reflect the data on the insured person (or several persons) in the original SZV-M, and all other information in the original report is correct (does not contain errors).

The “Cancelling” form type is used when the following is detected in the original SZV-M:

- unnecessary data (for example, data is provided for an employee who was fired a long time ago);

- erroneous/inaccurate information (for example, incorrect personal information of employees).

Step 3: Filling out the adjustment form

Once you have decided on the scope of corrections and selected the desired type of form, you can begin to draw up the corrective SZV-M.

To make adjustments, use the form on which you submitted the original report:

- from May 2021 - approved. Resolution of the Board of the Pension Fund of the Russian Federation dated April 15, 2021 No. 103p;

- until April 2021 - by Resolution of the Board of the Pension Fund of the Russian Federation dated 02/01/2016 No. 83p.

To clarify:

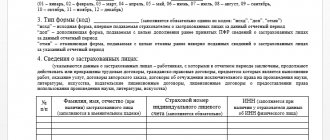

- in sections 1 and 2, fill in the details of the policyholder and the reporting period in the same way as the original SZV-M, which you are adjusting;

- in section 3 “Form type (code)” enter the selected form type (for example, you need to cancel previously submitted information):

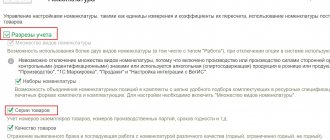

Correction of information in SZV-M regarding personal data of insured persons is made in section 4 “Information about insured persons”. In this section, provide the information you want to cancel. For example, this is what section 4 of the adjustment report looks like if an extra employee is included in the original SZV-M:

In such a situation, you should duplicate the data on the extra employee from the original SZV-M.

Download a sample of the corrective SZV-M

If it is necessary to correct erroneous information about an employee, you first need to submit the SZV-M form with the “Cancelling” type (similar to the sample presented above), and then the SZV-M form with the “Additional” type, in which you indicate the correct information. This should be done, for example, if the reason for completing the SZV-M adjustment was an error in the surname of the insured person.

The corrective form SZV-M includes information only for those employees whose data is subject to correction. Information on the remaining employees included in the original SZV-M and initially indicated correctly does not need to be re-entered.

See how and what errors can be corrected in the SZV-M report.

How to fix errors now

Errors and inaccuracies are corrected only in the accepted report. That is, after receiving a notification from the Pension Fund. Moreover, in some situations it will not be possible to avoid a fine.

For example, when preparing reports, the institution did not indicate in the SZV-M information about the newly hired employee. In this case, you will have to submit a supplementary form. For such a violation, representatives of the Pension Fund will issue penalties. It is almost impossible to challenge this punishment.

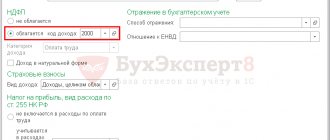

But there are errors in the full name. or the employee’s SNILS number will not be subject to fines. Let’s say that in May the accountant discovered that in the SZV-M for April he did not indicate the middle name of a foreign employee who got a job in April. How to fix the error:

- Submit a cancellation form to the Pension Fund.

- Submit the supplementary form.

Information is prepared only for the employee whose personal information was inaccurate.

The key rules for filling out reports and the unified form remain the same. We talked about them in detail in a special material “Submitting reports: instructions for filling out the SZV-M.”

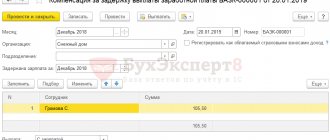

When submitting SZV-M, the wrong reporting period was indicated

Unfortunately, sometimes an accountant, when generating a report in the program, sends it without checking whether the reporting period is indicated correctly.

Sometimes it happens that the report is sent for the current month, and not for the past one. Our readers also found themselves in such a mess.

I received a fine under SZV-M for May in the amount of 22,000 (500 for each).

When generating the report, I didn’t pay attention to what period I was submitting it for. By default, Specialists (I will remember forever) of 1C companies set a period equal to the filling date. In general, out of the blue, a fine of 22,000 rubles, hello, I don’t even have time to figure out WHAT? Now my mood is sharply in the minus, I almost had enough convulsions. If they come up with laws, it’s not so bad; they also remove mitigating circumstances. — Alexander 28

Be careful when filling out the report form!

Pension Fund error codes

| Error code | What is the problem |

| 20 | The TIN control digits of an individual are a number calculated using the algorithm for generating the TIN control number. |

| The TIN element of the insured person is filled in. | |

| 30 | The SNILS contained in the insurance certificate is indicated. |

| The full name contained in the insurance certificate is indicated. | |

| The status of the ILS in the register of the insured person as of the date of the document being checked should not be equal to the value of the UPRZ. | |

| You must specify at least one of the Last Name or First Name elements. | |

| 50 | The file being checked is sent as a correctly completed XML document. |

| The file being checked does not comply with the XSD schema. | |

| The electronic signature is incorrect. | |

| Element "Registration number". The number under which the policyholder is registered as a payer of insurance premiums is indicated, indicating the codes of the region and district according to the classification adopted by the Pension Fund. | |

| The taxpayer identification number does not match the Pension Fund data. | |

| When providing information about insured persons with the “initial” form type, the presence of previously provided information with the “initial” type for the reporting period for which the information is provided is not allowed. | |

| The period for providing SZV-M is no earlier than April 2021. | |

| For all types of SZV-M forms, the reporting period for which the form is submitted is less than or equal to the month in which the audit is carried out. |

Results

SZV-M with incorrect, incomplete or missing data must be corrected. This should be done on a regular report form, indicating in section 3 the required type of form: supplementary or canceling. At the same time, section 4 reflects data on insured persons, which are subject to adjustment. There are no financial sanctions for submitting an adjustment report to the Pension Fund if the employer has identified and corrected the errors independently or no later than 5 working days from the date of receipt of the notification from the fund.

Sources:

- Federal Law No. 27-FZ dated 04/01/1996 (as amended on 04/01/2019) “On individual (personalized) accounting in the compulsory pension insurance system”

- Resolution of the Board of the Pension Fund of the Russian Federation dated October 15, 2019 No. 519p “On approval of the Procedure for adjusting individual (personalized) accounting information and making clarifications (additions) to an individual personal account”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

What happens if you send corrections before notifying the Pension Fund

Errors in reporting can be corrected in two ways:

- on its own initiative, that is, when the institution independently identified an inaccuracy and sent corrective information to the Pension Fund;

- or the error was identified by the Pension Fund of Russia, then the inaccuracy is corrected within 5 business days - that’s how many days the company has to correct errors in SZV-M, for which the Pension Fund of Russia sent a notification, without penalties.

IMPORTANT!

The 5 working day rule now applies only to those errors pointed out by regulatory authorities. It will not be possible to correct other defects. There will be penalties for newly identified errors.

Self-identified inaccuracies are corrected only if two conditions are met: the report with the error was submitted in a timely manner and accepted by the Pension Fund, the organization independently sent corrective information to the Pension Fund of the Russian Federation before notification. Here's how to correct errors in SZV-M without a fine if you didn't specify an employee:

- Generate an additional reporting form for a specific employee.

- Send the register to the Pension Fund by the 15th.

If you submit the SZV-M later, a fine cannot be avoided.

Advice: generate and submit reports in the SZV-M form before the due date (15th day of the month following the reporting month). The organization has more time to correct inaccuracies and errors without applying penalties.

If the performer made a mistake in SNILS, code 30 pops up (inaccuracy status - VSZL.B-QUESTIONNAIRE.1.1). Pension Fund specialists will accept the SZV-M form, but not in full, but in part. The correction must be corrected by the 15th. Here's how to submit a new one if the SZV-M was submitted to SNILS with errors and was partially accepted:

- Create a new file. If you provide the same file to the Pension Fund, the system will automatically refuse to accept and process it.

- Indicate the correct SNILS of the employee and check it with the insurance certificate.

- Generate new reports with information about employees for whom an error was made.

- Mark the report type “supplementary” on the title page.

- Submit corrections by the 15th.

What does all this do to the budget?

Since the introduction of SZV-M, the accounting community has been perplexed by the absurdity of submitting this form for employees who have not reached retirement age.

After all, the point of this report is to identify working pensioners. In this regard, it becomes obvious that late submission of SZV-M for young employees does not cause any damage to the budget. But if the company employs pensioners, late submission of the form can lead to unpleasant consequences. The fact is that without receiving a report in which a pensioner appears, the Pension Fund automatically transfers him to the category of unemployed and indexes his pension. In the report for the next month, this pensioner appears again, but the pension will continue to be paid to him in the indexed amount. However, after the Pension Fund receives a report from the employer for the missed month, the error will be revealed and it will become clear that the indexation was carried out illegally and that budget funds were wasted.

Who should compensate for budget losses in this case? The Pension Fund makes claims against both the pensioner and the employer. Our readers have already encountered this phenomenon.

According to Article 1102 of the Civil Code of the Russian Federation, a person who acquired property without grounds established by law is obliged to return the unjustly acquired property (unjust enrichment). In case of refusal to voluntarily make a refund, the Pension Fund will be forced to go to court to force the recovery of the specified amount ( from the pensioner or from the organization

).

Fines for SZV-M in 2021

Responsibility for late submission of SZV-M and errors in the form is established by Article 17 of Law No. 27-FZ. The Pension Fund fines for:

- failure to submit a report;

- violation of the deadline;

- failure to provide information about the insured person;

- incomplete or unreliable presentation of information about the insured person.

For any of these violations, a fine of 500 rubles is established. for each employee whose information is to be included in the form for the reporting period.

In addition to the fine for the company, the Code of Administrative Offenses establishes administrative liability for the director - a fine of 300 to 500 rubles. If the company manages to reduce or cancel the fine, the directors will still be fined.

Take note:

How the SZV-M shape will change

Errors in SZV-M for which you will have to pay a fine

Even for self-corrected errors in SZV-M, the Pension Fund of the Russian Federation often fines organizations.

What exactly will the organization be attracted for?

1. The organization did not provide information in the SZV-M form for several months.

The organization should provide information in the SZV-M form for all months of failure to provide such information (for each period - month) for each insured person.

At the same time, the absence, according to the position of the Pension Fund of the Russian Federation, expressed in the letter of the Pension Fund of 05/06/2016 N 08-22/6356, “of the fact of accrual of payments and other remunerations for the reporting period is not a basis for failure to submit reports in the SZV-M form.”

And as a result, the organization should provide information in the SZV-M form for all months of failure to provide such information for each insured person.

According to Part 3 of Art. 17 of Federal Law No. 27-FZ financial sanctions in the amount of 500 rubles. apply to each insured person for each month for which the deadline for submitting information in the SZV-M form was missed.

Pension legislation does not provide for exemption from liability in case of violation by the policyholder of the requirements of clause 2.2 of Art. 11 of Federal Law N 27-FZ.

2. An individual performs mandatory free community service in an organization. The organization indicated information about such an individual in the SZV-M form. Is the indication of such an employee considered an error resulting in a fine?

If an individual performs mandatory free community service in an organization, then information about him is not subject to indication in the SZV-M form.

In accordance with Part 1 of Art. 3.13 of the Code of Administrative Offences, compulsory work consists of the performance by an individual who has committed an administrative offense, during his free time from his main job, service or study, of free socially useful work. Compulsory work is assigned by the judge.

The type of compulsory work and the list of organizations are determined by local government bodies in agreement with the territorial bodies of the federal executive body authorized to carry out the functions of compulsory execution of executive documents and ensuring the established procedure for the activities of courts.

According to Parts 2 and 4 of Art. 32.13 of the Code of Administrative Offenses of the Russian Federation - bailiffs keep records of persons who have been sentenced to administrative punishment in the form of compulsory labor, explain to such persons the procedure and conditions for serving compulsory labor, agree with local government bodies on the list of organizations in which persons who have been sentenced to administrative punishment in the form of compulsory labor work, serve compulsory labor, control the behavior of such persons, and keep a summary record of the time they worked.

Moreover, according to Part 11 of Art. 32.13 of the Code of Administrative Offenses of the Russian Federation, the administration of the organization in which a person who has been given an administrative punishment in the form of compulsory work is serving compulsory work is entrusted with monitoring the performance of this person's work specified for him, notifying the bailiff about the number of hours worked or the evasion of the person to whom An administrative penalty was imposed in the form of compulsory labor, from serving compulsory labor.

In accordance with Part 5 of Art. 32.13 of the Code of Administrative Offenses of the Russian Federation, persons who have been sentenced to compulsory labor are obliged to comply with the internal regulations of the organizations in which compulsory labor is served, to work conscientiously at the facilities determined for them during the period of compulsory labor established by the court, to notify the bailiff of the change place of residence, and also appear when called upon.

Working citizens mean the persons specified in Art. 7 of the Federal Law of December 15, 2001 N 167-FZ “On Compulsory Pension Insurance in the Russian Federation,” which includes those working under an employment contract.

And also in paragraph 4 of the SZV-M form itself it is said that data on the insured persons - employees with whom labor contracts and civil law contracts were concluded, continue to be valid or terminated during the reporting period - should be indicated.

However, an individual sent to an organization to undergo compulsory community service is not a full-time employee of the organization to which he is sent and is not in an employment relationship with the employer; he is not paid wages, that is, involving a citizen in completing compulsory free community service work does not constitute an employment relationship.

Thus, information about an individual sent to an organization to undergo compulsory free socially useful work is not subject to indication in the report in the SZV-M form.

In the situation under consideration, the employer needs to fill out the SZV-M form with the code “cancel” (cancelling form) for an individual, information about which must be removed from the initial data uploaded to the Pension Fund database.

In our opinion, filing a cancellation form later than the deadline for submitting information on the SZV-M form may result in a fine.

3. An employment contract was concluded with a minor employee (15 years old) to perform light labor for two months during the holidays.

According to Part 1, 3 Art. 63 of the Labor Code of the Russian Federation, the conclusion of an employment contract is allowed with persons who have reached the age of 16 years, with the exception of cases provided for by the Labor Code of the Russian Federation and other federal laws. With the written consent of one of the parents (guardian) and the guardianship and trusteeship authority, an employment contract can be concluded with a person receiving general education and who has reached the age of 14 years, to perform light labor in his free time from receiving education, which does not cause harm to his health, and without damage to the development of the educational program.

Working citizens mean the persons specified in Art. 7 of Federal Law No. 167-FZ, which includes those working under an employment contract.

Based on the issue, an employment contract was concluded with a minor for two months. There are no legal exceptions for minor workers.

Article 17 of Law No. 27-FZ provides for liability in the form of financial sanctions in the amount of 500 rubles for untimely submission or submission by the employer of incomplete and (or) unreliable information, including in the SZV-M form. for each insured person.

Thus, information about a minor employee with whom an employment contract has been concluded to perform light labor for two months during the holiday period must be included in the report in the SZV-M form for these two months. The employer may be subject to a fine of 500 rubles.

4. Representation of SZV-M for a single participant, if no agreement was concluded with him.

SZV-M for the founder must be submitted if the participant works in the organization on the basis of an employment contract or under a civil law contract, as well as if the only participant is the director of the organization without drawing up an agreement. The absence of accrual of payments in his favor for the reporting period is not a basis for failure to submit reports in the SZV-M form.

In accordance with paragraph 1 of Art. 7 of the Federal Law of December 15, 2001 N 167-FZ, persons working under an employment contract are considered insured, including heads of organizations who are the only participants (founders), or under a civil law contract, the subject of which is the performance of work and the provision of services.

Thus, if a participant is an employee of an organization on the basis of an employment contract (including if the only participant is a director), or works in the organization under a civil contract, then he is an insured person and the employer is obliged to submit information about him in the SZV-M form.

It is necessary to take into account that, in the opinion of Rostrud, as expressed in letter No. 177-6-1 dated 03/06/2013, labor legislation does not apply to the relations of the sole participant of the company with the company established by him. The only participant in the company in this situation must, by his decision, assume the functions of the sole executive body - the general director. In this case, management activities are carried out without concluding any contract, including an employment contract.

Thus, from the literal interpretation it follows that the only participant acts as a director without concluding an agreement and the organization is not obliged to submit the SZV-M form for him.

But, according to Art. 15 of the Labor Code of the Russian Federation, labor relations are relations based on an agreement between the employee and the employer on the personal performance by the employee for payment of a labor function (work according to the position in accordance with the staffing table, profession, specialty indicating qualifications, the specific type of work entrusted to the employee) in the interests, under management and control of the employer, subordination of the employee to internal labor regulations while the employer provides working conditions provided for by labor legislation and other regulatory legal acts containing labor law norms, collective agreements, agreements, local regulations, and employment contracts.

In accordance with Art. 16 of the Labor Code of the Russian Federation - labor relations between an employee and an employer arise on the basis of the employee’s actual admission to work with the knowledge or on behalf of the employer or his authorized representative in the case where the employment contract was not properly drawn up.

According to the letter of the Pension Fund of the Russian Federation dated July 13, 2016 N LCh-08-26/9856, if individuals (including the head of an organization, if he is its sole founder) are in labor relations with this organization, such persons for the purposes of Law No. 167 -FZ applies to working persons.

Therefore, according to the letter of the Ministry of Labor of Russia dated March 16, 2018 N 17-4/10/B-1846 SZV-M, the founder must be represented even if the only participant is the director of the organization without concluding an agreement.

At the same time, the absence of the fact of accrual of payments and other remunerations in favor of the above-mentioned persons (working on the basis of an agreement or without it) for the reporting period is not a basis for failure to submit reports in relation to these persons in the SZV-M form (PFR letter dated July 27, 2016 N LCH- 08-19/10581, dated 05/06/2016 N 08-22/6356).

5. Error in reporting period number.

This situation was considered in the Ruling of the Supreme Court dated January 22, 2018 N 301-KG17-20650.

The organization submitted the SZV-M form to the Pension Fund within the prescribed period. However, after the deadline for submitting information expired, an error was discovered: in the field for the reporting period number, instead of “08” (August), “07” (July) was indicated. The organization submitted the SZV-M form with the correct reporting period number. Since the deadline for submitting the report had already passed, the Pension Fund of the Russian Federation fined the organization for late submission of the SZV-M form.

Due to the fact that the organization did not fulfill the demand for payment of a fine stated by the Pension Fund of the Russian Federation within the prescribed period, the fund went to court. Partially satisfying the stated requirement, the court of first instance recognized the legality of holding the organization liable, while considering it possible to reduce the amount of the fine. When determining the amount of the fine, the court took into account the legal position expressed in the Resolution of the Constitutional Court of the Russian Federation of January 19, 2016 N 2-P.

In most cases, courts significantly reduce the amount of the fine, based on the position of the Constitutional Court of the Russian Federation.

When going to court, you can also point out other circumstances that prevented the report from being submitted on time (computer failure, accountant illness).

The organization, in turn, not agreeing with this court decision, appealed to the appellate court, which subsequently overturned the decision of the first instance court and refused to satisfy the request of the Pension Fund of the Russian Federation.

The Court of Appeal proceeded from the fact that the organization submitted reliable information in the SZV-M form for August 2016 within the prescribed period, and therefore the Pension Fund of the Russian Federation had no grounds for holding it accountable.

In the cassation appeal, the Pension Fund of the Russian Federation asked to cancel the decision of the appellate court as illegal and unfounded, citing the inconsistency of the conclusions set out in it with the circumstances of the case.

However, the Supreme Court did not find grounds for reviewing the judicial act in cassation.

It is worth paying attention to a number of points noted by the appellate court that influenced the outcome of the case:

— The Pension Fund of the Russian Federation previously received information for July;

— the initially submitted report with an error in the field for the reporting period number was designated as “output”;

— the organization submitted objections to the inspection report with explanations of why it corrected the error.

In such a situation, controllers were able to identify timely submitted information on the SZV-M form with the reporting period number “07” as a report for August. Consequently, there were no grounds for a fine.

Let us note that Determination No. 301-KG17-20650 dated January 22, 2018 is not the only decision in which the court does not consider it necessary to impose a fine for the fact that the organization mixed up the month in the “Reporting period” field. Such conclusions, in particular, were reached by the arbitrators in the decisions of the AS PO dated December 11, 2017 No. F06-27663/2017 in case No. A65-15614/2017, the Eighth Arbitration Court of Appeal dated October 5, 2017 No. 08AP-11145/2017 in case No. A81 -3334/2017.

6. Submission of additional information.

It happens that after the timely submission of the report, the organization has a need to send to the Pension Fund of the Russian Federation an additional SZV-M form for some more employees. In a number of decisions, the courts recognized the right of the organization to supplement and clarify information about the insured persons.

Let us turn to the Resolution of the Twentieth Arbitration Court of Appeal dated October 18, 2017 in case No. A54-3773/2017. The arbitrators agreed with the conclusion of the court of first instance that the decision of the Pension Fund of the Russian Federation to impose a fine, contested by the organization, does not comply with the current legislation, and also violates the rights and legitimate interests of the organization.

In the decision under consideration, in the opinion of the fund, a two-week period can only be applied in the case of providing false information and cannot be applied to an offense expressed in the provision of incomplete information. It was especially noted that among the persons for whom information was submitted in the supplementary SZV-M form, there were three pensioners receiving an old-age insurance pension; as a result, untimely submission of individual information in the SZV-M form may lead to overspending of budget funds.

Thus, corrections and corrections of information are made to the form in a special manner if the policyholder identifies an error in the previously submitted information regarding the insured person.

The judges noted that the organization, before the fund discovered a discrepancy between the submitted individual information and the data based on the results of the audit and, accordingly, before the contested decision was made, submitted the necessary corrective information. At the same time, the submission of corrective information later than the established deadline does not constitute an offense imputed to the company (submission of information that is incomplete and (or) containing false information).

So, having established the above circumstances, the court made the correct conclusion that the personalized accounting information initially submitted in a timely manner by the insured, containing shortcomings that were later independently corrected by the company, cannot be regarded as incomplete information, since they are corrected in accordance with current legislation.

A similar position is set out in the Ruling of the Supreme Arbitration Court of the Russian Federation dated 02/11/2013 No. VAC-1010/13 in case No. A76-7462/2012, and the Resolution of the Supreme Arbitration Court of the Russian Federation dated 04/10/2017 in case No. A16-1601/2016.

It should be noted that taking into account the provisions of the new Instruction on the procedure for maintaining individual (personalized) records of information about insured persons, approved by Order of the Ministry of Labor of the Russian Federation dated December 21, 2016 N 766n, as well as the fact that from January 1, 2017 Art. 17 of Federal Law No. 27-FZ defines the procedure for applying financial sanctions for failure by the policyholder to submit within the prescribed period or submission of incomplete and (or) unreliable information of individual (personalized) accounting; it will be more difficult to prove the right to supplement and clarify information about the insured persons after the deadline. However, today there are already decisions in which arbitrators are guided by the norms of existing documents.

In the Resolution of the Ninth Arbitration Court of Appeal dated January 31, 2018 N 09AP-68324/2017 in case N A40-179114/2017, the court noted that according to paragraph 39 of the new Instructions, the policyholder has the right, if an error is identified in previously submitted individual information in relation to the insured person, until detection of an error by the territorial body of the Pension Fund of the Russian Federation, independently submit updated (corrected) information about this insured person for the reporting period in which this information is updated, and financial sanctions are not applied to such an insured.